Global Microseismic Monitoring Technology Market size was valued at USD 660.8 Mn. in 2024 and the total Microseismic Monitoring Technology Market revenue is expected to grow by 6.8% from 2025 to 2032, reaching nearly USD 1118.51 Mn.Microseismic Monitoring Technology Market Overview :

Microseismic Monitoring Technology is a bespoke geophysical approach used to detect, locate, and characterize low-magnitude seismic events caused by natural or human-related subsurface activity. Microseismic monitoring is important for the operations in oil & gas, civil engineering, mining, geothermal energy, carbon capture, and storage (CCUS), and more. Microseismic monitoring typically utilizes sensitive sensors such as geophones, accelerometers, and distributed acoustic sensing (DAS) systems (that may be on-surface or downhole/deployed below ground) to track and map real-time fracture behavior, rock stability, and reservoir performance. Microseismic seismic monitoring approaches were traditionally applied for hydraulic fracturing to monitor hydrocarbon reservoir stimulation; the market is evolving quickly toward new applications such as environmental risk mitigation, geothermal well monitoring, and CO₂ injection and storage site validation and measurement in CCUS projects. in geothermal and mining operations, fiber-optic-based real-time DAS or borehole microseismic systems are being deployed to perform continuous monitoring and provide high-resolution seismic measures.To know about the Research Methodology :- Request Free Sample Report The report provides a detailed breakdown of the significant factors driving market growth, which include the expansion of unconventional hydrocarbon exploration activities, increased access to renewable energy projects, as well as regulatory requirements for subsurface integrity. There are several leading companies in this global space, including Schlumberger, Halliburton, Baker Hughes, ESG Solutions, and Geospace Technologies, who are all moving towards greater capabilities with AI-enabled analytics and edge computing, and hardened sensor networks. The industry supply chain includes service providers and is going through a local evolution to automated, real-time, and wireless monitoring solutions to maintain operational efficiency, safety, and environmental sustainability. Several leading trends influence the Microseismic Monitoring Technology market, including the adoption of wireless seismic nodes, the use of fiber optic cables for distributed sensing, and AI-enabled seismic event classification, mostly related to energy transition and sustainable practices in resource extraction.

Microseismic Monitoring Technology Market Dynamics

Growing Demand in the Oil and Gas Industry to Drive the Market Growth The growing demand for microseismic monitoring technology in the oil and gas industry boosts the Microseismic Monitoring Technology market growth. In hydraulic fracturing operations, Microseismic Monitoring Technology plays a significant role. Microseismic monitoring technology helps with real-time monitoring and analysis of the seismic events induced during the fracking process. It helps understand the underground fracture networks, optimize well placement, and improve the efficiency of the extraction process. Microseismic monitoring technology helps in assessing the effectiveness of fracking operations by providing valuable data on reservoir behavior, production rates, and the potential for reservoir depletion. This information is important for decision-making, such as adjusting fracking parameters and optimizing production strategies. The demand for oil and gas continues to grow thanks to factors such as the rapid population increase and the growth of energy consumption. These resources require advanced extraction techniques like fracking, where microseismic monitoring technology plays a crucial role in ensuring optimal production. The extraction of natural gas from shale formations through hydraulic fracturing has increased the demand for microseismic monitoring technology. According to an MMR report, the extraction of shale gas and tight oil in the U.S. increased dramatically since 2000, from about 300 billion cubic feet to over 26 trillion cubic feet in 2024. The economic viability of shale exploration is a result of technological advances in horizontal drilling and hydraulic fracturing. Technological Advancements in Microseismic Monitoring to Boost the Microseismic Monitoring Technology Market Growth Technological advancements in microseismic monitoring significantly contributed to the growth of the microseismic monitoring technology market. These advancements continuously improved the capabilities, accuracy, and efficiency of microseismic monitoring systems. Technological advancements develop more sensitive and strong sensors for microseismic monitoring. These sensors detect the slightest ground vibrations, providing highly accurate data for analysis, which allows for a more comprehensive understanding of subsurface activities and improves monitoring efficiency. the progress in data processing and analysis techniques revolutionized microseismic monitoring. Sophisticated algorithms and machine learning capabilities help to faster and more precise interpretation of large volumes of microseismic data. Technological advancements enable the continuous integration of microseismic monitoring systems with advanced analytics and visualization tools. This integration empowers users to conduct in-depth data analysis, recognize patterns, and create predictive models. These capabilities provide valuable insights, enable visualization of complex data sets, and facilitate data-driven decision-making, thus augmenting the value of microseismic monitoring technology. High Implementation cost to restrain the market growth Implementing microseismic monitoring technology requires specialized equipment, including sensitive sensors, data acquisition systems, and data processing software. These components are expensive and require customization based on specific project requirements. The infrastructure necessary to support the technology, such as data storage and communication systems, adds to the overall implementation costs. operating microseismic monitoring systems requires skilled personnel with expertise in geophysics, data analysis, and interpretation techniques. continuous training and skill development are essential to keep up with evolving technologies and techniques, adding to the long-term implementation costs. Proper deployment and installation of microseismic monitoring systems require meticulous planning and execution. The costs associated with deployment, including logistics, manpower, and equipment, are substantial. For larger projects or operations covering vast areas, achieving comprehensive coverage with microseismic monitoring is costly. It requires a higher number of sensors, data acquisition systems, and personnel to monitor and analyze the data effectively. The scalability of the system to accommodate expanding operations or new project sites adds to the implementation costs. Mitigating the high implementation costs requires strategic planning and exploring cost-effective solutions. High Implementation cost limits the Microseismic Monitoring Technology Market growth. Growing investments in infrastructure development create lucrative growth opportunities for the Market Infrastructure projects such as transportation systems, tunnels, bridges, dams, and high-rise buildings require thorough monitoring to ensure structural integrity and safety. Microseismic monitoring technology assesses and monitors ground stability, detecting potential risks such as landslides and rock bursts, and providing early warning systems for seismic events. If Infrastructure projects become more complex and extensive, the demand for reliable monitoring technologies like microseismic monitoring increases. The increasing importance of safety and risk management in infrastructure development drives the adoption of microseismic monitoring technology. Microseismic monitoring technology provides valuable insights into the behavior and performance of infrastructure. It allows continuous monitoring of structural integrity, identifying potential weaknesses or changes in conditions that impact the longevity and functionality of the infrastructure. This information helps with timely maintenance and repair activities, reducing the risk and improving the overall lifespan of the infrastructure.Global Microseismic Monitoring Technology Market Segment Analysis

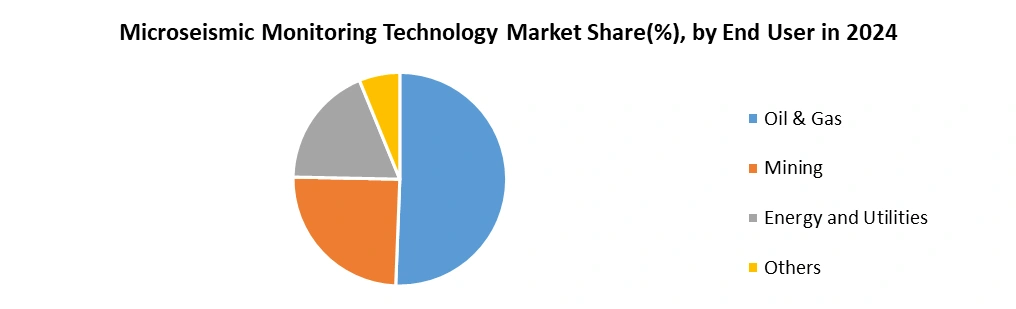

Based on Processes, the data processing segment dominates the Microseismic Monitoring Technology Market in the year 2024. Data processing involves the collection, administration, and study of the data generated through Microseismic monitoring systems. Data processing in microcosm monitoring technology guarantees that the data collected is administered, analyzed, and efficiently transformed into actionable insight. It helps with real-time monitoring, enhances decision-making capabilities, and supports proactive risk management in various industries, including oil and gas, mining, geotechnical engineering, and infrastructure development. Data collection involves capturing and recording these seismic events in real-time, ensuring the data is accurately and reliably captured for further processing. Managing the collected data is essential to ensure its integrity, accessibility, and availability for analysis. This includes data storage, organization, and retrieval, often utilizing database solutions. Proper data management practices ensure that the collected data is readily accessible for analysis and interpretation, enabling effective decision-making. Therefore data processing segment rapidly growing during the forecast period. Based on End Users, The Oil and gas Segment dominates the Microseismic Monitoring Technology Market in the year 2024. Microseismic monitoring is important in hydraulic fracturing operations in the oil and gas industry. Microseismic monitoring helps monitor and analyze the induced seismic events during the fracking process. The oil and gas industry places significant importance on safety and risk management. Microseismic monitoring technology supports assessing and managing risks associated with drilling operations, well integrity, and induced seismicity. It helps identify potential hazards, monitor ground stability, and provide early warning systems for seismic events, ensuring the safety of personnel, equipment, and infrastructure. The oil and gas industry's unique requirements, scale of operations, and regulatory compliance make it the primary driving force behind the microseismic monitoring technology market.

Microseismic Monitoring Technology Market Regional Insights

North America dominates the global Microseismic Monitoring Technology market in the year 2024. The United States experienced a significant gas revolution. The extraction of natural gas from shale formations through hydraulic fracturing has increased the demand for microseismic monitoring technology. It is used to monitor and optimize the fracturing process, ensuring efficient extraction of gas from the shale reservoirs. The extensive shale gas reserves and advanced drilling techniques propelled the adoption of microseismic monitoring technology in this region. The availability of advanced sensors, data acquisition systems, and software platforms boosts the market growth in North America. well-established regulatory frameworks govern the oil and gas industry. These regulations require the monitoring and assessment resulting from hydraulic fracturing and other drilling activities. The stringent regulations and focus on environmental sustainability have further boosted the demand for microseismic monitoring in the region. The presence of numerous exploration and production companies, service providers, and technology vendors has created a favorable environment for the adoption of microseismic monitoring technology. The mining industry in North America contributes to the demand for microseismic monitoring technology.Microseismic Monitoring Technology Market Competitive Landscape The market for microseismic monitoring technology is extremely competitive and is dominated by two U.S.-based organizations, Schlumberger and Halliburton. These companies continue to maintain key differentiators through innovations, partnerships, and global infrastructure capabilities. Schlumberger provides the most mature offering across sensors, acquisition systems and analytics, including the OPTIMA fiber optic microseismic monitoring platform (launched 2023), and imaging technologies through Q Land for improved 4-D seismic interpretation. The convening of significant research and development investment, inclusive of AI-denoted capabilities and a digital environment, assists the company in maintaining its industry leadership in reservoir characterization including induced (micro)seismicity support processes. In comparison, Halliburton’s competitor systems include FiberVSP and Odassea, with both systems operational in real-time, enabled and integrated into TGS seismic imaging workflows with fiber-optics, to provide high-resolution reservoir monitoring; Halliburton's recent contract for geothermal and lithium-brine extraction wells indicates an expanding deployment of microseismic technology into emerging energy applications. In conclusion, Schlumberger and Halliburton will continue to enhance the growing microseismic technology market with desirable technological offerings and cross-sector employee delivery, including CCUS and geothermal, including peer-to-peer exchanging capabilities with actors seeking services that either address regulatory or planned operational needs/requirements on a global scale. Microseismic Monitoring Technology Market Recent Development • In 2025, Schlumberger Limited (USA) launched its Real Time Induced Seismicity Monitoring (RT ISM) system, a first-of-its-kind automated microseismic platform that continuously detects induced seismic events using distributed acoustic sensing (DAS) fiber-optic technology and edge computing for rapid regulatory compliance, especially in CCUS and geothermal operations. • In May 2025, Halliburton (USA) introduced EarthStar® 3DX, a horizontal look-ahead resistivity service enabling real-time geological insight up to 50 ft ahead of the drill bit. While primarily a well-geosteering innovation, it enhances microseismic workflows by improving pre-fracture planning. • In 2025, Geospace Technologies Corporation (USA) continues advancing compact, automated passive seismic array systems with phased-volume compact arrays for real-time reservoir pressure monitoring, supporting gigatonne-scale CO₂ sequestration initiatives. • October 2023, Silixa Ltd introduced DScover, a new unconventional well surveillance and optimization service. The solution helps operators enhance well placement and completion design by integrating advanced analysis with higher-quality data from DTS, DAS, and the latest DSS measurements. Microseismic Monitoring Technology Market Recent Trends

Category Key Trend Example Product Market Impact Sensor Innovation Miniaturized, low-cost sensors and wireless networks enable broader deployment Compact wireless accelerometers and seismic nodes Reduces barrier to entry; expands microseismic use across mining, infrastructure, and smaller energy firms Environmental & Regulatory Focus Expanded use of microseismic monitoring in environmental risk management and subsurface storage Monitoring projects in India, EU & CCS initiatives Growth fueled by environmental safety mandates and public investment in seismic observatories Cloud & IoT Connectivity Migration to cloud platforms and IoT-enabled nodes for remote data visualization SaaS dashboards and IoT-connected sensor arrays Enhances accessibility, scalability for remote & real-time monitoring operations Microseismic Monitoring Technology Market Scope : Inquire Before Buying

Global Microseismic Monitoring Technology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 660.8 Mn. Forecast Period 2025 to 2032 CAGR: 6.8% Market Size in 2032: USD 1118.51 Mn. Segments Covered: by Component Services Installation Maintenance Consulting Hardware Geophones Seismometer Sensors Others Software by Processes Data Processing Data Interpretation Data Acquisition Others by Technology Passive Seismic Monitoring Active Seismic Monitoring Distributed Acoustic Sensing (DAS) by Deployment Onshore Offshore by End Use Oil & Gas Mining Energy and Utilities Other Microseismic Monitoring Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Microseismic Monitoring Technology Market, Key Players

North America 1. Schlumberger Limited (USA) 2. ESG Solutions (Deep Imaging Technologies) (Canada) 3. Geospace Technologies Corporation (USA) 4. Baker Hughes Company (USA) 5. Landtech Geophysics Ltd (Canada) 6. Halliburton Company (USA) 7. MicroSeismic, Inc. (U.S.) 8. Weir-Jones Group (U.S.) Europe 1. Guralp Systems Limited (United Kingdom) 2. Silixa Ltd (U.K.) 3. OptaSense (Luna Innovations) (U.K.) Asia Pacific 1. SensoGuard Ltd. (Israel) 2. Terra15 (Australia) 3. FiberSense (Australia) 4. Yokogawa (Japan) 5. NEC (Japan) 6. Huawei OptiXsense (China) 7. YB Photonics (China)Frequently Asked Questions:

1] What segments are covered in the Global Microseismic Monitoring Technology Market report? Ans. The segments covered in the Microseismic Monitoring Technology Market report are based on Component, Process, Technology, Deployment Type, End-user, and Regions. 2] Which region is expected to hold the highest share in the Global Microseismic Monitoring Technology Market? Ans. North America is expected to hold the highest share of the Microseismic Monitoring Technology Market. 3] What was the market size of the Global Microseismic Monitoring Technology Market by 2024? Ans. The market size of the Microseismic Monitoring Technology Market by 2024 expected to reach USD 660.8 Mn. 4] What is the forecast period for the Global Microseismic Monitoring Technology Market? Ans. The forecast period for the Microseismic Monitoring Technology Market is 2025-2032. 5] What is the market size of the Global Microseismic Monitoring Technology Market in 2032? Ans. The market size of the Microseismic Monitoring Technology Market in 2032 is valued at USD 1118.51 Mn.

1. Microseismic Monitoring Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Microseismic Monitoring Technology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Microseismic Monitoring Technology Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Microseismic Monitoring Technology Market: Dynamics 3.1. Microseismic Monitoring Technology Market Trends by Region 3.1.1. North America Microseismic Monitoring Technology Market Trends 3.1.2. Europe Microseismic Monitoring Technology Market Trends 3.1.3. Asia Pacific Microseismic Monitoring Technology Market Trends 3.1.4. Middle East and Africa Microseismic Monitoring Technology Market Trends 3.1.5. South America Microseismic Monitoring Technology Market Trends 3.2. Microseismic Monitoring Technology Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Microseismic Monitoring Technology Market Drivers 3.2.1.2. North America Microseismic Monitoring Technology Market Restraints 3.2.1.3. North America Microseismic Monitoring Technology Market Opportunities 3.2.1.4. North America Microseismic Monitoring Technology Market Challenges 3.2.2. Europe 3.2.2.1. Europe Microseismic Monitoring Technology Market Drivers 3.2.2.2. Europe Microseismic Monitoring Technology Market Restraints 3.2.2.3. Europe Microseismic Monitoring Technology Market Opportunities 3.2.2.4. Europe Microseismic Monitoring Technology Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Microseismic Monitoring Technology Market Drivers 3.2.3.2. Asia Pacific Microseismic Monitoring Technology Market Restraints 3.2.3.3. Asia Pacific Microseismic Monitoring Technology Market Opportunities 3.2.3.4. Asia Pacific Microseismic Monitoring Technology Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Microseismic Monitoring Technology Market Drivers 3.2.4.2. Middle East and Africa Microseismic Monitoring Technology Market Restraints 3.2.4.3. Middle East and Africa Microseismic Monitoring Technology Market Opportunities 3.2.4.4. Middle East and Africa Microseismic Monitoring Technology Market Challenges 3.2.5. South America 3.2.5.1. South America Microseismic Monitoring Technology Market Drivers 3.2.5.2. South America Microseismic Monitoring Technology Market Restraints 3.2.5.3. South America Microseismic Monitoring Technology Market Opportunities 3.2.5.4. South America Microseismic Monitoring Technology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Microseismic Monitoring Technology Industry 3.8. Analysis of Government Schemes and Initiatives For Microseismic Monitoring Technology Industry 3.9. Microseismic Monitoring Technology Market Trade Analysis 3.10. The Global Pandemic Impact on Microseismic Monitoring Technology Market 4. Microseismic Monitoring Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 4.1.1. Services 4.1.2. Hardware 4.1.3. Software 4.2. Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 4.2.1. Software 4.2.2. Data Processing 4.2.3. Data Interpretation 4.2.4. Data Acquisition 4.2.5. Others 4.3. Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 4.3.1. Passive Seismic Monitoring 4.3.2. Active Seismic Monitoring 4.3.3. Distributed Acoustic Sensing (DAS) 4.4. Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 4.4.1. Onshore 4.4.2. Offshore 4.5. Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 4.5.1. Oil & Gas 4.5.2. Mining 4.5.3. Energy and Utilities 4.5.4. Other 4.6. Microseismic Monitoring Technology Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Microseismic Monitoring Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 5.1.1. Services 5.1.2. Hardware 5.1.3. Software 5.2. North America Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 5.2.1. Software 5.2.2. Data Processing 5.2.3. Data Interpretation 5.2.4. Data Acquisition 5.2.5. Others 5.3. North America Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 5.3.1. Passive Seismic Monitoring 5.3.2. Active Seismic Monitoring 5.3.3. Distributed Acoustic Sensing (DAS) 5.4. North America Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 5.4.1. Onshore 5.4.2. Offshore 5.5. North America Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 5.5.1. Oil & Gas 5.5.2. Mining 5.5.3. Energy and Utilities 5.5.4. Other 5.6. North America Microseismic Monitoring Technology Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 5.6.1.1.1. Services 5.6.1.1.2. Hardware 5.6.1.1.3. Software 5.6.1.2. United States Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 5.6.1.2.1. Software 5.6.1.2.2. Data Processing 5.6.1.2.3. Data Interpretation 5.6.1.2.4. Data Acquisition 5.6.1.2.5. Others 5.6.1.3. United States Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 5.6.1.3.1. Passive Seismic Monitoring 5.6.1.3.2. Active Seismic Monitoring 5.6.1.3.3. Distributed Acoustic Sensing (DAS) 5.6.1.4. United States Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 5.6.1.4.1. Onshore 5.6.1.4.2. Offshore 5.6.1.5. United States Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Oil & Gas 5.6.1.5.2. Mining 5.6.1.5.3. Energy and Utilities 5.6.1.5.4. Other 5.6.2. Canada 5.6.2.1. Canada Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 5.6.2.1.1. Services 5.6.2.1.2. Hardware 5.6.2.1.3. Software 5.6.2.2. Canada Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 5.6.2.2.1. Software 5.6.2.2.2. Data Processing 5.6.2.2.3. Data Interpretation 5.6.2.2.4. Data Acquisition 5.6.2.2.5. Others 5.6.2.3. Canada Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 5.6.2.3.1. Passive Seismic Monitoring 5.6.2.3.2. Active Seismic Monitoring 5.6.2.3.3. Distributed Acoustic Sensing (DAS) 5.6.2.4. Canada Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 5.6.2.4.1. Onshore 5.6.2.4.2. Offshore 5.6.2.5. Canada Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Oil & Gas 5.6.2.5.2. Mining 5.6.2.5.3. Energy and Utilities 5.6.2.5.4. Other 5.6.3. Mexico 5.6.3.1. Mexico Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 5.6.3.1.1. Services 5.6.3.1.2. Hardware 5.6.3.1.3. Software 5.6.3.2. Mexico Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 5.6.3.2.1. Software 5.6.3.2.2. Data Processing 5.6.3.2.3. Data Interpretation 5.6.3.2.4. Data Acquisition 5.6.3.2.5. Others 5.6.3.3. Mexico Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 5.6.3.3.1. Passive Seismic Monitoring 5.6.3.3.2. Active Seismic Monitoring 5.6.3.3.3. Distributed Acoustic Sensing (DAS) 5.6.3.4. Mexico Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 5.6.3.4.1. Onshore 5.6.3.4.2. Offshore 5.6.3.5. Mexico Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Oil & Gas 5.6.3.5.2. Mining 5.6.3.5.3. Energy and Utilities 5.6.3.5.4. Other 6. Europe Microseismic Monitoring Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.2. Europe Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.3. Europe Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.4. Europe Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.5. Europe Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6. Europe Microseismic Monitoring Technology Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.1.2. United Kingdom Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.1.3. United Kingdom Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.1.4. United Kingdom Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.1.5. United Kingdom Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.2.2. France Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.2.3. France Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.2.4. France Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.2.5. France Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.3.2. Germany Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.3.3. Germany Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.3.4. Germany Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.3.5. Germany Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.4.2. Italy Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.4.3. Italy Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.4.4. Italy Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.4.5. Italy Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.5.2. Spain Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.5.3. Spain Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.5.4. Spain Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.5.5. Spain Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.6.2. Sweden Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.6.3. Sweden Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.6.4. Sweden Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.6.5. Sweden Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.7.2. Austria Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.7.3. Austria Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.7.4. Austria Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.7.5. Austria Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 6.6.8.2. Rest of Europe Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 6.6.8.3. Rest of Europe Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 6.6.8.4. Rest of Europe Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 6.6.8.5. Rest of Europe Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.3. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.4. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.5. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.1.2. China Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.1.3. China Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.1.4. China Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.1.5. China Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.2.2. S Korea Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.2.3. S Korea Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.2.4. S Korea Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.2.5. S Korea Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.3.2. Japan Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.3.3. Japan Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.3.4. Japan Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.3.5. Japan Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.4.2. India Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.4.3. India Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.4.4. India Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.4.5. India Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.5.2. Australia Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.5.3. Australia Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.5.4. Australia Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.5.5. Australia Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.6.2. Indonesia Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.6.3. Indonesia Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.6.4. Indonesia Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.6.5. Indonesia Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.7.2. Malaysia Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.7.3. Malaysia Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.7.4. Malaysia Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.7.5. Malaysia Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.8.2. Vietnam Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.8.3. Vietnam Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.8.4. Vietnam Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.8.5. Vietnam Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.9.2. Taiwan Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.9.3. Taiwan Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.9.4. Taiwan Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.9.5. Taiwan Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 7.6.10.2. Rest of Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 7.6.10.3. Rest of Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 7.6.10.4. Rest of Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 7.6.10.5. Rest of Asia Pacific Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 8.3. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 8.4. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 8.5. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Microseismic Monitoring Technology Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 8.6.1.2. South Africa Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 8.6.1.3. South Africa Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 8.6.1.4. South Africa Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 8.6.1.5. South Africa Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 8.6.2.2. GCC Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 8.6.2.3. GCC Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 8.6.2.4. GCC Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 8.6.2.5. GCC Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 8.6.3.2. Nigeria Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 8.6.3.3. Nigeria Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 8.6.3.4. Nigeria Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 8.6.3.5. Nigeria Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 8.6.4.2. Rest of ME&A Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 8.6.4.3. Rest of ME&A Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 8.6.4.4. Rest of ME&A Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 8.6.4.5. Rest of ME&A Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 9. South America Microseismic Monitoring Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 9.2. South America Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 9.3. South America Microseismic Monitoring Technology Market Size and Forecast, by Technology(2024-2032) 9.4. South America Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 9.5. South America Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 9.6. South America Microseismic Monitoring Technology Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 9.6.1.2. Brazil Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 9.6.1.3. Brazil Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 9.6.1.4. Brazil Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 9.6.1.5. Brazil Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 9.6.2.2. Argentina Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 9.6.2.3. Argentina Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 9.6.2.4. Argentina Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 9.6.2.5. Argentina Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Microseismic Monitoring Technology Market Size and Forecast, by Component (2024-2032) 9.6.3.2. Rest Of South America Microseismic Monitoring Technology Market Size and Forecast, by Processes (2024-2032) 9.6.3.3. Rest Of South America Microseismic Monitoring Technology Market Size and Forecast, by Technology (2024-2032) 9.6.3.4. Rest Of South America Microseismic Monitoring Technology Market Size and Forecast, by Deployment (2024-2032) 9.6.3.5. Rest Of South America Microseismic Monitoring Technology Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Schlumberger Limited (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ESG Solutions (Deep Imaging Technologies) (Canada) 10.3. Geospace Technologies Corporation (USA) 10.4. Baker Hughes Company (USA) 10.5. Landtech Geophysics Ltd (Canada) 10.6. Halliburton Company (USA) 10.7. MicroSeismic, Inc. (U.S.) 10.8. Weir-Jones Group (U.S.) 10.9. Guralp Systems Limited (United Kingdom) 10.10. Silixa Ltd (U.K.) 10.11. OptaSense (Luna Innovations) (U.K.) 10.12. SensoGuard Ltd. (Israel) 10.13. Terra15 (Australia) 10.14. FiberSense (Australia) 10.15. Yokogawa (Japan) 10.16. NEC (Japan) 10.17. Huawei OptiXsense (China) 10.18. YB Photonics (China) 11. Key Findings 12. Industry Recommendations 13. Microseismic Monitoring Technology Market: Research Methodology 14. Terms and Glossary