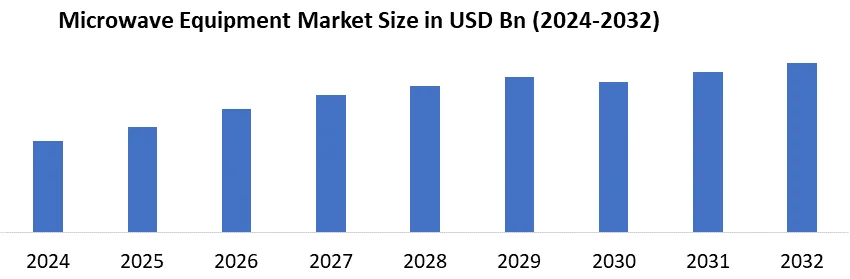

Microwave Equipment Market was valued at 6.60 Bn in 2024, and total Microwave Equipment Market revenue is expected to grow at a CAGR of 5.1% from 2025 to 2032, reaching nearly USD 9.83 Bn.Microwave Equipment Market Overview

Microwave equipment market consists of active and passive devices designed to transmit, receive or process microwave frequencies for communication, radar and medical applications. These systems operate across various bands, including L-Band, Ku-Band, and X-Band, and are essential for high-speed data transmission, electronic warfare, and medical diagnostics. The market refers to the global ecosystem of manufacturers, suppliers and end-users of microwave technologies across sectors like telecommunications, defence, space and healthcare. Driver propelling market growth has been the rising adoption of microwave enabled medical instruments, mainly for cancer diagnostics and treatments like microwave ablation. Also, the rollout of 5G and demand in satellite communication systems have intensified product demand. Electronic warfare threats and communication jamming risks challenge market expansion. In supply, advancements in component miniaturization and integration are enabling high-performance and cost-effective solutions. North America dominated by its defence investments and presence of major manufacturers, while Asia Pacific region is rapidly expanding by increased telecom infrastructure and government backed R&D initiatives. Key players like L3Harris (U.S.), Thales (France) and Huawei (China) drive innovation by advanced product launches and global contracts. End-user sectors like defence and telecom account for the bulk of revenue, with recent trade policies favoring domestic sourcing further shaping the market landscape. The report covers the dynamics and structure of the Microwave Equipment market, analyzing market segments and projecting the Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in the Microwave Equipment Market.To know about the Research Methodology:- Request Free Sample Report

Microwave Equipment Market Dynamics

Increasing Demand for Medical Instruments Equipped Microwave Devices to Boost Market Growth

There is rapid growth in the healthcare industry to increase the demand for medical equipment equipped with microwave technology, as these devices provide test results with a high degree of precision or accuracy. Microwave tomography, a form of medical imaging that uses microwave technology, is now widely used for detecting cancer. Microwaves play an important role in the fight against cancer, providing a new way to treat the disease. Microwave ablation is often used to remove unwanted tissue, for example, liver tumors, lungs, and prostate ablation, and to treat large tumors. In recent years, cancer disease has been the second-largest cause of death in the world. According to the World Health Organization (WHO), cancer is one of the leading causes of death worldwide, accounting for nearly 10 million deaths in 2020. The increase in the number of cancer patients is due to the late detection of the disease. Therefore, the demand for cancer detection systems has highly increased across the world as early diagnostic methods with suitable treatments improve the survival rates significantly.High Risk of Communication Jamming is a Major Challenge for Market Growth

The increased threat of communication jamming and congestion due to the changing nature of warfare is expected to limit the market growth. The worldwide radiation or magnetic field exposure to prevent the efficient use of the electromagnetic spectrum is known as electromagnetic (EM) jamming. It is a new form of electronic attack that is an integral part of the electric war. Electronic attack (EA) is a significant component of electronic warfare and refers to a range of technologies and tactics for attacking individuals, facilities, or equipment using electromagnetic energy or anti-radiation weaponry. EA is most typically employed to influence how an opponent uses the electromagnetic spectrum (EMS) Filtration . Electronic attack uses EM energy, direct energy, or anti-radiation weapons to confuse, disable, or destroy an enemy’s electronic systems. Weapons used for electronic attack leverage lasers, electro-optical, infrared, and RF/microwave technologies. With an increase in the adoption of microwave devices for military communication, the risk of communication jamming is also increasing. Moreover, the growing cyber threats and interruptions are one of the major factors hindering the market growth.Microwave Equipment Market Segmentation

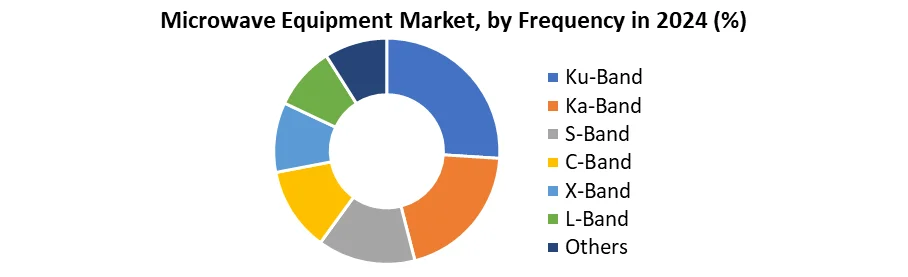

Based on type, the market is bifurcated into active and passive. The active segment registered the largest market share in 2024. Active devices, such as transistors, amplifiers, oscillators, tubes, diodes, and integrated circuits, are widely used in electrical systems. This large share of active devices is due to the increase in development of advanced microwave systems that are used in various industries such as telecommunications and networking. Microwave radio transmission is commonly used in point-to-point communication systems on the earth's surface, in satellite communications, and in deep space radio communications. Thus, this segment is expected to remain the largest component during the study period. In addition, the passive segment is expected to grow at a significant annual growth rate between 2025-2032. Passive microwave passive devices are used in measuring instruments and to combine instruments to create more complex measurement systems. The growing demand for measuring devices with higher accuracy and precision is expected to boost the segment growth in the forthcoming years. Based on frequency, the market is segmented into Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others. The Ku-Band segment is projected to be the fastest-growing segment during the forecast period owing to increasing satellite launches, and investment in space research & development activities is expected to drive the market growth. Moreover, the rising usage of Ku-Band systems and devices for defense applications is expected to fuel the market growth in the near future. The L-Band segment held the largest market share in 2021. The dominance of the segment is due to the growing adoption of advanced L-Band microwave systems for Global Positioning Systems (GPS), radio, telecommunications, and aircraft surveillance applications. Due to the rising usage of these bands for numerous applications, such as telecom, mobile phones, Bluetooth, GPS, radio communication, and space telemetry, the S-Band, X-Band, C-Band, and Ka-Band are expected to have a significant market share during the projected period.

Microwave Equipment Market Regional Insights

North America was the Dominating Region in the Microwave Equipment Market in 2024 North America is expected to dominate the market and is forecasted to grow during the forecast period. The rise in the adoption of advanced communication systems in defence, aviation, and the industrial and commercial industry is expected to fuel the North America market growth. In addition, large defense spending and the presence of several key players in the U.S. are supporting the microwave devices market growth in North America. High adoption of microwave equipment in developed countries, deployment of effective Private 5G network services, presence of prominent key players in the region and well-developed IT & telecom sector and electronics industry are some of the prominent factors behind the market growth.

Microwave Equipment Market Competitive Landscape

Microwave equipment market is leading with companies constantly innovating to maintain technological dominance, expand global reach and capture strategic defense and commercial contracts. Top players, L3Harris Technologies, Inc. (U.S.), Thales Group (France) and Huawei Technologies Co., Ltd. (China) are dominating by their diversified product portfolios, sustained R&D investments and global project execution capabilities. 1. L3Harris Technologies is U.S. based defense technology leader in high frequency microwave solutions, radar systems and tactical communication networks. Company's collaboration with U.S. military and aerospace agencies to consistently secure large scale contracts, making it a dominant force in North America. 2. Thales Group, in France, merges microwave technologies into broader defense, space and aerospace systems. Company is renowned for innovation in radar surveillance and communication equipment, with solid footprint across Europe, Middle East, and Asia. 3. Huawei Technologies leads Asia Pacific by strong wireless infrastructure offering and 5G microwave backhaul systems. Facing regulatory hurdles in Western market, Huawei's integration in global telecom ecosystems and relentless R&D efforts give a resilient edge.Microwave Equipment Market Trends

Trends Description Rising Demand for 5G and Satellite Communication The rollout of 5G networks and the increasing demand for high-speed data transmission are driving adoption of microwave equipment in telecom and space. Miniaturization and Integration of Components Market is witnessing a shift toward compact, energy-efficient microwave modules integrated with advanced materials and digital control technologies. Growing Use in Defense and Aerospace Applications Increased defense budgets and demand for advanced radar, surveillance, and electronic warfare systems are fueling microwave technology deployment. Microwave Equipment Market Key Developments

1. 13th February 2025, Kratos Defense (U.S) reported increased revenues in Microwave Products division, attributed to organic growth in its Turbine Technologies, C5ISR and Defense Rocket Support sectors. This growth underscores company's expanding role in microwave technologies for defense applications. 2. In February 2025, L3Harris (U.S) introduced the RF-9850W HCLOS Microwave Radio System, designed for high capacity line of sight communications. This system is part of their mission systems solutions, catering to tactical communication needs in defense operations. 3. 20th May 2025, Microchip Technology (U.S) which acquired Microsemi, announced cost optimized PolarFire Core FPGAs and SoCs. These devices deliver high performance with a 30% lower price tag, catering to applications requiring secure and reliable processing, including microwave systems. 4. 15th April 2025, Qorvo (U.S) expanded its portfolio with new RF front end modules designed for 5G infrastructure and defense applications. These modules integrate advanced filtering and amplification technologies to enhance performance in microwave frequency bands. 5. 30th January 2025, Thales (France) launched new line of microwave communication systems aimed at enhancing secure military communications. These systems offer improved bandwidth and resistance to electronic warfare tactics. 6. 5th June 2025, Huawei Technologies (China) unveiled its fully upgraded Xinghe Intelligent Network portfolio including Asia Pacific specific microwave capable routers and optical modules at a regional summit, aiming to support high bandwidth, low latency digital infrastructure.Microwave Equipment Market Scope: Inquire before buying

Microwave Equipment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.60 Bn Forecast Period 2025 to 2032 CAGR: 5.1% Market Size in 2032: USD 9.83 Bn Segments Covered: by Type Active Passive by Frequency Ku-Band Ka-Band S-Band C-Band X-Band L-Band Others by End-user Telecommunication Space Defense Industrial Healthcare Others Microwave Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Microwave Equipment Market Key Players

North America 1. L3Harris Technologies, Inc. (U.S) 2. Communications & Power Industries – CPI (U.S) 3. Analog Devices, Inc. (U.S) 4. MACOM Technology Solutions (U.S) 5. Teledyne Technologies (U.S) 6. Kratos Defense & Security Solutions (U.S) 7. Microchip Technology (U.S) 8. Keysight Technologies (U.S) 9. Qorvo, Inc. (U.S) 10. Skyworks Solutions, Inc. (U.S) Europe 11. Thales Group (France) 12. Rohde & Schwarz (Germany) 13. Nokia Networks (Finland) 14. Ericsson (Sweden) 15. Cobham Advanced Electronic Solutions (United Kingdom) 16. Leonardo S.p.A. (Italy) 17. Infineon Technologies AG (Germany) Asia Pacific 18. Huawei Technologies Co., Ltd. (China) 19. NEC Corporation (Japan) 20. Fujitsu Limited (Japan) 21. ZTE Corporation (China) 22. Sumitomo Electric Industries, Ltd. (Japan) 23. Murata Manufacturing Co., Ltd. (Japan) 24. Anritsu Corporation (Japan) 25. Rakon Limited (New Zealand) Middle East and Africa 26. Elcome International LLC (United Arab Emirates) South America 27. Embraer Defense & Security (Brazil) 28. Omnisys Engenharia (Brazil) 29. Tectel Telecom (Brazil)Microwave Equipment Market FAQs

1] What segments are covered in the Microwave Equipment Market report? Ans. The segments covered in the Microwave Equipment Market report are By Type, By Frequency and By End-user. 2] Which region is expected to hold the highest share in the Microwave Equipment Market? Ans. The North America region is expected to hold the highest share in the Microwave Equipment Market. 3] What is the market size of the Microwave Equipment Market by 2032? Ans. The Microwave Equipment market size is expected to reach USD 9.83 Bn by 2032 4] What is the forecast period for the Microwave Equipment Market? Ans. The forecast period for the Microwave Equipment Market is 2025-2032. 5] What was the market size of the Microwave Equipment Market in 2024? Ans. The market size of the Microwave Equipment Market in 2024 was valued at USD 6.60 Bn.

1. Microwave Equipment Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Microwave Equipment Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Microwave Equipment Market: Dynamics 3.1. Region-wise Trends of Microwave Equipment Market 3.1.1. North America Microwave Equipment Market Trends 3.1.2. Europe Microwave Equipment Market Trends 3.1.3. Asia Pacific Microwave Equipment Market Trends 3.1.4. Middle East and Africa Microwave Equipment Market Trends 3.1.5. South America Microwave Equipment Market 3.2. Microwave Equipment Market Dynamics 3.2.1. Microwave Equipment Market Drivers 3.2.1.1. Rising Cancer Cases 3.2.1.2. 5G Network Expansion 3.2.1.3. Defense Modernization 3.2.2. Microwave Equipment Market Restraints 3.2.3. Microwave Equipment Market Opportunities 3.2.3.1. Space R&D Investments 3.2.3.2. Miniatured Microwave Modules 3.2.3.3. Asia Pacific Telecom Growth 3.2.4. Microwave Equipment Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Trade Tariffs Policy Shift 3.4.2. 5G & AI Tech Innovation 3.4.3. Aging Population 3.5. Microwave Equipment Rate (%), by region 3.6. Technological Advancements in Microwave Equipment 3.7. Price Trend Analysis by Region 3.8. Technological Roadmap 3.9. Regulatory Landscape by Region 3.9.1. North America 3.9.2. Europe 3.9.3. Asia Pacific 3.9.4. Middle East and Africa 3.9.5. South America 3.10. Analysis of Government Schemes and Initiatives for Microwave Equipment Industry 3.11. Key Opinion Leader Analysis 4. Microwave Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Microwave Equipment Market Size and Forecast, By Type (2024-2032) 4.1.1. Active 4.1.2. Passive 4.2. Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 4.2.1. Ku-Band 4.2.2. Ka-Band 4.2.3. S-Band 4.2.4. C-Band 4.2.5. X-Band 4.2.6. L-Band 4.2.7. Others 4.3. Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 4.3.1. Telecommunication 4.3.2. Space 4.3.3. Defence 4.3.4. Industrial 4.3.5. Healthcare 4.3.6. Others 4.4. Microwave Equipment Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Microwave Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Microwave Equipment Market Size and Forecast, By Type (2024-2032) 5.1.1. Active 5.1.2. Passive 5.2. North America Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 5.2.1. Ku-Band 5.2.2. Ka-Band 5.2.3. S-Band 5.2.4. C-Band 5.2.5. X-Band 5.2.6. L-Band 5.2.7. Others 5.3. Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 5.3.1. Telecommunication 5.3.2. Space 5.3.3. Defence 5.3.4. Industrial 5.3.5. Healthcare 5.3.6. Others 5.4. North America Microwave Equipment Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Microwave Equipment Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Active 5.4.1.1.2. Passive 5.4.1.2. United States Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 5.4.1.2.1. Ku-Band 5.4.1.2.2. Ka-Band 5.4.1.2.3. S-Band 5.4.1.2.4. C-Band 5.4.1.2.5. X-Band 5.4.1.2.6. L-Band 5.4.1.2.7. Others 5.4.1.3. United States Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Telecommunication 5.4.1.3.2. Space 5.4.1.3.3. Defence 5.4.1.3.4. Industrial 5.4.1.3.5. Healthcare 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Microwave Equipment Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Active 5.4.2.1.2. Passive 5.4.2.2. Canada Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 5.4.2.2.1. Ku-Band 5.4.2.2.2. Ka-Band 5.4.2.2.3. S-Band 5.4.2.2.4. C-Band 5.4.2.2.5. X-Band 5.4.2.2.6. L-Band 5.4.2.2.7. Others 5.4.2.3. Canada Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Telecommunication 5.4.2.3.2. Space 5.4.2.3.3. Defence 5.4.2.3.4. Industrial 5.4.2.3.5. Healthcare 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Microwave Equipment Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Active 5.4.3.1.2. Passive 5.4.3.2. Mexico Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 5.4.3.2.1. Ku-Band 5.4.3.2.2. Ka-Band 5.4.3.2.3. S-Band 5.4.3.2.4. C-Band 5.4.3.2.5. X-Band 5.4.3.2.6. L-Band 5.4.3.2.7. Others 5.4.3.3. Mexico Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 5.4.3.3.1. Telecommunication 5.4.3.3.2. Space 5.4.3.3.3. Defence 5.4.3.3.4. Industrial 5.4.3.3.5. Healthcare 5.4.3.3.6. Others 6. Europe Microwave Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.2. Europe Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.3. Europe Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Microwave Equipment Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.1.3. United Kingdom Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.2.3. France Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.3.3. Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.3.4. Germany Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.4.3. Italy Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.5.3. Spain Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.6.3. Sweden Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Russia Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.7.3. Russia Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Microwave Equipment Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 6.4.8.3. Rest of Europe Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Microwave Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.3. Asia Pacific Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Microwave Equipment Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.1.3. China Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.2.3. S Korea Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.3.3. Japan Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.4.3. India Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.5.3. Australia Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.6.3. Indonesia Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Malaysia Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.7.3. Malaysia Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.8. Philippians 7.4.8.1. Philippians Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Philippians Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.8.3. Philippians Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Thailand Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.9.3. Thailand Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Vietnam Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.10.3. Vietnam Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Microwave Equipment Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 7.4.11.3. Rest of Asia Pacific Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Microwave Equipment Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 8.3. Middle East and Africa Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Microwave Equipment Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 8.4.1.3. South Africa Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 8.4.2.3. GCC Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Egypt Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 8.4.3.3. Egypt Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Nigeria Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 8.4.4.3. Nigeria Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Microwave Equipment Market Size and Forecast, By Type (2024-2032) 8.4.5.2. Rest of ME&A Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9. South America Microwave Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.2. South America Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3. South America Microwave Equipment Market Size and Forecast, By Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.3.1.2. Brazil Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3.1.3. Brazil Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.3.2.2. Argentina Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3.2.3. Argentina Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.3.3.2. Colombia Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3.3.3. Colombia Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.3.4.2. Chile Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3.4.3. Chile Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 9.3.5. Rest of South America 9.3.5.1. Rest of South America Microwave Equipment Market Size and Forecast, By Type (2024-2032) 9.3.5.2. Rest of South America Microwave Equipment Market Size and Forecast, By Frequency (2024-2032) 9.3.5.3. Rest of South America Microwave Equipment Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. L3Harris Technologies, Inc. (U.S) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. Communications & Power Industries – CPI (U.S) 10.3. Analog Devices, Inc. (U.S) 10.4. MACOM Technology Solutions (U.S) 10.5. Teledyne Technologies (U.S) 10.6. Kratos Defense & Security Solutions (U.S) 10.7. Microchip Technology (U.S) 10.8. Keysight Technologies (U.S) 10.9. Qorvo, Inc. (U.S) 10.10. Skyworks Solutions, Inc. (U.S) 10.11. Thales Group (France) 10.12. Rohde & Schwarz (Germany) 10.13. Nokia Networks (Finland) 10.14. Ericsson (Sweden) 10.15. Cobham Advanced Electronic Solutions (United Kingdom) 10.16. Leonardo S.p.A. (Italy) 10.17. Infineon Technologies AG (Germany) 10.18. Huawei Technologies Co., Ltd. (China) 10.19. NEC Corporation (Japan) 10.20. Fujitsu Limited (Japan) 10.21. ZTE Corporation (China) 10.22. Sumitomo Electric Industries, Ltd. (Japan) 10.23. Murata Manufacturing Co., Ltd. (Japan) 10.24. Anritsu Corporation (Japan) 10.25. Rakon Limited (New Zealand) 10.26. Elcome International LLC (United Arab Emirates) 10.27. Embraer Defense & Security (Brazil) 10.28. Omnisys Engenharia (Brazil) 10.29. Tectel Telecom (Brazil) 11. Key Findings 12. Analyst Recommendations 13. Microwave Equipment Market: Research Methodology