Global Power Rental Systems Market size was valued at USD 10.88 billion in 2024 and the total revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 18.01 Billion by 2032, electrified by rising energy demand & grid instability.Power Rental Systems Market Overview

The power rental Systems Market is a renting of Generators, whether they run on gas or diesel, are rented out in the power rental systems market. It offers an assortment of parts for use in power plants along with fully operational power equipment. Additionally, while handling power outages, it offers businesses speed, flexibility, and cost-effectiveness. While also supplying more energy to communities and industry, the market position of the power rental system Market aims to assist in stabilizing utility power networks. It is therefore applied in a variety of fields, including mining, building and construction, oil and gas. Power leasing equipment is likely to be used more frequently during a power outage, which is fuelling the growth of the global power rental market. Power rental systems provide backup power during blackouts to ensure that a variety of industries continue operating. The elements driving the need for a steady supply of electricity in the mining, oil, and gas sectors, as well as the expanding need for electrification and rural power delivery. Because of the aging electrical infrastructure, grid stability is necessary. power rentals are used for generator sets that are rented for machinery that produces electricity using gasoline, diesel, or other fuels. It offers studies on the rental power generation industry as well as a variety of scalable power plant components. Additionally, it provides businesses with the affordability, speed, flexibility, and dependability they require to handle momentary power shortages. Power rental services stabilize utility power systems and provide additional energy to communities and businesses. Because of this, it finds extensive use in the mining, construction, and oil and gas sectors.To Know About The Research Methodology :- Request Free Sample Report

Global Power Rental Systems Market Dynamics

Drivers in the Global Power Rental Systems Market The demand for power leasing systems is driven by the fact they provide a dependable solution for emergencies, planned repairs, and remote operations. Temporary power solutions are becoming more and more necessary to restore energy in places devastated by natural disasters such as hurricanes, earthquakes, floods, and wildfires, as their frequency and intensity rise. After such incidents, electricity infrastructure is quickly and easily restored with the help of power renting systems. The demand for power leasing systems is driven by the fact that they provide a dependable solution for emergencies, planned repairs, and remote operations. Temporary power solutions are becoming more and more necessary to restore energy in places devastated by natural disasters such as hurricanes, earthquakes, floods, and wildfires, as their frequency and intensity rise. Systems for renting out power offer a rapid and adaptable means of restoring power. Power rental systems are becoming more dependable, effective, and ecologically friendly due to ongoing developments in generator technology, fuel efficiency, pollution control, and remote monitoring capabilities. These technical advancements increase the industry by drawing in more consumers. Restraints and Challenges of the Global Power Rental Systems Market The growth and operations of the global power rental system market are impacted by several obstacles and problems. Volatility of Fuel Prices Natural gas, propane, and diesel are common fuels used in power generation. Fuel price fluctuations have an impact on rental Key companies' operating expenses and profit margins. Also, the industry is vulnerable to environmental issues and geopolitical dangers because it relies on fossil fuels. Environmental Issues The examination of emissions from power-producing activities has increased as environmental issues have gained more attention. Power rental companies must make large capital investments and technological adjustments to invest in greener and more sustainable technology. Competition and market saturation the market used for power rentals is getting more and more competitive, with several companies fighting for market share. For businesses, this results in Company profitability and pricing pressure, particularly in areas with high market saturation. Regulatory Restrictions Systems for renting out electricity frequently function within regionally specific regulatory frameworks. Adherence to regional statutes concerning pollutants, decibel levels, and security requirements provides difficulties and escalates business expenses. Infrastructure Difficulties To operate power rental systems, sufficient infrastructure must frequently be in place for installation, transit, and upkeep. The deployment and effective operation of rental equipment are impeded by logistical constraints in rural or underdeveloped places with limited infrastructure. Disruptions and Technological Advancements The power rental sector is faced with both Market opportunities and Market challenges due to the swift progress made in renewable energy technology and energy storage solutions. These technologies force rental firms to adjust to shifting client preferences and regulatory constraints, even as they provide greener alternatives to conventional fossil fuel-based generators and upend market dynamics.Global Power Rental Systems Market Segment Analysis

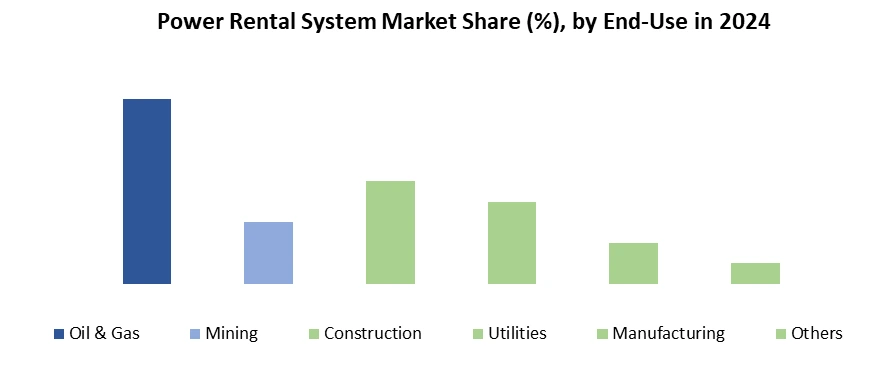

Based on By Power ratings, Power Rental Systems Market is segmented into Up to 50 kW, 51-500 kW, 501-2000 kW and Above 2500 kW. The 501-2000 kW segment dominated the power rental systems market in 2024, as it caters to the sweet spot of industrial and commercial demand—balancing high-capacity needs with operational flexibility. This range powers critical applications like manufacturing plants, data centers, and large-scale events, where temporary or backup power is essential during outages, peak shaving, or grid instability. Its dominance stems from cost-efficiency versus larger systems (above 2500 kW) and sufficient output for mid-sized to large facilities, unlike sub-500 kW units used for smaller operations. The rise of construction projects, hybrid energy systems, and unreliable grid infrastructure in emerging markets further drives adoption, making 501-2000 kW the go-to solution for reliable, scalable power. Based on End-Use, Power Rental Systems Market is segmented into Mining, Construction, Manufacturing, Utilities, Events, Oil & Gas, Others. In 2024, the oil & gas segment dominates the power rental systems market, driven by the industry's critical need for reliable, high-capacity temporary power in remote and offshore operations. Oil & gas facilities—including drilling sites, refineries, and pipelines—require uninterrupted electricity for extraction, processing, and safety systems, often in regions with limited or unstable grid infrastructure. The sector's reliance on rental systems is further amplified by rig mobilization, emergency backup during outages, and compliance with stringent operational uptime mandates.

Global Power Rental Market Regional Insights

North America dominated the Global Power rental Market with a CAGR of 4.3% in 2023. The region is expected to grow at a CAGR of 6.1% during the forecast period to preserve its domination. Because power rental systems provide a regular, stable power source with low maintenance requirements and low installation costs, their demand is growing in the North American market. The primary drivers of the power rental industry are the lack of suitable grid manufacturers and the frequent power outages in the North American region. In addition, the necessity for a consistent and reliable power supply has increased due to the rise in infrastructure construction projects. In addition, several countries' governments are taking action to grow their airport and metro train infrastructure. This has helped the market increase in tandem with the region's growing building of hotels and shopping centres. Europe, The European Union's growing need for temporary power solutions aging power infrastructure, erratic weather, and an increase in natural disasters are some of the reasons driving up the demand for temporary power solutions in Europe. This fuels the need for dependable backup options like power renting systems. Events & Entertainment Sector Throughout the year, Europe is home to a large number of festivals, events, and sporting competitions that need temporary power solutions to run well. Companies that provide power rentals meet these needs by offering generators and associated machinery.Global Power Rental Systems Market Competitive Landscapes There was fierce competition among major participants in the global power rental systems market, with well-known firms like Aggreko, and Cummins Inc., and they are Leading Players. These massive companies in the field have powerful and widespread brands. Examining this competitive environment shows that workers were a major factor in these businesses' success. The creation and provision of superior rental solutions were made possible by informed and skilled staff members, who also increased client loyalty. As businesses fought to draw and keep the best employees in the sector, wages became a crucial factor. Maintaining a motivated workforce and sustaining business growth became dependent on providing competitive compensation and benefits. Companies continued to prioritize making a profit despite the intense competition. A thorough examination of these components yields insights. 1. In 2024 with the finest power-to-weight ratio in its class, Cummins L9 diesel offers exceptional productivity on schedule and within budget. Long-lasting components including roller followers, bypass oil filtering, targeted-piston cooling, and a replacement wet liner extend the engine's lifespan. 2. Aggreko Energy Trend Transition Solutions and farmers powering communities collaborate on November 15, 2023, to support the historic community solar program.

Power Rental Systems Market Scope: Inquire before buying

Global Power Rental Systems Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.88 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 18.01 Bn. Segments Covered: by Fuel Type Diesel Natural Gas by Equipment Generators Transformers Load Banks by Power Rating Up to 50 kW 51-500 kW 501-2000 kW Above 2500 kW by Rental Type Short Term Long Term by End Use Mining Construction Manufacturing Utilities Events Oil & Gas Others Power Rental Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Power Rental System Market, Key Players

1. Cummins Inc 2. Aggreko 3. perennial technologies 4. herc rentals 5. APR Energy 6. Atlas Copco AB 7. Reddy Generators 8. United Rentals, Inc. 9. Caterpillar Inc. 10. Ashtead Group 11. Atlas Copco 12. Speedy Hire 13. Bredenoord 14. Shenton Group 15. Global Power Supply 16. JTC Kuwait 17. Power Electrics 18. Modernenergy.co.in 19. FG Wilson 20. HIMOINSAFAQs:

1. What is the forecast period of the Global Power Rental Systems Market? Ans. The forecast period of the market is 2025 to 2032. 2. What are the challenges for Global Power Rental Systems Market growth? Ans. Infrastructure Difficulties and, Place for installation, are the challenges for the Global Power Rental Systems Market. 3. Which region is the fastest-growing region in the Global Power Rental Systems Market during the forecast period? Ans. North America is the fastest-growing region in the Global Power Rental Systems Market during the forecast period. 4. What is the projected market size & and growth rate of the Global Power Rental Systems Market? Ans. Global Power Rental Systems Market size was valued at USD 10.88 billion in 2024 and the total revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 18.01 Billion by 2032. 5. What segments are covered in the Global Power Rental Systems Market report? Ans. The segments covered in the Global Power Rental Systems Market report are fuel type, By End-Use, By power rating, by rental type, and By Equipment.

1. Power Rental Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Power Rental Systems Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Power Rental Systems Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Power Rental Systems Market: Dynamics 3.1. Power Rental Systems Market Trends by Region 3.1.1. North America Power Rental Systems Market Trends 3.1.2. Europe Power Rental Systems Market Trends 3.1.3. Asia Pacific Power Rental Systems Market Trends 3.1.4. Middle East and Africa Power Rental Systems Market Trends 3.1.5. South America Power Rental Systems Market Trends 3.2. Power Rental Systems Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Power Rental Systems Market Drivers 3.2.1.2. North America Power Rental Systems Market Restraints 3.2.1.3. North America Power Rental Systems Market Opportunities 3.2.1.4. North America Power Rental Systems Market Challenges 3.2.2. Europe 3.2.2.1. Europe Power Rental Systems Market Drivers 3.2.2.2. Europe Power Rental Systems Market Restraints 3.2.2.3. Europe Power Rental Systems Market Opportunities 3.2.2.4. Europe Power Rental Systems Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Power Rental Systems Market Drivers 3.2.3.2. Asia Pacific Power Rental Systems Market Restraints 3.2.3.3. Asia Pacific Power Rental Systems Market Opportunities 3.2.3.4. Asia Pacific Power Rental Systems Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Power Rental Systems Market Drivers 3.2.4.2. Middle East and Africa Power Rental Systems Market Restraints 3.2.4.3. Middle East and Africa Power Rental Systems Market Opportunities 3.2.4.4. Middle East and Africa Power Rental Systems Market Challenges 3.2.5. South America 3.2.5.1. South America Power Rental Systems Market Drivers 3.2.5.2. South America Power Rental Systems Market Restraints 3.2.5.3. South America Power Rental Systems Market Opportunities 3.2.5.4. South America Power Rental Systems Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Power Rental Systems Industry 3.8. Analysis of Government Schemes and Initiatives For Power Rental Systems Industry 3.9. Power Rental Systems Market Trade Analysis 3.10. The Global Pandemic Impact on Power Rental Systems Market 4. Power Rental Systems Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 4.1.1. Diesel 4.1.2. Natural Gas 4.2. Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 4.2.1. Generators 4.2.2. Transformers 4.2.3. Load Banks 4.3. Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 4.3.1. Up to 50 kW 4.3.2. 51-500 kW 4.3.3. 501-2000 kW 4.3.4. Above 2500 kW 4.4. Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 4.4.1. Short Term 4.4.2. Long Term 4.5. Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 4.5.1. Mining 4.5.2. Construction 4.5.3. Manufacturing 4.5.4. Utilities 4.5.5. Events 4.5.6. Oil & Gas 4.5.7. Others 4.6. Power Rental Systems Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Power Rental Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 5.1.1. Diesel 5.1.2. Natural Gas 5.2. North America Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 5.2.1. Generators 5.2.2. Transformers 5.2.3. Load Banks 5.3. North America Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 5.3.1. Up to 50 kW 5.3.2. 51-500 kW 5.3.3. 501-2000 kW 5.3.4. Above 2500 kW 5.4. North America Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 5.4.1. Short Term 5.4.2. Long Term 5.5. North America Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 5.5.1. Mining 5.5.2. Construction 5.5.3. Manufacturing 5.5.4. Utilities 5.5.5. Events 5.5.6. Oil & Gas 5.5.7. Others 5.6. North America Power Rental Systems Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 5.6.1.1.1. Diesel 5.6.1.1.2. Natural Gas 5.6.1.2. United States Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 5.6.1.2.1. Generators 5.6.1.2.2. Transformers 5.6.1.2.3. Load Banks 5.6.1.3. United States Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 5.6.1.3.1. Up to 50 kW 5.6.1.3.2. 51-500 kW 5.6.1.3.3. 501-2000 kW 5.6.1.3.4. Above 2500 kW 5.6.1.4. United States Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 5.6.1.4.1. Short Term 5.6.1.4.2. Long Term 5.6.1.5. United States Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. Mining 5.6.1.5.2. Construction 5.6.1.5.3. Manufacturing 5.6.1.5.4. Utilities 5.6.1.5.5. Events 5.6.1.5.6. Oil & Gas 5.6.1.5.7. Others 5.6.2. Canada 5.6.2.1. Canada Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 5.6.2.1.1. Diesel 5.6.2.1.2. Natural Gas 5.6.2.2. Canada Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 5.6.2.2.1. Generators 5.6.2.2.2. Transformers 5.6.2.2.3. Load Banks 5.6.2.3. Canada Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 5.6.2.3.1. Up to 50 kW 5.6.2.3.2. 51-500 kW 5.6.2.3.3. 501-2000 kW 5.6.2.3.4. Above 2500 kW 5.6.2.4. Canada Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 5.6.2.4.1. Short Term 5.6.2.4.2. Long Term 5.6.2.5. Canada Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. Mining 5.6.2.5.2. Construction 5.6.2.5.3. Manufacturing 5.6.2.5.4. Utilities 5.6.2.5.5. Events 5.6.2.5.6. Oil & Gas 5.6.2.5.7. Others 5.6.3. Mexico 5.6.3.1. Mexico Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 5.6.3.1.1. Diesel 5.6.3.1.2. Natural Gas 5.6.3.2. Mexico Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 5.6.3.2.1. Generators 5.6.3.2.2. Transformers 5.6.3.2.3. Load Banks 5.6.3.3. Mexico Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 5.6.3.3.1. Up to 50 kW 5.6.3.3.2. 51-500 kW 5.6.3.3.3. 501-2000 kW 5.6.3.3.4. Above 2500 kW 5.6.3.4. Mexico Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 5.6.3.4.1. Short Term 5.6.3.4.2. Long Term 5.6.3.5. Mexico Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. Mining 5.6.3.5.2. Construction 5.6.3.5.3. Manufacturing 5.6.3.5.4. Utilities 5.6.3.5.5. Events 5.6.3.5.6. Oil & Gas 5.6.3.5.7. Others 6. Europe Power Rental Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.2. Europe Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.3. Europe Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.4. Europe Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.5. Europe Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Power Rental Systems Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.1.2. United Kingdom Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.1.3. United Kingdom Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.1.4. United Kingdom Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.1.5. United Kingdom Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.2.2. France Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.2.3. France Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.2.4. France Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.2.5. France Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.3.2. Germany Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.3.3. Germany Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.3.4. Germany Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.3.5. Germany Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.4.2. Italy Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.4.3. Italy Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.4.4. Italy Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.4.5. Italy Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.5.2. Spain Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.5.3. Spain Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.5.4. Spain Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.5.5. Spain Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.6.2. Sweden Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.6.3. Sweden Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.6.4. Sweden Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.6.5. Sweden Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.7.2. Austria Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.7.3. Austria Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.7.4. Austria Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.7.5. Austria Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 6.6.8.2. Rest of Europe Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 6.6.8.3. Rest of Europe Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 6.6.8.4. Rest of Europe Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 6.6.8.5. Rest of Europe Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Power Rental Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.2. Asia Pacific Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.3. Asia Pacific Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.4. Asia Pacific Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.5. Asia Pacific Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Power Rental Systems Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.1.2. China Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.1.3. China Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.1.4. China Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.1.5. China Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.2.2. S Korea Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.2.3. S Korea Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.2.4. S Korea Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.2.5. S Korea Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.3.2. Japan Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.3.3. Japan Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.3.4. Japan Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.3.5. Japan Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.4.2. India Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.4.3. India Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.4.4. India Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.4.5. India Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.5.2. Australia Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.5.3. Australia Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.5.4. Australia Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.5.5. Australia Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.6.2. Indonesia Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.6.3. Indonesia Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.6.4. Indonesia Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.6.5. Indonesia Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.7.2. Malaysia Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.7.3. Malaysia Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.7.4. Malaysia Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.7.5. Malaysia Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.8.2. Vietnam Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.8.3. Vietnam Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.8.4. Vietnam Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.8.5. Vietnam Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.9.2. Taiwan Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.9.3. Taiwan Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.9.4. Taiwan Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.9.5. Taiwan Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 7.6.10.3. Rest of Asia Pacific Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 7.6.10.4. Rest of Asia Pacific Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 7.6.10.5. Rest of Asia Pacific Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Power Rental Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 8.2. Middle East and Africa Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 8.3. Middle East and Africa Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 8.4. Middle East and Africa Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 8.5. Middle East and Africa Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Power Rental Systems Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 8.6.1.2. South Africa Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 8.6.1.3. South Africa Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 8.6.1.4. South Africa Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 8.6.1.5. South Africa Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 8.6.2.2. GCC Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 8.6.2.3. GCC Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 8.6.2.4. GCC Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 8.6.2.5. GCC Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 8.6.3.2. Nigeria Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 8.6.3.3. Nigeria Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 8.6.3.4. Nigeria Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 8.6.3.5. Nigeria Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 8.6.4.2. Rest of ME&A Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 8.6.4.3. Rest of ME&A Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 8.6.4.4. Rest of ME&A Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 8.6.4.5. Rest of ME&A Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 9. South America Power Rental Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 9.2. South America Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 9.3. South America Power Rental Systems Market Size and Forecast, by Power Rating(2024-2032) 9.4. South America Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 9.5. South America Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 9.6. South America Power Rental Systems Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 9.6.1.2. Brazil Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 9.6.1.3. Brazil Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 9.6.1.4. Brazil Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 9.6.1.5. Brazil Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 9.6.2.2. Argentina Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 9.6.2.3. Argentina Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 9.6.2.4. Argentina Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 9.6.2.5. Argentina Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Power Rental Systems Market Size and Forecast, by Fuel Type (2024-2032) 9.6.3.2. Rest Of South America Power Rental Systems Market Size and Forecast, by Equipment (2024-2032) 9.6.3.3. Rest Of South America Power Rental Systems Market Size and Forecast, by Power Rating (2024-2032) 9.6.3.4. Rest Of South America Power Rental Systems Market Size and Forecast, by Rental Type (2024-2032) 9.6.3.5. Rest Of South America Power Rental Systems Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Cummins Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Aggreko 10.3. perennial technologies 10.4. herc rentals 10.5. APR Energy 10.6. Atlas Copco AB 10.7. Reddy Generators 10.8. United Rentals, Inc. 10.9. Caterpillar Inc. 10.10. Ashtead Group 10.11. Atlas Copco 10.12. Speedy Hire 10.13. Bredenoord 10.14. Shenton Group 10.15. Global Power Supply 10.16. JTC Kuwait 10.17. Power Electrics 10.18. Modernenergy.co.in 10.19. FG Wilson 10.20. HIMOINSA 11. Key Findings 12. Industry Recommendations 13. Power Rental Systems Market: Research Methodology 14. Terms and Glossary