The Global Shot Blasting Machine Market is estimated to be valued at USD 1295.25 million in 2024. The market is expected to reach USD 2115.08 million by 2032, exhibiting a compound annual growth rate (CAGR) of 6.32% from 2025 to 2032.Global Shot Blasting Machine Market Overview

A shot blasting machine is equipment used to remove surface contaminants (such as rust, paint, or scale) or to prepare surfaces before processes like welding, painting, or coating. This is achieved by propelling abrasive material at high velocity toward the surface. The shot blasting machine market encompasses the global industry focused on the manufacturing and supply of machines used for surface preparation and finishing, primarily through abrasive blasting. These machines are crucial for cleaning, descaling, peening, and otherwise preparing metal parts for further processing or coating. The market is experiencing steady growth, driven by increasing demand across various industries like automotive, aerospace, construction, and shipbuilding. Key Companies Insights • Norican Group (Wheelabrator): On September 24-25,2024, join DISA, Simpson, and Wheelabrator at METAL 2024, part of the Targi Kielce Industrial Autumn, this premier International Fair of Technologies for Foundry to showcase cutting-edge advancements in metallurgy, heat treatment, non-ferrous metal processing, and recycling. Meet us and our Agent Foundry Partner to discover future-ready solutions set to shape the next era of foundry innovation. Don’t miss this industry-defining event. • OMSG: In 2017, OMSG reinforced its market position through the strategic acquisition of CARLO BANFI, a renowned shot blasting manufacturer with over 4,000 machines installed globally. This move significantly broadened OMSG’s technological expertise and international reach. By integrating CARLO BANFI’s legacy and specialized knowledge, OMSG strengthened its brand presence and consolidated its position in key global markets under a unified, expert-driven group. • Sinto AGTOS GmbH: Sinto AGTOS’s acquisition by SINTOKOGIO LTD. and integration into the WINOA SA Group have significantly enhanced its global reach and capabilities. These strategic partnerships provide access to expanded resources, advanced technologies, and new markets. By combining Sinto AGTOS’s precision wheel blasting expertise with WINOA’s premium abrasives and SINTOKOGIO’s global foundry solutions, the company is now better positioned to deliver comprehensive, high-performance surface preparation systems backed by cross-company innovation.To know about the Research Methodology :- Request Free Sample Report

Global Shot Blasting Machine Market Dynamics

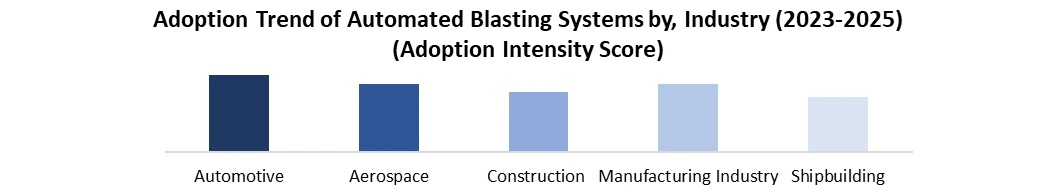

Rising Adoption of Automated Blasting Systems Across Diverse Industries The automotive sector is witnessing a growing adoption of automated blasting systems as a part of advanced surface preparation processes. These systems are increasingly used to remove paint, rust, and contaminants from metal parts, ensuring surfaces are clean and smooth before further finishing. The trend reflects a shift toward precision and efficiency in achieving high-quality surface finishes, essential for aesthetic appeal and corrosion resistance. Additionally, the ability of automated systems to develop consistent surface textures supports both functional and design requirements, aligning with the industry's emphasis on quality assurance and streamlined production. • In February 2025, Alupress (Italy) implemented a continuous-feed spinner hanger shot-blast machine with transport automation from Rösler. Designed for die-cast aluminum and magnesium parts used in electric vehicle components, this system ensures gentle de flashing, prevents distortion, and automates both blasting and cleaning stages In the aerospace industry, automated blasting systems are becoming an integral part of Maintenance, Repair, and Overhaul (MRO) operations. As the industry adheres to extremely stringent safety and performance standards, there is a notable trend toward replacing manual processes with highly controlled, automated surface preparation solutions. These systems are vital for cleaning engine parts, structural elements, and critical components, removing oxides and old coatings with exceptional precision. The increasing demand for defect-free maintenance workflows is driving the adoption of automated blasting systems, which enhance safety, reliability, and compliance with aerospace regulations. The manufacturing sector is embracing automated blasting systems for a broad spectrum of applications, with a trend toward enhancing operational efficiency and surface consistency. These systems are now routinely used for cleaning molds and dies, preparing surfaces for welding, and creating specific finishes to improve adhesion or aesthetics. Manufacturers are leveraging automation to manage large work volumes with minimal human intervention, thereby increasing throughput and reducing downtime. Particularly in metal fabrication, the growing demand for customized surface textures is reinforcing the shift toward programmable and repeatable blasting operations. Automated blasting systems are gaining traction in the construction and shipbuilding industries, where surface preparation is critical for structural integrity and performance. In construction, there's a rising trend of using these systems to clean concrete, prepare steel structures, and remove coatings efficiently. Meanwhile, in shipbuilding, they are being increasingly used for hull maintenance, where the removal of marine growth and aged paint is essential to maintain vessel efficiency and longevity. The shift from manual to automated solutions in these sectors is driven by the need for consistent results, labor savings, and improved safety on job sites. BlastOne Acquires VertiDrive (Abr. Blasting Robots) • In April 2023, BlastOne International (Ohio, USA) acquired Netherlands-based VertiDrive, a robotics specialist in abrasive blasting. The acquisition aims to integrate VertiDrive’s robot systems into sectors like shipbuilding, heavy fabrication, and infrastructure.

Global Shot Blasting Machine Market Segmentation

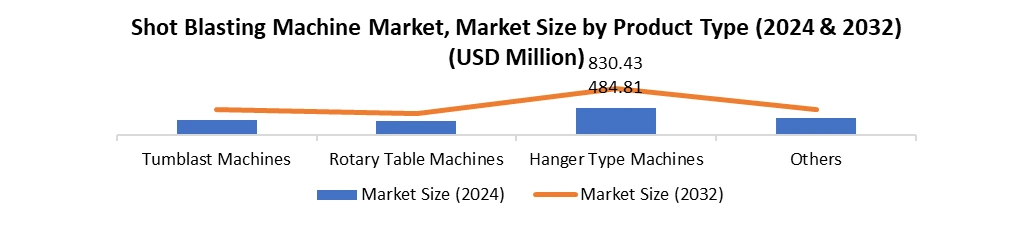

By Product Type – “Dominance of Hanger Type Machines” In 2024, Hanger Type Machines emerged as the most dominant product segment, capturing a significant market size of USD 484.81 million. These machines are widely preferred across industries due to their versatility and ability to handle large, delicate, or irregularly shaped components without causing damage. Their operational design allows parts to be suspended and rotated during blasting, ensuring thorough and uniform surface treatment. This is particularly valuable in sectors like automotive, aerospace, and heavy machinery, where the structural integrity and finish quality of components are critical. In contrast, Tumblast Machines and Rotary Table Machines are more commonly used for batch cleaning of smaller or moderately heavy parts. While these segments hold solid ground in foundry and metalworking applications, they do not offer the same level of flexibility and part-handling capability as hanger systems. The “Others” category, which includes belt, mesh, and pipe-blasting variants, collectively shows traction but remains fragmented and more application-specific. The strong preference for hanger-type machines underscores the market's shift toward equipment that balances precision, efficiency, and adaptability in increasingly automated and high-throughput production environments. By Technology – “Dominance of Wheel Blasting” Within the technology segment, Wheel Blasting leads the market with a size of USD 715.50 million in 2024, outpacing Air Blasting, which stands at USD XX million. Wheel blasting systems are favored for their high-speed, high-volume capability and lower operational cost per cycle, key factors for large-scale industrial applications such as automotive component processing, foundry cleaning, and construction equipment surface prep. The core advantage lies in the use of centrifugal wheels to project abrasives, making the process more energy-efficient and ideal for bulk material throughput. Industries that need continuous and consistent blasting at scale, like casting plants and structural steel manufacturers, rely heavily on this method. On the other hand, Air Blasting systems are typically used in applications requiring greater precision or flexibility, such as maintenance of aerospace components, surface texturing for coating preparation, or manual touch-up work. While air blasting is indispensable in MRO (Maintenance, Repair, and Overhaul) and specialty metal finishing, it lacks the processing speed and cost-effectiveness of wheel blasting for high-volume tasks. Thus, wheel blasting’s leadership is a reflection of its dominance in mass-production industries, aligning with the broader trend toward automated, cost-efficient, and durable surface treatment solutions.

Global Shot Blasting Machine Market Regional Analysis

Asia-Pacific – “The Global Powerhouse in Shot Blasting Machines” The Asia-Pacific region dominates the global shot blasting machine market in 2024 with a market size of USD 457.88 million, driven by rapid industrialization, heavy investment in infrastructure, and a robust manufacturing ecosystem. China, with a leading market share of USD 162.79 million, anchors this dominance. As the world’s largest manufacturing hub, China has a massive demand for shot blasting machines across automotive parts, foundries, shipbuilding, and steel fabrication. Government-led infrastructure megaprojects and the push for smart manufacturing further bolster demand for automated surface preparation systems. Japan and South Korea follow closely, benefiting from advanced machinery production, strict surface quality requirements in aerospace and electronics, and high automation standards. Japanese firms especially lead in precision manufacturing and MRO services, where air blasting and rotary table machines are commonly used. India is an emerging growth driver, spurred by its fast-expanding automotive, railways, and construction sectors. The government’s “Make in India” initiative and increasing automation in fabrication facilities have led to a rising adoption of hanger and tumblast machines. Australia and Indonesia, though smaller markets, contribute through niche applications in mining equipment maintenance and oil & gas infrastructure, reflecting sector-specific demand. In sum, Asia-Pacific’s leadership stems from its diverse industrial base, high-volume production requirements, and increasing automation penetration, especially in China and developed East Asian economies.Europe – “Quality-Driven, Technologically Mature Market” Europe represents a mature yet innovation-driven market in 2024, valued at USD 287.93 million. The region’s dominance in high-end engineering, surface treatment standards, and export-driven manufacturing sustains its global relevance. Germany leads within Europe with a market size of USD 64.04 million, owing to its strong automotive and machinery sectors, where precision and quality assurance are paramount. German OEMs and Tier-1 suppliers often invest in automated wheel blasting systems to maintain surface uniformity and performance. France and the UK follow, both having robust defence, aerospace, and energy equipment industries. French companies emphasize surface preparation in aerospace MRO, while the UK maintains demand from marine engineering and oil & gas applications, especially in offshore assets. Italy supports market share through its die-casting and metalworking cluster, where hanger-type machines are heavily used for decorative and structural components. Spain contributes via shipbuilding and construction steel finishing operations, particularly in coastal regions. Although not as high-growth as Asia-Pacific, Europe's market is defined by technical sophistication, high regulatory standards, and a shift toward robot-assisted and energy-efficient blasting systems, sustaining long-term competitiveness.

Shot Blasting Market Regulations Analysis

North America: • OSHA 1910.109 – Explosives and Blasting Agents OSHA 1910.109 regulates the handling, storage, and transportation of explosives and blasting agents, which applicable to shot blasting when explosive-actuated devices are used. The defines standards for safe storage in magazines, separation of blasting caps, and prohibits practices that pose undue hazard. Though traditional shot blasting uses mechanical means, any use of explosive-driven tools or blasting agents falls under this rule. Employers ensure materials are not detonable with a No. 8 blasting cap and must comply with Department of Transportation classifications. Compliance prevents workplace injuries and ensures legal operation of blasting procedures. • SAE J444 – Particle Size Classification of Abrasives SAE J444 establishes a standardized system for classifying metallic abrasives especially steel shot and grit by particle size through sieve analysis. Widely used in North America, this standard helps shot blasting operators select the abrasive size for specific surface preparation tasks such as cleaning, peening, or profiling. Consistent sizing ensures uniform surface finishes, optimized equipment performance, and minimal abrasive waste. Manufacturers adhere to SAE J444 to meet customer demands for precision and repeatability. It supports quality assurance programs and enhances productivity in blasting operations across automotive, aerospace, and construction sectors. • SAE J827 – High-Carbon Cast Steel Shot Specification SAE J827 defines the required characteristics of high-carbon cast steel shot used in shot blasting. It specifies chemical composition, hardness range, microstructure, and mechanical properties to ensure abrasive consistency and durability. These criteria allow for high impact strength, minimal breakdown, and multiple reuse cycles, making it a preferred standard in North American industries like automotive and heavy machinery. By conforming to SAE J827, manufacturers ensure optimal cleaning and peening effectiveness. The standard is essential for maintaining quality control, reducing operational costs, and achieving reliable surface preparation in industrial shot blasting. Global Shot Blasting Machine Market Competitive Landscape The global shot blasting machine market is marked by intense rivalry and rapid innovation, with leading players such as Graco Inc., Airblast, and Wheelabrator (Norican Group) competing across technologies, geographies, and customer segments. Each firm brings distinct strengths, from product diversity to digital upgrades, that shape their competitive edge in a market increasingly defined by automation, sustainability, and customization. Graco Inc., a global fluid handling and surface treatment solutions leader, commands a unique space with its EcoQuip 2 Vapor Abrasive Blasting Equipment. Unlike traditional dry blasting, Graco’s systems reduce dust by up to 92%, promoting safe and clean operations, making them highly attractive in industrial and commercial applications focused on sustainability. With 62.9% of its revenue generated from the Americas and nearly 59% coming from industrial applications, Graco's dominance is particularly strong in construction, automotive refinishing, and infrastructure maintenance. Its modular, lean-manufactured systems like the EQm, EQs, EQp, and EQ400t are designed to be highly portable and customizable, addressing both mass market and niche use cases. The company’s strategic advantage lies in its integration of digital tools, smart controls, and sustainability engineering, supported by an R&D spend of over 4–5% of annual revenue. Graco maintains a premium market image through a customer-centric marketing approach that combines robust online tools with global distributor training. Airblast, with over 50 years of legacy, has established itself as a globally trusted name in high-performance shot blasting solutions. Its strength lies in a vertically integrated model that controls every aspect, from engineering to final assembly, across its European and Far East production bases. Airblast’s portfolio spans wheelblast and airblast equipment, including manual wet/dry blast cabinets, internal cleaning machines, and roller conveyor systems. Uniquely, the company excels at combining standard systems with deeply customized solutions, which enables it to serve clients in heavy industries like shipbuilding, oil & gas, and construction, where operational environments demand tailored machinery. Moreover, Airblast is pioneering zero-emission blasting technologies, aligning its product innovation with global sustainability goals. Its wide distribution network and global service model ensure agility in delivery and support, giving it a strong competitive hold, particularly in regions where regulation, terrain, or technical demands vary significantly. Wheelabrator, now part of the Norican Group through its merger with DISA, stands as a technology titan with over 130 years of expertise. Specializing in wheel and air blast machines, it boasts industry-leading performance in sectors like automotive, aerospace, foundries, and energy. Its RC-Line, TB-Line, and HP-Line shot blasting systems offer advanced capabilities in roller conveyor, tumble belt, and hanger pass-through configurations, each engineered for high throughput and durability. What sets Wheelabrator apart is its digital-first service strategy, offering remote smart services (RSS), simulation-based equipment optimization, and lifecycle-based performance upgrades. Investments in metallography labs and blast simulation technologies also help shorten development cycles and enhance wear part performance. Operating from major manufacturing hubs in Europe, China, and North America, Wheelabrator leverages global reach with local expertise. Its sustainability ethos is embedded in dust recovery, abrasive recycling, and environmentally responsible descaling solutions, making it a market leader in both productivity and ESG compliance.Shot Blasting Machine Market Recent Development 1. Wheelabrator (Norican Group) • In 2024, launched a new compact wheel blast machine for medium-sized metal components, optimized for low energy consumption and minimal maintenance. • In 2023: Introduced SmartLine system upgrades integrating IoT and remote diagnostics for predictive maintenance. 2. Rosler Oberflächentechnik GmbH • 2024: Expanded its automated blast cell solutions with robotic part handling and real-time process monitoring for aerospace and automotive clients. • 2023: Partnered with major European automotive manufacturers to provide customized inline shot blasting systems. 3. Sinto Group (Sintokogio Ltd.) • 2024: Developed a high-throughput blast system for foundry operations with improved dust collection and enhanced abrasive flow control.

Sr. No. Company Name Market Share (%) 1. Airblast B.V. 2.78% 2. Rösler XX% 3. Graco Inc 5.56% 4. Norican (Wheelabrator) 11.30% 5. Shandong Kaitai XX% 6. Others XX% Shot Blasting Machine Market Scope: Inquire before buying

Shot Blasting Machine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1295.25 Mn. Forecast Period 2025 to 2032 CAGR: 6.32% Market Size in 2032: USD 2115.08 Mn. Segments Covered: by Product Type Tumblast Machines Rotary Table Machines Hanger Type Machines Others by Technology Wheel Blasting Air Blasting by Mode of Operation Automatic Semi-Automatic Manual by Application Automotive Construction Aerospace Metalworking Oil & Gas Others Global Shot Blasting Machine Market, By Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Global Shot Blasting Machine Market key players

1. Airblast B.V. 2. Airo Shot Blast 3. C.M. Surface Treatment 4. COGEIM 5. Coniex SA 6. Goff Inc. 7. Graco Inc. 8. Guyson International Limited 9. HBC System 10. Kaltenbach Group 11. Norican Group (Wheelabrator) 12. OMSG 13. ORBITECH SHOTBLASTING EQUIPMENTS 14. Oteco 15. Pangborn 16. Quingdao Qinggong Machinery Co., Ltd. 17. Rösler Oberflächentechnik GmbH 18. Shandong Kaitai Group Co., Ltd 19. Siapro 20. Sinto AGTOS GmbH 21. TOSCA 22. Turbotecnica S.P.A. 23. Viking CorporationFrequently Asked Questions

Q1. Which product type dominates? Ans: Hanger Type Machines lead due to flexibility, high throughput, and compatibility with automation. Q2. What are the Key trends in the Shot Blasting Machine Market? Ans: Automation, eco-friendly systems, portable blasting units, and MRO applications are on the rise. Q3. Who are the Major players in the Shot Blasting Machine Market? Ans: Graco Inc., Wheelabrator, Airblast—competing via innovation, global reach, and product range. Q4. What challenges does the market face? Ans: Key challenges include high initial equipment costs, complex maintenance, and compliance with environmental regulations, especially in mature and regulated markets like Europe and North America. Q5. What is the market size of 2024 and the growth rate (%) for the Shot Blasting Machine Market? Ans: The market is valued at approximately USD 1295.25 Million in 2024, and the market is expected to grow at a CAGR of ~6.32% between 2024 and 2032.

1. Shot Blasting Machine Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Shot Blasting Machine Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Service Segment 2.2.3. End-User Segment 2.2.4. Revenue (2024) 2.2.5. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Shot Blasting Machine Market: Dynamics 3.1. Shot Blasting Machine Market Trends 3.2. Shot Blasting Machine Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Shot Blasting Machine Market: Technological Advancements and Innovations 5. Price Trend Analysis (For Shot Blasting Machines Market) 5.1. Comparative Price Lists of Italian and Major European Companies for Wheel Type Machines (Shot & Sand Blasting), In 2024 5.2. Historical Price Trends (2019–2024) 5.3. Current Pricing by Segment (2024) 5.4. Price Sensitivity & Buyer Preferences 5.5. Impact of Customization Needs on Pricing 5.6. Cost Preferences By Applicationr Industry 5.7. Impact of Raw Material Costs 6. Shot Blasting and Sand Blasting Machine Market: Supply Chain Analysis 6.1. Raw Material Procurement for Blasting Chambers 6.2. Manufacturing Footprint & Regional Supplier Ecosystems 6.3. Waste Recovery & Recycling of Blast Media 6.4. Green Blasting Media Adoption Trends 6.5. Emission Control & Dust-Free Machine Designs 7. Shot Blasting Machine Market: Regulatory Landscape & Compliance by Region 7.1. Workplace Safety Norms 7.2. Environmental Compliance 7.3. Import/Export Tariffs on Blasting Equipment 7.4. Industry Certification Standards 7.5. Impact of U.S. Tariff Regulations on the Machine Industry 8. Shot Blasting Machine Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 8.1. Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 8.1.1. Tumblast Machines 8.1.2. Rotary Table Machines 8.1.3. Hanger Type Machines 8.1.4. Others 8.2. Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 8.2.1. Wheel Blasting 8.2.2. Air Blasting 8.3. Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 8.3.1. Automatic 8.3.2. Semi-Automatic 8.3.3. Manual 8.4. Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 8.4.1. Automotive 8.4.2. Construction 8.4.3. Aerospace 8.4.4. Metalworking 8.4.5. Oil & Gas 8.4.6. Others 8.5. Shot Blasting Machine Market Size and Forecast, By Region (2024-2032) 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 9. North America Shot Blasting Machine Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 9.1. North America Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 9.1.1. Tumblast Machines 9.1.2. Rotary Table Machines 9.1.3. Hanger Type Machines 9.1.4. Others 9.2. North America Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 9.2.1. Wheel Blasting 9.2.2. Air Blasting 9.3. North America Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 9.3.1. Automatic 9.3.2. Semi-Automatic 9.3.3. Manual 9.4. North America Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 9.4.1. Automotive 9.4.2. Construction 9.4.3. Aerospace 9.4.4. Metalworking 9.4.5. Oil & Gas 9.4.6. Others 9.5. North America Shot Blasting Machine Market Size and Forecast, by Country (2024-2032) 9.5.1. United States 9.5.1.1. United States Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 9.5.1.1.1. Tumblast Machines 9.5.1.1.2. Rotary Table Machines 9.5.1.1.3. Hanger Type Machines 9.5.1.1.4. Others 9.5.1.2. United States Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 9.5.1.2.1. Wheel Blasting 9.5.1.2.2. Air Blasting 9.5.1.3. United States Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 9.5.1.3.1. Automatic 9.5.1.3.2. Semi-Automatic 9.5.1.3.3. Manual 9.5.1.4. United States Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 9.5.1.4.1. Automotive 9.5.1.4.2. Construction 9.5.1.4.3. Aerospace 9.5.1.4.4. Metalworking 9.5.1.4.5. Oil & Gas 9.5.1.4.6. Others 9.5.2. Canada 9.5.2.1. Canada Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 9.5.2.1.1. Tumblast Machines 9.5.2.1.2. Rotary Table Machines 9.5.2.1.3. Hanger Type Machines 9.5.2.1.4. Others 9.5.2.2. Canada Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 9.5.2.2.1. Wheel Blasting 9.5.2.2.2. Air Blasting 9.5.2.3. Canada Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 9.5.2.3.1. Automatic 9.5.2.3.2. Semi-Automatic 9.5.2.3.3. Manual 9.5.2.4. Canada Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 9.5.2.5. End-Use (2024-2032) 9.5.2.5.1. Automotive 9.5.2.5.2. Construction 9.5.2.5.3. Aerospace 9.5.2.5.4. Metalworking 9.5.2.5.5. Oil & Gas 9.5.2.5.6. Others 9.5.3. Mexico 9.5.3.1. Mexico Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 9.5.3.1.1. Tumblast Machines 9.5.3.1.2. Rotary Table Machines 9.5.3.1.3. Hanger Type Machines 9.5.3.1.4. Others 9.5.3.2. Mexico Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 9.5.3.2.1. Wheel Blasting 9.5.3.2.2. Air Blasting 9.5.3.3. Mexico Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 9.5.3.3.1. Automatic 9.5.3.3.2. Semi-Automatic 9.5.3.3.3. Manual 9.5.3.4. Mexico Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 9.5.3.4.1. Automotive 9.5.3.4.2. Construction 9.5.3.4.3. Aerospace 9.5.3.4.4. Metalworking 9.5.3.4.5. Oil & Gas 9.5.3.4.6. Others 10. Europe Shot Blasting Machine Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 10.1. Europe Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.2. Europe Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.3. Europe Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.4. Europe Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5. Europe Shot Blasting Machine Market Size and Forecast, by Country (2024-2032) 10.5.1. United Kingdom 10.5.1.1. United Kingdom Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.1.2. United Kingdom Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.1.3. United Kingdom Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.1.4. United Kingdom Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.2. France 10.5.2.1. France Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.2.2. France Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.2.3. France Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.2.4. France Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.3. Germany 10.5.3.1. Germany Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.3.2. Germany Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.3.3. Germany Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.3.4. Germany Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.4. Italy 10.5.4.1. Italy Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.4.2. Italy Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.4.3. Italy Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.4.4. Italy Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.5. Spain 10.5.5.1. Spain Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.5.2. Spain Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.5.3. Spain Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.5.4. Spain Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.6. Sweden 10.5.6.1. Sweden Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.6.2. Sweden Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.6.3. Sweden Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.6.4. Sweden Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.7. Russia 10.5.7.1. Russia Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.7.2. Russia Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.7.3. Russia Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.7.4. Russia Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 10.5.8. Rest of Europe 10.5.8.1. Rest of Europe Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 10.5.8.2. Rest of Europe Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 10.5.8.3. Rest of Europe Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 10.5.8.4. Rest of Europe Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11. Asia Pacific Shot Blasting Machine Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 11.1. Asia Pacific Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.2. Asia Pacific Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.3. Asia Pacific Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.4. Asia Pacific Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5. Asia Pacific Shot Blasting Machine Market Size and Forecast, by Country (2024-2032) 11.5.1. China 11.5.1.1. China Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.1.2. China Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.1.3. China Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.1.4. China Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.2. S Korea 11.5.2.1. S Korea Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.2.2. S Korea Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.2.3. S Korea Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.2.4. S Korea Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.3. Japan 11.5.3.1. Japan Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.3.2. Japan Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.3.3. Japan Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.3.4. Japan Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.4. India 11.5.4.1. India Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.4.2. India Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.4.3. India Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.4.4. India Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.5. Australia 11.5.5.1. Australia Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.5.2. Australia Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.5.3. Australia Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.5.4. Australia Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.6. Indonesia 11.5.6.1. Indonesia Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.6.2. Indonesia Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.6.3. Indonesia Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.6.4. Indonesia Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.7. Malaysia 11.5.7.1. Malaysia Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.7.2. Malaysia Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.7.3. Malaysia Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.7.4. Malaysia Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.8. Philippines 11.5.8.1. Philippines Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.8.2. Philippines Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.8.3. Philippines Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.8.4. Philippines Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.9. Thailand 11.5.9.1. Thailand Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.9.2. Thailand Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.9.3. Thailand Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.9.4. Thailand Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.10. Vietnam 11.5.10.1. Vietnam Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.10.2. Vietnam Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.10.3. Vietnam Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.10.4. Vietnam Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 11.5.11. Rest of Asia Pacific 11.5.11.1. Rest of Asia Pacific Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 11.5.11.2. Rest of Asia Pacific Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 11.5.11.3. Rest of Asia Pacific Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 11.5.11.4. Rest of Asia Pacific Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12. Middle East and Africa Shot Blasting Machine Market Size and Forecast (by Value in USD Million and Volume in Units) (2024-2032 12.1. Middle East and Africa Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.2. Middle East and Africa Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.3. Middle East and Africa Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.4. Middle East and Africa Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12.5. Middle East and Africa Shot Blasting Machine Market Size and Forecast, by Country (2024-2032) 12.5.1. South Africa 12.5.1.1. South Africa Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.5.1.2. South Africa Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.5.1.3. South Africa Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.5.1.4. South Africa Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12.5.2. GCC 12.5.2.1. GCC Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.5.2.2. GCC Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.5.2.3. GCC Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.5.2.4. GCC Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12.5.3. Egypt 12.5.3.1. Egypt Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.5.3.2. Egypt Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.5.3.3. Egypt Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.5.3.4. Egypt Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12.5.4. Nigeria 12.5.4.1. Nigeria Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.5.4.2. Nigeria Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.5.4.3. Nigeria Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.5.4.4. Nigeria Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 12.5.5. Rest of ME&A 12.5.5.1. Rest of ME&A Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 12.5.5.2. Rest of ME&A Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 12.5.5.3. Rest of ME&A Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 12.5.5.4. Rest of ME&A Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13. South America Shot Blasting Machine Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032 13.1. South America Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.2. South America Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.3. South America Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.4. South America Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13.5. South America Shot Blasting Machine Market Size and Forecast, by Country (2024-2032) 13.5.1. Brazil 13.5.1.1. Brazil Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.5.1.2. Brazil Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.5.1.3. Brazil Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.5.1.4. Brazil Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13.5.2. Argentina 13.5.2.1. Argentina Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.5.2.2. Argentina Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.5.2.3. Argentina Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.5.2.4. Argentina Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13.5.3. Colombia 13.5.3.1. Colombia Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.5.3.2. Colombia Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.5.3.3. Colombia Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.5.3.4. Colombia Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13.5.4. Chile 13.5.4.1. Chile Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.5.4.2. Chile Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.5.4.3. Chile Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.5.4.4. Chile Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 13.5.5. Rest Of South America 13.5.5.1. Rest Of South America Shot Blasting Machine Market Size and Forecast, By Product Type (2024-2032) 13.5.5.2. Rest Of South America Shot Blasting Machine Market Size and Forecast, By Technology (2024-2032) 13.5.5.3. Rest Of South America Shot Blasting Machine Market Size and Forecast, By Mode of Operation (2024-2032) 13.5.5.4. Rest Of South America Shot Blasting Machine Market Size and Forecast, By Application (2024-2032) 14. Company Profile: Key Players 14.1. Airblast B.V. 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. Airo Shot Blast 14.3. C.M. Surface Treatment 14.4. COGEIM 14.5. Coniex SA 14.6. Goff Inc. 14.7. Graco Inc. 14.8. Guyson International Limited 14.9. HBC System 14.10. Kaltenbach Group 14.11. Norican Group (Wheelabrator) 14.12. OMSG 14.13. ORBITECH SHOTBLASTING EQUIPMENTS 14.14. Oteco 14.15. Pangborn 14.16. Quingdao Qinggong Machinery Co., Ltd. 14.17. Rösler Oberflächentechnik GmbH 14.18. Shandong Kaitai Group Co., Ltd 14.19. Siapro 14.20. Sinto AGTOS GmbH 14.21. TOSCA 14.22. Turbotecnica S.P.A. 14.23. Viking Corporation 15. Key Findings 16. Industry Recommendations 17. Shot Blasting Machine Market: Research Methodology