The Peracetic Acid Market size was valued at USD 1.02 Billion in 2024 and is expected to reach USD 2.07 Billion by 2032, at a CAGR of 9.2%.Peracetic Acid Market Overview

Peracetic acid, a strong oxidizing agent, is widely valued for its broad-spectrum efficacy against bacteria, fungi, spores, and viruses, coupled with the unique advantage of decomposing into harmless byproducts such as water, oxygen, and acetic acid, making it a safer alternative to chlorine-based disinfectants. Its applications span diverse sectors, including food and beverage, healthcare, water treatment, pulp and paper, commercial laundry, and veterinary hygiene, where stringent hygiene standards and regulatory frameworks drive Peracetic Acid Market demand. In the food and beverage industry, PAA plays a crucial role in sterilizing packaging, processing equipment, and beverage production lines, ensuring product safety and extended shelf life. In healthcare, it is extensively used for hospital sterilization and is rapidly penetrating specialized areas such as dialysis centers, dental sterilization, and ophthalmology, creating demand for ultra-pure formulations.To know about the Research Methodology :- Request Free Sample Report The pulp and paper sector relies on PAA for eco-friendly bleaching processes, while municipal and industrial wastewater treatment plants benefit from its strong disinfecting capabilities without generating harmful residues. Europe dominates the Peracetic Acid Market due to strict EU regulations promoting sustainable and safe disinfectants, along with strong institutional frameworks provided by organizations such as PAA Europe under CEFIC. North America follows with its advanced healthcare and food industries, while Asia-Pacific is emerging as a high-growth market driven by rapid industrialization, urbanization, and growing food safety awareness.

Peracetic Acid Market Dynamics

Increasing Demand in the Food & Beverage Industry to Drive Peracetic Acid Market Growth The rapid rise in global population, urbanization, and changing lifestyles, consumer preferences toward packaged, ready-to-eat, and convenience foods, which require stringent sterilization and disinfection solutions during processing and packaging. In the Peracetic Acid Market, the chemical plays a critical role in sterilizing food-contact surfaces, equipment, and packaging materials, ensuring safety and extending shelf life without leaving toxic residues. Peracetic Acid exhibits superior performance compared to other biocides, offering long shelf life, high oxidative strength, slow thermal degradation, and excellent antimicrobial efficacy, which make it particularly valuable in the beverage industry for applications such as sterilizing soft drink bottles, dairy equipment, and brewing systems. The growing awareness about foodborne illnesses and stringent government regulations mandating hygienic food processing practices are accelerating its adoption across both developed and emerging economies. For instance, the increasing demand for processed dairy, meat, poultry, and packaged beverages in fast-growing markets such as India, China, and Brazil is significantly boosting the consumption of peracetic acid in food sterilization and preservation. High Cost and Limited Awareness to restrain Peracetic Acid Market Growth Peracetic acid, though highly effective, is relatively more expensive than widely available alternatives such as hydrogen peroxide, chlorine, sodium hypochlorite, and calcium hypochlorite, which continue to dominate cost-sensitive markets, especially in developing regions. The price difference deters small- and medium-scale industries from adopting peracetic acid, which hampers the Peracetic Acid Market. The limited awareness about the unique benefits of peracetic acid, such as residue-free sterilization, effectiveness against a wide spectrum of microorganisms, and environmental safety, restricts its penetration in industries where traditional disinfectants are already well established. This challenge is compounded by the need for specialized handling and storage, as PAA is highly corrosive and unstable under improper conditions, which adds to operational costs.Peracetic Acid Market Segment Analysis

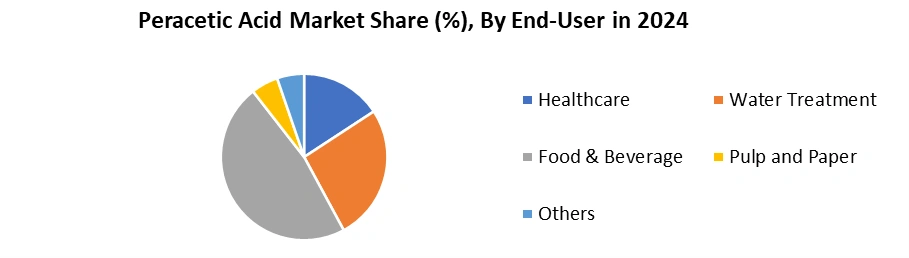

Based on Application, the market is segmented into disinfectants, sterilants, sanitizers, and others. The disinfectant dominated the Peracetic Acid Market share in 2024. The rising need for stringent hygiene standards in healthcare facilities, water treatment plants, and food processing industries has amplified the use of peracetic acid as a disinfectant. The ability to effectively destroy bacteria, fungi, spores, and viruses, making it highly reliable for high-purity water treatment processes that are crucial in medical device manufacturing. Its wide application in poultry processing plants and food processing services is also fueling demand, as it ensures microbial safety and extends the shelf life of consumables without leaving toxic residues. For instance, according to the China Food Industry (CFI), in 2024, more than 1,500 tonnes of fresh and packaged food, along with nearly 1.8 billion bottles of disinfectant solution, were sold, showcasing the growing reliance on safe disinfectant solutions like peracetic acid. The environmental friendliness and quick decomposition into non-toxic byproducts such as acetic acid, oxygen, and water give it a competitive edge over chlorine-based disinfectants. The global push for safe, sustainable, and effective disinfection solutions, particularly after the COVID-19 pandemic, has further accelerated their adoption. The chemical’s application as a disinfectant in wastewater treatment plants, breweries, and dairy farms is rising. This versatility, coupled with its regulatory approval by agencies such as the U.S. FDA and EPA for use in food and healthcare applications, drives the Peracetic Acid Market growth. Based on the End User, the Peracetic Acid Market is segmented into Healthcare, Water Treatment, Food & Beverage, Pulp and paper, and others. The Food & Beverage segment held the largest Peracetic Acid Market share in 2024. The increasing adoption of peracetic acid in this sector is due to its role as a powerful antimicrobial agent that provides effective sterilization without compromising food quality or safety. It is widely used in beverage bottling plants, dairy facilities, breweries, and meat processing units for sterilizing equipment, packaging materials, and food-contact surfaces. It leaves no harmful residues, making it an environmentally friendly and consumer-safe option, unlike chlorine-based chemicals. Food packaging is sterilized with peracetic acid solutions to ensure beverages and edible products remain uncontaminated during production and storage, thereby supporting food safety regulations and standards set by global authorities. The chemical’s ability to meet strict hygiene requirements, coupled with its biodegradable nature, has made it the preferred choice for multinational food and beverage producers seeking to balance consumer safety with sustainability commitments. The increasing consumer demand for packaged and processed foods across emerging economies such as India, China, and Brazil has amplified the need for effective sterilization solutions, boosting the Peracetic Acid Market.

Peracetic Acid Market Regional Insights

Europe dominated the Peracetic Acid Market in 2024 and is expected to continue its dominance over the forecast period. Within Europe, PAA Europe, the dedicated sector group of the European Chemical Industry Council (CEFIC), plays a pivotal role in shaping industry practices, ensuring compliance with European Union (EU) chemical safety standards, and promoting safe, sustainable applications of peracetic acid. PAA is widely used across multiple industries in Europe owing to its status as a broad-spectrum biocide capable of effectively neutralizing bacteria, fungi, spores, and viruses without leaving harmful residues, making it highly aligned with the EU’s stringent health, safety, and environmental protection directives. Its versatility has driven large-scale adoption in commercial laundry services, the food and beverage industry, veterinary hygiene, pulp and paper manufacturing, hospital hygiene, and water and wastewater treatment facilities, all of which are highly regulated sectors in the region. In food and drinks, for instance, PAA is employed for packaging sterilization and beverage plant disinfection, supporting the EU’s food safety standards, while in hospitals, its rapid disinfection capability provides critical infection control. The Peracetic Acid Market in the region is supported by the advanced pulp and paper sector, which uses peracetic acid for bleaching as it offers an eco-friendlier alternative to chlorine-based agents. The EU’s Green Deal and its emphasis on environmentally friendly chemicals boost the adoption of PAA as it decomposes into harmless byproducts, acetic acid, oxygen, and water, reducing ecological risks. Commercial formulations in Europe typically range from below 0.1% to 40% PAA concentration, with strict guidelines around safe handling due to its oxidizing and corrosive nature. European authorities mandate precautions such as preventing contamination with metals or incompatible chemicals, avoiding confinement in sealed systems due to oxygen release, and enforcing strict personal protective equipment (PPE) standards for workers, ensuring safe use. Peracetic Acid Market Competitive Landscape The Peracetic Acid Market is Competitive globally and fragmented within regions. Competitors span integrated peroxide manufacturers, application-focused formulators, and numerous local blenders and distributors. Demand concentrates in food and beverage sanitation, municipal and industrial water treatment, healthcare sterilization, pulp and paper, and agriculture. Because PAA is synthesized from hydrogen peroxide and acetic acid, producers with upstream peroxide capacity, proven process safety, and robust distribution enjoy structural cost and reliability advantages, especially in high-purity and stabilized grades. Global leaders include Evonik and Solvay, leveraging multi-plant hydrogen peroxide networks, mature safety systems, and strong technical service to supply high-purity, stabilized, and tailor-made concentrations. Mitsubishi Gas Chemical and other Asian producers compete on consistency and regionally optimized packaging and logistics. These companies emphasize compliance with biocidal regulations, tight stability specifications, and turnkey dosing and monitoring solutions for high-stakes uses that require validated microbiological performance and strict impurity control. Peracetic Acid Market Recent Developments • Evonik Industries AG – December 15, 2023: On December 15, 2023, Evonik Industries AG announced the complete acquisition of Thai Peroxide Co., Ltd., which was previously a joint venture. This strategic move significantly strengthens Evonik’s presence in the Asia-Pacific region by expanding its hydrogen peroxide and Peracetic Acid (PAA) production capabilities. The acquisition enables Evonik to meet growing demand in water treatment, food safety, and healthcare applications, where peracetic acid is widely used as a disinfectant and sterilant. • Enviro Tech Chemical Services, Inc. – March 31, 2023: At the Texas Water 2023 Conference held April 11–14, 2023, Enviro Tech Chemical Services, Inc. showcased its advanced 15% and 22% peracetic acid formulations designed for municipal wastewater disinfection. These solutions, marketed under the Peragreen WW line, emphasize enhanced pathogen reduction while minimizing overall chemical usage. The technology was presented as a sustainable alternative to chlorine, offering improved safety, environmental compatibility, and effectiveness against a broad range of microorganisms. Enviro Tech highlighted how peracetic acid can help utilities achieve stricter regulatory compliance for effluent discharge, reduce harmful byproducts, and promote cost efficiency. • Enviro Tech Chemical Services, Inc. – March 11, 2025: On March 11, 2025, Enviro Tech received EPA approval for a label amendment for its PeraGuard AH, a 15% peracetic acid antimicrobial formulation. This update officially authorizes its use for disinfecting against avian influenza (HPAI) on poultry farms, a breakthrough for agricultural biosecurity. The approval allows poultry producers to adopt peracetic acid as a safer and more effective alternative to conventional disinfectants, supporting disease prevention and flock health. PeraGuard AH is marketed as easy to apply, environmentally friendly, and highly effective against viruses and bacteria. Peracetic Acid Market Key Trends

Key Trend Description Industry Impact Integration of IoT & AI in PAA Dosing Systems Industrial users in dairy processing, breweries, and municipal utilities are adopting smart dosing systems equipped with real-time sensors, AI-driven flow optimization, and predictive maintenance. Enhances operational efficiency, reduces chemical wastage, ensures consistent sterilization, and supports sustainable industrial practices. On-site Peracetic Acid Generation Units To mitigate transportation and storage risks of high-concentration PAA, industries in Africa, Southeast Asia, and Latin America are adopting localized modular PAA generation systems derived from H₂O₂ and acetic acid. Provides fresh and consistent PAA supply, lowers logistics costs, reduces safety risks, and strengthens supply chain resilience in emerging markets. Healthcare Expansion into Micro-Specialties Beyond hospitals, PAA demand is rising in dialysis centers, dental sterilizers, and ophthalmology units, requiring ultra-pure, residue-free “ultra-grade PAA” formulations. Creates high-margin niche opportunities, drives innovation in healthcare sterilization, and accelerates adoption in advanced medical facilities. Peracetic Acid Industry Ecosystem

Global Peracetic Acid Market Scope: Inquiry Before Buying

Global Peracetic Acid Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.02 Bn. Forecast Period 2025 to 2032 CAGR: 9.2% Market Size in 2032: USD 2.07 Bn. Segments Covered: by Product Form Liquid Solutions Powder/Granules Aqueous Blends Others by Grade Less than 5% Grade 5%-15% Grade Greater than 15% Grade by Application Disinfectant Sterilant Sanitizer Others by End-User Healthcare Water treatment Food & Beverage Pulp and paper Others Global Peracetic Acid Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Peracetic Acid Market, Key Players

North America 1. PeroxyChem LLC (United States) 2. Enviro Tech Chemical Services, Inc. (United States) 3. FMC Corporation (United States) 4. Shepherd Chemical Company (United States) 5. Ecolab Inc. (United States) 6. Biosan LLC (United States) 7. AquaBond Inc. (United States) Europe 8. Solvay S.A. (Belgium) 9. Evonik Industries AG (Germany) 10. Kemira Oyj (Finland) 11. Christeyns NV (Belgium) 12. Promox S.p.A. (Italy) 13. Airedale Chemical Company Ltd (United Kingdom) 14. Lenntech B.V. (Netherlands) Asia Pacific 15. Mitsubishi Gas Chemical Company Inc. (Japan) 16. Aditya Birla Chemicals (India) 17. National Peroxide Ltd. (India) 18. JINKE Company Limited (China) 19. Shandong Huatai Interox Chemical Co., Ltd. (China) 20. Hebei Kangtai Chemical Co., Ltd. (China) Middle East & Africa 21. Middle East Chemicals Company (Saudi Arabia) 22. National Detergent Company SAOG (Oman) 23. African Chemicals Ltd. (South Africa) 24. Delta Chemicals (Egypt) South America 25. Quimica Anastacio S/A (Brazil) 26. Peróxidos do Brasil Ltda (Brazil) 27. Oxiteno S.A. (Brazil)FAQ:

1] What are the major Key players in the Peracetic Acid Market? Ans. The top companies in the Peracetic Acid Market are Solvay S.A., Evonik Industries AG, PeroxyChem LLC, Mitsubishi Gas Chemical Company Inc., Enviro Tech Chemical Services Inc., Kemira Oyj, FMC Corporation, and Aditya Birla Chemicals. 2] Which region has the largest share in the Peracetic Acid Market? Ans. The Europe region held the largest Peracetic Acid Market share in 2024. 3] What is the market size of the Peracetic Acid Market by 2032? Ans. The market size of the Peracetic Acid Market by 2032 is expected to reach USD 2.07 billion. 4] What is covered in the Peracetic Acid Market report? Ans. The Global Peracetic Acid Market (AMS) report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 5] What was the market size of the Peracetic Acid Market in 2024? Ans. The market size of the Peracetic Acid Market in 2024 was valued at USD 1.02 billion.

1. Peracetic Acid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Peracetic Acid Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Peracetic Acid Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Peracetic Acid Market: Dynamics 3.1. Peracetic Acid Market Trends by Region 3.1.1. North America Peracetic Acid Market Trends 3.1.2. Europe Peracetic Acid Market Trends 3.1.3. Asia Pacific Peracetic Acid Market Trends 3.1.4. Middle East and Africa Peracetic Acid Market Trends 3.1.5. South America Peracetic Acid Market Trends 3.2. Peracetic Acid Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Peracetic Acid Market Drivers 3.2.1.2. North America Peracetic Acid Market Restraints 3.2.1.3. North America Peracetic Acid Market Opportunities 3.2.1.4. North America Peracetic Acid Market Challenges 3.2.2. Europe 3.2.2.1. Europe Peracetic Acid Market Drivers 3.2.2.2. Europe Peracetic Acid Market Restraints 3.2.2.3. Europe Peracetic Acid Market Opportunities 3.2.2.4. Europe Peracetic Acid Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Peracetic Acid Market Drivers 3.2.3.2. Asia Pacific Peracetic Acid Market Restraints 3.2.3.3. Asia Pacific Peracetic Acid Market Opportunities 3.2.3.4. Asia Pacific Peracetic Acid Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Peracetic Acid Market Drivers 3.2.4.2. Middle East and Africa Peracetic Acid Market Restraints 3.2.4.3. Middle East and Africa Peracetic Acid Market Opportunities 3.2.4.4. Middle East and Africa Peracetic Acid Market Challenges 3.2.5. South America 3.2.5.1. South America Peracetic Acid Market Drivers 3.2.5.2. South America Peracetic Acid Market Restraints 3.2.5.3. South America Peracetic Acid Market Opportunities 3.2.5.4. South America Peracetic Acid Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Peracetic Acid Industry 3.8. Analysis of Government Schemes and Initiatives For Peracetic Acid Industry 3.9. Peracetic Acid Market Trade Analysis 3.10. The Global Pandemic Impact on Peracetic Acid Market 4. Peracetic Acid Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 4.1.1. Liquid Solutions 4.1.2. Powder/Granules 4.1.3. Aqueous Blends 4.1.4. Others 4.2. Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 4.2.1. Less than 5% Grade 4.2.2. 5%-15% Grade 4.2.3. Greater than 15% Grade 4.3. Peracetic Acid Market Size and Forecast, by Application (2024-2032) 4.3.1. Disinfectant 4.3.2. Sterilant 4.3.3. Sanitizer 4.3.4. Others 4.4. Peracetic Acid Market Size and Forecast, by End User (2024-2032) 4.4.1. Healthcare 4.4.2. Water treatment 4.4.3. Food & Beverage 4.4.4. Pulp and paper 4.4.5. Others 4.5. Peracetic Acid Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Peracetic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 5.1.1. Liquid Solutions 5.1.2. Powder/Granules 5.1.3. Aqueous Blends 5.1.4. Others 5.2. North America Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 5.2.1. Less than 5% Grade 5.2.2. 5%-15% Grade 5.2.3. Greater than 15% Grade 5.3. North America Peracetic Acid Market Size and Forecast, by Application (2024-2032) 5.3.1. Disinfectant 5.3.2. Sterilant 5.3.3. Sanitizer 5.3.4. Others 5.4. North America Peracetic Acid Market Size and Forecast, by End User (2024-2032) 5.4.1. Healthcare 5.4.2. Water treatment 5.4.3. Food & Beverage 5.4.4. Pulp and paper 5.4.5. Others 5.5. North America Peracetic Acid Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 5.5.1.1.1. Liquid Solutions 5.5.1.1.2. Powder/Granules 5.5.1.1.3. Aqueous Blends 5.5.1.1.4. Others 5.5.1.2. United States Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 5.5.1.2.1. Less than 5% Grade 5.5.1.2.2. 5%-15% Grade 5.5.1.2.3. Greater than 15% Grade 5.5.1.3. United States Peracetic Acid Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Disinfectant 5.5.1.3.2. Sterilant 5.5.1.3.3. Sanitizer 5.5.1.3.4. Others 5.5.1.4. United States Peracetic Acid Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Healthcare 5.5.1.4.2. Water treatment 5.5.1.4.3. Food & Beverage 5.5.1.4.4. Pulp and paper 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 5.5.2.1.1. Liquid Solutions 5.5.2.1.2. Powder/Granules 5.5.2.1.3. Aqueous Blends 5.5.2.1.4. Others 5.5.2.2. Canada Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 5.5.2.2.1. Less than 5% Grade 5.5.2.2.2. 5%-15% Grade 5.5.2.2.3. Greater than 15% Grade 5.5.2.3. Canada Peracetic Acid Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Disinfectant 5.5.2.3.2. Sterilant 5.5.2.3.3. Sanitizer 5.5.2.3.4. Others 5.5.2.4. Canada Peracetic Acid Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Healthcare 5.5.2.4.2. Water treatment 5.5.2.4.3. Food & Beverage 5.5.2.4.4. Pulp and paper 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 5.5.3.1.1. Liquid Solutions 5.5.3.1.2. Powder/Granules 5.5.3.1.3. Aqueous Blends 5.5.3.1.4. Others 5.5.3.2. Mexico Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 5.5.3.2.1. Less than 5% Grade 5.5.3.2.2. 5%-15% Grade 5.5.3.2.3. Greater than 15% Grade 5.5.3.3. Mexico Peracetic Acid Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Disinfectant 5.5.3.3.2. Sterilant 5.5.3.3.3. Sanitizer 5.5.3.3.4. Others 5.5.3.4. Mexico Peracetic Acid Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Healthcare 5.5.3.4.2. Water treatment 5.5.3.4.3. Food & Beverage 5.5.3.4.4. Pulp and paper 5.5.3.4.5. Others 6. Europe Peracetic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.2. Europe Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.3. Europe Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.4. Europe Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5. Europe Peracetic Acid Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.1.2. United Kingdom Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.1.3. United Kingdom Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.2.2. France Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.2.3. France Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.3.2. Germany Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.3.3. Germany Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.4.2. Italy Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.4.3. Italy Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.5.2. Spain Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.5.3. Spain Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.6.2. Sweden Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.6.3. Sweden Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.7.2. Austria Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.7.3. Austria Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Peracetic Acid Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 6.5.8.2. Rest of Europe Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 6.5.8.3. Rest of Europe Peracetic Acid Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Peracetic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.2. Asia Pacific Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.3. Asia Pacific Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Peracetic Acid Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.1.2. China Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.1.3. China Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.2.2. S Korea Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.2.3. S Korea Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.3.2. Japan Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.3.3. Japan Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.4.2. India Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.4.3. India Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.5.2. Australia Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.5.3. Australia Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.6.2. Indonesia Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.6.3. Indonesia Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.7.2. Malaysia Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.7.3. Malaysia Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.8.2. Vietnam Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.8.3. Vietnam Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.9.2. Taiwan Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.9.3. Taiwan Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Peracetic Acid Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 7.5.10.2. Rest of Asia Pacific Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 7.5.10.3. Rest of Asia Pacific Peracetic Acid Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Peracetic Acid Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Peracetic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 8.2. Middle East and Africa Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 8.3. Middle East and Africa Peracetic Acid Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Peracetic Acid Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Peracetic Acid Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 8.5.1.2. South Africa Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 8.5.1.3. South Africa Peracetic Acid Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Peracetic Acid Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 8.5.2.2. GCC Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 8.5.2.3. GCC Peracetic Acid Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Peracetic Acid Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 8.5.3.2. Nigeria Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 8.5.3.3. Nigeria Peracetic Acid Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Peracetic Acid Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 8.5.4.2. Rest of ME&A Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 8.5.4.3. Rest of ME&A Peracetic Acid Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Peracetic Acid Market Size and Forecast, by End User (2024-2032) 9. South America Peracetic Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 9.2. South America Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 9.3. South America Peracetic Acid Market Size and Forecast, by Application(2024-2032) 9.4. South America Peracetic Acid Market Size and Forecast, by End User (2024-2032) 9.5. South America Peracetic Acid Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 9.5.1.2. Brazil Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 9.5.1.3. Brazil Peracetic Acid Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Peracetic Acid Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 9.5.2.2. Argentina Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 9.5.2.3. Argentina Peracetic Acid Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Peracetic Acid Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Peracetic Acid Market Size and Forecast, by Product Form (2024-2032) 9.5.3.2. Rest Of South America Peracetic Acid Market Size and Forecast, by Grade (2024-2032) 9.5.3.3. Rest Of South America Peracetic Acid Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Peracetic Acid Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. PeroxyChem LLC (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Enviro Tech Chemical Services, Inc. (United States) 10.3. FMC Corporation (United States) 10.4. Shepherd Chemical Company (United States) 10.5. Ecolab Inc. (United States) 10.6. Biosan LLC (United States) 10.7. AquaBond Inc. (United States) 10.8. Solvay S.A. (Belgium) 10.9. Evonik Industries AG (Germany) 10.10. Kemira Oyj (Finland) 10.11. Christeyns NV (Belgium) 10.12. Promox S.p.A. (Italy) 10.13. Airedale Chemical Company Ltd (United Kingdom) 10.14. Lenntech B.V. (Netherlands) 10.15. Mitsubishi Gas Chemical Company Inc. (Japan) 10.16. Aditya Birla Chemicals (India) 10.17. National Peroxide Ltd. (India) 10.18. JINKE Company Limited (China) 10.19. Shandong Huatai Interox Chemical Co., Ltd. (China) 10.20. Hebei Kangtai Chemical Co., Ltd. (China) 10.21. Middle East Chemicals Company (Saudi Arabia) 10.22. National Detergent Company SAOG (Oman) 10.23. African Chemicals Ltd. (South Africa) 10.24. Delta Chemicals (Egypt) 10.25. Quimica Anastacio S/A (Brazil) 10.26. Peróxidos do Brasil Ltda (Brazil) 10.27. Oxiteno S.A. (Brazil) 11. Key Findings 12. Industry Recommendations 13. Peracetic Acid Market: Research Methodology 14. Terms and Glossary