The Global Pest Control Market size was valued at USD 23.97 Bn in 2023 and is expected to reach USD 34.63 Bn by 2030, at a CAGR of 5.4 %.Pest Control Market Overview

Pest control encompasses the systematic management and prevention of pests, including insects, rodents, and other animals, to mitigate their potential damage to crops, structures, and various environments. A range of pest control strategies exists, incorporating both physical and chemical approaches. Physical methods involve actions such as the installation of traps and barriers, the removal or destruction of nests, the blocking of entry points like holes, windows, or doorways, as well as the implementation of temperature control measures to eliminate pests. The graphical representation and structural exclusive information showed the dominating region of the Pest Control Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Pest Control Market.To know about the Research Methodology :- Request Free Sample Report

Pest Control Market Dynamics

The expansion of the pest control market is fuelled by heightened consumer awareness regarding the importance of pest control services. This surge in awareness acts as a catalyst for insect pest control market growth, especially in emerging markets, where the demand for efficient pest control solutions is steadily increasing. Proof marketing strategies, which underscore the proven efficacy of pest control measures, play a pivotal role in augmenting this demand, providing companies with opportunities to establish a strong presence in the burgeoning target market for pest control. Within the broader pest control landscape, the termite control market emerges as a substantial growth opportunity. Escalating concerns related to termite infestations and a growing emphasis on preventive measures are driving the demand for termite control services. Companies are proactively exploring the Pest Control Market potential in the US, strategically positioning themselves to tap into markets such as India. The termite control segment serves as a crucial driver for sustained growth and expansion within the industry. Within the continuously expanding US pest control market, companies are strategically exploring avenues for growth, focusing particularly on entering the termite control sector. The target market for pest control services is undergoing a broadening phase, creating significant potential for market expansion. Implementing proof marketing strategies, which emphasize the efficacy of pest control services, plays a crucial role in influencing consumer decisions and establishing a strong presence in the competitive landscape. Within the broader pest control landscape, the termite control market emerges as a substantial growth opportunity. Escalating concerns related to termite infestations and a growing emphasis on preventive measures are driving the demand for termite control services. Companies are proactively exploring the Pest Control Market potential in the US, strategically positioning themselves to tap into markets such as India. The termite control segment serves as a crucial driver for sustained growth and expansion within the industry. Initiatives to penetrate the pest control market involve catering to the insect pest control segment and addressing the specific needs of the growing customer base by proof marketing pest control. Pest control companies, aware of the market potential in the US, are investing in efficient scheduling practices and technology-driven solutions. This includes the adoption of route scheduling software and GPS systems to optimize technician productivity, enabling them to serve a larger customer base and effectively penetrate new markets. Looking beyond the US, companies are actively considering international expansion, aiming for market share in European countries and seeking Pest Control Market growth in nations like Germany and Mexico. Establishing a presence in these markets demands a nuanced understanding of regional pest control dynamics, necessitating the tailoring of services to meet local demands. Pricing strategies, including competitive pest control services prices, are crucial to gaining traction in diverse markets. Pricing sensitivity in the provision of pest control services poses a delicate challenge in Pest Control Market. Despite the myriad of growth drivers and opportunities, the pest control market faces certain challenges and restraints. Notably, the pricing sensitivity in the provision of pest control services poses a delicate challenge. Striking a balance between offering competitive pest control services prices and maintaining profitability is crucial for market sustainability. Additionally, regulatory considerations and compliance with varying standards, particularly in European countries, present hurdles to seamless market penetration and expansion. Managing staff levels remains a critical consideration for pest control companies, particularly in addressing seasonal fluctuations in demand. To navigate this challenge, companies strategically hire part-time workers during peak periods while maintaining experienced technicians throughout the year to ensure expertise in pesticide application. The provision of annual pest control contracts emerges as a stabilizing factor, contributing to consistent cash flow and allowing firms to retain a permanent staff despite seasonal shifts in demand.Pest Control Market Segment Analysis

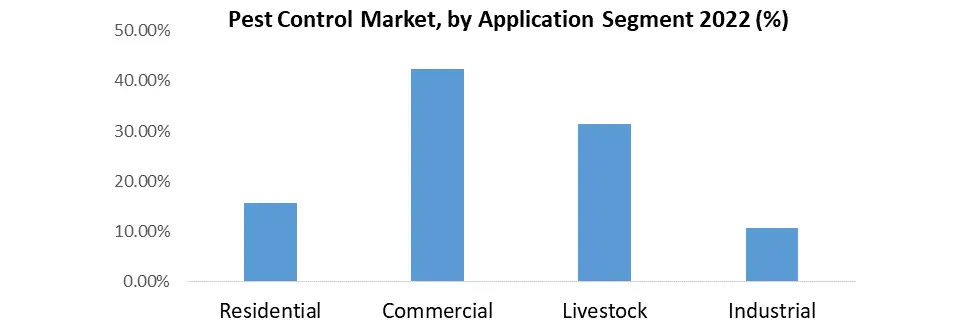

Technologies: Digital pest management stands out as the dominant force in the pest control market, driving substantial growth. The integration of digital hand-held devices, remote monitoring, online portals, and data analysis has proven robust and secure. This comprehensive approach responds effectively to consumer needs, achieving high levels of customer satisfaction. The real-time nature of digital pest management enhances its efficiency and efficacy. In the forecasted period, sterile insect techniques are gaining prominence in the market due to their environmentally friendly nature. This technique involves mass rearing and sterilization processes using radiation for target pests, followed by the systematic area-wide release of sterile males via air over defined regions. This method disrupts the breeding cycle, leading to a declining pest population. The eco-friendly aspects of sterile insect techniques align with the increasing emphasis on sustainable pest control practices. Additional technologies influencing the pest control market include Ultrasonic defence, Electronic Monitoring, Insect Light Traps, and Pheromones. These methods contribute to the diverse and evolving landscape of pest management, offering alternative and effective solutions tailored to different pest control needs.Pest Control Methods: Among pest control methods, digital and organic pest control methods are currently dominating the market. The advancement of technology has facilitated permanent pest elimination, with a particular focus on using organic and natural methods. Consumers prefer these methods due to their safety, ensuring the well-being of children, pets, and plants. The increasing adoption of digital and organic pest control methods reflects a growing awareness of the environmental and health impacts associated with chemical alternatives. While digital and organic methods lead the market, chemical, biological, and electronic pest control methods continue to play significant roles. The diversity in pest control methods allows for a tailored approach based on the severity of the infestation, environmental considerations, and consumer preferences. Technological advancements in electronic pest control contribute to its growing adoption as a viable and efficient method. Application and Pest Types: Pest control applications vary across residential, commercial, livestock, industrial, and other sectors. Homeowners, particularly concerned about pests like ants, spiders, mice, termites, and bedbugs, seek effective solutions. In the U.S., termites and mosquitoes pose significant threats, causing structural damage that can be expensive to repair. Pest control methods, including traps, cater to different settings, with advancements in digital technologies enhancing the effectiveness of newer generation traps. Traps remain one of the oldest yet effective methods of pest management. Various types of traps, such as glue traps, rat traps, mesh, mousetraps, cages, and snare traps, offer affordable and reusable options. While manual handling is common for most traps, the emergence of a new generation incorporating digital technologies signifies advancements in traditional pest management methods.

Pest Control Market Regional Analysis

In North America, the pest control market stands as a robust and well-established industry addressing a spectrum of pests including termites, mosquitoes, and rodents. The region witnesses a pronounced demand for pest control services, largely fuelled by stringent regulations governing public health and safety. Furthermore, a heightened environmental awareness is steering the adoption of sustainable and eco-friendly pest control solutions. The competitive landscape in this target market for pest control underscores a commitment to technological advancements, with a specific focus on integrated pest management strategies designed to tackle the evolving challenges effectively. The Asia Pacific pest control market is currently undergoing substantial growth, primarily propelled by rapid urbanization, increased population density, and evolving lifestyles. The densely populated urban areas within the region face significant pest threats, necessitating the implementation of effective pest control services. This dynamic market exhibits a harmonious blend of traditional and modern methods, with a discernible shift towards the adoption of professional pest management services. The competitive arena is marked by companies innovating to provide solutions aligned with the hygiene and disease prevention needs of the diverse population. The Asia Pacific region emerges as a burgeoning market with immense growth potential. Europe's pest control market strikes a delicate balance between stringent regulations and an escalating demand for sustainable pest management solutions. The adoption of integrated pest management practices is on the rise, particularly in urban settings grappling with challenges related to rodents and insects. There is a discernible demand for professional pest control services, showcasing a diverse array of methods encompassing advanced technologies and traditional approaches. Regulatory compliance and adherence to safety standards play a pivotal role in influencing the market dynamics, thus impacting Pest Control Market share in European countries. Latin America presents unique challenges in the market, attributed to its diverse ecosystems and varying climates. Both urban and agricultural settings contend with pest issues, and the demand for pest control services is particularly pronounced in agriculture-dependent economies. The region is undergoing increased urbanization, heightening awareness about health risks associated with pests. This has prompted a growing emphasis on integrated pest management and the adoption of advanced technologies. The Latin American market is evolving to meet distinctive challenges in both residential and commercial pest control domains. In the Middle East, the pest control market is shaped by arid climates and rapid urbanization, presenting unique challenges, including pest’s specific to deserts. This dynamic has driven the demand for pest-free environments, influenced by a focus on public health, stringent regulations, and the requirements of the hospitality industry. Pest control services in the Middle East seamlessly integrate technology-driven solutions to effectively address the region's environmental factors. The market in the Middle East showcases a harmonious blend of traditional and modern pest control methods to provide comprehensive solutions. The African pest control market reflects a rich diversity, mirroring the continent's varied ecosystems and economic conditions. Agriculture remains a significant driver of the demand for pest control services, especially in dealing with pests impacting crop yields. Urban areas in Africa focus on managing pests that pose health risks, contributing to a growing awareness of the importance of professional pest management services. Economic development, climate conditions, and public health concerns all contribute to shaping the regional dynamics of the pest control market in Africa.Pest Control Market Competitive Landscape

Terminix Global Holdings, Inc. (NYSE: TMX), a prominent provider of essential termite and pest management services for residential and commercial customers, announced that its shareholders have approved the merger agreement with Rentokil Initial plc. This strategic move positions Terminix as a key player in the pest control market. Terminix, headquartered in Memphis, Tenn., offers comprehensive pest management services, safeguarding against termites, mosquitoes, rodents, and other pests. With over 11,500 employees and 2.9 million customers across 24 countries and territories, the company conducts visits to more than 50,000 homes and businesses daily, reinforcing its significant presence in the global market. Rentokil Initial plc and Terminix Global Holdings, Inc. have entered into a definitive agreement for Rentokil Initial to acquire Terminix for a combination of stock and cash. This transaction, creating the Combined Group, positions the entities as the global leaders in both pest control and hygiene & wellbeing. Furthermore, it solidifies their position as the leading force in the pest control business within North America, the largest pest control market globally. This acquisition underscores the commitment of both companies to elevate their presence and influence in the pest control market, serving as a strategic move in response to the evolving needs of customers worldwide. As part of the Agreement, Rentokil Initial will issue approximately 643.29 million new shares (equivalent to around 128.66 million American depository shares) and provide US$1.3 billion in cash to Terminix shareholders at the closing. The total consideration values Terminix at US$6.7 billion, reflecting a share capital of US$55.00 per Terminix common stock. This mix comprises 80% stock and 20% cash, demonstrating Rentokil Initial's commitment to ensuring a balanced and strategic approach to the acquisition. The terms of this Agreement highlight the significance of the pest control market and the potential for growth and synergy in this dynamic industry.Pest Control Market Scope: Inquiry Before Buying

Pest Control Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.97 Bn. Forecast Period 2024 to 2030 CAGR: 5.4% Market Size in 2030: US $ 34.63 Bn. Segments Covered: by Technologies Digital pest management Sterile insect techniques Ultrasonic defence Electronic Monitoring Insect Light Traps Pheromones by Pest Control Methods Organic Pest Control Chemical Pest Control Biological pest control Electronic pest control Hygiene pest control Electronic pest by Application and Pest Types Residential Commercial Livestock Industrial Others Pest Control Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pest Control Market Key Players

1. The Terminix International Company (U.S.) 2. FMC Corporation (U.S.) 3. Ratsense (U.S.) 4. PelGar International (U.S.) 5. Brandenburg (U.S.) 6. Adam’s Pest Control (U.S.) 7. Woodstream Corporation (U.S.) 8. JT Eaton & Co. Inc. (U.S.) 9. V3 Smart Technologies (U.S.) 10. Rollins Inc. (U.S.) 11. Bell Laboratories Inc (U.S.) 12. Corteva Agriscience (U.S.) 13. Ecolab Inc. (U.S.) 14. Rentokil (U.K.) 15. Rentokil Initial plc (U.K.) 16. ICB pharma (Germany) 17. BASF SE (Germany) 18. Bayer Crop Science (Germany) 19. Anticimex (Sweden) 20. Sumitomo Chemical Co. Ltd. (Japan) 21. Adama ( Israel)Frequently Asked Questions

1. What is the Pest Control Market? Ans: The Pest Control Market refers to the industry involved in the management and transportation of goods and services, encompassing processes such as warehousing, distribution, and supply chain management. 2. What Drives Growth in the Pest Control Market? Ans: Growth in the Pest Control Market is primarily driven by factors like globalization, e-commerce expansion, technological advancements, and supply chain optimization. 3. Which Regions Exhibit High Pest Control Market Growth? Ans: Regions like the United States, India, China, Germany, and certain parts of Europe show significant growth in the Pest Control Market. 4. What Are Key Players in the Pest Control Market? Ans: Key players includeThe Terminix International Company, FMC Corporation, BASF SE, and other global logistics and transportation companies. 5. What Are the Major Challenges in the Pest Control Market? Ans: Challenges include logistical inefficiencies, environmental concerns, geopolitical issues, and regulatory complexities, which require innovative solutions for market growth.

1. Pest Control Market: Research Methodology 2. Pest Control Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Pest Control Market: Dynamics 3.1 Pest Control Market Trends by Region 3.1.1 Global Pest Control Market Trends 3.1.2 North America Pest Control Market Trends 3.1.3 Europe Pest Control Market Trends 3.1.4 Asia Pacific Pest Control Market Trends 3.1.5 Middle East and Africa Pest Control Market Trends 3.1.6 South America Pest Control Market Trends 3.2 Pest Control Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Pest Control Market Drivers 3.2.1.2 North America Pest Control Market Restraints 3.2.1.3 North America Pest Control Market Opportunities 3.2.1.4 North America Pest Control Market Challenges 3.2.2 Europe 3.2.2.1 Europe Pest Control Market Drivers 3.2.2.2 Europe Pest Control Market Restraints 3.2.2.3 Europe Pest Control Market Opportunities 3.2.2.4 Europe Pest Control Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Pest Control Market Market Drivers 3.2.3.2 Asia Pacific Pest Control Market Restraints 3.2.3.3 Asia Pacific Pest Control Market Opportunities 3.2.3.4 Asia Pacific Pest Control Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Pest Control Market Drivers 3.2.4.2 Middle East and Africa Pest Control Market Restraints 3.2.4.3 Middle East and Africa Pest Control Market Opportunities 3.2.4.4 Middle East and Africa Pest Control Market Challenges 3.2.5 South America 3.2.5.1 South America Pest Control Market Drivers 3.2.5.2 South America Pest Control Market Restraints 3.2.5.3 South America Pest Control Market Opportunities 3.2.5.4 South America Pest Control Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Pest Control Industry 3.8 The Global Pandemic and Redefining of The Pest Control Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Pest Control Trade Analysis (2017-2023) 3.11.1 Global Import of Pest Control 3.11.2 Global Export of Pest Control 3.12 Global Pest Control Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Pest Control Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Pest Control Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Pest Control Market Size and Forecast, by Technologies (2023-2030) 4.1.1 Digital pest management 4.1.2 Sterile insect techniques 4.1.3 Ultrasonic defence 4.1.4 Electronic Monitoring 4.1.5 Insect Light Traps 4.1.6 Pheromones 4.2 Global Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 4.2.1 Organic Pest Control 4.2.2 Chemical Pest Control 4.2.3 Biological pest control 4.2.4 Electronic pest control 4.2.5 Hygiene pest control 4.2.6 Electronic pest 4.3 Global Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 4.3.1 Residential 4.3.2 Commercial 4.3.3 Livestock 4.3.4 Industrial 4.3.5 Others 4.4 Global Pest Control Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Pest Control Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Pest Control Market Size and Forecast, by Technologies (2023-2030) 5.1.1 Digital pest management 5.1.2 Sterile insect techniques 5.1.3 Ultrasonic defence 5.1.4 Electronic Monitoring 5.1.5 Insect Light Traps 5.1.6 Pheromones 5.2 North America Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 5.2.1 Organic Pest Control 5.2.2 Chemical Pest Control 5.2.3 Biological pest control 5.2.4 Electronic pest control 5.2.5 Hygiene pest control 5.2.6 Electronic pest 5.3 North America Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 5.3.1 Residential 5.3.2 Commercial 5.3.3 Livestock 5.3.4 Industrial 5.3.5 Others 5.4 North America Pest Control Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Pest Control Market Size and Forecast, by Technologies (2023-2030) 5.4.1.1.1 Digital pest management 5.4.1.1.2 Sterile insect techniques 5.4.1.1.3 Ultrasonic defence 5.4.1.1.4 Electronic Monitoring 5.4.1.1.5 Insect Light Traps 5.4.1.1.6 Pheromones 5.4.1.2 United States Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 5.4.1.2.1 Organic Pest Control 5.4.1.2.2 Chemical Pest Control 5.4.1.2.3 Biological pest control 5.4.1.2.4 Electronic pest control 5.4.1.2.5 Hygiene pest control 5.4.1.2.6 Electronic pest 5.4.1.3 United States Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 5.4.1.3.1 Residential 5.4.1.3.2 Commercial 5.4.1.3.3 Livestock 5.4.1.3.4 Industrial 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Pest Control Market Size and Forecast, by Technologies (2023-2030) 5.4.2.1.1 Digital pest management 5.4.2.1.2 Sterile insect techniques 5.4.2.1.3 Ultrasonic defence 5.4.2.1.4 Electronic Monitoring 5.4.2.1.5 Insect Light Traps 5.4.2.1.6 Pheromones 5.4.2.2 Canada Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 5.4.2.2.1 Organic Pest Control 5.4.2.2.2 Chemical Pest Control 5.4.2.2.3 Biological pest control 5.4.2.2.4 Electronic pest control 5.4.2.2.5 Hygiene pest control 5.4.2.2.6 Electronic pest 5.4.2.3 Canada Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 5.4.2.3.1 Residential 5.4.2.3.2 Commercial 5.4.2.3.3 Livestock 5.4.2.3.4 Industrial 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Pest Control Market Size and Forecast, by Technologies (2023-2030) 5.4.3.1.1 Digital pest management 5.4.3.1.2 Sterile insect techniques 5.4.3.1.3 Ultrasonic defence 5.4.3.1.4 Electronic Monitoring 5.4.3.1.5 Insect Light Traps 5.4.3.1.6 Pheromones 5.4.3.2 Mexico Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 5.4.3.2.1 Organic Pest Control 5.4.3.2.2 Chemical Pest Control 5.4.3.2.3 Biological pest control 5.4.3.2.4 Electronic pest control 5.4.3.2.5 Hygiene pest control 5.4.3.2.6 Electronic pest 5.4.3.3 Mexico Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 5.4.3.3.1 Residential 5.4.3.3.2 Commercial 5.4.3.3.3 Livestock 5.4.3.3.4 Industrial 5.4.3.3.5 Others 6. Europe Pest Control Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.2 Europe Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.3 Europe Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4 Europe Pest Control Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.1.2 United Kingdom Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.1.3 United Kingdom Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.2 France 6.4.2.1 France Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.2.2 France Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.2.3 France Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.3.2 Germany Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.3.3 Germany Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.4.2 Italy Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.4.3 Italy Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.5.2 Spain Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.5.3 Spain Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.6.2 Sweden Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.6.3 Sweden Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.7.2 Austria Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 6.4.7.3 Austria Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Pest Control Market Size and Forecast, by Technologies (2023-2030) 6.4.8.2 Rest of Europe Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030). 6.4.8.3 Rest of Europe Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7. Asia Pacific Pest Control Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.2 Asia Pacific Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.3 Asia Pacific Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4 Asia Pacific Pest Control Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.1.2 China Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.1.3 China Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.2.2 S Korea Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.2.3 S Korea Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.3.2 Japan Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.3.3 Japan Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.4 India 7.4.4.1 India Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.4.2 India Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.4.3 India Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.5.2 Australia Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.5.3 Australia Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.6.2 Indonesia Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.6.3 Indonesia Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.7.2 Malaysia Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.7.3 Malaysia Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.8.2 Vietnam Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.8.3 Vietnam Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.9.2 Taiwan Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.9.3 Taiwan Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.10.2 Bangladesh Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.10.3 Bangladesh Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.11.2 Pakistan Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.11.3 Pakistan Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Pest Control Market Size and Forecast, by Technologies (2023-2030) 7.4.12.2 Rest of Asia PacificPest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 7.4.12.3 Rest of Asia Pacific Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8. Middle East and Africa Pest Control Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.2 Middle East and Africa Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.3 Middle East and Africa Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8.4 Middle East and Africa Pest Control Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.4.1.2 South Africa Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.4.1.3 South Africa Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.4.2.2 GCC Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.4.2.3 GCC Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.4.3.2 Egypt Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.4.3.3 Egypt Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.4.4.2 Nigeria Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.4.4.3 Nigeria Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Pest Control Market Size and Forecast, by Technologies (2023-2030) 8.4.5.2 Rest of ME&A Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 8.4.5.3 Rest of ME&A Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 9. South America Pest Control Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Pest Control Market Size and Forecast, by Technologies (2023-2030) 9.2 South America Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 9.3 South America Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 9.4 South America Pest Control Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Pest Control Market Size and Forecast, by Technologies (2023-2030) 9.4.1.2 Brazil Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 9.4.1.3 Brazil Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Pest Control Market Size and Forecast, by Technologies (2023-2030) 9.4.2.2 Argentina Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 9.4.2.3 Argentina Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Pest Control Market Size and Forecast, by Technologies (2023-2030) 9.4.3.2 Rest Of South America Pest Control Market Size and Forecast, by Pest Control Methods (2023-2030) 9.4.3.3 Rest Of South America Pest Control Market Size and Forecast, by Application and Pest Types (2023-2030) 10. Global Pest Control Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Isobutyric Acid Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 The Terminix International Company (U.S.) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 FMC Corporation (U.S.) 11.3 Ratsense (U.S.) 11.4 PelGar International (U.S.) 11.5 Brandenburg (U.S.) 11.6 Adam’s Pest Control (U.S.) 11.7 Woodstream Corporation (U.S.) 11.8 JT Eaton & Co. Inc. (U.S.) 11.9 V3 Smart Technologies (U.S.) 11.10 Rollins Inc. (U.S.) 11.11 Bell Laboratories Inc (U.S.) 11.12 Corteva Agriscience (U.S.) 11.13 Ecolab Inc. (U.S.) 11.14 Rentokil (U.K.) 11.15 Rentokil Initial plc (U.K.) 11.16 ICB pharma (Germany) 11.17 BASF SE (Germany) 11.18 Bayer Crop Science (Germany) 11.19 Anticimex (Sweden) 11.20 Sumitomo Chemical Co. Ltd. (Japan) 11.21 Adama ( Israel) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary