The Offshore Energy Storage Market was valued at USD 290.23 Mn in 2024 and is expected to grow at a CAGR of 10.2% to reach USD 630.74 Mn by 2032.Offshore Energy Storage Market Overview

The Offshore energy storage encompasses technologies and systems designed to capture and store energy produced from offshore sources, primarily wind farms. These solutions allow surplus energy to be stored and used when needed, ensuring a consistent and transportable power supply. Offshore Energy Storage represents a new area of interest under renewable energy infrastructure. Offshore energy storage involves capturing and storing energy generated from offshore sources, such as wind farms and oil and gas facilities, using technologies such as lithium-ion batteries, compressed air energy storage (CAES), and hydrogen storage. Leading countries advancing in this sector include Germany, the UK, and France, which are heavily investing in offshore wind and energy storage infrastructure; Taiwan, with large-scale projects like Hai Long and Greater Changhua; India, expanding wind farms at Jaisalmer and Muppandal with integrated storage; and the United States, increasing offshore wind capacity and hybrid storage projects supported by government clean energy initiatives.To know about the Research Methodology :- Request Free Sample Report The expansion of offshore renewable energy capacity drives the Offshore Energy Storage Market, with governments and industry stakeholders investing in offshore wind farms to meet clean energy targets and reduce carbon emissions. Europe’s regulatory incentives and North America’s initiatives for grid stabilization further support this growth, exemplified by Taiwan’s Hai Long and Greater Changhua projects, which are expected to significantly boost renewable energy generation with integrated storage by 2025–2026. Opportunities lie in hybrid offshore energy storage systems that combine lithium-ion, hydrogen, and CAES technologies to enhance efficiency, flexibility, and resilience, addressing renewable intermittency and supporting industrial-scale power users. For instance, in Mississippi, USA, solar-plus-storage projects, combining a 150MW solar array with 50MW battery storage, demonstrate how hybrid solutions strengthen energy reliability for both corporate and residential users. The offshore energy storage market is set for rapid global expansion, driven by offshore renewable growth and innovations in hybrid storage systems that reinforce grid and industrial energy resilience.

Global Offshore Energy Storage Market Dynamics

Rising Offshore Renewable Energy Projects to Drive Offshore Energy Storage Market Growth The global offshore energy storage market is being strongly Driven by the rapid expansion of offshore renewable energy projects. Countries are increasingly investing in offshore wind farms and other marine renewable sources, driving demand for storage solutions that balance and stabilize the intermittent power generated. In Europe, the UK’s North Sea projects are expanding offshore wind capacity, particularly in shallow waters, necessitating storage systems to maintain grid reliability. Germany and France are also heavily investing in offshore wind and energy storage infrastructure to meet aggressive clean energy and climate targets, with companies such as Siemens providing critical storage solutions. In the Asia-Pacific region, China leads in installed offshore wind capacity, while Japan and South Korea focus on floating wind farms and energy storage technologies to diversify energy sources and reduce carbon emissions. South Korean companies such as LG Chem play a significant role in the battery storage segment. High Capital Costs and Harsh Offshore Conditions limits the growth of Offshore Energy Storage Market The offshore energy storage market faces significant restraints due to high capital costs and challenging offshore conditions. Projects such as Dominion’s Coastal Virginia Offshore Wind (CVOW) in the U.S., a 2.6GW installation, require over $8.7 billion in capital, excluding onshore transmission. The levelized cost of energy (LCOE) for CVOW is estimated at $91/MWh, considerably higher than onshore wind or solar projects. Integrating storage technologies like batteries or hydrogen further increases upfront costs, making these projects economically feasible primarily through subsidies, long-term power purchase agreements, or government support. Floating offshore wind (FOW) projects in Europe, such as Norway’s Hywind Tampen (88MW) and Scotland’s Green Volt (560MW), face costs around $2 million per MW, double that of fixed-bottom installations, due to specialized engineering, vessels, and lack of standardization. Harsh offshore conditions add another layer of complexity. Turbines and storage systems must endure hurricanes, typhoons, and large waves, leading to potential cable damage, mooring line failures, and accelerated material fatigue. Repairing a single offshore cable can cost $ 5–10 million, with floating installations incurring even higher expenses. Limited operational data for large-scale offshore storage and floating wind farms creates uncertainty around technical reliability and long-term performance. In regions such as France, Japan, and South Korea, extreme weather and operational interruptions extend payback periods, making project financing more challenging. Until industrial standardization, supply chain efficiency, and mass manufacturing improve, high costs and offshore risks continue to constrain Offshore Energy Storage Market growth despite strong long-term potential. Integration with Green Hydrogen and Hybrid Offshore Systems To Create Opportunities The integration of green hydrogen with offshore wind and hybrid storage systems presents a significant opportunity to address renewable energy intermittency and enable scalable, zero-carbon power for industry, transport, and national grids. In Germany, Siemens Gamesa and Siemens Energy have developed a fully integrated offshore wind-to-hydrogen system, where electrolyzers installed at the base of turbines convert surplus wind energy into green hydrogen. This hydrogen can be stored in subsea geological formations, such as depleted gas reservoirs and salt caverns, providing long-duration, flexible energy supply. The system’s first large-scale demonstration under the H2Mare initiative is expected in 2025/2026, supported by the German government. In the UK, co-location projects are emerging that combine green hydrogen production and battery storage directly with offshore wind farms. Excess electricity from high winds is stored as hydrogen or in batteries and transported via pipelines to industrial or transport hubs, reducing infrastructure costs and enhancing supply resilience. In India, hybrid systems combining batteries and green hydrogen optimize operational flexibility and economics. Projects connected to the ISTS (Inter-State Transmission System) balance energy supply and generate additional revenue from surplus power. Integrating green hydrogen with hybrid storage provides both fast-response and long-duration solutions, strengthening reliability and making offshore energy storage a cornerstone of the global clean energy transition.Offshore Energy Storage Market Segment Analysis

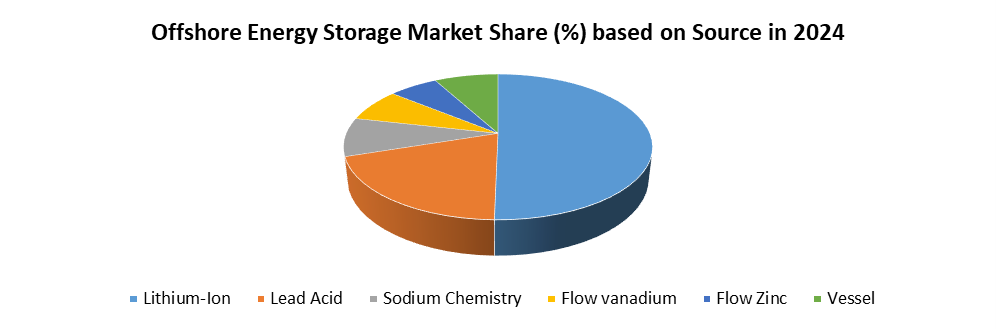

Based On Source, the market is segmented into Lithium Ion, Lead Acid, Sodium Chemisty, Flow Vanadium, Flow Zinc, Vessel. Among this, lithium-ion dominated the source segment of Offshore Energy Storage Market in 2024. Due to their superior performance, scalability, and cost advantages. Lithium-ion technology has become the preferred choice for offshore projects as it offers high energy density, longer lifecycle, rapid response times, and compact design, making it well-suited for integration with offshore wind farms and hybrid energy systems. The steady decline in lithium-ion battery costs, driven by mass production and technological improvements, has further accelerated adoption compared to traditional options such as lead-acid, which suffer from low efficiency and short lifespan.Lithium-ion systems are easier to deploy and maintain in offshore environments than flow batteries or vessel-based storage, which are still in demonstration or early commercialization phases. Their ability to provide both short-term grid balancing and reliable backup power makes them highly attractive for large-scale renewable integration. Backed by strong investments from companies and governments, lithium-ion batteries continue to dominate the offshore energy storage segment, ensuring stable and efficient energy supply while supporting the global shift toward clean power.

Offshore Energy Storage Market Regional Insights

Asia pacific region dominated the Offshore Energy Storage Market in 2024.The rapid offshore wind expansion and strong policy support helps to boost the Offshore Energy Storage Market. Countries such as China, Japan, South Korea, and Taiwan have leveraged favorable coastal geography to establish large-scale offshore wind farms, with offshore wind accounting for more than 90% of new projects. This expansion has intensified the demand for reliable energy storage solutions to balance intermittent renewable generation. Government initiatives have been pivotal in driving market growth. China led the region with nearly 60% of the offshore energy market share in 2023, supported by subsidies, tax incentives, and direct state involvement. Japan, influenced by the Fukushima disaster, emphasized energy independence through floating wind farms paired with hydrogen and battery storage. South Korea advanced its "K-New Deal," investing in both offshore wind projects exceeding 1 GW in 2024 and subsea storage technologies. Taiwan also gained traction, with offshore wind capacity reaching 2.25 GW in 2023 and projected to almost double by 2028. India, while at an early stage, accelerated pumped storage developments with major projects in Madhya Pradesh and Maharashtra. Technological innovation has further reinforced the region’s dominance. Advancements in lithium-ion chemistries, pumped hydro, floating wind platforms, and modular subsea storage have reduced costs and enabled deeper water deployment. Additionally, collaborations involving global firms such as Siemens and ABB with regional players have fast-tracked commercialization. Dense coastal populations, high energy consumption, and vulnerability to disruptions have positioned Asia Pacific as the global leader in offshore energy storage. Offshore Energy Storage Market Competitive Landscape The offshore energy storage market is competitive due to advanced technologies, strong government support, and large-scale offshore renewable projects. Two prominent companies leading this transformation are Mitsubishi Heavy Industries (Japan) and China Three Gorges Corporation (China). Mitsubishi Heavy Industries has positioned itself at the forefront of hydrogen-based offshore energy storage. The company is actively developing compressed air energy storage (CAES) and Power-to-Gas solutions, supported by collaborations with domestic organizations such as NEDO and leading utilities. Its strategy aligns with Japan’s 2040 carbon neutrality targets, emphasizing long-term innovation, safety, and integration into Japan’s emerging hydrogen economy. Mitsubishi’s engineering expertise enables it to develop pilot hydrogen parks and offshore storage systems tailored to enhance renewable energy reliability. China Three Gorges Corporation, meanwhile, focuses on integrating large-scale offshore wind projects with advanced storage technologies. Strongly backed by government policy, it deploys projects such as the Jiangsu offshore battery storage system and floating platforms in Hainan. The company benefits from a vertically integrated supply chain and rapid project execution, ensuring scalability and cost competitiveness. Together, Mitsubishi’s innovation-driven approach and China Three Gorges’ execution speed and scale make them pivotal in shaping Asia Pacific’s offshore energy storage market. Offshore Energy Storage Key Development In February 11 ,2021, Siemens Energy and Maersk Drilling entered into an agreement to upgrade two environmentally sensitive CJ70 jack-up drilling rigs, Maersk Intrepid and Maersk Integrator, operating in the North Sea. The rigs were equipped with hybrid power plants powered by lithium-ion energy storage systems, utilizing Siemens Energy’s BlueVault™ batteries. This upgrade marked a significant milestone as the first jack-up rigs on the Norwegian continental shelf to adopt integrated hybrid low-emission solutions, enhancing operational efficiency while reducing fuel consumption and carbon emissions. In June 2023, Agratas Energy Storage Solutions Pvt Ltd, a subsidiary of the Tata Group, signed an agreement with the Gujarat government to establish India’s first giga plant for lithium-ion battery manufacturing. Announced at the company’s inception, this initiative represents a major step toward strengthening India’s domestic battery ecosystem and accelerating the country’s renewable energy and electric mobility ambitions. Key Trends of Market

Category Key Trend Example Project Market Impact Hybrid Technologies Integration of multiple storage types (e.g., battery + compressed air) ABB hybrid compressed air and battery systems in the North Sea Improved load balancing and reliability for floating offshore wind farms in Europe Hydrogen Storage Growing use of hydrogen as a long-duration offshore energy storage medium Mitsubishi Heavy Industries & Kepco’s hydrogen storage project off South Korea Enhanced renewable utilization; supports decarbonization strategies in APAC Localized Infrastructure Investment in region-specific storage platforms (e.g., subsea battery hubs) Siemens Energy & Hitachi Energy’s subsea battery systems across the UK, Germany, and Japan Increased energy independence; reduced need for long transmission to shore Marine Energy Integration Use of wave or tidal energy to power offshore storage units GE & Ocean Power Technologies’ wave-powered storage buoys in the U.S. Strengthened microgrid support; expanded applications for remote coastal and island communities Global Offshore Energy Storage Market Scope Inquire before buying

Global Offshore Energy Storage Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 290.23 Mn. Forecast Period 2025 to 2032 CAGR: 10.2% Market Size in 2032: USD 630.74 Mn. Segments Covered: by Source Lithium Ion Lead Acid Sodium Chemisty Flow Vanadium Flow Zinc Vessel by Application Renewables integration Grid services Platform & microgrid Arbitrage & peak management Others by End Users Offshore Wind Oil and gas Offshore Energy Storage Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Offshore Energy Storage Market: Key Players are

1. Siemens Energy (Germany) 2. ABB Ltd. (Switzerland) 3. General Electric – GE (United States) 4. Tesla, Inc. (United States) 5. LG Chem / LG Energy Solution (South Korea) 6. Samsung SDI (South Korea) 7. Fluence Energy, Inc. (United States) 8. BYD Company Ltd. (China) 9. Equinor ASA (Norway) 10. RWE AG (Germany) 11. EDF Renewables (France) 12. NextEra Energy, Inc. (United States) 13. ENGIE SA (France) 14. BP plc (United Kingdom) 15. Enel Green Power (Italy) 16. TotalEnergies SE (France) 17. Deepwater Wind (United States) 18. Duke Energy (United States) 19. E.ON SE (Germany) 20. Johnson Controls (United States) 21. SolarEdge Technologies (Israel) 22. Toshiba Corporation (Japan) 23. Wärtsilä Corporation (Finland) 24. MAN Energy Solutions (Germany) 25. Lockheed Martin Energy (United States) 26. Corvus Energy (Canada/Norway) 27. EST-Floattech (Netherlands) 28. Leclanché SA (Switzerland) 29. ZEM AS (Norway)Frequently Asked Questions:

1. Which region has the largest share in Global Offshore Energy Storage Market ? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Offshore Energy Storage Market? Ans: The Global Offshore Energy Storage Market is growing at a CAGR of 10.2% during forecasting period 2025-2032. 3. What is scope of the Global Offshore Energy Storage Market report? Ans: Global Offshore Energy Storage Market report helps with the PESTEL, Porter's, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What is the study period of this Market? Ans: The Global Offshore Energy Storage Market is studied from 2024 to 2032.

1. Offshore Energy Storage Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Offshore Energy Storage Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Offshore Energy Storage Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Offshore Energy Storage Market: Dynamics 3.1. Offshore Energy Storage Market Trends by Region 3.1.1. North America Offshore Energy Storage Market Trends 3.1.2. Europe Offshore Energy Storage Market Trends 3.1.3. Asia Pacific Offshore Energy Storage Market Trends 3.1.4. Middle East and Africa Offshore Energy Storage Market Trends 3.1.5. South America Offshore Energy Storage Market Trends 3.2. Offshore Energy Storage Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Offshore Energy Storage Market Drivers 3.2.1.2. North America Offshore Energy Storage Market Restraints 3.2.1.3. North America Offshore Energy Storage Market Opportunities 3.2.1.4. North America Offshore Energy Storage Market Challenges 3.2.2. Europe 3.2.2.1. Europe Offshore Energy Storage Market Drivers 3.2.2.2. Europe Offshore Energy Storage Market Restraints 3.2.2.3. Europe Offshore Energy Storage Market Opportunities 3.2.2.4. Europe Offshore Energy Storage Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Offshore Energy Storage Market Drivers 3.2.3.2. Asia Pacific Offshore Energy Storage Market Restraints 3.2.3.3. Asia Pacific Offshore Energy Storage Market Opportunities 3.2.3.4. Asia Pacific Offshore Energy Storage Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Offshore Energy Storage Market Drivers 3.2.4.2. Middle East and Africa Offshore Energy Storage Market Restraints 3.2.4.3. Middle East and Africa Offshore Energy Storage Market Opportunities 3.2.4.4. Middle East and Africa Offshore Energy Storage Market Challenges 3.2.5. South America 3.2.5.1. South America Offshore Energy Storage Market Drivers 3.2.5.2. South America Offshore Energy Storage Market Restraints 3.2.5.3. South America Offshore Energy Storage Market Opportunities 3.2.5.4. South America Offshore Energy Storage Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Offshore Energy Storage Industry 3.8. Analysis of Government Schemes and Initiatives For Offshore Energy Storage Industry 3.9. Offshore Energy Storage Market Trade Analysis 3.10. The Global Pandemic Impact on Offshore Energy Storage Market 4. Offshore Energy Storage Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 4.1.1. Lithium Ion 4.1.2. Lead Acid 4.1.3. Sodium Chemisty 4.1.4. Flow Vanadium 4.1.5. Flow Zinc 4.1.6. Vessel 4.2. Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 4.2.1. Renewables integration 4.2.2. Grid services 4.2.3. Platform & microgrid 4.2.4. Arbitrage & peak management 4.2.5. Others 4.3. Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 4.3.1. Offshore Wind 4.3.2. Oil and gas 4.4. Offshore Energy Storage Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Offshore Energy Storage Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 5.1.1. Lithium Ion 5.1.2. Lead Acid 5.1.3. Sodium Chemisty 5.1.4. Flow Vanadium 5.1.5. Flow Zinc 5.1.6. Vessel 5.2. North America Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 5.2.1. Renewables integration 5.2.2. Grid services 5.2.3. Platform & microgrid 5.2.4. Arbitrage & peak management 5.2.5. Others 5.3. North America Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 5.3.1. Offshore Wind 5.3.2. Oil and gas 5.4. North America Offshore Energy Storage Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 5.4.1.1.1. Lithium Ion 5.4.1.1.2. Lead Acid 5.4.1.1.3. Sodium Chemisty 5.4.1.1.4. Flow Vanadium 5.4.1.1.5. Flow Zinc 5.4.1.1.6. Vessel 5.4.1.2. United States Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Renewables integration 5.4.1.2.2. Grid services 5.4.1.2.3. Platform & microgrid 5.4.1.2.4. Arbitrage & peak management 5.4.1.2.5. Others 5.4.1.3. United States Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Offshore Wind 5.4.1.3.2. Oil and gas 5.4.2. Canada 5.4.2.1. Canada Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 5.4.2.1.1. Lithium Ion 5.4.2.1.2. Lead Acid 5.4.2.1.3. Sodium Chemisty 5.4.2.1.4. Flow Vanadium 5.4.2.1.5. Flow Zinc 5.4.2.1.6. Vessel 5.4.2.2. Canada Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Renewables integration 5.4.2.2.2. Grid services 5.4.2.2.3. Platform & microgrid 5.4.2.2.4. Arbitrage & peak management 5.4.2.2.5. Others 5.4.2.3. Canada Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Offshore Wind 5.4.2.3.2. Oil and gas 5.4.3. Mexico 5.4.3.1. Mexico Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 5.4.3.1.1. Lithium Ion 5.4.3.1.2. Lead Acid 5.4.3.1.3. Sodium Chemisty 5.4.3.1.4. Flow Vanadium 5.4.3.1.5. Flow Zinc 5.4.3.1.6. Vessel 5.4.3.2. Mexico Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Renewables integration 5.4.3.2.2. Grid services 5.4.3.2.3. Platform & microgrid 5.4.3.2.4. Arbitrage & peak management 5.4.3.2.5. Others 5.4.3.3. Mexico Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Offshore Wind 5.4.3.3.2. Oil and gas 6. Europe Offshore Energy Storage Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.2. Europe Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.3. Europe Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4. Europe Offshore Energy Storage Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.1.2. United Kingdom Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.2.2. France Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.3.2. Germany Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.4.2. Italy Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.5.2. Spain Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.6.2. Sweden Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.7.2. Austria Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 6.4.8.2. Rest of Europe Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Offshore Energy Storage Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.2. Asia Pacific Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific Offshore Energy Storage Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.1.2. China Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.2.2. S Korea Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.3.2. Japan Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.4.2. India Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.5.2. Australia Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.6.2. Indonesia Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.7.2. Malaysia Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.8.2. Vietnam Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.9.2. Taiwan Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 7.4.10.2. Rest of Asia Pacific Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Offshore Energy Storage Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 8.2. Middle East and Africa Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa Offshore Energy Storage Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 8.4.1.2. South Africa Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 8.4.2.2. GCC Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 8.4.3.2. Nigeria Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 8.4.4.2. Rest of ME&A Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 9. South America Offshore Energy Storage Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 9.2. South America Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 9.3. South America Offshore Energy Storage Market Size and Forecast, by End User(2024-2032) 9.4. South America Offshore Energy Storage Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 9.4.1.2. Brazil Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 9.4.2.2. Argentina Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Offshore Energy Storage Market Size and Forecast, by Source (2024-2032) 9.4.3.2. Rest Of South America Offshore Energy Storage Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Offshore Energy Storage Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Siemens Energy (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ABB Ltd. (Switzerland) 10.3. General Electric – GE (United States) 10.4. Tesla, Inc. (United States) 10.5. LG Chem / LG Energy Solution (South Korea) 10.6. Samsung SDI (South Korea) 10.7. Fluence Energy, Inc. (United States) 10.8. BYD Company Ltd. (China) 10.9. Equinor ASA (Norway) 10.10. RWE AG (Germany) 10.11. EDF Renewables (France) 10.12. NextEra Energy, Inc. (United States) 10.13. ENGIE SA (France) 10.14. BP plc (United Kingdom) 10.15. Enel Green Power (Italy) 10.16. TotalEnergies SE (France) 10.17. Deepwater Wind (United States) 10.18. Duke Energy (United States) 10.19. E.ON SE (Germany) 10.20. Johnson Controls (United States) 10.21. SolarEdge Technologies (Israel) 10.22. Toshiba Corporation (Japan) 10.23. Wärtsilä Corporation (Finland) 10.24. MAN Energy Solutions (Germany) 10.25. Lockheed Martin Energy (United States) 10.26. Corvus Energy (Canada/Norway) 10.27. EST-Floattech (Netherlands) 10.28. Leclanché SA (Switzerland) 10.29. ZEM AS (Norway) 11. Key Findings 12. Industry Recommendations 13. Offshore Energy Storage Market: Research Methodology 14. Terms and Glossary