The global SATCOM Equipment Market size was valued at 28.74 billion in 2024, and the total SATCOM Equipment Market revenue is expected to grow by 11.8% from 2025 to 2032, reaching nearly USD 70.15 billion.SATCOM Equipment Market Overview

The SATCO (Satellite Communication) Equipment market includes the hardware/systems—satellite antennas (VSAT, parabolic, phased-array), transceivers, modems, amplifiers, transponders, and network management units—necessary for transmitting, receiving, and processing signals to/from a satellite. SATCOM Equipment Market has been experiencing robust growth due to several factors, including rapid growth of Low Earth Orbit (LEO) mega-constellations, like Starlink and OneWeb, that are generating tremendous interest for user terminals and create large and advanced ground infrastructure; with high global demand for high speed, low latency broadband internet (this is all reflected in remote and mobile applications to include maritime, aeronautical, and land-based), satellite networks being utilized for ubiquitous 5G integration; and government/defence spending continuing to increase (potentially catalysed by the pandemic) for secure, resilient communication systems for national security. New technologies in development are geared toward more innovative, lower-profile/size, lower-power/efficient, and cheaper user equipment, as well as electronically steered flat-panel antennas (ESAs for both commercial and government markets), software-defined modems to provide interoperability between networks, and pragmatically higher-throughput satellites (HTS) and materials like gallium nitride (GaN) for amplification. North America continues to be the largest market and, because of advanced satellite operators and defence contracts, but the Asia-Pacific market is the fastest growing region, partially driven by government programs and emphasis to accelerate a digital divide and general public infrastructure modernisation.To know about the Research Methodology :- Request Free Sample Report Key players in the SATCOM Equipment Market like Viasat, Hughes Network Systems, Cobham Satcom, Gilat Satellite Networks, and Comtech Telecommunications are competing through intense investment in Research & Development (R&D) of antenna technology, strategic partnerships with constellation operators, and through integrated solutions and offers for end-to-end managed service, suggesting that, as satellite technology continues to be a transformational driver for global connectivity, and commercial space opens access to the sky for all, the market is positioned for continued growth.

SATCOM Equipment Market Dynamic:

Rising Demand for Global Connectivity to Drive the Growth of the SATCO Equipment Market The unquenchable global demand for high-speed, low-latency broadband internet for remote, maritime, and aeronautical applications is the primary motive behind SATCO. Additionally, the rapid deployment of Low Earth Orbit (LEO) mega-constellations such as Starlink and OneWeb is driving enormous investment in ground infrastructure and user terminals, ultimately making satellite communication more ubiquitous and effective in both consumer and enterprise markets. 5G Integration and Network Modernisation to Drive SATCO Equipment Market Growth The synchronised efforts of satellite networks and terrestrial 5G for uninterrupted, accessible connectivity are causing an unprecedented surge in SATCO equipment investments. In upgrading communications infrastructure to accommodate IoT, autonomous systems, and smart networks, the market has been experiencing strong demand for modern satellite transceivers, modems, and network management systems capable of operating in these added capabilities in next-gen hybrid networks. Technical Complexities and High System Costs to Restrain SATCO Equipment Market Growth The high cost of advanced SATCO equipment, including satellite antennas (ESAs), electronically steered antenna systems, and specialised installation and programming costs, represents a significant barrier to entry and expansion. Technical elements like latency at higher orbits, interference to the surrounding spectrum, and maintenance and upgrading of network management systems may pose restrictions to growth markets, especially in cost-sensitive environments and developing markets. Advancements in Antenna and Amplifier Technology to Create Growth Opportunities Antenna technology is continually evolving and offers performance improvement and a reduction in terminal cost and size. Research and development into low-profile, electronically steered flat-panel antennas (please see the article in this issue by Aas et al.) for commercialisation, as well as material advances such as the use of Gallium Nitride (GaN) to fabricate more efficient, higher-performance amplifiers, are examples of how much the performance of antennas can be improved. These developments will create new applications and profit opportunities in mobile connectivity for consumers and small airborne systems using electronically steered antennas. Stringent Regulatory and Spectrum Allocation Hurdles to Restrain Market Growth Market players confront difficulties stemming from complex and often fragmented international regulations around satellite spectrum allocation and equipment certification. Lengthy licensing timelines, ongoing compliance risks related to different national approaches to approval standards, and concerns about orbital debris mitigation are all obstacles that potentially delay a product launch and increase operational costs, which may inhibit innovation and growth into new markets.SATCOM Equipment Market Segment Analysis

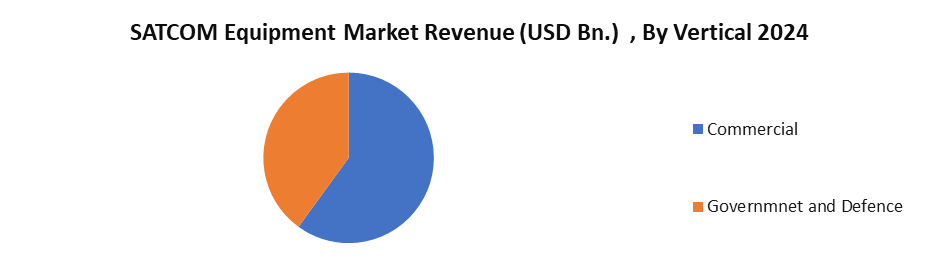

Based on end-use, the maritime SATCOM equipment segment is estimated to contribute the largest share of the global market in 2024. For instance, commercial and naval vessels are at sea for long periods, and they have robust SATCOM systems to maintain contact with shore under any weather and sea conditions. Maritime satellite communication systems also provide the best turnkey terminals for internet access and television reception. Based on a vertical, the commercial segment is expected to register a major revenue share in the SATCOM equipment market globally. SATCOM equipment is used for different applications, like communications, earth observation, scientific research, meteorology, exploration, mapping, asset tracking, surveillance, security, and educational training. The miniaturisation of SATCOM systems and equipment has made satellite communication economically and possibly more viable for widespread usage in the civil, commercial, government, and military sectors.

SATCOM Equipment Market Regional Insights

The Asia-Pacific region is likely to dominate the SATCO Equipment market share throughout the forecast time frame, but following closely are North America and Europe. The rapidly growing economies in the Asia-Pacific region are quickly demonstrating a clear commitment to digitalisation, creating huge demand for satellite communication to overcome the digital divide across the continent's vast and often remote geographies. The governments of large countries like India, China, Japan and Australia have set major initiatives in motion for broadband availability, overall infrastructure modernisation, and national security communications to enable an immediate impact of investment on ground station equipment, user terminals, and network management systems. The convergence of comprehensive economic growth, ambitious digital infrastructure goals, and generous government funding will create the region as the single solution for the market growth (searching for affordably priced VSAT and new LEO terminal solutions, respectively). SATCO Equipment in North America is a well-established, technologically advanced marketplace, with established satellite operators, leading defence contractors, and innovative LEO constellation operators. North America is a global hub for innovation, with a large amount of defence and government spending on secure, resilient, and airborne satellite communication systems used in military and homeland security applications. In addition, relatively high disposable income and the early adoption of advanced consumer technologies, including mobile satellite services for recreational vehicles and broadband-at-sea, support a solid and sophisticated commercial marketplace, ensuring that North America maintains a significant segment of the overall market. Europe represents a further significant and established market and has strong regulatory support from the European Union, advocating for secure and independent connectivity infrastructure, and significant commercial maritime and aeronautical industries. The focus for Europe is on technological innovations and developing the equipment that not only complies with EU and stringent international standards, but also incorporates satellite networks with terrestrial 5G infrastructure. Programs between member states collaborating to enhance their strategic autonomy, space, and communications create consistent demand for SATCO with advanced capabilities, and position Europe as a leading R&D and high-value manufacturing hub. SATCOM Equipment Market Competitive Landscape: A closer look at the SATCOM (satellite communication) market reveals that L3Harris Technologies and Viasat Inc. stand out as two leading competitors, each adopting distinct strategies and areas of focus. L3Harris Technologies is a leading defence contractor formed by the merger in 2019 of L3 Technologies and Harris Corporation. L3Harris is known for its secure, mission-critical communications systems, as well as for developing rugged SATCOM terminals, antennas and network systems aimed at defence and government customers. L3Harris's specific competences include tactical satellite communications and resilient network infrastructures to exchange information rapidly and securely in near real-time battlefield, safety, and emergency conditions in near real-time. This is extremely significant for space situational awareness, ISR (intelligence, surveillance, reconnaissance), and mobile connectivity. L3 Harris continues to enhance its SATCOM capabilities through ongoing R&D on protected waveforms, small form-factor terminals, and AI. SATCOM Equipment Market Key Developments: • September 2024 – Viasat – Europe & Global – SATCOM Equipment Market Viasat, with the aid of European cybersecurity company CYSEC, was producing a satellite communication security project under its ELEVATE program. CYSEC's ARCA SATCOM VPN technology has the capability to encrypt and accelerate the communication stream, allowing throughput improvement up to 30% (with no latency) over any given location, enabling Viasat to improve security while providing a robust pathway for global SATCOM equipment market data assurance. • July 2024 – Thales Group – France/Europe – SATCOM Equipment Market Thales Group signed the Neptune contract with the French defence procurement agency (DGA) for 30 dual-band X/Ka satellite communication stations to be supplied to the French Army on board the Serval armoured vehicle. The dual-band station enables secure and high-data-rate communications on an armoured vehicle, using expeditionary forces globally. This contract expands the capabilities of defence satellite communication equipment in the European market. • September 2024 – Intelsat – Global – SATCOM Equipment Market Intelsat officially announced it would launch a multi-orbit terminal strategy (with support from multiple new terminal providers) by mid-2025, and investment in innovative terminal providers in the SATCOM equipment market to ultimately provide capability and benefits to economies on advanced commercial use of satellite-based technology, helping spur innovation in the global SATCOM equipment business. • July 2024 – SES – Global – SATCOM Equipment Market SES announced it is pursuing the acquisition of Intelsat, and if successful, it would be a leading global satellite communications provider. SES aims to take out operational synergies on this transaction as well and would plan further investment to result in innovative technology improvements in the overall SATCOM equipment market around the world. SATCOM Equipment Market Key Trends: • Technological development in satellite equipment: The implementation of high-throughput satellites (HTS) combined with low-earth orbit (LEO) constellations will transform the SATCOM ecosystem. A high-throughput satellite provide higher data transmissions, further increases the efficiency and capacity of satellite communications, and increase affordability. A low Earth orbit (LEO) satellite will provide low-latency and high-speed internet access anywhere it is challenged with high-speed data requirements across industries. • Integration of SATCOM with terrestrial networks: The integration of satellite and terrestrial communication systems to obtain a single network experience is a relevant market trend. Integrated systems with 5G/6G enable seamless connectivity by providing multiple layers of communication to develop a more resilient network, using the strengths of both satellite and terrestrial. This is also particularly useful to deliver reliable communication systems to remote areas.SATCOM Equipment Market Scope: Inquire before buying

Global SATCOM Equipment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 28.74 Bn. Forecast Period 2025 to 2032 CAGR: 11.8% Market Size in 2032: USD 70.15 Bn. Segments Covered: by Product SATCOM Receiver SATCOM Transmitter/Transponder SATCOM Transceiver SATCOM Antenna SATCOM Modem/Router Others by Vertical Government & Defence Commercial by Technology SATCOM VSAT SATCOM Telemetry SATCOM AIS SATCOM-on-the-Move SATCOM-on-the-Pause by Frequency Band C-band X-band Ku-band Ka-band L-band S-band VHF/UHF by End use Portable SATCOM Equipment Land Mobile SATCOM Equipment Maritime SATCOM Equipment Airborne SATCOM Equipment Land Fixed SATCOM Equipment SATCOM Equipment Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina, Rest of South America)SATCOM Equipment Market, Key Players

North America 1. General Dynamics Mission Systems (North America) 2. L3Harris Technologies (North America) 3. Viasat, Inc. (North America) 4. Iridium Communications (North America) 5. Hughes Network Systems (EchoStar) (North America) 6. Intelsat (North America) 7. Raytheon Technologies (North America) 8. Comtech EF Data (North America) 9. Datum Systems (North America) 10. Kymeta Corporation (North America) 11. Terrasat Communications (North America) 12. DataPath, Inc. (North America) Europe / Middle East 1. Thales Group (Europe) 2. SES S.A. (Europe) 3. Inmarsat (Europe) 4. Eutelsat (Europe) 5. Gilat Satellite Networks (Europe / Middle East) 6. Aselsan (Europe / Middle East) 7. Intellian Technologies (Europe / Middle East) 8. Cobham Satcom (Europe) 9. Holkirk Communications (Europe) 10. Newtec (Europe) 11. Satcom Global (Europe) 12. ND Satcom (Europe) 13. Network Innovations (Europe) 14. Avl Technologies (Europe) 15. Kacific Broadband Satellites (Asia‑Pacific / Europe overlap) Asia‑Pacific 1. EM Solutions Pty Ltd. (Asia‑Pacific) 2. ST Engineering (Asia‑Pacific) 3. Isotropic Systems (Asia‑Pacific)Frequently Asked Questions

1. Which region has the largest share in the Global SATCOM Equipment Market? Ans: The Asia Pacific region held the highest share in the Global SATCOM Equipment Market in 2024. 2. What is the growth rate of the Global SATCOM Equipment Market? Ans: The Global is growing at a CAGR of 11.8% during the forecasting period 2025-2032. 3. What is the scope of the Global SATCOM Equipment Market report? Ans: The Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors& Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global SATCOM Equipment Market? Ans: The important key players in the Global Market are – Denso Corporation, Hanon Systems, Sanden Holding Corporation, Mitsubishi Heavy Industries Ltd, MAHLE GmbH, Valeo SA, Keihin Corporation, Calsonic Kansei Corporation, SamvardhanaMotherson Group, Subros Limited, SMAC Auto Air, TransAir Manufacturing, Eberspacher Group, Marelli Corporation. 5. What is the study period of this Market? Ans: The Global SATCOM Equipment Market is studied from 2024 to 2032.

1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. SATCOM Equipment Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and SATCOM Receiver Acquisitions Details 2.7. KANO Model Analysis 3. Global SATCOM Equipment Market: Dynamics 3.1. Region-wise Trends of the SATCOM Equipment Market 3.1.1. North America SATCOM Equipment Market Trends 3.1.2. Europe SATCOM Equipment Market Trends 3.1.3. Asia Pacific SATCOM Equipment Market Trends 3.1.4. Middle East and Africa SATCOM Equipment Market Trends 3.1.5. South America SATCOM Equipment Market Trends 3.2. SATCOM Equipment Market Dynamics 3.2.1. Global SATCOM Equipment Market Drivers 3.2.2. Global SATCOM Equipment Market Restraints 3.2.3. Global SATCOM Equipment Market Opportunities 3.2.3.1. Connectivity 3.2.3.2. LEOConstellations 3.2.4. Global SATCOM Equipment Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. SATCOM Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 4.1.1. SATCOM RECEIVER 4.1.2. SATCOM TRANSMITTER/TRANSPONDER 4.1.3. SATCOM Transceiver 4.1.4. SATCOM Antenna 4.1.5. SATCOM Modem/Router 4.1.6. Others 4.2. SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 4.2.1. Government and Defence 4.2.2. Commercial 4.3. SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 4.3.1. SATCOM VSAT 4.3.2. SATCOM Telemetry 4.3.3. SATCOM AIS 4.3.4. SATCOM-on-the-Move 4.3.5. SATCOM-on-the-Pause 4.4. SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 4.4.1. C-band 4.4.2. X-band 4.4.3. Ku-band 4.4.4. Ka-band 4.4.5. L-Band 4.4.6. S-band 4.4.7. VHF/UHF 4.5. SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 4.5.1. PORTABLE SATCOM EQUIPMENT 4.5.2. Land Mobile SATCOM Equipment 4.5.3. Maritime SATCOM Equipment 4.5.4. Airborne SATCOM Equipment 4.5.5. Land Fixed SATCOM Equipment 4.6. SATCOM Equipment Market Size and Forecast, By Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America SATCOM Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 5.1.1. SATCOM RECEIVER 5.1.2. SATCOM TRANSMITTER/TRANSPONDER 5.1.3. SATCOM Transceiver 5.1.4. SATCOM Antenna 5.1.5. SATCOM Modem/Router 5.1.6. Others 5.2. North America SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 5.2.1. Government and Defence 5.2.2. Commercial 5.3. North America SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 5.3.1. SATCOM VSAT 5.3.2. SATCOM Telemetry 5.3.3. SATCOM AIS 5.3.4. SATCOM-on-the-Move 5.3.5. SATCOM-on-the-Pause 5.4. North America SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 5.4.1. C-band 5.4.2. X-band 5.4.3. Ku-band 5.4.4. Ka-band 5.4.5. L-band 5.4.6. S-band 5.4.7. VHF/UHF 5.5. North America SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 5.5.1. PORTABLE SATCOM EQUIPMENT 5.5.2. Land Mobile SATCOM Equipment 5.5.3. Maritime SATCOM Equipment 5.5.4. Airborne SATCOM Equipment 5.5.5. Land Fixed SATCOM Equipment 5.6. North America SATCOM Equipment Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 5.6.1.1.1. SATCOM RECEIVER 5.6.1.1.2. SATCOM TRANSMITTER/TRANSPONDER 5.6.1.1.3. SATCOM Transceiver 5.6.1.1.4. SATCOM Antenna 5.6.1.1.5. SATCOM Modem/Router 5.6.1.1.6. Others 5.6.1.2. United States SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 5.6.1.2.1. Government and Defence 5.6.1.2.2. Commercial 5.6.1.3. United States SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 5.6.1.3.1. SATCOM VSAT 5.6.1.3.2. SATCOM Telemetry 5.6.1.3.3. SATCOM AIS 5.6.1.3.4. SATCOM-on-the-Move 5.6.1.3.5. SATCOM-on-the-Pause 5.6.1.4. United States SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 5.6.1.4.1. C-band 5.6.1.4.2. X-band 5.6.1.4.3. Ku-band 5.6.1.4.4. Ka-band 5.6.1.4.5. L-band 5.6.1.4.6. S-band 5.6.1.4.7. VHF/UHF 5.6.1.5. United States SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 5.6.1.5.1. PORTABLE SATCOM EQUIPMENT 5.6.1.5.2. Land Mobile SATCOM Equipment 5.6.1.5.3. Maritime SATCOM Equipment 5.6.1.5.4. Airborne SATCOM Equipment 5.6.1.5.5. Land Fixed SATCOM Equipment 5.6.2. Canada 5.6.2.1. Canada SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 5.6.2.1.1. SATCOM RECEIVER 5.6.2.1.2. SATCOM TRANSMITTER/TRANSPONDER 5.6.2.1.3. SATCOM Transceiver 5.6.2.1.4. SATCOM Antenna 5.6.2.1.5. SATCOM Modem/Router 5.6.2.1.6. Others 5.6.2.2. Canada SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 5.6.2.2.1. Government and Defence 5.6.2.2.2. Commercial 5.6.2.3. Canada SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 5.6.2.3.1. SATCOM VSAT 5.6.2.3.2. SATCOM Telemetry 5.6.2.3.3. SATCOM AIS 5.6.2.3.4. SATCOM-on-the-Move 5.6.2.3.5. SATCOM-on-the-Pause 5.6.2.4. Canada SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 5.6.2.4.1. C-band 5.6.2.4.2. X-band 5.6.2.4.3. Ku-band 5.6.2.4.4. Ka-band 5.6.2.4.5. L-band 5.6.2.4.6. S-band 5.6.2.4.7. VHF/UHF 5.6.2.5. Canada SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 5.6.2.5.1. PORTABLE SATCOM EQUIPMENT 5.6.2.5.2. Land Mobile SATCOM Equipment 5.6.2.5.3. Maritime SATCOM Equipment 5.6.2.5.4. Airborne SATCOM Equipment 5.6.2.5.5. Land Fixed SATCOM Equipment 5.6.3. Mexico 5.6.3.1. Mexico SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 5.6.3.1.1. SATCOM RECEIVER 5.6.3.1.2. SATCOM TRANSMITTER/TRANSPONDER 5.6.3.1.3. SATCOM Transceiver 5.6.3.1.4. SATCOM Antenna 5.6.3.1.5. SATCOM Modem/Router 5.6.3.1.6. Others 5.6.3.2. Mexico SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 5.6.3.2.1. Government and Defence 5.6.3.2.2. Commercial 5.6.3.3. Mexico SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 5.6.3.3.1. SATCOM VSAT 5.6.3.3.2. SATCOM Telemetry 5.6.3.3.3. SATCOM AIS 5.6.3.3.4. SATCOM-on-the-Move 5.6.3.3.5. SATCOM-on-the-Pause 5.6.3.4. Mexico SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 5.6.3.4.1. C-band 5.6.3.4.2. X-band 5.6.3.4.3. Ku-band 5.6.3.4.4. KA-band 5.6.3.4.5. L-band 5.6.3.4.6. S-band 5.6.3.4.7. VHF/UHF 5.6.3.5. Mexico SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 5.6.3.5.1. PORTABLE SATCOM EQUIPMENT 5.6.3.5.2. Land Mobile SATCOM Equipment 5.6.3.5.3. Maritime SATCOM Equipment 5.6.3.5.4. Wave and Tidal Connection 5.6.3.5.5. Land Fixed SATCOM Equipment 6. Europe SATCOM Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.2. Europe SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.3. Europe SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.4. Europe SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.5. Europe SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6. Europe SATCOM Equipment Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.1.2. United Kingdom SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.1.3. United Kingdom SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.1.4. United Kingdom SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.1.5. United Kingdom SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.2. France 6.6.2.1. France SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.2.2. France SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.2.3. France SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.2.4. France SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.2.5. France SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.3.2. Germany SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.3.3. Germany SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.3.4. Germany SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.3.5. Germany SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.4.2. Italy SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.4.3. Italy SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.4.4. Italy SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.4.5. Italy SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.5.2. Spain SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.5.3. Spain SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.5.4. Spain SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.5.5. Spain SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.6.2. Sweden SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.6.3. Sweden SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.6.4. Sweden SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.6.5. Sweden SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.7. Russia 6.6.7.1. Russia SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.7.2. Russia SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.7.3. Russia SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.7.4. Russia SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.7.5. Russia SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 6.6.8.2. Rest of Europe SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 6.6.8.3. Rest of Europe SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 6.6.8.4. Rest of Europe SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 6.6.8.5. Rest of Europe SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7. Asia Pacific SATCOM Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.3. Asia Pacific SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.4. Asia Pacific SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.5. Asia Pacific SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6. Asia Pacific SATCOM Equipment Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.1.2. China SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.1.3. China SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.1.4. China SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.1.5. China SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.2.2. S Korea SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.2.3. S Korea SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.2.4. S Korea SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.2.5. S Korea SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.3.2. Japan SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.3.3. Japan SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.3.4. Japan SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.3.5. Japan SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.4. India 7.6.4.1. India SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.4.2. India SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.4.3. India SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.4.4. India SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.4.5. India SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.5.2. Australia SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.5.3. Australia SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.5.4. Australia SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.5.5. Australia SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.6.2. Indonesia SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.6.3. Indonesia SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.6.4. Indonesia SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.6.5. Indonesia SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.7.2. Malaysia SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.7.3. Malaysia SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.7.4. Malaysia SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.7.5. Malaysia France SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.8. Philippines 7.6.8.1. Philippines SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.8.2. Philippines SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.8.3. Philippines SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.8.4. Philippines SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.8.5. Philippines SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.9. Thailand 7.6.9.1. Thailand SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.9.2. Thailand SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.9.3. Thailand SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.9.4. Thailand SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.9.5. Thailand SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.10. Vietnam 7.6.10.1. Vietnam SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.10.2. Vietnam SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.10.3. Vietnam SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.10.4. Vietnam SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.10.5. Vietnam SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 7.6.11. Rest of Asia Pacific 7.6.11.1. Rest of Asia Pacific SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 7.6.11.2. Rest of Asia Pacific SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 7.6.11.3. Rest of Asia Pacific SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 7.6.11.4. Rest of Asia Pacific SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 7.6.11.5. Rest of Asia Pacific SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8. Middle East and Africa SATCOM Equipment Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.3. Middle East and Africa SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.4. Middle East and Africa SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.5. Middle East and Africa SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8.6. Middle East and Africa SATCOM Equipment Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.6.1.2. South Africa SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.6.1.3. South Africa SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.6.1.4. South Africa SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.6.1.5. South Africa SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.6.2.2. GCC SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.6.2.3. GCC SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.6.2.4. GCC SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.6.2.5. GCC SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8.6.3. Egypt 8.6.3.1. Egypt SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.6.3.2. Egypt SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.6.3.3. Egypt SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.6.3.4. Egypt SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.6.3.5. Egypt SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8.6.4. Nigeria 8.6.4.1. Nigeria SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.6.4.2. Nigeria SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.6.4.3. Nigeria SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.6.4.4. Nigeria SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.6.4.5. Nigeria SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 8.6.5. Rest of ME&A 8.6.5.1. Rest of ME&A SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 8.6.5.2. Rest of ME&A SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 8.6.5.3. Rest of ME&A SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 8.6.5.4. Rest of ME&A SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 8.6.5.5. Rest of ME&A SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9. South America SATCOM Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.2. South America SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.3. South America SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.4. South America SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.5. South America SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9.6. South America SATCOM Equipment Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.6.1.2. Brazil SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.6.1.3. Brazil SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.6.1.4. Brazil SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.6.1.5. Brazil SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.6.2.2. Argentina SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.6.2.3. Argentina SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.6.2.4. Argentina SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.6.2.5. Argentina SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9.6.3. Colombia 9.6.3.1. Colombia SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.6.3.2. Colombia SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.6.3.3. Colombia SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.6.3.4. Colombia SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.6.3.5. Colombia SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9.6.4. Chile 9.6.4.1. Chile SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.6.4.2. Chile SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.6.4.3. Chile SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.6.4.4. Chile SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.6.4.5. Chile SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 9.6.5. Rest of South America 9.6.5.1. Rest of South America SATCOM Equipment Market Size and Forecast, By Product (2024-2032) 9.6.5.2. Rest of South America SATCOM Equipment Market Size and Forecast, By Vertical (2024-2032) 9.6.5.3. Rest of South America SATCOM Equipment Market Size and Forecast, By Technology (2024-2032) 9.6.5.4. Rest of South America SATCOM Equipment Market Size and Forecast, By Frequency Band (2024-2032) 9.6.5.5. Rest of South America SATCOM Equipment Market Size and Forecast, By End Use (2024-2032) 10. Company Profile: Key Players 10.1. L3Harris Technologies (North America) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. General Dynamics Mission Systems (North America) 10.3. L3Harris Technologies (North America) 10.4. Viasat, Inc. (North America) 10.5. Iridium Communications (North America) 10.6. Hughes Network Systems (EchoStar) (North America) 10.7. Intelsat (North America) 10.8. Raytheon Technologies (North America) 10.9. Comtech EF Data (North America) 10.10. Datum Systems (North America) 10.11. Kymeta Corporation (North America) 10.12. Terrasat Communications (North America) 10.13. DataPath, Inc. (North America) 10.14. Thales Group (Europe) 10.15. SES S.A. (Europe) 10.16. Inmarsat (Europe) 10.17. Eutelsat (Europe) 10.18. Gilat Satellite Networks (Europe / Middle East) 10.19. Aselsan (Europe / Middle East) 10.20. Intellian Technologies (Europe / Middle East) 10.21. Cobham Satcom (Europe) 10.22. Holkirk Communications (Europe) 10.23. Newtec (Europe) 10.24. Satcom Global (Europe) 10.25. ND Satcom (Europe) 10.26. Network Innovations (Europe) 10.27. Avl Technologies (Europe) 10.28. Kacific Broadband Satellites (Asia‑Pacific / Europe overlap) 10.29. EM Solutions Pty Ltd. (Asia‑Pacific) 10.30. ST Engineering (Asia‑Pacific) 10.31. Isotropic Systems (Asia‑Pacific) 11. Key Findings 12. Industry Recommendations 13. SATCOM Equipment Market: Research Methodology