The Molecular Biology Enzymes Reagents and Kits Market size was valued at USD 24.05 Billion in 2025 and the total Molecular Biology Enzymes Reagents and Kits revenue is expected to grow at a CAGR of 11.1% from 2026 to 2032, reaching nearly USD 50.25 Billion by 2032.Molecular Biology Enzymes Reagents and Kits Market Overview:

The promotion of chemical reactions in biological systems is greatly aided by biological enzymes. These substances are also used in a number of procedures, including DNA sequencing, cell analysis, and polymerase chain reaction (PCR). A few major driving forces, including robust funding for genomics, lowering sequencing process costs, and rising chronic disease prevalence, are thought to be responsible for the market's expansion. Constant technical improvements in the molecular biology sector had a substantial impact on life sciences research conducted for the management of medical disorders, which has increased usage of molecular biology supplies. Furthermore the adoption rate of the products available in the market for molecular biology enzymes, reagents, and kits has led development of precise computational tools combined with continuously updated biological databases.Research Scope:

The Research aims to provide market participants in depth analysis of Molecular Biology Enzymes Reagents and Kits Market. The study looks at the markets recent, ongoing, and predicted future changes. It also provides a simple analysis of complex data. New entrants, industry titans, and followers are some of the primary forces that actively and carefully perform research. The study displays the results of the PORTER and PESTEL analyses as well as probable outcomes of the microeconomic market elements. After accounting for internal and external variables that can have a favorable or unfavorable impact on the firm, decision-makers will have a clear futuristic perspective of the market. The market segmentation analysis and market size forecast in the research help investors better understand the dynamics and structure of the Molecular Biology Enzymes Reagents and Kits Market. Comprehensive analysis of market drivers and restraints are analyzed locally, regionally, and globally have helped our analyst to estimate and forecast the market size without leaving any aspect that has affected the business internally or externally. Primary and secondary data collection methods were used to collect data. Online primary Interviews were carried out with selected respondents which were selected by keeping Whole business ecosystem into account. Primary respondents include representatives from Healthcare industries, hospitals. Manufacturing companies who recently emerged in the product line of industry Molecular Biology Enzymes Reagents and Kits Market were also interviewed to validate the key findings.To know about the Research Methodology :- Request Free Sample Report

Molecular Biology Enzymes Reagents and Kits Market Dynamics:

Market Drivers: The demand for molecular enzymes, reagents, and kits is driven by an increase in omics-based research projects. The product landscape has been significantly shaped by technological and scientific developments, which has led to the establishment of new regulations for these emerging technologies. Common key federal agencies that manages potential environmental and health concerns associated with these items include the Food and Drug Administration (FDA) and the World Health Organization, these elements encourage the use of the enzymes, reagents, and kits sold in this market for molecular biology. Over 60 million patients' genomes are predicted to be generated by the healthcare industry. Government funding of $4 billion in at least 14 countries is helping to finance the expanding integration of genetic sequencing into healthcare systems. As part of a 200 million public-private collaboration between nonprofit groups and pharmaceutical corporations, the UK has announced the launch of the largest genome project in the world. Through the 100,000 Genomes Project, the nation has already created the largest genome database in the entire globe. The project was started to support researchers and industries through funding to combine data and real-world evidence obtained from UK health services as well as to create new products and services for more effective and early disease diagnosis. These aforementioned factors has driven the Market. Market Restraints: Reimbursement guidelines for genetic tests are rigid. The majority of US health insurance plans do not pay for genetic testing unless doctor has prescribed it. Thus the provider’s policy is the only factor affecting coverage and payment for instance, individuals with cancer diagnoses who are eligible for Medicare coverage of genetic testing for an inherited mutation are covered for such testing. These worries are limiting market expansion on a global scale. Market Opportunities: The genomics sector has seen substantial technological progress due to grants and funding from government organizations. The market for molecular biology enzymes, kits, and reagents has potential growth opportunities as a result of R&D investments. The expansion of the market for molecular biology enzymes, kits, and reagents is thus supported by the manufacturers' and governments' ongoing investments in the field of genomics which has led to the growth opportunity. For instance, a new round of funding headed by LeapFrog Investments, a global impact investing business, raised US$ 55 million (about INR 419 crore) for Bengaluru, India-based MedGenome, this company specializes in genetic diagnoses, research, and data. In addition, MedGenome asserts has created the largest database of South Asian genetic variations for use in genetic diagnostics in India and collaborative research it has collected samples from more than 550 hospitals and 6,000 clinicians throughout India and performed more than 200,000 genetic testing thus far.Molecular Biology Enzymes Reagents and Kits Market Segment Analysis:

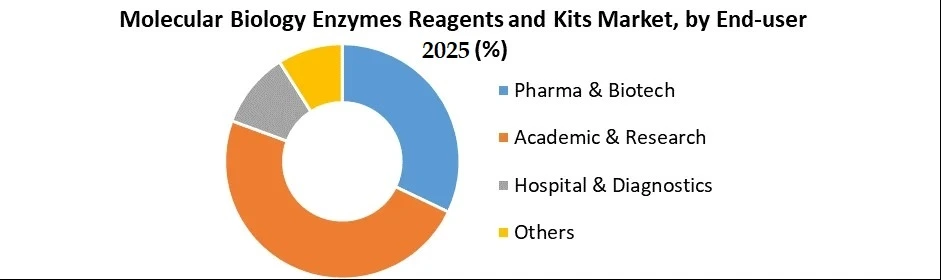

Based on Product type, the Molecular Biology Enzymes, Reagents and Kit’s market is segmented by kits and reagents, enzymes. With a revenue share of 69%, kits and reagents dominated the market for molecular biology enzymes, reagents, and kits. This is because kits and reagents are widely accessible, and important companies have developed cutting-edge products. For instance, Assurgent, Inc. released the AmplideX PCR/CE SMN1/2 Kit in March 2019 to provide a dependable and quick method for the 4-hour detection of SMN2 and SMN1 exon 7 copy number. It is employed for molecular diagnostics and is based on a Polymerase Chain Reaction (PCR). Global COVID-19 cases are increasing exponentially, which has prompted biotechnology and healthcare companies to speed up the production of RT-PCR-based testing kits. Thermo Fisher announced that it intended to produce up to 5.0 million new tests for the COVID-19 detection. As a result, it is anticipated that increased commercial availability of COVID-19 testing items will boost demand for the kits and reagents required for COVID-19 diagnosis. Proteinases, an enzyme that is utilized in diagnosis and has gained popularity as a result of the pandemic. Based on Application type, in the market for molecular biology enzymes, reagents, and kits in 2025, the sequencing segment held a 34.9% revenue share. The market is anticipated to expand quickly and profitably. The development of Next-generation Sequencing (NGS) has greatly advanced genetic research and the identification of human disorders. Biomarker discovery for cancer diagnostics and tumour stratification is driven by NGS analysis of tumour epigenomics, genomics, and transcriptomics. The advantages of NGS include the ability to detect the smallest mutations, the simplicity of combining SNP and bigger abnormalities for detection, and the crucial combination of high throughput, speed, and resolution. Additionally, it is anticipated that a growth in the use of targeted and whole-exome sequencing will fuel the demand for sequencing In terms of revenue, the market for molecular biology enzymes, reagents, and kits saw PCR capture the second-largest revenue share in 2025. The technology is now more accessible and portable thanks to the recent development of miniPCR. However, the development of droplet digital PCR (ddPCR), which combines fluorescence-activated cell sorting with traditional PCR, provides a highly automated and reliable approach for the detection of rare targets in samples. This market's revenue is anticipated to be driven by such PCR technology advancements.Based on End-User, the market for molecular biology enzymes, kits, and reagents is divided into three end-user categories: biotech and pharmaceutical firms, medical facilities and diagnostic centers, and academic and research institutions. The segment of biotech and pharmaceutical businesses held the largest market share, it is anticipated that segment would see the highest CAGR throughout the forecast period. The market for molecular biology enzymes, reagents, and kits was dominated by the Pharma and biotech segment, with a revenue share of 37.3 %. The demand for molecular biology enzymes and reagents is being driven by a surge in R&D activities and a number of active clinical studies in the pharmaceutical and biotech industries. The market for sequencing products has increased as a result of collaborations and mergers with regard to sequencing technology as well as preferences changing toward companion diagnostics and personalized medicine. Players in the market are implementing product launch and expansion strategies to adapt consumer preferences around the world while maintaining their brand recognition.

Molecular Biology Enzymes Reagents and Kits Regional Insights:

Due to the presence of well-known market players like Pharmozyme, Inc., North America currently holds the top spot in the global market for molecular biology enzymes, reagents, and kits. North America will account for 44.2% of global revenue. Initiatives like the National Human Genomes Research Institutes' Public Health programmes, which examine newborns for genetic disorders and use birth sequencing in genomic medicine, help the region grow. The market expansion for molecular biology enzymes, reagents, and kits is projected to be boosted by these factors. The market for molecular biology enzymes, reagents, and kits is anticipated to expand at a profitable rate in the Asia Pacific region throughout the course of the forecast period. One of the key elements driving the market's expansion in the region is the regional players' ongoing development and commercialization of point of care PCR tools and supplies. For instance, the commercialization of PCR reagents for the automated coronavirus test instrument was started by the Japanese company Fujifilm Wako Pure Chemical Corp.Molecular Biology Enzymes Reagents and Kits Market Scope: Inquire before buying

Molecular Biology Enzymes Reagents and Kits Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 24.05 Bn. Forecast Period 2026 to 2032 CAGR: 11.1% Market Size in 2032: USD 50.25 Bn. Segments Covered: by Product type kits and reagents Enzymes by Application Cloning Sequencing PCR Epigenetics Restriction Digestion Others by End-user Pharma & Biotech Academic & Research Hospital & Diagnostics Others Molecular Biology Enzymes Reagents and Kits Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Molecular Biology Enzymes Reagents and Kits Key Companies are:

1. Thermo Fisher Scientific, Inc. 2. QIAGEN 3. Illumina, Inc. 4. F. Hoffmann-La Roche Ltd. 5. Agilent Technologies, Inc. 6. Bio-Rad Laboratories, Inc. 7. New England Biolabs 8. Merck KGaA 9. Promega Corporation 10. Takara Bio, Inc. 11. LGC Limited FAQs: 1. Which is the potential market for the Market in terms of the region? Ans. In North America region, the growing business and are expected to help drive the use of collaborative screens. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for Markets in educational institutes 3. What is expected to drive the growth of the Market in the forecast period? Ans. A major driver in the Market is the prevalence of COVID-19 pandemic 4. What was the Global Market size in 2025? Ans: The Global Molecular Biology Enzymes Reagents and Kits Market size was USD 24.05 Billion in 2025. 5. What segments are covered in the Market report? Ans. The segments covered are by Product type, by Application, by End-user, by Region.

1. Global Molecular Biology Enzymes Reagents and Kits Market: Research Methodology 2. Global Molecular Biology Enzymes Reagents and Kits Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Molecular Biology Enzymes Reagents and Kits Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Molecular Biology Enzymes Reagents and Kits Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region 3.12 COVID-19 Impact 4. Global Molecular Biology Enzymes Reagents and Kits Market Segmentation 4.1 Global Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 4.2 Global Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 4.3 Global Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 5. North America Molecular Biology Enzymes Reagents and Kits Market (2025-2032) 5.1 North America Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 5.2 North America Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 5.3 North America Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 5.5 North America Molecular Biology Enzymes Reagents and Kits Market, by Country (2025-2032) 6. Europe Molecular Biology Enzymes Reagents and Kits Market (2025-2032) 6.1. European Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 6.2. European Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 6.3. European Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 6.4. European Molecular Biology Enzymes Reagents and Kits Market, by Country (2025-2032) 7. Asia Pacific Molecular Biology Enzymes Reagents and Kits Market (2025-2032) 7.1. Asia Pacific Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 7.2. Asia Pacific Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 7.3. Asia Pacific Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 7.4. Asia Pacific Molecular Biology Enzymes Reagents and Kits Market, by Country (2025-2032) 8. Middle East and Africa Molecular Biology Enzymes Reagents and Kits Market (2025-2032) 8.1 Middle East and Africa Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 8.2. Middle East and Africa Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 8.3. Middle East and Africa Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 8.4. Middle East and Africa Molecular Biology Enzymes Reagents and Kits Market, by Country (2025-2032) 9. South America Molecular Biology Enzymes Reagents and Kits Market (2025-2032) 9.1. South America Molecular Biology Enzymes Reagents and Kits Market, by Application (2025-2032) 9.2. South America Molecular Biology Enzymes Reagents and Kits Market, by End-User (2025-2032) 9.3. South America Molecular Biology Enzymes Reagents and Kits Market, by Product type (2025-2032) 9.4. South America Molecular Biology Enzymes Reagents and Kits Market, by Country (2025-2032) 10. Company Profile: Key players 10.1 Thermo Fisher Scientific, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 QIAGEN 10.3 Illumina, Inc. 10.4 F. Hoffmann-La Roche Ltd. 10.5 Agilent Technologies, Inc. 10.6 Bio-Rad Laboratories, Inc. 10.7 New England Biolabs 10.8 Merck KGaA 10.9 Promega Corporation 10.10 Takara Bio, Inc. 10.11 LGC Limited