Global Lipid Market size was valued at USD 12.76 Bn. in 2024, and the total Lipid Market is expected to grow by 8.09% from 2025 to 2032, reaching nearly USD 23.78 BnGlobal Lipids Market Overview

Lipids are organic compounds that include fats, oils, sterols, phospholipids, and fat-soluble vitamins, playing a crucial role in energy storage, cell signaling, and structural functions. They are widely utilized across industries such as food & beverages, pharmaceuticals, nutraceuticals, and cosmetics due to their nutritional and functional properties. The global lipids market is gaining strong momentum, driven by the growing demand for healthier, fortified, and functional products among consumers. The rising adoption of vegan and plant-based alternatives creates lucrative growth opportunities to Lipids Market. With the increasing shift toward plant-derived nutrition, major companies like Cargill and DuPont are investing in innovative lipid ingredients sourced from algae and other plant-based oils. For example, the growing popularity of algae-based omega-3 oils in the U.S. and Europe reflects consumer preference for sustainable, non-animal products. In addition, structured lipids are being increasingly applied in infant and clinical nutrition, where companies such as Nestlé are formulating products closer to the nutritional profile of human milk, creating new growth avenues. The expanding use of lipids in the food & beverage industry boosts the demand of lipids. Lipids enhance flavor, texture, and nutritional value, with omega-3 enriched functional foods witnessing robust demand. Rising awareness of cardiovascular health and cognitive development continues to boost the integration of lipids in food products globally, strengthening their market.To know about the Research Methodology :- Request Free Sample Report

Global Lipids Market Dynamics:

Increasing Demand in Food & Beverage Industry to Drive the growth Lipids Market The global lipids market is witnessing strong growth, driven by increasing demand from the food and beverage industry. Lipids such as triglycerides, phospholipids, and omega-3 fatty acids are widely used in bakery, dairy, confectionery, and infant nutrition products, owing to their role in nutritional enrichment, flavor, and texture enhancement. The shift toward functional foods and health-oriented diets has significantly increased the use of healthy lipids in daily nutrition. For example, the demand for omega-3 fortified foods like dairy products, breakfast cereals, and nutrition bars has risen sharply due to rising health consciousness. According to the FAO, global consumption of fats and oils continues to increase, especially in developing countries. Moreover, leading players such as Cargill and ADM are expanding their lipid-based ingredient portfolios to meet consumer demand for healthier, sustainable, and functional food products. Lipid-based emulsifiers are also widely adopted in processed and convenience foods to enhance shelf life and maintain product quality. As consumers increasingly seek nutritious, ready-to-eat, and premium food products, the expanding food and beverage sector will remain a key growth driver for the global lipids market. Fluctuations in Raw Material Prices limits the growth of Lipids Market The fluctuation in raw material prices is the major challenges restraining the lipids market growth is. Lipid production relies heavily on agricultural commodities such as soybean, sunflower, and palm oil, which are vulnerable to climate change, trade restrictions, and geopolitical issues. For instance, the Russia–Ukraine conflict disrupted sunflower oil exports in 2022, leading to a spike in global edible oil prices and directly impacting lipid manufacturers. Similarly, the palm oil industry in Malaysia and Indonesia frequently experiences price fluctuations due to labor shortages, deforestation concerns, and environmental regulations. Such volatility disrupts the supply chain and increases production costs for food, pharmaceutical, and cosmetics companies dependent on lipids. Multinational companies such as Nestlé and Unilever are committed to sourcing sustainable palm oil through RSPO-certified practices, but these sustainable initiatives often come with higher costs. Smaller players in the market find it difficult to balance profitability with sustainable sourcing. As a result, inconsistent pricing and supply instability remain a key restraint that limits the predictable growth of the lipids market globally. Addressing these challenges through diversification of raw material sources and sustainable farming practices is crucial for long-term market growth. Application in Vegan and Plant-Based Products creates lucrative growth opportunities to Lipids Market The surge in veganism and plant-based diets worldwide is creating lucrative opportunities for the lipids market. Plant-derived lipids from sources such as algae, flaxseed, canola, and sunflower are increasingly used in vegan and vegetarian food formulations. These lipids help replicate the taste, texture, and functionality of animal-derived fats, making them essential in meat substitutes, dairy alternatives, and nutrition supplements. For instance, Beyond Meat and Impossible Foods use plant-based oils like coconut and canola to mimic the juiciness of meat, while Oatly relies on oat-derived lipids for the creaminess in oat milk. According to the Good Food Institute (2023), global plant-based food sales surpassed $8 billion, with lipid-rich categories such as dairy alternatives and plant-based meat leading the growth. Moreover, algae-derived omega-3 fatty acids are emerging as sustainable alternatives to fish oil, addressing both health and environmental concerns. Companies such as DSM and Corbion are investing heavily in plant-based innovations, strengthening the market’s growth potential. With rising consumer demand for ethical, sustainable, and health-oriented foods, vegan and plant-based lipid applications are expected to revolutionize the global lipids market.Global Lipids Market Segment Analysis:

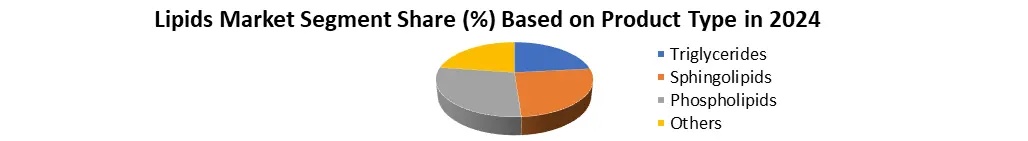

Based on Product Type, Lipids Market is segmented into Triglycerides, Sphingolipids, Phospholipids and Others. glycerophospholipids (phospholipids) segment dominated the product type segment in 2024. The glycerophospholipids (phospholipids) segment dominated the market, holding the largest share. This dominance is attributed to their extensive applications across pharmaceuticals, nutraceuticals, food, and cosmetics. Phospholipids are critical in cell membrane structure, making them vital for biological functions and therapeutic use. Their role as natural emulsifiers enhances product stability in food and beverage formulations, while in pharmaceuticals, they are widely used in liposome and lipid nanoparticle (LNP) technologies for advanced drug and vaccine delivery systems, including mRNA-based therapies. Growing research in lipid-based drug delivery and rising consumer demand for functional foods drive their adoption. Moreover, the shift towards natural and bio-based ingredients in health supplements and personal care products has strengthened their demand. Compared to triglycerides and sphingolipids, phospholipids offer broader utility, high biocompatibility, and technological relevance, solidifying their leadership in the Lipids Market.

Global Lipids Market Regional Analysis:

Asia Pacific dominated the Lipids Market in 2024. Due to its large consumer base and strong industrial expansion. The region’s leadership is primarily supported by rising health awareness, particularly regarding nutrition for women, infants, and aging populations. This has significantly boosted the consumption of lipid-based nutrients such as omega-3 fatty acids, triglycerides, and phospholipids, which are widely used in dietary supplements and fortified food products. The food & beverage industry in countries like China, India, and Japan is expanding rapidly, with lipids increasingly incorporated as functional ingredients to enhance product stability and nutrition. Similarly, the cosmetics and personal care sector relies heavily on lipids as moisturizers and bioactive compounds, adding to demand. Government-backed initiatives, such as India’s investments in pharmaceutical R&D and China’s nutrition awareness programs, accelerate lipid adoption in healthcare and biotechnology. China remains the largest market, boosted by functional food and supplement consumption, while India is emerging as a key pharmaceutical hub, focusing on lipid-based drug delivery and vaccine formulations. The rise of plant-based and sustainable lipids also resonates strongly with APAC’s clean-label and eco-conscious consumer base, reinforcing the region’s Lipids market dominance. Global Lipid Market Competitive Analysis: The global lipids market is competitive. The high competition intensifying among biotech innovators, marine oil specialists, and food ingredient producers. Leading players leverage global refining networks, integrated logistics, and deep regulatory expertise to secure large-scale contracts with pharmaceutical companies and consumer packaged goods (CPG) manufacturers. At the same time, biotech startups are disrupting supply chains through the development of single-cell oils, which offer consistent quality and sustainability benefits by avoiding seasonal variability in marine capture. As the market evolves, established companies are actively pursuing strategic acquisitions of niche firms specializing in encapsulation, fermentation, and novel lipid technologies. These deals provide access to proprietary strains, intellectual property, and advanced formulation expertise. Additionally, synthetic biology firms are forming alliances with agricultural commodity giants to strengthen raw material access and expand sustainable production. In the pharmaceutical excipients space, competition is intense but limited to a smaller pool of suppliers, as stringent requirements for clinical-grade purity and compliance with Good Manufacturing Practices (GMP) create high entry barriers. Meanwhile, digital nutrition platforms are reshaping consumer engagement by combining personalized lipid formulations with genetic testing, pushing traditional bulk suppliers to move toward value-added services and enhancing long-term customer loyalty. Global Lipids Market Key Trends: Increasing Demand for Plant-Based Lipids Consumer preference for natural, sustainable, and health-friendly ingredients is driving demand for plant-based lipids derived from algae, seeds, and microorganisms. These lipids offer stability, functional benefits, and a reduced environmental footprint compared to animal sources. Growing vegan, clean-label, and eco-conscious trends further accelerate their adoption across food, supplements, cosmetics, and pharmaceutical formulations. Developments in Drug Delivery Systems Lipids are increasingly vital in modern drug delivery, enhancing solubility, stability, and absorption of active compounds. Technologies such as liposomes and lipid nanoparticles (LNPs) allow controlled release and targeted delivery, significantly improving therapeutic efficacy. Their pivotal role in mRNA vaccines and advanced therapies highlights the expanding importance of lipid-based systems in global pharmaceutical innovation. Global Lipid Market Key Development: In early 2024, DSM-Firmenich announced plans to carve out its Animal Nutrition & Health (ANH) division, which includes feed ingredients such as vitamins, enzymes, carotenoids, and lipids, by the end of 2025. The decision aims to reduce exposure to the volatile vitamins market and allow ANH to grow under new ownership. This follows DSM-Firmenich’s exit from the Feed Enzymes Alliance, fully acquired by Novonesis for $ 1.5 billion. October, 1 2024 , KD Pharma Group has completed the acquisition of dsm-firmenich’s Marine Lipids business, including its omega-3 fish oil segment, MEG-3 brand, and facilities in Peru and Canada. In exchange, dsm-firmenich gained a minority stake in KD Pharma. The deal strengthens KD Pharma’s global leadership in pharmaceutical and nutritional lipids, expanding its manufacturing footprint to seven sites worldwide.Lipids Market Scope: Inquire before buying

Lipids Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 12.76 Bn. Forecast Period 2025 to 2032 CAGR: 8.09% Market Size in 2032: USD 23.78 Bn. Segments Covered: by Type Natural Lipids Synthetic Lipids by Product Type Triglycerides Sphingolipids Phospholipids Others by Phase Clinical Pre-clinical Others by Form Powders/Emulsions Tablets/Capsules Others by Application Pharmaceuticals Vaccines & Drugs Scientific Research Nutrition & Supplements Food & Beverages Others by Distribution Channel Direct Tender Retail Sales Others Global Lipids Market, By Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America) North America 1. Cargill, Incorporated (US) 2. Archer Daniels Midland Company — ADM (US) 3. Bunge Limited (US) 4. The Stepan Company (US) 5. Omega Protein Corporation (US) 6. Nordic Naturals, Inc. (US) 7. Cayman Chemical Company (US) 8. Ashland Inc. (US) 9. Bunge (US) 10. Emery Oleochemicals (USA) Europe 11. BASF SE (Germany) 12. Evonik Industries AG (Germany) 13. Merck KGaA (Germany) 14. Lipoid GmbH (Germany) 15. Koninklijke DSM N.V. — DSM (Netherlands) 16. Corbion (Netherlands) 17. Croda International plc (UK) 18. Kerry Group plc (Ireland) 19. DSM-Firmenich (Switzerland) 20. KD Pharma Group (Germany) Asia Pacific 21. Wilmar International (Singapore) 22. Godrej Industries (India) 23. VVF Ltd (India) 24. Musim Mas (Indonesia) 25. Clover Corporation (Australia) 26. Godrej (India) Middle East and Africa 27. Bidco Africa (Kenya)Global Lipid Market Frequently Asked Questions

1. The Application of the Global Lipid Market? Ans: Pharmaceuticals, Nutrition & Supplements, Food & Beverages, Others the Application Global Lipid Market? 2. Global Lipid Market dominated region? Ans: Asia Pacific is the region which dominates Global Lipid Market. 3. What is the study period of this market? Ans: The Global Lipid Market is studied from 2024 to 2032. 4. Which key trends are observed in the Global Lipid Market? Ans: Increasing Demand for Plant-Based Lipids, Developments in Drug Delivery Systems, Enhanced Attention to Nutritional Supplements, Costing and Availability of Raw Materials are observed in the Global Lipid Market.

1. Lipids Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Lipids Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Lipids Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Lipids Market: Dynamics 3.1. Lipids Market Trends by Region 3.1.1. North America Lipids Market Trends 3.1.2. Europe Lipids Market Trends 3.1.3. Asia Pacific Lipids Market Trends 3.1.4. Middle East and Africa Lipids Market Trends 3.1.5. South America Lipids Market Trends 3.2. Lipids Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Lipids Market Drivers 3.2.1.2. North America Lipids Market Restraints 3.2.1.3. North America Lipids Market Opportunities 3.2.1.4. North America Lipids Market Challenges 3.2.2. Europe 3.2.2.1. Europe Lipids Market Drivers 3.2.2.2. Europe Lipids Market Restraints 3.2.2.3. Europe Lipids Market Opportunities 3.2.2.4. Europe Lipids Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Lipids Market Drivers 3.2.3.2. Asia Pacific Lipids Market Restraints 3.2.3.3. Asia Pacific Lipids Market Opportunities 3.2.3.4. Asia Pacific Lipids Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Lipids Market Drivers 3.2.4.2. Middle East and Africa Lipids Market Restraints 3.2.4.3. Middle East and Africa Lipids Market Opportunities 3.2.4.4. Middle East and Africa Lipids Market Challenges 3.2.5. South America 3.2.5.1. South America Lipids Market Drivers 3.2.5.2. South America Lipids Market Restraints 3.2.5.3. South America Lipids Market Opportunities 3.2.5.4. South America Lipids Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Lipids Industry 3.8. Analysis of Government Schemes and Initiatives For Lipids Industry 3.9. Lipids Market Trade Analysis 3.10. The Global Pandemic Impact on Lipids Market 4. Lipids Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Lipids Market Size and Forecast, by Type (2024-2032) 4.1.1. Natural Lipids 4.1.2. Synthetic Lipids 4.2. Lipids Market Size and Forecast, by Product Type (2024-2032) 4.2.1. Triglycerides 4.2.2. Sphingolipids 4.2.3. Phospholipids 4.2.4. Others 4.3. Lipids Market Size and Forecast, by Phase (2024-2032) 4.3.1. Clinical 4.3.2. Pre-clinical 4.3.3. Others 4.4. Lipids Market Size and Forecast, by Form (2024-2032) 4.4.1. Powders/Emulsions 4.4.2. Tablets/Capsules 4.4.3. Others 4.5. Lipids Market Size and Forecast, by Application (2024-2032) 4.5.1. Pharmaceuticals 4.5.2. Vaccines & Drugs 4.5.3. Scientific Research 4.5.4. Nutrition & Supplements 4.5.5. Food & Beverages 4.5.6. Others 4.6. Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 4.6.1. Direct Tender 4.6.2. Retail Sales 4.6.3. Others 4.7. Lipids Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Lipids Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Lipids Market Size and Forecast, by Type (2024-2032) 5.1.1. Natural Lipids 5.1.2. Synthetic Lipids 5.2. North America Lipids Market Size and Forecast, by Product Type (2024-2032) 5.2.1. Triglycerides 5.2.2. Sphingolipids 5.2.3. Phospholipids 5.2.4. Others 5.3. North America Lipids Market Size and Forecast, by Phase (2024-2032) 5.3.1. Clinical 5.3.2. Pre-clinical 5.3.3. Others 5.4. North America Lipids Market Size and Forecast, by Form (2024-2032) 5.4.1. Powders/Emulsions 5.4.2. Tablets/Capsules 5.4.3. Others 5.5. North America Lipids Market Size and Forecast, by Application (2024-2032) 5.5.1. Pharmaceuticals 5.5.2. Vaccines & Drugs 5.5.3. Scientific Research 5.5.4. Nutrition & Supplements 5.5.5. Food & Beverages 5.5.6. Others 5.6. North America Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 5.6.1. Direct Tender 5.6.2. Retail Sales 5.6.3. Others 5.7. North America Lipids Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Lipids Market Size and Forecast, by Type (2024-2032) 5.7.1.1.1. Natural Lipids 5.7.1.1.2. Synthetic Lipids 5.7.1.2. United States Lipids Market Size and Forecast, by Product Type (2024-2032) 5.7.1.2.1. Triglycerides 5.7.1.2.2. Sphingolipids 5.7.1.2.3. Phospholipids 5.7.1.2.4. Others 5.7.1.3. United States Lipids Market Size and Forecast, by Phase (2024-2032) 5.7.1.3.1. Clinical 5.7.1.3.2. Pre-clinical 5.7.1.3.3. Others 5.7.1.4. United States Lipids Market Size and Forecast, by Form (2024-2032) 5.7.1.4.1. Powders/Emulsions 5.7.1.4.2. Tablets/Capsules 5.7.1.4.3. Others 5.7.1.5. United States Lipids Market Size and Forecast, by Application (2024-2032) 5.7.1.5.1. Pharmaceuticals 5.7.1.5.2. Vaccines & Drugs 5.7.1.5.3. Scientific Research 5.7.1.5.4. Nutrition & Supplements 5.7.1.5.5. Food & Beverages 5.7.1.5.6. Others 5.7.1.6. United States Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.1.6.1. Direct Tender 5.7.1.6.2. Retail Sales 5.7.1.6.3. Others 5.7.2. Canada 5.7.2.1. Canada Lipids Market Size and Forecast, by Type (2024-2032) 5.7.2.1.1. Natural Lipids 5.7.2.1.2. Synthetic Lipids 5.7.2.2. Canada Lipids Market Size and Forecast, by Product Type (2024-2032) 5.7.2.2.1. Triglycerides 5.7.2.2.2. Sphingolipids 5.7.2.2.3. Phospholipids 5.7.2.2.4. Others 5.7.2.3. Canada Lipids Market Size and Forecast, by Phase (2024-2032) 5.7.2.3.1. Clinical 5.7.2.3.2. Pre-clinical 5.7.2.3.3. Others 5.7.2.4. Canada Lipids Market Size and Forecast, by Form (2024-2032) 5.7.2.4.1. Powders/Emulsions 5.7.2.4.2. Tablets/Capsules 5.7.2.4.3. Others 5.7.2.5. Canada Lipids Market Size and Forecast, by Application (2024-2032) 5.7.2.5.1. Pharmaceuticals 5.7.2.5.2. Vaccines & Drugs 5.7.2.5.3. Scientific Research 5.7.2.5.4. Nutrition & Supplements 5.7.2.5.5. Food & Beverages 5.7.2.5.6. Others 5.7.2.6. Canada Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.2.6.1. Direct Tender 5.7.2.6.2. Retail Sales 5.7.2.6.3. Others 5.7.3. Mexico 5.7.3.1. Mexico Lipids Market Size and Forecast, by Type (2024-2032) 5.7.3.1.1. Natural Lipids 5.7.3.1.2. Synthetic Lipids 5.7.3.2. Mexico Lipids Market Size and Forecast, by Product Type (2024-2032) 5.7.3.2.1. Triglycerides 5.7.3.2.2. Sphingolipids 5.7.3.2.3. Phospholipids 5.7.3.2.4. Others 5.7.3.3. Mexico Lipids Market Size and Forecast, by Phase (2024-2032) 5.7.3.3.1. Clinical 5.7.3.3.2. Pre-clinical 5.7.3.3.3. Others 5.7.3.4. Mexico Lipids Market Size and Forecast, by Form (2024-2032) 5.7.3.4.1. Powders/Emulsions 5.7.3.4.2. Tablets/Capsules 5.7.3.4.3. Others 5.7.3.5. Mexico Lipids Market Size and Forecast, by Application (2024-2032) 5.7.3.5.1. Pharmaceuticals 5.7.3.5.2. Vaccines & Drugs 5.7.3.5.3. Scientific Research 5.7.3.5.4. Nutrition & Supplements 5.7.3.5.5. Food & Beverages 5.7.3.5.6. Others 5.7.3.6. Mexico Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.3.6.1. Direct Tender 5.7.3.6.2. Retail Sales 5.7.3.6.3. Others 6. Europe Lipids Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Lipids Market Size and Forecast, by Type (2024-2032) 6.2. Europe Lipids Market Size and Forecast, by Product Type (2024-2032) 6.3. Europe Lipids Market Size and Forecast, by Phase (2024-2032) 6.4. Europe Lipids Market Size and Forecast, by Form (2024-2032) 6.5. Europe Lipids Market Size and Forecast, by Application (2024-2032) 6.6. Europe Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7. Europe Lipids Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Lipids Market Size and Forecast, by Type (2024-2032) 6.7.1.2. United Kingdom Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.1.3. United Kingdom Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.1.4. United Kingdom Lipids Market Size and Forecast, by Form (2024-2032) 6.7.1.5. United Kingdom Lipids Market Size and Forecast, by Application (2024-2032) 6.7.1.6. United Kingdom Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.2. France 6.7.2.1. France Lipids Market Size and Forecast, by Type (2024-2032) 6.7.2.2. France Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.2.3. France Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.2.4. France Lipids Market Size and Forecast, by Form (2024-2032) 6.7.2.5. France Lipids Market Size and Forecast, by Application (2024-2032) 6.7.2.6. France Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Lipids Market Size and Forecast, by Type (2024-2032) 6.7.3.2. Germany Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.3.3. Germany Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.3.4. Germany Lipids Market Size and Forecast, by Form (2024-2032) 6.7.3.5. Germany Lipids Market Size and Forecast, by Application (2024-2032) 6.7.3.6. Germany Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Lipids Market Size and Forecast, by Type (2024-2032) 6.7.4.2. Italy Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.4.3. Italy Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.4.4. Italy Lipids Market Size and Forecast, by Form (2024-2032) 6.7.4.5. Italy Lipids Market Size and Forecast, by Application (2024-2032) 6.7.4.6. Italy Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Lipids Market Size and Forecast, by Type (2024-2032) 6.7.5.2. Spain Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.5.3. Spain Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.5.4. Spain Lipids Market Size and Forecast, by Form (2024-2032) 6.7.5.5. Spain Lipids Market Size and Forecast, by Application (2024-2032) 6.7.5.6. Spain Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Lipids Market Size and Forecast, by Type (2024-2032) 6.7.6.2. Sweden Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.6.3. Sweden Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.6.4. Sweden Lipids Market Size and Forecast, by Form (2024-2032) 6.7.6.5. Sweden Lipids Market Size and Forecast, by Application (2024-2032) 6.7.6.6. Sweden Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Lipids Market Size and Forecast, by Type (2024-2032) 6.7.7.2. Austria Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.7.3. Austria Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.7.4. Austria Lipids Market Size and Forecast, by Form (2024-2032) 6.7.7.5. Austria Lipids Market Size and Forecast, by Application (2024-2032) 6.7.7.6. Austria Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Lipids Market Size and Forecast, by Type (2024-2032) 6.7.8.2. Rest of Europe Lipids Market Size and Forecast, by Product Type (2024-2032) 6.7.8.3. Rest of Europe Lipids Market Size and Forecast, by Phase (2024-2032) 6.7.8.4. Rest of Europe Lipids Market Size and Forecast, by Form (2024-2032) 6.7.8.5. Rest of Europe Lipids Market Size and Forecast, by Application (2024-2032) 6.7.8.6. Rest of Europe Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Lipids Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Lipids Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Lipids Market Size and Forecast, by Product Type (2024-2032) 7.3. Asia Pacific Lipids Market Size and Forecast, by Phase (2024-2032) 7.4. Asia Pacific Lipids Market Size and Forecast, by Form (2024-2032) 7.5. Asia Pacific Lipids Market Size and Forecast, by Application (2024-2032) 7.6. Asia Pacific Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7. Asia Pacific Lipids Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Lipids Market Size and Forecast, by Type (2024-2032) 7.7.1.2. China Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.1.3. China Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.1.4. China Lipids Market Size and Forecast, by Form (2024-2032) 7.7.1.5. China Lipids Market Size and Forecast, by Application (2024-2032) 7.7.1.6. China Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Lipids Market Size and Forecast, by Type (2024-2032) 7.7.2.2. S Korea Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.2.3. S Korea Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.2.4. S Korea Lipids Market Size and Forecast, by Form (2024-2032) 7.7.2.5. S Korea Lipids Market Size and Forecast, by Application (2024-2032) 7.7.2.6. S Korea Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Lipids Market Size and Forecast, by Type (2024-2032) 7.7.3.2. Japan Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.3.3. Japan Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.3.4. Japan Lipids Market Size and Forecast, by Form (2024-2032) 7.7.3.5. Japan Lipids Market Size and Forecast, by Application (2024-2032) 7.7.3.6. Japan Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.4. India 7.7.4.1. India Lipids Market Size and Forecast, by Type (2024-2032) 7.7.4.2. India Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.4.3. India Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.4.4. India Lipids Market Size and Forecast, by Form (2024-2032) 7.7.4.5. India Lipids Market Size and Forecast, by Application (2024-2032) 7.7.4.6. India Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Lipids Market Size and Forecast, by Type (2024-2032) 7.7.5.2. Australia Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.5.3. Australia Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.5.4. Australia Lipids Market Size and Forecast, by Form (2024-2032) 7.7.5.5. Australia Lipids Market Size and Forecast, by Application (2024-2032) 7.7.5.6. Australia Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Lipids Market Size and Forecast, by Type (2024-2032) 7.7.6.2. Indonesia Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.6.3. Indonesia Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.6.4. Indonesia Lipids Market Size and Forecast, by Form (2024-2032) 7.7.6.5. Indonesia Lipids Market Size and Forecast, by Application (2024-2032) 7.7.6.6. Indonesia Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Lipids Market Size and Forecast, by Type (2024-2032) 7.7.7.2. Malaysia Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.7.3. Malaysia Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.7.4. Malaysia Lipids Market Size and Forecast, by Form (2024-2032) 7.7.7.5. Malaysia Lipids Market Size and Forecast, by Application (2024-2032) 7.7.7.6. Malaysia Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Lipids Market Size and Forecast, by Type (2024-2032) 7.7.8.2. Vietnam Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.8.3. Vietnam Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.8.4. Vietnam Lipids Market Size and Forecast, by Form (2024-2032) 7.7.8.5. Vietnam Lipids Market Size and Forecast, by Application (2024-2032) 7.7.8.6. Vietnam Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Lipids Market Size and Forecast, by Type (2024-2032) 7.7.9.2. Taiwan Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.9.3. Taiwan Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.9.4. Taiwan Lipids Market Size and Forecast, by Form (2024-2032) 7.7.9.5. Taiwan Lipids Market Size and Forecast, by Application (2024-2032) 7.7.9.6. Taiwan Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Lipids Market Size and Forecast, by Type (2024-2032) 7.7.10.2. Rest of Asia Pacific Lipids Market Size and Forecast, by Product Type (2024-2032) 7.7.10.3. Rest of Asia Pacific Lipids Market Size and Forecast, by Phase (2024-2032) 7.7.10.4. Rest of Asia Pacific Lipids Market Size and Forecast, by Form (2024-2032) 7.7.10.5. Rest of Asia Pacific Lipids Market Size and Forecast, by Application (2024-2032) 7.7.10.6. Rest of Asia Pacific Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Lipids Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Lipids Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Lipids Market Size and Forecast, by Product Type (2024-2032) 8.3. Middle East and Africa Lipids Market Size and Forecast, by Phase (2024-2032) 8.4. Middle East and Africa Lipids Market Size and Forecast, by Form (2024-2032) 8.5. Middle East and Africa Lipids Market Size and Forecast, by Application (2024-2032) 8.6. Middle East and Africa Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 8.7. Middle East and Africa Lipids Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Lipids Market Size and Forecast, by Type (2024-2032) 8.7.1.2. South Africa Lipids Market Size and Forecast, by Product Type (2024-2032) 8.7.1.3. South Africa Lipids Market Size and Forecast, by Phase (2024-2032) 8.7.1.4. South Africa Lipids Market Size and Forecast, by Form (2024-2032) 8.7.1.5. South Africa Lipids Market Size and Forecast, by Application (2024-2032) 8.7.1.6. South Africa Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Lipids Market Size and Forecast, by Type (2024-2032) 8.7.2.2. GCC Lipids Market Size and Forecast, by Product Type (2024-2032) 8.7.2.3. GCC Lipids Market Size and Forecast, by Phase (2024-2032) 8.7.2.4. GCC Lipids Market Size and Forecast, by Form (2024-2032) 8.7.2.5. GCC Lipids Market Size and Forecast, by Application (2024-2032) 8.7.2.6. GCC Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Lipids Market Size and Forecast, by Type (2024-2032) 8.7.3.2. Nigeria Lipids Market Size and Forecast, by Product Type (2024-2032) 8.7.3.3. Nigeria Lipids Market Size and Forecast, by Phase (2024-2032) 8.7.3.4. Nigeria Lipids Market Size and Forecast, by Form (2024-2032) 8.7.3.5. Nigeria Lipids Market Size and Forecast, by Application (2024-2032) 8.7.3.6. Nigeria Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Lipids Market Size and Forecast, by Type (2024-2032) 8.7.4.2. Rest of ME&A Lipids Market Size and Forecast, by Product Type (2024-2032) 8.7.4.3. Rest of ME&A Lipids Market Size and Forecast, by Phase (2024-2032) 8.7.4.4. Rest of ME&A Lipids Market Size and Forecast, by Form (2024-2032) 8.7.4.5. Rest of ME&A Lipids Market Size and Forecast, by Application (2024-2032) 8.7.4.6. Rest of ME&A Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Lipids Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Lipids Market Size and Forecast, by Type (2024-2032) 9.2. South America Lipids Market Size and Forecast, by Product Type (2024-2032) 9.3. South America Lipids Market Size and Forecast, by Phase(2024-2032) 9.4. South America Lipids Market Size and Forecast, by Form (2024-2032) 9.5. South America Lipids Market Size and Forecast, by Application (2024-2032) 9.6. South America Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 9.7. South America Lipids Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Lipids Market Size and Forecast, by Type (2024-2032) 9.7.1.2. Brazil Lipids Market Size and Forecast, by Product Type (2024-2032) 9.7.1.3. Brazil Lipids Market Size and Forecast, by Phase (2024-2032) 9.7.1.4. Brazil Lipids Market Size and Forecast, by Form (2024-2032) 9.7.1.5. Brazil Lipids Market Size and Forecast, by Application (2024-2032) 9.7.1.6. Brazil Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Lipids Market Size and Forecast, by Type (2024-2032) 9.7.2.2. Argentina Lipids Market Size and Forecast, by Product Type (2024-2032) 9.7.2.3. Argentina Lipids Market Size and Forecast, by Phase (2024-2032) 9.7.2.4. Argentina Lipids Market Size and Forecast, by Form (2024-2032) 9.7.2.5. Argentina Lipids Market Size and Forecast, by Application (2024-2032) 9.7.2.6. Argentina Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Lipids Market Size and Forecast, by Type (2024-2032) 9.7.3.2. Rest Of South America Lipids Market Size and Forecast, by Product Type (2024-2032) 9.7.3.3. Rest Of South America Lipids Market Size and Forecast, by Phase (2024-2032) 9.7.3.4. Rest Of South America Lipids Market Size and Forecast, by Form (2024-2032) 9.7.3.5. Rest Of South America Lipids Market Size and Forecast, by Application (2024-2032) 9.7.3.6. Rest Of South America Lipids Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Cargill, Incorporated (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Archer Daniels Midland Company — ADM (US) 10.3. Bunge Limited (US) 10.4. The Stepan Company (US) 10.5. Omega Protein Corporation (US) 10.6. Nordic Naturals, Inc. (US) 10.7. Cayman Chemical Company (US) 10.8. Ashland Inc. (US) 10.9. Bunge (US) 10.10. Emery Oleochemicals (USA) 10.11. BASF SE (Germany) 10.12. Evonik Industries AG (Germany) 10.13. Merck KGaA (Germany) 10.14. Lipoid GmbH (Germany) 10.15. Koninklijke DSM N.V. — DSM (Netherlands) 10.16. Corbion (Netherlands) 10.17. Croda International plc (UK) 10.18. Kerry Group plc (Ireland) 10.19. DSM-Firmenich (Switzerland) 10.20. KD Pharma Group (Germany) 10.21. Wilmar International (Singapore) 10.22. Godrej Industries (India) 10.23. VVF Ltd (India) 10.24. Musim Mas (Indonesia) 10.25. Clover Corporation (Australia) 10.26. Godrej (India) 10.27. Bidco Africa (Kenya) 11. Key Findings 12. Industry Recommendations 13. Lipids Market: Research Methodology 14. Terms and Glossary