The Silicone Market size was valued at USD 22.88 Billion in 2024 and the total Silicone revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 36.54 Billion.Global Silicone Market Overview

Silicone is an important component of photovoltaic cells, which are used in solar panels. The growth of solar energy installations contributes to silicone demand. It is integral to the development of sensors, actuators, and other electronic components used in smart manufacturing, contributing to the Silicone Market demand. The semiconductor sector is a large consumer of this component, and any increase in production prices has been affecting semiconductor and integrated circuit manufacture. This can result in higher component costs for electrical gadgets, affecting the entire electronic supply chain, influencing various industries, including the packaged food market, processed food industry, and ready-to-eat food market, where automation and electronics are widely used. China's electronics manufacturing sector, which includes consumer electronics, computers, and communication devices, is a major driver of silicone demand. The country's dominance in electronics manufacturing contributes significantly to its impact in this market.To know about the Research Methodology :- Request Free Sample Report

Silicone Market Dynamics:

Rising Electronics Production to Boost the Silicone Demand The increasing demand for silicone in the electronics industry is attributed to several factors. It is a versatile semiconductor material that plays a crucial role in the production of various electronic devices. Semiconductor devices are the backbone of electronic gadgets, providing the functionality and processing power required for a wide range of applications, from computing and communication to entertainment and automation. In the Asia-Pacific region, Taiwan is the biggest manufacturer of semiconductors; it accounts for over half of global production. The electronics sector is characterized by ongoing technological breakthroughs, which result in the production of more sophisticated and powerful gadgets. China is the dominant country in the electronics industry. A variety of factors include the dominance of China in the electronics market, such as a large and trained workforce, low labor costs, and robust supply chain infrastructure. China has several large electronics firms, especially Foxconn, which assembles products for corporations such as Apple. Global smartphone and computer adoption has been a major driver of silicone consumption. Expansion of the Solar Energy Sector Favors Silicone Market Development The solar industry heavily relies on silicone for the production of photovoltaic cells used in solar panels. The solar industry demands high-purity silicone to ensure optimal efficiency in photovoltaic cells. This is typically achieved through the production of polycrystalline or monocrystalline silicone, with monocrystalline silicone often favored for higher efficiency. In 2022, solar PV (photovoltaic) generation climbed by a record 270 TWh (up 26%), reaching about 1300 TWh. Hence, the high demand for silicone in solar energy sector is anticipated to have a positive impact on the Silicone Market growth.Silicone Market Regional Insights

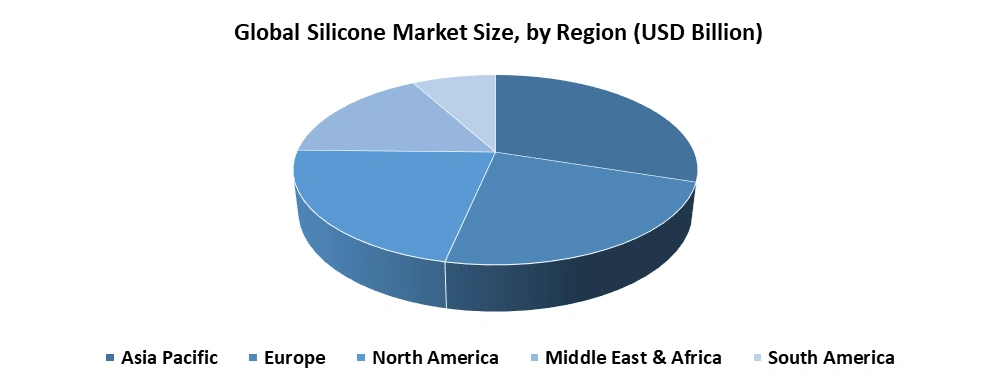

The Asia Pacific area, notably China, has dominated the Silicone sector. China is a vital hub for electronics production, producing a significant share of the world's electronic devices. Silicone is a fundamental material in semiconductor manufacturing, and the demand for electronic gadgets in China has driven significant Silicone consumption. China's rapid industrialization and economic growth have increased the overall demand for Silicone across various sectors, including construction, automotive, and manufacturing. Europe is anticipated to hold a significant market share. This is attributable to the increasing environmental regulations propelling the use of recyclable as well as sustainable silicone products. Similarly, the highly environmentally conscious population in European countries, fuelling the demand for electric vehicles, is anticipated to make a significant contribution to market progression.

Silicone Market Segment Analysis

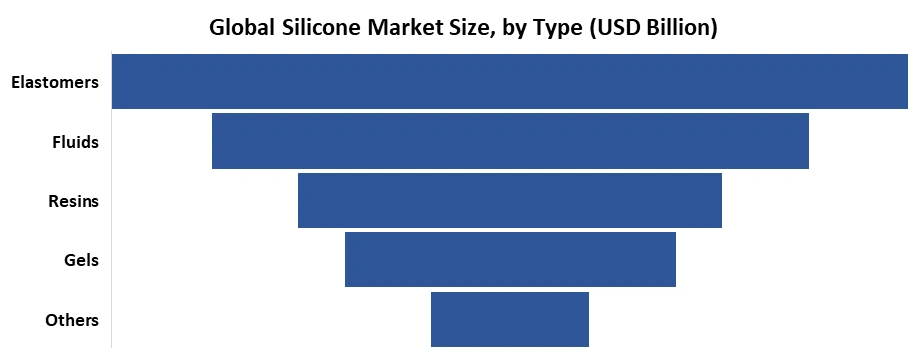

Based on Type, the Elastomer Segment held a dominant position in the global silicone market in 2024. The dominance of the segment is driven by its versatile applications across various industries. Silicone elastomers are highly valued for their exceptional properties, including high thermal stability, flexibility, and resistance to UV radiation and extreme temperatures. These elastomers withstand temperature ranges from -60°C to 250°C, making them ideal for applications in the automotive, aerospace, electronics sectors, and the packaged food industry for safe and durable food contact materials. For instance, in the automotive industry, silicone elastomers are used in gaskets, seals, and hoses, where they must endure temperatures up to 200°C under the hood.

Silicone Market Competitive Landscape

The competitive landscape of the Silicone market is rapid and shaped by the presence of key players, their strategies, and the developing global demand for Silicone-based products. Asian companies, especially those in China and South Korea, have become major players in the market. Companies like China National Offshore Oil Corporation (CNOOC) and Samsung Electronics have a significant impact on the Silicone Industry growth. Companies are adopting environmentally friendly production practices, and some are investing in the development of sustainable Silicone alternatives, including for eco-friendly packaged food packaging.Recent Developments

• In September 2024, Wacker Chemie AG, a Silicone manufacturer, declared an investment of USD 160.34 million to increase its Silicone production facilities in China. The plant can produce Silicone fluids, Silicone emulsions, and Silicone elastomer gels suitable for food-safe packaged food applications.Silicone Market Scope: Inquiry Before Buying

Global Silicone Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 22.88 Bn. Forecast Period 2025 to 2032 CAGR: 6.1% Market Size in 2032: USD 36.54 Bn. Segments Covered: by Type Fluids Gels Resins Elastomers Others by End Use Industries Transportation Construction Materials Electronics Healthcare Industrial Processes Personal Care and Consumer Products Others by Distribution Channel Offline Online Silicone Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Silicone Market, Key Players

1. General Atomics 2. Safran SA 3. MacTaggart, Scott and Company Limited 4. Sojitz Aerospace Corporation 5. QinetiQ Group plc 6. Zodiac Aerospace 7. General Atomics 8. Runway Safe 9. SCAMA AB 10. Boeing 11. Atech Inc 12. A-Laskuvarjo 13. Curtiss-Wright Corp 14. Escribana Mechanical & Engineering S.L 15. Foster-Mille, Inc 16. General Atomics 17. Scama AB 18. Victor Balata Belting Company 19. Wire Rope Industries 20. WireCo WorldGroup 21. Aries S.A 22. Dow Silicones 23. Wacker Chemie AG 24. Momentive Performance Materials 25. Elkem Silicones 26. Shin‑Etsu Chemical Co., Ltd. 27. KCC Silicone (KCC Corporation) 28. Silicone Engineering Ltd 29. Simtec Silicone Parts, LLC 30. Genesee Polymers CorporationFAQs:

1. What is the study period of the market? Ans. The Global Silicone Market is studied from 2024-2032. 2. What is the growth rate of the Silicone Market? Ans. The Silicone Market is growing at a CAGR of 6.1 % over the forecast period. 3. What is the market size of the Silicone Market by 2032? Ans. The market size of the Silicone Market by 2032 is expected to reach USD 36.54 Bn. 4. What is the forecast period for the Silicone Market? Ans. The forecast period for the Silicone Market is 2025-2032. 5. What was the Global Silicone Market size in 2024? Ans: The Global Silicone Market size was USD 22.88 Billion in 2024.

1. Silicone Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Silicone Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Silicone Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Silicone Market: Dynamics 3.1. Silicone Market Trends by Region 3.1.1. North America Silicone Market Trends 3.1.2. Europe Silicone Market Trends 3.1.3. Asia Pacific Silicone Market Trends 3.1.4. Middle East and Africa Silicone Market Trends 3.1.5. South America Silicone Market Trends 3.2. Silicone Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Silicone Market Drivers 3.2.1.2. North America Silicone Market Restraints 3.2.1.3. North America Silicone Market Opportunities 3.2.1.4. North America Silicone Market Challenges 3.2.2. Europe 3.2.2.1. Europe Silicone Market Drivers 3.2.2.2. Europe Silicone Market Restraints 3.2.2.3. Europe Silicone Market Opportunities 3.2.2.4. Europe Silicone Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Silicone Market Drivers 3.2.3.2. Asia Pacific Silicone Market Restraints 3.2.3.3. Asia Pacific Silicone Market Opportunities 3.2.3.4. Asia Pacific Silicone Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Silicone Market Drivers 3.2.4.2. Middle East and Africa Silicone Market Restraints 3.2.4.3. Middle East and Africa Silicone Market Opportunities 3.2.4.4. Middle East and Africa Silicone Market Challenges 3.2.5. South America 3.2.5.1. South America Silicone Market Drivers 3.2.5.2. South America Silicone Market Restraints 3.2.5.3. South America Silicone Market Opportunities 3.2.5.4. South America Silicone Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Silicone Industry 3.8. Analysis of Government Schemes and Initiatives For Silicone Industry 3.9. Silicone Market Trade Analysis 3.10. The Global Pandemic Impact on Silicone Market 4. Silicone Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Silicone Market Size and Forecast, by Type (2024-2032) 4.1.1. Fluids 4.1.2. Gels 4.1.3. Resins 4.1.4. Elastomers 4.1.5. Others 4.2. Silicone Market Size and Forecast, by End Use Industries (2024-2032) 4.2.1. Transportation 4.2.2. Construction Materials 4.2.3. Electronics 4.2.4. Healthcare 4.2.5. Industrial Processes 4.2.6. Personal Care and Consumer Products 4.2.7. Others 4.3. Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1. Offline 4.3.2. Online 4.4. Silicone Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Silicone Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Silicone Market Size and Forecast, by Type (2024-2032) 5.1.1. Fluids 5.1.2. Gels 5.1.3. Resins 5.1.4. Elastomers 5.1.5. Others 5.2. North America Silicone Market Size and Forecast, by End Use Industries (2024-2032) 5.2.1. Transportation 5.2.2. Construction Materials 5.2.3. Electronics 5.2.4. Healthcare 5.2.5. Industrial Processes 5.2.6. Personal Care and Consumer Products 5.2.7. Others 5.3. North America Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1. Offline 5.3.2. Online 5.4. North America Silicone Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Silicone Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Fluids 5.4.1.1.2. Gels 5.4.1.1.3. Resins 5.4.1.1.4. Elastomers 5.4.1.1.5. Others 5.4.1.2. United States Silicone Market Size and Forecast, by End Use Industries (2024-2032) 5.4.1.2.1. Transportation 5.4.1.2.2. Construction Materials 5.4.1.2.3. Electronics 5.4.1.2.4. Healthcare 5.4.1.2.5. Industrial Processes 5.4.1.2.6. Personal Care and Consumer Products 5.4.1.2.7. Others 5.4.1.3. United States Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1.3.1. Offline 5.4.1.3.2. Online 5.4.2. Canada 5.4.2.1. Canada Silicone Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Fluids 5.4.2.1.2. Gels 5.4.2.1.3. Resins 5.4.2.1.4. Elastomers 5.4.2.1.5. Others 5.4.2.2. Canada Silicone Market Size and Forecast, by End Use Industries (2024-2032) 5.4.2.2.1. Transportation 5.4.2.2.2. Construction Materials 5.4.2.2.3. Electronics 5.4.2.2.4. Healthcare 5.4.2.2.5. Industrial Processes 5.4.2.2.6. Personal Care and Consumer Products 5.4.2.2.7. Others 5.4.2.3. Canada Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2.3.1. Offline 5.4.2.3.2. Online 5.4.3. Mexico 5.4.3.1. Mexico Silicone Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Fluids 5.4.3.1.2. Gels 5.4.3.1.3. Resins 5.4.3.1.4. Elastomers 5.4.3.1.5. Others 5.4.3.2. Mexico Silicone Market Size and Forecast, by End Use Industries (2024-2032) 5.4.3.2.1. Transportation 5.4.3.2.2. Construction Materials 5.4.3.2.3. Electronics 5.4.3.2.4. Healthcare 5.4.3.2.5. Industrial Processes 5.4.3.2.6. Personal Care and Consumer Products 5.4.3.2.7. Others 5.4.3.3. Mexico Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3.3.1. Offline 5.4.3.3.2. Online 6. Europe Silicone Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Silicone Market Size and Forecast, by Type (2024-2032) 6.2. Europe Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.3. Europe Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4. Europe Silicone Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Silicone Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.1.3. United Kingdom Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2. France 6.4.2.1. France Silicone Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.2.3. France Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Silicone Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.3.3. Germany Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Silicone Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.4.3. Italy Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Silicone Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.5.3. Spain Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Silicone Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.6.3. Sweden Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Silicone Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.7.3. Austria Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Silicone Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Silicone Market Size and Forecast, by End Use Industries (2024-2032) 6.4.8.3. Rest of Europe Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Silicone Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Silicone Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.3. Asia Pacific Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4. Asia Pacific Silicone Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Silicone Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.1.3. China Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Silicone Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.2.3. S Korea Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Silicone Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.3.3. Japan Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4. India 7.4.4.1. India Silicone Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.4.3. India Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Silicone Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.5.3. Australia Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Silicone Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.6.3. Indonesia Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Silicone Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.7.3. Malaysia Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Silicone Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.8.3. Vietnam Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Silicone Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.9.3. Taiwan Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Silicone Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Silicone Market Size and Forecast, by End Use Industries (2024-2032) 7.4.10.3. Rest of Asia Pacific Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Silicone Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Silicone Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Silicone Market Size and Forecast, by End Use Industries (2024-2032) 8.3. Middle East and Africa Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 8.4. Middle East and Africa Silicone Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Silicone Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Silicone Market Size and Forecast, by End Use Industries (2024-2032) 8.4.1.3. South Africa Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Silicone Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Silicone Market Size and Forecast, by End Use Industries (2024-2032) 8.4.2.3. GCC Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Silicone Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Silicone Market Size and Forecast, by End Use Industries (2024-2032) 8.4.3.3. Nigeria Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Silicone Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Silicone Market Size and Forecast, by End Use Industries (2024-2032) 8.4.4.3. Rest of ME&A Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Silicone Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Silicone Market Size and Forecast, by Type (2024-2032) 9.2. South America Silicone Market Size and Forecast, by End Use Industries (2024-2032) 9.3. South America Silicone Market Size and Forecast, by Distribution Channel(2024-2032) 9.4. South America Silicone Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Silicone Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Silicone Market Size and Forecast, by End Use Industries (2024-2032) 9.4.1.3. Brazil Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Silicone Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Silicone Market Size and Forecast, by End Use Industries (2024-2032) 9.4.2.3. Argentina Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Silicone Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Silicone Market Size and Forecast, by End Use Industries (2024-2032) 9.4.3.3. Rest Of South America Silicone Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. General Atomics 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Safran SA 10.3. MacTaggart, Scott and Company Limited 10.4. Sojitz Aerospace Corporation 10.5. QinetiQ Group plc 10.6. Zodiac Aerospace 10.7. General Atomics 10.8. Runway Safe 10.9. SCAMA AB 10.10. Boeing 10.11. Atech Inc 10.12. A-Laskuvarjo 10.13. Curtiss-Wright Corp 10.14. Escribana Mechanical & Engineering S.L 10.15. Foster-Mille, Inc 10.16. General Atomics 10.17. Scama AB 10.18. Victor Balata Belting Company 10.19. Wire Rope Industries 10.20. WireCo WorldGroup 10.21. Aries S.A 10.22. Dow Silicones 10.23. Wacker Chemie AG 10.24. Momentive Performance Materials 10.25. Elkem Silicones 10.26. Shin‑Etsu Chemical Co., Ltd. 10.27. KCC Silicone (KCC Corporation) 10.28. Silicone Engineering Ltd 10.29. Simtec Silicone Parts, LLC 10.30. Genesee Polymers Corporation 11. Key Findings 12. Industry Recommendations 13. Silicone Market: Research Methodology 14. Terms and Glossary