The Global Sports Betting Market was valued at USD 103.05 Billion in 2024 and is projected to reach USD 233.76 Billion by 2032, growing at a CAGR of 10.78%. The Global Sports Betting Market is expanding rapidly as digitalization, regulatory reforms, and advanced technologies reshape the industry. Top markets such as the United States, United Kingdom, Italy, Australia, and Canada are driving adoption due to strong legalization efforts and high online penetration. In the U.S., leading operators such as DraftKings, FanDuel, BetMGM, and Caesars Sportsbook continue to expand through state-level approvals. Europe remains a mature hub, with the UK and Italy generating consistent online sports wagering demand. Technology is a major growth catalyst. AI-powered odds engines, live in-play betting, blockchain-based transparency tools, and mobile betting apps are enhancing user experience. Real-time data partnerships with the NBA, NFL, UEFA, and major esports leagues are enabling more accurate betting models and improving engagement. The rise of fantasy sports, esports betting, and micro-betting platforms is attracting younger users, while retail sportsbooks in casinos are boosting commercial demand. SEO-driven keywords such as online sports betting, mobile wagering, legalized sports gambling, live betting, and sportsbook platforms continue to define market visibility and digital growth across major regions.To know about the Research Methodology :- Request Free Sample Report Expansion of Legalized Sports Gambling Driving Sports Betting Market Growth The expansion of legalized sports gambling is a major force accelerating the Sports Betting Market worldwide, unlocking new revenue streams for operators and governments. Countries such as Canada, Germany, the Netherlands, Australia, and Ireland have updated their gambling regulations, allowing licensed sportsbook operators to enter newly legalized markets. This shift has increased competition and boosted innovation in online sports betting, mobile betting apps, AI-driven odds, and live in-play betting, strengthening market growth. Real-time examples include major operators such as Betway, DraftKings, FanDuel, and Bet365, which have rapidly expanded their cross-border offerings following regulatory approval. In the U.S. Sports Betting Market, the repeal of PASPA in 2018 enabled states to legalize sports betting individually. Currently, 36 states have legalized sports betting, and 30 have fully operational markets. States like New Jersey and New York report record betting handles, reflecting how legalization drives tax revenue and digital wagering adoption. In the UK, the rise of eSports betting during the pandemic highlighted the shift toward digital engagement. The UK Gambling Commission’s 2024 regulatory updates strengthened consumer protection but maintained steady market growth, supported by high smartphone penetration and trusted regulated operators. Top Sports Betting Apps Worldwide

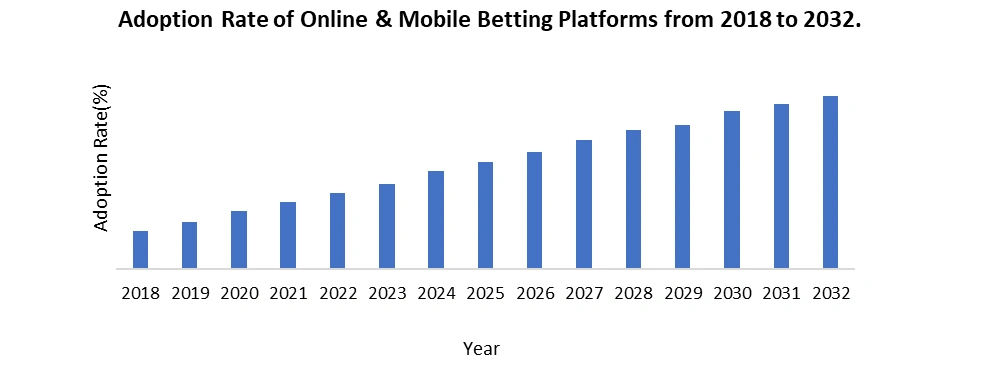

Strict Regulatory & Licensing Barriers limits the growth of Sports Betting Market Strict regulatory and licensing barriers remain one of the biggest restraints for the Sports Betting Market, limiting expansion in both mature and emerging regions. Countries follow different legal frameworks, creating uncertainty for operators. For example, in the United States, each state has its own licensing structure. States such as New York and Pennsylvania charge high licensing fees and apply heavy tax rates New York’s 51% tax on online betting revenue significantly reduces operator margins, discouraging smaller sportsbooks from entering the market. In India, sports betting is still largely restricted, with only a few states exploring regulation. This unclear legal environment pushes consumers toward offshore and illegal betting platforms, slowing the growth of authorized operators. Similarly, in Germany, the 2021 Interstate Gambling Treaty introduced tough compliance rules, strict advertising limits, and monthly deposit caps of USD 1,000, making it difficult for operators to scale and acquire customers. These regulatory complexities increase operational costs, reduce competition, and delay product launches. The market growth weakens despite rising demand. Stronger transparency, uniform licensing rules, and balanced taxation are essential to unlock the full potential of the global sports betting industry and improve market accessibility. Rapid Growth of Online & Mobile Betting Platforms creates lucrative growth opportunities to the market The rapid growth of online and mobile betting platforms is creating major opportunities in the sports betting market, driven by widespread smartphone adoption, secure digital payment systems, and the convenience of app-based betting. Online sportsbooks such as Bet365, Flutter Entertainment, DraftKings, and 888 Holdings are transforming user engagement through in-play betting, live analytics, personalized odds, and AI-powered recommendations. These features boost user interaction, increase betting frequency, and attract younger, tech-savvy audiences. High-speed internet, mobile wallets, and cryptocurrency payments strengthen trust and enable smooth, fast transactions, making mobile betting the preferred choice for modern bettors. Expanding legalization across North America, Europe, and parts of Asia further accelerates online betting adoption, giving operators wider access to regulated users. Mobile sports betting is also gaining popularity due to real-time wagering, live video streams, and interactive odds that enhance the overall betting experience. Millennials and Gen Z are emerging as key contributors, with rising participation driven by esports betting and mobile-first platforms. Overall, convenience, accessibility, and advanced digital features position mobile betting as the fastest-growing opportunity in the global sports gambling industry.

App Name Region / Key Markets Key Features Bet365 Global (especially Europe, UK, Australia) Very wide range of sports, in-play/live betting, strong liquidity, trusted brand. FanDuel United States High in-game/live betting performance, mobile-first UI, strong brand reach. DraftKings United States, some international presence Large user base, strong marketing, combined fantasy + sportsbook model. BetMGM United States Casino + sportsbook integration, loyalty through MGM ecosystem. WynnBET United States Premium branding, reliability, casino-sports blend.

Sports Betting Market Segment Analysis

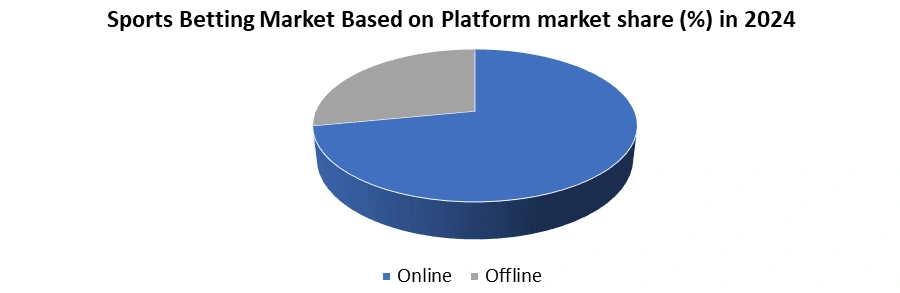

Based on Platform, The Sports Betting Market is segmented into Online and Offline. The Online segment dominated the Sports Betting platform segment in 2024. Due to rapid digital adoption, smartphone penetration, and the widespread use of mobile apps. Users increasingly prefer placing bets through online platforms because they offer convenience, instant access, and advanced features such as in-play betting, live streaming, and AI-driven odds. For example, leading operators Such as Bet365, DraftKings, FanDuel, and Flutter Entertainment reported record user activity on their apps during major events like the FIFA World Cup, IPL, and the NFL season. Online betting also grew quickly because of secure digital payments, including mobile wallets, UPI, and cryptocurrencies, which improved user trust. In regions like the U.S. and Europe, regulatory changes further boosted the online segment. States such as New Jersey and Colorado saw the majority of bets placed through mobile apps rather than physical sportsbooks. The appeal of interactive features, personalized recommendations, and 24/7 accessibility solidified the dominance of the online segment, making it the fastest-growing platform in the global sports betting industry.

Sports Betting Market Regional Analysis

North America dominated the Sports Betting Market in year 2024. Due to rapid legalization, strong digital adoption, and massive investments by leading operators. After the 2018 PASPA repeal, states such as New Jersey, Pennsylvania, and Nevada quickly established billion-dollar betting ecosystems. New York became the world’s largest regulated market, crossing USD 2 billion in monthly handle shortly after launch. This regulatory expansion boosted the overall North America Sports Betting Market and attracted major brands such as DraftKings, FanDuel, BetMGM, and Caesars. High smartphone usage, widespread 5G penetration, and the popularity of online and mobile betting further accelerated growth. Over 85% of sports bets in New Jersey and Pennsylvania come from mobile platforms, strengthening the region’s leadership. Strong partnerships between leading sportsbooks and major leagues such as the NFL, NBA, MLB, and NHL elevated trust and engagement. Additionally, record-high tax revenues over USD 5 billion in the U.S. alone encouraged more states to legalize sports betting, making North America the fastest-growing and most competitive sports wagering market globally.Sports Betting Market: Competitive Landscape

The Sports Betting Market is highly competitive, driven by rapid digital adoption, expanding legalization, and aggressive market entry strategies. Leading global sportsbook operators such as FanDuel, DraftKings, BetMGM, Caesars Sportsbook, 888 Holdings, Flutter Entertainment, and Bet365 are intensifying competition through innovative online sports betting platforms, advanced analytics, and real-time odds technology. In the North America sports betting market, FanDuel and DraftKings dominate with strong brand visibility, exclusive league partnerships, and superior mobile interfaces. Across Europe and Asia-Pacific, operators like Entain, William Hill, Betsson, and Kindred Group are strengthening their presence through acquisitions, localized content, and diversified sports wagering services. Competitive momentum is further amplified by live betting, AI-powered personalization, and integrated casino-sportsbook platforms. As more states and countries legalize online wagering, operators are investing heavily in marketing, celebrity endorsements, and responsible gaming tools to capture market share. Intense rivalry, technological innovation, and regulatory expansion continue to shape the global sports betting industry.Sports Betting Market: Recent Development

1. In June 2024, Betsson AB strengthened its position in the Latin America sports betting market by securing new licenses in Peru for its Betsafe and Betsson brands. The operator also revealed plans to obtain additional Inkabet licenses, expanding its footprint in a region where it already maintains active operations in Argentina and Colombia. This strategic move supports Betsson’s broader goal of leading the online sports betting industry in Latin America. 2. In March 2024, Bally’s Corporation enhanced its influence in the U.S. iGaming industry by launching a fully integrated online gaming platform in Rhode Island. The platform offers a wide catalogue of digital casino games accessible via desktop and iOS apps, further supported by a partnership with Stakelogic to deliver high-quality live casino experiences. 3. In September 2024, Flutter Entertainment expanded aggressively in Brazil by acquiring a 56% stake in NSX Group, operator of Betnacional, for approximately $350 million. With Brazil expected to finalize full sports betting regulation by early 2025, Flutter plans to merge Betnacional with its Betfair Brazil brand, mirroring its successful U.S. strategy to capture leadership in the rapidly growing Brazil sports wagering market.Global Sports Betting Market Scope: Inquire before buying

Global Sports Betting Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 103.05 Bn. Forecast Period 2025 to 2032 CAGR: 10.78% Market Size in 2032: USD 233.76 Bn. Segments Covered: by Platform Online Offline by Betting Type Fixed Odds Wagering Exchange Betting Live/In-Play Betting eSports Betting Others by Sports Type Football Basketball Baseball Horse Racing Cricket Hockey Others Global Sports Betting Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sports Betting Key Players

1. Betson AB 2. Flutter Entertainment PLC 3. DraftKings Co., Ltd. 4. Kindred Group PLC 5. 1XBET 6. 22BET 7. Sports Pesa 8. FORTUNA ENTERTAINMENT GROUP 9. LAS VEGAS SANDS CORPORATION (U.S.), 10. Entain (U.K.), 11. MGM Resorts International 12. Wynn Resorts Holdings LLC. 13. NOVIBET (Greece) 14. Galaxy Entertainment Group Limited 15. Resorts World at Sentosa Pte. Ltd. 16. Sun International 17. RTSmunity a.s. 18. Sky Infotech 19. Peermont Global Proprietary Limited 20. SJM Holdings Limited 21. Sportradar AG 22. FanUp Inc. 23. Rivalry Ltd. 24. EveryMatrixFrequently Asked Questions:

1. What are the growth drivers for the Sports Betting market? Ans. The legalization of sports betting in various regions, technological advancements, increased sports events and viewership, mobile betting apps, and a growing inclination toward online gambling are expected to be the major drivers for the Sports Betting market. 2. What are the factors restraining the global Sports Betting market growth during the forecast period? Ans. legal complexities, the risk of gambling addiction, concerns over match-fixings are expected to be the major factors restraining the global Sports Betting market growth during the forecast period. 3. Which region is expected to lead the global Sports Betting market during the forecast period? Ans. North America is expected to lead the global Sports Betting market during the forecast period. 4. What was the Global Sports Betting Market size in 2024? Ans: The Global Sports Betting Market size was USD 103.05 Billion in 2024. 5. What segments are covered in the Sports Betting Market report? Ans. The segments covered in the Sports Betting market report are Platform, Game Type, Betting Type, and Region.

1. Sports Betting Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Sports Betting Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Sports Betting Market: Dynamics 3.1. Sports Betting Market Trends 3.2. Sports Betting Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Sports Betting Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Sports Betting Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Sports Betting Market Size and Forecast, By Platform (2024-2032) 4.1.1. Online 4.1.2. Offline 4.2. Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 4.2.1. Fixed Odds Wagering 4.2.2. Exchange Betting 4.2.3. Live/In-Play Betting 4.2.4. eSports Betting 4.2.5. Others 4.3. Sports Betting Market Size and Forecast, By End-User (2024-2032) 4.3.1. Football 4.3.2. Basketball 4.3.3. Baseball 4.3.4. Horse Racing 4.3.5. Cricket 4.3.6. Hockey 4.3.7. Others 4.4. Sports Betting Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Sports Betting Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Sports Betting Market Size and Forecast, By Platform (2024-2032) 5.1.1. Online 5.1.2. Offline 5.2. North America Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 5.2.1. Fixed Odds Wagering 5.2.2. Exchange Betting 5.2.3. Live/In-Play Betting 5.2.4. eSports Betting 5.2.5. Others 5.3. North America Sports Betting Market Size and Forecast, By End-User (2024-2032) 5.3.1. Football 5.3.2. Basketball 5.3.3. Baseball 5.3.4. Horse Racing 5.3.5. Cricket 5.3.6. Hockey 5.3.7. Others 5.4. North America Sports Betting Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Sports Betting Market Size and Forecast, By Platform (2024-2032) 5.4.1.2. United States Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 5.4.1.3. United States Sports Betting Market Size and Forecast, By End-User (2024-2032) 5.4.2. Canada 5.4.2.1. Canada Sports Betting Market Size and Forecast, By Platform (2024-2032) 5.4.2.2. Canada Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 5.4.2.3. Canada Sports Betting Market Size and Forecast, By End-User (2024-2032) 5.4.3. Mexico 5.4.3.1. Mexico Sports Betting Market Size and Forecast, By Platform (2024-2032) 5.4.3.2. Mexico Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 5.4.3.3. Mexico Sports Betting Market Size and Forecast, By End-User (2024-2032) 6. Europe Sports Betting Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Sports Betting Market Size and Forecast, By Platform (2024-2032) 6.2. Europe Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 6.3. Europe Sports Betting Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Sports Betting Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Sports Betting Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Sports Betting Market Size and Forecast, By Platform (2024-2032) 7.2. Asia Pacific Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 7.3. Asia Pacific Sports Betting Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Sports Betting Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Sports Betting Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Sports Betting Market Size and Forecast, By Platform (2024-2032) 8.2. Middle East and Africa Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 8.3. Middle East and Africa Sports Betting Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Sports Betting Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Sports Betting Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Sports Betting Market Size and Forecast, By Platform (2024-2032) 9.2. South America Sports Betting Market Size and Forecast, By Betting Type (2024-2032) 9.3. South America Sports Betting Market Size and Forecast, By End-User (2024-2032) 9.4. South America Sports Betting Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Betson AB 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Flutter Entertainment PLC 10.3. DraftKings Co., Ltd. 10.4. Kindred Group PLC 10.5. 1XBET 10.6. 22BET 10.7. Sports Pesa 10.8. Fortuna Entertainment Group 10.9. Las Vegas Sands Corporation (U.S.), 10.10. Entain (U.K.), 10.11. MGM Resorts International 10.12. Wynn Resorts Holdings LLC. 10.13. NOVIBET (Greece) 10.14. Galaxy Entertainment Group Limited 10.15. Resorts World at Sentosa Pte. Ltd. 10.16. Sun International 10.17. RTSmunity a.s. 10.18. Sky Infotech 10.19. Peermont Global Proprietary Limited 10.20. SJM Holdings Limited 10.21. Sportradar AG 10.22. FanUp Inc. 10.23. Rivalry Ltd. 10.24. EveryMatrix 11. Key Findings 12. Analyst Recommendations 13. Sports Betting Market – Research Methodology