Global Mill Liner Market size was valued at USD 854.72 Mn. in 2024, and the total Mill Liner Market revenue is expected to grow by 6.2% from 2025 to 2032, reaching nearly USD 1382.99 Mn.Mill Liner Market Overview:

The mill liner market is a vital segment within the mining, cement, and power generation industries, providing essential wear-protection solutions for grinding mills. Mill liners, manufactured from steel, rubber, or composite materials, shield mill shells from impact and abrasion during ore or material grinding, improving efficiency, reducing downtime, and extending equipment lifespan. The market is defined by material composition, application segments, and end-user industries, with a strong focus on product types, technological advancements, and their contribution to operational optimization. The mill liner market is witnessing growth driven by rising mineral production, the expansion of cement manufacturing, and increasing adoption of high-performance liners for cost-effective maintenance. Advances in manufacturing techniques and the growing presence of suppliers in both developed and emerging markets are expanding product availability. On the supply side, global and regional manufacturers are focusing on delivering customized, application-specific solutions that meet the demands of different industrial processes. Regionally, the mill liner market is dominated by North America in 2024, supported by strong mining output in the U.S., Canada, and Mexico. According to segment analysis, the mining sector accounts for the largest share of demand, followed by cement plants and thermal power stations. This comprehensive market overview provided stakeholders with valuable insights into growth opportunities, competitive strategies, and regional trends shaping the industry’s future.To know about the Research Methodology :- Request Free Sample Report

Mill Liner Market Dynamics

Mining, Oil & Gas and Cement Sectors to Fuel Mill Liner Market Expansion A key driver for the mill liner market is the rise in the number of mining refineries, which has boosted the demand for mills in grinding operations. As mining activities expand, especially in mineral-rich regions, the need for efficient milling systems continues to grow, thereby increasing demand for mill liners. The oil and gas industry also contributes to market growth through its exploration and production operations, which involve seeking, exploring, drilling, and extraction. Offshore exploration efforts have increased in response to the rising demand for fuel and electricity generation. Mill systems, and by extension mill liners, are required for these operations, further propelling market demand. Mill liners enhance productivity and throughput by increasing grinding capacity, enabling the processing of larger volumes of material. This efficiency gain supports higher operational output, which acts as a significant growth driver for the market. The expanding cement sector presents another major growth opportunity. The sector’s rising demand for grinding mills is expected to fuel rapid growth in mill liner consumption, with projections indicating market expansion to nearly US$ xx Mn by 2032. The cement industry’s growing reliance on grinding mills, along with the continued expansion of applications in mining, is supplementing global market growth. Operational and Economic Factors to Create Mill Liner Market Challenge While the mill liner market is experiencing strong growth momentum, challenges persist. The steady but slower rate of demand growth in the mining industry compared to rapid expansion in cement and other sectors could limit the overall growth pace in certain regions. Additionally, fluctuations in raw material prices and the cyclical nature of mining operations can impact procurement decisions and investment in milling infrastructure, posing a restraint on the market’s consistent expansion.Mill Liner Market Segment Analysis

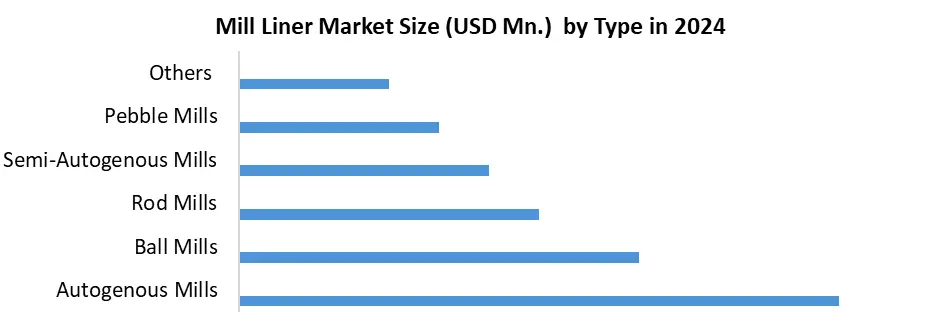

Based on Material, Market is segmented into Steel, Rubber and composite, where Rubber dominated the Mill Liner Market in 2024 and expected to hold largest share in forecast period. Rubber mill liners are utilized in secondary and regrind milling applications, and they may also be adapted for new ones. A rubber mill liner is often made up of a combination of natural and synthetic rubber. They're being employed on a big scale in primary grinding applications, because of better materials and computer-aided design techniques. Based on Type, Market is segmented into Autogenous Mills, Semi-Autogenous Mills, Ball Mills, Rod Mills, Pebble Mills, Others where Autogenous Mills dominated the Mill Liner Market in 2024 and expected to hold largest share in forecast period. Because they can operate with minimal or no human supervision, which is crucial for improving efficiency, safety and flexibility in the most demanding environments. Autonomous robots rely on a suite of sensors, AI, sensor fusion, GPS, LiDAR, and machine vision to avoid obstacles, and navigate complex terrain and environments while performing critical tasks (e.g., surveillance and reconnaissance) or mission-essential tasks (e.g., search-and-rescue) without prolonged remote control. The autopilot-like navigation and remote monitoring capability reduces the need for human beings to be present in hazardous or potentially life-threatening environments such as warfields, disaster areas, or harsh industrial environments, thereby minimizing operational risk and cost.

Mill Liner Market Regional Insight

By 2032, North America is expected to have the greatest market share of xx%. Because of the increased use of modern technology and the need for minerals, a great number of mining projects are being developed in North America. North American governments, both developing and developed, such as Canada's and the United States, are taking steps to increase mining investment, which is propelling the Global Mill Liner Market forward. The growth of grinding mills in the United States is likely to enhance the mill liner market in the area. The Global Mill Liner Market is being driven by an increase in the number of oil and gas refineries as a result of the growing need for energy and electricity generation. The need for energy and power-efficient solutions has increased in developing and developed economies in APAC, such as China and India, as a result of increasing population, industrialization, and urbanization, which is contributing to the growth of oil and gas refineries, thereby increasing the demand for mill liners in the region.Competitive Landscape of Mill Liner Market:

The MMR Competition Matrix for the Mill Liner Market becomes a full representation focused on the innovative solutions and strategic positioning for their business size that emphasizes top players in the industry. The report profiled detailed company profiles that highlight their headquarters, product portfolio, revenue exposure, market share signals, regional footprint, and what end-users they focus mainly on (mining, cement, power). The report also highlights Key Players Benchmarking using metrics such as their financial performance, technology (rubber-metal composites, high-chrome alloy, complex lifter geometries, digital wear monitoring), manufacturing footprint, aftermarket service capability, and installed base, and access to the overall market overview. While this Competition Matrix shows competitive strengths by players it also surfaces growth potential by categorizing companies by their positioning in the marketplace of leading players (e.g., Metso Outotec - Finland; FLSmidth - Denmark; Magotteaux - Belgium; Bradken - Australia; ME Elecmetal - Chile/USA;); follower players (e.g., Trelleborg AB - Sweden; Multotec - South Africa; Weir Minerals - UK; AIA Engineering/VEGA - India; Polycorp - Canada); and emerging players (regional fabricators, and specialty suppliers of rubber and ceramic liner Producers across LATAM, ASEAN, and CEE). Perspective on mergers and acquisitions, capacity expansions, distributor relationships, and R&D (material science, quick change-out designs, AI-based wear prediction) signal the fast-paced evolution of the marketplace. The report provided important historical information from 2019–2024, and profiled 2025 forecasts. The report identified trends, such as the shift of materials toward composite liners, bundling OEM-service contracts, mine-to-mill contracting for productivity, and material selection driven by sustainability concerns. The report also assessed technological innovations, and strategic developments around competition pricing discipline versus value-based contracts, localizing strategies in regional mining hubs, and aftermarket capture trends. The full report also provided insights for action by stakeholders in terms of supplier selection and evaluation of partnerships, and "white-space" opportunities with brownfield dredging upgrades and greenfield high-throughput mills.Recent development in Mill Liner Market

1. July 2025 – United Kingdom – Weir Group – Introduced the Vulco R67 rubber compound for mill liners, featuring advanced raw-material formulations that deliver a 20% increase in wear life compared to previous compounds. This innovation promises significantly reduced downtime, lower installation costs, and extended maintenance intervals for milling operations worldwide. 2. July 2025 – Finland – Metso – Announced the acquisition of TL Solution’s recycling operations and induction heating technology, bringing its Poly-Met mill liner recycling services fully in-house. This move expected to finalize in August 2025 strengthens Metso’s capabilities in sustainable mill liner recycling via induction heating, reinforcing its leadership in circular mining practices and enabling more scalable, high-quality service delivery to contract customers. 3. September 2024 – India – Tega Industries – Rolled out a new mill liner product named DynaPrime, a rubber-steel composite liner designed as a direct replacement for traditional steel mill liners. This innovation is a key focus for growth, offering improved durability, reduced downtime, and higher throughput making it a strategic launch point in the company’s product expansion roadmap. 4. July 2025 – Chile – ME Elecmetal – Announced a heavy-duty mill liner design for 1250 tower mills that achieved a 50% increase in availability due to a dramatic extension of liner lifespan. The rugged new alloy and redistributed steel design extended operational campaigns from approximately four months to six months, reduced maintenance frequency by one cycle per year, and delivered up to 33% better wear performance and up to 46% lower wear rates compared to standard liners.Key trends shaping the Mill Liner Market:

1. Shift Toward Advanced Materials and Compounds for Longer Wear Life – Companies like Weir Group and ME Elemental are introducing innovative rubber compounds and heavy-duty alloy-steel designs that significantly extend liner lifespan (up to 20–50% longer), directly reducing downtime and operating costs. 2. Integration of Sustainability and Circular Economy Practices Players such as Metso are investing in mill liner recycling and in-house processing technologies, aligning with industry-wide efforts to promote resource efficiency, reduce waste, and comply with environmental regulations. 3. Focus on Hybrid and Composite Designs for Performance Optimization Tega Industries’ launch of rubber-steel composite liners illustrates the growing adoption of hybrid materials that combine the wear resistance of steel with the shock absorption of rubber, improving throughput and operational efficiency.Report Objectives:

1. Landscape analysis of the Market 2. competitive benchmarking 3. Past and current status of the industry with the forecasted market size and trends 4. Evaluation of potential key players that include market leaders, followers, and new entrants 5. Technology trends 6. The potential impact of micro-economic factors on the market 7. External and Internal factors affecting the market have been analyzed The report also helps in understanding the Market dynamics, structure by analyzing the market segments project the Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Market make the report investor’s guide.Mill Liner Market Scope: Inquiry Before Buying

Mill Liner Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 854.72 Mn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 1382.99 Mn. Segments Covered: by Mill Type Autogenous Mills Semi-Autogenous Mills Ball Mills Rod Mills Pebble Mills Others by Liner material Steel Rubber Composites by End-user Cement Industries Mining Power plants Others Mill Liner Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Mill Liner Market, Key Players

North America 1. Metso Outotec – Finland (Note: global presence, headquartered in Finland; major operations in North America) 2. Weir Group – United Kingdom (Strong North American operations) 3. Polycorp – Canada 4. Eriez Manufacturing – USA 5. H-E Parts International – USA Europe 1. FLSmidth – Denmark 2. Magotteaux – Belgium 3. Trelleborg AB – Sweden 4. Metso Outotec – Finland 5. Rema Tip Top – Germany Asia-Pacific 1. Tega Industries – India 2. Bradken – Australia 3. Multotec – South Africa (regions overlap Africa / APAC) 4. ME Elecmetal – ChileFrequently Asked Questions:

1. Which region has the largest share in Global Mill Liner Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Mill Liner Market? Ans: The Global Mill Liner Market is growing at a CAGR of 6.2% during forecasting period 2025-2032. 3. What is scope of the Global Mill Liner Market report? Ans: Global Mill Liner Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Mill Liner Market? Ans: The important key players in the Global Mill Liner Market are – The Weir Group, FLSmidth, ME ELECMETAL, Magotteaux, Eriez Manufacturing, Trelleborg, Multotec, Polycorp, H-E Parts International, WHEMCO, Honyu Material, Tega Industries, Fengxing, Teknikum. 5. What is the study period of Mill Liner Market? Ans: The Global Mill Liner Market is studied from 2024 to 2032.

1. Mill Liner Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Mill Liner Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Mill Liner Market: Dynamics 3.1. Region wise Trends of Mill Liner Market 3.1.1. North America Mill Liner Market Trends 3.1.2. Europe Mill Liner Market Trends 3.1.3. Asia Pacific Mill Liner Market Trends 3.1.4. Middle East and Africa Mill Liner Market Trends 3.1.5. South America Mill Liner Market Trends 3.2. Mill Liner Market Dynamics 3.2.1. Global Mill Liner Market Drivers 3.2.2. Global Mill Liner Market Restraints 3.2.3. Global Mill Liner Market Opportunities 3.2.4. Global Mill Liner Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Technological 3.4.2. Economic 3.4.3. Legal 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Mill Liner Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 4.1. Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 4.1.1. Autogenous Mills 4.1.2. Semi-Autogenous Mills 4.1.3. Ball Mills 4.1.4. Rod Mills 4.1.5. Pebble Mills 4.1.6. Others 4.2. Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 4.2.1. Steel 4.2.2. Rubber 4.2.3. Composites 4.3. Mill Liner Market Size and Forecast, By End User (2024-2032) 4.3.1. Cement Industries 4.3.2. Mining 4.3.3. Power Plants 4.3.4. Others 4.4. Mill Liner Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Mill Liner Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 5.1. North America Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 5.1.1. Autogenous Mills 5.1.2. Semi-Autogenous Mills 5.1.3. Ball Mills 5.1.4. Rod Mills 5.1.5. Pebble Mills 5.1.6. Others 5.2. North America Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 5.2.1. Steel 5.2.2. Rubber 5.2.3. Composites 5.3. North America Mill Liner Market Size and Forecast, By End User (2024-2032) 5.3.1. Cement Industries 5.3.2. Mining 5.3.3. Power Plants 5.3.4. Others 5.4. North America Mill Liner Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 5.4.1.1.1. Autogenous Mills 5.4.1.1.2. Semi-Autogenous Mills 5.4.1.1.3. Ball Mills 5.4.1.1.4. Rod Mills 5.4.1.1.5. Pebble Mills 5.4.1.1.6. Others 5.4.1.2. United States Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 5.4.1.2.1. Steel 5.4.1.2.2. Rubber 5.4.1.2.3. Composites 5.4.1.3. United States Mill Liner Market Size and Forecast, By End User (2024-2032) 5.4.1.3.1. Cement Industries 5.4.1.3.2. Mining 5.4.1.3.3. Power Plants 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 5.4.2.1.1. Autogenous Mills 5.4.2.1.2. Semi-Autogenous Mills 5.4.2.1.3. Ball Mills 5.4.2.1.4. Rod Mills 5.4.2.1.5. Pebble Mills 5.4.2.1.6. Others 5.4.2.1. Canada Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 5.4.2.1.2. Steel 5.4.2.1.3. Rubber 5.4.2.1.4. Composites 5.4.2.2. Canada Mill Liner Market Size and Forecast, By End User (2024-2032) 5.4.2.2.2. Cement Industries 5.4.2.2.3. Mining 5.4.2.2.4. Power Plants 5.4.2.2.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 5.4.3.1.2. Autogenous Mills 5.4.3.1.3. Semi-Autogenous Mills 5.4.3.1.4. Ball Mills 5.4.3.1.5. Rod Mills 5.4.3.1.6. Pebble Mills 5.4.3.1.7. Others 5.4.3.2. Mexico Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 5.4.3.2.2. Steel 5.4.3.2.3. Rubber 5.4.3.2.4. Composites 5.4.3.2.5. Textile 5.4.3.2.6. Mining 5.4.3.3. Mexico Mill Liner Market Size and Forecast, By End User (2024-2032) 5.4.3.3.2. Cement Industries 5.4.3.3.3. Mining 5.4.3.3.4. Power Plants 5.4.3.3.5. Others 6. Europe Mill Liner Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 6.1. Europe Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.2. Europe Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.3. Europe Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4. Europe Mill Liner Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.1.2. United Kingdom Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.1.3. United Kingdom Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.2. France 6.4.2.1. France Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.2.2. France Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.2.3. France Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.3.2. Germany Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.3.3. Germany Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.4.2. Italy Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.4.3. Italy Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.5.2. Spain Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.5.3. Spain Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.6.2. Sweden Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.6.3. Sweden Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.7.2. Austria Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.7.3. Austria Mill Liner Market Size and Forecast, By End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 6.4.8.2. Rest of Europe Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 6.4.8.3. Rest of Europe Mill Liner Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Mill Liner Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 7.1. Asia Pacific Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.2. Asia Pacific Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.3. Asia Pacific Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4. Asia Pacific Mill Liner Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.1.2. China Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.1.3. China Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.2.2. S Korea Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.2.3. S Korea Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.3.2. Japan Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.3.3. Japan Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.4. India 7.4.4.1. India Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.4.2. India Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.4.3. India Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.5.2. Australia Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.5.3. Australia Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.6.2. Indonesia Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.6.3. Indonesia Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.7.2. Philippines Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.7.3. Philippines Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.8.2. Malaysia Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.8.3. Malaysia Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.9.2. Vietnam Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.9.3. Vietnam Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.10.2. Thailand Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.10.3. Thailand Mill Liner Market Size and Forecast, By End User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 7.4.11.3. Rest of Asia Pacific Mill Liner Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Mill Liner Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 8.1. Middle East and Africa Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 8.2. Middle East and Africa Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 8.3. Middle East and Africa Mill Liner Market Size and Forecast, By End User (2024-2032) 8.4. Middle East and Africa Mill Liner Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 8.4.1.2. South Africa Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 8.4.1.3. South Africa Mill Liner Market Size and Forecast, By End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 8.4.2.2. GCC Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 8.4.2.3. GCC Mill Liner Market Size and Forecast, By End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 8.4.3.2. Nigeria Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 8.4.3.3. Nigeria Mill Liner Market Size and Forecast, By End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 8.4.4.2. Rest of ME&A Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 8.4.4.3. Rest of ME&A Mill Liner Market Size and Forecast, By End User (2024-2032) 9. South America Mill Liner Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 9.1. South America Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 9.2. South America Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 9.3. South America Mill Liner Market Size and Forecast, By End User (2024-2032) 9.4. South America Mill Liner Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 9.4.1.2. Brazil Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 9.4.1.3. Brazil Mill Liner Market Size and Forecast, By End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 9.4.2.2. Argentina Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 9.4.2.3. Argentina Mill Liner Market Size and Forecast, By End User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Mill Liner Market Size and Forecast, By Mill Type (2024-2032) 9.4.3.2. Rest of South America Mill Liner Market Size and Forecast, By Liner Material (2024-2032) 9.4.3.3. Rest of South America Mill Liner Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Power Output Players) 10.1. Metso Outotec Company Overview 10.1.1. Business Portfolio 10.1.2. Financial Overview 10.1.3. SWOT Analysis 10.1.4. Strategic Analysis 10.1.5. Recent Developments 10.2. Weir Group – United Kingdom (Strong North American operations) 10.3. Polycorp – Canada 10.4. Eriez Manufacturing – USA 10.5. H-E Parts International – USA 10.6. FLSmidth – Denmark 10.7. Magotteaux – Belgium 10.8. Trelleborg AB – Sweden 10.9. Metso Outotec – Finland 10.10. Rema Tip Top – Germany 10.11. Tega Industries – India 10.12. Bradken – Australia 10.13. Multotec – South Africa (regions overlap Africa / APAC) 10.14. ME Elecmetal – Chile 11. Key Findings 12. Analyst Recommendations 13. Mill Liner Market: Research Methodology