Global Resilient Flooring Market size was valued at USD 42.5 Bn. in 2024, and the total Resilient Flooring Market revenue is expected to grow by 8.1 % from 2025 to 2032, reaching nearly USD 79.25 Bn.Resilient Flooring Market Overview:

Resilient flooring is a type of flooring material recognized for its flexibility, durability, and capacity to regain its original shape after being compressed or subjected to pressure. Its durability, flexibility, and ability to withstand heavy use across residential, commercial, and industrial sectors. Resilient flooring, which includes vinyl, rubber, linoleum, cork, and luxury vinyl tiles (LVT), is increasingly preferred for its water resistance, easy maintenance, and long-lasting performance. Rising urbanization and the rapid expansion of residential and commercial construction projects are major drivers fueling demand. Additionally, industries such as healthcare, hospitality, and sports facilities are adopting resilient flooring due to its hygienic, slip-resistant, and antimicrobial properties. Technological advancements, including digital printing for customized designs and hybrid material innovations, are enhancing product aesthetics and functionality, further boosting adoption. Growing infrastructure development in emerging markets, coupled with rising disposable incomes, presents lucrative opportunities for market players. Also, the increasing focus on eco-friendly and PVC-free flooring solutions aligns with sustainability trends, appealing to environmentally conscious consumers. Renovation and remodeling activities worldwide are also generating strong replacement demand. For instance, Mohawk Industries recently introduced PureTech, a PVC-free resilient flooring solution, highlighting industry efforts toward sustainable innovation. Similarly, the surge in U.S. residential construction and expanding commercial projects in Asia Pacific and Europe are reinforcing Resilient Flooring Market growth globally.To know about the Research Methodology :- Request Free Sample Report

Resilient Flooring Market Dynamics:

Construction Growth and Aesthetic Demand to drive the Resilient Flooring Market Expanding urbanization, large-scale infrastructure investments, and residential housing booms in key economies are creating substantial opportunities for resilient flooring suppliers. China, the world’s largest construction market valued at over $1 trillion annually, continues to expand through urban development, transportation upgrades, and green building initiatives. Similarly, the U.S. construction industry is expected to approach $2 trillion by 2030, supported by strong residential activity, infrastructure upgrades under the Infrastructure Investment and Jobs Act (IIJA), and commercial building projects. India, the third-largest construction market, is witnessing accelerated demand through government-backed initiatives such as Smart Cities and affordable housing, positioning resilient flooring as a preferred solution. Resilient flooring is increasingly chosen for its durability, cost-effectiveness, low maintenance, and ability to replicate premium materials like wood and stone at lower prices. In the U.S., for example, new housing permits grew in early 2023, signaling strong residential momentum that directly boosted flooring demand. Builders and homeowners favor luxury vinyl tiles (LVT) and planks for their combination of practicality and design appeal. Companies such as Mohawk Industries have introduced eco-friendly, PVC-free flooring lines to align with sustainability preferences while enhancing aesthetics. Beyond residential projects, commercial and hospitality sectors are adopting resilient flooring due to its hygienic, slip-resistant, and visually appealing qualities. Rising remodeling and modernization trends worldwide further support adoption, making construction growth and aesthetic demand pivotal drivers for Resilient Flooring Market growth. Raw Material Price Volatility limits the Resilient Flooring Market growth Volatility in raw material prices presents a significant restraint to the resilient flooring market. The industry is highly dependent on petroleum-based inputs such as vinyl, polymers, and adhesives, making it vulnerable to fluctuations in crude oil prices. Between 2021 and 2023, crude oil prices recorded an average increase of 18%, directly elevating manufacturing costs. Such unpredictability forces producers to either absorb rising expenses, thereby compressing profit margins, or pass the additional costs on to customers, which often dampens market demand. In 2025, the U.S. resilient flooring industry faced further challenges due to supply chain disruptions and rising import tariffs on vinyl sourced from key regions such as the Netherlands and Taiwan. These factors not only raised costs but also limited the availability of certain product designs, constraining market growth. Also, global environmental regulations and ongoing geopolitical tensions have contributed to volatile pricing of essential materials such s polymers and timber. This volatility continues to challenge manufacturers worldwide, creating uncertainty in production planning, reducing product affordability, and ultimately restraining the pace of resilient flooring market growth. Technological Advancements creates lucrative growth opportunities to Resilient Flooring Market Technological advancements are opening significant opportunities in the resilient flooring market by improving sustainability, functionality, and design versatility. Major development is the introduction of PVC-free and recycled material flooring, which reduces environmental impact without compromising durability or performance. For example, in March 2024, Mohawk Industries launched PureTech, a PVC-free resilient flooring line that incorporates 70% recycled content and an 80% renewable organic core. The product offers enhanced waterproofing, scratch resistance, and stain protection, directly addressing the rising demand for eco-friendly yet high-performance flooring solutions. Advances in digital printing technology further support market growth by enabling manufacturers to produce flooring that closely replicates natural materials such as wood, marble, and stone with remarkable realism. This capability not only broadens design options but also allows consumers to achieve premium aesthetics at lower costs. Also, modular and click-lock installation systems make flooring easier and more affordable to install, attracting both homeowners and contractors. Emerging innovations such as smart flooring integrated with sensors to monitor wear or indoor air quality add value, particularly in commercial, healthcare, and institutional applications. Collectively, these technological improvements align with global sustainability goals, growing urbanization, and consumer design preferences, creating lucrative opportunities for market growth.Resilient Flooring Market Segment Analysis:

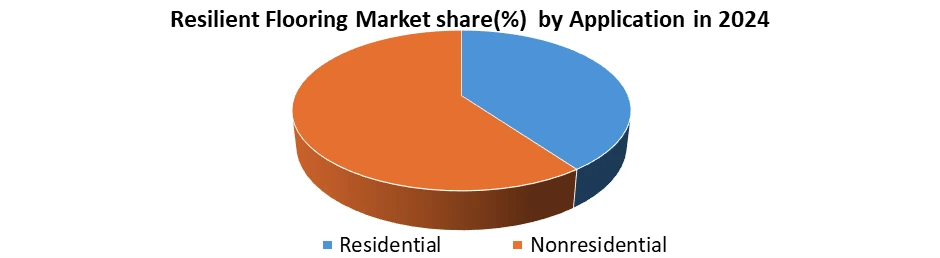

Based on the Product, the Resilient Flooring Market is segmented into Luxury Vinyl Tiles, Vinyl Sheet & Floor Tile, Linoleum, Cork, and Rubber. Luxury Vinyl Tiles segment dominated the product segment in 2024. The products' increasing commercial availability and advantages including better aesthetics, less maintenance, and simple installation are the key drivers of its rising appeal in both residential and commercial flooring applications. Due to their water-resistance, vinyl sheets and floor tiles are expected to have significant increase during the forecast period. Additionally, the goods' low maintenance requirements and long product lifespan are expected to increase their popularity in household end-use spaces such laundry rooms, baths, kitchens, and moisture-prone areas. Linoleum materials last longer and are more durable than vinyl alternatives. These floor coverings are completely biodegradable because they are made using jute resin, flax plant, limestone, and wood floor. The need for biodegradable materials for flooring is expected to rise as waste management and recycling become more important in developed economies like the United States, the United Kingdom, and Germany. Most of the resilient flooring utilised in commercial and institutional buildings is rubber flooring. This is because they are appropriate for severe conditions because to their waterproof and slip-resistant qualities. Primarily utilised on dance floors, health clubs, fitness centres, and other high-impact areas are natural and synthetic rubber floor tiles.Based on the Application, the Resilient Flooring Market is segmented into Residential, and Non-residential. Non-residential segment dominated the application segment in 2024. Resilient flooring's benefits in terms of ease of maintenance, sterilisation, slip resistance, and water resistance are factors that are expected to encourage its use in hospital wards and clinics to maintain the highest levels of hygiene. Resilient flooring is primarily employed in non-residential sectors due to the many advantages of this engineered product as well as its capacity to produce an infinite number of shapes and styles. Additionally, it is expected that the penetration of resilient flooring products grows with customised solutions in the design and dimension of the products. Residential segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. Due to Small and single-family homes, apartment buildings, complexes, and residential buildings all fall under the category of residential applications for resilient flooring. Due to their resistance to slip, shock, stain, and filth, resilient flooring is primarily employed in these structures. Additionally, robust materials' ability to act as a cushion is driving demand. The demand for flooring materials is expected to increase because of population growth and an increase in demand for single-family and multi-family residential spaces in major countries including India, China, South Africa, Turkey, and the Middle Eastern economy. Rising disposable income and the simple availability of mortgage loans are attributed as factors of this trend.

Resilient Flooring Market Regional Insights:

The Asia Pacific region dominated Resilient Flooring Market in 2024. This dominance is boosted by rapid urbanization, large-scale construction projects, and rising disposable incomes across major economies such as China, India, and Southeast Asian nations. The region’s expanding residential, commercial, and public infrastructure projects continue to generate significant demand for resilient flooring solutions. Urban development programs are key growth catalysts. In India, the Pradhan Mantri Awas Yojana-Urban initiative sanctioned over 12 million affordable homes by 2024, directly boosting flooring requirements in the residential sector. Similarly, China’s extensive urban expansion, coupled with ongoing investments in housing and commercial complexes, has strengthened the adoption of products such as luxury vinyl tiles (LVT), vinyl sheets, and rubber flooring. Affordability and durability remain central to consumer choice in the region, making resilient flooring highly attractive in densely populated urban environments. Moreover, technological innovations, including waterproof, slip-resistant, and antibacterial flooring, have gained traction in healthcare, hospitality, and retail applications. Growing environmental awareness is also driving adoption of recyclable and bio-based flooring materials. For example, tier-one cities in China are consistently integrating resilient flooring into residential and commercial projects due to its balance of durability, cost-effectiveness, and aesthetic appeal. With India’s affordable housing boom and Southeast Asia’s rapid infrastructure development, Asia Pacific is expected to maintain its dominance as the largest and fastest-growing resilient flooring market globally.Competitive Landscape of Resilient Flooring Market

Resilient Flooring Market is highly fragmented. The market is witnessing steady growth driven by sustainability, innovation, and expanded reach. Leading companies such as Mohawk Industries, Tarkett, and Shaw Industries are spearheading advancements through eco-friendly, recyclable, and PVC-free flooring solutions. For instance, Shaw invested $90 million in its Ringgold plant to double SPC and LVT capacity, while Tarkett introduced Collective Pursuit, a non-PVC resilient flooring line. Similarly, AHF Products launched Ingenious Plank, a lightweight, wood-fiber-based hybrid product combining durability and design. Other key players, including Gerflor, Forbo, B.I.G., Mannington Mills, and Interface, strengthen their positions through acquisitions, product diversification, and sustainability-focused strategies. Regional competitors leverage cost advantages and localized preferences, particularly in Asia Pacific. The industry remains competitive yet growth-oriented, shaped by technological innovations, sustainability commitments, and strategic expansions.Recent key developments in the Resilient Flooring Market

1. On July 10, 2024, AHF Products has launched Ingenious Plank, a next-generation hybrid resilient flooring that redefines sustainability, performance, and design. PVC-free and made from natural wood fibers within a high-performance resin, it is eco-friendly, waterproof, and 40% lighter than traditional rigid cores. Available in 23 wood visuals, it offers durability, scratch resistance, and enhanced acoustics with an attached pad. Featuring an Angle Lock system, it ensures easy installation for residential and light commercial use. 2. On October 24, 2024, Shaw Industries Group, Inc. (Shaw) is strengthening its domestic resilient flooring manufacturing with a $90 million investment in its Ringgold, Ga. Plant RP, which produces SPC and LVT flooring. The expansion, set to complete by 2026, more than double production capacity. Along with increased output, the upgrade delivers advanced product features, including smaller production runs, new embossing textures, improved dimensional stability for loose lay applications, and a wider range of product sizes. 3. On April 18, 2024, Tarkett has launched Collective Pursuit, its first non-PVC plank and tile resilient flooring collection in North America. Designed to meet sustainability goals, it offers performance comparable to luxury vinyl tile, with strong dimensional stability, impact resistance, and easy maintenance. The innovation reflects Tarkett’s commitment to eco-friendly, high-performance solutions, giving customers a durable alternative to traditional PVC-based flooring. 4. April 03,2023, B.I.G. has signed an agreement to acquire Australian B2B flooring wholesaler Signature Floors, expanding its presence in the Australian and New Zealand markets. The acquisition will enhance growth opportunities across soft, resilient, and hard flooring segments in the region. Aligned with its corporate strategy, B.I.G. continues to invest in key business areas and high-potential geographies.Key trends in the Resilient Flooring Market

1 Growing Demand for Luxury Vinyl Tiles (LVT) LVT is witnessing rapid adoption due to its durability, cost-effectiveness, and design versatility. Its ability to replicate natural materials like wood and stone, combined with easy installation and low maintenance, is driving preference across residential and commercial spaces. 2.Sustainability and Eco-friendly Flooring Solutions Increasing focus on green building standards is boosting demand for recyclable and non-PVC resilient flooring. Manufacturers are innovating with bio-based materials and low-VOC products, aligning with consumer and regulatory emphasis on sustainable construction practices.Resilient Flooring Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 42.5 Bn. Forecast Period 2025 to 2032 CAGR: 8.1% Market Size in 2032: USD 79.25 Bn. Segments Covered: by Product Luxury Vinyl Tiles Vinyl Sheet & Floor Tile Linoleum Cork Others by Application Residential Commercial Institutional & Industrial Resilient Flooring Market, by region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Resilient Flooring Market, Key Players are

1. Mohawk Industries (Calhoun, Georgia, USA) 2. Tarkett S.A. (Nanterre, France) 3. Shaw Industries Group (Dalton, Georgia, USA) 4. Armstrong Flooring (Lancaster, Pennsylvania, USA) 5. Mannington Mills (Salem, New Jersey, USA) 6. Forbo Flooring Systems (Baar, Switzerland) 7. Gerflor Group (Villeurbanne, France) 8. Interface, Inc. (Atlanta, Georgia, USA) 9. IVC Group (Avelgem, Belgium) 10. Beaulieu International Group (BIG) (Waregem, Belgium) 11. Polyflor Ltd. (Manchester, United Kingdom) 12. Karndean Designflooring (Evesham, United Kingdom) 13. Congoleum Corporation (Mercerville, New Jersey, USA) 14. Novalis Innovative Flooring (Shanghai, China) 15. Milliken & Company (Spartanburg, South Carolina, USA) 16. Fatra a.s. (Napajedla, Czech Republic) 17. Amtico International (Coventry, United Kingdom) 18. LG Hausys (Seoul, South Korea) 19. NOX Corporation (Seoul, South Korea) 20. Global Flooring Group (Oslo, Norway) 21. Burke Industries Inc. (San Jose, California, USA) 22. American Biltrite Inc. (Sherbrooke, Quebec, Canada) 23. Pergo (Mohawk subsidiary) (Raleigh, North Carolina, USA) 24. Metroflor Corporation (Norwalk, Connecticut, USA) 25. Raskin Industries LLC (Hazlet, New Jersey, USA) 26. Parterre Flooring Systems (Wilmington, Massachusetts, USA) 27. AHF, LLC (AHF Products) (Mountville, Pennsylvania, USA) 28. MONDO S.p.A. (Piedmont, Italy)Frequently Asked Questions:

1] Which region is expected to hold the highest share in the Resilient Flooring Market? Ans. The North American region is expected to hold the highest share in the Resilient Flooring Market. 2] Who are the top key players in the Resilient Flooring Market? Ans. Mohawk Industries (Calhoun, Georgia, USA), Tarkett S.A. (Nanterre, France), Shaw Industries Group (Dalton, Georgia, USA), Armstrong Flooring (Lancaster, Pennsylvania, USA), Mannington Mills (Salem, New Jersey, USA) 3] Which segment is expected to hold the largest market share in the Resilient Flooring Market by 2032? Ans. Luxury Vinyl Tiles segment is expected to hold the largest market share in the Resilient Flooring Market by 2032. 4] What is the market size of the Resilient Flooring Market by 2032? Ans. The market size of the Resilient Flooring Market is expected to reach US $79.25 Bn. by 2032. 5] What was the market size of the Resilient Flooring Market in 2024? Ans. The market size of the Resilient Flooring Market was worth US $42.5 Bn. in 2024.

1. Resilient Flooring Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Resilient Flooring Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Resilient Flooring Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Resilient Flooring Market: Dynamics 3.1. Resilient Flooring Market Trends by Region 3.1.1. North America Resilient Flooring Market Trends 3.1.2. Europe Resilient Flooring Market Trends 3.1.3. Asia Pacific Resilient Flooring Market Trends 3.1.4. Middle East and Africa Resilient Flooring Market Trends 3.1.5. South America Resilient Flooring Market Trends 3.2. Resilient Flooring Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Resilient Flooring Market Drivers 3.2.1.2. North America Resilient Flooring Market Restraints 3.2.1.3. North America Resilient Flooring Market Opportunities 3.2.1.4. North America Resilient Flooring Market Challenges 3.2.2. Europe 3.2.2.1. Europe Resilient Flooring Market Drivers 3.2.2.2. Europe Resilient Flooring Market Restraints 3.2.2.3. Europe Resilient Flooring Market Opportunities 3.2.2.4. Europe Resilient Flooring Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Resilient Flooring Market Drivers 3.2.3.2. Asia Pacific Resilient Flooring Market Restraints 3.2.3.3. Asia Pacific Resilient Flooring Market Opportunities 3.2.3.4. Asia Pacific Resilient Flooring Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Resilient Flooring Market Drivers 3.2.4.2. Middle East and Africa Resilient Flooring Market Restraints 3.2.4.3. Middle East and Africa Resilient Flooring Market Opportunities 3.2.4.4. Middle East and Africa Resilient Flooring Market Challenges 3.2.5. South America 3.2.5.1. South America Resilient Flooring Market Drivers 3.2.5.2. South America Resilient Flooring Market Restraints 3.2.5.3. South America Resilient Flooring Market Opportunities 3.2.5.4. South America Resilient Flooring Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Resilient Flooring Industry 3.8. Analysis of Government Schemes and Initiatives For Resilient Flooring Industry 3.9. Resilient Flooring Market Trade Analysis 3.10. The Global Pandemic Impact on Resilient Flooring Market 4. Resilient Flooring Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Resilient Flooring Market Size and Forecast, by Product (2024-2032) 4.1.1. Luxury Vinyl Tiles 4.1.2. Vinyl Sheet & Floor Tile 4.1.3. Linoleum 4.1.4. Cork 4.1.5. Others 4.2. Resilient Flooring Market Size and Forecast, by Application (2024-2032) 4.2.1. Residential 4.2.2. Commercial 4.2.3. Institutional & Industrial 4.3. Resilient Flooring Market Size and Forecast, by Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Resilient Flooring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Resilient Flooring Market Size and Forecast, by Product (2024-2032) 5.1.1. Luxury Vinyl Tiles 5.1.2. Vinyl Sheet & Floor Tile 5.1.3. Linoleum 5.1.4. Cork 5.1.5. Others 5.2. North America Resilient Flooring Market Size and Forecast, by Application (2024-2032) 5.2.1. Residential 5.2.2. Commercial 5.2.3. Institutional & Industrial 5.3. North America Resilient Flooring Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Resilient Flooring Market Size and Forecast, by Product (2024-2032) 5.3.1.1.1. Luxury Vinyl Tiles 5.3.1.1.2. Vinyl Sheet & Floor Tile 5.3.1.1.3. Linoleum 5.3.1.1.4. Cork 5.3.1.1.5. Others 5.3.1.2. United States Resilient Flooring Market Size and Forecast, by Application (2024-2032) 5.3.1.2.1. Residential 5.3.1.2.2. Commercial 5.3.1.2.3. Institutional & Industrial 5.3.2. Canada 5.3.2.1. Canada Resilient Flooring Market Size and Forecast, by Product (2024-2032) 5.3.2.1.1. Luxury Vinyl Tiles 5.3.2.1.2. Vinyl Sheet & Floor Tile 5.3.2.1.3. Linoleum 5.3.2.1.4. Cork 5.3.2.1.5. Others 5.3.2.2. Canada Resilient Flooring Market Size and Forecast, by Application (2024-2032) 5.3.2.2.1. Residential 5.3.2.2.2. Commercial 5.3.2.2.3. Institutional & Industrial 5.3.3. Mexico 5.3.3.1. Mexico Resilient Flooring Market Size and Forecast, by Product (2024-2032) 5.3.3.1.1. Luxury Vinyl Tiles 5.3.3.1.2. Vinyl Sheet & Floor Tile 5.3.3.1.3. Linoleum 5.3.3.1.4. Cork 5.3.3.1.5. Others 5.3.3.2. Mexico Resilient Flooring Market Size and Forecast, by Application (2024-2032) 5.3.3.2.1. Residential 5.3.3.2.2. Commercial 5.3.3.2.3. Institutional & Industrial 6. Europe Resilient Flooring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.2. Europe Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3. Europe Resilient Flooring Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.1.2. United Kingdom Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.2. France 6.3.2.1. France Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.2.2. France Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.3.2. Germany Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.4.2. Italy Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.5.2. Spain Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.6.2. Sweden Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.7.2. Austria Resilient Flooring Market Size and Forecast, by Application (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Resilient Flooring Market Size and Forecast, by Product (2024-2032) 6.3.8.2. Rest of Europe Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Resilient Flooring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Resilient Flooring Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.1.2. China Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.2.2. S Korea Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.3.2. Japan Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.4. India 7.3.4.1. India Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.4.2. India Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.5.2. Australia Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.6.2. Indonesia Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.7.2. Malaysia Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.8. Vietnam 7.3.8.1. Vietnam Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.8.2. Vietnam Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.9. Taiwan 7.3.9.1. Taiwan Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.9.2. Taiwan Resilient Flooring Market Size and Forecast, by Application (2024-2032) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Resilient Flooring Market Size and Forecast, by Product (2024-2032) 7.3.10.2. Rest of Asia Pacific Resilient Flooring Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Resilient Flooring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Resilient Flooring Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Resilient Flooring Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Resilient Flooring Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Resilient Flooring Market Size and Forecast, by Product (2024-2032) 8.3.1.2. South Africa Resilient Flooring Market Size and Forecast, by Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Resilient Flooring Market Size and Forecast, by Product (2024-2032) 8.3.2.2. GCC Resilient Flooring Market Size and Forecast, by Application (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Resilient Flooring Market Size and Forecast, by Product (2024-2032) 8.3.3.2. Nigeria Resilient Flooring Market Size and Forecast, by Application (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Resilient Flooring Market Size and Forecast, by Product (2024-2032) 8.3.4.2. Rest of ME&A Resilient Flooring Market Size and Forecast, by Application (2024-2032) 9. South America Resilient Flooring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Resilient Flooring Market Size and Forecast, by Product (2024-2032) 9.2. South America Resilient Flooring Market Size and Forecast, by Application (2024-2032) 9.3. South America Resilient Flooring Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Resilient Flooring Market Size and Forecast, by Product (2024-2032) 9.3.1.2. Brazil Resilient Flooring Market Size and Forecast, by Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Resilient Flooring Market Size and Forecast, by Product (2024-2032) 9.3.2.2. Argentina Resilient Flooring Market Size and Forecast, by Application (2024-2032) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Resilient Flooring Market Size and Forecast, by Product (2024-2032) 9.3.3.2. Rest Of South America Resilient Flooring Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Mohawk Industries (Calhoun, Georgia, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Tarkett S.A. (Nanterre, France) 10.3. Shaw Industries Group (Dalton, Georgia, USA) 10.4. Armstrong Flooring (Lancaster, Pennsylvania, USA) 10.5. Mannington Mills (Salem, New Jersey, USA) 10.6. Forbo Flooring Systems (Baar, Switzerland) 10.7. Gerflor Group (Villeurbanne, France) 10.8. Interface, Inc. (Atlanta, Georgia, USA) 10.9. IVC Group (Avelgem, Belgium) 10.10. Beaulieu International Group (BIG) (Waregem, Belgium) 10.11. Polyflor Ltd. (Manchester, United Kingdom) 10.12. Karndean Designflooring (Evesham, United Kingdom) 10.13. Congoleum Corporation (Mercerville, New Jersey, USA) 10.14. Novalis Innovative Flooring (Shanghai, China) 10.15. Milliken & Company (Spartanburg, South Carolina, USA) 10.16. Fatra a.s. (Napajedla, Czech Republic) 10.17. Amtico International (Coventry, United Kingdom) 10.18. LG Hausys (Seoul, South Korea) 10.19. NOX Corporation (Seoul, South Korea) 10.20. Global Flooring Group (Oslo, Norway) 10.21. Burke Industries Inc. (San Jose, California, USA) 10.22. American Biltrite Inc. (Sherbrooke, Quebec, Canada) 10.23. Pergo (Mohawk subsidiary) (Raleigh, North Carolina, USA) 10.24. Metroflor Corporation (Norwalk, Connecticut, USA) 10.25. Raskin Industries LLC (Hazlet, New Jersey, USA) 10.26. Parterre Flooring Systems (Wilmington, Massachusetts, USA) 10.27. AHF, LLC (AHF Products) (Mountville, Pennsylvania, USA) 10.28. MONDO S.p.A. (Piedmont, Italy) 11. Key Findings 12. Industry Recommendations 13. Resilient Flooring Market: Research Methodology 14. Terms and Glossary