Rocket Propulsion Market size was valued at USD 6.36 Bn. in 2023. Rocket Propulsion Market will encourage a great deal of transformation in the Aerospace and Defence Industry.Rocket Propulsion Market Overview:

An aeroplane, a spacecraft, a missile, or any other thrust-generating vehicle is classified as a rocket. The rocket's propulsion mechanism generates thrust. Rocket propulsion is a type of reaction propulsion in which the oxidizer and fuel are transported with the rocket engine. Rocket propulsion is frequently confused with jet propulsion, however, there is a significant distinction between the two. The oxidizer in jet propulsion is atmospheric air, whereas the oxidizer in rocket propulsion is nitric acid.To know about the Research Methodology :- Request Free Sample Report Solid, liquid, and hybrid propellants are used in rocket engines. It is suitable for both commercial and military aircraft. They're utilized in space and, more lately, in space tourism. Solid rocket engines are more reliable than other propulsion systems as they use solid fuels and create tremendous thrust, while solid rocket engines cannot be restarted.

Rocket Propulsion Market Dynamics:

A prominent factor expected to fuel the growth of the rocket propulsion market over the forecast period is the increasing deployment of innovative liquid propulsion engines and high-performance rocket motors for space launch vehicles. The increased demand for rocket propulsion as a result of an increase in the number of space missions is expected to fuel the target market's growth through the forecast period. In addition, increased government and industry spending on space exploration is expected to drive the target market's growth through the forecast period. Factors such as growing investments by major economies across the globe in space centers and satellite launches increased efforts to reduce carbon footprints by using alternative fuels, technological advancements aimed at lowering manufacturing costs, and increasing fuel efficiency is all driving the market. Government entities help major players in the industry with large space-related investments, allowing them to spend more on R&D and develop more efficient and innovative technology. However, the lack of procedures for the disposal of orbital debris is expected to hinder the growth of the rocket propulsion market over the forecast period. In addition, a dearth of launch vehicles for the installation of small satellites and a scarcity of intellectual assets in several countries are also expected to hamper the market growth. Participants in the market are concentrating on the development of low-cost rocket propulsion systems for deep space missions, as well as partnerships to help domestic enterprises.Rocket Propulsion Market Trends:

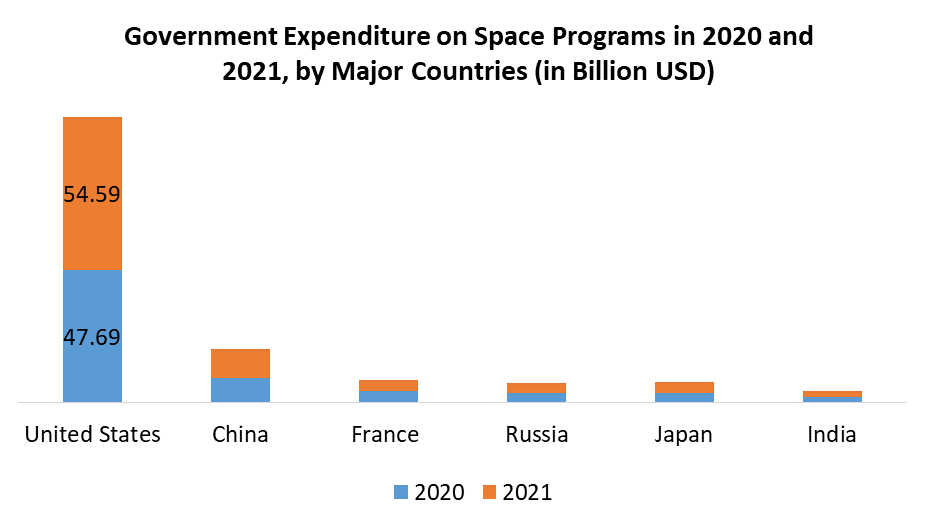

The world's biggest economies are devoting a considerable portion of their GDP to space exploration and the deployment of new satellites. The level of competition among space agencies is extremely high and has been for decades. Even now, numerous countries are investing extensively in space launch activities in order to accomplish milestones in space exploration and R&D, which could help them become pioneers in new space technology. For example, NASA has a budget of more than USD 23.3 billion for space exploration activities in 2021. The same trend is expected to continue during the forecast period, with countries expected to spend extensively on space exploration activities. This is due in part to many large-scale space programs planned for the next few years. NASA's intention to send a rover to Mars, ISRO's goal to send a manned spaceship to space, and similar initiatives from many other space agencies are expected to draw significant investment into the space launch sector, boosting the rocket propulsion systems market.

Rocket Propulsion Market Segmentation:

Based on Propulsion Type, the Rocket Propulsion Market is divided into Solid Propulsion, Liquid Propulsion, and Hybrid Propulsion. The Liquid Propulsion Type segment held the largest market share accounting for 68% in 2023. Because of its high density and specific impulse, the liquid propellant is often used in rockets. Liquid hydrogen fuel is widely employed for rocket propulsion by American space programs and other countries, according to NASA. The industry's success would be aided by leading market players' active investments in R&D and quick advancements in rocket propulsion. Based on Orbit, the Rocket Propulsion Market is segmented into LEO, MEO, GEO, and Beyond GEOs. The LEO segment is expected to witness significant growth at a CAGR of 8.6% during the forecast period. The growth is primarily attributed to the rising demand for climate change monitoring. A lower earth orbit uses the least amount of energy for satellite placement, offers the most bandwidth, and allows for frequent trips to low-altitude locations on the planet. Crew and servicing are easier to reach on space stations and satellites. Because placing a satellite in the Earth's lower orbit requires less energy, LEO is often used for communication applications. Based on Launch Vehicle Type, the Rocket Propulsion Market is segmented into Manned and Unmanned. The Unmanned segment held the largest market share accounting for 87% in 2023. Unmanned spacecraft are more effective and less expensive than manned spacecraft in exploring the solar system. The segment's growth will be aided by increased efforts by aerospace research centers and private enterprises to launch unmanned space shuttles.

Rocket Propulsion Market Regional Insights:

Europe region held the largest market share accounting for 51.9% in 2023. The growing need for space launch services for various payloads, such as satellites, manned spacecraft, missions to the International Space Station, and testing probes, is expected to propel the market in North America region forward. The region is heavily spending on space tourism, exploration, and probe missions, which is fuelling the rocket propulsion market's growth. The market in Asia-Pacific is expected to grow at the fastest rate at a CAGR of 8.4% through the forecast period, owing to increased investments in the space launch industry. The objective of the report is to present a comprehensive analysis of the Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Market dynamics, and structure by analyzing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Market make the report investor’s guide.Rocket Propulsion Market Scope: Inquiry Before Buying

Rocket Propulsion Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 6.36 Bn. Forecast Period 2024 to 2030 CAGR: 8.43% Market Size in 2030: USD 11.20 Bn. Segments Covered: by Type Rocket Motor Rocket Engine by Orbit LEO MEO GEO Beyond GEO by Component Motor Casing Nozzle Igniter Hardware Turbo Pump Propellant Others by Launch Vehicle Type Manned Unmanned by Propulsion Type Solid Propulsion Liquid Propulsion Hybrid Propulsion by End User Military & Government Commercial Rocket Propulsion Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Rocket Propulsion Market, Key Players

1. Antrix 2.Blue Origin 3.NPO Energomash 4.Aerojet Rocketdyne 5.Mitsubishi Heavy Industries 6.Orbital ATK 7.Safran S.A. 8.Spacex 9.Virgin Galactic 10.IHI 11.JSC Kuznetsov 12.Yuzhmash 13.Rocket Lab 14.The Raytheon Company 15.Thales Group 16.Saab AB 17.Kongsberg Gruppen ASA 18.General Dynamics Corporation 19.Denel Dynamics 20.Roketsan A.S. 21.Rafael Advanced Defense Systems Ltd. 22.Mesko S.A. 23.MBDA Holdings SAS 24.Lockheed Martin FAQ: 1] What segments are covered in the Rocket Propulsion Market report? Ans. The segments covered in the Rocket Propulsion Market report are based on Type, Propulsion Type, Orbit, Component, Launch Vehicle Type, and End User. 2] Which region is expected to hold the highest share in the Rocket Propulsion Market? Ans. Europe region is expected to hold the highest share in the Rocket Propulsion Market. 3] What is the market size of the Rocket Propulsion Market by 2030? Ans. The market size of the Rocket Propulsion Market by 2030 is USD 11.20 Bn. 4] What is the forecast period for the Rocket Propulsion Market? Ans. The Forecast period for Rocket Propulsion Market is 2024-2030. 5] What was the market size of the Rocket Propulsion Market in 2023? Ans. The market size of the Rocket Propulsion Market in 2023 was USD 6.36 Bn.

1. Rocket Propulsion Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rocket Propulsion Market: Dynamics 2.1. Rocket Propulsion Market Trends by Region 2.1.1. North America Rocket Propulsion Market Trends 2.1.2. Europe Rocket Propulsion Market Trends 2.1.3. Asia Pacific Rocket Propulsion Market Trends 2.1.4. Middle East and Africa Rocket Propulsion Market Trends 2.1.5. South America Rocket Propulsion Market Trends 2.2. Rocket Propulsion Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rocket Propulsion Market Drivers 2.2.1.2. North America Rocket Propulsion Market Restraints 2.2.1.3. North America Rocket Propulsion Market Opportunities 2.2.1.4. North America Rocket Propulsion Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rocket Propulsion Market Drivers 2.2.2.2. Europe Rocket Propulsion Market Restraints 2.2.2.3. Europe Rocket Propulsion Market Opportunities 2.2.2.4. Europe Rocket Propulsion Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rocket Propulsion Market Drivers 2.2.3.2. Asia Pacific Rocket Propulsion Market Restraints 2.2.3.3. Asia Pacific Rocket Propulsion Market Opportunities 2.2.3.4. Asia Pacific Rocket Propulsion Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rocket Propulsion Market Drivers 2.2.4.2. Middle East and Africa Rocket Propulsion Market Restraints 2.2.4.3. Middle East and Africa Rocket Propulsion Market Opportunities 2.2.4.4. Middle East and Africa Rocket Propulsion Market Challenges 2.2.5. South America 2.2.5.1. South America Rocket Propulsion Market Drivers 2.2.5.2. South America Rocket Propulsion Market Restraints 2.2.5.3. South America Rocket Propulsion Market Opportunities 2.2.5.4. South America Rocket Propulsion Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rocket Propulsion Industry 2.8. Analysis of Government Schemes and Initiatives For Rocket Propulsion Industry 2.9. Rocket Propulsion Market Trade Analysis 2.10. The Global Pandemic Impact on Rocket Propulsion Market 3. Rocket Propulsion Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 3.1.1. Rocket Motor 3.1.2. Rocket Engine 3.2. Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 3.2.1. LEO 3.2.2. MEO 3.2.3. GEO 3.2.4. Beyond GEO 3.3. Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 3.3.1. Motor Casing 3.3.2. Nozzle 3.3.3. Igniter Hardware 3.3.4. Turbo Pump 3.3.5. Propellant 3.3.6. Others 3.4. Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 3.4.1. Manned 3.4.2. Unmanned 3.5. Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 3.5.1. Solid Propulsion 3.5.2. Liquid Propulsion 3.5.3. Hybrid Propulsion 3.5.4. EE4 3.5.5. EE5 3.5.6. EE6 3.5.7. EE7 3.5.8. EE8 3.5.9. EE9 3.6. Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 3.6.1. Military & Government 3.6.2. Commercial 3.6.3. 3.7. Rocket Propulsion Market Size and Forecast, by Region (2023-2030) 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 4. North America Rocket Propulsion Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 4.1.1. Rocket Motor 4.1.2. Rocket Engine 4.2. North America Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 4.2.1. LEO 4.2.2. MEO 4.2.3. GEO 4.2.4. Beyond GEO 4.3. North America Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 4.3.1. Motor Casing 4.3.2. Nozzle 4.3.3. Igniter Hardware 4.3.4. Turbo Pump 4.3.5. Propellant 4.3.6. Others 4.4. North America Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 4.4.1. Manned 4.4.2. Unmanned 4.5. North America Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 4.5.1. Solid Propulsion 4.5.2. Liquid Propulsion 4.5.3. Hybrid Propulsion 4.5.4. EE4 4.5.5. EE5 4.5.6. EE6 4.5.7. EE7 4.5.8. EE8 4.5.9. EE9 4.6. North America Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 4.6.1. Military & Government 4.6.2. Commercial 4.6.3. 4.7. North America Rocket Propulsion Market Size and Forecast, by Country (2023-2030) 4.7.1. United States 4.7.1.1. United States Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 4.7.1.1.1. Rocket Motor 4.7.1.1.2. Rocket Engine 4.7.1.2. United States Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 4.7.1.2.1. LEO 4.7.1.2.2. MEO 4.7.1.2.3. GEO 4.7.1.2.4. Beyond GEO 4.7.1.3. United States Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 4.7.1.3.1. Motor Casing 4.7.1.3.2. Nozzle 4.7.1.3.3. Igniter Hardware 4.7.1.3.4. Turbo Pump 4.7.1.3.5. Propellant 4.7.1.3.6. Others 4.7.1.4. United States Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 4.7.1.4.1. Manned 4.7.1.4.2. Unmanned 4.7.1.5. United States Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 4.7.1.5.1. Solid Propulsion 4.7.1.5.2. Liquid Propulsion 4.7.1.5.3. Hybrid Propulsion 4.7.1.5.4. EE4 4.7.1.5.5. EE5 4.7.1.5.6. EE6 4.7.1.5.7. EE7 4.7.1.5.8. EE8 4.7.1.5.9. EE9 4.7.1.6. United States Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 4.7.1.6.1. Military & Government 4.7.1.6.2. Commercial 4.7.1.6.3. 4.7.2. Canada 4.7.2.1. Canada Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 4.7.2.1.1. Rocket Motor 4.7.2.1.2. Rocket Engine 4.7.2.2. Canada Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 4.7.2.2.1. LEO 4.7.2.2.2. MEO 4.7.2.2.3. GEO 4.7.2.2.4. Beyond GEO 4.7.2.3. Canada Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 4.7.2.3.1. Motor Casing 4.7.2.3.2. Nozzle 4.7.2.3.3. Igniter Hardware 4.7.2.3.4. Turbo Pump 4.7.2.3.5. Propellant 4.7.2.3.6. Others 4.7.2.4. Canada Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 4.7.2.4.1. Manned 4.7.2.4.2. Unmanned 4.7.2.5. Canada Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 4.7.2.5.1. Solid Propulsion 4.7.2.5.2. Liquid Propulsion 4.7.2.5.3. Hybrid Propulsion 4.7.2.5.4. EE4 4.7.2.5.5. EE5 4.7.2.5.6. EE6 4.7.2.5.7. EE7 4.7.2.5.8. EE8 4.7.2.5.9. EE9 4.7.2.6. Canada Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 4.7.2.6.1. Military & Government 4.7.2.6.2. Commercial 4.7.2.6.3. 4.7.3. Mexico 4.7.3.1. Mexico Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 4.7.3.1.1. Rocket Motor 4.7.3.1.2. Rocket Engine 4.7.3.2. Mexico Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 4.7.3.2.1. LEO 4.7.3.2.2. MEO 4.7.3.2.3. GEO 4.7.3.2.4. Beyond GEO 4.7.3.3. Mexico Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 4.7.3.3.1. Motor Casing 4.7.3.3.2. Nozzle 4.7.3.3.3. Igniter Hardware 4.7.3.3.4. Turbo Pump 4.7.3.3.5. Propellant 4.7.3.3.6. Others 4.7.3.4. Mexico Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 4.7.3.4.1. Manned 4.7.3.4.2. Unmanned 4.7.3.5. Mexico Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 4.7.3.5.1. Solid Propulsion 4.7.3.5.2. Liquid Propulsion 4.7.3.5.3. Hybrid Propulsion 4.7.3.5.4. EE4 4.7.3.5.5. EE5 4.7.3.5.6. EE6 4.7.3.5.7. EE7 4.7.3.5.8. EE8 4.7.3.5.9. EE9 4.7.3.6. Mexico Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 4.7.3.6.1. Military & Government 4.7.3.6.2. Commercial 4.7.3.6.3. 5. Europe Rocket Propulsion Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.2. Europe Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.3. Europe Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.4. Europe Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.5. Europe Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.6. Europe Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7. Europe Rocket Propulsion Market Size and Forecast, by Country (2023-2030) 5.7.1. United Kingdom 5.7.1.1. United Kingdom Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.1.2. United Kingdom Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.1.3. United Kingdom Rocket Propulsion Market Size and Forecast, by Component(2023-2030) 5.7.1.4. United Kingdom Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.1.5. United Kingdom Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.1.6. United Kingdom Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.2. France 5.7.2.1. France Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.2.2. France Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.2.3. France Rocket Propulsion Market Size and Forecast, by Component(2023-2030) 5.7.2.4. France Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.2.5. France Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.2.6. France Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.3. Germany 5.7.3.1. Germany Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.3.2. Germany Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.3.3. Germany Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.7.3.4. Germany Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.3.5. Germany Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.3.6. Germany Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.4. Italy 5.7.4.1. Italy Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.4.2. Italy Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.4.3. Italy Rocket Propulsion Market Size and Forecast, by Component(2023-2030) 5.7.4.4. Italy Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.4.5. Italy Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.4.6. Italy Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.5. Spain 5.7.5.1. Spain Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.5.2. Spain Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.5.3. Spain Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.7.5.4. Spain Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.5.5. Spain Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.5.6. Spain Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.6. Sweden 5.7.6.1. Sweden Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.6.2. Sweden Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.6.3. Sweden Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.7.6.4. Sweden Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.6.5. Sweden Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.6.6. Sweden Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.7. Austria 5.7.7.1. Austria Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.7.2. Austria Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.7.3. Austria Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.7.7.4. Austria Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.7.5. Austria Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.7.6. Austria Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 5.7.8. Rest of Europe 5.7.8.1. Rest of Europe Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 5.7.8.2. Rest of Europe Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 5.7.8.3. Rest of Europe Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 5.7.8.4. Rest of Europe Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 5.7.8.5. Rest of Europe Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 5.7.8.6. Rest of Europe Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Rocket Propulsion Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.3. Asia Pacific Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.4. Asia Pacific Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.5. Asia Pacific Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.6. Asia Pacific Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7. Asia Pacific Rocket Propulsion Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.7.1.1. China Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.1.2. China Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.1.3. China Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.1.4. China Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.1.5. China Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.1.6. China Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.2. S Korea 6.7.2.1. S Korea Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.2.2. S Korea Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.2.3. S Korea Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.2.4. S Korea Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.2.5. S Korea Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.2.6. S Korea Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.3. Japan 6.7.3.1. Japan Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.3.2. Japan Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.3.3. Japan Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.3.4. Japan Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.3.5. Japan Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.3.6. Japan Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.4. India 6.7.4.1. India Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.4.2. India Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.4.3. India Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.4.4. India Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.4.5. India Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.4.6. India Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.5. Australia 6.7.5.1. Australia Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.5.2. Australia Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.5.3. Australia Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.5.4. Australia Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.5.5. Australia Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.5.6. Australia Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.6. Indonesia 6.7.6.1. Indonesia Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.6.2. Indonesia Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.6.3. Indonesia Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.6.4. Indonesia Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.6.5. Indonesia Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.6.6. Indonesia Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.7. Malaysia 6.7.7.1. Malaysia Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.7.2. Malaysia Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.7.3. Malaysia Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.7.4. Malaysia Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.7.5. Malaysia Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.7.6. Malaysia Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.8. Vietnam 6.7.8.1. Vietnam Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.8.2. Vietnam Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.8.3. Vietnam Rocket Propulsion Market Size and Forecast, by Component(2023-2030) 6.7.8.4. Vietnam Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.8.5. Vietnam Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.8.6. Vietnam Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.9. Taiwan 6.7.9.1. Taiwan Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.9.2. Taiwan Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.9.3. Taiwan Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.9.4. Taiwan Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.9.5. Taiwan Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.9.6. Taiwan Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 6.7.10. Rest of Asia Pacific 6.7.10.1. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 6.7.10.2. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 6.7.10.3. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 6.7.10.4. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 6.7.10.5. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 6.7.10.6. Rest of Asia Pacific Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Rocket Propulsion Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 7.3. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 7.4. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 7.5. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 7.6. Middle East and Africa Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 7.7. Middle East and Africa Rocket Propulsion Market Size and Forecast, by Country (2023-2030) 7.7.1. South Africa 7.7.1.1. South Africa Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 7.7.1.2. South Africa Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 7.7.1.3. South Africa Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 7.7.1.4. South Africa Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 7.7.1.5. South Africa Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 7.7.1.6. South Africa Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 7.7.2. GCC 7.7.2.1. GCC Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 7.7.2.2. GCC Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 7.7.2.3. GCC Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 7.7.2.4. GCC Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 7.7.2.5. GCC Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 7.7.2.6. GCC Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 7.7.3. Nigeria 7.7.3.1. Nigeria Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 7.7.3.2. Nigeria Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 7.7.3.3. Nigeria Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 7.7.3.4. Nigeria Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 7.7.3.5. Nigeria Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 7.7.3.6. Nigeria Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 7.7.4. Rest of ME&A 7.7.4.1. Rest of ME&A Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 7.7.4.2. Rest of ME&A Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 7.7.4.3. Rest of ME&A Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 7.7.4.4. Rest of ME&A Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 7.7.4.5. Rest of ME&A Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 7.7.4.6. Rest of ME&A Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 8. South America Rocket Propulsion Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 8.2. South America Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 8.3. South America Rocket Propulsion Market Size and Forecast, by Component(2023-2030) 8.4. South America Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 8.5. South America Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 8.6. South America Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 8.7. South America Rocket Propulsion Market Size and Forecast, by Country (2023-2030) 8.7.1. Brazil 8.7.1.1. Brazil Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 8.7.1.2. Brazil Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 8.7.1.3. Brazil Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 8.7.1.4. Brazil Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 8.7.1.5. Brazil Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 8.7.1.6. Brazil Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 8.7.2. Argentina 8.7.2.1. Argentina Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 8.7.2.2. Argentina Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 8.7.2.3. Argentina Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 8.7.2.4. Argentina Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 8.7.2.5. Argentina Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 8.7.2.6. Argentina Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 8.7.3. Rest Of South America 8.7.3.1. Rest Of South America Rocket Propulsion Market Size and Forecast, by Type (2023-2030) 8.7.3.2. Rest Of South America Rocket Propulsion Market Size and Forecast, by Orbit (2023-2030) 8.7.3.3. Rest Of South America Rocket Propulsion Market Size and Forecast, by Component (2023-2030) 8.7.3.4. Rest Of South America Rocket Propulsion Market Size and Forecast, by Launch Vehicle Type (2023-2030) 8.7.3.5. Rest Of South America Rocket Propulsion Market Size and Forecast, by Propulsion Type (2023-2030) 8.7.3.6. Rest Of South America Rocket Propulsion Market Size and Forecast, by End User (2023-2030) 9. Global Rocket Propulsion Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rocket Propulsion Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Antrix 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Blue Origin 10.3. NPO Energomash 10.4. Aerojet Rocketdyne 10.5. Mitsubishi Heavy Industries 10.6. Orbital ATK 10.7. Safran S.A. 10.8. Spacex 10.9. Virgin Galactic 10.10. IHI 10.11. JSC Kuznetsov 10.12. Yuzhmash 10.13. Rocket Lab 10.14. The Raytheon Company 10.15. Thales Group 10.16. Saab AB 10.17. Kongsberg Gruppen ASA 10.18. General Dynamics Corporation 10.19. Denel Dynamics 10.20. Roketsan A.S. 10.21. Rafael Advanced Defense Systems Ltd. 10.22. Mesko S.A. 10.23. MBDA Holdings SAS 10.24. Lockheed Martin 11. Key Findings 12. Industry Recommendations 13. Rocket Propulsion Market: Research Methodology 14. Terms and Glossary