Phosphate Chemical Reagents Market size was valued at USD 5.34 Bn. in 2023 and the total Phosphate Chemical Reagents revenue is expected to grow by 4.8 % from 2024 to 2030, reaching nearly USD 7.42 Bn.Phosphate Chemical Reagents Market Overview:

The phosphate chemical reagents market covers a spectrum of chemical compounds primarily utilized in processes such as mineral flotation, water treatment, and industrial applications where the precise separation and conditioning of materials hold significant importance. The demand for these compounds in the mining industry, particularly for mineral beneficiation procedures, is a driving force behind the phosphate chemical reagents market. As the global population continues to grow, the requirement for minerals like phosphate, vital for agricultural fertilizers and various industrial uses, is escalating, thereby driving the need for efficient extraction and processing methods. Furthermore, strict environmental regulations mandating responsible waste management and reduced pollution are also fostering the adoption of phosphate chemical reagents. These reagents play a pivotal role in effectively separating valuable minerals from ores, contributing to minimized environmental impact.To know about the Research Methodology :- Request Free Sample Report A notable opportunity within the phosphate chemical reagents market lies in the development of environmentally friendly and sustainable reagent formulations. Manufacturers are progressively concentrating on producing reagents that have a lesser impact on the environment and human health, while simultaneously upholding or enhancing their effectiveness. This strategic shift is in harmony with the global emphasis on sustainability and provides a competitive advantage to companies capable of delivering efficient and environmentally responsible solutions. An evident trend in the phosphate chemical reagents market involves the integration of advanced technologies like data analytics and machine learning into the formulation and application processes of these reagents. Through harnessing insights derived from data-driven approaches, manufacturers and users can optimize reagent utilization, resulting in enhanced process efficiency, reduced operational expenses, and minimized waste generation. Additionally, the market is observing an upswing in partnerships and collaborations between reagent manufacturers and mining firms, facilitating the creation of tailored solutions and a deeper comprehension of industry-specific requisites.

Phosphate Chemical Reagents Market Scope and Research Methodology

The Phosphate Chemical Reagents Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Phosphate Chemical Reagents Market during the forecast period. The research on the Phosphate Chemical Reagents Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply, and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.Phosphate Chemical Reagents Market Dynamics:

Phosphate Chemical Reagents Market Drivers Increasing Demand for Clean Water Spurs Growth in Phosphate Chemical Reagents Market With mounting concerns about water scarcity and the degradation of water quality, there has been a notable upsurge in the requirement for effective solutions for water treatment. Within this context, phosphate chemical reagents have emerged as essential components of water treatment processes. Specifically, these reagents are employed to address challenges related to phosphate removal from wastewater and the regulation of nutrient levels in various water bodies. As urbanization and industrial activities continue to expand, pollutants like phosphates originating from sources such as agricultural runoff and industrial discharges significantly contribute to water pollution. Phosphate chemical reagents play a pivotal role in triggering precipitation reactions that aid in the removal of soluble phosphates, thereby addressing concerns related to eutrophication and the contamination of water resources. The imposition of stricter regulations by governmental bodies and environmental agencies across the globe further amplifies the urgency for clean water resources. This regulatory landscape is driving the demand for innovative water treatment solutions, consequently fueling the growth of the phosphate chemical reagents market. Phosphate Chemical Reagents Market Restraint Price Volatility of Raw Materials Challenges Phosphate Chemical Reagents Market The volatility in raw material prices poses a significant constraint on the phosphate chemical reagents market. The production of these reagents heavily relies on key components like phosphoric acid and other phosphate-based compounds, sourced primarily from phosphate rock. The availability and cost of phosphate rock are subject to various factors, including geopolitical tensions, imbalances in supply and demand, and regulatory shifts within regions rich in phosphate resources. These unpredictable elements contribute to fluctuations in the prices of raw materials, directly impacting the overall production costs of phosphate chemical reagents. This situation often challenges manufacturers in maintaining stable pricing structures and ensuring profitability amid the ever-changing raw material costs. Consequently, this restraint can impede the expansion of the market by undermining profit margins, limiting investments in research and development, and potentially resulting in elevated prices for end-users. Navigating this dynamic raw material landscape becomes an essential concern for all stakeholders operating within the phosphate chemical reagents industry. Phosphate Chemical Reagents Market Opportunities Catalysing Sustainable Innovations in Phosphate Chemical Reagents through Green Chemistry Advancements An auspicious avenue within the phosphate chemical reagents market arises from the accelerating momentum of green chemistry and its drive toward sustainable solutions. With heightened environmental consciousness, there's an escalating demand for reagent formulations that curtail adverse ecological impacts and prioritize human well-being. This escalating demand is instigating manufacturers to delve into the realm of eco-friendly alternatives, aiming to curtail toxicity, diminish waste generation, and streamline resource utilization throughout the lifecycle of phosphate chemical reagents. Aligning their efforts with the ethos of green chemistry, companies can not only meet regulatory stipulations but also gain a strategic edge by providing solutions that resonate profoundly with environmentally attuned consumers and industries. The opportunity holds the potential to instigate the expansion of a more sustainable, responsible, and future-oriented phosphate chemical reagents market. Example: A tangible manifestation of this opportunity materializes in the mining sector's transformation from conventional solvent-based collectors to innovative, sustainable alternatives. Historically, mining operations were intertwined with the usage of hazardous chemicals for mineral flotation procedures, ushering in threats to both environmental integrity and human health. Nevertheless, galvanized by the potential unlocked by green chemistry, numerous mining enterprises are recalibrating their approach, transitioning toward employing bio-derived or biodegradable collectors. These reagents, sourced from renewable reservoirs, exhibit significantly diminished toxicity levels, thereby mitigating the ecological impact inherent in mineral processing activities. This paradigm shift not only addresses environmental apprehensions but also bolsters the public perception of mining entities as conscientious industry stakeholders. This example distinctly underscores the transformative power embedded in embracing green chemistry opportunities within the landscape of phosphate chemical reagents, propelling pragmatic strides toward sustainability.Phosphate Chemical Reagents Market Segment Analysis:

Based on Type, the "Ammonium Phosphate" category emerges as an influential and significant segment within the broader phosphate chemical reagents market in the year 2023 and is expected to do the same during the forecast period. Ammonium phosphate compounds have garnered widespread utilization across a spectrum of industries, a testament to their versatile attributes and versatile applications. These compounds are the result of diverse combinations of ammonia and phosphate ions, yielding compounds like monoammonium phosphate (MAP) and diammonium phosphate (DAP). Central to the dominance of ammonium phosphate is its paramount role in the agricultural domain. The compounds MAP and DAP find extensive use as water-soluble fertilizers, offering vital nutrients such as nitrogen and phosphorus to plants. This contribution proves especially pivotal in nurturing robust growth and augmenting crop yields, thus rendering ammonium phosphate a pivotal element in contemporary agricultural practices. Moreover, the water solubility of these compounds facilitates effective nutrient absorption by plants. Beyond agriculture, ammonium phosphate compounds demonstrate their versatility across a diverse array of industrial sectors. They are integral to the production of fire retardants, corrosion inhibitors, and additives in the food industry. Notably, the flame-retardant properties of ammonium phosphate enhance fire safety in materials like textiles, plastics, and wood-based products. The adaptability of ammonium phosphate extends even further to encompass water treatment processes. Within this context, ammonium phosphate compounds find application in the removal of phosphates from water sources, addressing water pollution concerns linked to eutrophication. Given the breadth of applications and significant contributions spanning pivotal sectors such as agriculture, fire safety, and water treatment, the dominant presence of ammonium phosphate profoundly influences and shapes the overall landscape of the phosphate chemical reagents market. Phosphate Chemical Reagents Market Restraint Price Volatility of Raw Materials Challenges Phosphate Chemical Reagents Market The volatility in raw material prices poses a significant constraint on the phosphate chemical reagents market. The production of these reagents heavily relies on key components like phosphoric acid and other phosphate-based compounds, sourced primarily from phosphate rock. The availability and cost of phosphate rock are subject to various factors, including geopolitical tensions, imbalances in supply and demand, and regulatory shifts within regions rich in phosphate resources. These unpredictable elements contribute to fluctuations in the prices of raw materials, directly impacting the overall production costs of phosphate chemical reagents. This situation often challenges manufacturers in maintaining stable pricing structures and ensuring profitability amid the ever-changing raw material costs. Consequently, this restraint can impede the expansion of the market by undermining profit margins, limiting investments in research and development, and potentially resulting in elevated prices for end-users. Navigating this dynamic raw material landscape becomes an essential concern for all stakeholders operating within the phosphate chemical reagents industry. Phosphate Chemical Reagents Market Opportunities Catalysing Sustainable Innovations in Phosphate Chemical Reagents through Green Chemistry Advancements An auspicious avenue within the phosphate chemical reagents market arises from the accelerating momentum of green chemistry and its drive toward sustainable solutions. With heightened environmental consciousness, there's an escalating demand for reagent formulations that curtail adverse ecological impacts and prioritize human well-being. This escalating demand is instigating manufacturers to delve into the realm of eco-friendly alternatives, aiming to curtail toxicity, diminish waste generation, and streamline resource utilization throughout the lifecycle of phosphate chemical reagents. Aligning their efforts with the ethos of green chemistry, companies can not only meet regulatory stipulations but also gain a strategic edge by providing solutions that resonate profoundly with environmentally attuned consumers and industries. The opportunity holds the potential to instigate the expansion of a more sustainable, responsible, and future-oriented phosphate chemical reagents market. Example: A tangible manifestation of this opportunity materializes in the mining sector's transformation from conventional solvent-based collectors to innovative, sustainable alternatives. Historically, mining operations were intertwined with the usage of hazardous chemicals for mineral flotation procedures, ushering in threats to both environmental integrity and human health. Nevertheless, galvanized by the potential unlocked by green chemistry, numerous mining enterprises are recalibrating their approach, transitioning toward employing bio-derived or biodegradable collectors. These reagents, sourced from renewable reservoirs, exhibit significantly diminished toxicity levels, thereby mitigating the ecological impact inherent in mineral processing activities. This paradigm shift not only addresses environmental apprehensions but also bolsters the public perception of mining entities as conscientious industry stakeholders. This example distinctly underscores the transformative power embedded in embracing green chemistry opportunities within the landscape of phosphate chemical reagents, propelling pragmatic strides toward sustainability.Phosphate Chemical Reagents Market Segment Analysis:

Based on Type, the "Ammonium Phosphate" category emerges as an influential and significant segment within the broader phosphate chemical reagents market in the year 2023 and is expected to do the same during the forecast period. Ammonium phosphate compounds have garnered widespread utilization across a spectrum of industries, a testament to their versatile attributes and versatile applications. These compounds are the result of diverse combinations of ammonia and phosphate ions, yielding compounds like monoammonium phosphate (MAP) and diammonium phosphate (DAP). Central to the dominance of ammonium phosphate is its paramount role in the agricultural domain. The compounds MAP and DAP find extensive use as water-soluble fertilizers, offering vital nutrients such as nitrogen and phosphorus to plants. This contribution proves especially pivotal in nurturing robust growth and augmenting crop yields, thus rendering ammonium phosphate a pivotal element in contemporary agricultural practices. Moreover, the water solubility of these compounds facilitates effective nutrient absorption by plants. Beyond agriculture, ammonium phosphate compounds demonstrate their versatility across a diverse array of industrial sectors. They are integral to the production of fire retardants, corrosion inhibitors, and additives in the food industry. Notably, the flame-retardant properties of ammonium phosphate enhance fire safety in materials like textiles, plastics, and wood-based products. The adaptability of ammonium phosphate extends even further to encompass water treatment processes. Within this context, ammonium phosphate compounds find application in the removal of phosphates from water sources, addressing water pollution concerns linked to eutrophication. Given the breadth of applications and significant contributions spanning pivotal sectors such as agriculture, fire safety, and water treatment, the dominant presence of ammonium phosphate profoundly influences and shapes the overall landscape of the phosphate chemical reagents market.Phosphate Chemical Reagents Market ,By Type (%) In 2023

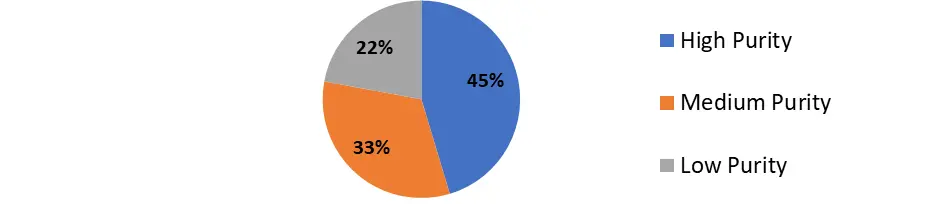

Based on Purity, the "High Purity" segment emerges as the prevailing category with significant influence within the phosphate chemical reagents market in the year 2023 and is expected to do the same during the forecast period. Distinguished by its exceptional degree of refinement, high purity phosphate chemical reagents consistently exceed stringent quality benchmarks. This segment's dominance is rooted in the premium placed on unwavering quality, precise composition, and dependability across a multitude of industries that rely upon these reagents. The salient prominence of the high-purity segment is notably attributed to its pivotal role in sectors such as pharmaceuticals, electronics, and specialized chemical synthesis. In the realm of pharmaceutical production, high purity phosphate reagents stand as vital components in manufacturing medications and therapeutic drugs. Even minute impurities possess the potential to yield adverse effects on patient health, underscoring the criticality of high-purity reagents. Similarly, the electronics domain leverages high-purity reagents as indispensable materials for fabricating semiconductors and microchips. Impurities, even in minute quantities, possess the capacity to disrupt the precise electronic performance of these components. Beyond these sectors, the demand for high purity phosphate reagents also resonates profoundly in research and development applications. Laboratories and scientific research institutions necessitate reagents of unparalleled purity to guarantee the precision and reproducibility of outcomes in experiments and analyses. The stringent requirements of these endeavors underscore the indispensability of high purity reagents in facilitating accurate scientific advancements.

Phosphate Chemical Reagents Market ,By Purity (%) In 2023

Phosphate Chemical Reagents Market Regional Insights:

North America region dominated the phosphate chemical reagents market in the year 2023 and is expected to continue its dominance during the forecast period, substantiated by a confluence of pivotal factors that distinctly establish North America's commanding position. Industrial Backbone and Niche Expertise: An instrumental driver behind North America's supremacy is its foundation of advanced and mature industries that heavily rely on phosphate chemical reagents. In particular, the United States boasts a well-entrenched mining sector that hinges on these reagents for intricate mineral beneficiation and extraction operations. This is complemented by the pronounced reliance on phosphate-based fertilizers within the agricultural domains of both the United States and Canada. This dual-front reliance significantly propels the demand for phosphate chemical reagents within the broader market. Innovation Powerhouse and Pioneering Pursuits: North America serves as an innovation incubator, notably exemplified by countries like the United States and Canada. The region's prowess in technology, substantial investments in research and development, and an embedded culture of ingenuity continuously shatter the confines of conventional applications for phosphate chemical reagents. An unwavering commitment to innovation catalyzes the emergence of novel formulations, streamlined processes, and elevated applications that define the market's progression. Driving Sustainable Practices through Stringent Regulations: The resonance of North America's influence is amplified by its steadfast adherence to rigorous environmental regulations. Stringent directives governing waste disposal and pollution control propel industries toward the adoption of effective separation and treatment methods. This, in turn, heightens the demand for phosphate chemical reagents as a linchpin in meeting these regulatory benchmarks. Moreover, North America's ascendancy within the phosphate chemical reagents market is meticulously hinged upon a well-established industrial framework, innovation-driven resilience, and a resolute commitment to environmental stewardship. This comprehensive prowess not only underscores the historical contributions of the region but also positions it as a formidable shaper of the market's evolutionary trajectory.Phosphate Chemical Reagents Market Scope: Inquire Before Buying

Global Phosphate Chemical Reagents Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.34 Bn. Forecast Period 2024 to 2030 CAGR: 4.8% Market Size in 2030: US $ 7.42 Bn. Segments Covered: by Type Ammonium Phosphate Calcium Phosphate Sodium Phosphate Potassium Phosphate Others by Purity High Purity Medium Purity Low Purity by Application Agriculture Water Treatment Food and Beverage Pharmaceuticals Industrial Processes Others Phosphate Chemical Reagents Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Phosphate Chemical Reagents Market, Key Players are

1. AAT Bioquest, Inc. 2. Alfa Aesar, Thermo Fisher Scientific. 3. Biosystems S.A. 4. Cayman Chemical 5. Geno Technology Inc. 6. High Purity Laboratory Chemicals Pvt. Ltd 7. HiMedia Laboratories 8. Honeywell International Inc. 9. ICL 10. KYORITSU CHEMICAL-CHECK Lab. Corp 11. Sigma-Aldrich, Inc. 12. Tintometer GmbH 13. Xilong Scientific Co., Ltd.4 14. Innophos 15. Prayon Group 16. OCP Group 17. Lanxess 18. Haifa Group 19. Italmatch Chemicals 20. Israel Chemicals Ltd. 21. Arkema 22. Jordan Phosphate Mines Company (JPMC) 23. Recochem Inc. 24. TKI Hrashtnik 25. Varna Products 26. Nutrien 27. Changshu New-Tech Chemicals Co., Ltd. Frequently Asked Questions: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Phosphate Chemical Reagents Market report are based on Type, Purity, Application, and Region. 2] Which region is expected to hold the highest share of the Global Phosphate Chemical Reagents Market? Ans. The North America region is expected to hold the highest share of the Phosphate Chemical Reagents Market. 3] What is the market size of the Global Phosphate Chemical Reagents Market by 2030? Ans. The market size of the Phosphate Chemical Reagents Market by 2030 is expected to reach US$ 7.42 Bn. 4] What is the forecast period for the Global Phosphate Chemical Reagents Market? Ans. The forecast period for the Phosphate Chemical Reagents Market is 2024-2030. 5] What was the market size of the Global Phosphate Chemical Reagents Market in 2023? Ans. The market size of the Phosphate Chemical Reagents Market in 2023 was valued at US$ 5.34 Bn.

1. Phosphate Chemical Reagents Market: Research Methodology 2. Phosphate Chemical Reagents Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Phosphate Chemical Reagents Market: Dynamics 3.1 Phosphate Chemical Reagents Market Trends by Region 3.1.1 Global Phosphate Chemical Reagents Market Trends 3.1.2 North America Phosphate Chemical Reagents Market Trends 3.1.3 Europe Phosphate Chemical Reagents Market Trends 3.1.4 Asia Pacific Phosphate Chemical Reagents Market Trends 3.1.5 Middle East and Africa Phosphate Chemical Reagents Market Trends 3.1.6 South America Phosphate Chemical Reagents Market Trends 3.2 Phosphate Chemical Reagents Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Phosphate Chemical Reagents Market Drivers 3.2.1.2 North America Phosphate Chemical Reagents Market Restraints 3.2.1.3 North America Phosphate Chemical Reagents Market Opportunities 3.2.1.4 North America Phosphate Chemical Reagents Market Challenges 3.2.2 Europe 3.2.2.1 Europe Phosphate Chemical Reagents Market Drivers 3.2.2.2 Europe Phosphate Chemical Reagents Market Restraints 3.2.2.3 Europe Phosphate Chemical Reagents Market Opportunities 3.2.2.4 Europe Phosphate Chemical Reagents Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Phosphate Chemical Reagents Market Market Drivers 3.2.3.2 Asia Pacific Phosphate Chemical Reagents Market Restraints 3.2.3.3 Asia Pacific Phosphate Chemical Reagents Market Opportunities 3.2.3.4 Asia Pacific Phosphate Chemical Reagents Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Phosphate Chemical Reagents Market Drivers 3.2.4.2 Middle East and Africa Phosphate Chemical Reagents Market Restraints 3.2.4.3 Middle East and Africa Phosphate Chemical Reagents Market Opportunities 3.2.4.4 Middle East and Africa Phosphate Chemical Reagents Market Challenges 3.2.5 South America 3.2.5.1 South America Phosphate Chemical Reagents Market Drivers 3.2.5.2 South America Phosphate Chemical Reagents Market Restraints 3.2.5.3 South America Phosphate Chemical Reagents Market Opportunities 3.2.5.4 South America Phosphate Chemical Reagents Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Phosphate Chemical Reagents Industry 3.8 The Global Pandemic and Redefining of The Phosphate Chemical Reagents Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Phosphate Chemical Reagents Trade Analysis (2017-2023) 3.11.1 Global Import of Phosphate Chemical Reagents 3.11.2 Global Export of Phosphate Chemical Reagents 3.12 Global Phosphate Chemical Reagents Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Phosphate Chemical Reagents Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Phosphate Chemical Reagents Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 4.1.1 Ammonium Phosphate 4.1.2 Calcium Phosphate 4.1.3 Sodium Phosphate 4.1.4 Potassium Phosphate 4.1.5 Others 4.2 Global Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 4.2.1 High Purity 4.2.2 Medium Purity 4.2.3 Low Purity 4.3 Global Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 4.3.1 Agriculture 4.3.2 Water Treatment 4.3.3 Food and Beverage 4.3.4 Pharmaceuticals 4.3.5 Industrial Processes 4.3.6 Others 4.4 Global Phosphate Chemical Reagents Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Phosphate Chemical Reagents Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 5.1.1 Ammonium Phosphate 5.1.2 Calcium Phosphate 5.1.3 Sodium Phosphate 5.1.4 Potassium Phosphate 5.1.5 Others 5.2 North America Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 5.2.1 High Purity 5.2.2 Medium Purity 5.2.3 Low Purity 5.3 North America Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 5.3.1 Agriculture 5.3.2 Water Treatment 5.3.3 Food and Beverage 5.3.4 Pharmaceuticals 5.3.5 Industrial Processes 5.3.6 Others 5.4 North America Phosphate Chemical Reagents Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1 Reagent Type 5.4.1.1.2 Industrial Type 5.4.1.2 United States Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 5.4.1.2.1 More than 98% 5.4.1.2.2 Less than 98% 5.4.1.3 United States Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 5.4.1.3.1 Synthetic Phosphate Chemical Reagents 5.4.1.3.2 Renewable Phosphate Chemical Reagents 5.4.2 Canada 5.4.2.1 Canada Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1 Ammonium Phosphate 5.4.2.1.2 Calcium Phosphate 5.4.2.1.3 Sodium Phosphate 5.4.2.1.4 Potassium Phosphate 5.4.2.1.5 Others 5.4.2.2 Canada Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 5.4.2.2.1 High Purity 5.4.2.2.2 Medium Purity 5.4.2.2.3 Low Purity 5.4.2.3 Canada Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1 Agriculture 5.4.2.3.2 Water Treatment 5.4.2.3.3 Food and Beverage 5.4.2.3.4 Pharmaceuticals 5.4.2.3.5 Industrial Processes 5.4.2.3.6 Others 5.4.3 Mexico 5.4.3.1 Mexico Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1 Ammonium Phosphate 5.4.3.1.2 Calcium Phosphate 5.4.3.1.3 Sodium Phosphate 5.4.3.1.4 Potassium Phosphate 5.4.3.1.5 Others 5.4.3.2 Mexico Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 5.4.3.2.1 High Purity 5.4.3.2.2 Medium Purity 5.4.3.2.3 Low Purity 5.4.3.3 Mexico Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1 Agriculture 5.4.3.3.2 Water Treatment 5.4.3.3.3 Food and Beverage 5.4.3.3.4 Pharmaceuticals 5.4.3.3.5 Industrial Processes 5.4.3.3.6 Others 6. Europe Phosphate Chemical Reagents Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.2 Europe Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.3 Europe Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4 Europe Phosphate Chemical Reagents Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.1.2 United Kingdom Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.1.3 United Kingdom Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.2 France 6.4.2.1 France Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.2.2 France Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.2.3 France Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.3.2 Germany Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.3.3 Germany Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.4.2 Italy Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.4.3 Italy Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.5.2 Spain Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.5.3 Spain Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.6.2 Sweden Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.6.3 Sweden Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.7.2 Austria Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 6.4.7.3 Austria Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 6.4.8.2 Rest of Europe Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030). 6.4.8.3 Rest of Europe Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Phosphate Chemical Reagents Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.2 Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.3 Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4 Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.1.2 China Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.1.3 China Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.2.2 S Korea Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.2.3 S Korea Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.3.2 Japan Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.3.3 Japan Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.4 India 7.4.4.1 India Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.4.2 India Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.4.3 India Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.5.2 Australia Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.5.3 Australia Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.6.2 Indonesia Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.6.3 Indonesia Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.7.2 Malaysia Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.7.3 Malaysia Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.8.2 Vietnam Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.8.3 Vietnam Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.9.2 Taiwan Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.9.3 Taiwan Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.10.2 Bangladesh Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.10.3 Bangladesh Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.11.2 Pakistan Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.11.3 Pakistan Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 7.4.12.2 Rest of Asia PacificPhosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 7.4.12.3 Rest of Asia Pacific Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Phosphate Chemical Reagents Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.2 Middle East and Africa Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.3 Middle East and Africa Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8.4 Middle East and Africa Phosphate Chemical Reagents Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.4.1.2 South Africa Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.4.1.3 South Africa Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.4.2.2 GCC Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.4.2.3 GCC Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.4.3.2 Egypt Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.4.3.3 Egypt Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.4.4.2 Nigeria Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.4.4.3 Nigeria Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 8.4.5.2 Rest of ME&A Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 8.4.5.3 Rest of ME&A Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 9. South America Phosphate Chemical Reagents Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 9.2 South America Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 9.3 South America Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 9.4 South America Phosphate Chemical Reagents Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 9.4.1.2 Brazil Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 9.4.1.3 Brazil Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 9.4.2.2 Argentina Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 9.4.2.3 Argentina Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Phosphate Chemical Reagents Market Size and Forecast, by Type (2023-2030) 9.4.3.2 Rest Of South America Phosphate Chemical Reagents Market Size and Forecast, by Purity (2023-2030) 9.4.3.3 Rest Of South America Phosphate Chemical Reagents Market Size and Forecast, by Application (2023-2030) 10. Global Phosphate Chemical Reagents Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Phosphate Chemical Reagents Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 AAT Bioquest, Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Alfa Aesar, Thermo Fisher Scientific. 11.3 Biosystems S.A. 11.4 Cayman Chemical 11.5 Geno Technology Inc. 11.6 High Purity Laboratory Chemicals Pvt. Ltd 11.7 HiMedia Laboratories 11.8 Honeywell International Inc. 11.9 ICL 11.10 KYORITSU CHEMICAL-CHECK Lab. Corp 11.11 Sigma-Aldrich, Inc. 11.12 Tintometer GmbH 11.13 Xilong Scientific Co., Ltd.4 11.14 Innophos 11.15 Prayon Group 11.16 OCP Group 11.17 Lanxess 11.18 Haifa Group 11.19 Italmatch Chemicals 11.20 Israel Chemicals Ltd. 11.21 Arkema 11.22 Jordan Phosphate Mines Company (JPMC) 11.23 Recochem Inc. 11.24 TKI Hrashtnik 11.25 Varna Products 11.26 Nutrien 11.27 Changshu New-Tech Chemicals Co., Ltd. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary