The Pharmaceutical Packaging Market size was valued at USD 170.09 Bn in 2024, reaching USD 741.16 Bn by 2032, and is growing at a CAGR of 20.2% from 2025 to 2032Pharmaceutical Packaging Market Overview

Pharmaceutical packaging ensures the safety, integrity, and efficacy of medicines by protecting them from contamination, damage, and tampering. It includes materials such as blister packs, bottles, and eco-friendly alternatives. Driven by regulations, technological advancements, and sustainability trends, the market supports patient safety, supply chain efficiency, and evolving healthcare needs globally. The increasing demand for innovative, safe, and sustainable packaging solutions that meet the evolving needs of the healthcare industry. With the expansion of the pharmaceutical sector, increased prevalence of chronic diseases, advancements in biologics, and the growth of generic drugs, the need for reliable and high-quality packaging has intensified. The Pharmaceutical Packaging Market plays a critical role in protecting products from contamination, ensuring proper dosage, and maintaining the efficacy of medications throughout their shelf life.To know about the Research Methodology :- Request Free Sample Report The stringent regulatory requirements set through agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other global bodies mandate strict compliance with quality and safety standards, further boosting the demand for advanced packaging solutions. Technological innovations, such as smart packaging, tamper-evident features, and track-and-trace systems, are gaining traction as they enhance patient safety, enable supply chain transparency, and address counterfeit drug concerns. The increasing trend toward personalized medicine and self-administration of drugs is creating demand for user-friendly, portable, and patient-centric packaging formats, driving Pharmaceutical Packaging Market growth.

Global Pharmaceutical Packaging Market Dynamics

Increasing Demand for Smart and Sustainable Packaging Solutions to Drive Pharmaceutical Packaging Market Growth The stricter global regulations, rising consumer awareness, and the industry’s ambitious environmental commitments. sustainable pharma packaging is no longer a niche initiative but a mainstream imperative, driven by the global push to reduce plastic use, ban single-use materials, and embrace the principles of a circular economy. Innovations such as biodegradable and compostable materials, such as cornstarch, mushrooms, sugarcane-based bioplastics, seaweed derivatives, and FSC-certified paper, to recyclable HDPE, PCR plastics, and high-quality Type I borosilicate glass vials, ampoules, syringes, and cartridges. Smart packaging technologies, including QR codes, NFC tags, e-labeling, and sensor-embedded designs, are merging environmental stewardship with patient safety. These technologies enable reduced paper waste, enhanced product authentication, and real-time tracking. In the Pharmaceutical Packaging Market, flexible packaging, leveraging lightweight multi-layer barrier films, is gaining ground for its space efficiency, lower carbon footprint, and reduced transport costs, while 3D printing is opening doors to personalized, dosage-specific containers that minimize production waste. Leading companies such as Amcor plc, Berry Global Inc., AptarGroup, Inc.,West Pharmaceutical Services, Inc., Becton, Dickinson and Company (BD) and global pharmaceutical giants are integrating renewable energy into manufacturing, optimizing fill-and-finish processes, and adopting waste-minimizing designs such as pre-filled, recyclable pen systems sycg as PenCycle. The collaborations, such as Schneider Electric’s Energize program, uniting major pharma brands to cut supply chain emissions, and nearly half the industry has joined the UN’s Race to Zero campaign, targeting a 45.8% reduction in Scope 1 and 2 emissions within 12 years. This momentum reflects a shift from compliance-driven sustainability to brand-defining strategy, where packaging is not only a protective medium but also a sustainability statement that meets patient expectations, regulatory mandates, and environmental imperatives. Rapid growth of biologics and personalized Medicines to Create Market Opportunities Biologics derived from living cells or organisms require far more stringent packaging, handling, and storage conditions than traditional small-molecule drugs, due to their heightened sensitivity to temperature, light, and environmental factors. Many advanced therapies, such as cell and gene treatments, demand cryogenic storage to maintain stability and efficacy, placing exceptional demands on primary and secondary packaging solutions. The rise of personalized medicine, where treatments are tailored to an individual’s genetic profile, condition, or therapeutic response, is transforming packaging requirements Pharmaceutical Packaging Market. Precision dosing, patient-specific labeling, and highly customized container formats are becoming essential to ensure safety, accuracy, and regulatory compliance. This shift is driving innovation in labeling technologies, serialization, and tamper-evident features, alongside the use of smart packaging equipped with NFC, RFID, or IoT sensors to enable real-time tracking and authentication. The Pharmaceutical companies and Contract Development and Manufacturing Organizations (CDMOs) are investing in advanced packaging capabilities, including temperature-controlled formats, specialized vial and syringe systems, and multi-layer labeling solutions tha accommodate extensive product information without sacrificing usability. Coupled with sustainability initiatives such as recyclable materials, biodegradable components, and energy-efficient production processes, these innovations are positioning the Pharmaceutical Packaging Industry for growth. High Cost in Packaging Solutions to Create Restraint in the Drive Pharmaceutical Packaging Market Pharmaceutical packaging adheres to stringent international regulations concerning safety, quality, and traceability, which require specialized materials, sterile environments, and complex production processes. These factors significantly increase manufacturing costs, particularly for small and mid-sized pharmaceutical companies that lack the infrastructure to support such investments. Also, the frequent updates to global compliance standards and the need for validation testing further add to operational and time-related costs. This financial burden limits innovation and slows down Pharmaceutical Packaging Market penetration, especially in price-sensitive or developing regions, posing a major restraint to the overall growth of the market.Global Pharmaceutical Packaging Market Segment Analysis

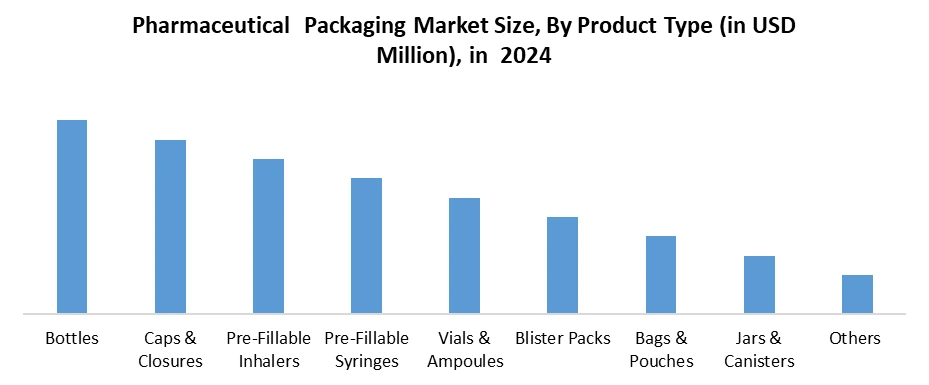

Based on Material, the market is segmented into the Plastic & Polymers, Glass, Paper and paperboard and Others. Plastic & polymers hold the dominant share in the global pharmaceutical packaging market in 2024. Due to their versatility, cost-effectiveness, and compatibility with a wide range of drug formulations. They offer excellent barrier properties against moisture, oxygen, and contaminants, ensuring product stability and extended shelf life. Materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC) are widely used for bottles, blister packs, pouches, and caps. The lightweight nature of plastics reduces transportation costs and enhances ease of handling, while their moldability enables innovative, patient-friendly designs. Additionally, plastics support advanced features such as tamper-evidence, child resistance, and unit-dose packaging, improving patient safety and compliance. Recent innovations in biodegradable and recyclable plastics are boosting adoption, aligning with sustainability goals. Their compatibility with high-speed manufacturing lines and adaptability for sterile and non-sterile applications reinforce their leadership in the Pharmaceutical Packaging Market. Based on Product Type, the market is categorized into Bottles, Caps & Closures, Pre-Fillable Inhalers, Pre-Fillable Syringes, Vials & Ampoules, Blister Packs, Bags & Pouches, Jars & Canisters and Others. Blister packs are the dominant packaging type in the pharmaceutical packaging market in 2024, widely used for solid oral dosage forms such as tablets and capsules. They offer an ideal combination of protection, dosage accuracy, and patient convenience. Made primarily from a combination of plastic films (such as PVC, PVDC, or PET) and aluminum foil, blister packs provide an effective moisture, oxygen, and light barrier, safeguarding drug stability and efficacy throughout its shelf life. The unit-dose format of blister packs minimizes contamination risks, ensures hygienic handling, and supports medication adherence by allowing patients to track dosage schedules easily. Regulatory bodies, including the FDA and EMA, favor blister packaging for its tamper-evident and child-resistant properties, which enhance safety and compliance. The format also facilitates product identification through clear labeling and transparent cavities, making it user-friendly for patients and caregivers. Blister packs are cost-effective for high-volume production and adaptable for various.

Pharmaceutical Packaging Market Regional Insights

North America held the largest Pharmaceutical Packaging Market Share in 2024. The strong pharmaceutical manufacturing base, a highly developed healthcare infrastructure, and strong adoption of cutting-edge packaging technologies drive the Pharmaceutical Packaging Market. The region’s market leadership is reinforced by stringent regulatory frameworks, significantly those implemented by the U.S. Food and Drug Administration (FDA), which enforce strict quality, safety, and compliance standards, ensuring that packaging solutions meet the highest global benchmarks. This regulatory environment fosters innovation while safeguarding patient health. The increasing demand for specialized packaging solutions to accommodate the rising production of biologics, personalized medicines, and controlled-release drug formulations is further driving market expansion. Pharmaceutical companies and contract packaging organizations (CPOs) in the region are investing heavily in advanced materials, smart packaging systems, and sustainable solutions to address the evolving needs of healthcare providers, patients, and regulators. The growing emphasis on patient safety, product integrity, and supply chain traceability is encouraging the integration of features such as tamper-evident seals, child-resistant closures, and RFID-enabled tracking systems. Additionally, demographic trends, including an aging population and the increasing prevalence of chronic diseases, are driving the demand for reliable, convenient, and compliant packaging formats. Rising healthcare expenditure, strong R&D investments, and a focus on sustainability are influencing product development strategies, with companies increasingly adopting recyclable materials, reducing packaging waste, and optimizing transportation efficiency. Pharmaceutical Packaging Market Competitive Landscape The Pharmaceutical Packaging Market is highly competitive, driven by innovation, regulatory compliance, and the growing demand for sustainable, high-performance solutions. Global leaders such as Amcor plc, Berry Global Inc., Gerresheimer AG, SCHOTT Pharma, West Pharmaceutical Services, AptarGroup, Catalent, and Constantia Flexibles dominate through diversified portfolios that cater to every stage of pharmaceutical distribution from sterile primary packaging like vials, syringes, and blister packs to secondary cartons and tamper-evident closures. In North America, players like such as e Amcor, Berry Global, WestRock, and BD excel in advanced manufacturing and FDA-compliant solutions for biologics and specialty drugs. Europe stands out for precision glass and eco-friendly packaging, with Gerresheimer, SCHOTT, Stevanato Group, and SGD Pharma leading in premium quality and sustainable innovation. Meanwhile, the Asia-Pacific region is emerging as a growth powerhouse, driven by cost-efficient manufacturing, expanding pharmaceutical exports, and investments from both local champions such as Piramal Glass and global giants.Key Development in the Pharmaceutical Packaging Market • On April 2025, Amcor completed construction of an advanced healthcare packaging coating facility in Selangor, Malaysia, marking the first in Asia to feature state-of-the-art air knife coating technology. This advancement enables local production of both top and bottom substrates for medical device packaging, significantly reducing lead times and enhancing supply security. The facility incorporates water-based coating systems, online inspection mechanisms, and precision air knife technology to boost operational efficiency while minimizing waste. Alongside this milestone, Amcor expanded its Asia Pacific presence through strategic acquisitions, including MDK in China, a grid lacquer paper unit in India, and a co-extrusion blown film and printing plant in Singapore. • On October 31, 2024 – Berry Global launched its ClariPPil™ range of clarified polypropylene (PP) bottles for healthcare applications, offering enhanced sustainability, improved recyclability, and superior product protection compared to traditional PET bottles. Certified RecyClass A, these bottles deliver up to 84% better moisture ingress protection and approximately 71% lower CO₂ emissions than PET manufacturing. Available in various sizes and colors, including customizable options, they are compatible with standard closures and meet diverse product needs such as vitamins, nutraceuticals, and OTC treatments. Berry will showcase these innovations, alongside its CDMO services, at Pharmapack 2025 in Paris, reinforcing its commitment to advancing sustainable, high-performance solutions in the Pharmaceutical Packaging Market. Key Trends of the Pharmaceutical Packaging Market

Trend Description Impact on Market Sustainable & Eco-Friendly Packaging Growing shift towards biodegradable, recyclable, and plastic-free materials to meet environmental regulations and consumer preferences. Drives innovation in packaging materials and boosts adoption of green solutions. Smart & Connected Packaging Integration of QR codes, NFC tags, and sensors for authentication, patient engagement, and supply chain tracking. Enhances patient safety, combats counterfeiting, and improves traceability. Rise in Biologic & Injectable Drugs Increased demand for pre-filled syringes, vials, and advanced containment solutions to support biologics. Spurs growth in specialized, high-barrier, and sterile packaging formats. Pharmaceutical Packaging Market Scope: Inquire before buying

Global Pharmaceutical Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 170.09 Bn. Forecast Period 2025 to 2032 CAGR: 20.2% Market Size in 2032: USD 741.06 Bn. Segments Covered: by Material Plastic & Polymers Polyvinyl Chloride (PVC) Polypropylene (PP) Polyethylene Terephthalate (PET) Polyethylene (PE) HDPE LDPE LLDPE Polystyrene (PS) Others Glass Paper and paperboard Others by Type Bottles Caps & Closures Pre-Fillable Inhalers Pre-Fillable Syringes Vials & Ampoules Blister Packs Bags & Pouches Jars & Canisters Others by Packaging Type Primary Secondary Tertiary by Drug Delivery Mode Injectable Packaging Oral Drug Delivery Packaging Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging Transdermal Drug Delivery Packaging Ocular Drug & Nasal Drug Delivery Packaging Others by End Use Pharmaceutical Manufacturing Companies Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) Hospitals & Clinics Retail Pharmacies Others Pharmaceutical Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pharmaceutical Packaging Key Players

North America 1. Amcor plc 2. Berry Global Inc. 3. AptarGroup, Inc. 4. West Pharmaceutical Services, Inc. 5. Becton, Dickinson and Company (BD) 6. Corning Inc. 7. Catalent, Inc. 8. WestRock Company 9. Sonoco Products Co. 10. Winpak Ltd. Europe 1. Gerresheimer AG 2. SCHOTT Pharma 3. Constantia Flexibles 4. Stevanato Group 5. Vetter Pharma 6. August Faller GmbH & Co. KG 7. Romaco Group 8. GEA Pharma Systems 9. Erweka GmbH 10. SGD Pharma Asia-Pacific 1. Piramal Glass Private Limited 2. Schott AG 3. Gerresheimer AG 4. Stevanato Group 5. Vetter Pharma 6. Constantia Flexibles 7. SGD Pharma 8. Corning Inc. 9. Catalent, Inc. 10. AptarGroup, Inc.Frequently Asked Questions:

1. Which region has the largest share in the Global Pharmaceutical Packaging Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Pharmaceutical Packaging Market? Ans: The Global Pharmaceutical Packaging Market is growing at a CAGR of 20.2% during the forecasting period 2025-2032. 3. What is the scope of the Global Pharmaceutical Packaging Market report? Ans: The Global Pharmaceutical Packaging Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Pharmaceutical Packaging Market? Ans: The key players in the Global Pharmaceutical Packaging Market are Amcor plc, Berry Global Inc., AptarGroup, Inc.,West Pharmaceutical Services, Becton, Dickinson and Company (BD) and Others. 5. What is the study period of this Market? Ans: The Global Pharmaceutical Packaging Market is studied from 2024 to 2032.

1. Pharmaceutical Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Pharmaceutical Packaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Pharmaceutical Packaging Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Pharmaceutical Packaging Market: Dynamics 3.1. Pharmaceutical Packaging Market Trends by Region 3.1.1. North America Pharmaceutical Packaging Market Trends 3.1.2. Europe Pharmaceutical Packaging Market Trends 3.1.3. Asia Pacific Pharmaceutical Packaging Market Trends 3.1.4. Middle East and Africa Pharmaceutical Packaging Market Trends 3.1.5. South America Pharmaceutical Packaging Market Trends 3.2. Pharmaceutical Packaging Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Pharmaceutical Packaging Market Drivers 3.2.1.2. North America Pharmaceutical Packaging Market Restraints 3.2.1.3. North America Pharmaceutical Packaging Market Opportunities 3.2.1.4. North America Pharmaceutical Packaging Market Challenges 3.2.2. Europe 3.2.2.1. Europe Pharmaceutical Packaging Market Drivers 3.2.2.2. Europe Pharmaceutical Packaging Market Restraints 3.2.2.3. Europe Pharmaceutical Packaging Market Opportunities 3.2.2.4. Europe Pharmaceutical Packaging Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Pharmaceutical Packaging Market Drivers 3.2.3.2. Asia Pacific Pharmaceutical Packaging Market Restraints 3.2.3.3. Asia Pacific Pharmaceutical Packaging Market Opportunities 3.2.3.4. Asia Pacific Pharmaceutical Packaging Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Pharmaceutical Packaging Market Drivers 3.2.4.2. Middle East and Africa Pharmaceutical Packaging Market Restraints 3.2.4.3. Middle East and Africa Pharmaceutical Packaging Market Opportunities 3.2.4.4. Middle East and Africa Pharmaceutical Packaging Market Challenges 3.2.5. South America 3.2.5.1. South America Pharmaceutical Packaging Market Drivers 3.2.5.2. South America Pharmaceutical Packaging Market Restraints 3.2.5.3. South America Pharmaceutical Packaging Market Opportunities 3.2.5.4. South America Pharmaceutical Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Pharmaceutical Packaging Industry 3.8. Analysis of Government Schemes and Initiatives For Pharmaceutical Packaging Industry 3.9. Pharmaceutical Packaging Market Trade Analysis 3.10. The Global Pandemic Impact on Pharmaceutical Packaging Market 4. Pharmaceutical Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 4.1.1. Plastic & Polymers 4.1.2. Glass 4.1.3. Paper and paperboard 4.1.4. Others 4.2. Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 4.2.1. Bottles 4.2.2. Caps & Closures 4.2.3. Pre-Fillable Inhalers 4.2.4. Pre-Fillable Syringes 4.2.5. Vials & Ampoules 4.2.6. Blister Packs 4.2.7. Bags & Pouches 4.2.8. Jars & Canisters 4.2.9. Others 4.3. Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 4.3.1. Primary 4.3.2. Secondary 4.3.3. Tertiary 4.4. Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 4.4.1. Injectable Packaging 4.4.2. Oral Drug Delivery Packaging 4.4.3. Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging 4.4.4. Transdermal Drug Delivery Packaging 4.4.5. Ocular Drug & Nasal Drug Delivery Packaging 4.4.6. Others 4.5. Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 4.5.1. Pharmaceutical Manufacturing Companies 4.5.2. Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) 4.5.3. Hospitals & Clinics 4.5.4. Retail Pharmacies 4.5.5. Others 4.6. Pharmaceutical Packaging Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Pharmaceutical Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 5.1.1. Plastic & Polymers 5.1.2. Glass 5.1.3. Paper and paperboard 5.1.4. Others 5.2. North America Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 5.2.1. Bottles 5.2.2. Caps & Closures 5.2.3. Pre-Fillable Inhalers 5.2.4. Pre-Fillable Syringes 5.2.5. Vials & Ampoules 5.2.6. Blister Packs 5.2.7. Bags & Pouches 5.2.8. Jars & Canisters 5.2.9. Others 5.3. North America Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 5.3.1. Primary 5.3.2. Secondary 5.3.3. Tertiary 5.4. North America Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 5.4.1. Injectable Packaging 5.4.2. Oral Drug Delivery Packaging 5.4.3. Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging 5.4.4. Transdermal Drug Delivery Packaging 5.4.5. Ocular Drug & Nasal Drug Delivery Packaging 5.4.6. Others 5.5. North America Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 5.5.1. Pharmaceutical Manufacturing Companies 5.5.2. Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) 5.5.3. Hospitals & Clinics 5.5.4. Retail Pharmacies 5.5.5. Others 5.6. North America Pharmaceutical Packaging Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 5.6.1.1.1. Plastic & Polymers 5.6.1.1.2. Glass 5.6.1.1.3. Paper and paperboard 5.6.1.1.4. Others 5.6.1.2. United States Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 5.6.1.2.1. Bottles 5.6.1.2.2. Caps & Closures 5.6.1.2.3. Pre-Fillable Inhalers 5.6.1.2.4. Pre-Fillable Syringes 5.6.1.2.5. Vials & Ampoules 5.6.1.2.6. Blister Packs 5.6.1.2.7. Bags & Pouches 5.6.1.2.8. Jars & Canisters 5.6.1.2.9. Others 5.6.1.3. United States Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 5.6.1.3.1. Primary 5.6.1.3.2. Secondary 5.6.1.3.3. Tertiary 5.6.1.4. United States Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 5.6.1.4.1. Injectable Packaging 5.6.1.4.2. Oral Drug Delivery Packaging 5.6.1.4.3. Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging 5.6.1.4.4. Transdermal Drug Delivery Packaging 5.6.1.4.5. Ocular Drug & Nasal Drug Delivery Packaging 5.6.1.4.6. Others 5.6.1.5. United States Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. Pharmaceutical Manufacturing Companies 5.6.1.5.2. Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) 5.6.1.5.3. Hospitals & Clinics 5.6.1.5.4. Retail Pharmacies 5.6.1.5.5. Others 5.6.2. Canada 5.6.2.1. Canada Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 5.6.2.1.1. Plastic & Polymers 5.6.2.1.2. Glass 5.6.2.1.3. Paper and paperboard 5.6.2.1.4. Others 5.6.2.2. Canada Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 5.6.2.2.1. Bottles 5.6.2.2.2. Caps & Closures 5.6.2.2.3. Pre-Fillable Inhalers 5.6.2.2.4. Pre-Fillable Syringes 5.6.2.2.5. Vials & Ampoules 5.6.2.2.6. Blister Packs 5.6.2.2.7. Bags & Pouches 5.6.2.2.8. Jars & Canisters 5.6.2.2.9. Others 5.6.2.3. Canada Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 5.6.2.3.1. Primary 5.6.2.3.2. Secondary 5.6.2.3.3. Tertiary 5.6.2.4. Canada Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 5.6.2.4.1. Injectable Packaging 5.6.2.4.2. Oral Drug Delivery Packaging 5.6.2.4.3. Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging 5.6.2.4.4. Transdermal Drug Delivery Packaging 5.6.2.4.5. Ocular Drug & Nasal Drug Delivery Packaging 5.6.2.4.6. Others 5.6.2.5. Canada Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. Pharmaceutical Manufacturing Companies 5.6.2.5.2. Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) 5.6.2.5.3. Hospitals & Clinics 5.6.2.5.4. Retail Pharmacies 5.6.2.5.5. Others 5.6.3. Mexico 5.6.3.1. Mexico Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 5.6.3.1.1. Plastic & Polymers 5.6.3.1.2. Glass 5.6.3.1.3. Paper and paperboard 5.6.3.1.4. Others 5.6.3.2. Mexico Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 5.6.3.2.1. Bottles 5.6.3.2.2. Caps & Closures 5.6.3.2.3. Pre-Fillable Inhalers 5.6.3.2.4. Pre-Fillable Syringes 5.6.3.2.5. Vials & Ampoules 5.6.3.2.6. Blister Packs 5.6.3.2.7. Bags & Pouches 5.6.3.2.8. Jars & Canisters 5.6.3.2.9. Others 5.6.3.3. Mexico Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 5.6.3.3.1. Primary 5.6.3.3.2. Secondary 5.6.3.3.3. Tertiary 5.6.3.4. Mexico Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 5.6.3.4.1. Injectable Packaging 5.6.3.4.2. Oral Drug Delivery Packaging 5.6.3.4.3. Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging 5.6.3.4.4. Transdermal Drug Delivery Packaging 5.6.3.4.5. Ocular Drug & Nasal Drug Delivery Packaging 5.6.3.4.6. Others 5.6.3.5. Mexico Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. Pharmaceutical Manufacturing Companies 5.6.3.5.2. Contract Packaging Organizations (CPOs) Contract Manufacturing Organizations (CMOs) 5.6.3.5.3. Hospitals & Clinics 5.6.3.5.4. Retail Pharmacies 5.6.3.5.5. Others 6. Europe Pharmaceutical Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.2. Europe Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.3. Europe Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.4. Europe Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.5. Europe Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Pharmaceutical Packaging Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.1.2. United Kingdom Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.1.3. United Kingdom Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.1.4. United Kingdom Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.1.5. United Kingdom Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.2.2. France Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.2.3. France Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.2.4. France Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.2.5. France Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.3.2. Germany Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.3.3. Germany Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.3.4. Germany Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.3.5. Germany Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.4.2. Italy Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.4.3. Italy Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.4.4. Italy Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.4.5. Italy Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.5.2. Spain Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.5.3. Spain Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.5.4. Spain Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.5.5. Spain Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.6.2. Sweden Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.6.3. Sweden Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.6.4. Sweden Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.6.5. Sweden Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.7.2. Austria Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.7.3. Austria Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.7.4. Austria Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.7.5. Austria Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 6.6.8.2. Rest of Europe Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 6.6.8.3. Rest of Europe Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 6.6.8.4. Rest of Europe Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 6.6.8.5. Rest of Europe Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Pharmaceutical Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.2. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.4. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.5. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.1.2. China Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.1.3. China Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.1.4. China Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.1.5. China Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.2.2. S Korea Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.2.3. S Korea Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.2.4. S Korea Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.2.5. S Korea Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.3.2. Japan Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.3.3. Japan Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.3.4. Japan Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.3.5. Japan Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.4.2. India Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.4.3. India Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.4.4. India Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.4.5. India Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.5.2. Australia Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.5.3. Australia Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.5.4. Australia Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.5.5. Australia Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.6.2. Indonesia Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.6.3. Indonesia Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.6.4. Indonesia Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.6.5. Indonesia Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.7.2. Malaysia Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.7.3. Malaysia Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.7.4. Malaysia Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.7.5. Malaysia Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.8.2. Vietnam Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.8.3. Vietnam Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.8.4. Vietnam Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.8.5. Vietnam Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.9.2. Taiwan Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.9.3. Taiwan Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.9.4. Taiwan Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.9.5. Taiwan Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 7.6.10.2. Rest of Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 7.6.10.5. Rest of Asia Pacific Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 8.2. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 8.4. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 8.5. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Pharmaceutical Packaging Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 8.6.1.2. South Africa Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 8.6.1.3. South Africa Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 8.6.1.4. South Africa Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 8.6.1.5. South Africa Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 8.6.2.2. GCC Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 8.6.2.3. GCC Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 8.6.2.4. GCC Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 8.6.2.5. GCC Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 8.6.3.2. Nigeria Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 8.6.3.3. Nigeria Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 8.6.3.4. Nigeria Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 8.6.3.5. Nigeria Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 8.6.4.2. Rest of ME&A Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 8.6.4.3. Rest of ME&A Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 8.6.4.4. Rest of ME&A Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 8.6.4.5. Rest of ME&A Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 9. South America Pharmaceutical Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 9.2. South America Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 9.3. South America Pharmaceutical Packaging Market Size and Forecast, by Packaging Type(2024-2032) 9.4. South America Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 9.5. South America Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 9.6. South America Pharmaceutical Packaging Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 9.6.1.2. Brazil Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 9.6.1.3. Brazil Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 9.6.1.4. Brazil Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 9.6.1.5. Brazil Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 9.6.2.2. Argentina Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 9.6.2.3. Argentina Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 9.6.2.4. Argentina Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 9.6.2.5. Argentina Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Pharmaceutical Packaging Market Size and Forecast, by Material (2024-2032) 9.6.3.2. Rest Of South America Pharmaceutical Packaging Market Size and Forecast, by Type (2024-2032) 9.6.3.3. Rest Of South America Pharmaceutical Packaging Market Size and Forecast, by Packaging Type (2024-2032) 9.6.3.4. Rest Of South America Pharmaceutical Packaging Market Size and Forecast, by Drug Delivery Mode (2024-2032) 9.6.3.5. Rest Of South America Pharmaceutical Packaging Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Amcor plc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Berry Global Inc. 10.3. AptarGroup, Inc. 10.4. West Pharmaceutical Services, Inc. 10.5. Becton, Dickinson and Company (BD) 10.6. Corning Inc. 10.7. Catalent, Inc. 10.8. WestRock Company 10.9. Sonoco Products Co. 10.10. Winpak Ltd. 10.11. Gerresheimer AG 10.12. SCHOTT Pharma 10.13. Constantia Flexibles 10.14. Stevanato Group 10.15. Vetter Pharma 10.16. August Faller GmbH & Co. KG 10.17. Romaco Group 10.18. GEA Pharma Systems 10.19. Erweka GmbH 10.20. SGD Pharma 10.21. Piramal Glass Private Limited 10.22. Schott AG 10.23. Gerresheimer AG 10.24. Stevanato Group 10.25. Vetter Pharma 10.26. Constantia Flexibles 10.27. SGD Pharma 10.28. Corning Inc. 10.29. Catalent, Inc. 10.30. AptarGroup, Inc. 11. Key Findings 12. Industry Recommendations 13. Pharmaceutical Packaging Market: Research Methodology 14. Terms and Glossary