Global Shared Mobility Market size was valued at USD 515.82 Bn in 2023 and is expected to reach USD 867.54 Bn by 2030, at a CAGR of 7.71%.Shared Mobility Market Overview

Shared mobility is a concept of individuals or groups accessing transportation resources on a shared basis rather than owning or leasing their vehicles. It encompasses various modes of transportation, including but not limited to vehicles, motorcycles, scooters, bicycles, and public transit. The essence of shared mobility lies in the efficient utilization of transportation assets, allowing multiple users to access them as needed, thereby reducing the overall number of vehicles on the road and maximizing resource efficiency which boosts the Shared Mobility Market. Shared mobility services are facilitated through technological platforms that enable users to locate, reserve and access shared vehicles or rides in real time. This model of transportation promotes sustainability by minimizing traffic congestion, reducing greenhouse gas emissions, and optimizing land use. Shared mobility enhances accessibility by providing cost-effective transportation options for individuals, especially in urban areas where parking and congestion are significant challenges.To know about the Research Methodology :- Request Free Sample Report The shared Mobility industry has experienced significant growth driven by urbanization, environmental concerns, and advancements in technology. This market encompasses various services including ride-hailing, car-sharing, bike-sharing, and scooter-sharing, offering users convenient and flexible transportation options without the need for vehicle ownership. Key players include established companies such as Uber, Lyft, and Zipcar, as well as emerging startups and city-sponsored programs. The proliferation of smartphone apps and digital platforms has facilitated seamless access to shared mobility services, enhancing user experience and promoting adoption. The COVID-19 pandemic has spurred innovation in shared mobility, with an emphasis on safety measures and hygiene protocols. With increasing urbanization and a growing emphasis on sustainability, the Shared Mobility Market is expected to boost continuously, providing consumers with diverse and efficient transportation solutions while contributing to reduced traffic congestion and environmental impact.

Shared Mobility Market Trend

Shift Towards Multimodal Integration In today's fast-paced world, individuals seek seamless, convenient, and flexible transportation solutions that transcend traditional modes of travel. Multimodal integration, which involves the seamless combination of various transportation modes such as ride-hailing, bike-sharing, public transit, and car-sharing, offers users greater flexibility, accessibility, and affordability in navigating their urban environments. By integrating multiple modes of transportation into a single platform or service, users enjoy the benefits of personalized mobility solutions tailored to their specific needs, preferences, and constraints. Advancements in technology, particularly the proliferation of smartphone apps, GPS tracking systems, and data analytics, enable real-time connectivity, route optimization, and payment integration across different modes of transportation which drive Shared Mobility Market growth. As cities grapple with increasing traffic congestion, air pollution, and limited parking infrastructure, policymakers and urban planners are increasingly turning to multimodal solutions as a means to promote sustainable urban mobility and reduce reliance on single-occupancy vehicles. By incentivizing the use of shared and alternative modes of transportation, such as bike-sharing and public transit, cities alleviate congestion, mitigate environmental impact, and enhance the overall quality of life for residents.Shared Mobility Market Dynamics

Increasing Urbanization Boosts Market Growth As urban populations continue to swell globally, burgeoning cities face mounting challenges such as congestion, pollution, and limited parking space. Consequently, individuals are seeking alternative modes of transportation that are more efficient, cost-effective, and environmentally sustainable. Shared mobility solutions, including ride-sharing, bike-sharing, car-sharing, and scooter-sharing services, emerge as a compelling reaction to these pressing urban mobility needs and drive Shared Mobility Market growth. By leveraging technology and connectivity, shared mobility platforms optimize the utilization of existing transportation infrastructure and resources, offering convenient and flexible mobility options that align with the evolving preferences of urban dwellers. The proliferation of smartphones and the advent of innovative mobile applications facilitate seamless access to shared transportation services, enhancing the overall user experience and promoting widespread adoption. Shared mobility models promote resource sharing and foster a collaborative consumption ethos, thereby contributing to reduced traffic congestion, greenhouse gas emissions, and reliance on private car ownership. The rise of the sharing economy ethos coupled with shifting consumer behaviors towards prioritizing access over ownership accelerates the uptake of shared mobility services which boosts Shared Mobility Market growth. From commuters seeking first-mile and last-mile connectivity to city dwellers opting for on-demand transportation solutions, shared mobility caters to a diverse array of mobility needs, thereby reshaping urban transportation landscapes and promoting sustainable urban development paradigms. The challenge of regulatory and policy hurdles to hamper Market Growth The challenge of regulatory and policy hurdles serves as a significant restraint on the shared mobility industry’s growth. This is primarily due to the complex and often fragmented regulatory landscape governing transportation services, particularly in urban environments. Issues such as licensing requirements, insurance regulations, safety standards, and data privacy concerns vary widely across different regions and jurisdictions, creating barriers for shared mobility providers looking to operate efficiently and scale their services. The emergence of new technologies and business models in the shared mobility space, such as ride-hailing, bike-sharing, and scooter rentals, has outpaced the development of comprehensive regulatory frameworks, leading to uncertainty and ambiguity for both companies and regulators alike. Without clear and adaptable regulatory frameworks that balance innovation with public safety and consumer protection, the Shared Mobility Market is expected to reach its full potential and deliver sustainable transportation solutions for urban communities across the globe.Shared Mobility Market Segment Analysis

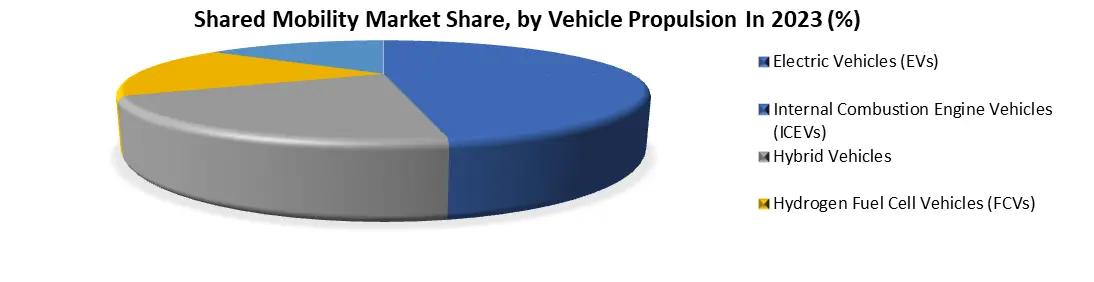

Based on the Service Model, the market is segmented into Bike Sharing, Car Sharing, Ride-hailing, Public Transit, and Others. Ride-hailing dominated the Shared Mobility Market in 2023 and is expected to continue its dominance over the forecast period. Ride-hailing has emerged as the dominant service model in the Shared Mobility industry, revolutionizing urban transportation by providing convenient, on-demand rides through smartphone applications. Platforms like Uber and Lyft serve as intermediaries, connecting passengers with nearby drivers who offer personalized transportation services. The process begins with customers ordering a ride through the app, which sends their location and request to available drivers in the vicinity. Upon accepting the ride, customers track the arrival of their assigned vehicle and view details such as the driver's name and vehicle information. Payment is seamlessly handled through the app, with charges automatically deducted from the customer's card, eliminating the need for cash transactions. Ride-hailing platforms operate through a combination of driver and rider apps, along with dispatch systems that facilitate communication between parties. These platforms support various business models, including transport network companies (TNCs) that engage private drivers using their vehicles, taxi ride-hailing platforms that partner with licensed taxi companies, and hybrid models that combine both private drivers and taxi fleets. This versatility allows ride-hailing platforms to adapt their services to local regulations and market dynamics. As a dominant force in the Shared Mobility Market, ride-hailing offers users unparalleled convenience, flexibility, and accessibility, shaping the future of urban transportation in the Asia Pacific region and beyond.By Vehicle propulsion, the market is segmented into Electric Vehicles (EVs), Internal Combustion Engine Vehicles (ICEVs), Hybrid Vehicles, Hydrogen Fuel Cell Vehicles (FCVs) and Others. Electric Vehicles (EVs) held the largest vehicle propulsion Shared Mobility Market share in 2023. Electric vehicles (EVs) have emerged as the dominant propulsion technology in the Shared Mobility industry, revolutionizing urban transportation with their eco-friendly and cost-effective features. Utilizing a battery pack to store electrical energy, EVs produce zero direct exhaust or tailpipe emissions, making them categorized as zero-emission vehicles by regulatory bodies such as the U.S. Environmental Protection Agency. Available in both heavy-duty and light-duty variants, EVs are paving the way for a sustainable future in transportation. Factors such as driving conditions, temperature extremes, and vehicle load affect the efficiency and range of EVs, with city driving conditions proving to be more favorable due to the benefits of regenerative braking. Modern EVs primarily utilize lithium-ion batteries for their longevity and energy retention capabilities, contributing to low running costs and reduced environmental impact. Charging an EV at home is cost-effective, with the potential for free charging in public spaces. Despite challenges such as thermal runaway in battery technology, ongoing efforts focus on enhancing the safety and efficiency of EVs, ensuring their continued dominance in the Shared Mobility Market. As urban centers increasingly prioritize sustainability and emission reduction, EVs represent a compelling solution for meeting transportation needs while minimizing environmental impact and driving toward a cleaner, greener future.

Shared Mobility Market Regional Insights

Asia Pacific dominated the Shared Mobility market in 2023 and is expected to continue its dominance over the forecast period. As Asia emerges as the world's consumption growth engine, the shared mobility sector stands to benefit immensely, with the potential for a $10 trillion consumption growth opportunity. With a significant portion of global consumption growth expected to occur in Asia, players in the automotive industry adapt to capitalize on these emerging trends. In countries with lower incomes, such as Indonesia and Malaysia, ride-hailing penetration rates are higher compared to higher-income nations like Japan and South Korea. Asian companies such as Didi, Grab, and Gojek have driven high penetration rates of ride-hailing services, reshaping mobility value pools and creating opportunities for automotive players to collaborate with shared mobility platforms. OEMs have been exploring partnerships with ride-hailing companies to offer electric vehicles (EVs) and other sustainable options, tapping into the growing demand for eco-conscious transportation solutions. Economic pressures, changing consumer attitudes, and technological advancements have prompted many Asian consumers to explore alternatives to traditional car ownership, including renting, subscribing, sharing, or buying second-hand. Major car manufacturers and startups are launching subscription-based car services to cater to this shift in consumer preferences. Companies such as Toyota and Hyundai are offering monthly subscription services that include insurance, maintenance, and registration, providing consumers with flexibility and convenience without the commitment of long-term ownership. OEMs seize opportunities in this evolving landscape by adapting their revenue models to accommodate new notions of ownership, such as partnering with mobility providers or offering subscription-based services. The convergence of digital ecosystems is reshaping consumer demand and transforming the role of OEMs in the shared mobility market. As digital natives embrace new channels, vehicles are no longer just modes of transportation but hubs for various aspects of consumers' lives, including entertainment and shopping. Connectivity-enabled vehicles offer opportunities for automotive companies to shift from one-time sales to ongoing revenue models and value-added services. Asian consumers are increasingly willing to pay for advanced connectivity solutions, indicating a growing demand for integrated digital experiences in mobility which Shared Mobility Market growth. OEMs leverage partnerships with local tech players and develop mobility ecosystems to meet the evolving expectations of consumers. By revamping customer engagement strategies and embracing digital channels, automotive companies create seamless experiences that cater to the preferences of modern Asian consumers. Shared Mobility Competitive Landscape The Competitive Landscape of the Shared Mobility market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. The key players have adopted strategies such as pricing investments, expansion of the product portfolio, mergers and acquisition collaboration, agreements and geographical expansion for the enhancement of the Shared Mobility industry. Some of the Shared Mobility Key players are Uber (San Francisco, California, USA), Lyft (San Francisco, California, USA), Didi Chuxing (Beijing, China), Grab (Singapore), Ola Cabs (Bangalore, India), Zipcar (Boston, Massachusetts, USA), me (San Francisco, California, USA) and other.Many key players have conducted research and development activities to increase their portfolios and fulfill consumer requirements. The Delhi government's focus on transitioning to electric vehicles (EVs) in the ridesharing sector, coupled with Uber's commitment to sustainability, underscores a pivotal moment in reimagining shared mobility. With plans to bring 25,000 EVs onto its platform and aim for 100% zero-emission rides by 2040, Uber acknowledges the significance of EV adoption. The push towards EV bike taxis aligns with the need for greener transportation options, yet the transition fair to drivers, businesses, and commuters. Uber advocates for equitable electrification mandates across sectors, ensuring a level playing field for ridesharing and delivery services. Collaborative industry dialogues are essential to navigate this transition, ensuring sustainability goals are met without compromising the livelihoods of millions.

Shared Mobility Market Scope: Inquiry Before Buying

Global Shared Mobility Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 515.82 Bn. Forecast Period 2024 to 2030 CAGR: 7.71% Market Size in 2030: US $ 867.54 Bn. Segments Covered: by Service Model Bike Sharing Car Sharing Ride-hailing Public Transit Others by Vehicle Type Two-wheelers Passenger Cars Others by Vehicle Propulsion Electric Vehicles (EVs) Internal Combustion Engine Vehicles (ICEVs) Hybrid Vehicles Hydrogen Fuel Cell Vehicles (FCVs) Others by Sales Channel Offline Online Shared Mobility Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Shared Mobility Key players

Global 1. Uber (San Francisco, California, USA) 2. Lyft (San Francisco, California, USA) 3. Didi Chuxing (Beijing, China) 4. Grab (Singapore) 5. Ola Cabs (Bangalore, India) North America 1. Zipcar(Boston, Massachusetts, USA) 2. Lime (San Francisco, California, USA) 3. Bird (Santa Monica, California, USA) Europe 1. BlaBlaCar (Paris, France) 2. Gett (London, UK) 3. Bolt (formerly Taxify) (Tallinn, Estonia) 4. TIER (Berlin, Germany) Asia Pacific: 1. Didi Chuxing (Beijing, China) 2. Grab (Singapore) 3. Ola Cabs (Bangalore, India) 4. Gojek (Jakarta, Indonesia) 5. DiDi Australia (Melbourne, Australia) Frequently Asked Questions: 1] What is the growth rate of the Global Shared Mobility Market? Ans. The Global Shared Mobility Market is growing at a significant rate of 7.71% during the forecast period. 2] Which region is expected to dominate the Global Shared Mobility Market? Ans. Asia Pacific is expected to dominate the Shared Mobility Market during the forecast period. 3] What is the expected Global Shared Mobility Market size by 2030? Ans. The Shared Mobility Market size is expected to reach USD 867.54Billion by 2030. 4] Which are the top players in the Global Shared Mobility Market? Ans. The major top players in the Global Shared Mobility Market are Uber (San Francisco, California, USA), Lyft (San Francisco, California, USA), Didi Chuxing (Beijing, China), Grab (Singapore), Ola Cabs (Bangalore, India), Zipcar (Boston, Massachusetts, USA), me (San Francisco, California, USA) and Others. 5] What are the factors driving the Global Shared Mobility Market growth? Ans. Urbanization and Technological Advancements are expected to drive market growth during the forecast period.

1. Shared Mobility Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Shared Mobility Market: Dynamics 2.1. Shared Mobility Market Trends by Region 2.1.1. North America Shared Mobility Market Trends 2.1.2. Europe Shared Mobility Market Trends 2.1.3. Asia Pacific Shared Mobility Market Trends 2.1.4. Middle East and Africa Shared Mobility Market Trends 2.1.5. South America Shared Mobility Market Trends 2.2. Shared Mobility Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Shared Mobility Market Drivers 2.2.1.2. North America Shared Mobility Market Restraints 2.2.1.3. North America Shared Mobility Market Opportunities 2.2.1.4. North America Shared Mobility Market Challenges 2.2.2. Europe 2.2.2.1. Europe Shared Mobility Market Drivers 2.2.2.2. Europe Shared Mobility Market Restraints 2.2.2.3. Europe Shared Mobility Market Opportunities 2.2.2.4. Europe Shared Mobility Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Shared Mobility Market Drivers 2.2.3.2. Asia Pacific Shared Mobility Market Restraints 2.2.3.3. Asia Pacific Shared Mobility Market Opportunities 2.2.3.4. Asia Pacific Shared Mobility Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Shared Mobility Market Drivers 2.2.4.2. Middle East and Africa Shared Mobility Market Restraints 2.2.4.3. Middle East and Africa Shared Mobility Market Opportunities 2.2.4.4. Middle East and Africa Shared Mobility Market Challenges 2.2.5. South America 2.2.5.1. South America Shared Mobility Market Drivers 2.2.5.2. South America Shared Mobility Market Restraints 2.2.5.3. South America Shared Mobility Market Opportunities 2.2.5.4. South America Shared Mobility Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Shared Mobility Industry 2.8. Analysis of Government Schemes and Initiatives For Shared Mobility Industry 2.9. Shared Mobility Market Trade Analysis 2.10. The Global Pandemic Impact on Shared Mobility Market 3. Shared Mobility Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 3.1.1. Bike Sharing 3.1.2. Car Sharing 3.1.3. Ride-hailing 3.1.4. Public Transit 3.1.5. Others 3.2. Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 3.2.1. Two-wheelers 3.2.2. Passenger Cars 3.2.3. Others 3.3. Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 3.3.1. Electric Vehicles (EVs) 3.3.2. Internal Combustion Engine Vehicles (ICEVs) 3.3.3. Hybrid Vehicles 3.3.4. Hydrogen Fuel Cell Vehicles (FCVs) 3.3.5. Others 3.4. Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 3.4.1. Offline 3.4.2. Online 3.5. Shared Mobility Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Shared Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 4.1.1. Bike Sharing 4.1.2. Car Sharing 4.1.3. Ride-hailing 4.1.4. Public Transit 4.1.5. Others 4.2. North America Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Two-wheelers 4.2.2. Passenger Cars 4.2.3. Others 4.3. North America Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 4.3.1. Electric Vehicles (EVs) 4.3.2. Internal Combustion Engine Vehicles (ICEVs) 4.3.3. Hybrid Vehicles 4.3.4. Hydrogen Fuel Cell Vehicles (FCVs) 4.3.5. Others 4.4. North America Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 4.4.1. Offline 4.4.2. Online 4.5. North America Shared Mobility Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 4.5.1.1.1. Bike Sharing 4.5.1.1.2. Car Sharing 4.5.1.1.3. Ride-hailing 4.5.1.1.4. Public Transit 4.5.1.1.5. Others 4.5.1.2. United States Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.1.2.1. Two-wheelers 4.5.1.2.2. Passenger Cars 4.5.1.2.3. Others 4.5.1.3. United States Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 4.5.1.3.1. Electric Vehicles (EVs) 4.5.1.3.2. Internal Combustion Engine Vehicles (ICEVs) 4.5.1.3.3. Hybrid Vehicles 4.5.1.3.4. Hydrogen Fuel Cell Vehicles (FCVs) 4.5.1.3.5. Others 4.5.1.4. United States Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 4.5.1.4.1. Offline 4.5.1.4.2. Online 4.5.2. Canada 4.5.2.1. Canada Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 4.5.2.1.1. Bike Sharing 4.5.2.1.2. Car Sharing 4.5.2.1.3. Ride-hailing 4.5.2.1.4. Public Transit 4.5.2.1.5. Others 4.5.2.2. Canada Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.2.2.1. Two-wheelers 4.5.2.2.2. Passenger Cars 4.5.2.2.3. Others 4.5.2.3. Canada Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 4.5.2.3.1. Electric Vehicles (EVs) 4.5.2.3.2. Internal Combustion Engine Vehicles (ICEVs) 4.5.2.3.3. Hybrid Vehicles 4.5.2.3.4. Hydrogen Fuel Cell Vehicles (FCVs) 4.5.2.3.5. Others 4.5.2.4. Canada Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 4.5.2.4.1. Offline 4.5.2.4.2. Online 4.5.3. Mexico 4.5.3.1. Mexico Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 4.5.3.1.1. Bike Sharing 4.5.3.1.2. Car Sharing 4.5.3.1.3. Ride-hailing 4.5.3.1.4. Public Transit 4.5.3.1.5. Others 4.5.3.2. Mexico Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.3.2.1. Two-wheelers 4.5.3.2.2. Passenger Cars 4.5.3.2.3. Others 4.5.3.3. Mexico Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 4.5.3.3.1. Electric Vehicles (EVs) 4.5.3.3.2. Internal Combustion Engine Vehicles (ICEVs) 4.5.3.3.3. Hybrid Vehicles 4.5.3.3.4. Hydrogen Fuel Cell Vehicles (FCVs) 4.5.3.3.5. Others 4.5.3.4. Mexico Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 4.5.3.4.1. Offline 4.5.3.4.2. Online 5. Europe Shared Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.2. Europe Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.3. Europe Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.4. Europe Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5. Europe Shared Mobility Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.1.2. United Kingdom Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.1.3. United Kingdom Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.1.4. United Kingdom Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.2. France 5.5.2.1. France Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.2.2. France Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.2.3. France Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.2.4. France Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.3.2. Germany Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.3. Germany Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.3.4. Germany Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.4.2. Italy Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.4.3. Italy Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.4.4. Italy Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.5.2. Spain Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.5.3. Spain Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.5.4. Spain Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.6.2. Sweden Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.6.3. Sweden Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.6.4. Sweden Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.7.2. Austria Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.7.3. Austria Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.7.4. Austria Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 5.5.8.2. Rest of Europe Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.8.3. Rest of Europe Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 5.5.8.4. Rest of Europe Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6. Asia Pacific Shared Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.2. Asia Pacific Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.3. Asia Pacific Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.4. Asia Pacific Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5. Asia Pacific Shared Mobility Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.1.2. China Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.3. China Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.1.4. China Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.2.2. S Korea Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.3. S Korea Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.2.4. S Korea Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.3.2. Japan Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.3. Japan Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.3.4. Japan Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.4. India 6.5.4.1. India Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.4.2. India Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.3. India Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.4.4. India Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.5.2. Australia Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.3. Australia Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.5.4. Australia Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.6.2. Indonesia Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.3. Indonesia Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.6.4. Indonesia Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.7.2. Malaysia Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.3. Malaysia Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.7.4. Malaysia Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.8.2. Vietnam Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.8.3. Vietnam Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.8.4. Vietnam Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.9.2. Taiwan Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.9.3. Taiwan Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.9.4. Taiwan Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 6.5.10.2. Rest of Asia Pacific Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 6.5.10.4. Rest of Asia Pacific Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 7. Middle East and Africa Shared Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 7.2. Middle East and Africa Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 7.3. Middle East and Africa Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 7.4. Middle East and Africa Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 7.5. Middle East and Africa Shared Mobility Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 7.5.1.2. South Africa Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.3. South Africa Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 7.5.1.4. South Africa Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 7.5.2.2. GCC Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.3. GCC Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 7.5.2.4. GCC Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 7.5.3.2. Nigeria Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.3. Nigeria Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 7.5.3.4. Nigeria Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 7.5.4.2. Rest of ME&A Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.3. Rest of ME&A Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 7.5.4.4. Rest of ME&A Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 8. South America Shared Mobility Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 8.2. South America Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 8.3. South America Shared Mobility Market Size and Forecast, by Vehicle Propulsion(2023-2030) 8.4. South America Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 8.5. South America Shared Mobility Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 8.5.1.2. Brazil Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.3. Brazil Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 8.5.1.4. Brazil Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 8.5.2.2. Argentina Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.3. Argentina Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 8.5.2.4. Argentina Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Shared Mobility Market Size and Forecast, by Service Model (2023-2030) 8.5.3.2. Rest Of South America Shared Mobility Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.3. Rest Of South America Shared Mobility Market Size and Forecast, by Vehicle Propulsion (2023-2030) 8.5.3.4. Rest Of South America Shared Mobility Market Size and Forecast, by Sales Channel (2023-2030) 9. Global Shared Mobility Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Shared Mobility Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Uber (San Francisco, California, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lyft (San Francisco, California, USA) 10.3. Didi Chuxing (Beijing, China) 10.4. Grab (Singapore) 10.5. Ola Cabs (Bangalore, India) 10.6. Zipcar (Boston, Massachusetts, USA) 10.7. Lime (San Francisco, California, USA) 10.8. Bird (Santa Monica, California, USA) 10.9. BlaBlaCar (Paris, France) 10.10. Gett (London, UK) 10.11. Bolt (formerly Taxify) (Tallinn, Estonia) 10.12. TIER (Berlin, Germany) 10.13. Didi Chuxing (Beijing, China) 10.14. Grab (Singapore) 10.15. Ola Cabs (Bangalore, India) 10.16. Gojek (Jakarta, Indonesia) 10.17. DiDi Australia (Melbourne, Australia) 11. Key Findings 12. Industry Recommendations 13. Shared Mobility Market: Research Methodology 14. Terms and Glossary