Global Pneumatic Actuators Market size was valued at USD 16.38 Bn. in 2024 and the total Pneumatic Actuators Market revenue is expected to grow by 5% from 2025 to 2032, reaching nearly USD 24.2 Bn.Pneumatic Actuators Market Overview:

Pneumatic actuators are a crucial automation element utilized in a multitude of industries to convert compressed air to mechanical motion, allowing accurate control of valves, dampers, and similar mechanical devices; there are linear actuators, rotary actuators, diaphragm actuators, and piston actuators for motion control and flow control applications in automotive, oil & gas, mining, manufacturing, and process industries.To know about the Research Methodology :- Request Free Sample Report The pneumatic actuators market continues to move away from traditional purely mechanical designs to more sophisticated integrated designs with position feedback, smart sensors, and energy-efficient air management systems that comply with Industry 4.0 and predictive maintenance. Pneumatic Actuators Market demand is propelled by rapid industrial automation, the growth of manufacturing capacity in developing countries, and the need for cost-effective, reliable, and explosion-proof actuation as a solution in adverse environments. One prime example is the prevalent use of rotary actuators for valve automation in oil & gas, as well as water treatment applications. The report's detailed analysis of key Pneumatic Actuators Market drivers, such as the need for energy-efficient manufacturing, advances in smart pneumatic technology, and the shift toward low-maintenance designs resistant to corrosion for heavy-duty industries. Major players in the global Pneumatic Actuators Market include Emerson Electric Co., Parker Hannifin, SMC Corporation, Festo SE & Co. KG, Rotork, ABB, and Honeywell International Inc. Value chain analysis in the industry shows that companies offer improvements in digital monitoring, modular design, and engineering focused on sustainability to reconcile the demands for optimized operational performance. The report highlights key trends such as the increasing adoption of electro-pneumatic hybrid actuators, growth in demand for compact actuators for mobile robotics and the demand for pneumatic actuation in renewable energy and offshore oil & gas applications.

Pneumatic Actuators Market Dynamics

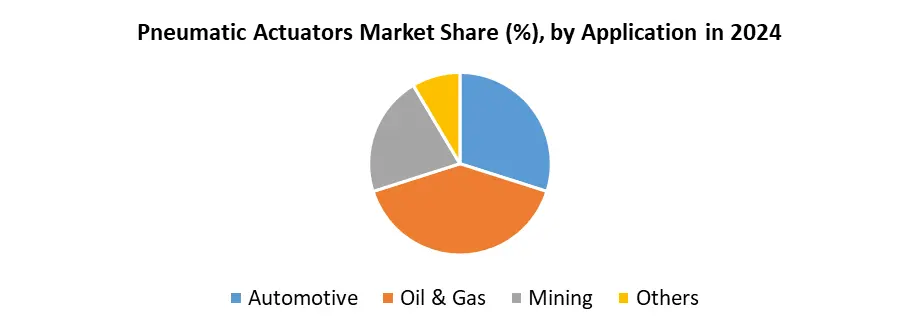

Remote Operation Capability to Drive Pneumatic Actuators Market Growth The shift toward pneumatic actuators rather than employees manually manipulating gears is gaining traction as companies transform manual mechanical gears into pneumatic systems that can be actuated without a physical presence at the pipelines, The benefit is a more operationally convenient tool, but the advantages extend beyond that to include quicker actions, better safety, and reduced human interactions on important operations. The potential to control the actuator remotely is highly valued in many industries, including oil & gas, chemicals, and manufacturing. Planned Petrochemical Capacity Expansion in Emerging Markets to Create Growth Opportunities in the Pneumatic Actuators Market The anticipated capacity expansion for petrochemical products in countries including South Africa and Turkey will generate demand for pneumatic actuators. Because of new petrochemical plants and upgrades to existing facilities, reliable flow control systems that are also efficient are essential. Pneumatic actuators will satisfy the operational aspects of these large-scale industrial projects with relatively low costs, durability, and the ability to work in risky situations, which will create opportunities for growth for industry players. Cost Escalation and Quality Maintenance to Pose Challenges for the Pneumatic Actuators Market Manufacturers in the pneumatic actuators market are facing an obstacle due to increased cost for both production and installation and operating costs. Manufacturers have to carefully balance keeping up the quality of their products and trying to keep prices competitive enough in order to keep up their market share. It is becoming increasingly difficult to balance these factors when customers are looking for lower-priced products to maintain their operations and costs, so they seek cost-effective solutions by purchasing product that meets their needs without sacrificing performance. In addition to rising costs for production and installation, prices for raw materials have fluctuated throughout the past few years and there is increasing competition from non-pneumatic actuation technologies. Global Pneumatic Actuators Market Segment Analysis Based on the Motion, the global Pneumatic Actuators market is segmented into Linear Actuators and Rotary Actuators. The linear actuator segment is expected to hold the largest market share of xx% by 2032. Linear actuators are critical to the overall operation of robotic and automated processes in a wide range of sophisticated manufacturing applications. They are also used in a variety of sectors where linear positioning is necessary. Damper doors, welding, and other major applications are examples. These actuators can be used for straight-line movements such as damper opening and shutting, door locking, and braking machine action. The growing use in the automation industry is the primary reason for the increased utilization. So, this major benefit will drive the growth of the control valves segment in the global industrial oil & gas automation market during the forecast period 2025-2032. Based on the Type, the global Pneumatic Actuators market is segmented into Diaphragm Actuators and Piston Actuators. The diaphragm actuators segment held the largest market share of xx% in the global Pneumatic Actuators market in 2024. Diaphragm actuators utilise pressurized gas to apply pressure to a movable membrane known as a diaphragm, whereas piston actuators can handle higher input pressures and have a shorter cylinder capacity, allowing for faster operation.Based on the End-Use, the global Pneumatic Actuators market is segmented into Flow Control and Motion Control. The motion control segment is expected to grow at a higher CAGR of xx% in the global Pneumatic Actuators market during the forecast period 2025-2032. The growing applications in the electrical and electronics sectors are the primary drivers of growth. Motion controllers are often electrical components that run software to improve movement on computerised machines. They are primarily intended to control certain actuators, which means that these controllers have the intelligence to expertise either electric actuators, hydraulic actuators, or pneumatic actuators. Based on the Application, the global Pneumatic Actuators market is segmented into Automotive, Oil & Gas, Mining, and Others. The Oil & Gas segment held the largest market share of xx% in the global Pneumatic Actuators market in 2024. This is owing to the massive amount of money invested in the business. This tendency naturally increases demand for pneumatic actuators, which are an essential component of the design framework of oil and gas plants. The capacity to reduce methane emissions at good pads is the primary advantage of pneumatic actuators in the oil and gas sector. With the sharp drop in oil barrel prices, businesses are under constant pressure to optimize and enhance their operations to increase effectiveness while complying with rigorous safety regulations.

Pneumatic Actuators Market Regional Insights

North America is expected to dominate the global Pneumatic Actuators market during the forecast period 2025-2032. North America held the largest market share of xx% in 2024. In the United States, the consumption of pneumatic actuators is being driven by improved industrial automation, transportation, and marine industries. Europe held the 2nd largest market share of xx% in 2024. So, these major benefits will drive the growth of this region in the global Pneumatic Actuators market during the forecast period. Pneumatic Actuators Market Competitive Landscape The competition in the Pneumatic Actuators Market is fierce primarily due to the increasing demand for automation, the emergence of Industry 4.0, and the increasing need for energy-efficient industrial solutions. Emerson Electric Co. and Parker Hannifin are two key competitors in this area, and continue to offer large pneumatic actuator product portfolios to industries like oil & gas, water treatment, automotive, and manufacturing. Emerson Electric has gained a competitive edge with its 2025 Project Beyond, a software-defined automation platform that offers remote control and an actuator with connectivity that facilitates predictive maintenance. Parker Hannifin has quickly established its focus on accurate engagement with acquisitions made in 2024 in the micro pneumatic market, targeting growth industries like Robotics and Medical devices. The depth of product development, extensive globally recognized service networks, and advanced engineering make both companies well-positioned to enable growth markets as more industries transition to modernization, with an emphasis on operational efficiency. Pneumatic Actuators Market Recent Development • In 2025, Emerson Electric Co. (USA) announced a new software-defined, OT-ready digital platform that integrates industrial automation stacks using AI and enhances the value of existing automation investments. • In 2025, SMC Corporation (Japan) launched numerous new products, including electric actuators (compatible with manifold controllers), cylinders, valves, and sensors. SMC also celebrated National Pneumatics Day with open houses and launched a community-focused campaign, and in June 2025, earned the prestigious FOOMA 2025 Award for its HF2A-LEY linear electric actuator. • In March 2025, Rotork plc (UK) acquired Noah Actuation (South Korea), strengthening its electric actuator portfolio with compact, high-torque designs. Rotork also supplied pneumatic actuators for ONE-Dyas’s next-generation offshore gas platform targeting near-zero emissions, set to be the North Sea’s first fully electrified platform. • Festo SE & Co. KG (Germany) showcased its multi-axis positioning systems at Automate 2025 (May), delivering systems that can be specified in minutes and installed in hours. Pneumatic Actuators Market Recent Trends

Category Key Trend Example Product Market Impact Digital Integration Growing adoption of smart, IoT-enabled pneumatic actuators for predictive maintenance and remote monitoring Festo’s “Controlled Pneumatics” with digital closed-loop control Enhances precision, reduces downtime, and positions pneumatics for Industry 4.0 adoption Energy Efficiency Shift toward low-energy-consumption actuators to meet sustainability goals SMC’s HF2A-LEY linear electric actuator (FOOMA 2025 Award winner) Supports carbon reduction targets and appeals to eco-conscious industrial buyers Rapid Deployment Systems Demand for quick-installation, modular pneumatic solutions Festo’s multi-axis positioning systems Reduces installation time and cost, improving ROI for automation projects Global Pneumatic Actuators Market Scope: Inquire before buying

Global Pneumatic Actuators Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 16.38 Bn. Forecast Period 2025 to 2032 CAGR: 5% Market Size in 2032: USD 24.2 Bn. Segments Covered: by Motion Linear Actuators Rotary Actuators by Type Diaphragm Actuators Piston Actuators by End-Use Flow Control Motion Control by Application Automotive Oil & Gas Mining Others Global Pneumatic Actuators Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Pneumatic Actuators Market, Key Players

North America 1. Emerson Electric Co. (US) 2. Parker Hannifin (US) 3. Tolomatic (US) 4. CRANE ChemPharma and Energy (US) 5. Habonim (US) 6. Bray (US) 7. ATI (US) 8. Schlumberger (US) 9. Pentair (US) 10. Humphrey (US) 11. Johnson Controls (US) Europe 1. Festo SE & Co. KG (Germany) 2. Rotork (UK) 3. ABB (Switzerland) 4. Air Torque (Italy) 5. Prisma (Italy) 6. VALBIA (Italy) 7. Siemens (Germany) 8. Omal S.p.A. (Italy) Asia Pacific 1. SMC Corporation (Japan) 2. Nihon KOSO (Japan) 3. Haitima (Taiwan)Frequently Asked Questions:

1] What segments are covered in the Pneumatic Actuators Market report? Ans. The segments covered in the Pneumatic Actuators Market report are based on Motion, Type, End-Use and Application. 2] Which region is expected to hold the highest share in the global Pneumatic Actuators Market? Ans. North America is expected to hold the highest share in the global market. 3] What is the market size of the global Pneumatic Actuators Market by 2032? Ans. The market size of global market size by 2032 is USD 24.2 Bn. 4] Who are the top key players in the global Pneumatic Actuators Market? Ans. Festo, Parker, Air Torque, Nihon KOSO, Prisma, and Tolomatic are key players in the global Pneumatic Actuators Market Key Players market. 5] What was the market size of the global Pneumatic Actuators Market in 2024? Ans. The market size of the global Pneumatic Actuators Market Key Players market in 2024 was USD 16.38 Bn.

1. Pneumatic Actuators Market: Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pneumatic Actuators Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Pneumatic Actuators Market: Dynamics 3.1. Region-wise Trends of Pneumatic Actuators Market 3.1.1. North America Pneumatic Actuators Market Trends 3.1.2. Europe Pneumatic Actuators Market Trends 3.1.3. Asia Pacific Pneumatic Actuators Market Trends 3.1.4. Middle East and Africa Pneumatic Actuators Market Trends 3.1.5. South America Pneumatic Actuators Market Trends 3.2. Pneumatic Actuators Market Dynamics 3.2.1. Global Pneumatic Actuators Market Drivers 3.2.1.1. Higher efficiency, better serviceability, and faster operation compared to manual gears 3.2.1.2. Replacement of manual gears with pneumatic actuators due to remote operation capability without physical presence at the pipelines 3.2.1.3. Established technology with potential for further price reduction in the future 3.2.2. Global Pneumatic Actuators Market Restraints 3.2.3. Global Pneumatic Actuators Market Opportunities 3.2.3.1. Growing scope for modernization and upgrade of machinery in linked industries 3.2.3.2. Planned capacity expansion for petrochemical products in countries such as South Africa and Turkey 3.2.4. Global Pneumatic Actuators Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government incentives for industrial Application adoption 3.4.2. Rising demand from oil & gas, water treatment, and manufacturing sectors 3.4.3. Increasing focus on workplace safety and ergonomic operations 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Pneumatic Actuators Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 4.1.1. Linear Actuators 4.1.2. Rotary Actuators 4.2. Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 4.2.1. Diaphragm Actuators 4.2.2. Piston Actuators 4.3. Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 4.3.1. Flow Control 4.3.2. Motion Control 4.4. Pneumatic Actuators Market Size and Forecast, by Application (2024-2032) 4.4.1 Automotive 4.4.2 Oil & Gas 4.4.3 Mining 4.4.4 Others 4.5. Pneumatic Actuators Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Pneumatic Actuators Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 5.1.1. Linear Actuators 5.1.2. Rotary Actuators 5.2. North America Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 5.2.1. Diaphragm Actuators 5.2.2. Piston Actuators 5.3. North America Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 5.3.1. Flow Control 5.3.2. Motion Control 5.4. North America Pneumatic Actuators Market Size and Forecast, by Application (2024-2032) 5.4.1 Automotive 5.4.2 Oil & Gas 5.4.3 Mining 5.4.4 Others 5.5. North America Pneumatic Actuators Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 5.5.1.1.1. Linear Actuators 5.5.1.1.2. Rotary Actuators 5.5.1.2. United States Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 5.5.1.2.1. Diaphragm Actuators 5.5.1.2.2. Piston Actuators 5.5.1.3. United States Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 5.5.1.3.1. Flow Control 5.5.1.3.2. Motion Control 5.5.1.4. United States Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Automotive 5.5.1.4.2. Oil & Gas 5.5.1.4.3. Mining 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 5.5.2.1.1. Linear Actuators 5.5.2.1.2. Rotary Actuators 5.5.2.2. Canada Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 5.5.2.2.1. Diaphragm Actuators 5.5.2.2.2. Piston Actuators 5.5.2.3. Canada Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 5.5.2.3.1. Flow Control 5.5.2.3.2. Motion Control 5.5.2.4. Canada Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Automotive 5.5.2.4.2. Oil & Gas 5.5.2.4.3. Mining 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 5.5.3.1.1. Linear Actuators 5.5.3.1.2. Rotary Actuators 5.5.3.2. Mexico Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 5.5.3.2.1. Diaphragm Actuators 5.5.3.2.2. Piston Actuators 5.5.3.3. Mexico Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 5.5.3.3.1. Flow Control 5.5.3.3.2. Motion Control 5.5.3.4. Mexico Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Automotive 5.5.3.4.2. Oil & Gas 5.5.3.4.3. Mining 5.5.3.4.4. Others 6. Europe Pneumatic Actuators Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.2. Europe Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.3. Europe Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.4. Europe Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5. Europe Pneumatic Actuators Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.1.2. United Kingdom Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.1.3. United Kingdom Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.1.4. United Kingdom Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.2.2. France Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.2.3. France Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.2.4. France Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.3.2. Germany Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.3.3. Germany Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.3.4. Germany Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.4.2. Italy Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.4.3. Italy Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.4.4. Italy Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.5.2. Spain Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.5.3. Spain Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.5.4. Spain Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.6.2. Sweden Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.6.3. Sweden Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.6.4. Sweden Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.7.2. Austria Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.7.3. Austria Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.7.4. Austria Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 6.5.8.2. Rest of Europe Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 6.5.8.3. Rest of Europe Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 6.5.8.4. Rest of Europe Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Pneumatic Actuators Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.2. Asia Pacific Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.4. Asia Pacific Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Pneumatic Actuators Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.1.2. China Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.1.3. China Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.1.4. China Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.2.2. S Korea Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.2.3. S Korea Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.2.4. S Korea Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.3.2. Japan Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.3.3. Japan Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.3.4. Japan Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.4.2. India Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.4.3. India Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.4.4. India Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.5.2. Australia Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.5.3. Australia Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.5.4. Australia Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.6.2. Indonesia Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.6.3. Indonesia Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.6.4. Indonesia Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.7.2. Philippines Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.7.3. Philippines Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.7.4. Philippines Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.8.2. Malaysia Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.8.3. Malaysia Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.8.4. Malaysia Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.9.2. Vietnam Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.9.3. Vietnam Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.9.4. Vietnam Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.10.2. Thailand Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.10.3. Thailand Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.10.4. Thailand Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 7.5.11.2. Rest of Asia Pacific Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 7.5.11.4. Rest of Asia Pacific Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Pneumatic Actuators Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 8.2. Middle East and Africa Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 8.4. Middle East and Africa Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Pneumatic Actuators Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 8.5.1.2. South Africa Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 8.5.1.3. South Africa Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 8.5.1.4. South Africa Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 8.5.2.2. GCC Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 8.5.2.3. GCC Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 8.5.2.4. GCC Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 8.5.3.2. Nigeria Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 8.5.3.3. Nigeria Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 8.5.3.4. Nigeria Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 8.5.4.2. Rest of ME&A Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 8.5.4.3. Rest of ME&A Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 8.5.4.4. Rest of ME&A Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 9. South America Pneumatic Actuators Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 9.2. South America Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 9.3. South America Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 9.4. South America Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 9.5. South America Pneumatic Actuators Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 9.5.1.2. Brazil Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 9.5.1.3. Brazil Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 9.5.1.4. Brazil Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 9.5.2.2. Argentina Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 9.5.2.3. Argentina Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 9.5.2.4. Argentina Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Pneumatic Actuators Market Size and Forecast, By Motion (2024-2032) 9.5.3.2. Rest of South America Pneumatic Actuators Market Size and Forecast, By Type (2024-2032) 9.5.3.3. Rest of South America Pneumatic Actuators Market Size and Forecast, By End Use (2024-2032) 9.5.3.4. Rest of South America Pneumatic Actuators Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Application Players) 10.1. Emerson Electric Co. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Parker Hannifin (US) 10.3. Tolomatic (US) 10.4. CRANE ChemPharma and Energy (US) 10.5. Habonim (US) 10.6. Bray (US) 10.7. ATI (US) 10.8. Schlumberger (US) 10.9. Pentair (US) 10.10. Humphrey (US) 10.11. Johnson Controls (US) 10.12. Festo SE & Co. KG (Germany) 10.13. Rotork (UK) 10.14. ABB (Switzerland) 10.15. Air Torque (Italy) 10.16. Prisma (Italy) 10.17. VALBIA (Italy) 10.18. Siemens (Germany) 10.19. Omal S.p.A. (Italy) 10.20. SMC Corporation (Japan) 10.21. Nihon KOSO (Japan) 10.22. Haitima (Taiwan) 11. Key Findings 12. Analyst Recommendations 13. Pneumatic Actuators Market: Research Methodology