Global Stick Packaging Market size was valued at USD 403.06 Mn. in 2024, and the total Dill Pickles Market revenue is expected to grow by 6.21% from 2025 to 2032, reaching nearly USD 652.67 Mn.Stick Packaging Market Overview

Stick packaging refers to slim, single-dose pouches primarily used for powders, liquids, and tablet, offering portability and convenience. The stick packaging market encompasses flexible packaging solutions catering to industries like food, pharmaceuticals, and personal care. Also, stringent plastic regulations and high material costs pose challenges. Regionally, North America led the Stick Packaging Market in 2024, by its lifestyle shifts and clean label trends, while Asia Pacific emerges as the fastest growing market, supported by the increasing middle class. The stick packaging market's Key players, like Amcor and Berry Global, dominate through sustainable films and high barrier technologies. End-users, particularly FMCG and pharma, prioritise lightweight, compliant packaging. Trade policies, such as plastic bans in Europe, further shape market dynamics, pushing the adoption of recyclable alternatives. The report covered the Stick Packaging Market dynamics, structure by analysing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Stick Packaging Market.To know about the Research Methodology:- Request Free Sample Report

Stick Packaging Market Dynamics

Rising Disposable Income and Retail Expansion to Drive Stick Packaging Market Growth

Rising disposable income, coupled with a growing number of retail industries, is a major factor expected to drive the growth of the global market. In addition, increasing demand for packaged food due to its health benefits, coupled with the busy lifestyle of consumers, who prefer packaged products, are some other factors that drive the growth of the global market. Furthermore, the changing preference of consumers from rigid to flexible packaging is expected to drive revenue growth of the target market over the forecast period.Stringent Plastic Regulations and High Costs to Restrain the Stick Packaging Market

Nevertheless, a stringent regulation towards the use of plastic is the major factor anticipated to restrain the growth of the global market. Additionally, the high cost of the packaging material may hinder the market growth.Healthcare, Eco-Innovation, and High-Value Segments to Create Stick Packaging Market Opportunity

The market presents significant opportunities, particularly in the pharmaceutical and nutraceutical sectors, where single-dose convenience and portability are driving demand, and the growing potential in emerging markets, where rising middle-class populations and increasing health awareness are accelerating the adoption of on-the-go stick-packaged products. Additionally, sustainability-focused innovations such as compostable and recyclable materials are creating new revenue streams, with major FMCG brands investing in eco-friendly formats to meet tightening regulations and consumer preferences. The shift toward premiumization in cosmetics and food supplements further expands the market, with stick packaging enabling precise dosing and enhanced shelf appeal.Stick Packaging Market Segment Analysis

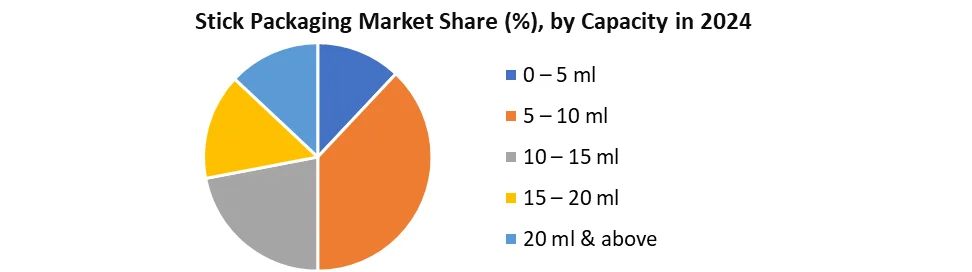

Based on filler, the global stick packaging is segmented into powder, liquid, and tablet. The powder segment held the Largest Market Share in 2024. Stick packaging is most suitable for powder packaging as it offers easy handling and convenience. The global market is vastly fragmented, and the major players have used numerous strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market.Based on Capacity, the 5 ml - 10 ml capacity segment dominated the market in 2024. This segment is widely used in the packaging of single-serve products such as nutraceutical powders, instant coffee, energy drinks, and liquid supplements. The format offers the ideal balance between portability and sufficient quantity, making it a preferred choice in the food, pharma, and personal care industries. Its popularity is further driven by the increasing demand for on-the-go and portion-controlled packaging, especially in urban markets.

Packaging Market Regional Insights

Geographically, the North American market is projected to account for the highest revenue share in the global market over the forecast period (2025-2032), because of changing lifestyles coupled with increasing awareness regarding clean food, clean water, and pharmaceuticals in countries in the region. The European market is anticipated to account for the second-highest revenue share in the global market, because of the busy lifestyle of the consumers that encourages the consumption of on-the-go products and packaged products in the countries in the region. The market in the Asia Pacific is expected to register the fastest growth rate in terms of revenue, caused by the rising middle-class population and increasing disposable income of the people in the countries in the region. Also, the markets in Latin America, and Middle East & Africa are likely to register moderate growth revenue over the forecast period.Stick Packaging Market Competitive Landscape

The market's major key players include Amcor Plc, Berry Global Inc., Constantia Flexibles, Uflex Ltd., and Bemis Company. Leaders differentiate themselves through innovative material solutions, sustainability initiatives, and advanced manufacturing technologies. Amcor focuses on recyclable and biodegradable film, while Berry Global emphasizes lightweight and high-barrier films to enhance shelf life. Constantia Flexible invests in flexible and eco-friendly packaging, and Uflex Ltd. leverages cost-effective, high-performance laminated films. Bemis stands out with customized packaging solutions for the pharmaceutical and food sectors. Dominance from strong R&D capability, global supply chain, and strategic acquisition, allowing it to cater to diverse industries like FMCG, healthcare, and personal care. Sustainability remains a key driver, with these players adopting mono-material films and compostable packaging to meet regulatory and consumer demands. Also, digital printing and smart packaging innovation enhance brand appeal, ensuring their leadership in the rapidly evolving stick packaging market.Stick Packaging Market Key Trends

Trend Description Impact on Market Sustainability & Eco-Friendly Materials Shift toward biodegradable, compostable, and mono-material films (e.g., PLA, paper-based solutions). Increased demand from eco-conscious brands; regulatory push for recyclable packaging. High-Barrier Films Use of advanced materials (e.g., metallised films, EVOH) to extend the shelf life of sensitive products. Growth in food, pharma, and nutraceutical sectors requires oxygen/moisture protection. Digital Printing Adoption of digital printing for short runs, customisation, and vibrant branding. Cost-effective personalisation, faster turnaround, and reduced waste. Smart Packaging Integration of QR codes, NFC tags, and freshness indicators for traceability and engagement. Enhanced consumer interaction and compliance with anti-counterfeiting measures. Stick Packaging Market Recent Development

1. On November 19, 2024, Amcor Plc (Switzerland) announced an all-stock merger with Berry Global valued at $8.4 billion. The deal was approved by shareholders on February 26, 2025, and received European Commission antitrust approval on April 25, 2025. The merger officially closed on April 30, 2025, creating a global leader in consumer and healthcare packaging solutions. 2. On April 24, 2025, ProAmpac (USA) announced its participation in the SPC Impact 2025 conference in Seattle, Washington, where it showcased its latest sustainable packaging solutions, including recyclable and compostable packaging, food-to-go packaging, and high-performance flexible films.Stick Packaging Market Report Scope: Inquire before buying

Global Stick Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 403.06 Mn Forecast Period 2025 to 2032 CAGR: 6.21% Market Size in 2032: USD 652.67 Mn Segments Covered: by Material Type Polyester Polyethylene Paper Metallized Films Others by Filler Powder Liquid Tablets by Capacity 0 - 5 ml 5 ml - 10 ml 10 ml - 15 ml 15 ml - 20 ml 20 ml & above by Application Cosmetics & Personal Care Food & Beverages Industrial Pharmaceuticals Others Stick Packaging Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Stick Packaging Key Players are:

North America 1. Bemis Company (USA) 2. Berry Global Inc. (USA) 3. Pactiv Evergreen (USA) 4. Glenroy Inc. (USA) 5. Catalent, Inc. (USA) 6. ePac Holdings, LLC (USA) 7. Kimac Industries (USA) 8. CarePac (USA) 9. ProAmpac (USA) 10. Elitefill (USA) 11. Associated Labels & Packaging (Canada) 12. Polynova Industries Inc. (Canada) Europe 13. Amcor Plc (Switzerland) 14. Constantia Flexibles (Austria) 15. Bosch Packaging Technology (Germany) 16. Smurfit Kappa Group (Ireland) 17. SIG Group (Switzerland) 18. Bobst Group (Switzerland) Asia Pacific 19. Uflex Ltd. (India) 20. SCG Packaging Public Co. Ltd. (Thailand) 21. Toyochem Co., Ltd. (Japan) 22. Daibochi Berhad (Malaysia) 23. Jiangyin Zhongya Packaging Co., Ltd. (China) Middle East & Africa 24. Hotpack Global (UAE) 25. INDEVCO Group (Lebanon) 26. Nampak Ltd. (South Africa) South America 27. Klabin S.A. (Brazil) 28. Darnel Group (Colombia)FAQ:

1] What are the leading market players active in the Stick Packaging Market? Ans. The top players in the Stick Packaging market in 2024 include Amcor Plc (Switzerland), Berry Global Inc. (USA), Constantia Flexibles (Austria), Uflex Ltd. (India), and Bemis Company (USA). 2] What is the market in the Stick Packaging Market in 2024? Ans. The market size in the Stick Packaging Market in 2024 is USD 403.06 Million. 3] Which region is expected to hold the highest share in the Global Stick Packaging Market? Ans. The North America region is expected to hold the highest share in the Stick Packaging Market. 4] What is the forecast period for the Global Stick Packaging Market? Ans. The forecast period for the Stick Packaging Market is 2025-2032. 5] What segments are covered in the Global Stick Packaging Market report? Ans. The segments covered in the Stick Packaging Market report are based on Material Type, Filler, Capacity, and Application.

1. Stick Packaging Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Stick Packaging Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Stick Packaging Market: Dynamics 3.1. Region-wise Trends of Stick Packaging Market 3.1.1. North America Stick Packaging Market Trends 3.1.2. Europe Stick Packaging Market Trends 3.1.3. Asia Pacific Stick Packaging Market Trends 3.1.4. Middle East and Africa Stick Packaging Market Trends 3.1.5. South America Stick Packaging Market Trends 3.2. Stick Packaging Market Dynamics 3.2.1. Stick Packaging Market Drivers 3.2.1.1. Rising Disposable Income 3.2.1.2. Shift to Flexibles 3.2.2. Stick Packaging Market Restraints 3.2.3. Stick Packaging Market Opportunities 3.2.3.1. Eco-Friendly Innovations 3.2.3.2. Digital Printing Growth 3.2.4. Stick Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Plastic Ban Regulations 3.4.2. Smart Packaging Tools 3.4.3. Sustainable Packaging Push 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Stick Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 4.1.1. Polyester 4.1.2. Polyethylene 4.1.3. Paper 4.1.4. Metallized Films 4.1.5. Others 4.2. Stick Packaging Market Size and Forecast, By Filler (2024-2032) 4.2.1. Powder 4.2.2. Liquid 4.2.3. Tablets 4.3. Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 4.3.1. 0 - 5 ml 4.3.2. 5 ml - 10 ml 4.3.3. 10 ml - 15 ml 4.3.4. 15 ml - 20 ml 4.3.5. 20 ml & above 4.4. Stick Packaging Market Size and Forecast, By Application (2024-2032) 4.4.1. Cosmetics & Personal Care 4.4.2. Food & Beverages 4.4.3. Industrial 4.4.4. Pharmaceuticals 4.4.5. Others 4.5. Stick Packaging Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Stick Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 5.1.1. Polyester 5.1.2. Polyethylene 5.1.3. Paper 5.1.4. Metallized Films 5.1.5. Others 5.2. North America Stick Packaging Market Size and Forecast, By Filler (2024-2032) 5.2.1. Powder 5.2.2. Liquid 5.2.3. Tablets 5.3. North America Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 5.3.1. 0 - 5 ml 5.3.2. 5 ml - 10 ml 5.3.3. 10 ml - 15 ml 5.3.4. 15 ml - 20 ml 5.3.5. 20 ml & above 5.4. North America Stick Packaging Market Size and Forecast, By Application (2024-2032) 5.4.1. Cosmetics & Personal Care 5.4.2. Food & Beverages 5.4.3. Industrial 5.4.4. Pharmaceuticals 5.4.5. Others 5.5. North America Stick Packaging Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 5.5.1.1.1. Polyester 5.5.1.1.2. Polyethylene 5.5.1.1.3. Paper 5.5.1.1.4. Metallized Films 5.5.1.1.5. Others 5.5.1.2. United States Stick Packaging Market Size and Forecast, By Filler (2024-2032) 5.5.1.2.1. Powder 5.5.1.2.2. Liquid 5.5.1.2.3. Tablets 5.5.1.3. United States Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 5.5.1.3.1. 0 - 5 ml 5.5.1.3.2. 5 ml - 10 ml 5.5.1.3.3. 10 ml - 15 ml 5.5.1.3.4. 15 ml - 20 ml 5.5.1.3.5. 20 ml & above 5.5.1.4. United States Stick Packaging Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Cosmetics & Personal Care 5.5.1.4.2. Food & Beverages 5.5.1.4.3. Industrial 5.5.1.4.4. Pharmaceuticals 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 5.5.2.1.1. Polyester 5.5.2.1.2. Polyethylene 5.5.2.1.3. Paper 5.5.2.1.4. Metallized Films 5.5.2.1.5. Others 5.5.2.2. Canada Stick Packaging Market Size and Forecast, By Filler (2024-2032) 5.5.2.2.1. Powder 5.5.2.2.2. Liquid 5.5.2.2.3. Tablets 5.5.2.3. Canada Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 5.5.2.3.1. 0 - 5 ml 5.5.2.3.2. 5 ml - 10 ml 5.5.2.3.3. 10 ml - 15 ml 5.5.2.3.4. 15 ml - 20 ml 5.5.2.3.5. 20 ml & above 5.5.2.4. Canada Stick Packaging Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Cosmetics & Personal Care 5.5.2.4.2. Food & Beverages 5.5.2.4.3. Industrial 5.5.2.4.4. Pharmaceuticals 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 5.5.3.1.1. Polyester 5.5.3.1.2. Polyethylene 5.5.3.1.3. Paper 5.5.3.1.4. Metallized Films 5.5.3.1.5. Others 5.5.3.2. Mexico Stick Packaging Market Size and Forecast, By Filler (2024-2032) 5.5.3.2.1. Powder 5.5.3.2.2. Liquid 5.5.3.2.3. Tablets 5.5.3.3. Mexico Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 5.5.3.3.1. 0 - 5 ml 5.5.3.3.2. 5 ml - 10 ml 5.5.3.3.3. 10 ml - 15 ml 5.5.3.3.4. 15 ml - 20 ml 5.5.3.3.5. 20 ml & above 5.5.3.4. Mexico Stick Packaging Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Cosmetics & Personal Care 5.5.3.4.2. Food & Beverages 5.5.3.4.3. Industrial 5.5.3.4.4. Pharmaceuticals 5.5.3.4.5. Others 6. Europe Stick Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.2. Europe Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.3. Europe Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.4. Europe Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5. Europe Stick Packaging Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.1.2. United Kingdom Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.1.3. United Kingdom Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.1.4. United Kingdom Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.2.2. France Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.2.3. France Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.2.4. France Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.3.2. Germany Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.3.3. Germany Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.3.4. Germany Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.4.2. Italy Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.4.3. Italy Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.4.4. Italy Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.5.2. Spain Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.5.3. Spain Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.5.4. Spain Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.6.2. Sweden Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.6.3. Sweden Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.6.4. Sweden Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.7.2. Russia Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.7.3. Russia Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.7.4. Russia Stick Packaging Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 6.5.8.2. Rest of Europe Stick Packaging Market Size and Forecast, By Filler (2024-2032) 6.5.8.3. Rest of Europe Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 6.5.8.4. Rest of Europe Stick Packaging Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Stick Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.2. Asia Pacific Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.3. Asia Pacific Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.4. Asia Pacific Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Stick Packaging Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.1.2. China Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.1.3. China Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.1.4. China Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.2.2. S Korea Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.2.3. S Korea Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.2.4. S Korea Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.3.2. Japan Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.3.3. Japan Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.3.4. Japan Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.4.2. India Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.4.3. India Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.4.4. India Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.5.2. Australia Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.5.3. Australia Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.5.4. Australia Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.6.2. Indonesia Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.6.3. Indonesia Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.6.4. Indonesia Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.7.2. Malaysia Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.7.3. Malaysia Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.7.4. Malaysia Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.8.2. Philippines Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.8.3. Philippines Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.8.4. Philippines Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.9.2. Thailand Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.9.3. Thailand Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.9.4. Thailand Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.10.2. Vietnam Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.10.3. Vietnam Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.10.4. Vietnam Stick Packaging Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Stick Packaging Market Size and Forecast, By Filler (2024-2032) 7.5.11.3. Rest of Asia Pacific Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 7.5.11.4. Rest of Asia Pacific Stick Packaging Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Stick Packaging Market Size and Forecast (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.2. Middle East and Africa Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.3. Middle East and Africa Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.4. Middle East and Africa Stick Packaging Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Stick Packaging Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.5.1.2. South Africa Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.5.1.3. South Africa Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.5.1.4. South Africa Stick Packaging Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.5.2.2. GCC Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.5.2.3. GCC Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.5.2.4. GCC Stick Packaging Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.5.3.2. Egypt Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.5.3.3. Egypt Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.5.3.4. Egypt Stick Packaging Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.5.4.2. Nigeria Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.5.4.3. Nigeria Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.5.4.4. Nigeria Stick Packaging Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 8.5.5.2. Rest of ME&A Stick Packaging Market Size and Forecast, By Filler (2024-2032) 8.5.5.3. Rest of ME&A Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 8.5.5.4. Rest of ME&A Stick Packaging Market Size and Forecast, By Application (2024-2032) 9. South America Stick Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.2. South America Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.3. South America Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.4. South America Stick Packaging Market Size and Forecast, By Application (2024-2032) 9.5. South America Stick Packaging Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.5.1.2. Brazil Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.5.1.3. Brazil Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.5.1.4. Brazil Stick Packaging Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.5.2.2. Argentina Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.5.2.3. Argentina Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.5.2.4. Argentina Stick Packaging Market Size and Forecast, By Application (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.5.3.2. Colombia Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.5.3.3. Colombia Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.5.3.4. Colombia Stick Packaging Market Size and Forecast, By Application (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.5.4.2. Chile Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.5.4.3. Chile Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.5.4.4. Chile Stick Packaging Market Size and Forecast, By Application (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Stick Packaging Market Size and Forecast, By Material Type (2024-2032) 9.5.5.2. Rest Of South America Stick Packaging Market Size and Forecast, By Filler (2024-2032) 9.5.5.3. Rest Of South America Stick Packaging Market Size and Forecast, By Capacity (2024-2032) 9.5.5.4. Rest Of South America Stick Packaging Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. Bemis Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Berry Global Inc. (USA) 10.3. Pactiv Evergreen (USA) 10.4. Glenroy Inc. (USA) 10.5. Catalent, Inc. (USA) 10.6. ePac Holdings, LLC (USA) 10.7. Kimac Industries (USA) 10.8. CarePac (USA) 10.9. ProAmpac (USA) 10.10. Elitefill (USA) 10.11. Associated Labels & Packaging (Canada) 10.12. Polynova Industries Inc. (Canada) 10.13. Amcor Plc (Switzerland) 10.14. Constantia Flexibles (Austria) 10.15. Bosch Packaging Technology (Germany) 10.16. Smurfit Kappa Group (Ireland) 10.17. SIG Group (Switzerland) 10.18. Bobst Group (Switzerland) 10.19. Uflex Ltd. (India) 10.20. SCG Packaging Public Co. Ltd. (Thailand) 10.21. Toyochem Co., Ltd. (Japan) 10.22. Daibochi Berhad (Malaysia) 10.23. Jiangyin Zhongya Packaging Co., Ltd. (China) 10.24. Hotpack Global (UAE) 10.25. INDEVCO Group (Lebanon) 10.26. Nampak Ltd. (South Africa) 10.27. Klabin S.A. (Brazil) 10.28. Darnel Group (Colombia) 11. Key Findings 12. Industry Recommendations 13. Stick Packaging Market: Research Methodology