Global Silver Nanoparticles Market size was valued at USD 2.56 Bn in 2023 and is expected to reach USD 5.82 Bn by 2030, at a CAGR of 12.45 %.Silver Nanoparticles Market Overview

Silver nanoparticles are nanoscale particles ranging from 1 to 100 nanometers in size, known for their unique properties and diverse applications in fields such as antimicrobial coatings, electronics, catalysis, and healthcare. The increasing demand for antimicrobial coatings in various industries such as healthcare, electronics, textiles, and packaging driving the growth of silver nanoparticles market. The current scenario depicts a steady rise in the adoption of silver nanoparticles owing to their excellent antimicrobial properties, which help inhibit the growth of bacteria and fungi on surfaces, thus reducing the risk of infections and extending the shelf life of products. The rising demand for electronic devices and conductive inks further boosts Silver Nanoparticles Market growth, as silver nanoparticles are widely used in electronics for their excellent conductivity and compatibility with printing technologies. The growing emphasis on sustainable and eco-friendly manufacturing processes has led to the development of green synthesis methods for silver nanoparticles, utilizing biological agents such as bacteria and plants, thereby enhancing market sustainability and reducing environmental impact. Silver Nanoparticles Market Key players are focusing on research and development activities to innovate new applications and improve production processes. For instance, recent developments include advancements in the synthesis methods to enhance the stability and dispersibility of silver nanoparticles, as well as the development of novel applications such as silver nanoparticle-based drug delivery systems and diagnostic tools. The silver nanoparticles market is poised for significant growth during forecast period, driven by technological advancements, increasing research activities, and expanding applications across diverse sectors.To know about the Research Methodology :- Request Free Sample Report

Silver Nanoparticles Market Dynamics:

Advancements in Medical Applications with Increasing Research in Nanotechnology driving the growth of Silver Nanoparticles Market The rising demand for antimicrobial coatings, especially in healthcare settings, is driving the growth of Silver Nanoparticles Market. For instance, Sciessent LLC offers Agion antimicrobial technology, which integrates silver nanoparticles into medical textiles, effectively reducing microbial growth and ensuring a safer environment for patients. The expanding electronics industry is driving the need for conductive materials, with silver nanoparticles being preferred for their excellent conductivity and compatibility with printing technologies. Applied Nanotech Holdings Inc. provides silver nanoparticle-based inks for printed electronics, facilitating the production of flexible circuits and electronic devices. Growing focus on sustainable packaging solutions, leading to increased adoption of silver nanoparticle-based packaging materials. Pureti Group's Pureti Clean & Fresh, for example, utilizes a photocatalytic coating containing silver nanoparticles to decompose organic contaminants, ensuring freshness and extending the shelf life of packaged goods. Additionally, advancements in medical applications are propelling market growth, as seen with Nanosys Inc.'s development of Silverlon wound dressings, which leverage silver nanoparticles to prevent infection and promote wound healing in burns and chronic wounds. Furthermore, ongoing research in nanotechnology, exemplified by UCLA's development of stable silver nanoparticles using plant extracts, is expanding the range of applications and driving innovation in the market. Government Initiatives Driving Nanotechnology Innovation: Funding and FocusRegulatory Concerns and Safety Issues hindering the growth of Silver Nanoparticles Market Regulatory concerns and safety issues pose significant obstacles, with stringent regulations mandating extensive testing for environmental and human health impacts before commercial use, as seen with the U.S. EPA's regulation of nanosilver under FIFRA hindering the growth of Silver Nanoparticles Market. High production costs associated with synthesizing silver nanoparticles limit affordability and market scalability, exemplified by the energy-intensive processes involved in chemical reduction methods, such as citrate reduction. Australian Regulatory Agencies (And Associated Regulatory Acts) With Responsibility For Nano-Silver Products

Country Initiative Budget Duration Focus and Key Contributors United States National Nanotechnology Initiative (NNI) $1.99 billion Ongoing Diverse areas including nanoscience, device development, and addressing global challenges like COVID-19. Key contributors: NIH, NSF, DOE, DOD European Union NANORIGO €4.7 million 50 months Aims to create a comprehensive Risk Governance Framework (RGF) and a corresponding Council (RGC) for nanomaterials and nano-enabled products. Emphasizes stakeholder engagement across various sectors. Focuses on developing a framework backed by scientific data for assessing nanomaterial risks. Collaborating with initiatives like RiskGONE and Gov4Nano. Japan Strategic Investment 19.74 trillion yen Ongoing Significant uptick in R&D investments, increasing by 2.6% in 2021. Focus on innovation and development in nanotechnology sector. Emergence of self-powered nanotechnology devices. Future plans for a total investment of 120 trillion yen, demonstrating commitment to maintaining and enhancing global leadership in nanotechnology. China Strategic Pioneering Programme 1 billion yuan 5 Years Launched in 2012, allocating a substantial budget over five years. Spearheaded by the Chinese Academy of Sciences in Beijing. Propelled China to the forefront of the nanotechnology field. Resulted in China ranking first globally in both nanotechnology-related scientific publications and patents. Environmental impact considerations further impede Silver Nanoparticles Market growth, with studies demonstrating the potential accumulation of silver nanoparticles in aquatic ecosystems and their toxicity to marine organisms. Challenges in standardization and characterization complicate quality control and regulatory compliance efforts, highlighting the need for standardized testing methods, particularly in the absence of ISO guidelines. Health risks and concerns over biocompatibility underscore the importance of thorough assessment and risk mitigation strategies, as evidenced by research highlighting cytotoxic effects on human cells. Emerging issues, such as the development of silver-resistant microorganisms and competition from substitute materials like graphene-based conductive inks, further compound market challenges. Public perception and acceptance of nanotechnology products play a crucial role in market adoption, with consumer skepticism and negative media coverage influencing purchasing behavior. Intellectual property disputes and patent issues create uncertainties for industry players, hindering innovation and market growth. These challenges collectively underscore the complexity of navigating the silver nanoparticles market and the need for strategic solutions to overcome them.

REGULATORY AGENCY RELEVANT ACT COMMENT Comcare Occupational Health and Safety Act 1991 Safety, Rehabilitation and Compensation Act 1998 Workplace safety issues NICNAS Industrial Chemicals (Notification and Assessment) Act 1989 Industrial chemicals, including cosmetics TGA Therapeutic Goods Act 1989 Therapeutic goods including medicines and medical products APVMA Agricultural and Veterinary Chemicals (Code) Act 1994 Agricultural and Veterinary Chemicals Administration Act 1994 Pesticides and veterinary medicines FZANS Food Standards Code Food and food safety ACCC Trade Practices Act Product labeling Department of Environment and Heritage Environment Protection and Biodiversity Con servation Act 1999 Environmental protection e.g. life cycle assessments, bioaccumulation; water, air and land exposure and toxicity, environmental release Silver Nanoparticles Market Segment Analysis

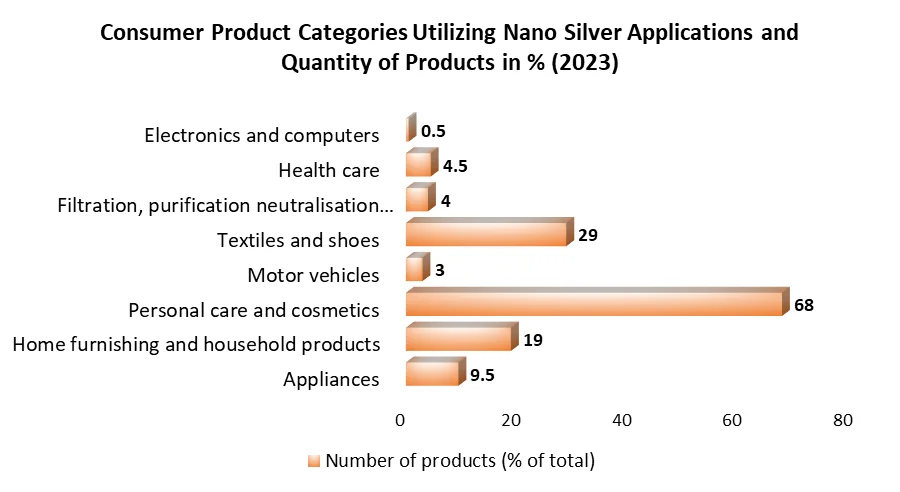

Based on Application, Antimicrobial applications dominated the Silver Nanoparticles Market in 2023 and is expected to maintain its dominance over the forecast period. It driven by the need for effective infection control measures in healthcare settings and consumer products. The electronics sector utilizes silver nanoparticles for their excellent conductivity, supporting the development of flexible circuits and electronic devices. In catalysis, silver nanoparticles serve as catalysts for various chemical reactions, finding applications in industries such as automotive and pharmaceuticals. Medical and healthcare applications leverage silver nanoparticles' antimicrobial properties for wound dressings, drug delivery systems, and diagnostic tools. In photovoltaics, silver nanoparticles enhance the efficiency of solar cells by improving conductivity in electrodes. While antimicrobial and electronics applications dominate the Market due to their widespread adoption and established demand, catalysis, medical, and photovoltaics segments show promising growth potential, driven by technological advancements and evolving market needs.

Silver Nanoparticles Market Regional Insights

Asia-Pacific dominated the Silver Nanoparticles Market as a leading producing region, with countries such as China, Japan, and South Korea leading the production of silver nanoparticles. For instance, China boasts robust manufacturing capabilities and strategic investments in nanotechnology, contributing to its status as a major producer. North America and Europe stand out as major consuming regions, driven by high demand for silver nanoparticles in industries such as healthcare, electronics, and cosmetics. The United States, in particular, demonstrates substantial consumption due to its advanced healthcare sector and thriving electronics industry. Analyzing regional import-export data further elucidates market dynamics, with regions like Europe importing silver nanoparticles for various applications while also exporting to meet global demand. For example, Germany imports silver nanoparticles for use in automotive catalysis and medical devices, while simultaneously exporting to emerging markets in Asia-Pacific. Similarly, Japan imports silver nanoparticles for electronics manufacturing while exporting to countries such as India for medical applications. These regional insights underscore the interplay between production, consumption, and trade dynamics, shaping the global landscape of the Silver Nanoparticles Market.Silver Nanoparticles Market Scope: Inquire before buying

Global Silver Nanoparticles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.56 Bn. Forecast Period 2024 to 2030 CAGR: 12.45% Market Size in 2030: US $ 5.82 Bn. Segments Covered: by Application Antimicrobial Applications Electronics Catalysis Medical & Healthcare Photovoltaics by By End-Use Industry Healthcare Industry Electronics Textiles Food & Beverages Cosmetics Silver Nanoparticles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Silver Nanoparticles Market Key Players:

North America: 1. Nanocomposix - Headquarters: San Diego, California, USA 2. Meliorum Technologies - Headquarters: Rochester, New York, USA 3. Nanophase Technologies Corporation - Headquarters: Romeoville, Illinois, USA 4. American Elements - Headquarters: Los Angeles, California, USA 5. NanoComposix - Headquarters: San Diego, California, USA Europe: 1. Sigma-Aldrich Corporation (now part of Merck KGaA) - Headquarters: Darmstadt, Germany 2. BBI Solutions - Headquarters: Cardiff, Wales, UK 3. PlasmaChem GmbH - Headquarters: Berlin, Germany 4. Nanogap Sub-nm-particles S.L. - Headquarters: San Sebastian, Spain 5. Particular GmbH - Headquarters: Hannover, Germany Asia-Pacific: 1. Advanced Nano Products Co., Ltd. - Headquarters: Suwon, South Korea 2. PlasmaChem Japan - Headquarters: Tokyo, Japan 3. QuantumSphere Japan - Headquarters: Tokyo, Japan 4. Particular Japan - Headquarters: Tokyo, Japan 5. Avantama AG India Pvt. Ltd. - Headquarters: Mumbai, India Frequently Asked Questions: 1] What is the growth rate of the Global Silver Nanoparticles Market? Ans. The Global Market is growing at a significant rate of 12.45 % during the forecast period. 2] Which region is expected to dominate the Global Silver Nanoparticles Market? Ans. North America is expected to dominate the Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The Market size is expected to reach USD 5.82 Billion by 2030.

1. Silver Nanoparticles Market: Research Methodology 2. Silver Nanoparticles Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Silver Nanoparticles Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Service Segment 3.3.3. End-Use Industry Segment 3.3.4. Revenue (2023) 3.3.5. Company Locations 3.4. Leading Silver Nanoparticles Market Companies, by Market Capitalization 3.5. Market Structure 3.5.1. Market Leaders 3.5.2. Market Followers 3.5.3. Emerging Players 3.6. Mergers and Acquisitions Details 4. Silver Nanoparticles Market: Dynamics 4.1. Silver Nanoparticles Market Trends by Region 4.1.1. North America Silver Nanoparticles Market Trends 4.1.2. Europe Silver Nanoparticles Market Trends 4.1.3. Asia Pacific Silver Nanoparticles Market Trends 4.1.4. Middle East and Africa Silver Nanoparticles Market Trends 4.1.5. South America Silver Nanoparticles Market Trends 4.2. Silver Nanoparticles Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Silver Nanoparticles Market Drivers 4.2.1.2. North America Silver Nanoparticles Market Restraints 4.2.1.3. North America Silver Nanoparticles Market Opportunities 4.2.1.4. North America Silver Nanoparticles Market Challenges 4.2.2. Europe 4.2.2.1. Europe Silver Nanoparticles Market Drivers 4.2.2.2. Europe Silver Nanoparticles Market Restraints 4.2.2.3. Europe Silver Nanoparticles Market Opportunities 4.2.2.4. Europe Silver Nanoparticles Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Silver Nanoparticles Market Drivers 4.2.3.2. Asia Pacific Silver Nanoparticles Market Restraints 4.2.3.3. Asia Pacific Silver Nanoparticles Market Opportunities 4.2.3.4. Asia Pacific Silver Nanoparticles Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Silver Nanoparticles Market Drivers 4.2.4.2. Middle East and Africa Silver Nanoparticles Market Restraints 4.2.4.3. Middle East and Africa Silver Nanoparticles Market Opportunities 4.2.4.4. Middle East and Africa Silver Nanoparticles Market Challenges 4.2.5. South America 4.2.5.1. South America Silver Nanoparticles Market Drivers 4.2.5.2. South America Silver Nanoparticles Market Restraints 4.2.5.3. South America Silver Nanoparticles Market Opportunities 4.2.5.4. South America Silver Nanoparticles Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Application Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. Silver Nanoparticles Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 5.1.1. Open Loop Systems 5.1.2. Closed Loop Systems 5.2. Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 5.2.1. Residential 5.2.2. Commercial 5.3. Silver Nanoparticles Market Size and Forecast, by Region (2023-2030) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Silver Nanoparticles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. North America Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 6.1.1. Antimicrobial Applications 6.1.2. Electronics 6.1.3. Catalysis 6.1.4. Medical & Healthcare 6.1.5. Photovoltaics 6.2. North America Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 6.2.1. Healthcare Industry 6.2.2. Electronics 6.2.3. Textiles 6.2.4. Food & Beverages 6.2.5. Cosmetics 6.3. North America Silver Nanoparticles Market Size and Forecast, by Country (2023-2030) 6.3.1. United States 6.3.1.1. United States Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 6.3.1.1.1. Antimicrobial Applications 6.3.1.1.2. Electronics 6.3.1.1.3. Catalysis 6.3.1.1.4. Medical & Healthcare 6.3.1.1.5. Photovoltaics 6.3.1.2. United States Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 6.3.1.2.1. Healthcare Industry 6.3.1.2.2. Electronics 6.3.1.2.3. Textiles 6.3.1.2.4. Food & Beverages 6.3.1.2.5. Cosmetics 6.3.2. Canada 6.3.2.1. Canada Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 6.3.2.1.1. Antimicrobial Applications 6.3.2.1.2. Electronics 6.3.2.1.3. Catalysis 6.3.2.1.4. Medical & Healthcare 6.3.2.1.5. Photovoltaics 6.3.2.2. Canada Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 6.3.2.2.1. Healthcare Industry 6.3.2.2.2. Electronics 6.3.2.2.3. Textiles 6.3.2.2.4. Food & Beverages 6.3.2.2.5. Cosmetics 6.3.3. Mexico 6.3.3.1. Mexico Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 6.3.3.1.1. Antimicrobial Applications 6.3.3.1.2. Electronics 6.3.3.1.3. Catalysis 6.3.3.1.4. Medical & Healthcare 6.3.3.1.5. Photovoltaics 6.3.3.2. Mexico Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 6.3.3.2.1. Healthcare Industry 6.3.3.2.2. Electronics 6.3.3.2.3. Textiles 6.3.3.2.4. Food & Beverages 6.3.3.2.5. Cosmetics 7. Europe Silver Nanoparticles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Europe Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.2. Europe Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3. Europe Silver Nanoparticles Market Size and Forecast, by Country (2023-2030) 7.3.1. United Kingdom 7.3.1.1. United Kingdom Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.1.2. United Kingdom Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.2. France 7.3.2.1. France Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.2.2. France Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.3. Germany 7.3.3.1. Germany Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.3.2. Germany Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.4. Italy 7.3.4.1. Italy Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.4.2. Italy Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.5. Spain 7.3.5.1. Spain Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.5.2. Spain Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.6. Sweden 7.3.6.1. Sweden Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.6.2. Sweden Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.7. Austria 7.3.7.1. Austria Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.7.2. Austria Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 7.3.8. Rest of Europe 7.3.8.1. Rest of Europe Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 7.3.8.2. Rest of Europe Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8. Asia Pacific Silver Nanoparticles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Asia Pacific Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.2. Asia Pacific Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3. Asia Pacific Silver Nanoparticles Market Size and Forecast, by Country (2023-2030) 8.3.1. China 8.3.1.1. China Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.1.2. China Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.2. S Korea 8.3.2.1. S Korea Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.2.2. S Korea Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.3. Japan 8.3.3.1. Japan Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.3.2. Japan Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.4. India 8.3.4.1. India Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.4.2. India Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.5. Australia 8.3.5.1. Australia Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.5.2. Australia Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.6. Indonesia 8.3.6.1. Indonesia Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.6.2. Indonesia Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.7. Malaysia 8.3.7.1. Malaysia Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.7.2. Malaysia Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.8. Vietnam 8.3.8.1. Vietnam Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.8.2. Vietnam Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.9. Taiwan 8.3.9.1. Taiwan Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.9.2. Taiwan Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 8.3.10. Rest of Asia Pacific 8.3.10.1. Rest of Asia Pacific Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 8.3.10.2. Rest of Asia Pacific Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 9. Middle East and Africa Silver Nanoparticles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. Middle East and Africa Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 9.2. Middle East and Africa Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 9.3. Middle East and Africa Silver Nanoparticles Market Size and Forecast, by Country (2023-2030) 9.3.1. South Africa 9.3.1.1. South Africa Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 9.3.1.2. South Africa Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 9.3.2. GCC 9.3.2.1. GCC Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 9.3.2.2. GCC Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 9.3.3. Nigeria 9.3.3.1. Nigeria Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 9.3.3.2. Nigeria Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 9.3.4. Rest of ME&A 9.3.4.1. Rest of ME&A Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 9.3.4.2. Rest of ME&A Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 10. South America Silver Nanoparticles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 10.1. South America Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 10.2. South America Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 10.3. South America Silver Nanoparticles Market Size and Forecast, by Country (2023-2030) 10.3.1. Brazil 10.3.1.1. Brazil Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 10.3.1.2. Brazil Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 10.3.2. Argentina 10.3.2.1. Argentina Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 10.3.2.2. Argentina Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 10.3.3. Rest Of South America 10.3.3.1. Rest Of South America Silver Nanoparticles Market Size and Forecast, By Application (2023-2030) 10.3.3.2. Rest Of South America Silver Nanoparticles Market Size and Forecast, By End-Use Industry (2023-2030) 11. Company Profile: Key Players 11.1. Nanocomposix 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Meliorum Technologies 11.3. Nanophase Technologies Corporation 11.4. American Elements 11.5. NanoComposix 11.6. Advanced Nano Products Co., Ltd. 11.7. PlasmaChem Japan 11.8. QuantumSphere Japan 11.9. Particular Japan 11.10. Avantama AG India Pvt. Ltd. 11.11. Sigma-Aldrich Corporation (now part of Merck KGaA) 11.12. BBI Solutions 11.13. PlasmaChem GmbH 11.14. Nanogap Sub-nm-particles S.L. 11.15. Particular GmbH 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary