The Robotic Grippers Market size was valued at USD 2.27 Bn in 2024, and the Robotic Grippers revenue is growing at a CAGR of 6.5% from 2025 to 2032, reaching USD 3.76 Bn by 2032.Robotic Grippers Market Overview

Robotic grippers, end-of-arm devices attached to industrial robots that grasp, hold, and manipulate objects, are a critical component of industrial automation. The global robotic gripper market is rapidly evolving, driven by advancements in robotics, AI, and machine vision, with products ranging from simple mechanical two-finger grippers to adaptive and soft grippers for delicate or complex tasks. Rising adoption of Industry 4.0 practices, coupled with the demand for precision, efficiency, and operational flexibility, is fueling market growth, while innovations in modular and customizable grippers enhance supply capabilities across sectors.To know about the Research Methodology :- Request Free Sample Report Regionally, Asia-Pacific dominated due to strong manufacturing bases in China, Japan, and South Korea, followed by North America and Europe, where automation is integral to the automotive and electronics industries. Leading companies such as Schunk, Zimmer Group, SMC Corporation, Piab, and OnRobot are driving competitiveness through product portfolio expansion and technological innovation. Automotive and electronics sectors account for the largest end-user share, while emerging applications in e-commerce, healthcare, and food & beverage are creating new growth opportunities. Overall, the market presents strategic insights for stakeholders and investors, highlighting opportunities driven by technological advancements and evolving industry demands.

Robotic Grippers Market Dynamics

Rising Automation in Manufacturing and Industrial Applications to drive the Market The robotic gripper market is driven by the rapid adoption of automation across various industries, including automotive, electronics, logistics, healthcare, and food & beverage. Manufacturers are increasingly deploying robotic grippers to improve operational efficiency, enhance precision, and reduce labor costs in repetitive handling tasks. The rising demand for collaborative robots (cobots) has further fueled the adoption of grippers, as they enable safe human-robot interaction on factory floors. Additionally, advancements in material science and sensor technologies are leading to the development of lightweight, adaptive, and high-precision grippers capable of handling diverse objects, thereby supporting their integration across multiple industries worldwide. High Initial Investment and Technical Limitations to Restrain the Robotic Grippers Market One of the major restraints in the robotic gripper market is the high upfront cost of advanced gripper systems, including installation, programming, and integration with robotic arms. Small and medium enterprises (SMEs) often find it challenging to adopt such solutions due to budget constraints. Furthermore, technical limitations such as difficulty in handling irregularly shaped, fragile, or highly varied objects pose adoption challenges. Maintenance requirements and the need for skilled operators also increase the total cost of ownership. In certain sectors, concerns about reliability and adaptability of grippers in unstructured environments can slow market penetration. Growth in Smart, AI-Integrated, and Adaptive Grippers to Boost the Market Growth The robotic gripper market presents significant opportunities with the development of smart, AI-powered, and sensor-integrated grippers that can adapt to varying shapes, sizes, and textures. Innovations in soft robotics and vacuum-based gripping solutions are enabling safe handling of delicate items, opening opportunities in industries like food processing, e-commerce logistics, and healthcare. The rise of Industry 4.0, coupled with the expansion of smart factories and warehouse automation, is creating high demand for flexible end-of-arm tooling solutions. Emerging markets, particularly in Asia-Pacific region, offer vast growth potential due to rapid industrialization and government initiatives promoting automation. Additionally, modular and customizable gripper designs, along with subscription-based robotics-as-a-service (RaaS) models, present recurring revenue streams for market players.Robotic Grippers Market Segment Analysis

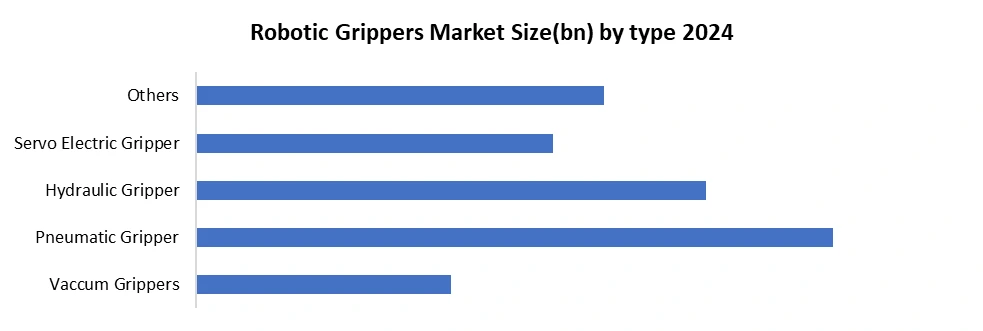

Based on type, the robotic grippers market is segmented into vacuum grippers, pneumatic grippers, hydraulic grippers, servo-electric grippers, and others. Among these, pneumatic grippers account for the dominant segment due to their cost-effectiveness, simplicity, and widespread usage across industries such as automotive, electronics, and general manufacturing. These grippers rely on compressed air, enabling them to deliver consistent force, lightweight operation, and high-speed performance, which makes them ideal for repetitive pick-and-place applications. Their lower upfront cost compared to servo-electric and hydraulic grippers, along with minimal maintenance needs, further supports their strong adoption, particularly among small and medium-scale manufacturers. While vacuum grippers are gaining ground in packaging and logistics, and servo-electric grippers are increasingly used in precision-driven applications and collaborative robots, pneumatic grippers continue to lead the market because of their versatility, reliability, and suitability for traditional industrial automation.

Robotic Grippers Market Regional Insights

Asia-Pacific emerged as the fastest-growing region in the global Robotic Gripper market in 2024, contributing a significant share of global revenue at xx%, driven by rapid industrialization, expansion of manufacturing hubs, and rising adoption of automation across diverse industries. China leads the market with large-scale deployment of robotic grippers in automotive, electronics, and e-commerce logistics, supported by government initiatives such as “Made in China 2025” that encourage advanced manufacturing. Japan and South Korea remain key contributors with their strong robotics ecosystems, technological innovations, and high penetration of collaborative robots in precision industries, while India is witnessing accelerated adoption due to rising investments in smart factories, warehousing, and food processing automation. The region benefits from a large labor-intensive industrial base seeking automation to enhance efficiency, reduce costs, and address workforce shortages. Global players such as ABB, FANUC, and Yaskawa Electric, along with regional innovators like Kawasaki Robotics and Hyundai Robotics, strengthen the competitive landscape. Additionally, supportive government policies, increasing foreign direct investments (FDI) in manufacturing, and the rise of e-commerce are fueling demand for adaptive and cost-efficient robotic grippers. With expanding urbanization, Industry 4.0 adoption, and growing demand for flexible automation solutions, the Asia-Pacific is expected to outpace other regions and emerge as the key growth engine of the global robotic gripper market during the forecast period. Robotic Grippers Market Competitive Landscape The robotic gripper market is highly competitive, with players differentiating through technology, integration, and end-use focus. SCHUNK, a long-established industrial automation leader, offers a comprehensive range of pneumatic, electric, vacuum, and magnetic grippers. The company excels in precision, durability, and payload versatility, making it a preferred choice for automotive, metalworking, and heavy industrial applications. SCHUNK also provides extensive EOAT solutions, including sensors, tool changers, and software integration, backed by a strong global service network. In contrast, OnRobot has positioned itself as a leader in the collaborative robotics segment, emphasizing ease of use, plug-and-play electric grippers, and compatibility with universal robots (UR+) and other cobots. OnRobot focuses on flexibility, affordability, and fast deployment for high-mix, small- to medium-scale production and logistics environments. The competition between SCHUNK and OnRobot illustrates the robotic gripper market's dual dynamics as SCHUNK dominates in traditional industrial settings with proven reliability, engineering depth, and large-scale integration, while OnRobot captures emerging cobot and SME applications with adaptive, user-friendly solutions. Both companies compete indirectly in overlapping segments such as light-duty industrial automation and packaging, where SCHUNK’s reliability and OnRobot’s simplicity and cost-effectiveness are key differentiators. Regional competitors and AI-enabled startups further intensify the market, but SCHUNK and OnRobot remain benchmark players, representing the contrast between traditional industrial strength and modern collaborative flexibility. Key Development in the Robotic Grippers Market • April 2025, United States & Germany – AI-Enabled Adaptive Grippers Gain Traction Automation leaders in the United States and Germany introduced robotic grippers integrated with AI and vision systems, enabling adaptive handling of irregular, delicate, and high-mix products. These solutions are being adopted across e-commerce, logistics, and food processing industries to improve efficiency, reduce product damage, and enhance precision in automated operations. • March 2025, Canada & United States – Surge in Collaborative Robot Deployments Manufacturers in Canada and the United States accelerated the adoption of lightweight, plug-and-play grippers for collaborative robots (cobots), focusing on small- and medium-scale production environments. The trend is driven by demand for flexible automation, ease of integration, and workforce augmentation in light industrial and packaging applications. • January 2025, China & India – Growth in Cost-Effective Pneumatic and Electric Grippers Markets in China and India witnessed strong demand for affordable pneumatic and electric grippers, driven by rapid industrialization, small- to medium-sized manufacturing units, and increased adoption of local robot platforms. These cost-effective solutions are enabling widespread automation across assembly, material handling, and packaging lines. • December 2024, Germany & United Kingdom – Focus on Smart Manufacturing and Industry 4.0 Integration Companies in Germany and the United Kingdom are advancing grippers with integrated force sensing, machine vision, and connectivity to Industry 4.0 platforms. This enables real-time monitoring, predictive maintenance, and adaptive handling in automotive, electronics, and high-precision manufacturing sectors, supporting higher productivity and quality standards. Key Trends of the Robotic Grippers Market • Rise of Collaborative and Plug-and-Play Grippers – There is growing adoption of lightweight, electric, and adaptive grippers designed for collaborative robots (cobots). These grippers offer easy integration, UR+ compatibility, and simplified programming, enabling small- and medium-sized enterprises to deploy automation quickly without extensive engineering support. • Integration of AI and Vision for Adaptive Handling – Grippers are increasingly being paired with AI, machine vision, and force-sensing technologies to handle irregular, delicate, or high-mix products. This trend is especially prominent in e-commerce, logistics, food processing, and electronics industries, where flexible and intelligent gripping solutions improve efficiency, accuracy, and product safety.Global Robotic Grippers Market Scope: Inquire before buying

Global Robotic Grippers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.27 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 3.76 Bn. Segments Covered: by Type Vacuum Grippers Pneumatic Grippers Hydraulic Grippers Servo-electric Grippers Others by Jaw Type 2-Jaw Grippers 3-Jaw Grippers 4-Jaw Grippers Others by Application Material Handling General Assembly Inspection Others Robotic Grippers Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Robotic Grippers Market: Key Players are

Europe 1. SCHUNK SE & Co. KG – Lauffen am Neckar, Germany 2. KUKA AG – Augsburg, Germany 3. Festo AG & Co. KG – Esslingen am Neckar, Germany 4. Weiss Robotics GmbH & Co. KG – Buchen, Germany North America 1. ABB Ltd. – Zurich, Switzerland 2. OnRobot A/S – Odense, Denmark 3. DESTACO – Auburn Hills, Michigan, USA 4. Applied Robotics, Inc. – Glenville, New York, USA 5. Festo Inc. – Hauppauge, New York, USA Asia-Pacific 1. Techman Robot Inc. – Taoyuan, Taiwan 2. Siasun Robot & Automation Co. Ltd. – Shenyang, China 3. IAI- Japan 4. SMC Corporation – Tokyo, JapanFrequently Asked Questions:

1] What segments are covered in the Robotic Grippers Market report? Ans. The segments covered in the Robotic Grippers Market report are based on Type, Application, and End-User. 2] Which region is expected to hold the highest share in the global Robotic Grippers Market? Ans. Asia Pacific is expected to hold the highest share in the global Robotic Grippers Market. 3] What is the market size of the global Robotic Grippers Market by 2032? Ans. The market size of the global Robotic Grippers Market by 2032 is USD 3.76 Bn. 4] Who are the top key players in the global Robotic Grippers Market? Ans. Schunk, Festo, SMC, Robotiq, and Zimmer are the top key players in the global market. 5] What was the global Robotic Grippers Market Size in 2024? Ans. The global Robotic Grippers Market size was USD 2.27 Bn in 2024.

1. Robotic Grippers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Robotic Grippers Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Robotic Grippers Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Robotic Grippers Market: Dynamics 3.1. Robotic Grippers Market Trends by Region 3.1.1. North America Robotic Grippers Market Trends 3.1.2. Europe Robotic Grippers Market Trends 3.1.3. Asia Pacific Robotic Grippers Market Trends 3.1.4. Middle East and Africa Robotic Grippers Market Trends 3.1.5. South America Robotic Grippers Market Trends 3.2. Robotic Grippers Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Robotic Grippers Market Drivers 3.2.1.2. North America Robotic Grippers Market Restraints 3.2.1.3. North America Robotic Grippers Market Opportunities 3.2.1.4. North America Robotic Grippers Market Challenges 3.2.2. Europe 3.2.2.1. Europe Robotic Grippers Market Drivers 3.2.2.2. Europe Robotic Grippers Market Restraints 3.2.2.3. Europe Robotic Grippers Market Opportunities 3.2.2.4. Europe Robotic Grippers Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Robotic Grippers Market Drivers 3.2.3.2. Asia Pacific Robotic Grippers Market Restraints 3.2.3.3. Asia Pacific Robotic Grippers Market Opportunities 3.2.3.4. Asia Pacific Robotic Grippers Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Robotic Grippers Market Drivers 3.2.4.2. Middle East and Africa Robotic Grippers Market Restraints 3.2.4.3. Middle East and Africa Robotic Grippers Market Opportunities 3.2.4.4. Middle East and Africa Robotic Grippers Market Challenges 3.2.5. South America 3.2.5.1. South America Robotic Grippers Market Drivers 3.2.5.2. South America Robotic Grippers Market Restraints 3.2.5.3. South America Robotic Grippers Market Opportunities 3.2.5.4. South America Robotic Grippers Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Robotic Grippers Industry 3.8. Analysis of Government Schemes and Initiatives For Robotic Grippers Industry 3.9. Robotic Grippers Market Trade Analysis 3.10. The Global Pandemic Impact on Robotic Grippers Market 4. Robotic Grippers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 4.1.1. Drilling equipment 4.1.2. Field production machinery 4.1.3. Pumps 4.1.4. Valves 4.1.5. Others 4.2. Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 4.2.1. 2-Jaw Grippers 4.2.2. 3-Jaw Grippers 4.2.3. 4-Jaw Grippers 4.2.4. Others 4.3. Robotic Grippers Market Size and Forecast, by Application (2024-2032) 4.3.1. Material Handling 4.3.2. General Assembly 4.3.3. Inspection 4.3.4. Others 4.4. Robotic Grippers Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Robotic Grippers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 5.1.1. Drilling equipment 5.1.2. Field production machinery 5.1.3. Pumps 5.1.4. Valves 5.1.5. Others 5.2. North America Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 5.2.1. 2-Jaw Grippers 5.2.2. 3-Jaw Grippers 5.2.3. 4-Jaw Grippers 5.2.4. Others 5.3. North America Robotic Grippers Market Size and Forecast, by Application (2024-2032) 5.3.1. Material Handling 5.3.2. General Assembly 5.3.3. Inspection 5.3.4. Others 5.4. North America Robotic Grippers Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 5.4.1.1.1. Drilling equipment 5.4.1.1.2. Field production machinery 5.4.1.1.3. Pumps 5.4.1.1.4. Valves 5.4.1.1.5. Others 5.4.1.2. United States Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 5.4.1.2.1. 2-Jaw Grippers 5.4.1.2.2. 3-Jaw Grippers 5.4.1.2.3. 4-Jaw Grippers 5.4.1.2.4. Others 5.4.1.3. United States Robotic Grippers Market Size and Forecast, by Application (2024-2032) 5.4.1.3.1. Material Handling 5.4.1.3.2. General Assembly 5.4.1.3.3. Inspection 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 5.4.2.1.1. Drilling equipment 5.4.2.1.2. Field production machinery 5.4.2.1.3. Pumps 5.4.2.1.4. Valves 5.4.2.1.5. Others 5.4.2.2. Canada Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 5.4.2.2.1. 2-Jaw Grippers 5.4.2.2.2. 3-Jaw Grippers 5.4.2.2.3. 4-Jaw Grippers 5.4.2.2.4. Others 5.4.2.3. Canada Robotic Grippers Market Size and Forecast, by Application (2024-2032) 5.4.2.3.1. Material Handling 5.4.2.3.2. General Assembly 5.4.2.3.3. Inspection 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 5.4.3.1.1. Drilling equipment 5.4.3.1.2. Field production machinery 5.4.3.1.3. Pumps 5.4.3.1.4. Valves 5.4.3.1.5. Others 5.4.3.2. Mexico Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 5.4.3.2.1. 2-Jaw Grippers 5.4.3.2.2. 3-Jaw Grippers 5.4.3.2.3. 4-Jaw Grippers 5.4.3.2.4. Others 5.4.3.3. Mexico Robotic Grippers Market Size and Forecast, by Application (2024-2032) 5.4.3.3.1. Material Handling 5.4.3.3.2. General Assembly 5.4.3.3.3. Inspection 5.4.3.3.4. Others 6. Europe Robotic Grippers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.2. Europe Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.3. Europe Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4. Europe Robotic Grippers Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.1.2. United Kingdom Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.1.3. United Kingdom Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.2. France 6.4.2.1. France Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.2.2. France Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.2.3. France Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.3.2. Germany Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.3.3. Germany Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.4.2. Italy Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.4.3. Italy Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.5.2. Spain Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.5.3. Spain Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.6.2. Sweden Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.6.3. Sweden Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.7.2. Austria Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.7.3. Austria Robotic Grippers Market Size and Forecast, by Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 6.4.8.2. Rest of Europe Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 6.4.8.3. Rest of Europe Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Robotic Grippers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.2. Asia Pacific Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.3. Asia Pacific Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Robotic Grippers Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.1.2. China Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.1.3. China Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.2.2. S Korea Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.2.3. S Korea Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.3.2. Japan Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.3.3. Japan Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.4. India 7.4.4.1. India Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.4.2. India Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.4.3. India Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.5.2. Australia Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.5.3. Australia Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.6.2. Indonesia Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.6.3. Indonesia Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.7.2. Malaysia Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.7.3. Malaysia Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.8.2. Vietnam Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.8.3. Vietnam Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.9.2. Taiwan Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.9.3. Taiwan Robotic Grippers Market Size and Forecast, by Application (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 7.4.10.2. Rest of Asia Pacific Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Robotic Grippers Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Robotic Grippers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 8.2. Middle East and Africa Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 8.3. Middle East and Africa Robotic Grippers Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Robotic Grippers Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 8.4.1.2. South Africa Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 8.4.1.3. South Africa Robotic Grippers Market Size and Forecast, by Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 8.4.2.2. GCC Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 8.4.2.3. GCC Robotic Grippers Market Size and Forecast, by Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 8.4.3.2. Nigeria Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 8.4.3.3. Nigeria Robotic Grippers Market Size and Forecast, by Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 8.4.4.2. Rest of ME&A Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 8.4.4.3. Rest of ME&A Robotic Grippers Market Size and Forecast, by Application (2024-2032) 9. South America Robotic Grippers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 9.2. South America Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 9.3. South America Robotic Grippers Market Size and Forecast, by Application(2024-2032) 9.4. South America Robotic Grippers Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 9.4.1.2. Brazil Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 9.4.1.3. Brazil Robotic Grippers Market Size and Forecast, by Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 9.4.2.2. Argentina Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 9.4.2.3. Argentina Robotic Grippers Market Size and Forecast, by Application (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Robotic Grippers Market Size and Forecast, by Equipment (2024-2032) 9.4.3.2. Rest Of South America Robotic Grippers Market Size and Forecast, by Jaw Type (2024-2032) 9.4.3.3. Rest Of South America Robotic Grippers Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. SCHUNK SE & Co. KG – Lauffen am Neckar, Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KUKA AG – Augsburg, Germany 10.3. Festo AG & Co. KG – Esslingen am Neckar, Germany 10.4. Weiss Robotics GmbH & Co. KG – Buchen, Germany 10.5. ABB Ltd. – Zurich, Switzerland 10.6. OnRobot A/S – Odense, Denmark 10.7. DESTACO – Auburn Hills, Michigan, USA 10.8. Applied Robotics, Inc. – Glenville, New York, USA 10.9. Festo Inc. – Hauppauge, New York, USA 10.10. Techman Robot Inc. – Taoyuan, Taiwan 10.11. Siasun Robot & Automation Co. Ltd. – Shenyang, China 10.12. IAI- Japan 10.13. SMC Corporation – Tokyo, Japan 11. Key Findings 12. Industry Recommendations 13. Robotic Grippers Market: Research Methodology 14. Terms and Glossary