The Prefilled Syringes Market size was valued at USD 25.22 Billion in 2023 and the total Prefilled Syringes revenue is expected to grow at a CAGR of 9.32 % from 2024 to 2030, reaching nearly USD 47.06 Billion by 2030. Prefilled syringes are pre-packaged medical devices containing a precise dosage of medication or vaccine, designed for single-use administration, eliminating manual filling and reducing risks of dosage errors or contamination. They offer convenient, ready-to-use solutions for safe and accurate drug delivery. The prefilled syringes market includes the production, distribution, and utilization of syringes pre-filled with a specific dosage of medication or vaccine. As of the latest data available, the Prefilled Syringes Market has experienced significant growth due to several factors. The rising demand for convenient and easy-to-use drug delivery systems, coupled with advancements in biologics and biosimilars, has boosted the Prefilled Syringes Market growth. The emphasis on reducing medication errors, improving patient compliance, and minimizing cross-contamination risks in healthcare settings has further driven the adoption of prefilled syringes.To know about the Research Methodology :- Request Free Sample Report Prefilled Syringes Market key players have been actively engaged in developments aimed at enhancing product features, such as innovations in materials to improve drug stability, safety features to prevent needlestick injuries, and the incorporation of smart technologies for better tracking and monitoring. The recent advancements include initiatives by major pharmaceutical companies collaborating with packaging experts to introduce novel designs for prefilled syringes, ensuring enhanced safety, user-friendliness, and compatibility with various medications. Leading Prefilled Syringes companies have also focused on sustainable practices, introducing eco-friendly materials for syringe production, fulfilling to the growing demand for environmentally conscious healthcare solutions. The prefilled Syringes Market is expected to continue growth, driven by ongoing technological advancements and a growing preference for self-administration of medications among patients.

Prefilled Syringes Market Dynamics:

Rising Demand for User-Friendly Prefilled Syringes Driven by Home Medication Self-Administration The rising demand for biologic drugs such as insulin, monoclonal antibodies, and vaccines driving the growth of the prefilled syringe market. With the global insulin market expected to reach USD 39.2 billion by 2026, the reliance on prefilled syringes as a primary delivery system is evident, especially with the rising prevalence of diabetes. As patients require convenient drug delivery mechanisms, the prefilled syringes market continues to grow. Innovations in syringe technology have played a significant role in Prefilled Syringes Market growth, particularly in response to safety concerns. Needlestick injuries prompted the development of safety-enhanced syringes, spurring companies such as BD to report increased sales in safety-engineered devices, including prefilled syringes, leading to substantial revenue growth. The Prefilled Syringes Market has seen growth due to the growing trend of patients self-administering medications at home, with over 60% preferring self-injectable treatments. This preference has amplified the demand for user-friendly prefilled syringes, boosting Prefilled Syringes Market growth. Regulatory intervention mandating safety-engineered devices to minimize needlestick injuries, such as the Needlestick Safety and Prevention Act in the U.S. has significantly amplified the adoption of prefilled syringes in healthcare settings, driving Prefilled Syringes Market growth. The aging population, prone to chronic diseases requiring regular medication, has fostered increased demand for prefilled syringes. Diseases such as rheumatoid arthritis and multiple sclerosis, which necessitate long-term drug therapies, have further boosted the market, with the global rheumatoid arthritis market expected to surpass USD 38 billion by 2026, primarily reliant on prefilled syringes. The surge in vaccine development and immunization programs globally, particularly witnessed during the COVID-19 vaccination drive, has also bolstered prefilled syringe demand significantly. These drivers collectively showcase the multifaceted growth trajectory of the prefilled syringes market. Initial Investments and Drug-Syringe Compatibility Challenges Affect Drug Stability and Integrity Assurance Pose Barriers to Accessing Prefilled Syringes The production complexities of prefilled syringes, driven by stringent quality control and sterility demands, present formidable challenges for manufacturers resulting in a challenge to the growth of the Prefilled syringe market. Ensuring drug-syringe compatibility necessitates extensive testing and specialized techniques, significantly elevating production intricacies and costs. Complying with varied regional regulations, such as the divergent guidelines set by the FDA and EMA, substantially affects manufacturing approaches and Prefilled Syringes market access across different regions. Compatibility issues between drugs and syringe materials pose a threat to drug stability, particularly for biologics that require rigorous testing and specialized manufacturing processes to maintain their integrity. The capital-intensive nature of specialized manufacturing infrastructure and sophisticated equipment creates substantial barriers for new entrants, imposing significant setup costs that deter Prefilled Syringes market growth. Disruptions in the supply chain, especially during global crises, impede raw material availability, disrupting production schedules and impacting prefilled syringe market supply. The growing prevalence of alternative drug delivery methods, such as auto-injectors and wearable devices, intensifies competition, mandating continuous innovation to sustain Prefilled Syringes market share. Environmental concerns surrounding the disposal of single-use plastic syringes drive regulatory and consumer preferences toward eco-friendly alternatives, challenging the conventional materials used in prefilled syringes. The rapid pace of technological advancements necessitates continual adaptation and investment for manufacturers to remain competitive, creating additional hurdles amid evolving trends and innovations. The increasing cost pressures within global healthcare systems, despite the waste-reducing benefits of prefilled syringes, impede adoption, particularly in resource-constrained settings. Consumer perceptions favoring alternative delivery methods and hesitancy toward self-administration also hamper the widespread adoption of prefilled syringes, necessitating robust educational and marketing efforts to drive acceptance and usage.Financial Barriers in the Prefilled Syringes Market

Financial Barriers Description Cost Estimate(in millions) Initial Investment Costs Substantial capital needed for specialized manufacturing infrastructure and sophisticated equipment. $50 - $100 Manufacturing Complexities Higher production costs due to stringent quality control, sterility requirements, and compatibility testing. $10 - $20 Technological Adaptation Ongoing investment required to keep up with rapid technological advancements in the industry. $5 - $15 Market Entry Challenges Varied regional regulations influencing production methodologies and requiring compliance investments. $20 - $30 Supply Chain Disruptions Impact on production costs due to disruptions in raw material availability caused by logistical challenges. $15 - $25 Environmental Compliance Additional costs incurred to transition to eco-friendly materials in response to environmental concerns. $8 - $12 Prefilled Syringes Market Segment Analysis:

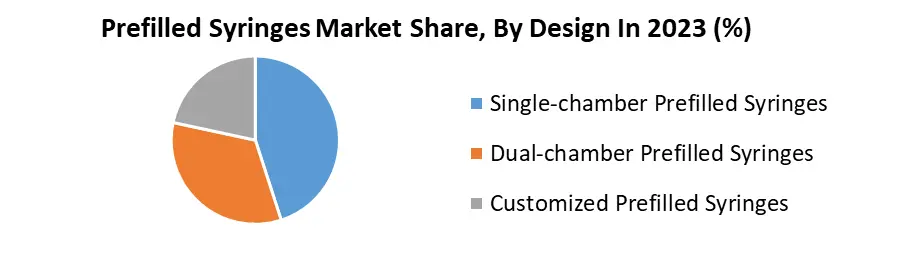

Based on Material, Glass-based syringes is historically prevalent in the Prefilled Syringes Market, and find extensive usage in applications requiring stability for sensitive drugs such as biologics and vaccines. Their inert nature and compatibility with a wide range of medications make them a preferred choice for such formulations. Plastic-based syringes are rapidly growing segment gained momentum owing to their lighter weight, reduced breakage risk, and cost-effectiveness in production. They're increasingly adopted in applications demanding convenience, such as self-administration of regular medications or disposable units for specific therapies. Plastic-based syringes, while suitable for various drugs, might pose compatibility challenges with certain formulations sensitive to leaching or interaction with plastic materials. Their adoption often hinges on the specific drug characteristics and the need for convenience versus drug stability, marking a dynamic interplay between the two materials in different applications within the prefilled syringes market.Based on Design, Single-chamber prefilled syringes, dominated the prefilled syringes market in 2023 as it is the most commonly used design, find widespread adoption for delivering standard medications and vaccines. They offer simplicity in usage, ease of handling, and are cost-effective for mass production. Dual-chamber prefilled syringes is rapidly growing segment as it finds applications requiring the mixing of two separate components or medications just before administration, ensuring stability and efficacy. Their adoption is prevalent in fields like reconstitution of lyophilized drugs or combination therapies. Customized prefilled syringes, tailored to specific patient needs or specialized drug delivery requirements, offer flexibility but often come with higher production costs. Their adoption is observed in personalized medicine, niche therapies, or instances requiring precise dosing, catering to unique patient populations. The market dynamics display a balancing act between standardized, cost-efficient designs and specialized, tailored solutions based on the specific needs of diverse applications within healthcare.

Prefilled Syringes Market Regional Insights:

Europe’s Dominance in the Prefilled Syringes Market Europe serves as a major production hub, driven by advanced healthcare infrastructure and stringent regulatory frameworks fostering innovation. With a robust emphasis on patient convenience, North America emerges as a prominent consumer of prefilled syringes market, supported by a blooming pharmaceutical industry. Analyzing import-export data, Europe notably leads in exporting prefilled syringes to regions such as North America and Asia-Pacific, leveraging superior product quality and adherence to strict regulatory standards. In contrast, the Asia-Pacific region exhibits escalating demand driven by healthcare investments, expanding pharmaceutical manufacturing capabilities, and a surge in chronic disease prevalence, resulting in substantial import figures to meet burgeoning healthcare needs. South America and the Middle East & Africa regions demonstrate consistent growth in consumption and production capacities, driven by improving healthcare access and a rising understanding of advanced drug delivery systems. This market manifests a dynamic interplay of production, consumption, and trade patterns influenced by distinct healthcare landscapes, regulatory environments, and evolving patient needs.Prefilled Syringes Industry Ecosystem

Prefilled Syringes Market Scope: Inquire before buying

Prefilled Syringes Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 25.22 Bn. Forecast Period 2024 to 2030 CAGR: 9.32% Market Size in 2030: US $ 47.06 Bn. Segments Covered: by Type Conventional Prefilled Syringes Safety Prefilled Syringes by Material Glass-based Plastic-based by Design Single-chamber Prefilled Syringes Dual-chamber Prefilled Syringes Customized Prefilled Syringes by Application Anaphylaxis Rheumatoid Arthritis Diabetes Others Prefilled Syringes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Prefilled Syringes Market Key Players:

Major Contributors in the Prefilled Syringes Industry in North America: 1. Baxter International Inc - Headquarters: Illinois, USA 2. BD (Becton, Dickinson, and Company), New Jersey, USA 3. Cardinal Health - Headquarters: Ohio, USA 4. Catalent, Inc., New Jersey, USA 5. Gerresheimer AG, New York, USA 6. MedPro Inc. - Headquarters: California, USA 7. Owen Mumford - Headquarters: Oxfordshire, UK 8. SCHOTT North America, Inc., New York, USA 9. Unilife Corporation - Headquarters: Pennsylvania, USA 10. West Pharmaceutical Services, Inc., Pennsylvania, USA Leading players in the Europe Prefilled Syringes Market: 1. Gerresheimer - Headquarters: Düsseldorf, Germany 2. Haselmeier - Headquarters: Stuttgart, Germany 3. Nemera, Paris, France 4. Ompi - Headquarters: Italy 5. Oval Medical Technologies - Headquarters: Cambridge, UK 6. SCHOTT AG - Headquarters: Mainz, Germany 7. Stevanato Group, Padua, Italy 8. Vetter Pharma International GmbH - Headquarters: Ravensburg, Germany 9. Ypsomed Holding AG - Headquarters: Burgdorf, Switzerland Key players driving the Asia-Pacific Prefilled Syringes market: 1. Nipro Corporation, Osaka, Japan 2. Schott AG (Asia-Pacific), Singapore 3. Daikyo Seiko, Ltd., Tokyo, Japan 4. Shandong Weigao Group Medical Polymer, China 5. Terumo Medical Corporation - Headquarters: Tokyo, JapanFAQs:

1. What segments are covered in the Global Market report? Ans. The segments covered in the Prefilled Syringes Market report are based on Type, Material, Design, Application, and Region. 2. Which region is expected to hold the highest share in the Global Market? Ans. Europe region is expected to hold the highest share in the Prefilled Syringes market. 3. What is the market size of the Global Market by 2030? Ans. The market size of the Prefilled Syringes Market by 2030 is expected to reach US$ 47.06 Bn. 4. What is the forecast period for the Global Market? Ans. The forecast period for the Prefilled Syringes Market is 2024-2030. 5. What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 25.22 Bn.

1. Prefilled Syringes Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Prefilled Syringes Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Market Size Estimation Methodology 3.1.1. Bottom-Up Approach 3.1.2. Top-Down Approach 4. Market Dynamics 4.1. Prefilled Syringes Market Trends By Region 4.1.1. North America Prefilled Syringes Market Trends 4.1.2. Europe Prefilled Syringes Market Trends 4.1.3. Asia Pacific Prefilled Syringes Market Trends 4.1.4. South America Prefilled Syringes Market Trends 4.1.5. Middle East & Africa (MEA) Prefilled Syringes Market Trends 4.2. Prefilled Syringes Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. PESTLE Analysis 4.5. Regulatory Landscape By Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 4.6. Analysis of Government Schemes and Initiatives For the Prefilled Syringes Industry 4.7. Value Chain Analysis 4.8. Supply Chain Analysis 4.9. Pricing Analysis 4.9.1. Average Selling Price Trend Analysis 4.10. Prefilled Syringes Industry Ecosystem 4.10.1. Key Players in the Prefilled Syringes Industry Ecosystem 4.10.2. Role of Companies in the Prefilled Syringes Industry Ecosystem 4.11. Patent Analysis 4.11.1. Key Companies with the Highest number of Patents 4.11.2. Patent Registration Analysis 4.11.3. Number of Patents Granted Still 2024 4.12. Trade Analysis of Prefilled Syringes Market By Region (2018-2023) 4.12.1. Import Data of Prefilled Syringes Market 4.12.2. Export data of Prefilled Syringes Market 4.13. Technology Analysis 4.13.1. Integration Disinfection Unit 4.13.2. Cyclic Olefin Polymers and Olefin Copolymers 4.13.3. Integration With Autoinjectors 5. Prefilled Syringes Market: Global Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 5.1. Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 5.1.1. Conventional Prefilled Syringes 5.1.2. Safety Prefilled Syringes 5.2. Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 5.2.1. Glass-based 5.2.2. Plastic-based 5.3. Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 5.3.1. Single-chamber Prefilled Syringes 5.3.2. Dual-chamber Prefilled Syringes 5.3.3. Customized Prefilled Syringes 5.4. Prefilled Syringes Market Size and Forecast, By Application(2023-2030) 5.4.1. Anaphylaxis 5.4.2. Rheumatoid Arthritis 5.4.3. Diabetes 5.4.4. Others 5.5. Prefilled Syringes Market Size and Forecast, By Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Prefilled Syringes Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 6.1. North America Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 6.1.1. Conventional Prefilled Syringes 6.1.2. Safety Prefilled Syringes 6.2. North America Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 6.2.1. Glass-based 6.2.2. Plastic-based 6.3. North America Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 6.3.1. Single-chamber Prefilled Syringes 6.3.2. Dual-chamber Prefilled Syringes 6.3.3. Customized Prefilled Syringes 6.4. North America Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 6.4.1. Anaphylaxis 6.4.2. Rheumatoid Arthritis 6.4.3. Diabetes 6.4.4. Others 6.5. North America Prefilled Syringes Market Size and Forecast, By Country (2023-2030) 6.5.1. United States 6.5.1.1. United States Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 6.5.1.1.1. Conventional Prefilled Syringes 6.5.1.1.2. Safety Prefilled Syringes 6.5.1.2. United States Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 6.5.1.2.1. Glass-based 6.5.1.2.2. Plastic-based 6.5.1.3. United States Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 6.5.1.3.1. Single-chamber Prefilled Syringes 6.5.1.3.2. Dual-chamber Prefilled Syringes 6.5.1.3.3. Customized Prefilled Syringes 6.5.1.4. United States Prefilled Syringes Market Size and Forecast By Application (2023-2030) 6.5.1.4.1. Anaphylaxis 6.5.1.4.2. Rheumatoid Arthritis 6.5.1.4.3. Diabetes 6.5.1.4.4. Others 6.5.2. Canada 6.5.2.1. Canada Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 6.5.2.1.1. Conventional Prefilled Syringes 6.5.2.1.2. Safety Prefilled Syringes 6.5.2.2. Canada Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 6.5.2.2.1. Glass-based 6.5.2.2.2. Plastic-based 6.5.2.3. Canada Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 6.5.2.3.1. Single-chamber Prefilled Syringes 6.5.2.3.2. Dual-chamber Prefilled Syringes 6.5.2.3.3. Customized Prefilled Syringes 6.5.2.4. Canada Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 6.5.2.4.1. Anaphylaxis 6.5.2.4.2. Rheumatoid Arthritis 6.5.2.4.3. Diabetes 6.5.2.4.4. Others 6.5.3. Mexico 6.5.3.1. Mexico Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 6.5.3.1.1. Conventional Prefilled Syringes 6.5.3.1.2. Safety Prefilled Syringes 6.5.3.2. Mexico Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 6.5.3.2.1. Glass-based 6.5.3.2.2. Plastic-based 6.5.3.3. Mexico Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 6.5.3.3.1. Single-chamber Prefilled Syringes 6.5.3.3.2. Dual-chamber Prefilled Syringes 6.5.3.3.3. Customized Prefilled Syringes 6.5.3.4. Mexico Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 6.5.3.4.1. Anaphylaxis 6.5.3.4.2. Rheumatoid Arthritis 6.5.3.4.3. Diabetes 6.5.3.4.4. Others 7. Europe Prefilled Syringes Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 7.1. Europe Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.2. Europe Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.3. Europe Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.4. Europe Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5. Europe Prefilled Syringes Market Size and Forecast, By Country (2023-2030) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.1.2. United Kingdom Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.1.3. United Kingdom Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.1.4. United Kingdom Prefilled Syringes Market Size and Forecast By Application (2023-2030) 7.5.2. France 7.5.2.1. France Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.2.2. France Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.2.3. France Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.2.4. France Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.3. Germany 7.5.3.1. Germany Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.3.2. Germany Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.3.3. Germany Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.3.4. Germany Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.4. Italy 7.5.4.1. Italy Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.4.2. Italy Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.4.3. Italy Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.4.4. Italy Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.5. Spain 7.5.5.1. Spain Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.5.2. Spain Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.5.3. Spain Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.5.4. Spain Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.6. Sweden 7.5.6.1. Sweden Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.6.2. Sweden Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.6.3. Sweden Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.6.4. Sweden Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.7. Austria 7.5.7.1. Austria Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.7.2. Austria Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.7.3. Austria Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.7.4. Austria Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 7.5.8.2. Rest of Europe Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 7.5.8.3. Rest of Europe Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 7.5.8.4. Rest of Europe Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8. Asia Pacific Prefilled Syringes Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 8.1. Asia Pacific Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.2. Asia Pacific Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.3. Asia Pacific Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.4. Asia Pacific Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5. Asia Pacific Prefilled Syringes Market Size and Forecast, By Country (2023-2030) 8.5.1. China 8.5.1.1. China Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.1.2. China Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.1.3. China Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.1.4. China Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.2. S Korea 8.5.2.1. S Korea Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.2.2. S Korea Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.2.3. S Korea Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.2.4. S Korea Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.3. Japan 8.5.3.1. Japan Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.3.2. Japan Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.3.3. Japan Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.3.4. Japan Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.4. India 8.5.4.1. India Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.4.2. India Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.4.3. India Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.4.4. India Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.5. Australia 8.5.5.1. Australia Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.5.2. Australia Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.5.3. Australia Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.5.4. Australia Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.6. ASEAN 8.5.6.1. ASEAN Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.6.2. ASEAN Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.6.3. ASEAN Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.6.4. ASEAN Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 8.5.7.2. Rest of Asia Pacific Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 8.5.7.3. Rest of Asia Pacific Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 8.5.7.4. Rest of Asia Pacific Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 9. South America Prefilled Syringes Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 9.1. South America Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 9.2. South America Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 9.3. South America Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 9.4. South America Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 9.5. South America Prefilled Syringes Market Size and Forecast, By Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 9.5.1.2. Brazil Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 9.5.1.3. Brazil Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 9.5.1.4. Brazil Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 9.5.2.2. Argentina Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 9.5.2.3. Argentina Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 9.5.2.4. Argentina Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 9.5.3.2. Rest Of South America Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 9.5.3.3. Rest Of South America Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 9.5.3.4. Rest Of South America Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 10. Middle East and Africa Prefilled Syringes Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 10.1. Middle East and Africa Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 10.2. Middle East and Africa Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 10.3. Middle East and Africa Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 10.4. Middle East and Africa Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 10.5. Middle East and Africa Prefilled Syringes Market Size and Forecast, By Country (2023-2030) 10.5.1. South Africa 10.5.1.1. South Africa Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 10.5.1.2. South Africa Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 10.5.1.3. South Africa Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 10.5.1.4. South Africa Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 10.5.2. GCC 10.5.2.1. GCC Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 10.5.2.2. GCC Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 10.5.2.3. GCC Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 10.5.2.4. GCC Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Prefilled Syringes Market Size and Forecast, By Type (2023-2030) 10.5.3.2. Rest Of MEA Prefilled Syringes Market Size and Forecast, By Material(2023-2030) 10.5.3.3. Rest Of MEA Prefilled Syringes Market Size and Forecast, By Design(2023-2030) 10.5.3.4. Rest Of MEA Prefilled Syringes Market Size and Forecast, By Application (2023-2030) 11. Company Profile: Key Players 11.1. Baxter International Inc 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. BD (Becton, Dickinson, and Company) 11.3. Cardinal Health 11.4. Catalent, Inc. 11.5. Gerresheimer AG 11.6. MedPro Inc. 11.7. Owen Mumford 11.8. SCHOTT 11.9. Unilife Corporation 11.10. West Pharmaceutical Services, Inc. 11.11. Gerresheimer 11.12. Haselmeier 11.13. Nemera 11.14. Ompi 11.15. Oval Medical Technologies 11.16. SCHOTT AG 11.17. Stevanato Group 11.18. Vetter Pharma International GmbH 11.19. Ypsomed Holding AG 12. Key Findings 13. Analyst Recommendations 13.1. Attractive Opportunities for Players in the Prefilled Syringes Market 13.2. Future Outlooks 14. Prefilled Syringes Market: Research Methodology