Navigation Satellite System Market size was valued at USD 290.8 Billion in 2024 and the total Global Navigation Satellite System Market revenue is expected to grow at a CAGR of 12.20% from 2025 to 2032, reaching nearly USD 730.36 Billion.Navigation Satellite System Market Overview

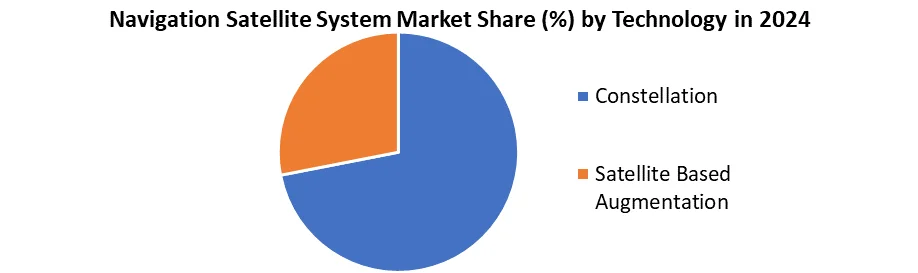

Navigation Satellite System is a space-based system that provides positioning, navigation, and timing (PNT) services globally. It enables exact location tracking for various civilian and military applications. Global navigation satellite system market increasing reliance on satellite-based positioning across industries such as automotive, defence, agriculture, logistics and consumer electronics. The demand for accurate real time location data surged with the rise of autonomous vehicles, smart infrastructure and IoT-enabled devices. Governments and space agencies worldwide intensified investments in expanding and modernizing GNSS constellations like GPS, BeiDou, Galileo, GLONASS and regional systems like NAVIC and QZSS. These developments significantly improved signal accessibility, accuracy and resilience. The Constellation segment dominated the market in 2024 as these systems form the fundamental structure overall satellite navigation facilities. The Asia-Pacific region emerged as the leading regional market, propelled by large-scale satellite launches government support, and increasing applications in transportation, agriculture and defence. Rising with the integration of GNSS in AI-based platforms and multi-constellation receivers. The navigation satellite system market saw high demand across sectors seeking enhanced navigation accuracy, safety, and efficiency, reinforcing GNSS as a critical global technology. Major key players leading the Navigation Satellite System market included China Aerospace Science and Technology Corporation, ISRO, European Space Agency, Trimble Inc., and Garmin Ltd. These companies run the navigation satellite system market through satellite deployments, advanced GNSS solutions, and strong regional influence.To know about the Research Methodology :- Request Free Sample Report

Navigation Satellite System Market Dynamics:

Technological Advancements and Rising Consumer Applications to Drive Navigation Satellite System Market Growth

Growing uses in numerous industrial verticals, increasing technological advancements, and the need to improve the performance of positioning solutions, especially in adverse situations are driving the GNSS market growth across the globe. Cheap transaction costs, minimum environmental effect, and increased revenue from value-added services are also driving product demand. Spacecraft are using global navigation system receivers to determine exact orbits without relying on ground tracking. In addition, a global navigation satellite system receiver is used in the geocoding of photographs. When a digital camera's photos are combined with position data from the global navigation satellite system, the user can look up the locations where the photos were taken or examine them on a map. It has been observed that in recent years, young people have become increasingly interested in wildlife photography, which is expected to have a positive impact on the GNSS market growth during the forecast period. The growing number of consumer electronics with navigation and positioning capabilities is expected to drive up demand for low-power GNSS processors. Currently, technologically advanced wearable devices are in high demand. For instance, more than 50% of the world's population wears tech-advanced wearable gadgets like fitness bands and smartwatches. GNSS chips are widely used in these devices, which provide exact location information to users while running, walking, or driving. These factors are expected to boost the market growth during the forecast period.Rising Demand for Real-Time Positioning PNT Devices to Drive Navigation Satellite System Market Expansion

Global Navigation Satellite System (GNSS) has been widely used, thanks to its performance, which includes accuracy, integrity, continuity, and availability, which is driving the GNSS market growth. In addition, the growing importance of positioning, navigation, and timing (PNT) devices in the military, industrial, government, and commercial applications, along with the growing demand for navigation tools and solutions that protect users' privacy are also fueling the GNSS market growth across the globe. Unmanned robotic vehicles (URV) have become more popular in recent years across the globe. The increased capacities of numerous industry verticals such as automotive, aviation, agriculture, maritime, and transportation and logistics are driving this demand. Unmanned aerial vehicles (UAVs), autonomous underwater vehicles (AUVs), and unmanned ground vehicles (UGVs) all require the incorporation of navigation satellite system receivers in order to obtain exact real-time positional information. This data is essential for a variety of applications, including surveying, search and rescue, mapping, autonomous deliveries, and military combat operations. In addition, advanced GNSS receivers enable an unmanned vehicle to operate effectively and efficiently even in areas with poor signal reception. As a result, there is a greater demand for navigation-based gadgets that are integrated into UAVs. These factors are expected to fuel the growth of GNSS market growth throughout the forecast period.Navigation Satellite System Market Segment Analysis:

Based on the Type, the Navigation Satellite System Market is segmented into GPS, GLONASS, Galileo, Baidoa, and Others. The GPS segment held the largest market share, accounting for 36% in 2024. The Global Positioning System (GPS) segment growth is attributed to its advanced technology and it can be found in practically every industry area. GPS is used for identifying location, navigation, building world maps, monitoring objects or personal movement, and bringing exact timing to the globe. In addition, GPS receivers may be found in a variety of commercial items, including smartphones, fitness watches, vehicles, and GIS devices, all of which are expected to grow the market during the forecast period. The increased demand for GPS receivers among military and civilian users is also expected to boost the GNSS market's growth. Based on Technology, the market is segmented into Constellation, Satellite Based Augmentation. Constellation segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. This Dominance Due to its foundational role in delivering global positioning and navigation facilities. Major systems like GPS, BeiDou, Galileo, and GLONASS provided broad dependable coverage and supported a extensive range of applications across sectors such as automotive, agriculture, defence and consumer electronics. Continued investments by space activities and governments in rising and modernizing satellite constellations further increased this segment. With increased demand for high precision navigation in smartphones, autonomous vehicles, and IoT devices, constellation based GNSS continued the core technology outpacing Satellite Based Augmentation Systems in global adoption.

Navigation Satellite System Market Regional Analysis

Asia Pacific region dominated the market in 2024 & is expected to hold largest share during the forecast period. Due to rapid advancements in satellite technology, increased government investments, and rising demand across diverse sectors. China’s BeiDou Navigation Satellite System reached full global coverage and significantly extended user base across Asia positioning China as a global GNSS leader. India through ISRO, advanced its NAVIC system with plans for second generation satellites, while Japan’s QZSS continued enhancing GNSS accuracy in urban environments. The Asia Pacific region witnessed high GNSS integration in consumer electronics, agriculture, transportation and defence. Governments in Asia-Pacific actively supported GNSS research and satellite deployment with multiple launches by CASC and ISRO in 2024. The accessibility of affordable GNSS chips from regional manufacturers and the rising use of multi-constellation receivers in smart devices also fuelled the market. Asia developed as the dominant region in 2024 offering both technological leadership and mass scale adoption across industries.Navigation Satellite System Market Competitive Landscape

Major key players like China Aerospace Science and Technology Corporation (CASC), Mitsubishi Electric Corporation, and Topcon Corporation each holding a strategic position. CASC a state-owned enterprise plays a pivotal role in the development and deployment of China’s BeiDou Navigation Satellite System (BDS). With strong government management CASC benefits from full control over satellite industri launch and GNSS infrastructure, securing its dominance across Asia and expanding influence in emerging markets. Mitsubishi Electric Corporation, contributes significantly to the Quasi-Zenith Satellite System (QZSS), supplying advanced satellite subsystems GNSS, payloads and receivers. Its technological management and partnerships with Japanese space agencies strengthen its place in regional GNSS enhancement. Topcon Corporation leads in precision GNSS applications offering multi-constellation receivers and positioning solutions for construction, agriculture, and surveying. Competing with Trimble and Leica, Topcon attentions on delivering high-accuracy GNSS systems integrated with smart technology. These companies drive innovation, regional GNSS independence and competitive advancements in satellite navigation technology market.Navigation Satellite System Market Trends

Trends Description Rising Adoption of Multi-Constellation GNSS Devices increasingly support GPS, GLONASS, Galileo, and BeiDou for higher accuracy. Expansion of Regional GNSS Systems NAVIC (India), QZSS (Japan), and BeiDou (China) expanding global or regional coverage. Integration in Consumer Devices GNSS chips widely integrated into smartphones, wearables, and IoT devices. Navigation Satellite System Market Key Development

• In 10 January 2024, Roscosmos (Eastern Europe) successfully launched the first GLONASS-K2 satellite from the Plesetsk Cosmodrome. The satellite offers enhanced security, improved signal accuracy, and extended operational life. • In 12 June 2024, ISRO (Asia-Pacific, India) approved a strategic roadmap to launch five new NAVIC satellites by 2025–2026. This initiative aims to boost the regional navigation capabilities and coverage of the NAVIC system. • In 12 February 2024 – (CASC) (Asia-Pacific) deployed new BeiDou-3 navigation satellites to enhance GNSS coverage across Asia and the Middle East, supporting regional positioning accuracy and strategic connectivity. • In 15 February 2025 – Garmin Ltd. (U.S./Switzerland) unveiled next-generation multi-band GNSS wearables featuring AI-assisted route prediction, enhancing navigation accuracy and user experience for fitness and outdoor enthusiasts. • In 21 May 2025 – ESA & Thales Alenia Space (Europe) announced a joint initiative to develop next-generation atomic clock systems for the Galileo GNSS, aiming to enhance timing precision and satellite reliability.Navigation Satellite System Market Scope: Inquiry Before Buying

Global Navigation Satellite System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 290.8 Billion Forecast Period 2025 to 2032 CAGR: 12.20% Market Size in 2032: USD 730.36 Billion Segments Covered: by Type GPS GLONASS Baidoa Others by Technology Constellation Satellite Based Augmentation by End-User Automotive Consumer Electronics Industrial Military & Defence Travel & tourism Others Navigation Satellite System Market by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Navigation Satellite System Market Key Players

North America 1. Lockheed Martin Corporation (U.S.) 2. Raytheon Technologies Corporation (U.S.) 3. Northrop Grumman Corporation (U.S.) 4. Trimble Inc. (U.S.) 5. Garmin Ltd. (U.S./Switzerland) 6. Broadcom Inc. (U.S.) 7. Qualcomm Technologies Inc. (U.S.) 8. NovAtel Inc. (Canada) Europe 9. Airbus S.A.S. (France) 10. Thales Group (France) 11. OHB SE (Germany) 12. European Space Agency (ESA) (Europe) 13. GMV Innovating Solutions (Spain) 14. Septentrio N.V. (Belgium) 15. u-blox Holding AG (Switzerland) 16. Hexagon AB (Leica Geosystems) (Sweden) 17. Telit Communications PLC (UK/Italy) Asia-Pacific 18. China Aerospace Science and Technology Corporation (CASC) (China) 19. Mitsubishi Electric Corporation (Japan) 20. Topcon Corporation (Japan) 21. ISRO (Indian Space Research Organisation) (India) 22. MediaTek Inc. (Taiwan) 23. SkyTraq Technology Inc. (Taiwan) 24. Allystar Technology Co., Ltd. (China) 25. BeiDou Navigation Satellite System (BDS) (China) 26. QZSS (Quasi-Zenith Satellite System) (Japan) Middle East & Africa 27. Israel Aerospace Industries Ltd. (Israel) 28. South African National Space Agency (SANSA) (South Africa) South America 29. Agência Espacial Brasileira (AEB) (Brazil) 30. INPE (National Institute for Space Research) (Brazil)Frequently Asked Question

1: What was the value of the Navigation Satellite System Market in 2024? Ans: The market was valued at USD 290.8 Billion in 2024. 2: Which technology segment dominated the market in 2024? Ans: The Constellation segment dominated due to its core role in global navigation infrastructure. 3: Which region led the global Navigation Satellite System market in 2024? Ans: The Asia-Pacific region dominated, driven by satellite deployments and government support. 4: What is the forecasted market size of the GNSS market by 2032? Ans: The market is projected to reach USD 730.36 Billion by 2032. 5: Name one major key player in the Navigation Satellite System market. Ans: China Aerospace Science and Technology Corporation (CASC) is a major market player.

1. Navigation Satellite System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Navigation Satellite System Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Technology Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Navigation Satellite System Market: Dynamics 3.1. Region wise Trends of Navigation Satellite System Market 3.1.1. North America Navigation Satellite System Market Trends 3.1.2. Europe Navigation Satellite System Market Trends 3.1.3. Asia Pacific Navigation Satellite System Market Trends 3.1.4. Middle East and Africa Navigation Satellite System Market Trends 3.1.5. South America Navigation Satellite System Market Trends 3.2. Navigation Satellite System Market Dynamics 3.2.1. Global Navigation Satellite System Market Drivers 3.2.2. Global Navigation Satellite System Market Restraints 3.2.3. Global Navigation Satellite System Market Opportunities 3.2.3.1. Expansion in global markets 3.2.3.2. Typed Navigation Satellite System innovation 3.2.4. Global Navigation Satellite System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Navigation Satellite System Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 4.1.1. GPS 4.1.2. GLONASS 4.1.3. Galileo 4.1.4. Baidoa 4.1.5. Others 4.2. Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 4.2.1. Constellation 4.2.2. Satellite Based Augmentation 4.3. Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 4.3.1. Automotive 4.3.2. Consumer Electronics 4.3.3. Industrial 4.3.4. Military & Defence 4.3.5. Travel & Tourism 4.4. Navigation Satellite System Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Navigation Satellite System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 5.1.1. GPS 5.1.2. GLONASS 5.1.3. Galileo 5.1.4. Baidoa 5.1.5. Others 5.2. North America Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 5.2.1. Constellation 5.2.2. Satellite Based Augmentation 5.3. North America Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 5.3.1. Automotive 5.3.2. Consumer electronics 5.3.3. Industrial 5.3.4. Military & defence 5.3.5. Travel & tourism 5.3.6. Others 5.4. North America Navigation Satellite System Market Size and Forecast, by Country (2024-2032) 5.4.1. Unite Stateses 5.4.1.1. United States Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. GPS 5.4.1.1.2. GLONASS 5.4.1.1.3. Galileo 5.4.1.1.4. Baidoa 5.4.1.1.5. Others 5.4.1.2. United States Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. Bottle 5.4.1.2.2. Can 5.4.1.2.3. Others 5.4.1.3. United States Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Automotive 5.4.1.3.2. Consumer electronics 5.4.1.3.3. Industrial 5.4.1.3.4. Military & defence 5.4.1.3.5. Travel & tourism 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. GPS 5.4.2.1.2. GLONASS 5.4.2.1.3. Galileo 5.4.2.1.4. Baidoa 5.4.2.1.5. Others 5.4.2.2. Canada Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. Constellation 5.4.2.2.2. Satellite Based Augmentation 5.4.2.3. Canada Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 5.4.2.3.1. Automotive 5.4.2.3.2. Consumer electronics 5.4.2.3.3. Industrial 5.4.2.3.4. Military & defence 5.4.2.3.5. Travel & tourism 5.4.2.3.6. Others 5.4.2.4. Mexico Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 5.4.2.4.1. GPS 5.4.2.4.2. GLONASS 5.4.2.4.3. Galileo 5.4.2.4.4. Baidoa 5.4.2.5. Mexico Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 5.4.2.5.1. Constellation 5.4.2.5.2. Satellite Based Augmentation 5.4.2.6. Mexico Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 5.4.2.6.1. Automotive 5.4.2.6.2. Consumer electronics 5.4.2.6.3. Industrial 5.4.2.6.4. Military & Defence 5.4.2.6.5. Travel & Tourism 6. Europe Navigation Satellite System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.2. Europe Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Navigation Satellite System Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.2. France 6.4.2.1. France Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Navigation Satellite System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Navigation Satellite System Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.4. India 7.4.4.1. India Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Navigation Satellite System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Navigation Satellite System Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 9. South America Navigation Satellite System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 9.2. South America Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 9.3. South America Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 9.4. South America Navigation Satellite System Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Navigation Satellite System Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Navigation Satellite System Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America Navigation Satellite System Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Lockheed Martin Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Raytheon Technologies Corporation (U.S.) 10.3. Northrop Grumman Corporation (U.S.) 10.4. Trimble Inc. (U.S.) 10.5. Garmin Ltd. (U.S./Switzerland) 10.6. Broadcom Inc. (U.S.) 10.7. Qualcomm Technologies Inc. (U.S.) 10.8. NovAtel Inc. (Canada) 10.9. Airbus S.A.S. (France) 10.10. Thales Group (France) 10.11. OHB SE (Germany) 10.12. European Space Agency (ESA) (Europe) 10.13. GMV Innovating Solutions (Spain) 10.14. Septentrio N.V. (Belgium) 10.15. u-blox Holding AG (Switzerland) 10.16. Hexagon AB (Leica Geosystems) (Sweden) 10.17. Telit Communications PLC (UK/Italy) 10.18. China Aerospace Science and Technology Corporation (CASC) (China) 10.19. Mitsubishi Electric Corporation (Japan) 10.20. Topcon Corporation (Japan) 10.21. ISRO (Indian Space Research Organisation) (India) 10.22. MediaTek Inc. (Taiwan) 10.23. SkyTraq Technology Inc. (Taiwan) 10.24. Allystar Technology Co., Ltd. (China) 10.25. BeiDou Navigation Satellite System (BDS) (China) 10.26. QZSS (Quasi-Zenith Satellite System) (Japan) 10.27. Israel Aerospace Industries Ltd. (Israel) 10.28. South African National Space Agency (SANSA) (South Africa) 10.29. Agência Espacial Brasileira (AEB) (Brazil) 10.30. INPE (National Institute for Space Research) (Brazil) 11. Key Findings 12. Analyst Recommendations 13. Navigation Satellite System Market: Research Methodology