Solder Paste Market was valued at USD 730.87 Mn in 2023 and is expected to reach USD 798.37 Mn by 2030, at a CAGR of 1.27 percent during the forecast period.Solder Paste Market Overview

Solder paste is a material used in the electronics industry for attaching and soldering electronic components to printed circuit boards (PCBs). It is a mixture of tiny solder particles and flux, which is a chemical cleaning agent. The primary purpose of solder paste is to provide a convenient way to apply a controlled amount of solder to specific areas on a PCB before the components are placed. Solder paste contains very small particles of solder alloy, typically a mixture of tin and lead or other lead-free alloys. These particles have a specific size distribution, allowing for precise control over the amount of solder applied during the soldering process. Due to environmental concerns, there is a growing trend towards lead-free solder pastes. Lead-free solder alloys, typically based on tin, silver, and copper, are used as alternatives to traditional tin-lead solder. Lead-free solder pastes comply with various environmental regulations.To know about the Research Methodology :- Request Free Sample Report The solder paste market is influenced by the growth in the electronics industry, particularly the demand for electronic devices such as smartphones, laptops, consumer electronics, and automotive electronics. With a focus on environmental regulations and consumer safety, there is a growing trend toward lead-free solder paste formulations. Solder Paste manufacturers are developing and offering lead-free alternatives that comply with global regulations. The Asia-Pacific region, especially countries like China, Japan, South Korea, and Taiwan, has a dominant presence in the global solder paste market. This is attributed to the significant electronics manufacturing activities in the region.

Solder Paste Market Dynamics

Adoption of Surface-Mount Technology (SMT) to boost the Solder Paste Market growth The widespread adoption of Surface-Mount Technology (SMT) in electronic manufacturing processes is a key driver. SMT allows for the assembly of components directly onto the surface of PCBs, requiring solder paste for effective and efficient soldering. The trend toward miniaturization of electronic components and devices necessitates precise and controlled soldering processes. Solder paste is crucial in achieving fine pitch components and addressing the challenges associated with miniaturization. Ongoing technological advancements in solder paste formulations contribute to improved performance, reliability, and environmental sustainability. Innovations in solder powder particle size, flux formulations, and lead-free alternatives drive Solder Paste Market growth. Regulatory initiatives, such as RoHS (Restriction of Hazardous Substances), have led to increased adoption of lead-free solder paste formulations. Solder Paste Manufacturers and end-users prioritize environmentally friendly options to comply with global regulations. The Asia-Pacific region, particularly countries like China, Japan, South Korea, and Taiwan, is a hub for electronics manufacturing. The expansion of manufacturing activities in this region contributes significantly to the demand for solder paste, which significantly boosts the Solder Paste Market growth. The automotive industry's increasing reliance on electronic components and systems, including advanced driver-assistance systems (ADAS) and in-vehicle infotainment, fuels the demand for solder paste in automotive electronics manufacturing. The growth of renewable energy technologies, such as solar panels and wind turbines, involves the use of electronic components and PCBs. This, in turn, drives the demand for solder paste in the manufacturing of renewable energy devices. The expansion of global connectivity and the increasing adoption of IoT devices contribute to the demand for solder paste. These interconnected devices often require compact and reliable electronic components, driving the need for effective soldering solutions. Environmental Regulations and Lead-Free Transition to restrain Solder Paste Market growth Compliance with environmental regulations, particularly the transition to lead-free solder paste formulations, poses a challenge. While lead-free alternatives are more environmentally friendly, the transition requires adjustments in manufacturing processes and involve higher costs. The solder paste market is susceptible to supply chain disruptions. Events such as natural disasters, geopolitical tensions, and global crises (e.g., the COVID-19 pandemic) impact the availability of raw materials and logistics, affecting market stability. As electronic components continue to shrink in size, soldering smaller and more complex structures becomes technically challenging. Achieving precise soldering in fine-pitch components and addressing issues related to miniaturization is a restraint for some applications. Transitioning to lead-free solder paste formulations involves higher initial costs for Solder Paste manufacturers. Investments in new equipment, training, and research and development significant barriers for companies, particularly smaller ones. The energy-intensive nature of some solder paste manufacturing processes, especially in reflow soldering, poses environmental concerns. Energy consumption and associated carbon emissions is restraint, especially in regions with a strong emphasis on sustainability. The solder paste market is influenced by the prices of raw materials, such as metals and flux components. Volatility in raw material prices affect manufacturing costs and profit margins for both producers and end-users.Solder Paste Market Segment Analysis

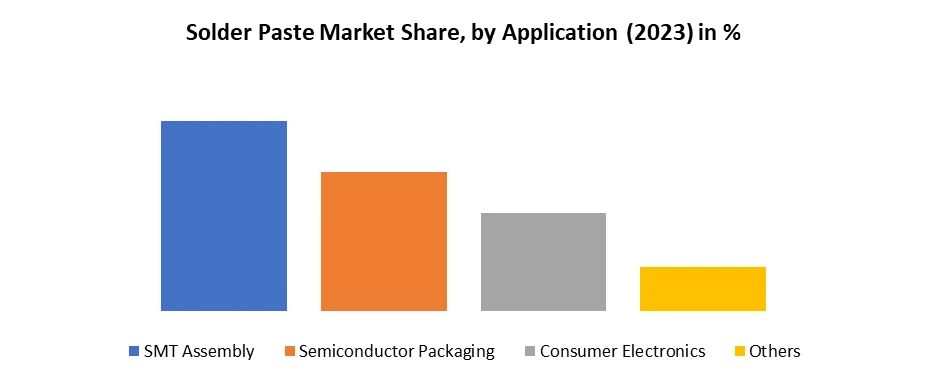

Based on Product, the market is segmented into Rosin Based Pastes, Water Soluble Pastes, and No-Clean Pastes. Rosin based pastes segment dominated the market in 2023 and is expected to hold the largest Solder Paste Market share over the forecast period. Rosin-based solder pastes are solder paste formulation that incorporates rosin as a key component in the flux. Rosin, derived from pine resin, is a natural material known for its excellent fluxing properties. The use of rosin in solder paste formulations provides several advantages in electronic soldering applications, which significantly boost the Solder Paste Market. Rosin-based solder pastes contain rosin as the primary fluxing agent. The flux plays a crucial role in the soldering process by removing oxides from metal surfaces, promoting wetting, and facilitating the formation of reliable solder joints. There are different types of rosin, and the choice of rosin type impact the performance of the solder paste. Common types include WW (Windowed White), WG (Windowed Gum), and others, each with specific characteristics that suit different applications. Rosin-based solder pastes are known for producing aesthetically pleasing solder joints with a shiny appearance. This visual quality is often desirable in electronic assemblies. Based on Application, the market is segmented into SMT Assembly and Semiconductor Packaging. SMT Assembly dominated the market in 2023 and is expected to hold the largest Solder Paste Market share over the forecast period. Surface Mount Technology (SMT) assembly is a key segment in the solder paste market, representing a significant portion of the electronics manufacturing process. SMT assembly is a method used for populating printed circuit boards (PCBs) with electronic components. Surface Mount Technology is a widely adopted method for assembling electronic components onto the surface of a PCB. Unlike through-hole technology, where component leads are inserted into holes on the PCB, SMT involves attaching components directly to the surface. Solder paste is a crucial material in the SMT assembly process. It acts as both an adhesive and a conductive medium, holding the SMDs in place on the PCB and forming reliable electrical connections between the component leads and the PCB pads, which boosts the Solder Paste Market growth.

Solder Paste Market Regional Insight

Dominance in Electronics Manufacturing to boost the Asia Pacific solder Paste Market growth The Asia-Pacific region, particularly countries such as China, Japan, South Korea, and Taiwan, is a global hub for electronics manufacturing. The robust growth of the electronics industry in the region significantly drives the demand for solder paste. The widespread adoption of Surface Mount Technology (SMT) in electronic manufacturing processes is observed in the Asia-Pacific region. SMT assembly, which heavily relies on solder paste, allows for the production of compact and high-density electronic devices. The rising demand for consumer electronics, including smartphones, laptops, and other gadgets, fuels the growth of the solder paste market. Asia-Pacific countries are major contributors to the production and consumption of consumer electronic devices. Rapid industrialization in emerging economies within the Asia-Pacific region, such as India, Vietnam, and Indonesia, results in increased production of electronic components and devices, boosting the overall demand for solder paste. The presence of major electronics manufacturers, both local and international, in countries such as China and Japan, enhances the demand for solder paste, which boosts the Solder Paste Market growth. These manufacturers often operate large-scale production facilities. Innovation and Technology Adoption to boost the North America Solder Paste Market growth North America has a strong focus on innovation and technology adoption. The region is often at the forefront of adopting new manufacturing technologies, including those related to soldering processes. This drive for innovation contributes to the development and adoption of advanced solder paste formulations. North America has a significant aerospace and defense industry, with major players in the United States. The manufacturing of electronic components for aerospace applications requires high-reliability soldering, leading to a demand for specialized solder paste formulations. The growth in this sector positively impacts the solder paste market. North America has a well-established and diverse electronics manufacturing ecosystem. The region is home to a wide range of industries, including telecommunications, medical devices, automotive electronics, and more. This diversity contributes to a sustained demand for solder paste across various applications, which is expected to boost the North America Solder Paste Market growth.Solder Paste Market Scope : Inquire before buying

Global Solder Paste Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 730.87 Mn. Forecast Period 2024 to 2030 CAGR: 1.27% Market Size in 2030: US $ 798.37 Mn. Segments Covered: by Product Rosin Based Pastes Water Soluble Pastes No-Clean Pastes by Application SMT Assembly Semiconductor Packaging Consumer Electronics Others Solder Paste Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solder Paste Manufacturers:

Global: 1. Nordson Corporation (Westlake, Ohio, USA) 2. Henkel AG & Co. KGaA (Germany) 3. KOKI Company Limited (Japan) 4. Nihon Almit Co., Ltd. (Japan) 5. Amtech (Alpha Assembly Solutions) (United Europe: 1. Almit GmbH (Asselbrunn, Hessen) 2. NeVo GmbH (Germany) 3. Balver Zinn Josef Jost GmbH & Co. KG (Germany) 4. Heraeus Holding GmbH (Germany) North America: 1. Indium Corporation (Clinton, NY, USA) 2. FCTA Mexico (Las Pintas, Jalisco, Mexico) 3. AIM Metals & Alloys LP (Montreal, QC Canada) 4. Kester (United States) 5. Solder Paste Plus (United States) 6. FCT Assembly (United States) Asia Pacific: 1. Senju Metal Industry Co., Ltd. (Tokyo, Japan) 2. Shenzhen Fitech Co., Ltd. (Shenzhen, China) 3. Alpha Assembly Solutions (Singapore) South America: 1. Marsma Solder Products (Brazil) 2. Metales Vela S.A. de C.V. (Mexico) 3. SOLDAMATIC S.A. (Argentina) Frequently Asked Questions: 1. What is solder paste, and how is it used in the electronics industry? Ans: Solder paste is a material used in the electronics industry for attaching and soldering electronic components to printed circuit boards (PCBs). It is a mixture of tiny solder particles and flux, which is a chemical cleaning agent. Solder paste provides a convenient way to apply a controlled amount of solder to specific areas on a PCB before the components are placed. 2. What is the composition of solder paste, and why is there a trend towards lead-free formulations? Ans: Solder paste contains very small particles of solder alloy, typically a mixture of tin and lead or other lead-free alloys. Due to environmental concerns, there is a growing trend towards lead-free solder pastes. Lead-free solder alloys, typically based on tin, silver, and copper, are used as alternatives to traditional tin-lead solder, complying with various environmental regulations. 3. Why is the Asia-Pacific region dominant in the global solder paste market? Ans: The Asia-Pacific region, including countries like China, Japan, South Korea, and Taiwan, is a global hub for electronics manufacturing. The robust growth of the electronics industry in this region drives substantial demand for solder paste. The adoption of Surface Mount Technology (SMT) and the rising demand for consumer electronics contribute to the region's dominance. 4. What challenges does the solder paste market face in terms of environmental regulations and lead-free transition? Ans: Compliance with environmental regulations, particularly the transition to lead-free solder paste formulations, poses challenges. While lead-free alternatives are more environmentally friendly, the transition requires adjustments in manufacturing processes and involves higher costs. 5. What are the restraints for the solder paste market in terms of miniaturization and lead-free transition? Ans: Achieving precise soldering in fine-pitch components and addressing challenges related to miniaturization is a restraint for some applications. Transitioning to lead-free solder paste formulations involves higher initial costs for manufacturers, including investments in new equipment, training, and research and development.

1. Solder Paste Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solder Paste Market: Dynamics 2.1. Solder Paste Market Trends by Region 2.1.1. North America Solder Paste Market Trends 2.1.2. Europe Solder Paste Market Trends 2.1.3. Asia Pacific Solder Paste Market Trends 2.1.4. Middle East and Africa Solder Paste Market Trends 2.1.5. South America Solder Paste Market Trends 2.2. Solder Paste Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Solder Paste Market Drivers 2.2.1.2. North America Solder Paste Market Restraints 2.2.1.3. North America Solder Paste Market Opportunities 2.2.1.4. North America Solder Paste Market Challenges 2.2.2. Europe 2.2.2.1. Europe Solder Paste Market Drivers 2.2.2.2. Europe Solder Paste Market Restraints 2.2.2.3. Europe Solder Paste Market Opportunities 2.2.2.4. Europe Solder Paste Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Solder Paste Market Drivers 2.2.3.2. Asia Pacific Solder Paste Market Restraints 2.2.3.3. Asia Pacific Solder Paste Market Opportunities 2.2.3.4. Asia Pacific Solder Paste Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Solder Paste Market Drivers 2.2.4.2. Middle East and Africa Solder Paste Market Restraints 2.2.4.3. Middle East and Africa Solder Paste Market Opportunities 2.2.4.4. Middle East and Africa Solder Paste Market Challenges 2.2.5. South America 2.2.5.1. South America Solder Paste Market Drivers 2.2.5.2. South America Solder Paste Market Restraints 2.2.5.3. South America Solder Paste Market Opportunities 2.2.5.4. South America Solder Paste Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Solder Paste Industry 2.8. Analysis of Government Schemes and Initiatives For Solder Paste Industry 2.9. The Global Pandemic Impact on Solder Paste Market 3. Solder Paste Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Solder Paste Market Size and Forecast, by Product (2023-2030) 3.1.1. Rosin Based Pastes 3.1.2. Water Soluble Pastes 3.1.3. No-Clean Pastes 3.2. Solder Paste Market Size and Forecast, by Application (2023-2030) 3.2.1. SMT Assembly 3.2.2. Semiconductor Packaging 3.3. Solder Paste Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Solder Paste Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Solder Paste Market Size and Forecast, by Product (2023-2030) 4.1.1. Rosin Based Pastes 4.1.2. Water Soluble Pastes 4.1.3. No-Clean Pastes 4.2. North America Solder Paste Market Size and Forecast, by Application (2023-2030) 4.2.1. SMT Assembly 4.2.2. Semiconductor Packaging 4.3. North America Solder Paste Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Solder Paste Market Size and Forecast, by Product (2023-2030) 4.3.1.1.1. Rosin Based Pastes 4.3.1.1.2. Water Soluble Pastes 4.3.1.1.3. No-Clean Pastes 4.3.1.2. United States Solder Paste Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. SMT Assembly 4.3.1.2.2. Semiconductor Packaging 4.3.2. Canada 4.3.2.1. Canada Solder Paste Market Size and Forecast, by Product (2023-2030) 4.3.2.1.1. Rosin Based Pastes 4.3.2.1.2. Water Soluble Pastes 4.3.2.1.3. No-Clean Pastes 4.3.2.2. Canada Solder Paste Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. SMT Assembly 4.3.2.2.2. Semiconductor Packaging 4.3.3. Mexico 4.3.3.1. Mexico Solder Paste Market Size and Forecast, by Product (2023-2030) 4.3.3.1.1. Rosin Based Pastes 4.3.3.1.2. Water Soluble Pastes 4.3.3.1.3. No-Clean Pastes 4.3.3.2. Mexico Solder Paste Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. SMT Assembly 4.3.3.2.2. Semiconductor Packaging 5. Europe Solder Paste Market Size and Forecast by Segmentation (by Value in USD Millin) (2023-2030) 5.1. Europe Solder Paste Market Size and Forecast, by Product (2023-2030) 5.2. Europe Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3. Europe Solder Paste Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.1.2. United Kingdom Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.2.2. France Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.3.2. Germany Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.4.2. Italy Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.5.2. Spain Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.6.2. Sweden Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.7.2. Austria Solder Paste Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Solder Paste Market Size and Forecast, by Product (2023-2030) 5.3.8.2. Rest of Europe Solder Paste Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Solder Paste Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Solder Paste Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Solder Paste Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.1.2. China Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.2.2. S Korea Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.3.2. Japan Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.4.2. India Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.5.2. Australia Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.6.2. Indonesia Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.7.2. Malaysia Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.8.2. Vietnam Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.9.2. Taiwan Solder Paste Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Solder Paste Market Size and Forecast, by Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Solder Paste Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Solder Paste Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Solder Paste Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Solder Paste Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Solder Paste Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Solder Paste Market Size and Forecast, by Product (2023-2030) 7.3.1.2. South Africa Solder Paste Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Solder Paste Market Size and Forecast, by Product (2023-2030) 7.3.2.2. GCC Solder Paste Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Solder Paste Market Size and Forecast, by Product (2023-2030) 7.3.3.2. Nigeria Solder Paste Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Solder Paste Market Size and Forecast, by Product (2023-2030) 7.3.4.2. Rest of ME&A Solder Paste Market Size and Forecast, by Application (2023-2030) 8. South America Solder Paste Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Solder Paste Market Size and Forecast, by Product (2023-2030) 8.2. South America Solder Paste Market Size and Forecast, by Application (2023-2030) 8.3. South America Solder Paste Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Solder Paste Market Size and Forecast, by Product (2023-2030) 8.3.1.2. Brazil Solder Paste Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Solder Paste Market Size and Forecast, by Product (2023-2030) 8.3.2.2. Argentina Solder Paste Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Solder Paste Market Size and Forecast, by Product (2023-2030) 8.3.3.2. Rest Of South America Solder Paste Market Size and Forecast, by Application (2023-2030) 9. Global Solder Paste Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Solder Paste Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nordson Corporation (Westlake, Ohio, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Henkel AG & Co. KGaA (Germany) 10.3. KOKI Company Limited (Japan) 10.4. Nihon Almit Co., Ltd. (Japan) 10.5. Amtech (Alpha Assembly Solutions) (United 10.6. Almit GmbH (Asselbrunn, Hessen) 10.7. NeVo GmbH (Germany) 10.8. Balver Zinn Josef Jost GmbH & Co. KG (Germany) 10.9. Heraeus Holding GmbH (Germany) 10.10. Indium Corporation (Clinton, NY, USA) 10.11. FCTA Mexico (Las Pintas, Jalisco, Mexico) 10.12. AIM Metals & Alloys LP (Montreal, QC Canada) 10.13. Kester (United States) 10.14. Solder Paste Plus (United States) 10.15. FCT Assembly (United States) 10.16. Senju Metal Industry Co., Ltd. (Tokyo, Japan) 10.17. Shenzhen Fitech Co., Ltd. (Shenzhen, China) 10.18. Alpha Assembly Solutions (Singapore) 10.19. Marsma Solder Products (Brazil) 10.20. Metales Vela S.A. de C.V. (Mexico) 10.21. SOLDAMATIC S.A. (Argentina) 11. Key Findings 12. Industry Recommendations 13. Solder Paste Market: Research Methodology 14. Terms and Glossary