Rapid Microbiology Testing Market has valued at US$ 4.20 Bn. in 2022. The Global Rapid Microbiology Testing Market size is estimated to grow at a CAGR of 9.4% over the forecast period.Rapid Microbiology Testing Market Overview:

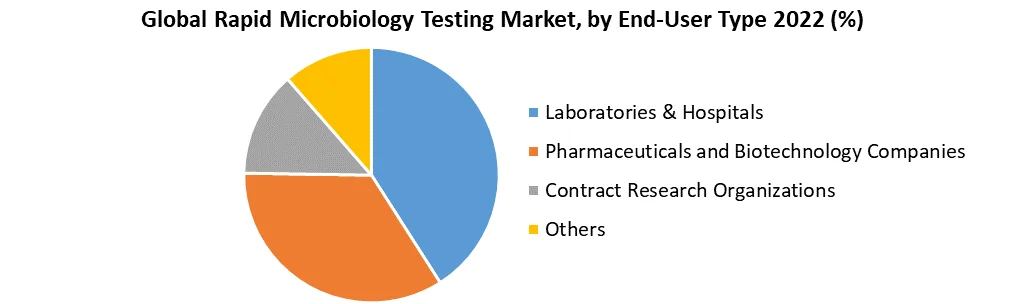

The Rapid Microbiology Testing Market analyzes and forecasts the market size in terms of value for the market (Billion). Further, the Rapid Microbiology Testing Market is segmented by Product, Application, End-User, and Region. Based on Product, the market is segmented into Instruments, Reagents and Kits, and Consumables. Based on Application, the market has been segmented into Clinical Disease Diagnosis, Food and Beverage Testing, Pharmaceutical and Biological Drug Testing, Environmental Testing, Cosmetics and Personal Care Products Testing, Research Applications, and Others. By End-User, the market is divided into Laboratories & Hospitals, Pharmaceuticals and Biotechnology Companies, Contract Research Organizations, and Others. North America is the dominant player in the market. The report thoroughly analyzes market drivers, limitations, and opportunities.To Know About The Research Methodology :- Request Free Sample Report Microbiology is the division of medical science that contracts with the handling, diagnosis, and stoppage of infectious diseases. Rapid microbiology testing helps to increase product safety profiles, track crucial control points in real-time, identify microbial hazards more quickly, enhance production processes, and reduce overall costs of quality programs. Rapid microbiology testing Application is also termed microbiological Applications and these are the type of technologies that are beneficial to get microbiology test outcomes faster as compared to outdated culture-plate Applications.

Global Rapid Microbiology Testing Market Dynamics:

Quick technologies in microbial detection are used to differentiate microbes from many samples in clinical diagnostics, food and beverage testing, and environmental End-Users. This Application is extensively used in medication, drug production, and other biotechnology grounds. By dropping the per-procedure consumable rate, these tests offer a profitable alternate for microbial identification. Growing food safety worries is the dynamic factor rising the market growth, rising fund, investigating allowances, and public-private funds, rising acceptance of microbiology testing for the analysis of infectious diseases in humans, increasing importance of effective and early disease diagnosis, an increasing number of research activities, rise in the number of infectious diseases and surge in the technological advancements are the major factors among others driving the rapid microbiology testing market. Also, growing management initiatives for the discovery of antimicrobial resistance, increasing emerging countries, and rising bioterrorism investigation are expected to create new opportunities for the rapid microbiology testing market during the forecasted period. The rising unfavorable compensation rules and the increasing cost of the rapid microbiology testing market are the major factors anticipated to obstruct the market growth during the forecast period. Rising Rates of Cancer and Infectious Diseases Numerous infectious diseases, including HIV, tuberculosis, malaria, and pneumonia, are now very common. The demand for rapid microbiology techniques for quicker and more accurate microbial screening, identification, and vulnerability testing against pathogens is anticipated to experience important growth during the forecast period because of the increase in the global burden of these diseases. Emerging Nations Offer Potential for Growth Players in the market for rapid microbiology testing have numerous chances to grow in emerging economies like India, South Korea, Brazil, and Mexico. This can be linked to a lack of regulatory obstacles, advancements in healthcare infrastructure, an increase in the number of patients, an increase in the prevalence of infectious diseases, and rising healthcare costs. The regulatory frameworks in some of these nations are more flexible and business-friendly than those in developed nations, which has driven major participants in the market for quick microbiological testing to focus on emerging nations. High capital Expenditure and Poor Cost-Benefit Ratio Due to the high drug erosion in clinical trials (with almost 30% of medicines failing in Phase III), diagnostic manufacturers are exposed to substantial monetary tasks. Important capital investments are required for the discovery, development, and validation of efficient rapid tests. Manufacturers require completed phase III clinical trials to receive regulatory approval for in vitro diagnostic (IVD). Huge investments are essential to run clinical trials and address strict regulatory requirements, which not only affect the potential of small companies to develop tests but also strictly affect innovation. Therefore, in addition to the high amount of capital savings, the low cost-benefit share is hampering the growth of the fast microbiology testing market. Operative Barriers Clinical laboratories across main markets are still developing; experts face operational tests in confirming active sample finding, storage, and carriage, especially while approving novel skills such as NGS and lab-on-a-chip PCR devices. Laboratory space also needs to be reconfigured to meet the necessities of directing specific diagnostic tests used for pathogen recognition as a means of avoiding cross-contamination and confirming efficient time management. This outcomes in significant cost appreciation to maintain and operate innovative rapid microbiology tests, particularly those capable of handling a single trial. Also, due to the quick transformation of microbes and the growing outburst of epidemics, clinical laboratories need to implement innovative technologies skilled in rapid sample diagnosis.Rapid Microbiology Testing Market Segment Analysis

Based on Type, the instruments segment accounted for the largest share of the rapid microbiology testing market because of the increased money for R&D, growing incidence of infectious disease and cancer, and technological developments. Based on End-User, the clinical disease diagnostics segment accounted for the largest share of the rapid microbiology testing market. The rising incidence of infectious diseases and cancer is fuelling the growth of this segment. COMPETITIVE LANDSCAPE The quick microbiology testing market also provides a detailed market analysis of every nation’s growing healthcare expenditure for capital equipment, the fixed base of different kinds of goods for the rapid microbiology testing market, the effect of technology using support curves, and variations in healthcare governing situations and their influence on the speedy microbiology testing market. The fast microbiology testing market competitive landscape provides details by a competitor. The major players in the market are Abbott, BD, BioMerieux SA, Bruker, Neogen Corporation, Quidel Corporation, Rapid Micro Biosystem Inc., TSI, Vivione Biosciences Inc., ERBA Diagnostics, Vedalab, Rtalabs, Shimadzu Corporation., Pall Corporation. and Mocon, Sartorius Group, Thermo Fisher Scientific, Charles River, Danaher, Don Whitley Scientific Limited, Merck KGaA.

Rapid Microbiology Testing Market Regional Insights:

The North American region held the largest market share and is expected to witness significant growth during the forecast period. The factors attributed to the growth are the occurrence of infectious diseases, R & D funding, and increased attention to early disease detection. The government of Canada and the United States supports in the form of compensation programs and health insurance, support the development of the regional market. Europe is anticipated to show the highest growth rate during the forecast period because of the introduction of advanced microbiological testing in the region and technological advances. The objective of the report is to present a comprehensive analysis of the global Rapid Microbiology Testing Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Rapid Microbiology Testing Market dynamic, and structure by analyzing the market segments and projecting the Rapid Microbiology Testing Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Rapid Microbiology Testing Market make the report investor’s guide.Rapid Microbiology Testing Market Scope: Inquire before buying

Global Rapid Microbiology Testing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 4.20 Bn. Forecast Period 2023 to 2029 CAGR: 9.4% Market Size in 2029: US$ 7.88 Bn. Segments Covered: by Product Instruments Reagents and Kits Consumables by End-User Laboratories & Hospitals Pharmaceuticals and Biotechnology Companies Contract Research Organizations Others by Application Clinical Disease Diagnosis Food and Beverage Testing Pharmaceutical and Biological Drug Testing Environmental Testing Cosmetics and Personal Care Products Testing Research Application Others Rapid Microbiology Testing Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South AmericaRapid Microbiology Testing Market Key Players:

1.Abbott Laboratories, Inc. (US) 2.Thermo Fisher Scientific (US) 3.Biomerieux SA (France) 4.Becton, Dickinson, and Company (US) 5.Danaher Corporation (US) 6.Merck KGaA (Germany) 7.NEOGEN Corporation (US) 8.Quidel Corporation (US) 9.Sartorius AG (Germany) 10.Thermo Fisher Scientific Inc. (US) 11.Don Whitley Scientific Limited (UK) 12.Rapid Micro Biosystems Inc. (US) 13.Vivione Biosciences LLC (US) 14.Mocon, Inc (US) Frequently asked questions: 1. What is the market growth of the Rapid Microbiology Testing Market? Ans. The Rapid Microbiology Testing Market was valued at USD 4.20 Billion in 2022 and is expected to reach USD 7.88 Billion by 2029, at a CAGR of 9.4% during the forecast period. 2. Which are the major key players in the Rapid Microbiology Testing Market? Ans. The key players in this market include Abbott Laboratories, Inc., Thermo Fisher Scientific, Biomerieux SA, Becton, Dickinson and Company, and Danaher Corporation. 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Rapid Microbiology Testing Market, 4. what is the forecast period for the Rapid Microbiology Testing Market? Ans. The forecast period for the market is from 2023 to 2029. 5. what is the segment in which the Rapid Microbiology Testing Market is divided? Ans. The Rapid Microbiology Testing Market is fragmented based on Product, End-User, and Application. It is also divided on basis of different regions.

1. Rapid Microbiology Testing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rapid Microbiology Testing Market: Dynamics 2.1. Rapid Microbiology Testing Market Trends by Region 2.1.1. North America Rapid Microbiology Testing Market Trends 2.1.2. Europe Rapid Microbiology Testing Market Trends 2.1.3. Asia Pacific Rapid Microbiology Testing Market Trends 2.1.4. Middle East and Africa Rapid Microbiology Testing Market Trends 2.1.5. South America Rapid Microbiology Testing Market Trends 2.2. Rapid Microbiology Testing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rapid Microbiology Testing Market Drivers 2.2.1.2. North America Rapid Microbiology Testing Market Restraints 2.2.1.3. North America Rapid Microbiology Testing Market Opportunities 2.2.1.4. North America Rapid Microbiology Testing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rapid Microbiology Testing Market Drivers 2.2.2.2. Europe Rapid Microbiology Testing Market Restraints 2.2.2.3. Europe Rapid Microbiology Testing Market Opportunities 2.2.2.4. Europe Rapid Microbiology Testing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rapid Microbiology Testing Market Drivers 2.2.3.2. Asia Pacific Rapid Microbiology Testing Market Restraints 2.2.3.3. Asia Pacific Rapid Microbiology Testing Market Opportunities 2.2.3.4. Asia Pacific Rapid Microbiology Testing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rapid Microbiology Testing Market Drivers 2.2.4.2. Middle East and Africa Rapid Microbiology Testing Market Restraints 2.2.4.3. Middle East and Africa Rapid Microbiology Testing Market Opportunities 2.2.4.4. Middle East and Africa Rapid Microbiology Testing Market Challenges 2.2.5. South America 2.2.5.1. South America Rapid Microbiology Testing Market Drivers 2.2.5.2. South America Rapid Microbiology Testing Market Restraints 2.2.5.3. South America Rapid Microbiology Testing Market Opportunities 2.2.5.4. South America Rapid Microbiology Testing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rapid Microbiology Testing Industry 2.8. Analysis of Government Schemes and Initiatives For Rapid Microbiology Testing Industry 2.9. Rapid Microbiology Testing Market Trade Analysis 2.10. The Global Pandemic Impact on Rapid Microbiology Testing Market 3. Rapid Microbiology Testing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 3.1.1. Instruments 3.1.2. Reagents and Kits 3.1.3. Consumables 3.2. Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 3.2.1. Laboratories & Hospitals 3.2.2. Pharmaceuticals and Biotechnology Companies 3.2.3. Contract Research Organizations 3.2.4. Others 3.3. Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 3.3.1. Clinical Disease Diagnosis 3.3.2. Food and Beverage Testing 3.3.3. Pharmaceutical and Biological Drug Testing 3.3.4. Environmental Testing 3.3.5. Cosmetics and Personal Care Products Testing 3.3.6. Research Application 3.3.7. Others 3.4. Rapid Microbiology Testing Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Rapid Microbiology Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 4.1.1. Instruments 4.1.2. Reagents and Kits 4.1.3. Consumables 4.2. North America Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 4.2.1. Laboratories & Hospitals 4.2.2. Pharmaceuticals and Biotechnology Companies 4.2.3. Contract Research Organizations 4.2.4. Others 4.3. North America Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 4.3.1. Clinical Disease Diagnosis 4.3.2. Food and Beverage Testing 4.3.3. Pharmaceutical and Biological Drug Testing 4.3.4. Environmental Testing 4.3.5. Cosmetics and Personal Care Products Testing 4.3.6. Research Application 4.3.7. Others 4.4. North America Rapid Microbiology Testing Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Instruments 4.4.1.1.2. Reagents and Kits 4.4.1.1.3. Consumables 4.4.1.2. United States Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 4.4.1.2.1. Laboratories & Hospitals 4.4.1.2.2. Pharmaceuticals and Biotechnology Companies 4.4.1.2.3. Contract Research Organizations 4.4.1.2.4. Others 4.4.1.3. United States Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Clinical Disease Diagnosis 4.4.1.3.2. Food and Beverage Testing 4.4.1.3.3. Pharmaceutical and Biological Drug Testing 4.4.1.3.4. Environmental Testing 4.4.1.3.5. Cosmetics and Personal Care Products Testing 4.4.1.3.6. Research Application 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Instruments 4.4.2.1.2. Reagents and Kits 4.4.2.1.3. Consumables 4.4.2.2. Canada Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 4.4.2.2.1. Laboratories & Hospitals 4.4.2.2.2. Pharmaceuticals and Biotechnology Companies 4.4.2.2.3. Contract Research Organizations 4.4.2.2.4. Others 4.4.2.3. Canada Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Clinical Disease Diagnosis 4.4.2.3.2. Food and Beverage Testing 4.4.2.3.3. Pharmaceutical and Biological Drug Testing 4.4.2.3.4. Environmental Testing 4.4.2.3.5. Cosmetics and Personal Care Products Testing 4.4.2.3.6. Research Application 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Instruments 4.4.3.1.2. Reagents and Kits 4.4.3.1.3. Consumables 4.4.3.2. Mexico Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 4.4.3.2.1. Laboratories & Hospitals 4.4.3.2.2. Pharmaceuticals and Biotechnology Companies 4.4.3.2.3. Contract Research Organizations 4.4.3.2.4. Others 4.4.3.3. Mexico Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Clinical Disease Diagnosis 4.4.3.3.2. Food and Beverage Testing 4.4.3.3.3. Pharmaceutical and Biological Drug Testing 4.4.3.3.4. Environmental Testing 4.4.3.3.5. Cosmetics and Personal Care Products Testing 4.4.3.3.6. Research Application 4.4.3.3.7. Others 5. Europe Rapid Microbiology Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.2. Europe Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.3. Europe Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 5.4. Europe Rapid Microbiology Testing Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.1.3. United Kingdom Rapid Microbiology Testing Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.2.3. France Rapid Microbiology Testing Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.3.3. Germany Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.4.3. Italy Rapid Microbiology Testing Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.5.3. Spain Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.6.3. Sweden Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.7.3. Austria Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 5.4.8.3. Rest of Europe Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Rapid Microbiology Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.3. Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.1.3. China Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.2.3. S Korea Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.3.3. Japan Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.4.3. India Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.5.3. Australia Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.6.3. Indonesia Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.7.3. Malaysia Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.8.3. Vietnam Rapid Microbiology Testing Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.9.3. Taiwan Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 6.4.10.3. Rest of Asia Pacific Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Rapid Microbiology Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 7.3. Middle East and Africa Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Rapid Microbiology Testing Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 7.4.1.3. South Africa Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 7.4.2.3. GCC Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 7.4.3.3. Nigeria Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 7.4.4.3. Rest of ME&A Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 8. South America Rapid Microbiology Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 8.2. South America Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 8.3. South America Rapid Microbiology Testing Market Size and Forecast, by Application(2022-2029) 8.4. South America Rapid Microbiology Testing Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 8.4.1.3. Brazil Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 8.4.2.3. Argentina Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Rapid Microbiology Testing Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Rapid Microbiology Testing Market Size and Forecast, by End-User (2022-2029) 8.4.3.3. Rest Of South America Rapid Microbiology Testing Market Size and Forecast, by Application (2022-2029) 9. Global Rapid Microbiology Testing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rapid Microbiology Testing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories, Inc. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thermo Fisher Scientific (US) 10.3. Biomerieux SA (France) 10.4. Becton, Dickinson, and Company (US) 10.5. Danaher Corporation (US) 10.6. Merck KGaA (Germany) 10.7. NEOGEN Corporation (US) 10.8. Quidel Corporation (US) 10.9. Sartorius AG (Germany) 10.10. Thermo Fisher Scientific Inc. (US) 10.11. Don Whitley Scientific Limited (UK) 10.12. Rapid Micro Biosystems Inc. (US) 10.13. Vivione Biosciences LLC (US) 10.14. Mocon, Inc (US) 11. Key Findings 12. Industry Recommendations 13. Rapid Microbiology Testing Market: Research Methodology 14. Terms and Glossary