Global Solar Power Equipment Market size was valued at USD 159.41 Bn in 2024 and the total Global Solar Power Equipment Market revenue is expected to grow at a CAGR of 10.8% from 2025 to 2032, reaching nearly USD 362.10 Bn by 2032.Global Solar Power Equipment Market Overview

Global solar power equipment market includes a range of technologies and devices essential for harnessing solar energy, including solar panels, inverters, batteries, mounting systems, and tracking devices. Increased demand for renewable energy sources, government encouragement to adopt clean energy and a global trend towards pure-zero carbon emissions are expected to experience a strong growth in the market. The growth of the solar power equipment market is driven by decreasing costs of photovoltaic (PV) technology, growing grid integration, and increasing deployment of off-grid solar solutions in remote areas. Moreover, advancements in solar storage systems and smart inverters are increasing efficiency and reliability, further accelerating adoption. Regulatory support, including tax credits, feed-in tariffs, and green energy mandates, is encouraging investments in solar infrastructure. Asia Pacific led the global market in 2024, fueled by large-scale solar projects, aggressive renewable targets, and supportive policies in countries like China, India, Japan, and South Korea. China, in particular, dominates the global supply chain of solar modules and related equipment. Top key players such as Trina Solar, First Solar, JA Solar, and SMA Solar Technology AG compete on parameters like technology efficiency, cost optimization, manufacturing scale, and global distribution. These companies are increasingly investing in automation, vertical integration, and next-generation solar technologies such as perovskite cells and bifacial modules to maintain competitive advantage. The report offers comprehensive insights into market dynamics, segment performance, and the competitive landscape. It evaluates key manufacturers based on equipment type, installation mode, end-user segments, and regional presence, providing a detailed forecast of the global solar power equipment market’s growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report The push towards renewable energy sources is driven by the need to manage and reduce current levels of carbon dioxide emissions while also preparing for future demands and potential environmental impacts. This has led to enhanced focus and stringent measures aimed at expanding the deployment of renewable energy sources like solar and wind power. The solar power equipment market is poised for significant growth as it responds to the dual demands of environmental sustainability and energy cost reduction, ensuring it remains at the forefront of the transition towards a greener, more sustainable energy landscape.

Global Solar Power Equipment Market Dynamics

Growing environmental awareness fuels demand for solar power equipment as shift from fossil fuels accelerates.

The growing awareness of the environmental impacts caused by conventional fossil fuels such as increased greenhouse gas emissions and air pollution has significantly driven the solar power equipment market as the public and policymakers push for cleaner, renewable energy alternatives. Technological advancements have made solar energy more cost-effective, while governments worldwide, through initiatives like the EU's increased renewable targets and the U.S.'s Inflation Reduction Act, are bolstering the market with economic incentives. Additionally, corporate commitments by major companies like Google and Amazon to operate entirely on renewable energy, along with a surge in consumer demand for sustainable energy solutions, are propelling the adoption of solar technology. These factors collectively underscore a dynamic shift towards solar energy, fuelled by both environmental concerns and economic opportunities. This multifaceted drive is propelling the solar power equipment market forward, offering both environmental benefits and economic opportunities, and signalling a transformative shift in how energy is produced and consumed worldwide.Global climate commitments and sustainability goals propel adoption of solar power systems

The commitment to combat climate change, as highlighted in the United Nations' Sustainable Development Goal 13 (SDG 13), is a major driver for the Solar Power Equipment industry. SDG 13 promotes urgent measures against climate change, which facilitates the adoption of renewable energy like solar power to reduce environmental impacts and carbon emissions. A key manifestation of this commitment is the European Green Deal, which sets ambitious targets for renewable energy and energy efficiency to make Europe climate-neutral by 2050. This deal supports solar energy through increased funding, subsidies for technological innovation, and streamlined regulatory processes, thereby stimulating investment and lowering costs in the solar sector. The result has been a significant increase in solar installations in European countries such as Germany, Spain, and France, aligning with a broader trend of shifting investments from fossil fuels to renewable energy sources. These policy initiatives are reshaping the energy market, aligning it with sustainability goals and accelerating the adoption of solar power, with ongoing impacts expected to deepen the role of solar energy in achieving a sustainable and resilient global energy future.Government incentives, including tax credits and subsidies, significantly boost the adoption of solar power equipment market globally

Government initiatives around the world are crucial in enhancing the adoption of solar power, contributing significantly to the growth of the solar equipment market. These initiatives typically manifest as financial incentives designed to reduce the financial burden for both residential and commercial entities interested in adopting solar energy. These incentives include tax rebates, grants, and subsidies, which collectively make the installation of solar power systems more economical and enhance the potential return on investment. A prime example of such incentives is the United States' federal solar tax credit, also known as the Investment Tax Credit (ITC). This policy allows individuals and businesses to deduct 26% of the cost of installing a solar energy system from their federal taxes. This deduction significantly lowers the initial cost of solar installations, thereby making solar energy more accessible and economically appealing. The ITC has been a pivotal factor in the expansion of the U.S. solar market, facilitating a widespread increase in solar system installations across the nation.Schemes in India

These global initiatives are fundamental in moving the world towards renewable energy adoption. They not only promote environmental sustainability but also foster economic growth by creating a robust market for solar technologies. Thus, governmental policies play a major role in driving the adoption of solar energy, underscoring the impact of strategic policy support on technological adoption and market development in the renewable energy sector.

Issuing Date Issuing Authority Name of the Policy Short Summary 06.10.2022 Ministry of New & Renewable Energy Extension of Phase-II of Grid Connected Rooftop Solar programme. Phase-II of Grid Connected Rooftop Solar programme is further extended upto 31.03.2026 without any finincial application. 24.08.2022 Ministry of New & Renewable Energy Grid Solar Power Division Scheme for Solarisation of sun-temple town of Modhera, District – Mehsana, Gujrat. he Ministry of New and Renewable Energy (MNRE) has unveiled a plan to achieve 100% solarization of Modhera, a town in Gujarat's Mehsana district, known for its historic Sun Temple dedicated to the Hindu Sun God. This initiative is designed to meet all the domestic and agricultural electricity requirements of Modhera's households exclusively with solar energy. This pioneering project aims to serve as a model for powering an entire village or town solely through solar energy. 30.09.2022 Ministry of New & Renewable Energy Grid Solar Power Division Production Linked Incentive Scheme (Tranche II) under ‘National Programme on High Efficiency Solar PV Modules. The Government has awarded 11 companies with the rights to develop a combined solar PV module manufacturing capacity of 39,600 MW under the Production Linked Incentive Scheme for High Efficiency Solar PV Modules (Tranche-II), committing a total financial outlay of Rs. 14,007 Crores. This initiative anticipates the activation of 7,400 MW capacity by October 2024, followed by 16,800 MW by April 2025, and the remaining 15,400 MW by April 2026. The second tranche of this incentive scheme is projected to attract investments worth Rs. 93,041 crores and is expected to create a total of 1,01,487 jobs, with 35,010 in direct employment and 66,477 in indirect employment roles. Global Solar Power Equipment Market Segment Analysis

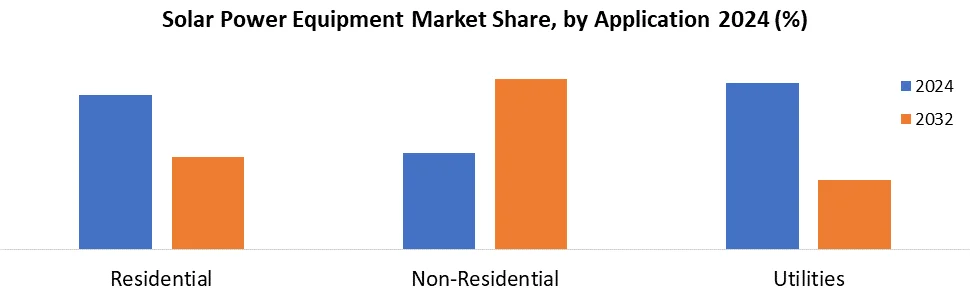

Based on Equipment Type, The Solar panels segment is expected to be the fastest-growing in the solar power equipment market during the forecast period. Solar Panels segment held the largest share, accounting for 34% of the market in 2024, and is expected to continue leading the market during the forecast period. Solar panels are the most commonly used component in solar power equipment, renowned for their ability to provide clean, emission-free electricity. These panels generate direct current (DC) electricity and are essential components of solar photovoltaic systems, which also include inverters to convert DC into alternating current (AC). Solar PV panels are manufactured using photovoltaic cells, similar to the material used in computer chips, making them a crucial element in solar technology. The solar power equipment market is poised to play an essential role in the global transition towards renewable energy sources, underscoring its importance in meeting environmental goals and achieving a sustainable future. Based on Application, the market is segmented by Residential, Non-residential and Utilities. The Utilities segment is the largest, accounting for 54% of the market share in 2024. This segment leads the market, primarily due to an increase in power purchase agreements (PPAs) between electricity boards and private sector companies. These agreements are set to further boost the implementation of solar energy solutions within the utility sector, reinforcing its position as the dominant solar power equipment market segment.

Global Solar Power Equipment Market Regional Insight

Asia Pacific region held the largest market share accounting for 33.9% in 2024. This region's market dominance is due to the surge in demand driven by numerous planned and ongoing solar power projects across Asia Pacific. Additionally, the solar power equipment sector is poised to benefit from robust government initiatives and substantial funding dedicated to promoting clean, renewable energy sources. These factors collectively are expected to propel the growth of the solar power equipment market in the region. In North America, the market is expected to experience substantial growth, with an expected CAGR of XX% during the forecast period. This growth is supported by initiatives from the US Department of Energy and the Electric Power Research Institute, which are actively funding solar energy projects for utility applications. These efforts are significantly enhancing the adoption of solar power equipment. Meanwhile, in Europe, the European Energy Research Alliance is playing a vital role in increasing market awareness and the production of solar energy. The growing utilization of solar energy within the region further stimulates the growth of the industry, aligning with broader energy transformation goals.Global Solar Power Equipment Market Competitive Landscape

Top key players such as Trina Solar, First Solar, JA Solar, SMA Solar Technology, and Sungrow Power Supply Co. are driving market development through innovations in photovoltaic technology, energy storage integration, and global manufacturing scale. These companies are focused on enhancing solar equipment performance, reducing levelized cost of energy (LCOE), and expanding smart energy ecosystems to address growing global demand for clean and reliable power. Trina Solar is known for its leadership in high-efficiency PV modules, especially N-type and bifacial technologies. The company continues to expand its vertically integrated supply chain and smart energy solutions, offering utility-scale solar products with integrated tracking and storage capabilities. Its strong R&D focus and global distribution network give it a strategic edge in emerging and developed markets. First Solar, a developer in thin-film photovoltaic technology, known for its low-carbon, high-temperature-resilient solar modules. The company emphasises sustainable manufacturing and long-term reliability, particularly for utility-scale projects. With advanced production facilities in the U.S., India, and Europe, First Solar is investing in scaling environmentally friendly production to support decarbonization goals globally. These companies compete based on module efficiency, inverter performance, storage capabilities, cost optimisation, and sustainability compliance. Ongoing investments in next-generation solar technologies, energy storage, AI-based monitoring, and regional manufacturing hubs are positioning them strongly in the evolving global solar power equipment market.Global Solar Power Equipment Market Recent Trends

Shift Toward High-Efficiency Modules Manufacturers are increasingly adopting N-type technologies such as Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) solar cells, which offer higher efficiency, lower degradation, and better performance in low-light conditions. This trend is driving module upgrades across utility and commercial projects. Solar + Storage Integration The combination of solar power with battery energy storage systems (BESS) is becoming a standard offering. Hybrid inverters and integrated solar-plus-storage solutions are gaining popularity, especially in regions with unstable grids or time-of-use pricing models. Smart Inverters & Digital Energy Management The adoption of smart inverters with real-time monitoring, grid support functions, and remote diagnostics is growing. These systems enhance grid stability and enable advanced energy management for residential and commercial users.Recent Development

Date Company Development March 24, 2025 Trina Solar (China) Trina Solar achieved a 25.44% conversion efficiency for its n-type heterojunction (HJT) solar modules, certified by Germany’s Fraunhofer CalLab an industry-leading milestone for single-crystalline silicon technology. March 23, 2025 SMA America (Germany) SMA America unveiled the Sunny Central Storage UP S, a grid-scale battery inverter featuring SiC MOSFET technology, offering up to 4,600 kVA and over 99.2% peak efficiency—a step change for utility-scale storage projects. Nov 2024 First Solar (China) Accelerating tandem solar cell development with perovskite technology, aimed at significantly increasing energy conversion efficiencies. Jan 6, 2025 Trina Solar (China) Achieved with its n-type i-TOPCon module, certified by Fraunhofer CalLab, setting a new benchmark in crystalline silicon efficiency. Solar Power Equipment Market Scope: Inquiry Before Buying

Global Solar Power Equipment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 159.41 Bn. Forecast Period 2025 to 2032 CAGR: 10.8% Market Size in 2032: USD 362.10 Bn. Segments Covered: by Application Residential Non-residential Utilities by Equipment Type Solar panels Mounting Racking & tracking system Storage system Global Solar Power Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Solar Power Equipment Market Key Players

North America 1. First Solar, Inc. (USA) 2. Canadian Solar Inc. (Canada) 3. Vivint Solar (USA) 4. SunPower Corporation (USA) 5. Enphase Energy, Inc. (USA) 6. Sunrun Inc. (USA) Europe 7. SMA Solar Technology AG (Germany) 8. ABB Group (Switzerland) 9. REC Group (Norway) Asia-Pacific 10. Trina Solar (China) 11. JA Solar Holdings (China) 12. LONGi Green Energy Technology Co., Ltd. (China) 13. Renesola Ltd. (China) 14. Huawei Technologies Co., Ltd. (China) 15. GCL-Poly Energy Holdings Limited (China) 16. Sungrow Power Supply Co., Ltd. (China) 17. Shunfeng International Clean Energy Limited (China) 18. Kyocera Corporation (Japan) 19. Sharp Corporation (Japan) 20. Hanwha Q Cells Co., Ltd. (South Korea)FAQs:

1. Which region has the largest share in the Solar Power Equipment Market? Ans: The Asia Pacific region held the highest share in 2024 in the Solar Power Equipment Market. 2. What are the key factors driving the growth of the Solar Power Equipment Market? Ans: Rising Demand for Clean and Renewable Energy to drive the demand during the forecast period. 3. Who are the key competitors in the Solar Power Equipment Market? Ans: Trina Solar, First Solar, JA Solar are the key competitors in the Solar Power Equipment Market. 4. What are the opportunities for the Solar Power Equipment Market? Ans: Increasing demand for hybrid systems that combine solar energy with battery storage is an opportunity for Solar Power Equipment Market. 5. Which equipment type segment dominates the Solar Power Equipment Market? Ans: The solar panels type segment dominated the Solar Power Equipment Market.

1. Solar Power Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Solar Power Equipment Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. Product Segment 2.3.4. End-user Segment 2.3.5. Revenue (2024) 2.4. Leading Solar Power Equipment Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model 3. Solar Power Equipment Market: Dynamics 3.1. Solar Power Equipment Market Trends by Region 3.1.1. North America Solar Power Equipment Market Trends 3.1.2. Europe Solar Power Equipment Market Trends 3.1.3. Asia Pacific Solar Power Equipment Market Trends 3.1.4. Middle East & Africa Solar Power Equipment Market rends 3.1.5. South America Solar Power Equipment Market Marke Trends 3.2. Solar Power Equipment Market Dynamics 3.2.1. Global Solar Power Equipment Market Drivers 3.2.1.1. Clean Energy Demand 3.2.1.2. Government Incentives 3.2.1.3. Falling Equipment Costs 3.2.2. Global Solar Power Equipment Market Restraints 3.2.3. Global Solar Power Equipment Market Opportunities 3.2.3.1. Urban Fleet Electrification 3.2.3.2. Hybrid Air-Electric Mobility 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Renewable Energy Targets 3.4.2. Green Investment Flow 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East & Africa 3.5.5. South America 4. Solar Power Equipment Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032) 4.1. Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 4.1.1. Residential 4.1.2. Non-residential 4.1.3. Utilities 4.2. Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 4.2.1. Solar panels 4.2.2. Mounting 4.2.3. Racking & tracking system 4.2.4. Storage system 4.3. Solar Power Equipment Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East & Africa 4.3.5. South America 5. North America Solar Power Equipment Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032) 5.1. North America Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 5.1.1. Residential 5.1.2. Non-residential 5.1.3. Utilities 5.2. North America Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 5.2.1. Solar panels 5.2.2. Mounting 5.2.3. Racking & tracking system 5.2.4. Storage system 5.3. North America Solar Power Equipment Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 5.3.1.1.1. Residential 5.3.1.1.2. Non-residential 5.3.1.1.3. Utilities 5.3.1.2. United States Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 5.3.1.2.1. Solar panels 5.3.1.2.2. Mounting 5.3.1.2.3. Racking & tracking system 5.3.1.2.4. Storage system 5.3.2. Canada 5.3.2.1. Canada Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 5.3.2.1.1. Residential 5.3.2.1.2. Non-residential 5.3.2.1.3. Utilities 5.3.2.2. Canada Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 5.3.2.2.1. Solar panels 5.3.2.2.2. Mounting 5.3.2.2.3. Racking & tracking system 5.3.2.2.4. Storage system 5.3.3. Mexico 5.3.3.1. Mexico Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 5.3.3.1.1. Residential 5.3.3.1.2. Non-residential 5.3.3.1.3. Utilities 5.3.3.2. Mexico Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 5.3.3.2.1. Solar panels 5.3.3.2.2. Mounting 5.3.3.2.3. Racking & tracking system 5.3.3.2.4. Storage system 6. Europe Solar Power Equipment Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032) 6.1. Europe Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.2. Europe Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3. Europe Solar Power Equipment Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.1.2. United Kingdom Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.2. France 6.3.2.1. France Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.2.2. France Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.3.2. Germany Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.4.2. Italy Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.5.2. Spain Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.6.2. Sweden Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.7.2. Austria Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 6.3.8.2. Rest of Europe Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 7. Asia Pacific Solar Power Equipment Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032) 7.1. Asia Pacific Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.2. Asia Pacific Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3. Asia Pacific Solar Power Equipment Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.1.2. China Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.1.3. China Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.2.2. S Korea Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.3.2. Japan Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.4. India 7.3.4.1. India Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.4.2. India Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.5.2. Australia Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.6.2. Indonesia Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.7. Philippines 7.3.7.1. Philippines Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.7.2. Philippines Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.8. Malaysia 7.3.8.1. Malaysia Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.8.2. Malaysia Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.9. Vietnam 7.3.9.1. Vietnam Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.9.2. Vietnam Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.10. Thailand 7.3.10.1. Thailand Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.10.2. Thailand Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.11. ASEAN 7.3.11.1. ASEAN Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.11.2. ASEAN Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 7.3.12. Rest of Asia Pacific 7.3.12.1. Rest of Asia Pacific Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 7.3.12.2. Rest of Asia Pacific Solar Power Equipment Market Size and Forecast, By Equipment Type (2024-2032) 8. Middle East and Africa Solar Power Equipment Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032) 8.1. Middle East and Africa Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 8.2. Middle East and Africa Solar Power Equipment Market Size and Forecast, By Equipment Types Model (2024-2032) 8.3. Middle East and Africa Solar Power Equipment Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 8.3.1.2. South Africa Solar Power Equipment Market Size and Forecast, By Equipment Types Model (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 8.3.2.2. GCC Solar Power Equipment Market Size and Forecast, By Equipment Types Model (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 8.3.3.2. Nigeria Solar Power Equipment Market Size and Forecast, By Equipment Types Model (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 8.3.4.2. Rest of ME&A Solar Power Equipment Market Size and Forecast, By Equipment Types Model (2024-2032) 9. South America Solar Power Equipment Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032) 9.1. South America Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 9.2. South America Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 9.3. South America Solar Power Equipment Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 9.3.1.2. Brazil Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 9.3.2.2. Argentina Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Solar Power Equipment Market Size and Forecast, By Application (2024-2032) 9.3.3.2. Rest Of South America Solar Power Equipment Market Size and Forecast, By Equipment Types (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 First Solar, Inc. 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Recent Development 10.2 Canadian Solar Inc. 10.3 Vivint Solar 10.4 SunPower Corporation 10.5 Enphase Energy, Inc. 10.6 Sunrun Inc. 10.7 SMA Solar Technology AG 10.8 ABB Group 10.9 REC Group 10.10 Trina Solar 10.11 JA Solar Holdings 10.12 LONGi Green Energy Technology Co., Ltd. 10.13 Renesola Ltd. 10.14 Huawei Technologies Co., Ltd. 10.15 GCL-Poly Energy Holdings Limited 10.16 Sungrow Power Supply Co., Ltd. 10.17 Shunfeng International Clean Energy Limited 10.18 Kyocera Corporation 10.19 Sharp Corporation 10.20 Hanwha Q Cells Co., Ltd. 11. Key Findings & Analyst Recommendations 12. Global Solar Power Equipment Markets: Research Methodology