The Global Smart Indoor Garden Market size was valued at USD 138.25 Million in 2024 and is expected to reach USD 250.12 Million by 2032, at a CAGR of 9.4 %Smart Indoor Garden Market Overview:

Smart indoor gardens are automated systems equipped with IoT sensors, LED grow lights, and self-watering mechanisms that enable year-round cultivation of herbs, vegetables, and decorative plants indoors. These systems are gaining popularity among urban consumers seeking convenient, eco-friendly, and space-efficient gardening solutions that align with modern smart home lifestyles. The growing preference for organic, pesticide-free food and the demand for aesthetically pleasing interiors are key factors propelling market expansion. Countries such as the United States, Canada, China, Japan, India, Germany, and the United Kingdom are witnessing strong adoption due to advancements in smart technology and changing consumer habits. North America continues to dominate in terms of technology integration and product innovation. Major companies including Click & Grow (Estonia), AeroGarden (USA), and LG Electronics (South Korea) are leading innovations in smart gardening solutions. With growing focus on sustainability and wellness, the market is set for continued expansion globally.To know about the Research Methodology:-Request Free Sample Report

Smart Indoor Garden Market Dynamics:

Urbanization and Technological Advancements Drive the Growth of the Smart Indoor Garden Market The Smart Indoor Garden Market is primarily driven by rapid urbanization, technological innovation, and growing consumer awareness about sustainable living. With over half of the global population living in urban areas, space constraints and limited access to arable land have accelerated the adoption of indoor gardening systems, hydroponic indoor grow kits, and smart home gardening systems. The integration of IoT indoor gardening solutions, smart soil monitoring systems, and AI-powered gardening devices allows users to automate watering, lighting, and nutrient supply, creating an efficient and energy-saving plant growth environment. Rising health consciousness and demand for organic herbs and vegetables have also encouraged households to invest in smart hydroponic gardens and indoor vegetable growing systems. Furthermore, advancements in smart LED grow lights, app-controlled gardening systems, and wireless indoor plant monitoring systems have enhanced convenience and productivity, promoting adoption across residential and commercial spaces. Government initiatives supporting sustainable indoor gardening technology and eco-friendly urban farming practices further stimulate market expansion, especially in the Asia-Pacific, Europe, and North American smart indoor farming markets. Collectively, these factors are fueling consistent growth and technological evolution in the smart indoor garden industry worldwide. High Costs and Technical Complexities Restrain the Growth of the Smart Indoor Garden Market The high setup and maintenance cost associated with smart hydroponic garden systems, automated indoor gardens, and connected plant growing technology. Incorporating IoT sensors, AI integration, and energy-efficient lighting raises initial expenses, making these systems less affordable for middle-income households. Additionally, the recurring costs of nutrients, seed pods, and replacement parts add to the long-term investment burden. Many users also struggle with the complexity of managing smart gardening devices, as calibration, cleaning, and connectivity issues can discourage beginners. Another concern is the dependency on stable internet connections and compatible software, which restricts device functionality in regions with poor connectivity. Environmental challenges, such as fluctuating indoor temperatures and humidity, further affect system performance. Moreover, the market faces reliability issues due to the closure of major smart indoor garden companies such as AeroGarden, which raises doubts about vendor sustainability. These economic and operational barriers collectively hinder mass adoption, especially in developing markets, slowing down the growth potential of automated indoor gardening systems and IoT-based smart home gardens. Innovation, Sustainability, and Smart-Home Integration Create Lucrative Opportunities in the Smart Indoor Garden Market The future of the Smart Indoor Garden Market holds significant opportunities driven by innovation, sustainability, and smart-home integration. As consumers seek self-sufficient, eco-friendly lifestyles, demand is rising for energy-efficient indoor garden systems, AI-powered gardening devices, and smart irrigation systems for home gardens. Manufacturers are focusing on developing affordable, modular, and app-controlled gardening systems that simplify plant care for beginners while appealing to tech-savvy urban dwellers. The rise of AI and IoT integration enables predictive plant management, nutrient optimization, and environmental control, transforming indoor gardening into a smart, connected experience. Expanding e-commerce platforms and partnerships with smart home device ecosystems such as Alexa and Google Home are boosting global accessibility for smart garden kits and smart hydroponic systems for home. Government sustainability programs in the Asia-Pacific and European regions promoting urban greening and food security are opening lucrative avenues for eco-friendly smart gardening solutions. With the growing popularity of smart gardening solutions for apartments and urban smart farming trends, the market is expected to witness exponential growth. Companies focusing on interoperability, automation, and affordability are well-positioned to lead this evolving industry through 2032.Smart Indoor Garden Market: Segment Analysis

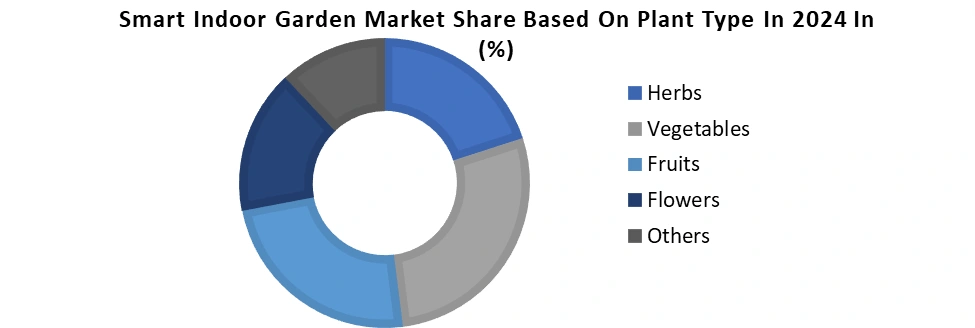

Based on Type, the Smart Indoor Garden Market segmented into Small Garden, Wall Gardea, Floor Garden and Others. The floor garden segment dominated the Type segment in 2024.Due to its versatility, scalability, and ease of installation. Floor gardens are designed to accommodate larger plant capacities compared to wall or small gardens, making them ideal for growing a wide variety of herbs, vegetables, and ornamental plants in both residential and commercial spaces. Their modular structure allows users to expand plant setups according to space availability and preferences. Also, floor gardens integrate advanced features such as automated irrigation, smart lighting, and nutrient delivery systems, providing a complete indoor farming solution. The growing adoption of smart hydroponic floor garden systems in urban apartments, offices, and restaurants further strengthens their market position. Consumers prefer floor gardens for their convenience, stable structure, and compatibility with IoT-based plant monitoring systems. With the increasing popularity of home-based organic food production and sustainable indoor farming, the floor garden segment continues to lead the market, driving overall growth across the smart indoor gardening industry.Based on Plant Type, the Smart Indoor Garden Market segmented into Herbs, Vegetables, Fruits, Flowers, Others. The Vegetables segment dominated the Plant Type segment in 2024. Due to rising consumer demand for fresh, pesticide-free produce and increasing awareness of homegrown food sustainability. Urban households are increasingly adopting smart hydroponic and IoT-based systems to grow vegetables such as lettuce, spinach, and tomatoes year-round, regardless of outdoor conditions. These systems offer faster growth cycles, efficient nutrient management, and minimal water usage, aligning with eco-friendly lifestyle trends. The convenience of producing nutritious vegetables at home, coupled with the integration of AI-enabled monitoring for temperature, lighting, and irrigation, has further boosted segment adoption. Moreover, the growing preference for organic and locally produced food, particularly in urban areas, continues to strengthen the dominance of the vegetable segment within the Smart Indoor Garden Market.

Smart Indoor Garden Market: Regional Analysis

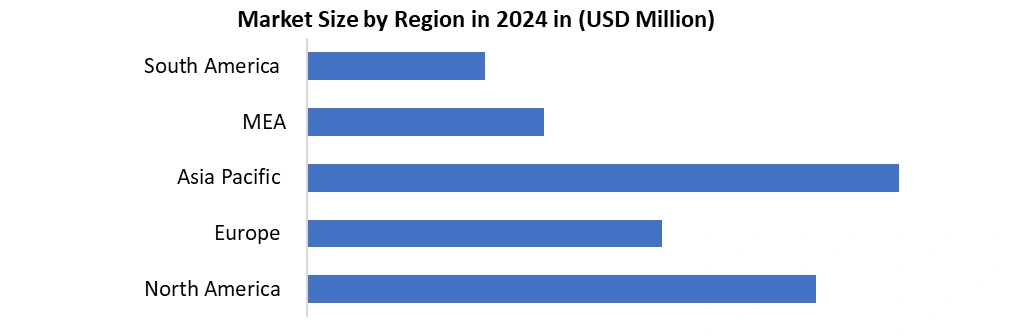

North America dominated the Smart Indoor Garden Market in year 2024, holding the largest market share due to strong smart-home adoption, advanced technology integration, and the presence of leading smart indoor garden companies such as Gardyn, Rise Gardens, and AeroGarden. The region’s leadership is reinforced by widespread adoption of IoT indoor gardening solutions, AI-powered gardening devices, and energy-efficient indoor garden systems that align with sustainability goals. Government initiatives like the U.S. Department of Energy’s horticultural lighting programs and the DesignLights Consortium’s guidelines for smart LED grow lights have accelerated the adoption of automated indoor gardens and connected plant-growing technology. Increasing consumer awareness about organic food and sustainable lifestyles has further fueled demand for indoor vegetable growing systems and smart home gardening systems, especially across urban households seeking convenience and fresh produce year-round. Meanwhile, the Asia-Pacific smart indoor garden market is projected to witness the fastest growth, driven by rapid urbanization, compact housing, and government initiatives promoting urban farming. Programs such as Singapore’s “30×30” food sustainability plan, India’s rooftop gardening incentives, and China’s smart-home integration policies have encouraged adoption of smart hydroponic gardens, indoor herb garden systems, and app-controlled gardening systems. Europe also shows significant expansion, supported by eco-friendly standards, smart gardening technology, and the popularity of eco-friendly smart gardening solutions among environmentally conscious consumers.

Smart Indoor Garden Market Scope

Smart Indoor Garden Market: Competitive landscape

The Smart Indoor Garden Market is becoming increasingly competitive as companies race to combine technology, design, and sustainability to meet growing global demand. The market is currently dominated by North American players such as Gardyn, Rise Gardens, and AeroGarden, which offer advanced smart hydroponic garden systems, AI-powered gardening devices, and app-controlled gardening systems for both residential and commercial users. However, AeroGarden’s 2024 shutdown reshaped the market landscape, giving room for newer brands and large corporations like LG Electronics, which recently introduced its indoor smart plant grower appliances integrated with ThinQ technology. These innovations demonstrate how established electronics brands are entering the connected indoor garden space, leveraging IoT and AI integration. European players such as Click & Grow and IKEA are emphasizing sustainable, eco-friendly smart gardening solutions and seamless IoT indoor gardening interoperability through Matter-supported smart home ecosystems. In Asia-Pacific, innovation is accelerating due to government initiatives promoting smart indoor farming and compact living solutions. Companies in this region are introducing cost-effective smart LED grow lights and energy-efficient indoor garden systems tailored for small apartments. As competition intensifies, market leaders are focusing on automation, energy efficiency, and user-friendly design to capture a larger share in the growing smart indoor garden devices and smart gardening technology markets.Smart Indoor Garden Market: Recent Development

On May 27, 2025, Little Kitchen Academy partnered exclusively with Click & Grow to integrate smart indoor gardens into its U.S. and Canadian locations. The collaboration enhances students’ hands-on, garden-to-table learning experience through sustainable Smart Gardens, promoting healthy eating habits and environmental awareness among children and families. On October 16, 2024, AeroGarden, the smart indoor planter brand owned by Scott’s Miracle-Gro, will shut down operations on January 1, 2026. While its app will function temporarily, users can manually control devices. Products purchased after November 1, 2025, carry a 90-day warranty. Despite closing its store, AeroGarden items and compatible third-party seed pods remain available on Amazon.Smart Indoor Garden Market: Trends

Trend Description IoT Integration Smart gardens with sensors and connected apps allow real-time monitoring of water, nutrients, and light, enhancing plant growth efficiency. AI-Powered Gardening AI algorithms optimize irrigation, lighting, and nutrient supply, predicting plant needs and improving yield. Hydroponic Systems Soil-free hydroponic gardens are increasingly popular for faster growth, reduced water use, and cleaner indoor gardening. Smart LED Grow Lights Energy-efficient, customizable LED lighting supports plant photosynthesis and year-round growth in indoor environments. App-Controlled Systems Mobile apps enable remote control, reminders, and notifications, simplifying garden management for beginners and tech-savvy users. Smart Indoor Garden Market Scope: Inquire before buying

Global Smart Indoor Garden Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2025: USD 138.25 Mn. Forecast Period 2025 to 2032 CAGR: 9.4% Market Size in 2032: USD 250.12 Mn. Segments Covered: by Type Small Garden Wall Garden Floor Garden Others by Plant Type Herbs Vegetables Fruits Flowers Others by Technology Self-watering Smart Sensing Smart Pest Management Others by End-User Residential Commercial by Distribution Channel Online Offline Smart Indoor Garden Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Smart Indoor Garden Market, Key Players

1. Aero Farms 2. Grow Smart Greens 3. BSH Home Appliances Group 4. Click & Grow LLC 5. CityCrop Automated Indoor Farming Ltd. 6. EDN Inc. 7. Grobo Inc. 8. Metropolis Farms Canada 9. Moistenland LLC 10. Plantui Oy 11. The Leaf Land Scape 12. Tower Garden 13. AeroGarden 14. Veritable 15. Rise Gardens 16. IGWorks 17. Gardyn 18. Lettuce Grow 19. Auk Eco AS 20. Gardens Illustrated 21. Urban Cultivator 22. Plantaform 23. Freight Farms, Inc. 24. Back to the Roots 25. Vertical Harvest 26. Farmshelf 27. The Greenhouse People 28. GreenBox 29. Aralab 30. Viemose.nuFrequently Asked Questions:

1. What is the growth rate of the Global Smart Indoor Garden Market? Ans: The Global Smart Indoor Garden Market is anticipated to grow at a CAGR of 9.4% during the forecast period. 2. Which region is projected to lead the Global Smart Indoor Garden Market? Ans: North America is expected to dominate the market due to advanced smart home adoption and rising indoor farming trends. 3. What will be the estimated market size of the Global Smart Indoor Garden Market by 2032? Ans: The market size is projected to reach USD 250.12 million by 2032, driven by increasing demand for automated home gardening systems. 4. Who are the major players operating in the Global Smart Indoor Garden Market? Ans: Key players include AeroFarms, Click & Grow, AVA Technologies, Bosch, Grobo, Agrilution, and BSH Hausgeräte, focusing on innovation and technology integration in indoor gardening. 5. What factors are driving the growth of the Global Smart Indoor Garden Market? Ans: Market growth is fueled by urbanization, consumer preference for fresh and pesticide-free produce, IoT and AI innovations, and growing sustainability awareness. 6. Which country accounted for the largest market share in 2024? Ans: The United States held the largest share of the Global Smart Indoor Garden Market in 2024.

1. Smart Indoor Garden Market: Research Methodology 2. Smart Indoor Garden Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Smart Indoor Garden Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End User Segment 3.3.4. Revenue (2024) 3.3.5. Headquarter 3.4. Mergers and Acquisitions Details 4. Smart Indoor Garden Market: Dynamics 4.1. Smart Indoor Garden Market Trends by Region 4.2. Smart Indoor Garden Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for Smart Indoor Garden Market 5. Smart Indoor Garden Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 5.1.1. Small Garden 5.1.2. Wall Garden 5.1.3. Floor Garden 5.1.4. Others 5.2. Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 5.2.1. Herbs 5.2.2. Vegetables 5.2.3. Fruits 5.2.4. Flowers 5.2.5. Others 5.3. Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 5.3.1. Self-watering 5.3.2. Smart Sensing 5.3.3. Smart Pest Management 5.3.4. Others 5.4. Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 5.4.1. Residential 5.4.2. Commercial 5.5. Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.1. Online 5.5.2. Offline 5.6. Smart Indoor Garden Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Smart Indoor Garden Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. North America Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 6.1.1. Small Garden 6.1.2. Wall Garden 6.1.3. Floor Garden 6.1.4. Others 6.2. North America Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 6.2.1. Herbs 6.2.2. Vegetables 6.2.3. Fruits 6.2.4. Flowers 6.2.5. Others 6.3. North America Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 6.3.1. Self-watering 6.3.2. Smart Sensing 6.3.3. Smart Pest Management 6.3.4. Others 6.4. North America Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 6.4.1. Residential 6.4.2. Commercial 6.5. North America Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.1. Online 6.5.2. Offline 6.6. North America Smart Indoor Garden Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Smart Indoor Garden Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.2. Europe Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.3. Europe Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.4. Europe Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.5. Europe Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6. Europe Smart Indoor Garden Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.1.1. United Kingdom Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.1.2. United Kingdom Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.1.3. United Kingdom Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.1.4. United Kingdom Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.1.5. United Kingdom Smart Indoor Garden Market Size and Forecast, By Distribution channel (2024-2032) 7.6.2. France 7.6.2.1. France Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.2.2. France Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.2.3. France Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.2.4. France Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.2.5. France Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6.3. Germany 7.6.3.1. Germany Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.3.2. Germany Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.3.3. Germany Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.3.4. Germany Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.3.5. Germany Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6.4. Italy 7.6.4.1. Italy Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.4.2. Italy Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.4.3. Italy Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.4.4. Italy Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.4.5. Italy Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6.5. Spain 7.6.5.1. Spain Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.5.2. Spain Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.5.3. Spain Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.5.4. Spain Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.5.5. Spain Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6.6. Russia 7.6.6.1. Russia Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.6.2. Russia Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.6.3. Russia Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.6.4. Russia Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.6.5. Russia Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 7.6.7. Rest of Europe 7.6.7.1. Rest of Europe Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 7.6.7.2. Rest of Europe Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 7.6.7.3. Rest of Europe Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 7.6.7.4. Rest of Europe Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 7.6.7.5. Rest of Europe Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8. Asia Pacific Smart Indoor Garden Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.2. Asia Pacific Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.3. Asia Pacific Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.4. Asia Pacific Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.5. Asia Pacific Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6. Asia Pacific Smart Indoor Garden Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.1.1. China Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.1.2. China Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.1.3. China Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.1.4. China Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.1.5. China Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6.2. S Korea 8.6.2.1. S Korea Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.2.2. S Korea Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.2.3. S Korea Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.2.4. S Korea Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.2.5. S Korea Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6.3. Japan 8.6.3.1. Japan Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.3.2. Japan Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.3.3. Japan Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.3.4. Japan Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.3.5. Japan Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6.4. India 8.6.4.1. India Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.4.2. India Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.4.3. India Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.4.4. India Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.4.5. India Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6.5. Australia 8.6.5.1. Australia Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.5.2. Australia Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.5.3. Australia Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.5.4. Australia Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.5.5. Australia Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 8.6.6. Rest of Asia Pacific 8.6.6.1. Rest of Asia Pacific Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 8.6.6.2. Rest of Asia Pacific Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 8.6.6.3. Rest of Asia Pacific Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 8.6.6.4. Rest of Asia Pacific Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 8.6.6.5. Rest of Asia Pacific Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 9. Middle East and Africa Smart Indoor Garden Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Middle East and Africa Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 9.2. Middle East and Africa Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 9.3. Middle East and Africa Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 9.4. Middle East and Africa Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 9.5. Middle East and Africa Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 9.6. Middle East and Africa Smart Indoor Garden Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.1.1. South Africa Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 9.6.1.2. South Africa Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 9.6.1.3. South Africa Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 9.6.1.4. South Africa Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 9.6.1.5. South Africa Smart Indoor Garden Market Size and Forecast, By Distribution Channel(2024-2032) 9.6.2. GCC 9.6.2.1. GCC Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 9.6.2.2. GCC Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 9.6.2.3. GCC Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 9.6.2.4. GCC Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 9.6.2.5. GCC Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.3. Nigeria 9.6.3.1. Nigeria Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 9.6.3.2. Nigeria Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 9.6.3.3. Nigeria Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 9.6.3.4. Nigeria Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 9.6.3.5. Nigeria Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.4. Rest of ME&A 9.6.4.1. Rest of ME&A Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 9.6.4.2. Rest of ME&A Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 9.6.4.3. Rest of ME&A Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 9.6.4.4. Rest of ME&A Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 9.6.4.5. Rest of ME&A Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 10. South America Smart Indoor Garden Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. South America Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 10.2. South America Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 10.3. South America Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 10.4. South America Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 10.5. South America Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 10.6. South America Smart Indoor Garden Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.1.1. Brazil Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 10.6.1.2. Brazil Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 10.6.1.3. Brazil Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 10.6.1.4. Brazil Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 10.6.1.5. Brazil Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.2. Argentina 10.6.2.1. Argentina Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 10.6.2.2. Argentina Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 10.6.2.3. Argentina Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 10.6.2.4. Argentina Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 10.6.2.5. Argentina Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.3. Rest Of South America 10.6.3.1. Rest Of South America Smart Indoor Garden Market Size and Forecast, By Type (2024-2032) 10.6.3.2. Rest Of South America Smart Indoor Garden Market Size and Forecast, By Plant Type (2024-2032) 10.6.3.3. Rest Of South America Smart Indoor Garden Market Size and Forecast, By Technology (2024-2032) 10.6.3.4. Rest Of South America Smart Indoor Garden Market Size and Forecast, By End-User (2024-2032) 10.6.3.5. Rest Of South America Smart Indoor Garden Market Size and Forecast, By Distribution Channel (2024-2032) 11. Company Profile: Key Players 11.1. Aero Farms 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Grow Smart Greens 11.3. BSH Home Appliances Group 11.4. Click & Grow LLC 11.5. CityCrop Automated Indoor Farming Ltd. 11.6. EDN Inc. 11.7. Grobo Inc. 11.8. Metropolis Farms Canada 11.9. Moistenland LLC 11.10. Plantui Oy 11.11. The Leaf Land Scape 11.12. Tower Garden 11.13. AeroGarden 11.14. Veritable 11.15. Rise Gardens 11.16. IGWorks 11.17. Gardyn 11.18. Lettuce Grow 11.19. Auk Eco AS 11.20. Gardens Illustrated 11.21. Urban Cultivator 11.22. Plantaform 11.23. Freight Farms, Inc. 11.24. Back to the Roots 11.25. Vertical Harvest 11.26. Farmshelf 11.27. The Greenhouse People 11.28. GreenBox 11.29. Aralab 11.30. Viemose.nu 12. Key Findings 13. Analyst Recommendations