Oil Well Cement Market Size valued at USD 1.36 Bn. in 2024 Growing at 7.4% CAGR to reach USD 2.41 Bn. in 2032 Growth fueled by shale drilling and deep water well innovations.Oil Well Cement Market Overview

Oil well cement, a specialized cement designed for oil and gas wellbores, ensures zonal isolation and structural integrity in drilling operations. The oil well cement market is expanding due to its rising global energy demand and government initiatives like the U.S. Inflation Reduction Act, which allocates $369 billion for energy security, including domestic drilling. North America leads the market, accounting for over 35% of global demand in 2024 by shale activity and Gulf of Mexico projects. Asia Pacific follows, with China's CNPC planning to boost oil output by 2 million bpd by 2025 under state mandates. Trade dynamics impact cost, with a U.S. tariff on Chinese cement (up to 25%) affecting supply chains. Also, OPEC's production cuts influence drilling investments, creating demand fluctuations. The oil well cement market remains pivotal for energy firms, with well integrity regulations tightening globally to prevent leaks and ensure operational safety. The report covers the Oil Well Cement Market dynamics, structure by analyzing the market segments and projecting the Oil Well Cement Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Oil Well Cement Market.To know about the Research Methodology :- Request Free Sample Report

Global Oil Well Cement Market Dynamics

Consistent Investment in E&P Activities Along with Untapped Hydrocarbon Reserves Set to Boost the Oil Well Cement Market Growth

Some of the major operators in the world and government entities are continuously investing in the expansion of drilling activities to meet the growing demand for hydrocarbons. Furthermore, the strategic planning and forecasting of oil and gas consumption is likely to underpin the market. Also, the enormous potential in untapped hydrocarbon reserves is expected to boost the market.Exponentially Rising Demand for Oil & Gas Likely to Drive the Oil Well Cement Market Growth

Oil & gas are the prime source of energy for many industry verticals. The World Bank recently reported that 80% of the world's GDP comes from cities. Thus, the expansion of urban areas is resulting in high consumption of oil and gas. In addition to this, the exponential growth in the transport sector may leverage the demand for oil and gas, which subsequently underpins the growth of the well cementing market.Volatility in Crude Oil to Create Oil Well Cement Market Opportunity

The oil well cement market remains highly sensitive to crude oil price fluctuations, as drilling activity is directly tied to oil market stability. In 2024, Brent crude prices have remained volatile, averaging around $80–$85/barrel amid OPEC+ production cuts and fluctuating global demand (EIA, 2024). While prices have stabilized compared to previous extremes, uncertainty persists due to geopolitical tensions in the Middle East and slower-than-expected economic recovery in China. This continued instability makes long-term planning difficult for cement suppliers, forcing oilfield service companies to frequently adjust production and pricing strategies, creating ongoing operational and financial challenges.Oil Well Cement Market Segment Analysis

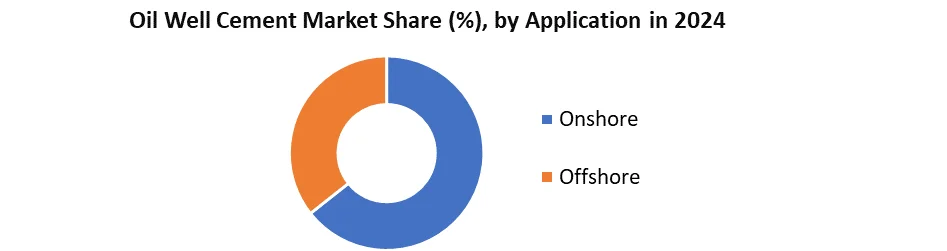

Based on Product, Class G oil well cement dominates the global market, holding the largest share due to its versatility and widespread use in various well conditions. It accounts for approximately 40-45% of the market, driven by its ability to withstand high temperature and pressure (HPHT) environments, making it ideal for deepwater and offshore drilling. Additionally, its compatibility with additives enhances performance in corrosive and extreme conditions, further boosting demand. The growth of unconventional oil & gas activities, such as shale and deepwater exploration, has solidified Class G's leading position, as it meets stringent API (American Petroleum Institute) standards for well integrity. Based on the application, the onshore segment is expected to lead the oil well cement market in 2024 and is estimated to generate more than US$ xx Mn market revenue by 2032, with a CAGR of xx%. The growing well operations in the onshore fields, particularly in Saudi Arabia, the U.S., China, and Russia, combined with the growing demand for oil and gas, are anticipated to have stable market growth in the onshore application.

Oil Well Cement Market Regional Insights

Geographically, the Oil Well Cement market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the prominent market share of xx% in 2024 and is expected to reach US$ Mn by the end of 2032, with a CAGR of xx%. Thanks to the growing oil and natural gas production in the region, along with factors such as rising offshore drilling activities, the shale boom in the Gulf of Mexico, and the quest for discovery of untapped oil and gas reserves. The market in the Asia Pacific is expected to grow at a high CAGR of xx% during the forecast period, owing to growing investment by exploration & production companies. The changes in government policies are boosting companies to carry out more drilling activities by permitting tax redemption and FDI to increase oil and gas production in the region.Oil Well Cement Market Competitive Landscape

The market is highly competitive, with key players like Cemex, Heidelberg Materials, China National Building Material (CNBM, China), LafargeHolcim, and Dangote Cement leading through innovation and strategic expansion. Cemex focuses on sustainable cement solutions and digital supply chain optimization to serve North America’s shale sector. Heidelberg Materials invests in low-carbon cement technologies and automation for deepwater drilling in Europe. China National Building Material (CNBM) dominates Asia Pacific with cost-effective, high-volume production and R&D in high-temperature resistant cement. LafargeHolcim leverage geopolymer and alternative raw materials to meet strict environmental regulations globally. Dangote Cement expands aggressively in Africa, improving localised production to reduce import dependency. Due to their strong R&D, compliance with API standards and adaptability to regional drilling trends these companies are leading ensuring reliability in extreme well conditions.Oil Well Cement Market Key Trends

Trend Description Rising Deepwater & HPHT Drilling Increasing offshore exploration (e.g., Gulf of Mexico, Brazil) demands high-performance cement like Class G/H for extreme pressure/temperature wells. Eco-Friendly Cement Formulations Strict emissions regulations push the adoption of low-CO₂ cement (e.g., geopolymers, slag-based). Companies like LafargeHolcim invest in sustainable alternatives to reduce their carbon footprint. Digitalization & Automation AI-driven cement quality monitoring and IoT-enabled well integrity systems minimise failures. Halliburton’s SmartCem tech reduces costs by optimising slurry design Supply Chain Localization Post-pandemic, companies like Cemex prioritize regional raw material sourcing to counter logistics disruptions (e.g., gypsum, clinker shortages). Oil Well Cement Key Recent Development

October 26, 2023 – GE Oil & Gas (United States) Unveiled IntelliSmart Well Cementing, featuring advanced sensors and analytics for real-time cement placement monitoring, enhancing efficiency and accuracy in the Oil Well Cement Market. December 12, 2023 – Schlumberger (France) Launched the Proprio CEMENT+ system, designed to improve zonal isolation in offshore wells, a critical requirement in the Oil Well Cement Market. September 29, 2023 – Halliburton (United States) Formed a partnership with Cudd Energy Services to develop digital well cementing solutions tailored for unconventional reservoirs, supporting innovation in the Oil Well Cement Market.Oil Well Cement Market Scope: Inquiry Before Buying

Global Oil Well Cement Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.36 Bn Forecast Period 2025 to 2032 CAGR: 7.4% Market Size in 2032: USD 2.41 Bn Segments Covered: by Product Class A Class G Class H Others by Type High Sulfate Resistant Moderate Sulfate Resistant by Application Offshore Onshore Oil Well Cement by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Oil Well Cement Key Players are:

North America 1. Cemex (Mexico) 2. Ash Grove Cement (USA) 3. CalPortland Company (USA) 4. Buzzi Unicem USA (USA) 5. Texas Lehigh Cement Company (USA) 6. Eagle Materials Inc. (USA) 7. GE Oil & Gas (United States) 8. Halliburton (United States) 9. Capitol Aggregates, Inc. (USA) Europe 10. Heidelberg Materials (Germany) 11. CRH plc (Ireland) 12. Italcementi (Italy) 13. Schlumberger (France) 14. LafargeHolcim (Switzerland) 15. Dyckerhoff GmbH (Germany) 16. Titan Cement Group (Greece) Asia Pacific 17. China National Building Material Company (China) 18. Anhui Conch Cement (China) 19. UltraTech Cement (India) 20. Shree Cement (India) 21. Taiheiyo Cement Corporation (Japan) 22. Adelaide Brighton Cement (Australia) Middle East and Africa 23. Dangote Cement (Nigeria) 24. Arabian Cement Company (Saudi Arabia) 25. Lafarge Egypt (Egypt) 26. Raysut Cement Company (Oman) 27. PPC Ltd (South Africa) South America 28. Votorantim Cimentos (Brazil) 29. Cementos Argos (Colombia) 30. InterCement (Brazil) 31. Cementos Pacasmayo (Peru) 32. Holcim Ecuador (Ecuador)Frequently Asked Questions:

1] What are the leading market players active in the Oil Well Cement Market? Ans. The leading market players active in the Oil Well Cement Market are LafargeHolcim, Heidelberg Materials, Cemex, China National Building Material Company, UltraTech Cement, Votorantim Cimentos, Ash Grove Cement, and CRH plc. 2] What is the market in the Oil Well Cement Market in 2024? Ans. The market size in the Oil Well Cement Market in 2024 is USD 1.36 Bn. 3] What is the market in the Oil Well Cement Market in 2032? Ans. The market size in the Oil Well Cement Market in 2032 is USD 2.41 Bn. 4] What is the projection period for the future that would help in taking further strategic steps? Ans. The Projections period for the future strategy for the Oil Well Cement Market is 2024-2032. 5] What is the scope of the Global Oil Well Cement market report? Ans. Global Oil Well Cement Market report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. Oil Well Cement Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Oil Well Cement Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Oil Well Cement Market: Dynamics 3.1. Region-wise Trends of Oil Well Cement Market 3.1.1. North America Oil Well Cement Market Trends 3.1.2. Europe Oil Well Cement Market Trends 3.1.3. Asia Pacific Oil Well Cement Market Trends 3.1.4. Middle East and Africa Oil Well Cement Market Trends 3.1.5. South America Oil Well Cement Market Trends 3.2. Oil Well Cement Market Dynamics 3.2.1. Oil Well Cement Market Drivers 3.2.1.1. Urbanization Growth 3.2.1.2. Transport Sector Expansion 3.2.2. Oil Well Cement Market Restraints 3.2.3. Oil Well Cement Market Opportunities 3.2.3.1. Energy Demand Surge 3.2.3.2. Strategic Forecasting Potential 3.2.4. Oil Well Cement Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Crude Oil Volatility 3.4.2. Urban GDP Growth 3.4.3. Advanced Drilling Techniques 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Oil Well Cement Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Oil Well Cement Market Size and Forecast, By Product (2024-2032) 4.1.1. Class A 4.1.2. Class G 4.1.3. Class H 4.1.4. Others 4.2. Oil Well Cement Market Size and Forecast, By Type (2024-2032) 4.2.1. High Sulfate Resistant 4.2.2. Moderate Sulfate Resistant 4.3. Oil Well Cement Market Size and Forecast, By Application (2024-2032) 4.3.1. Offshore 4.3.2. Onshore 4.4. Oil Well Cement Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Oil Well Cement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Oil Well Cement Market Size and Forecast, By Product (2024-2032) 5.1.1. Class A 5.1.2. Class G 5.1.3. Class H 5.1.4. Others 5.2. North America Oil Well Cement Market Size and Forecast, By Type (2024-2032) 5.2.1. High Sulfate Resistant 5.2.2. Moderate Sulfate Resistant 5.3. North America Oil Well Cement Market Size and Forecast, By Application (2024-2032) 5.3.1. Offshore 5.3.2. Onshore 5.4. North America Oil Well Cement Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Oil Well Cement Market Size and Forecast, By Product (2024-2032) 5.4.1.1.1. Class A 5.4.1.1.2. Class G 5.4.1.1.3. Class H 5.4.1.1.4. Others 5.4.1.2. United States Oil Well Cement Market Size and Forecast, By Type (2024-2032) 5.4.1.2.1. High Sulfate Resistant 5.4.1.2.2. Moderate Sulfate Resistant 5.4.1.3. United States Oil Well Cement Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Offshore 5.4.1.3.2. Onshore 5.4.2. Canada 5.4.2.1. Canada Oil Well Cement Market Size and Forecast, By Product (2024-2032) 5.4.2.1.1. Class A 5.4.2.1.2. Class G 5.4.2.1.3. Class H 5.4.2.1.4. Others 5.4.2.2. Canada Oil Well Cement Market Size and Forecast, By Type (2024-2032) 5.4.2.2.1. High Sulfate Resistant 5.4.2.2.2. Moderate Sulfate Resistant 5.4.2.3. Canada Oil Well Cement Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Offshore 5.4.2.3.2. Onshore 5.4.3. Mexico 5.4.3.1. Mexico Oil Well Cement Market Size and Forecast, By Product (2024-2032) 5.4.3.1.1. Class A 5.4.3.1.2. Class G 5.4.3.1.3. Class H 5.4.3.1.4. Others 5.4.3.2. Mexico Oil Well Cement Market Size and Forecast, By Type (2024-2032) 5.4.3.2.1. High Sulfate Resistant 5.4.3.2.2. Moderate Sulfate Resistant 5.4.3.3. Mexico Oil Well Cement Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Offshore 5.4.3.3.2. Onshore 6. Europe Oil Well Cement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.2. Europe Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.3. Europe Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4. Europe Oil Well Cement Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.1.2. United Kingdom Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.1.3. United Kingdom Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.2.2. France Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.2.3. France Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.3.2. Germany Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.3.3. Germany Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.4.2. Italy Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.4.3. Italy Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.5.2. Spain Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.5.3. Spain Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.6.2. Sweden Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.6.3. Sweden Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.7.2. Russia Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.7.3. Russia Oil Well Cement Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Oil Well Cement Market Size and Forecast, By Product (2024-2032) 6.4.8.2. Rest of Europe Oil Well Cement Market Size and Forecast, By Type (2024-2032) 6.4.8.3. Rest of Europe Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Oil Well Cement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Oil Well Cement Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.1.2. China Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.1.3. China Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.2.2. S Korea Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.2.3. S Korea Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.3.2. Japan Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.3.3. Japan Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.4.2. India Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.4.3. India Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.5.2. Australia Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.5.3. Australia Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.6.2. Indonesia Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.6.3. Indonesia Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.7.2. Malaysia Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.7.3. Malaysia Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.8.2. Philippines Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.8.3. Philippines Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.9.2. Thailand Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.9.3. Thailand Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.10.2. Vietnam Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.10.3. Vietnam Oil Well Cement Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Oil Well Cement Market Size and Forecast, By Product (2024-2032) 7.4.11.2. Rest of Asia Pacific Oil Well Cement Market Size and Forecast, By Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Oil Well Cement Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Oil Well Cement Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.4.1.2. South Africa Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.4.1.3. South Africa Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.4.2.2. GCC Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.4.2.3. GCC Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.4.3.2. Egypt Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.4.3.3. Egypt Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.4.4.2. Nigeria Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.4.4.3. Nigeria Oil Well Cement Market Size and Forecast, By Application (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Oil Well Cement Market Size and Forecast, By Product (2024-2032) 8.4.5.2. Rest of ME&A Oil Well Cement Market Size and Forecast, By Type (2024-2032) 8.4.5.3. Rest of ME&A Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9. South America Oil Well Cement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.2. South America Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.3. South America Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9.4. South America Oil Well Cement Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.4.1.2. Brazil Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.4.1.3. Brazil Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.4.2.2. Argentina Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.4.2.3. Argentina Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.4.3.2. Colombia Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.4.3.3. Colombia Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.4.4.2. Chile Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.4.4.3. Chile Oil Well Cement Market Size and Forecast, By Application (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Oil Well Cement Market Size and Forecast, By Product (2024-2032) 9.4.5.2. Rest Of South America Oil Well Cement Market Size and Forecast, By Type (2024-2032) 9.4.5.3. Rest of South America Oil Well Cement Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. LafargeHolcim (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cemex (Mexico) 10.3. Ash Grove Cement (USA) 10.4. CalPortland Company (USA) 10.5. Buzzi Unicem USA (USA) 10.6. Texas Lehigh Cement Company (USA) 10.7. Eagle Materials Inc. (USA) 10.8. Capitol Aggregates, Inc. (USA) 10.9. GE Oil & Gas (United States) 10.10. Schlumberger (France) 10.11. Halliburton (United States) 10.12. Heidelberg Materials (Germany) 10.13. CRH plc (Ireland) 10.14. Italcementi (Italy) 10.15. Dyckerhoff GmbH (Germany) 10.16. Titan Cement Group (Greece) 10.17. China National Building Material Company (China) 10.18. Anhui Conch Cement (China) 10.19. UltraTech Cement (India) 10.20. Shree Cement (India) 10.21. Taiheiyo Cement Corporation (Japan) 10.22. Adelaide Brighton Cement (Australia) 10.23. Dangote Cement (Nigeria) 10.24. Arabian Cement Company (Saudi Arabia) 10.25. Lafarge Egypt (Egypt) 10.26. Raysut Cement Company (Oman) 10.27. PPC Ltd (South Africa) 10.28. Votorantim Cimentos (Brazil) 10.29. Cementos Argos (Colombia) 10.30. InterCement (Brazil) 10.31. Cementos Pacasmayo (Peru) 10.32. Holcim Ecuador (Ecuador) 11. Key Findings 12. Industry Recommendations 13. Oil Well Cement Market: Research Methodology