The Global Submarine Cable System Market size was valued at USD 16.23 Bn in 2023 and is expected to reach USD 35.43 Bn by 2030, at a CAGR of 11.3 %Submarine Cable System Market: Overview

The Submarine Cable System Market is a pivotal sector that revolves around the intricate installation and operation of underwater cables. These cables serve as the linchpin for global telecommunications and internet connectivity by being strategically laid on the seabed, interconnecting continents and enabling the swift transmission of high volumes of data over vast distances. A paramount driver propelling the Submarine Cable System Market forward is the burgeoning demand for augmented connectivity and bandwidth. This surge is attributed to the proliferation of data-intensive applications, the pervasive use of cloud services, and an ever-growing reliance on the internet for various sectors. Submarine cable systems emerge as indispensable contributors to meeting this escalating demand, providing a bedrock of reliable, low-latency, and high-bandwidth connectivity between different regions. This, in turn, ensures the seamless flow of data for businesses, governments, and individuals globally.To know about the Research Methodology :- Request Free Sample Report Within the competitive landscape of the Submarine Cable System Market, SubCom (Submarine Communications) stands out as a major player. Specializing in providing cutting-edge solutions for submarine cables, SubCom has consistently led the industry in technological advancements. A notable recent development from SubCom is the successful completion of the HAVFRUE/AEC-2 subsea cable system, establishing a crucial link between the United States, Denmark, and Ireland. This groundbreaking project enhances transatlantic connectivity, offering not only increased capacity but also crucial network diversity. SubCom's unwavering commitment to innovation and the successful execution of projects of this magnitude solidify its position as a key influencer shaping the trajectory of the Submarine Cable System industry. The Submarine Cable System Market thrives on the escalating global demand for enhanced connectivity and bandwidth. As this market continues to evolve, key players such as SubCom remain at the forefront, making substantial contributions through groundbreaking projects like the HAVFRUE/AEC-2 subsea cable system, underscoring the critical role of submarine cables in modern telecommunications infrastructure.

Submarine Cable System Market Drivers

Data Boom Ignites Submarine Cable Renaissance: Navigating the Surge in Transatlantic Traffic with Cutting-Edge Connectivity Solutions In a notable headline from November 2023, Forbes reports on the unprecedented surge in transatlantic data traffic, prompting substantial investments in new submarine cable systems. The surge in data demand, fuelled by the ever-growing consumption of cloud computing, video streaming, and online gaming, underscores the critical need for robust and dependable high-speed internet infrastructure. Within this context, submarine cables emerge as indispensable components, connecting continents and islands to facilitate seamless data flow across vast distances. Recent Developments in the Submarine Cable System Market further highlight the industry's response to the escalating demand for connectivity. Tech giant Google, recognizing the imperative for enhanced redundancy and bandwidth, announces the launch of "Nuvem," a new transatlantic subsea cable system. This strategic move aims to fortify connectivity between North America and Europe, addressing the need for resilient and high-capacity data transmission. Governments in Southeast Asia are making substantial investments in submarine cable projects, emphasizing their commitment to bridging the digital divide and bolstering regional connectivity. Recognizing the pivotal role of submarine cables in supporting economic growth and fostering digital inclusion, these investments underscore the significance of the Submarine Cable System Market in meeting the connectivity demands of diverse regions. the surge in transatlantic data traffic and the subsequent investments in submarine cable systems highlight the pivotal role of the Submarine Cable System Market in addressing the insatiable demand for connectivity fuelled by contemporary technological trends. The recent developments, including Google's Nuvem announcement and Southeast Asian governments' investments, exemplify the industry's dynamic response to the evolving landscape of global data connectivity. Green Energy Revolution Driving Submarine Cable System Market The ongoing shift toward renewable energy, notably the rapid expansion of offshore wind farms, is significantly amplifying the demand for submarine power cables. These cables play a critical role in efficiently transmitting the electricity generated by offshore wind installations across substantial distances to mainland grids. This surge in demand marks a pivotal opportunity for the Submarine Cable System Market, propelled by key drivers that underscore the industry's growth trajectory. One fundamental driver is the escalating capacity of offshore wind projects globally. Governments, such as the European Union with its 300GW target by 2050 and China's ambitious 1,500GW goal, are steering the creation of numerous wind farms. Each of these ventures necessitates robust submarine cable connections to ensure the seamless integration of renewable energy into existing power grids. Technological advancements, particularly in High-Voltage Direct Current (HVDC) technology and the adoption of dry-plant technology, are instrumental in enhancing the efficiency and feasibility of submarine cable projects. HVDC technology facilitates the transmission of large quantities of power over extended distances with minimal energy loss, while dry-plant technology streamlines cable laying processes, reducing costs and increasing project viability. Environmental considerations are also playing a pivotal role in driving the market. Submarine power cables, serving as a sustainable alternative to traditional power transmission methods, contribute to a reduction in greenhouse gas emissions and support cleaner energy grids. As environmental regulations become increasingly stringent, the demand for eco-friendly cable systems that minimize environmental impact during production and operation is on the rise. The Submarine Cable System Market is witnessing significant growth in Asia Pacific and Europe. These regions are at the forefront of renewable energy adoption, with ambitious targets and substantial investments. Notably, China's plan for the world's longest HVDC submarine cable underscores the strategic importance of these investments in expanding the market. The green energy revolution, particularly the surge in offshore wind projects, is steering the Submarine Cable System Market toward unprecedented growth. With technological innovations, a focus on sustainability, and substantial regional investments, the market is poised for sustained expansion, heralding a new era in the global energy landscape. Submarine Cable System Market Restraint The Submarine Cable System Market encounters notable restraints and challenges, primarily stemming from the susceptibility of undersea cables to external threats and environmental factors. Recent data highlights that over 80% of submarine cable faults are attributed to factors such as ship anchoring, fishing activities, and natural disasters, emphasizing the vulnerability of these critical infrastructure components. Additionally, the escalating demand for renewable energy, particularly offshore wind projects, introduces complexities in cable planning and installation. The Submarine Cable System Market faces challenges in navigating regulatory frameworks, obtaining permits for cable routes, and ensuring environmental sustainability during the installation process. Balancing the need for expanding connectivity with addressing these challenges necessitates collaborative efforts from industry stakeholders, governments, and environmental organizations. Proactive measures, including advanced cable burial techniques, real-time monitoring systems, and comprehensive risk assessments, are imperative to mitigate the impact of these restraints and ensure the sustainable growth of the Submarine Cable System Market. Submarine Cable System Market Challenges The Submarine Cable System Market encounters several challenges that shape its dynamics and growth trajectory. One prominent challenge revolves around the vulnerability of undersea cables to external threats and environmental factors. Recent data indicates that a significant percentage of submarine cable faults, exceeding 80%, are attributed to factors such as ship anchoring, fishing activities, and natural disasters. This underscores the critical need for innovative solutions and advanced technologies to enhance the resilience of submarine cable networks. Another substantial challenge stems from the increasing demand for renewable energy, particularly the expansion of offshore wind projects. This presents complexities in planning and installing submarine cables, involving intricate regulatory processes, obtaining permits for cable routes, and ensuring environmental sustainability. Navigating these regulatory frameworks and addressing environmental concerns during the installation phase adds layers of complexity to submarine cable projects. The Submarine Cable System Market faces ongoing challenges in maintaining and upgrading aging cable infrastructure. As the demand for high-speed internet and data transmission continues to surge, ensuring the reliability and efficiency of existing submarine cable systems becomes a crucial aspect. Strategic planning for system upgrades and replacements is essential to meet evolving technological requirements and market demands. The challenges in the Submarine Cable System Market encompass external threats to cable infrastructure, intricate regulatory processes associated with renewable energy projects, and the imperative to maintain and upgrade aging systems. Addressing these challenges requires a comprehensive approach, combining technological innovation, regulatory cooperation, and strategic planning to ensure the sustained growth and resilience of the Submarine Cable System Market.Submarine Cable System Market Trends

Expanding Offshore Wind Connectivity A significant trend in the Submarine Cable System Market is the increasing demand for undersea cables to connect offshore wind farms to onshore grids. As countries globally intensify their focus on renewable energy sources, offshore wind projects are gaining prominence. Submarine cables play a pivotal role in transmitting the generated electricity from these wind farms to mainland power grids efficiently. Recent developments underscore this trend, with substantial investments and projects like the proposed world's longest high-voltage direct current (HVDC) submarine power cable in China, further emphasizing the crucial role of submarine cable systems in facilitating the expansion of offshore wind connectivity. Data Center Connectivity Demand Another notable trend shaping the Submarine Cable System Market is the rising demand for undersea cables to connect data centers across different regions. With the exponential growth of data traffic and the need for high-speed, reliable connectivity, submarine cables are becoming vital infrastructure for interconnecting data centers globally. As cloud computing, video streaming, and other data-intensive applications continue to proliferate, submarine cable systems are instrumental in ensuring seamless data transmission. The development of new transoceanic cable systems, like Google's Nuvem connecting North America and Europe, exemplifies the trend of enhancing data center connectivity through advanced submarine cable infrastructure. the Submarine Cable System Market is witnessing key trends, including the expansion of offshore wind connectivity and the growing demand for undersea cables to interconnect data centers. These trends underscore the market's adaptability to evolving needs in both renewable energy and digital connectivity domains, positioning submarine cable systems as critical components in shaping the future of global communications and sustainable energy transmission.

Company Headquarters Focus Recent Developments Nexans Group France Leading manufacturer of submarine cables for various applications. Developing high-voltage and environmentally friendly cable solutions. Prysmian Group Italy Global provider of submarine cables and systems. Awarded contracts for major offshore wind farm projects. NKT Cables A/S Denmark Manufacturer of submarine cables with a focus on offshore wind farms. Investing in production capacity and R&D for next-generation cables General Cable Corporation US Manufacturer of submarine cables for power and telecommunications. Expanding geographic reach and product portfolio. Fujitsu Cable Systems Ltd. Japan Leading provider of submarine cables for the Asian market. Collaborating with other companies on innovative cable projects. Submarine Cable System Market Segment Analysis

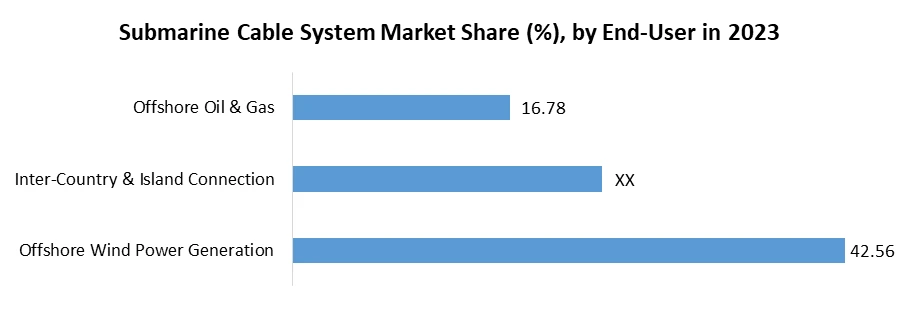

Based on End-User The Submarine Cable System Market is currently witnessing a notable trend with Offshore Wind Power Generation emerging as the leading end-user segment, commanding the largest market share. This dominance is expected to persist in the foreseeable future, and several key factors contribute to this prominent role. One pivotal aspect is the exponential growth of the global offshore wind energy market, projected to achieve a remarkable CAGR of over 20% from 2023 to 2030. This substantial expansion results in a heightened demand for submarine cables, crucial components connecting offshore wind farms to mainland grids. Offshore wind farms, often situated far from the shore, require high-performance cables capable of efficiently transmitting large volumes of electricity over extended distances with minimal energy loss. Submarine power cables perfectly address this essential need, positioning them as integral contributors to the success of offshore wind power generation. Government support further solidifies the dominance of Offshore Wind Power in the Submarine Cable System Market. Numerous governments worldwide have set ambitious targets and implemented supportive policies for offshore wind development, catalyzing substantial investments in submarine cable systems. The environmental advantages associated with offshore wind, as a clean and renewable energy source, align seamlessly with the global push for sustainability. This alignment plays a crucial role in driving the adoption of submarine power cables, contributing to the dominance of Offshore Wind Power as a leading end-user segment in the market. Recent developments underscore the significance of this trend, including China's substantial $34 billion investment in an offshore wind farm and its accompanying subsea cable network. The Dogger Bank Wind Farm in the UK, recognized as the world's largest, exemplifies the scale of infrastructure required, with 390 km of subsea cables. While Offshore Wind Power takes the spotlight, other notable end-user segments in the Submarine Cable System Market include Inter-Country & Island Connection, exhibiting steady growth driven by the increasing demand for regional connectivity and island electrification. However, the Offshore Oil & Gas segment is anticipated to witness slower growth due to environmental concerns and shifting energy priorities. Looking ahead, the market outlook for the Submarine Cable System in Offshore Wind Power Generation remains robust. Fueled by the ongoing boom in offshore wind power and the collective global commitment to clean energy solutions, the demand for these critical underwater connections is poised to continue its ascent, shaping the future trajectory of the market.

Submarine Cable System Market Regional Analysis:

Asia Pacific: A Booming Hub The Asia Pacific region stands as a burgeoning hub in the Submarine Cable System Market, commanding approximately 40% of the market share. Rapid economic development, particularly in countries like China, India, and Southeast Asian nations, is a significant driver. The growing economies fuel the demand for enhanced internet bandwidth and offshore wind energy, making the region a hotspot for submarine cable projects. Government initiatives, such as supportive policies and investments in infrastructure development, further create a conducive environment for the expansion of submarine cable networks. Regional players, including China and Japan, actively contribute to the market by spearheading new interconnectivity projects like the Southeast Asia-Middle East-West Europe (SEA-ME-WE) cable system. India's ambitious "Blue Economy" initiative underscores the region's commitment, with plans to lay 20,000 km of submarine cables to enhance connectivity and integrate offshore wind power. Additionally, China's world-record HVDC submarine cable project, aimed at transmitting renewable energy from the North Sea to eastern provinces, exemplifies the technological advancements driving growth in the Asia Pacific Submarine Cable System Market. Europe: A Powerhouse of Innovation Europe emerges as a powerhouse of innovation in the Submarine Cable System Market, claiming a market share of approximately 30%. Stringent environmental regulations drive the region's adoption of renewable energy sources, particularly offshore wind, necessitating extensive subsea cable infrastructure. European companies lead in cable design, manufacturing, and installation, offering high-performance solutions. The region's focus on data connectivity, with a growing demand for high-speed internet and cloud services, prompts investments in subsea data cable systems, contributing to the market's growth. The European Union's ambitious offshore wind targets, aiming for 300GW of capacity by 2050, necessitate significant investments in submarine power cables. Google's "Nuvem" transatlantic subsea cable is a notable recent development, enhancing Europe-North America connectivity with improved bandwidth and redundancy, showcasing the region's commitment to innovation in the Submarine Cable System Market. While Asia Pacific and Europe currently dominate the Submarine Cable System Market, North America shows promising growth potential. Increasing offshore wind projects and investments in data centers drive market expansion in the region. Africa In Africa, growing economies and initiatives like the Africa Union's "25 by 25" plan present opportunities for future development in the Submarine Cable System Market. Latin America Rising internet penetration and ambitious renewable energy goals offer exciting prospects for market growth in Latin America. The Submarine Cable System Market is poised for continued growth in the coming years, driven by surging data demands, the global transition to renewable energy, technological advancements, and supportive government policies. Understanding the specific drivers and developments within each region is crucial for businesses and investors seeking valuable insights into this dynamic and promising market.Submarine Cable System Market Scope: Inquire before buying

Global Submarine Cable System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 16.23 Bn. Forecast Period 2024 to 2030 CAGR: 11.3% Market Size in 2030: US $ 35.43 Bn. Segments Covered: by Type Single Core Cable Multi Core Cable by Application Submarine Power Cables Submarine Communication Cables by End User Offshore Wind Power Generation Inter Country & Island Connection Offshore Oil & Gas Submarine Cable System Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Submarine Cable System Market Key Players are:

North America: 1. TE Connectivity Switzerland) 2. Corning Inc. (United States) 3. SubCom (United States) 4. The Okonite Company (United States) Europe: 1. Nexans (France) 2. Prysmian (Italy) 3. Norddeutsche Seekabelwerke GmbH (Germany) 4. NKT (Denmark) 5. Hesfibel (Turkey) 6. Nokia (Finland) 7. TFKable (Poland) 8. Hexatronic (Sweden) Asia: 1. NEC (Japan) 2. Huawei Marine (China) 3. ZTT (China) 4. Hengtong (China) 5. Sumitomo Electric (Japan) 6. FUJITSU (Japan) 7. Apar Industries Ltd (India) Middle East: 1.Saudi Ericsson (Saudi Arabia) FAQs 1) What was the market size of the Market in 2023? Ans - Global Market was worth US$ 16.23 Bn. in 2023. 2) What is the market segment of the Submarine Cable System Market? Ans -The market segments are based on Type, Application and End-User. 3) What is the forecast period considered for Submarine Cable System Market? Ans -The forecast period for Global Submarine Cable System Market is 2023-2030. 4) What is the Submarine Cable System Market size in 2029? Ans –Submarine Cable System Market is expected to reach US$ 35.43 Bn. by 2030. 5) Which region is dominated in Global Submarine Cable System Market? Ans -In 2023, the Asia pacific region dominated the Submarine Cable System Market.

1. Submarine Cable System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Submarine Cable System Market: Dynamics 2.1. Submarine Cable System Market Trends by Region 2.1.1. North America Submarine Cable System Market Trends 2.1.2. Europe Submarine Cable System Market Trends 2.1.3. Asia Pacific Submarine Cable System Market Trends 2.1.4. Middle East and Africa Submarine Cable System Market Trends 2.1.5. South America Submarine Cable System Market Trends 2.2. Submarine Cable System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Submarine Cable System Market Drivers 2.2.1.2. North America Submarine Cable System Market Restraints 2.2.1.3. North America Submarine Cable System Market Opportunities 2.2.1.4. North America Submarine Cable System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Submarine Cable System Market Drivers 2.2.2.2. Europe Submarine Cable System Market Restraints 2.2.2.3. Europe Submarine Cable System Market Opportunities 2.2.2.4. Europe Submarine Cable System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Submarine Cable System Market Drivers 2.2.3.2. Asia Pacific Submarine Cable System Market Restraints 2.2.3.3. Asia Pacific Submarine Cable System Market Opportunities 2.2.3.4. Asia Pacific Submarine Cable System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Submarine Cable System Market Drivers 2.2.4.2. Middle East and Africa Submarine Cable System Market Restraints 2.2.4.3. Middle East and Africa Submarine Cable System Market Opportunities 2.2.4.4. Middle East and Africa Submarine Cable System Market Challenges 2.2.5. South America 2.2.5.1. South America Submarine Cable System Market Drivers 2.2.5.2. South America Submarine Cable System Market Restraints 2.2.5.3. South America Submarine Cable System Market Opportunities 2.2.5.4. South America Submarine Cable System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Submarine Cable System Industry 2.8. Analysis of Government Schemes and Initiatives For Submarine Cable System Industry 2.9. Submarine Cable System Market Trade Analysis 2.10. The Global Pandemic Impact on Submarine Cable System Market 3. Submarine Cable System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Submarine Cable System Market Size and Forecast, by Type (2023-2030) 3.1.1. Single Core Cable 3.1.2. Multi Core Cable 3.2. Submarine Cable System Market Size and Forecast, by Application (2023-2030) 3.2.1. Submarine Power Cables 3.2.2. Submarine Communication Cables 3.3. Submarine Cable System Market Size and Forecast, by End User (2023-2030) 3.3.1. Offshore Wind Power Generation 3.3.2. Inter Country & Island Connection 3.3.3. Offshore Oil & Gas 3.4. Submarine Cable System Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Submarine Cable System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Submarine Cable System Market Size and Forecast, by Type (2023-2030) 4.1.1. Single Core Cable 4.1.2. Multi Core Cable 4.2. North America Submarine Cable System Market Size and Forecast, by Application (2023-2030) 4.2.1. Submarine Power Cables 4.2.2. Submarine Communication Cables 4.3. North America Submarine Cable System Market Size and Forecast, by End User (2023-2030) 4.3.1. Offshore Wind Power Generation 4.3.2. Inter Country & Island Connection 4.3.3. Offshore Oil & Gas 4.4. North America Submarine Cable System Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Submarine Cable System Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Single Core Cable 4.4.1.1.2. Multi Core Cable 4.4.1.2. United States Submarine Cable System Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Submarine Power Cables 4.4.1.2.2. Submarine Communication Cables 4.4.1.3. United States Submarine Cable System Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Offshore Wind Power Generation 4.4.1.3.2. Inter Country & Island Connection 4.4.1.3.3. Offshore Oil & Gas 4.4.2. Canada 4.4.2.1. Canada Submarine Cable System Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Single Core Cable 4.4.2.1.2. Multi Core Cable 4.4.2.2. Canada Submarine Cable System Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Submarine Power Cables 4.4.2.2.2. Submarine Communication Cables 4.4.2.3. Canada Submarine Cable System Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Offshore Wind Power Generation 4.4.2.3.2. Inter Country & Island Connection 4.4.2.3.3. Offshore Oil & Gas 4.4.3. Mexico 4.4.3.1. Mexico Submarine Cable System Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Single Core Cable 4.4.3.1.2. Multi Core Cable 4.4.3.2. Mexico Submarine Cable System Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Submarine Power Cables 4.4.3.2.2. Submarine Communication Cables 4.4.3.3. Mexico Submarine Cable System Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Offshore Wind Power Generation 4.4.3.3.2. Inter Country & Island Connection 4.4.3.3.3. Offshore Oil & Gas 5. Europe Submarine Cable System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.2. Europe Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.3. Europe Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4. Europe Submarine Cable System Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Submarine Cable System Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Submarine Cable System Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Submarine Cable System Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Submarine Cable System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Submarine Cable System Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Submarine Cable System Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Submarine Cable System Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Submarine Cable System Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Submarine Cable System Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Submarine Cable System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Submarine Cable System Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Submarine Cable System Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Submarine Cable System Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Submarine Cable System Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Submarine Cable System Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Submarine Cable System Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Submarine Cable System Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Submarine Cable System Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Submarine Cable System Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Submarine Cable System Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Submarine Cable System Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Submarine Cable System Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Submarine Cable System Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Submarine Cable System Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Submarine Cable System Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Submarine Cable System Market Size and Forecast, by End User (2023-2030) 8. South America Submarine Cable System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Submarine Cable System Market Size and Forecast, by Type (2023-2030) 8.2. South America Submarine Cable System Market Size and Forecast, by Application (2023-2030) 8.3. South America Submarine Cable System Market Size and Forecast, by End User(2023-2030) 8.4. South America Submarine Cable System Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Submarine Cable System Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Submarine Cable System Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Submarine Cable System Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Submarine Cable System Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Submarine Cable System Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Submarine Cable System Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Submarine Cable System Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Submarine Cable System Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Submarine Cable System Market Size and Forecast, by End User (2023-2030) 9. Global Submarine Cable System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Submarine Cable System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. TE Connectivity (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Corning Inc. (United States) 10.3. SubCom (United States) 10.4. The Okonite Company (United States) 10.5. Nexans (France) 10.6. Prysmian (Italy) 10.7. Norddeutsche Seekabelwerke GmbH (Germany) 10.8. NKT (Denmark) 10.9. Hesfibel (Turkey) 10.10. Nokia (Finland) 10.11. TFKable (Poland) 10.12. Hexatronic (Sweden) 10.13. NEC (Japan) 10.14. Huawei Marine (China) 10.15. ZTT (China) 10.16. Hengtong (China) 10.17. Sumitomo Electric (Japan) 10.18. FUJITSU (Japan) 10.19. Apar Industries Ltd (India) 10.20. Saudi Ericsson (Saudi Arabia) 11. Key Findings 12. Industry Recommendations 13. Submarine Cable System Market: Research Methodology 14. Terms and Glossary