The Smart Railways Market is expected to reach US $ 65.96 billion by 2029, thanks to growth in the Rail Communication and Networking System segment. The report analyzes Smart Railways market dynamics by region, solutions, and services.Smart Railways Market Overview:

The global smart railways market was valued at US $ 29.15 Bn. in 2022, and it is expected to reach US $65.96 Bn. by 2029 with a CAGR of 12.37% during the forecast period. The demand for unorthodox methods for railway operations is growing as the demand for urban mobility and freight transportation grows. The worldwide rail market is likely to maintain its steady growth, with urban transportation experiencing the greatest CAGR of xx%. Simultaneously, rail traffic volume has climbed by 84% since 1981, despite no expansion in the size of the train network. This rapid expansion, combined with a restricted network, puts a lot of pressure on railway operators who are trying to meet the next generation of passenger and shipping demand.To know about the Research Methodology :- Request Free Sample Report Governments across the globe are establishing new targets for enhancing mass railway transportation to reduce traffic congestion, improve goods delivery, and increase sustainability. According to the International Energy Agency (IEA), global transportation emissions may surge in the 2030s unless trains are "actively" expanded. Smart rail technology advancements enable operators to achieve these objectives while also actively improving railway administration and operation. Transportation 4.0 – the concept of a multimodal transportation global future in which diverse modes of transportation are merged – is one example of transformation. Transportation 4.0 examines innovative approaches to streamline services for passengers while also making service providing easier for operators. Imagine purchasing a single ticket that allows you to travel by train, aircraft, and hotel – all while your luggage is waiting for you. The goal is to make travel experiences more efficient, greener, safer, and less disruptive, all while reducing travel times and costs for passengers. Smart railways provide transportation leaders with the opportunity to modernize their fundamental technology and transportation infrastructure, laying a new and better basis to meet rising mobility and commodities movement demands.

Smart Railways Market Dynamics:

Expanding High-Speed Railways

High-speed trains, which can travel at speeds of 300-500 kph (kilometer per hour), have distinct benefits over personal transportation by road, sea, and air. There are high-speed rail connections all over the world, with China leading the way with 35,000 kilometers and expanding. Not only is high-speed rail generally cheaper and faster than planes, particularly when considering air travel cancellations and delays because of weather and other circumstances, but it can also carry more passengers than automobiles.Increasing Autonomous and Internet of Things (IoT) Operations

In the next 12 years, an estimated US $30 billion is likely to be spent on IoT initiatives in the railway industry. Artificial Intelligence (AI) is being used to forecast rail delays, allowing capacity to be increased without the need for new infrastructure. Network Operation Centers (NOC) can help operators improve efficiency and safety by operating modern, smart railways. The NOC can slow, halt, or speed up the train as needed, reducing the possibility of accidents caused by human error. By 2030, an anticipated 106,290 autonomous railway units are likely to be in use, representing a 4.87% CAGR over the forecast period.Leading Ecological Integrity

The railway sector serves 8% of worldwide passengers and 7% of global freight while using only 2% of overall transport energy demand, making it one of the most energy-efficient means of transportation. Automation and near real-time feedback for operators enable smart railways to lead in environmental sustainability, contributing to increased efficiency and lower emissions. To reduce pollution and improve safety, governments across the globe are shifting their policies to focus transportation investment on developing trains and related infrastructure.Surging Competition

Railways compete for passengers with air travel and freight with the trucking business — with the trucking business winning the freight race so far. However, one of the most compelling arguments in favor of rail is its long-term viability. Rail freight accounts for only 2% of total greenhouse gas emissions in the United States. Increases in greenhouse gases are a real threat to our planet's stability over the forecast period. Using rails to convey just 10% of the freight hauled by the largest truck would save over 1.5 billion gallons of fuel every year. This might result in an annual reduction of more than 17 million tonnes of greenhouse gas emissions, which is the equivalent of removing 3.2 million automobiles from highways or planting 400 million trees.Experience of Passenger

The train passenger experience begins with travel planning and ticket or pass purchasing and finishes with luggage check-in at the railway terminal. The on-train portion of the journey can make or break passenger opinion once onboard and rolling. After the train arrives at its destination, the passenger disembarks, gets their belongings, and exit the terminal to catch the next available mode of transportation to their destination. Any mistake along the route might affect passenger’s willingness to use rail as a mode of transportation, thereby affecting the railway's reputation. Overcrowding in terminals with insufficient food or retail concessions, trouble with online train schedules, delays while riding the train, or no in-terminal or on-board internet access are all examples of passenger experience issues.Security of Data

Since many information technology systems are linked, cyberattacks on transportation agencies can have multistage consequences. Cybercrime is expected to cost the world US $6 trillion per year by 2022, according to experts. To protect operating systems, personnel, and operating systems from cyber threats, railway executives and governments must implement a broad range of cyber security solutions. Every functional unit of the Colorado Department of Transportation was affected by a hack in 2018. A dissatisfied employee infiltrated the transcontinental railway system's core switches using administrator credentials that were kept active after termination. Contact information for employees, responders, and consumers were among the information that was leaked. Given the threat of such attacks, administrators must consider the impact on freight and essential infrastructure, as well as the network's basic information technology. It could take weeks rather than days to recover from a skilled cyberattack.Surge Globalization Is Causing Need For Improved Transportation Infrastructure

Globalization has a direct impact on all sorts of railway transportation traffic. Increased speed, security, and dependability are in high demand. As a result, the future railway transportation ecosystem is likely in need to provide solutions that can meet demand from source to destination while maintaining a high quality of service, regardless of the distance travelled or the number of steps required to get there. People's needs change daily, demanding the development of more convenient travel options. Intelligent solutions such as advanced vehicle control systems , advanced PIS, and other systems offer information on the real-time location of vehicles, which can be used to monitor schedule adherence and alert passengers on the location of vehicles in transit. Passengers' comfort is likely to improve if accurate real-time information on the latest status of in-transit vehicles is made available to them.Global Smart Railways Market Segment Analysis:

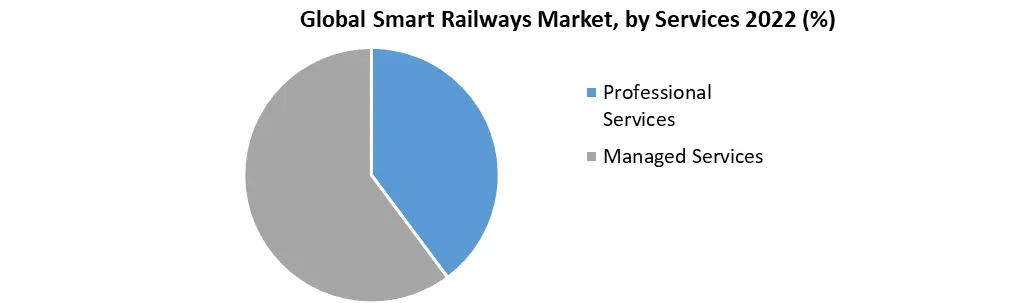

Based on Solutions, the smart railways market is segmented as, Passenger information system, Freight management system, Smart ticketing system, Security and safety solutions, Rail communication and Networking system, Rail analytics system, Rail asset management, and maintenance solutions, and Rail operation and control solutions. During the forecast period, the Rail communication and networking system segment are likely to dominate the market in terms of demand and revenue. The use of smart communication solutions in a variety of railway management applications helps to improve fast decision-making on topics like asset deployment, utilization, and maintenance. To maintain safety, security, and uninterrupted service, efficient railway operations rely on accurate, on-time communication among stations, control and dispatch centers, and rolling stock. Signaling, phone, video, and data traffic must consequently be reliably sent along railway lines and across backbone transmission networks by railway communication systems. Detailed information about each segment is covered in the MMR’s report. Based on Services, the smart railways market is segmented as, professional services, and managed services. During the forecast period, the managed services segment is likely to dominate the market by growing at a higher CAGR of approximately xx%. The growing need for managed services in the industry is expected to be driven by the growing demand to outsource the maintenance of smart railway technologies. One of the primary factors likely to uplift the growth of the smart railways market is the requirement for organizations to improve resource use. Managed services provide continuous upgrades and customized features to meet the ever-increasing expectations of customers. As a result, businesses outsource their tasks to managed service providers (MSPs) at a quick pace.

Smart Railways Market Regional Insights:

Asia-Pacific accounted for over 28% of the total railway network, according to the International Union of Railways (in terms of length of lines). India and China, with 65,000 km and 100,000 km of network, respectively, account for the majority of the share. In this region, regional governments have made considerable efforts to "revamp" and "upgrade" existing lines to improve the overall efficiency of their operations. Also, the emergence of megacities is likely to be strongest in Asia-Pacific emerging countries, with China accounting for four of the world's current 24 megacities. Chinese planners are planning to unite nine cities in the Pearl River Delta, from Shenzhen to Guangzhou, to develop a 26,000-square-kilometer urban region. This area is expected to be 26 times the size of Greater London. This project, which is likely to combine water, energy, transportation, and telecommunication networks, is anticipated to cost around US $260 billion over the next four years. However, various Chinese banks have teamed up to invest more than US $28 billion in public-private partnership (PPP) projects for the smart railway system. Similarly, Japan is working to implement smart solutions, such as providing a personal concierge service for passengers using artificial intelligence (AI). In terms of passenger traffic, the Shanghai Hongqiao railway station is one of the busiest in Asia. China Mobile Shanghai, in collaboration with Huawei, launched a 5G network at the station, which includes a 5G digital indoor system (DIS). Passengers can connect to a system-supported network and download 2 GB high-definition movies in less than 20 seconds. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global market dynamics, structure by analyzing the market segments and projecting the global market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global market makes the report investor's guide.Global Smart Railways Market Scope: Inquire before buying

Global Smart Railways Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 29.15 Bn. Forecast Period 2023 to 2029 CAGR: 12.37% Market Size in 2029: US $ 65.96 Bn. Segments Covered: by Solutions Passenger Information System Freight Management System Smart Ticketing System Security And Safety Solutions Rail Communication And Networking System Rail Analytics System Rail Asset Management And Maintenance Solutions Rail Operation And Control Solutions by Services Professional Services Managed Services by Device & Component Rail Sensors Video Surveillance Cameras Smart Cards Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) Others (Multimedia Displays) Smart Railways Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Smart Railways Market, Key Players are

1. Alstom 2. Cisco 3. Wabtec 4. ABB Ltd. 5. IBM 6. Hitachi 7. Huawei 8. Indra Sistemas 9. Siemens 10. Honeywell 11. Thales 12. Advantech 13. Fujitsu 14. Toshiba 15. Alcatel Lucent Enterprise 16. Moxa 17. Televic 18. Eurotech 19. Uptake 20. Tego 21. Delphisonic Frequently Asked Questions: 1. What is the forecast period considered for the Smart Railways market report? Ans. The forecast period for the global smart railways market is 2023-2029. 2. What are the challenges for the Smart Railways market? Ans. The surging competition, security of data, and experience of the passenger are key challenges expected to hinder the market growth during the forecast period. 3. What is the compound annual growth rate (CAGR) of the Smart Railways market for the next 8 years? Ans. The global smart railways market is expected to grow at a CAGR of 12.37% during the forecast period (2023-2029). 4. What are the key factors driving the growth of the Smart Railways market? Ans. The expansion of high-speed railways, surging autonomous and IoT operations, and leading ecological integrity are the key factors expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered for the Smart Railways market report? Ans. ABB Ltd., IBM, Hitachi, Huawei, Indra Sistemas, Siemens, Honeywell, Thales, Advantech, Fujitsu, Toshiba, Alcatel Lucent Enterprise, Moxa, Televic, Eurotech, Uptake, Tego, Delphisonic, and Others.

1. Smart Railways Market: Research Methodology 2. Smart Railways Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Smart Railways Market Qualitative Analysis 3.1. Importance of Smart Technologies in Railways 3.2. Technological Innovations 3.3. Future Outlook and Emerging Technologies 3.4. Investment and Funding Trends 4. Smart Railways Market: Dynamics 4.1. Smart Railways Market Trends by Region 4.1.1. North America Smart Railways Market Trends 4.1.2. Europe Smart Railways Market Trends 4.1.3. Asia Pacific Smart Railways Market Trends 4.1.4. Middle East and Africa Smart Railways Market Trends 4.1.5. South America Smart Railways Market Trends 4.2. Smart Railways Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Smart Railways Market Drivers 4.2.1.2. North America Smart Railways Market Restraints 4.2.1.3. North America Smart Railways Market Opportunities 4.2.1.4. North America Smart Railways Market Challenges 4.2.2. Europe 4.2.2.1. Europe Smart Railways Market Drivers 4.2.2.2. Europe Smart Railways Market Restraints 4.2.2.3. Europe Smart Railways Market Opportunities 4.2.2.4. Europe Smart Railways Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Smart Railways Market Drivers 4.2.3.2. Asia Pacific Smart Railways Market Restraints 4.2.3.3. Asia Pacific Smart Railways Market Opportunities 4.2.3.4. Asia Pacific Smart Railways Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Smart Railways Market Drivers 4.2.4.2. Middle East and Africa Smart Railways Market Restraints 4.2.4.3. Middle East and Africa Smart Railways Market Opportunities 4.2.4.4. Middle East and Africa Smart Railways Market Challenges 4.2.5. South America 4.2.5.1. South America Smart Railways Market Drivers 4.2.5.2. South America Smart Railways Market Restraints 4.2.5.3. South America Smart Railways Market Opportunities 4.2.5.4. South America Smart Railways Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 4.7. Key Opinion Leader Analysis For Smart Railways Market 4.8. Analysis of Government Schemes and Initiatives For Smart Railways Market 4.9. The Global Pandemic Impact on Smart Railways Market 5. Smart Railways Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Smart Railways Market Size and Forecast, by Solutions (2022-2029) 5.1.1. Passenger Information System 5.1.2. Freight Management System 5.1.3. Smart Ticketing System 5.1.4. Security And Safety Solutions 5.1.5. Rail Communication And Networking System 5.1.6. Rail Analytics System 5.1.7. Rail Asset Management And Maintenance Solutions 5.1.8. Rail Operation And Control Solutions 5.2. Smart Railways Market Size and Forecast, by Services (2022-2029) 5.2.1. Professional Services 5.2.2. Managed Services 5.3. Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 5.3.1. Rail Sensors 5.3.2. Video Surveillance Cameras 5.3.3. Smart Cards 5.3.4. Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) 5.3.5. Others (Multimedia Displays) 5.4. Smart Railways Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Smart Railways Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. North America Smart Railways Market Size and Forecast, by Solutions (2022-2029) 6.1.1. Passenger Information System 6.1.2. Freight Management System 6.1.3. Smart Ticketing System 6.1.4. Security And Safety Solutions 6.1.5. Rail Communication And Networking System 6.1.6. Rail Analytics System 6.1.7. Rail Asset Management And Maintenance Solutions 6.1.8. Rail Operation And Control Solutions 6.2. North America Smart Railways Market Size and Forecast, by Services (2022-2029) 6.2.1. Professional Services 6.2.2. Managed Services 6.3. North America Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 6.3.1. Rail Sensors 6.3.2. Video Surveillance Cameras 6.3.3. Smart Cards 6.3.4. Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) 6.3.5. Others (Multimedia Displays) 6.4. North America Smart Railways Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.1.1. United States Smart Railways Market Size and Forecast, by Solutions (2022-2029) 6.4.1.1.1. Passenger Information System 6.4.1.1.2. Freight Management System 6.4.1.1.3. Smart Ticketing System 6.4.1.1.4. Security And Safety Solutions 6.4.1.1.5. Rail Communication And Networking System 6.4.1.1.6. Rail Analytics System 6.4.1.1.7. Rail Asset Management And Maintenance Solutions 6.4.1.1.8. Rail Operation And Control Solutions 6.4.1.2. United States Smart Railways Market Size and Forecast, by Services (2022-2029) 6.4.1.2.1. Professional Services 6.4.1.2.2. Managed Services 6.4.1.3. United States Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 6.4.1.3.1. Rail Sensors 6.4.1.3.2. Video Surveillance Cameras 6.4.1.3.3. Smart Cards 6.4.1.3.4. Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) 6.4.1.3.5. Others (Multimedia Displays) 6.4.2. Canada 6.4.2.1. Canada Smart Railways Market Size and Forecast, by Solutions (2022-2029) 6.4.2.1.1. Passenger Information System 6.4.2.1.2. Freight Management System 6.4.2.1.3. Smart Ticketing System 6.4.2.1.4. Security And Safety Solutions 6.4.2.1.5. Rail Communication And Networking System 6.4.2.1.6. Rail Analytics System 6.4.2.1.7. Rail Asset Management And Maintenance Solutions 6.4.2.1.8. Rail Operation And Control Solutions 6.4.2.2. Canada Smart Railways Market Size and Forecast, by Services (2022-2029) 6.4.2.2.1. Professional Services 6.4.2.2.2. Managed Services 6.4.2.3. Canada Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 6.4.2.3.1. Rail Sensors 6.4.2.3.2. Video Surveillance Cameras 6.4.2.3.3. Smart Cards 6.4.2.3.4. Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) 6.4.2.3.5. Others (Multimedia Displays) 6.4.3. Mexico 6.4.3.1. Mexico Smart Railways Market Size and Forecast, by Solutions (2022-2029) 6.4.3.1.1. Passenger Information System 6.4.3.1.2. Freight Management System 6.4.3.1.3. Smart Ticketing System 6.4.3.1.4. Security And Safety Solutions 6.4.3.1.5. Rail Communication And Networking System 6.4.3.1.6. Rail Analytics System 6.4.3.1.7. Rail Asset Management And Maintenance Solutions 6.4.3.1.8. Rail Operation And Control Solutions 6.4.3.2. Mexico Smart Railways Market Size and Forecast, by Services (2022-2029) 6.4.3.2.1. Professional Services 6.4.3.2.2. Managed Services 6.4.3.3. Mexico Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 6.4.3.3.1. Rail Sensors 6.4.3.3.2. Video Surveillance Cameras 6.4.3.3.3. Smart Cards 6.4.3.3.4. Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.) 6.4.3.3.5. Others (Multimedia Displays) 7. Europe Smart Railways Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Europe Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.2. Europe Smart Railways Market Size and Forecast, by Services (2022-2029) 7.3. Europe Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4. Europe Smart Railways Market Size and Forecast, by Country (2022-2029) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.1.2. United Kingdom Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.1.3. United Kingdom Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.2. France 7.4.2.1. France Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.2.2. France Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.2.3. France Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.3. Germany 7.4.3.1. Germany Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.3.2. Germany Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.3.3. Germany Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.4. Italy 7.4.4.1. Italy Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.4.2. Italy Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.4.3. Italy Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.5. Spain 7.4.5.1. Spain Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.5.2. Spain Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.5.3. Spain Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.6. Sweden 7.4.6.1. Sweden Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.6.2. Sweden Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.6.3. Sweden Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.7. Austria 7.4.7.1. Austria Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.7.2. Austria Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.7.3. Austria Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Smart Railways Market Size and Forecast, by Solutions (2022-2029) 7.4.8.2. Rest of Europe Smart Railways Market Size and Forecast, by Services (2022-2029) 7.4.8.3. Rest of Europe Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8. Asia Pacific Smart Railways Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. Asia Pacific Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.2. Asia Pacific Smart Railways Market Size and Forecast, by Services (2022-2029) 8.3. Asia Pacific Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4. Asia Pacific Smart Railways Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.1.1. China Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.1.2. China Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.1.3. China Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.2. S Korea 8.4.2.1. S Korea Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.2.2. S Korea Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.2.3. S Korea Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.3. Japan 8.4.3.1. Japan Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.3.2. Japan Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.3.3. Japan Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.4. India 8.4.4.1. India Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.4.2. India Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.4.3. India Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.5. Australia 8.4.5.1. Australia Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.5.2. Australia Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.5.3. Australia Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.6. Indonesia 8.4.6.1. Indonesia Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.6.2. Indonesia Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.6.3. Indonesia Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.7. Malaysia 8.4.7.1. Malaysia Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.7.2. Malaysia Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.7.3. Malaysia Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.8. Vietnam 8.4.8.1. Vietnam Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.8.2. Vietnam Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.8.3. Vietnam Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.9. Taiwan 8.4.9.1. Taiwan Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.9.2. Taiwan Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.9.3. Taiwan Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 8.4.10. Rest of Asia Pacific 8.4.10.1. Rest of Asia Pacific Smart Railways Market Size and Forecast, by Solutions (2022-2029) 8.4.10.2. Rest of Asia Pacific Smart Railways Market Size and Forecast, by Services (2022-2029) 8.4.10.3. Rest of Asia Pacific Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 9. Middle East and Africa Smart Railways Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. Middle East and Africa Smart Railways Market Size and Forecast, by Solutions (2022-2029) 9.2. Middle East and Africa Smart Railways Market Size and Forecast, by Services (2022-2029) 9.3. Middle East and Africa Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 9.4. Middle East and Africa Smart Railways Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.1.1. South Africa Smart Railways Market Size and Forecast, by Solutions (2022-2029) 9.4.1.2. South Africa Smart Railways Market Size and Forecast, by Services (2022-2029) 9.4.1.3. South Africa Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 9.4.2. GCC 9.4.2.1. GCC Smart Railways Market Size and Forecast, by Solutions (2022-2029) 9.4.2.2. GCC Smart Railways Market Size and Forecast, by Services (2022-2029) 9.4.2.3. GCC Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 9.4.3. Nigeria 9.4.3.1. Nigeria Smart Railways Market Size and Forecast, by Solutions (2022-2029) 9.4.3.2. Nigeria Smart Railways Market Size and Forecast, by Services (2022-2029) 9.4.3.3. Nigeria Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Smart Railways Market Size and Forecast, by Solutions (2022-2029) 9.4.4.2. Rest of ME&A Smart Railways Market Size and Forecast, by Services (2022-2029) 9.4.4.3. Rest of ME&A Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 10. South America Smart Railways Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 10.1. South America Smart Railways Market Size and Forecast, by Solutions (2022-2029) 10.2. South America Smart Railways Market Size and Forecast, by Services (2022-2029) 10.3. South America Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 10.4. South America Smart Railways Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.1.1. Brazil Smart Railways Market Size and Forecast, by Solutions (2022-2029) 10.4.1.2. Brazil Smart Railways Market Size and Forecast, by Services (2022-2029) 10.4.1.3. Brazil Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 10.4.2. Argentina 10.4.2.1. Argentina Smart Railways Market Size and Forecast, by Solutions (2022-2029) 10.4.2.2. Argentina Smart Railways Market Size and Forecast, by Services (2022-2029) 10.4.2.3. Argentina Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Smart Railways Market Size and Forecast, by Solutions (2022-2029) 10.4.3.2. Rest Of South America Smart Railways Market Size and Forecast, by Services (2022-2029) 10.4.3.3. Rest Of South America Smart Railways Market Size and Forecast, by Device & Component (2022-2029) 11. Global Smart Railways Market: Competitive Landscape 11.1. MMR Competition Matrix 11.2. Competitive Landscape 11.3. Key Players Benchmarking 11.3.1. Company Name 11.3.2. Service Segment 11.3.3. End-user Segment 11.3.4. Revenue (2022) 11.3.5. Company Locations 11.4. Leading Smart Railways Market Companies, by Market Capitalization 11.5. Market Structure 11.5.1. Market Leaders 11.5.2. Market Followers 11.5.3. Emerging Players 11.6. Mergers and Acquisitions Details 12. Company Profile: Key Players 12.1. Alstom 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.1.6. Recent Developments 12.2. Cisco 12.3. Wabtec 12.4. ABB Ltd. 12.5. IBM 12.6. Hitachi 12.7. Huawei 12.8. Indra Sistemas 12.9. Siemens 12.10. Honeywell 12.11. Thales 12.12. Advantech 12.13. Fujitsu 12.14. Toshiba 12.15. Alcatel Lucent Enterprise 12.16. Moxa 12.17. Televic 12.18. Eurotech 12.19. Uptake 12.20. Tego 12.21. Delphisonic 13. Key Findings 14. Industry Recommendations