Phosphate Fertilizer Market size was valued at USD 65.21 Bn. in 2023 and the total Phosphatic Fertilizers revenue is expected to grow by 5.3 % from 2024 to 2030, reaching nearly USD 93.61 Bn.Phosphate Fertilizer Market Overview:

Phosphatic fertilizers contain phosphorus as a vital nutrient and play a key role in improving soil fertility and promoting robust plant growth. They encompass various types such as phosphate rock, single superphosphate, triple superphosphate, monoammonium phosphate, diammonium phosphate, and others.To know about the Research Methodology :- Request Free Sample Report The global Phosphate Fertilizer Market is expected a substantial growth due to the escalating demand for food, diminishing arable land, and the need to enhance agricultural productivity. Phosphatic fertilizers provide essential nutrients, particularly phosphorus, required for metabolic processes and crop development. Increasing demand for organic and sustainable farming practices offers an opportunity for manufacturers to develop innovative phosphatic fertilizers that minimize environmental impact and support sustainable agriculture. Diammonium phosphate (DAP), monoammonium phosphate (MAP), triple superphosphate (TSP), and other phosphate-based fertilizers are the main types available, with DAP and MAP being widely used due to their high phosphorus content and suitability for various crops. Key players in the Phosphate Fertilizer Market, such as Yara International ASA, Nutrien Ltd., OCP Group, The Mosaic Company, EuroChem Group AG, and ICL Group, are actively involved in expanding their product portfolios and promoting sustainable product formulations.

Phosphate Fertilizer Market Scope and Research Methodology

The Phosphate Fertilizer Market report represents innovation, policy support, increased competition, and environmental concerns by global and local players holding the Phosphate Fertilizer Market in different countries. The report covered Market structure by comparative analysis of key players, and market followers, which makes this report insightful to the Phosphatic Fertilizers Outlook. The Phosphate Fertilizer Market report aims to outlook the market size based on segments, regional distribution and industry competition. The bottom-up approach has been used to estimate and forecast market size and market growth. The report provides a detailed examination of the key players in the Phosphatic Fertilizers industry, including revenue. The report covers the global, regional and local level analysis of the Phosphate Fertilizer Market with the factors restraining, driving and challenging the market growth during the forecast period.Phosphate Fertilizer Market Dynamics:

Phosphate Fertilizer Market Drivers Government Subsidies and Initiatives boost the Market Growth Government initiatives and subsidies play a significant role as a market driver in the Phosphate Fertilizer Market. Governments worldwide, including India, are actively promoting the use of phosphatic fertilizers through subsidies and initiatives to support sustainable agriculture and ensure food security. In April 2023, the Indian government made a substantial expenditure of USD 1.9 Bn. out of the total budget of USD 21.3 Bn, demonstrating their commitment to agricultural growth, rural development, and food security. A notable allocation of USD 1.2 Bn was dedicated to P & K subsidies, emphasizing the government's support for phosphatic fertilizers. These subsidies ensure the availability of essential fertilizers to farmers at affordable prices, enabling them to enhance crop productivity. The government's proactive measures in disbursing subsidies and ensuring the availability of fertilizers reflect their dedication to farmers' welfare and the advancement of the agriculture industry. These initiatives contribute to the overall growth and sustainability of the Phosphate Fertilizer Market and support the prosperity of the agricultural sector. Phosphate Fertilizer Market Restraint Biofertilizers Reducing Reliance of Phosphatic Fertilizers in Modern Agriculture The use of biofertilizers hinders the market for phosphatic fertilizers due to biofertilizers enhance soil fertility, nutrient availability, and plant growth through biological processes. As farmers become more aware of biofertilizer benefits, they may reduce their reliance on phosphatic fertilizers. This led to a reduction in demand for phosphatic fertilizer products. For example, in certain regions where biofertilizers gained popularity, such as Europe and North America, there has been a noticeable shift towards organic and sustainable farming. Farmers are increasingly adopting biofertilizers to improve soil health and reduce synthetic fertilizers' impact. This shift in farming practices limits Phosphate Fertilizer Market share. Phosphate Fertilizer Market opportunities: Slow-Release of Phosphatic Fertilizers and Precision Agriculture Integration The emergence of precision agriculture technologies presents a promising market opportunity for phosphatic fertilizers. These advancements, including remote sensing and soil sensor, provide avenues for more precise and efficient fertilizer application techniques. Precision agriculture enables farmers to target their use of phosphatic fertilizers, optimizing nutrient distribution and minimizing waste. While research and development efforts focused on phosphatic fertilizers. Continued exploration and innovation in this field can lead to the development of enhanced efficiency fertilizers (EEFs) and controlled-release fertilizers (CRFs). These specialized fertilizers are designed to improve nutrient uptake, reduce nutrient losses, and enhance overall crop performance. For example, there is an opportunity to create slow-release phosphatic fertilizers that release phosphorus gradually, matching plants’ specific needs. This gradual release reduces the risk of nutrient leaching and enhances nutrient use efficiency. By tailoring the release of phosphorus to plant requirements, farmers can achieve optimal nutrient availability while minimizing environmental impact.

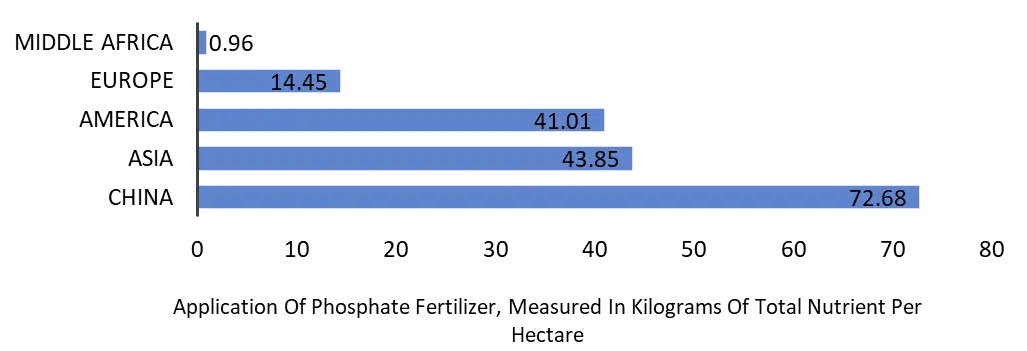

Phosphate Fertilizer Use Per Kg/Hectare Of Cropland, 2020

Phosphate Fertilizer Market Segment Analysis:

Based on Type, monoammonium phosphate, dominated the Phosphate Fertilizer Market with 33% of the total revenue. MAP is affordable to produce and contains a high level of phosphorous, which is essential for plants. MAP is widely used in agriculture as a granular fertilizer and can be used directly or as a raw material to make other fertilizers. Triple superphosphate was the second-largest product segment, accounting for about 18% of the revenue. TSP is a concentrated phosphorus fertilizer with around 46% diphosphorus pentoxide. The demand for TSP from the global agriculture industry is driving its growth. Other products include diammonium phosphate, single superphosphate, and others. DAP has various industrial uses, such as in metal finishing and as a fire retardant. It is also added to milk and wine for specific purposes. The increasing demand for agriculture in countries like Brazil and India is expected to drive the demand for DAP in agricultural applications in the future.Phosphate Fertilizer Market, By Type(%) In 2023

Phosphate Fertilizer Market Regional Insights:

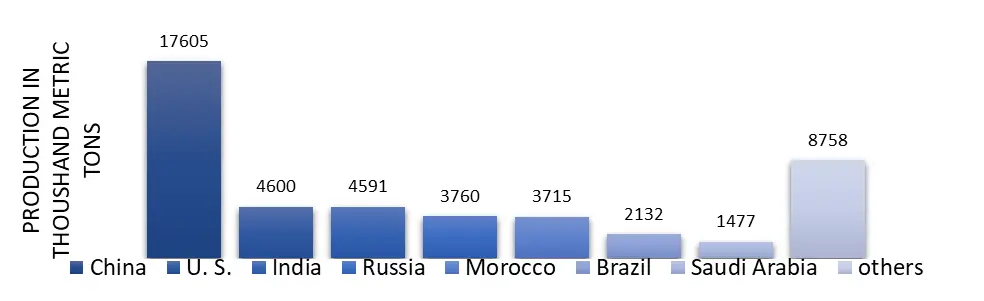

Asia Pacific dominated the Phosphate Fertilizer Market in 2023 with a 62% market share. Thanks to the region's increasing food production needs and the rising demand for food products, particularly rice and vegetables, from import-dependent countries in the Asia Pacific. According to Indian government data, the overall fertilizer production stood at 37 million metric tonnes, a 3% increase in the first 10 months of FY2021 compared with 36 million in the first 10 months of FY2020, India, one of the fastest-growing markets for agro-based industries results in driving the demand for phosphatic fertilizers. North America is a significant consumer of phosphatic fertilizers, fueled by high food demand and advanced agricultural practices. The United States and Canada contribute significantly to the regional market growth. Europe has a well-established agricultural sector and stringent regulations governing fertilizer usage. The region is characterized by the adoption of sustainable agriculture practices and an increasing demand for organic phosphatic fertilizers. In terms of trade, China, Morocco, and Egypt were the top exporters of phosphatic fertilizers in 2021, while Brazil, Bangladesh, and the United States were the top importers. The global trade in phosphatic fertilizers was valued at $2.8 billion in 2021, with China being the leading exporter and Brazil being the leading importer. The product complexity of phosphatic fertilizers ranked at -1.24, indicating moderate complexity, and the export growth rate from 2020 to 2021 was recorded at 90.7%, positioning phosphatic fertilizers as a growing segment in international trade.Phosphate Fertilizer Market Regional Insights, Production in Thoushand Metric Tons(2018)

Competitive Landscape:

The Phosphate Fertilizer Market is highly competitive, with numerous key players operating globally. Some notable companies in the market include Yara International ASA, Nutrien Ltd., OCP Group, The Mosaic Company, EuroChem Group AG, ICL Group, PhosAgro, CF Industries Holdings, Inc., PJSC Phosagro AG, and Coromandel International Limited. Phosphatic fertilizer companies employ strategies like mergers, product launches, and collaborations to gain a competitive advantage. China and India are significant players in the phosphatic fertilizers industry. In China, prominent manufacturing companies include Sinochem Group, China BlueChemical Ltd. (Bluesail Chemical Group), Hubei Xingfa Chemicals Group, Yuntianhua Group, Guizhou Kailin Group, and Yunnan Yuntianhua International Chemical Co., Ltd. These companies have extensive manufacturing facilities, diverse product portfolios, and strong distribution networks within China and globally. While, Indian Farmers Fertilizer Cooperative Limited (IFFCO), Coromandel International Limited, Rashtriya Chemicals and Fertilizers Limited (RCF), Gujarat State Fertilizers & Chemicals Ltd. (GSFC), and Chambal Fertilisers and Chemicals Limited are some major players in India. These companies operate multiple manufacturing units across the country and produce a wide range of phosphatic fertilizers, catering to the specific needs of farmers.Phosphate Fertilizer Market Scope : Inquire Before Buying

Global Phosphate Fertilizer Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 65.21 Bn. Forecast Period 2024 to 2030 CAGR: 5.3% Market Size in 2030: US $ 93.61 Bn. Segments Covered: by Type Monoammonium Phosphate (MAP) Diammonium Phosphate (DAP) Single Superphosphate (SSP) Triple Superphosphate (TSP) Others by Deployment Mode Fertigation Foliar Soil by Solubility Water Soluble Citric Acid Soluble Water and Citric Acid Insoluble by Crop Type Field Crops Horticultural Crops Turf & Ornamental Phosphate Fertilizer Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Phosphate Fertilizer Market Key Players

1. CF Industries 2. Chambal Fertilisers and Chemicals Limited 3. China BlueChemical Ltd. 4. Coromandel International Limited 5. EuroChem Group 6. Guizhou Kailin Group 7. Gujarat State Fertilizers & Chemicals Ltd. (GSFC) 8. Hubei Xingfa Chemicals Group 9. Indian Farmers Fertilizer Cooperative Limited (IFFCO) 10. OCP Group 11. PhosAgro 12. Rashtriya Chemicals and Fertilizers Limited (RCF) 13. Sinochem Group 14. The Mosaic Company 15. Yara International ASA 16. Yunnan Yuntianhua International Chemical Co., Ltd. 17. Yuntianhua Group Frequently Asked Questions: 1] What segments are covered in the Global Phosphate Fertilizer Market report? Ans. The segments covered in the Phosphate Fertilizer Market report are based on Type, Deployment Mode, Solubility, Crop Type and Region. 2] Which region is expected to hold the highest share of the Global Phosphate Fertilizer Market? Ans. The Asia Pacific region is expected to hold the highest share of the Phosphate Fertilizer Market. 3] What is the market size of the Global Phosphate Fertilizer Market by 2030? Ans. The market size of the Phosphate Fertilizer Market by 2030 is expected to reach US$ 93.61 Bn. 4] What is the forecast period for the Global Phosphate Fertilizer Market? Ans. The forecast period for the Phosphate Fertilizer Market is 2024-2030. 5] What was the market size of the Global Phosphate Fertilizer Market in 2023? Ans. The market size of the Phosphate Fertilizer Market in 2023 was valued at US$ 65.21 Bn.

1. Phosphate Fertilizer Market: Research Methodology 2. Phosphate Fertilizer Market: Executive Summary 3. Phosphate Fertilizer Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Phosphate Fertilizer Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Phosphate Fertilizer Market: Segmentation (by Value USD and Volume Units) 5.1. Phosphate Fertilizer Market, by Type (2023-2030) 5.1.1. Monoammonium Phosphate (MAP) 5.1.2. Diammonium Phosphate (DAP) 5.1.3. Single Superphosphate (SSP) 5.1.4. Triple Superphosphate (TSP) 5.1.5. Others 5.2. Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 5.2.1. Fertigation 5.2.2. Foliar 5.2.3. Soil 5.3. Phosphate Fertilizer Market, by Solubility (2023-2030) 5.3.1. Water Soluble 5.3.2. Citric Acid Soluble 5.3.3. Water and Citric Acid Insoluble 5.4. Phosphate Fertilizer Market, by Crop Type (2023-2030) 5.4.1. Field Crops 5.4.2. Horticultural Crops 5.4.3. Turf & Ornamental 5.5. Phosphate Fertilizer Market, by Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Phosphate Fertilizer Market (by Value USD and Volume Units) 6.1. North America Phosphate Fertilizer Market, by Type (2023-2030) 6.1.1. Monoammonium Phosphate (MAP) 6.1.2. Diammonium Phosphate (DAP) 6.1.3. Single Superphosphate (SSP) 6.1.4. Triple Superphosphate (TSP) 6.1.5. Others 6.2. North America Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 6.2.1. Fertigation 6.2.2. Foliar 6.2.3. Soil 6.3. North America Phosphate Fertilizer Market, by Solubility (2023-2030) 6.3.1. Water Soluble 6.3.2. Citric Acid Soluble 6.3.3. Water and Citric Acid Insoluble 6.4. North America Phosphate Fertilizer Market, by Crop Type (2023-2030) 6.4.1. Field Crops 6.4.2. Horticultural Crops 6.4.3. Turf & Ornamental 6.5. North America Phosphate Fertilizer Market, by Country (2023-2030) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Phosphate Fertilizer Market (by Value USD and Volume Units) 7.1. Europe Phosphate Fertilizer Market, by Type (2023-2030) 7.2. Europe Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 7.3. Europe Phosphate Fertilizer Market, by Solubility (2023-2030) 7.4. Europe Phosphate Fertilizer Market, by Crop Type (2023-2030) 7.5. Europe Phosphate Fertilizer Market, by Country (2023-2030) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Phosphate Fertilizer Market (by Value USD and Volume Units) 8.1. Asia Pacific Phosphate Fertilizer Market, by Type (2023-2030) 8.2. Asia Pacific Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 8.3. Asia Pacific Phosphate Fertilizer Market, by Solubility (2023-2030) 8.4. Asia Pacific Phosphate Fertilizer Market, by Crop Type (2023-2030) 8.5. Asia Pacific Phosphate Fertilizer Market, by Country (2023-2030) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Phosphate Fertilizer Market (by Value USD and Volume Units) 9.1. Middle East and Africa Phosphate Fertilizer Market, by Type (2023-2030) 9.2. Middle East and Africa Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 9.3. Middle East and Africa Phosphate Fertilizer Market, by Solubility (2023-2030) 9.4. Middle East and Africa Phosphate Fertilizer Market, by Crop Type (2023-2030) 9.5. Middle East and Africa Phosphate Fertilizer Market, by Country (2023-2030) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Phosphate Fertilizer Market (by Value USD and Volume Units) 10.1. South America Phosphate Fertilizer Market, by Type (2023-2030) 10.2. South America Phosphate Fertilizer Market, by Deployment Mode (2023-2030) 10.3. South America Phosphate Fertilizer Market, by Solubility (2023-2030) 10.4. South America Phosphate Fertilizer Market, by Crop Type (2023-2030) 10.5. South America Phosphate Fertilizer Market, by Country (2023-2030) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. CF Industries 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Chambal Fertilisers and Chemicals Limited 11.3. China BlueChemical Ltd. 11.4. Coromandel International Limited 11.5. EuroChem Group 11.6. Guizhou Kailin Group 11.7. Gujarat State Fertilizers & Chemicals Ltd. (GSFC) 11.8. Hubei Xingfa Chemicals Group 11.9. Indian Farmers Fertilizer Cooperative Limited (IFFCO) 11.10. OCP Group 11.11. PhosAgro 11.12. Rama Phosphates 11.13. Rashtriya Chemicals and Fertilizers Limited (RCF) 11.14. Sinochem Group 11.15. The Mosaic Company 11.16. Yara International ASA 11.17. Yunnan Yuntianhua International Chemical Co., Ltd. 12. Key Findings 13. Industry Recommendation