The Solar Shingles Market size was valued at USD 362.80 Million in 2023 and the total Solar Shingles revenue is expected to grow at a CAGR of 5.46% from 2024 to 2030, reaching nearly USD 526.36 Million. What is Solar Shingles: Solar shingles are also known as photovoltaic shingles or solar tiles. It is type of building-integrated photovoltaic (BIPV) technology that allows solar panels to be integrated into the design of a building's roof. Solar shingles consist of photovoltaic cells that are embedded within a shingle-like material.Global Solar Shingles Market Overview:

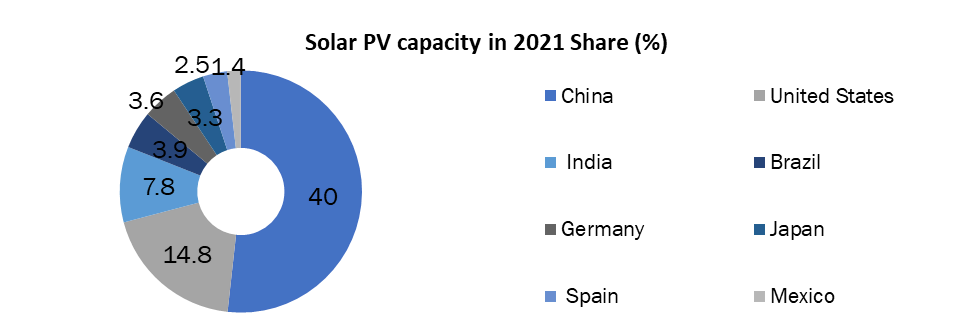

Solar shingles are a popular choice for homeowners and businesses who want to generate their own electricity using solar power while also maintaining a traditional aesthetic. The global solar shingles market growth is driven by increasing demand for renewable energy sources, government incentives and subsidies, and advances in solar technology. One of the major advantages of solar shingles is their ability to blend in seamlessly with the existing roofline of a building. It makes them an attractive option for homeowners and businesses who want to generate renewable energy without compromising the aesthetic appeal of their property. North America held the largest market for solar shingles, over 50% of the global market share. High adoption rate of solar technology across the developed economies like USA and Canada, favourable government policies and incentives are some of the factors that drive the Solar shingles market growth in North America. The Asia-Pacific region is also expected to see significant growth in the coming years by factors like high awareness of the benefits of renewable energy and demand for energy in countries like China and India. The major players in the solar shingles market include Tesla, CertainTeed, SunTegra, Luma Solar, Atlantis Energy, and Solarskin. Key players operating in the market are focusing on development and innovative and cost-effective solar shingle solutions that are easy to install and maintain, and that offer a high level of energy efficiency. As the cost of solar shingles continues to decline, they are expected to become an increasingly popular choice for homeowners and businesses, who are looking to generate their own electricity and reduce their reliance on traditional power sources.To know about the Research Methodology :- Request Free Sample Report

Solar Shingles Market Competitive Landscapes:

The solar shingles market is becoming increasingly competitive as many companies enter the market to meet the growing demand for renewable energy sources. Tesla is a leading player in the solar shingles market with its Solar Roof product. The Solar Roof is a unique product that combines the functionality of a roof with solar panels to generate renewable energy. The solar shingles market is a relatively new and growing market that has seen significant developments in recent years. Many companies are actively working to develop and improve solar shingle technology, as well as to expand their reach into new markets. There have been several partnerships and collaborations among these key players, as well as with other companies in the solar and construction industries. For example, Tesla has partnered with various roofing companies to install their solar shingles, while CertainTeed has collaborated with Solaria Corporation to develop their Apollo II solar shingle product. As the solar shingles market continues to grow and evolve, the partnerships and collaborations among key players are expected to drive to develop innovative new products and expand their reach into new markets.Solar shingles Product Benchmarking by Key Players:

Tesla Solar Roof - Tesla's solar roof uses shingles that are made of tempered glass and are embedded with solar cells. These shingles have a sleek, modern design and come in four different styles: textured, smooth, Tuscan, and slate. CertainTeed Solar Shingles - CertainTeed offers a range of solar shingles that are designed to blend in with the surrounding roofing materials. The Apollo II system features shingles that are made of high-performance tempered glass. Dow Powerhouse Solar Shingles - Dow's Powerhouse solar shingles are designed to mimic the look of traditional asphalt shingles while providing energy savings. RGS Energy Powerhouse 3.0 - RGS Energy's Powerhouse 3.0 solar shingles are an updated version of the Dow Powerhouse shingles.

Solar Shingles Market Dynamics:

Increasing demand for clean energy is expected to increase the demand for Solar Shingles

As the demand for clean energy continues to grow, many people are looking for alternative ways to power their homes and businesses. Solar shingles are a type of roofing material that contain photovoltaic cells, which can convert sunlight into electricity. solar shingles offer a number of advantages. As many people become aware of the benefits of solar shingles, the demand for solar shingles is expected to increase that also lead to more competition in the market. Solar shingles provide an attractive alternative to traditional solar panels, as they are aesthetically pleasing and blend in with the roof.Government incentives and policies: One of the Key Drivers for Solar Shingles Market Growth

Governments across the globe have introduced various incentives and policies to encourage the adoption of solar energy. The incentives include tax credits, rebates, and net metering programs, which make solar energy more affordable and accessible. In many countries, including the United States, government agencies have introduced a range of incentives and policies to encourage the adoption of solar energy, including solar shingles. One of the most important policies has been the introduction of feed-in tariffs, which provide financial incentives for homeowners and businesses that generate solar energy. Many governments have introduced tax credits and other incentives for individuals and businesses that install solar panels or solar shingles. Government policies are expected to assist to drive innovation in the solar shingle market, by encouraging research and development in the field. For example, the U.S. Department of Energy has funded research into the development of new solar technologies, including solar shingles, through its SunShot Initiative. The government incentives and policies have played a key role in driving the growth of the solar shingle marketAn Increase Popularity of Energy-Efficient Homes: Drive to Boost the Production Solar Shingles

The increase in popularity of energy-efficient homes has certainly contributed to the growing demand for solar shingles. As more homeowners and businesses seek to reduce their carbon footprint and lower their energy bills, solar shingles are becoming an increasingly attractive option for their roofing needs. Firstly, there is a growing awareness of the need to transition away from fossil fuels and towards renewable energy sources. This has led to government incentives and regulations that encourage the adoption of solar technology, including solar shingles. Secondly, advances in solar technology have made solar shingles more efficient and cost-effective than ever before. This has helped to drive down the cost of production, making them a more viable option for homeowners and businesses alike. The increase in popularity of energy-efficient homes and buildings has created a strong market demand for solar shingles. As more people seek to reduce their energy bills and their impact on the environment, solar shingles are becoming an increasingly popular choice.Global Expansion of the solar industry that drive demand for Solar Shingles

The solar industry has witnessed significant growth, with solar energy becoming an increasingly popular alternative to traditional sources of energy. As more countries around the world adopt policies and incentives to encourage the use of renewable energy, the demand for solar products has continued to rise. One of the most promising developments in the solar industry is the emergence of solar shingles. The global expansion of the solar industry is a major driver of demand for solar shingles. As more people become interested in solar energy, they are also looking for ways to incorporate it into their homes and businesses. Solar shingles offer a unique solution for those who want to generate their own electricity. In addition to demand from homeowners and businesses, governments around the world are also investing in solar energy as a way to reduce their dependence on fossil fuels and meet their climate goals. Many countries have set ambitious targets for renewable energy adoption, and solar shingles are expected to play a significant role in meeting those targets. As the technology improves and becomes more affordable, it is expected that solar shingles are expected to become an increasingly popular choice during the forecast period.Solar Shingles Market Trends

The solar shingles market is a rapidly growing segment of the renewable energy industry. The market growth is driven by the increasing demand for sustainable and energy-efficient building materials. Here are some of the latest trends in the solar shingles market: Growing demand of Solar Shingles for residential installations: With increasing awareness about the benefits of solar power and the availability of incentives for homeowners, the demand for solar shingles for residential applications is on the rise. Homeowners are now looking for more aesthetically pleasing solar solutions that can seamlessly integrate into their roofing system. Advancements in technology: The solar shingles market is witnessing rapid advancements in technology, resulting in more efficient and durable products. Manufacturers are leveraging innovative technologies like thin-film photovoltaic (PV) cells, which can be integrated into shingles, to increase energy efficiency and reduce installation costs. Emergence of new players: With the increasing demand for solar shingles, new players are entering the market, resulting in increased competition. Established roofing companies are also expanding their product offerings to include solar shingles, thereby driving growth in the market. Focus on sustainability: With increasing awareness about the environmental impact of building materials, there is a growing demand for sustainable roofing solutions. Solar shingles are an ideal solution, as they not only produce clean energy but also have a longer lifespan compared to traditional roofing materials.Solar Shingles Market Segment Analysis:

Based on Type, the solar shingles market is segmented based on the type of solar cell technology used in the shingles. Silicon solar shingles are made of silicon solar cells, which are the most commonly used solar cells in the world. They are efficient, durable, and have a long lifespan. Silicon solar shingles can be easily integrated into the existing roofing system and are available in a variety of colors and designs to match the aesthetic of the building. On the other hand, Copper-Indium-Gallium-Selenide (CIGS) solar shingles are made of CIGS solar cells, which are known for their high efficiency and flexibility. CIGS solar shingles are thinner and lighter than silicon solar shingles, making them easier to install. They also have a lower manufacturing cost, which translates to a lower overall cost for the end consumer.Silicon solar shingles are projected to be leading segment in the Solar Shingles Market

Silicon solar shingles are an innovative and sustainable alternative to traditional roofing materials. The Silicon solar shingles blend seamlessly with traditional roofing materials, creating a sleek and modern appearance that enhances the aesthetic appeal of home. Silicon solar shingles are designed to withstand extreme weather conditions, including hail, strong winds, and heavy rain. They are also resistant to corrosion and fire, making them a durable and safe choice for roofing. The silicon solar shingles help to reduce greenhouse gas emissions and promote a cleaner environment. They also help to conserve natural resources by reducing the demand for fossil fuels. Based on end user, the solar shingles market is segmented into residential, commercial and industrial. The residential segment is expected to hold a significant share of the solar shingles market because of growing demand for renewable energy sources in residential buildings. Solar shingles offer homeowners a more aesthetically pleasing option for generating solar power compared to traditional solar panels. Furthermore, the commercial segment is expected to witness significant growth in the market due to the increasing adoption of renewable energy sources in commercial buildings, such as offices, warehouses, and retail stores. Moreover, the government initiatives to promote the use of renewable energy sources in commercial buildings is also driving the growth of this segment. On the other hand, the industrial segment is expected to witness moderate growth in the solar shingles market due to the high initial cost associated with the installation of solar shingles. However, the long-term benefits of using solar shingles, such as cost savings and reduced carbon emissions, are expected to drive the adoption of solar shingles in the industrial sector

Solar Shingles Market Regional Insights:

The solar shingles market growth is driven by demand for sustainable energy sources and the decreasing cost of solar technology. The North American market for solar shingles is expected to experience significant growth because of its demand for sustainable energy sources in the United States and Canada. The U.S. is expected to be the largest market for solar shingles by factors like increasing awareness about the benefits of renewable energy sources and the availability of government incentives. Additionally, The Latin American market for solar shingles is expected to grow because of high demand for sustainable energy sources in countries like Brazil and Mexico. Brazil is expected to be the largest market for solar shingles in Latin America due to the government's support for renewable energy sources.Europe Solar Shingles Market Overview:

The Europe solar shingles market is expected to grow in the coming years, driven by factors such as increasing demand for sustainable and energy-efficient building materials, government incentives for renewable energy, and advances in solar technology. Some of the leading countries in the Europe solar shingles market include Germany, France, Italy, and the UK. However, the growth of the Europe market may be hindered by factors such as high installation costs, lack of awareness among consumers, and regulatory barriers. Additionally, competition from other renewable energy sources, such as wind and geothermal, may also impact the growth of the market.Solar Shingles Industry Overview in China

The Chinese government has been investing heavily in the solar industry, with the goal of increasing the share of renewable energy in its overall energy mix. In recent years, China has also been focusing on expanding its BIPV market, including solar shingles, as part of its efforts to promote sustainable development. There are several Chinese companies that manufacture and sell solar shingles, including Hanergy and Suntech. These companies are also involved in other areas of the solar industry, such as solar panels and solar cells. However, the production and sales of solar shingles in China are expected to be impacted by various factors like government policies, market demand, and competition from other renewable energy sources. China is the largest market for solar shingles in Asia Pacific. The country has set a target to achieve 1,000 GW of solar power capacity by 2030, which is driving the growth of the solar shingles market in the country.Asia Pacific region: Emerging Region for Solar Shingles Demand

The increasing demand for clean and renewable energy, coupled with supportive government policies and initiatives, is driving the growth of the solar shingles market in the region. Countries such as China, Japan, India, and Australia are leading the adoption of solar shingles in the Asia Pacific region. Japan is another key market for solar shingles, as the country has been actively promoting the adoption of renewable energy sources to reduce its reliance on nuclear power. India is also emerging as a significant market for solar shingles, driven by the country's ambitious target to achieve 175 GW of renewable energy capacity by 2022. The Indian government has implemented various initiatives and policies to support the growth of the solar power industry in the country, which is expected to boost the adoption of solar shingles. Australia is another promising market for solar shingles in the Asia Pacific region. The country has abundant solar resources and has set a target to achieve 50% renewable energy by 2030. The government has implemented various policies and incentives to encourage the adoption of solar power, which is expected to drive the growth of the solar shingles market in the country.Solar Shingles Market Scope: Inquiry Before Buying

Solar Shingles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 362.80 Mn Forecast Period 2024 to 2030 CAGR: 5.46% Market Size in 2030: USD 526.36 Mn Segments Covered: by Type Silicon Solar Shingles Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles by Roofing Type New Roofing Reroofing by End-User Residential Commercial Industrial Solar Shingles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solar Shingles Market, Key Players:

1. Solar Lighting International, Inc. (U.S.) 2. Azuri Technologies Ltd (Kenya) 3. Dyesol Ltd. (Australia) 4. Solarwatt (Germany) 5. Hanergy Holding Group Limited (China) 6. Ertex Solartechnik GmbH (Germany 7. Canadian Solar (Canada) 8. Sunflare (U.S.) 9. DOW (U.S.) 10. Tesla, (U.S.) 11. PVEL LLC (U.S.) 12. Ergosun (U.S.) 13. RGS Energy (U.S.) 14. FlexSol Solutions B.V. (Netherlands) 15. SunTegra Solar (U.S.) 16. SunMaster Solar Lighting Co.,Ltd. (China) 17. SolarOne Solutions, Inc. (U.S.) 18. Best Solar Street Lights USA (U.S.)FAQs:

1] What segments are covered in the Global Solar Shingles Market report? Ans. The segments covered in the Solar Shingles report are based on Type, Roofing Type, End user and Region. 2] Which region is expected to hold the highest share in the Global Solar Shingles Market during the forecast period? Ans. The Asia Pacific region is expected to hold the highest share of the market during the forecast period. 3] What is the market size of the Global Solar Shingles by 2030? Ans. The market size of the Solar Shingles by 2030 is expected to reach USD 526.36 Mn. 4] What is the forecast period for the Global Solar Shingles Market? Ans. The forecast period for the market is 2024-2030. 5] What was the Global Solar Shingles Market size in 2023? Ans: The Global Solar Shingles Market size was USD 362.80 Billion in 2023.

1. Solar Shingles Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solar Shingles Market: Dynamics 2.1. Solar Shingles Market Trends by Region 2.1.1. North America Solar Shingles Market Trends 2.1.2. Europe Solar Shingles Market Trends 2.1.3. Asia Pacific Solar Shingles Market Trends 2.1.4. Middle East and Africa Solar Shingles Market Trends 2.1.5. South America Solar Shingles Market Trends 2.2. Solar Shingles Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Solar Shingles Market Drivers 2.2.1.2. North America Solar Shingles Market Restraints 2.2.1.3. North America Solar Shingles Market Opportunities 2.2.1.4. North America Solar Shingles Market Challenges 2.2.2. Europe 2.2.2.1. Europe Solar Shingles Market Drivers 2.2.2.2. Europe Solar Shingles Market Restraints 2.2.2.3. Europe Solar Shingles Market Opportunities 2.2.2.4. Europe Solar Shingles Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Solar Shingles Market Drivers 2.2.3.2. Asia Pacific Solar Shingles Market Restraints 2.2.3.3. Asia Pacific Solar Shingles Market Opportunities 2.2.3.4. Asia Pacific Solar Shingles Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Solar Shingles Market Drivers 2.2.4.2. Middle East and Africa Solar Shingles Market Restraints 2.2.4.3. Middle East and Africa Solar Shingles Market Opportunities 2.2.4.4. Middle East and Africa Solar Shingles Market Challenges 2.2.5. South America 2.2.5.1. South America Solar Shingles Market Drivers 2.2.5.2. South America Solar Shingles Market Restraints 2.2.5.3. South America Solar Shingles Market Opportunities 2.2.5.4. South America Solar Shingles Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Solar Shingles Industry 2.8. Analysis of Government Schemes and Initiatives For Solar Shingles Industry 2.9. Solar Shingles Market Trade Analysis 2.10. The Global Pandemic Impact on Solar Shingles Market 3. Solar Shingles Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Solar Shingles Market Size and Forecast, by Type (2023-2030) 3.1.1. Silicon Solar Shingles 3.1.2. Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles 3.2. Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 3.2.1. New Roofing 3.2.2. Reroofing 3.3. Solar Shingles Market Size and Forecast, by End User (2023-2030) 3.3.1. Residential 3.3.2. Commercial 3.3.3. Industrial 3.4. Solar Shingles Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Solar Shingles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Solar Shingles Market Size and Forecast, by Type (2023-2030) 4.1.1. Silicon Solar Shingles 4.1.2. Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles 4.2. North America Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 4.2.1. New Roofing 4.2.2. Reroofing 4.3. North America Solar Shingles Market Size and Forecast, by End User (2023-2030) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. North America Solar Shingles Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Solar Shingles Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Silicon Solar Shingles 4.4.1.1.2. Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles 4.4.1.2. United States Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 4.4.1.2.1. New Roofing 4.4.1.2.2. Reroofing 4.4.1.3. United States Solar Shingles Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Residential 4.4.1.3.2. Commercial 4.4.1.3.3. Industrial 4.4.2. Canada 4.4.2.1. Canada Solar Shingles Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Silicon Solar Shingles 4.4.2.1.2. Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles 4.4.2.2. Canada Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 4.4.2.2.1. New Roofing 4.4.2.2.2. Reroofing 4.4.2.3. Canada Solar Shingles Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Residential 4.4.2.3.2. Commercial 4.4.2.3.3. Industrial 4.4.3. Mexico 4.4.3.1. Mexico Solar Shingles Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Silicon Solar Shingles 4.4.3.1.2. Copper - Indium - Gallium - Selenide (CIGS) Solar Shingles 4.4.3.2. Mexico Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 4.4.3.2.1. New Roofing 4.4.3.2.2. Reroofing 4.4.3.3. Mexico Solar Shingles Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Residential 4.4.3.3.2. Commercial 4.4.3.3.3. Industrial 5. Europe Solar Shingles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.2. Europe Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.3. Europe Solar Shingles Market Size and Forecast, by End User (2023-2030) 5.4. Europe Solar Shingles Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.1.3. United Kingdom Solar Shingles Market Size and Forecast, by End User(2023-2030) 5.4.2. France 5.4.2.1. France Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.2.3. France Solar Shingles Market Size and Forecast, by End User(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.3.3. Germany Solar Shingles Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.4.3. Italy Solar Shingles Market Size and Forecast, by End User(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.5.3. Spain Solar Shingles Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.6.3. Sweden Solar Shingles Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.7.3. Austria Solar Shingles Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Solar Shingles Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 5.4.8.3. Rest of Europe Solar Shingles Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Solar Shingles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.3. Asia Pacific Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Solar Shingles Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.1.3. China Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.2.3. S Korea Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.3.3. Japan Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.4.3. India Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.5.3. Australia Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.6.3. Indonesia Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.7.3. Malaysia Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.8.3. Vietnam Solar Shingles Market Size and Forecast, by End User(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.9.3. Taiwan Solar Shingles Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Solar Shingles Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Solar Shingles Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Solar Shingles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Solar Shingles Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 7.3. Middle East and Africa Solar Shingles Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Solar Shingles Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Solar Shingles Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 7.4.1.3. South Africa Solar Shingles Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Solar Shingles Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 7.4.2.3. GCC Solar Shingles Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Solar Shingles Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 7.4.3.3. Nigeria Solar Shingles Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Solar Shingles Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 7.4.4.3. Rest of ME&A Solar Shingles Market Size and Forecast, by End User (2023-2030) 8. South America Solar Shingles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Solar Shingles Market Size and Forecast, by Type (2023-2030) 8.2. South America Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 8.3. South America Solar Shingles Market Size and Forecast, by End User(2023-2030) 8.4. South America Solar Shingles Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Solar Shingles Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 8.4.1.3. Brazil Solar Shingles Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Solar Shingles Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 8.4.2.3. Argentina Solar Shingles Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Solar Shingles Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Solar Shingles Market Size and Forecast, by Roofing Type (2023-2030) 8.4.3.3. Rest Of South America Solar Shingles Market Size and Forecast, by End User (2023-2030) 9. Global Solar Shingles Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Solar Shingles Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Solar Lighting International, Inc. (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Azuri Technologies Ltd (Kenya) 10.3. Dyesol Ltd. (Australia) 10.4. Solarwatt (Germany) 10.5. Hanergy Holding Group Limited (China) 10.6. Ertex Solartechnik GmbH (Germany 10.7. Canadian Solar (Canada) 10.8. Sunflare (U.S.) 10.9. DOW (U.S.) 10.10. Tesla, (U.S.) 10.11. PVEL LLC (U.S.) 10.12. Ergosun (U.S.) 10.13. RGS Energy (U.S.) 10.14. FlexSol Solutions B.V. (Netherlands) 10.15. SunTegra Solar (U.S.) 10.16. SunMaster Solar Lighting Co.,Ltd. (China) 10.17. SolarOne Solutions, Inc. (U.S.) 10.18. Best Solar Street Lights USA (U.S.) 11. Key Findings 12. Industry Recommendations 13. Solar Shingles Market: Research Methodology 14. Terms and Glossary