The Pharmaceutical Robots Market size was valued at USD 182.23 Bn. in 2023 and the total Pharmaceutical Robots Market revenue is expected to grow at a CAGR of 12.3% from 2024 to 2030, reaching nearly USD 410.47 Bn.Pharmaceutical Robots Market Overview

Pharmaceutical robots are specialized automated machines designed to perform various tasks in pharmaceutical manufacturing processes, including dispensing, packaging, labeling, inspection, and laboratory automation. These robots are equipped with advanced features such as precision control, high-speed operation, and integration with data management systems to enhance efficiency, accuracy, and safety in pharmaceutical production environments. The global pharmaceutical robots market is witnessing significant growth, driven by factors such as increasing demand for high-quality pharmaceuticals, rising adoption of automation in healthcare, and advancements in robotics technology. The current scenario indicates a surge in the deployment of robotic solutions across pharmaceutical manufacturing facilities worldwide, aiming to improve productivity, ensure regulatory compliance, and reduce operational costs. Key drivers of market growth include the need for enhanced efficiency and quality in pharmaceutical production, the shift towards personalized medicine, and the increasing focus on maintaining sterile manufacturing environments. Growth factors such as advancements in artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) technologies are enabling the development of smarter and more adaptable robotic systems tailored to meet the evolving needs of the pharmaceutical industry. Recent trends in the pharmaceutical robots market include the integration of collaborative robotics (cobots) designed to work alongside human operators, enabling safer and more efficient production processes. Cobots offer benefits such as easy programming, flexibility, and space-saving designs, making them ideal for tasks requiring human-robot collaboration, such as assembly, pick-and-place operations, and small-batch manufacturing. There is a growing emphasis on the development of robotic systems capable of handling a wide range of pharmaceutical applications, including drug synthesis, formulation, and laboratory automation. These advancements are driven by the need for increased production flexibility, faster time-to-market, and reduced reliance on manual labor. Opportunities in the pharmaceutical robots market abound, particularly in emerging economies with expanding pharmaceutical industries and a growing focus on healthcare modernization. Market players are actively pursuing collaborations, partnerships, and strategic acquisitions to strengthen their product portfolios and expand their market presence. Investments in research and development (R&D) aimed at enhancing robotic capabilities, such as vision systems, artificial intelligence, and robotic arms, are poised to drive innovation and differentiation in the market. Recent developments by key Pharmaceutical Robots Market players include the introduction of advanced robotic solutions tailored to meet specific pharmaceutical manufacturing requirements, such as improved accuracy in dispensing, faster inspection speeds, and enhanced flexibility in production workflows. These developments underscore the industry's commitment to addressing evolving customer needs and driving technological advancements in pharmaceutical automation.To know about the Research Methodology :- Request Free Sample Report

Pharmaceutical Robots Market Dynamics:

Improving Product Quality and Consistency with Pharmaceutical Robots: The need for expediting the identification of potential drug candidates drives the demand for pharmaceutical robots market in high-throughput screening. For instance, the utilization of robotic systems like Hamilton Microlab STAR in drug discovery laboratories accelerates compound screening processes, enabling researchers to identify promising candidates faster. Pharmaceutical robots ensure reproducibility and consistency in compound synthesis, leading to improved product quality. Robots like the ABB FlexPicker are adept at precisely handling delicate materials, minimizing variations in formulations, and ensuring batch-to-batch consistency, thereby elevating the overall quality of pharmaceutical products. Automation streamlines various manufacturing processes, leading to increased efficiency. Robots such as the FANUC M-20iA/35M facilitate tasks like labeling and packaging with speed and accuracy, reducing production cycle times and operational costs while boosting throughput in pharmaceutical manufacturing facilities. Automation reduces the potential for human error in critical procedures, enhancing manufacturing safety and reliability. For example, robotic systems like the Kawasaki duAro2 are employed in pharmaceutical packaging to minimize manual handling errors, ensuring precise placement of labels, and reducing the risk of product defects or contamination. The incorporation of robotics and automation technologies results in long-term cost savings for pharmaceutical manufacturers. By automating labor-intensive tasks such as quality control inspections, robots like the Universal Robots UR5e reduce the need for manual intervention, leading to lower operational costs and improved profit margins over time. Continuous advancements in robotics technology, including artificial intelligence and machine learning, drive Pharmaceutical Robots Market growth. For instance, the integration of AI-powered robotic systems like the ABB IRB 910SC enables real-time data analysis and adaptive manufacturing processes, fostering innovation and expanding Pharmaceutical Robots Market opportunities for pharmaceutical robots. Pharmaceutical robots help companies meet stringent regulatory standards by ensuring process adherence and data integrity. Robots such as the Yaskawa Motoman MH5L are equipped with advanced safety features and compliance protocols, enabling pharmaceutical manufacturers to adhere to regulatory guidelines while maintaining operational efficiency and product quality. The evolution towards personalized medicine necessitates flexible manufacturing systems, driving demand for adaptable robotic solutions. For example, collaborative robots (cobots) like the Rethink Robotics Sawyer enable pharmaceutical companies to customize production processes quickly, accommodating variations in dosage forms and formulations to meet individual patient needs. The adoption of Industry 4.0 principles in pharmaceutical manufacturing, characterized by connectivity and data-driven decision-making, fuels demand for robotics. Robots integrated with IoT sensors and analytics platforms, such as the KUKA KR AGILUS, enable real-time monitoring of manufacturing processes, optimizing efficiency, and facilitating predictive maintenance, thus driving Pharmaceutical Robots Market growth.The need to address cybersecurity risks associated with increased automation stimulates innovation in robotic technologies. For instance, companies like FANUC invest in developing secure communication protocols and encryption methods for their robots, ensuring the protection of sensitive manufacturing data, and mitigating cyber threats, thereby fostering trust, and driving market adoption. Enhancing Health and Safety Through Robotic Automation in Pharmaceutical Manufacturing: Robotics play a crucial role in maintaining product quality by reducing the risk of contamination in pharmaceutical manufacturing environments. With operators being a significant source of contamination, replacing manual operations with robotic solutions enhances production cleanliness. For instance, robots used within barrier systems like RABS minimize human interaction, ensuring aseptic conditions and improving overall product quality. Automation and robotics streamline production processes and enable efficient data management in pharmaceutical manufacturing. Robots record detailed operation logs, environmental parameters, and equipment statuses, facilitating comprehensive batch recordkeeping. By leveraging smart data analytics and machine learning, the company identifies process trends, implements preventive measures, and optimizes production efficiency to meet growing Pharmaceutical Robots Market demands. The integration of robotics aligns with Industry 4.0 principles, emphasizing connectivity, data-driven decision-making, and predictive maintenance. Robots equipped with IoT sensors and analytics platforms enable real-time monitoring of manufacturing processes, ensuring optimal performance, and minimizing downtime. For example, robots like the KUKA KR AGILUS enable seamless integration into smart manufacturing ecosystems, supporting agile and responsive production operations. Advanced robotic systems, such as Stevanato Group's Vision Robot Unit (VRU), leverage artificial intelligence to enhance visual inspection processes in pharmaceutical manufacturing. By automatically detecting cosmetic and particulate defects in drug containers, these robotic solutions improve production efficiency and product quality. For example, the VRU module enhances inspection accuracy and repeatability, ensuring compliance with regulatory standards and minimizing defects in pharmaceutical products. The demand for automation in clean room environments, particularly in medical and pharmaceutical molding plants, is driving the adoption of specialized robotic solutions. Sepro Group's MED Series robots, designed for ISO 7 and 8 clean room applications, enhance productivity and precision in sensitive manufacturing environments. These robots offer ready-to-use solutions tailored to the unique requirements of medical and pharmaceutical production, supporting continuous productivity and compliance with stringent cleanliness standards for the Pharmaceutical Robots Market. The Pharmaceutical Robots Market is witnessing rapid growth in the adoption of robotic solutions for inspection and packaging processes. Companies like Stevanato Group are introducing innovative robotic units, such as the VRU, to automate visual inspection tasks and enhance production efficiency. These robotic systems leverage artificial intelligence to improve defect detection and ensure the quality and integrity of pharmaceutical products, meeting the increasing demand for high-quality and safe medications. The expanding role of robots in pharmaceutical manufacturing extends beyond traditional tasks to include complex operations like drug synthesis and formulation. With advancements in robotics technology, companies are exploring new applications for robots in drug manufacturing processes. For example, robots equipped with precise handling capabilities, like the ABB FlexPicker, enable accurate dispensing of materials and formulations, enhancing product consistency and quality in pharmaceutical production.

High upfront investment hinders robotic adoption in pharmaceutical manufacturing: The high upfront costs associated with implementing robotic solutions in pharmaceutical manufacturing is a significant barrier for companies, particularly smaller ones. For example, the purchase and installation of robotic systems like the ABB FlexPicker or the KUKA KR AGILUS require substantial capital investment, which deters some companies from adopting these technologies, leading to slower Pharmaceutical Robots Market penetration and adoption rates. Integrating robotic systems into existing pharmaceutical manufacturing workflows is complex and time-consuming. For instance, companies face challenges retrofitting their facilities to accommodate robotic equipment like the Sawyer by Rethink Robotics, requiring modifications to infrastructure and production layouts. These integration complexities prolong implementation timelines, delay production efficiency improvements, and incur additional costs for companies. Stringent regulatory standards governing pharmaceutical manufacturing impose strict requirements for the validation and qualification of robotic systems. For example, companies must ensure that robotic solutions such as the Stevanato Group's Vision Robot Unit (VRU) comply with Good Manufacturing Practice (GMP) guidelines and other regulatory frameworks. Meeting these compliance requirements adds complexity and cost to the deployment of robotic technologies, slowing down the adoption rate in the pharmaceutical industry. The shift towards robotic automation in pharmaceutical manufacturing necessitates a skilled workforce capable of operating and maintaining these advanced technologies. For instance, companies investing in robots like Sepro Group's MED Series must train personnel to effectively utilize and troubleshoot these systems. The need for specialized training and expertise in robotics poses challenges for companies in recruiting and retaining skilled personnel, hindering the widespread adoption of robotic solutions. The rapid pace of technological advancement in the field of robotics poses a risk of technological obsolescence for pharmaceutical companies investing in these solutions. For example, companies hesitate to invest in robotic systems like the ABB IRB 910SC if they anticipate newer, more advanced technologies emerging shortly after deployment. Concerns about the longevity and relevance of robotic investments lead to cautious adoption strategies and slower Pharmaceutical Robots Market growth for pharmaceutical robots.

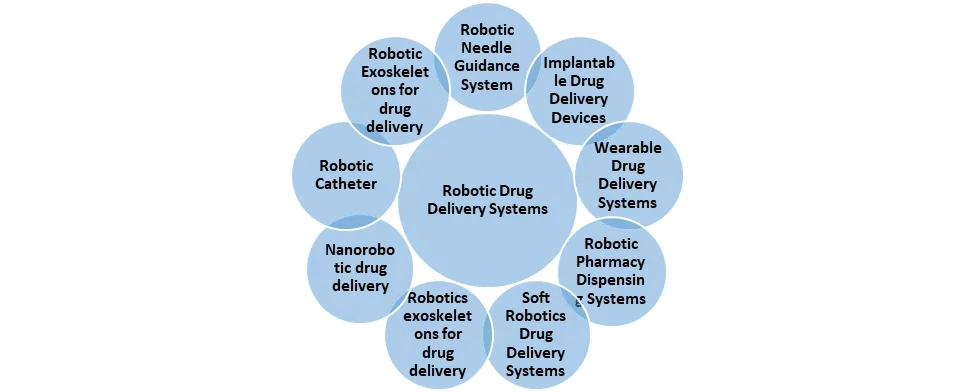

Chart: Applications of Innovative Robotic Drug Delivery Systems in Medicine:

Pharmaceutical Robots Market Segment Analysis:

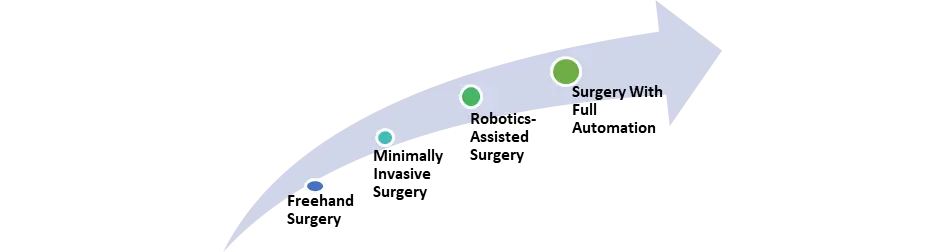

Based on product, traditional robots have dominated the Pharmaceutical Robots Market in 2023 and expected to grow in the forecast period, due to their early adoption and established presence in manufacturing processes. These robots typically exhibit high precision and efficiency, making them suitable for a wide range of applications, such as packaging, labelling, and material handling. Articulated robots have emerged as a prominent competitor, offering increased flexibility and maneuverability in complex pharmaceutical production environments. Their ability to perform intricate tasks with multiple axes of motion makes them well-suited to tasks like assembly and inspection. Collaborative pharmaceutical robots have gained traction due to their ability to work alongside human operators safely. These robots are equipped with advanced safety features, such as force and proximity sensors, enabling close collaboration with humans without the need for physical barriers. Their application to tasks requiring human-robot interaction, such as assembly and small-batch production, has contributed to their growing dominance. Collaborative pharmaceutical robots are expected to continue dominating the Pharmaceutical Robots Market, driven by the increasing emphasis on safety, efficiency, and flexibility in pharmaceutical manufacturing. Their adoption is projected to expand further as companies prioritize human-robot collaboration to optimize production processes and adapt to evolving market demands. Traditional and articulated robots will maintain significant Pharmaceutical Robots Market shares, particularly in applications requiring high-speed and precision operations.Chart: The technological development for the surgery

Pharmaceutical Robots Market Regional Insights:

The pharmaceutical robots market exhibits varied dominance across regions, with North America emerging as a dominant force in the global landscape. North America currently leads the Pharmaceutical Robots Market due to its advanced healthcare infrastructure, strong emphasis on technological innovation, and significant investments in pharmaceutical automation. For example, the United States accounts for a substantial portion of the market share, driven by the presence of major pharmaceutical companies and a conducive regulatory environment. Asia-Pacific showcases considerable growth potential, fueled by increasing pharmaceutical manufacturing activities, rising healthcare expenditures, and government initiatives to enhance healthcare infrastructure. Countries like China and India are witnessing the rapid adoption of pharmaceutical robots, supported by expanding pharmaceutical production capacities and a growing focus on quality and efficiency. Europe also holds a significant Pharmaceutical Robots Market share, leveraging advanced robotics technology to streamline pharmaceutical manufacturing processes and comply with stringent regulatory standards. The Middle East, Africa, and South America regions lag in terms of Pharmaceutical Robots Market dominance, primarily due to factors such as limited access to advanced healthcare infrastructure and lower adoption rates of pharmaceutical automation technologies. Nevertheless, these regions present untapped opportunities for Pharmaceutical Robots Market growth, driven by increasing healthcare investments and a growing demand for pharmaceutical products. North America currently dominates the pharmaceutical robot’s market, while Asia-Pacific is expected to witness the fastest growth in the coming years, fueled by robust pharmaceutical industry growth and rising adoption of automation technologies in the region.The recent developments in robotic technology by Johnson & Johnson MedTech, FANUC CORPORATION, and Datalogic S.p.A. signify a significant shift towards enhanced automation in various industries. These advancements will drive Pharmaceutical Robots Market growth by revolutionizing surgical procedures, optimizing industrial automation, and pioneering cognitive computing systems for robotics. With a focus on efficiency, precision, and safety, these innovations create opportunities for improved patient care, streamlined manufacturing processes, and increased productivity. As companies invest in cutting-edge technology to meet evolving demands, the market for robotic solutions is poised for substantial expansion, offering transformative benefits across healthcare, manufacturing, and beyond. On November 7, 2023, Johnson & Johnson MedTech unveiled plans to introduce the OTTAVA robotic surgical system, slated for submission to the FDA for an investigational device exemption by late 2024. Leveraging over 135 years of surgical expertise, the OTTAVA system aims to revolutionize surgical procedures by enhancing OR efficiency, simplifying workflows, and integrating Ethicon instrumentation. Hani Abouhalka, Company Group Chairman of Robotics & Digital at Johnson & Johnson MedTech, emphasized a commitment to personalized surgery, highlighting the system's potential to elevate patient care, surgeon performance, and OR staff satisfaction worldwide. On October 19, 2023, FANUC CORPORATION, a pioneer in factory automation, announced the milestone production of its one-millionth industrial robot. With a legacy spanning over five decades, FANUC's robots are integral to global production, serving the diverse automotive and aerospace industries. President and CEO Mike Cicco highlighted the growing demand for automated solutions amidst a labor shortage, emphasizing FANUC's ability to deliver quick returns on investment. Leveraging its expertise, FANUC employs its robots to manufacture robots, controllers, and machine tools, renowned for reliability and precision. The company's expansion, including the upcoming West Campus, underscores its commitment to meeting customer needs with innovative automation solutions. on December 21, 2023, Datalogic S.p.A. announced the acquisition of a minority stake in Oversonic Robotics Srl Benefit Corporation, reinforcing its commitment to AI. Oversonic Robotics pioneers cognitive computing systems, notably RoBee, the first humanoid robot certified for Industry 5.0 manufacturing. Datalogic aims to revolutionize industrial automation, collaborating with Oversonic on sales, R&D, and marketing. The investment aligns with Datalogic's ethos of innovation, prioritizing productivity and worker safety. RoBee integrates Datalogic's Safety Laser Scanners and vision systems, enhancing tasks in manufacturing and healthcare by ensuring safe interaction with operators and obstacle-free navigation. This strategic move underscores Datalogic's dedication to advancing AI-driven robotics for industrial applications.

Competitive Landscape

Global Pharmaceutical Robots Market Scope:Inquire Before Buying

Global Pharmaceutical Robots Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 182.23 Bn. Forecast Period 2024 to 2030 CAGR: 12.3% Market Size in 2030: US $ 410.47 Bn. Segments Covered: by Product Traditional Robots Articulated Robots SCARA Robots Delta/Parallel Robots Cartesian Robots Dual-arm Robots Collaborative Pharmaceutical Robots By Application Picking and Packaging Inspection of Pharmaceutical Drugs Laboratory Applications By End-use Pharmaceutical Companies Research Laboratories Pharmaceutical Robots Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Pharmaceutical Robots Market Key Players:

Key Players in North America: 1. FANUC America Corporation (Michigan, United States) 2. TRANSCRIPTIC INC.(California, United States) 3. Lockheed Martin (Maryland, United States) 4. Mazor Robotics (Caesarea, Israel) 5. Gridbots Technologies (North America) Key Players in Europe: 1. ABB Ltd. (Switzerland) 2. Marchesini Group S.p.A (Pianoro, Italy) 3. Seiko Epson Corporation (Nagano, Japan) 4. Shibuya Corporation (Europe) 5. Robert Bosch GmbH (Stuttgart, Germany) Key Players in Asia Pacific: 1. Universal Robots A/S (Asia Pacific) 2. Denso Wave, Inc. (Japan) 3. Mitsubishi Electric Corporation (Tokyo, Japan) 4. Kawasaki Heavy Industries Ltd. (Japan) 5. YUJIN ROBOT Co.,Ltd. (South Korea)FAQs:

1. What are the growth drivers for the Pharmaceutical Robots Market? Ans. Improving Product Quality and Consistency with Pharmaceutical Robots and is expected to be the major driver for the Pharmaceutical Robots Market. 2. What is the major Opportunity for the Pharmaceutical Robots Market growth? Ans. Enhancing Health and Safety Through Robotic Automation in Pharmaceutical Manufacturing is expected to be the major Opportunity in the Pharmaceutical Robots Market. 3. Which country is expected to lead the global Pharmaceutical Robots Market during the forecast period? Ans. North America is expected to lead the Pharmaceutical Robots Market during the forecast period. 4. What is the projected market size and growth rate of the Pharmaceutical Robots Market? Ans. The Pharmaceutical Robots Market size was valued at USD 182.23 billion in 2023 and the total Pharmaceutical Robots Market revenue is expected to grow at a CAGR of 12.3 % from 2024 to 2030, reaching nearly USD 410.47 billion. 5. What segments are covered in the Pharmaceutical Robots Market report? Ans. The segments covered in the Pharmaceutical Robots Market report are by Product, Application, End-use, and Region.

1. Pharmaceutical Robots Market: Research Methodology 2. Pharmaceutical Robots Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Pharmaceutical Robots Market: Dynamics 3.1 Pharmaceutical Robots Market Trends by Region 3.1.1 North America Pharmaceutical Robots Market Trends 3.1.2 Europe Pharmaceutical Robots Market Trends 3.1.3 Asia Pacific Pharmaceutical Robots Market Trends 3.1.4 Middle East and Africa Pharmaceutical Robots Market Trends 3.1.5 South America Pharmaceutical Robots Market Trends 3.2 Pharmaceutical Robots Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Pharmaceutical Robots Market Drivers 3.2.1.2 North America Pharmaceutical Robots Market Restraints 3.2.1.3 North America Pharmaceutical Robots Market Opportunities 3.2.1.4 North America Pharmaceutical Robots Market Challenges 3.2.2 Europe 3.2.2.1 Europe Pharmaceutical Robots Market Drivers 3.2.2.2 Europe Pharmaceutical Robots Market Restraints 3.2.2.3 Europe Pharmaceutical Robots Market Opportunities 3.2.2.4 Europe Pharmaceutical Robots Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Pharmaceutical Robots Market Drivers 3.2.3.2 Asia Pacific Pharmaceutical Robots Market Restraints 3.2.3.3 Asia Pacific Pharmaceutical Robots Market Opportunities 3.2.3.4 Asia Pacific Pharmaceutical Robots Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Pharmaceutical Robots Market Drivers 3.2.4.2 Middle East and Africa Pharmaceutical Robots Market Restraints 3.2.4.3 Middle East and Africa Pharmaceutical Robots Market Opportunities 3.2.4.4 Middle East and Africa Pharmaceutical Robots Market Challenges 3.2.5 South America 3.2.5.1 South America Pharmaceutical Robots Market Drivers 3.2.5.2 South America Pharmaceutical Robots Market Restraints 3.2.5.3 South America Pharmaceutical Robots Market Opportunities 3.2.5.4 South America Pharmaceutical Robots Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Pharmaceutical Robots Industry 3.8 The Global Pandemic and Redefining of The Pharmaceutical Robots Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Pharmaceutical Robots Market: Global Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 Global Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 4.1.1 Traditional Robots 4.1.2 Articulated Robots 4.1.3 SCARA Robots 4.1.4 Delta/Parallel Robots 4.1.5 Cartesian Robots 4.1.6 Dual-arm Robots 4.1.7 Collaborative Pharmaceutical Robots 4.2 Global Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 4.2.1 Picking and Packaging 4.2.2 Inspection of Pharmaceutical Drugs 4.2.3 Laboratory Applications 4.3 Global Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 4.3.1 Pharmaceutical Companies 4.3.2 Research Laboratories 4.4 Global Pharmaceutical Robots Market Size and Forecast, by region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Pharmaceutical Robots Market Size and Forecast by Segmentation (Value) (2023-2030) 5.1 North America Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 5.1.1 Traditional Robots 5.1.2 Articulated Robots 5.1.3 SCARA Robots 5.1.4 Delta/Parallel Robots 5.1.5 Cartesian Robots 5.1.6 Dual-arm Robots 5.1.7 Collaborative Pharmaceutical Robots 5.2 North America Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 5.2.1 Picking and Packaging 5.2.2 Inspection of Pharmaceutical Drugs 5.2.3 Laboratory Applications 5.3 North America Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 5.3.1 Pharmaceutical Companies 5.3.2 Research Laboratories 5.4 North America Pharmaceutical Robots Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 5.4.1.1.1 Traditional Robots 5.4.1.1.2 Articulated Robots 5.4.1.1.3 SCARA Robots 5.4.1.1.4 Delta/Parallel Robots 5.4.1.1.5 Cartesian Robots 5.4.1.1.6 Dual-arm Robots 5.4.1.1.7 Collaborative Pharmaceutical Robots 5.4.1.2 United States Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 5.4.1.2.1 Picking and Packaging 5.4.1.2.2 Inspection of Pharmaceutical Drugs 5.4.1.2.3 Laboratory Applications 5.4.1.3 United States Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 5.4.1.3.1 Pharmaceutical Companies 5.4.1.3.2 Research Laboratories 5.4.2 Canada 5.4.2.1 Canada Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 5.4.2.1.1 Traditional Robots 5.4.2.1.2 Articulated Robots 5.4.2.1.3 SCARA Robots 5.4.2.1.4 Delta/Parallel Robots 5.4.2.1.5 Cartesian Robots 5.4.2.1.6 Dual-arm Robots 5.4.2.1.7 Collaborative Pharmaceutical Robots 5.4.2.2 Canada Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 5.4.2.2.1 Picking and Packaging 5.4.2.2.2 Inspection of Pharmaceutical Drugs 5.4.2.2.3 Laboratory Applications 5.4.2.3 Canada Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 5.4.2.3.1 Pharmaceutical Companies 5.4.2.3.2 Research Laboratories 5.4.3 Mexico 5.4.3.1 Mexico Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 5.4.3.1.1 Traditional Robots 5.4.3.1.2 Articulated Robots 5.4.3.1.3 SCARA Robots 5.4.3.1.4 Delta/Parallel Robots 5.4.3.1.5 Cartesian Robots 5.4.3.1.6 Dual-arm Robots 5.4.3.1.7 Collaborative Pharmaceutical Robots 5.4.3.2 Mexico Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 5.4.3.2.1 Picking and Packaging 5.4.3.2.2 Inspection of Pharmaceutical Drugs 5.4.3.2.3 Laboratory Applications 5.4.3.3 Mexico Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 5.4.3.3.1 Pharmaceutical Companies 5.4.3.3.2 Research Laboratories 6. Europe Pharmaceutical Robots Market Size and Forecast by Segmentation (Value) (2023-2030) 6.1 Europe Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.2 Europe Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.3 Europe Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4 Europe Pharmaceutical Robots Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.1.2 United Kingdom Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.1.3 United Kingdom Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.2 France 6.4.2.1 France Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.2.2 France Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.2.3 France Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.3.2 Germany Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.3.3 Germany Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.4.2 Italy Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.4.3 Italy Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.5.2 Spain Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.5.3 Spain Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.6.2 Sweden Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.6.3 Sweden Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.7.2 Austria Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 6.4.7.3 Austria Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 6.4.8.2 Rest of Europe Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030). 6.4.8.3 Rest of Europe Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7. Asia Pacific Pharmaceutical Robots Market Size and Forecast by Segmentation (Value) (2023-2030) 7.1 Asia Pacific Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.2 Asia Pacific Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.3 Asia Pacific Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4 Asia Pacific Pharmaceutical Robots Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.1.2 China Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.1.3 China Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.2.2 S Korea Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.2.3 S Korea Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.3.2 Japan Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.3.3 Japan Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.4 India 7.4.4.1 India Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.4.2 India Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.4.3 India Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.5.2 Australia Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.5.3 Australia Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.6.2 Indonesia Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.6.3 Indonesia Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.7.2 Malaysia Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.7.3 Malaysia Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.8.2 Vietnam Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.8.3 Vietnam Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.9.2 Taiwan Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.9.3 Taiwan Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.10.2 Bangladesh Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.10.3 Bangladesh Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.11.2 Pakistan Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.11.3 Pakistan Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 7.4.12.2 Rest of Asia Pacific Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 7.4.12.3 Rest of Asia Pacific Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8. Middle East and Africa Pharmaceutical Robots Market Size and Forecast by Segmentation (Value) (2023-2030) 8.1 Middle East and Africa Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.2 Middle East and Africa Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.3 Middle East and Africa Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8.4 Middle East and Africa Pharmaceutical Robots Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.4.1.2 South Africa Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.4.1.3 South Africa Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.4.2.2 GCC Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.4.2.3 GCC Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.4.3.2 Egypt Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.4.3.3 Egypt Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.4.4.2 Nigeria Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.4.4.3 Nigeria Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 8.4.5.2 Rest of ME&A Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 8.4.5.3 Rest of ME&A Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 9. South America Pharmaceutical Robots Market Size and Forecast by Segmentation (Value) (2023-2030) 9.1 South America Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 9.2 South America Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 9.3 South America Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 9.4 South America Pharmaceutical Robots Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 9.4.1.2 Brazil Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 9.4.1.3 Brazil Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 9.4.2.2 Argentina Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 9.4.2.3 Argentina Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Pharmaceutical Robots Market Size and Forecast, By Product (2023-2030) 9.4.3.2 Rest Of South America Pharmaceutical Robots Market Size and Forecast, By Application (2023-2030) 9.4.3.3 Rest Of South America Pharmaceutical Robots Market Size and Forecast, By End-use (2023-2030) 10. Global Pharmaceutical Robots Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Pharmaceutical Robots Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 FANUC America Corporation (Michigan, United States) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 A TRANSCRIPTIC INC. (California, United States) 11.3 Lockheed Martin (Maryland, United States) 11.4 Mazor Robotics (Caesarea, Israel) 11.5 Gridbots Technologies (North America) 11.6 ABB Ltd. (Switzerland) 11.7 Marchesini Group S.p.A (Pianoro, Italy) 11.8 Seiko Epson Corporation (Nagano, Japan) 11.9 Shibuya Corporation (Europe) 11.10 Robert Bosch GmbH (Stuttgart, Germany) 11.11 Universal Robots A/S (Asia Pacific) 11.12 Denso Wave, Inc. (Japan) 11.13 Mitsubishi Electric Corporation (Tokyo, Japan) 11.14 Kawasaki Heavy Industries Ltd. (Japan) 11.15 YUJIN ROBOT Co.,Ltd. (South Korea) 12. Key Findings and Analyst Recommendations 13. Terms and Glossary