The Global Linear Motion System Market size was valued at USD 3.9 Bn. in 2024, and the total Linear Motion System Market revenue is expected to grow by 4.8 % from 2025 to 2032, reaching nearly USD 5.67 Bn.Linear Motion System Market Overview:

The Linear Motion System is designed, manufactured, and distributed to move something in a linear path, usually with high precision, speed, and efficiency. Often, the system contains parts such as linear guides and tables, drive systems, actuators, and motors, and is typically considered as being applied across the semiconductor, automotive, medical devices, machine tools, food and beverage, and aerospace industries. The report has delivered a granular analysis of the Linear Motion System Market covering components for product availability, demand-supply situation, and regional markets, to underscore how the growing focus on industrial automation and precision engineering drives adoption of linear motion systems.To know about the Research Methodology :- Request Free Sample Report The report indicates that the Asia-Pacific region leads the Linear Motion System Market, largely due to strong manufacturing output in countries such as China, Japan, and South Korea, followed by North America and Europe. The report also highlighted some of the significant players in the market, such as THK Co., Ltd., Bosch Rexroth AG, HIWIN Technologies, NSK Ltd., and SKF Group, as well as an assessment of end-user participation and revenue generation, with semiconductor & electronics and automotive being the leading industrial participants.

Linear Motion System Market Dynamics

Increased need for quality inspection and automation to boost the Linear Motion System Market growth Product quality is a prime concern in manufacturing industries, pharmaceuticals, food & beverages, automotive, electronics, and semiconductors. The quality control branch plays an important role. Linear Motion System manufacturers worldwide widely adopt automated linear motion products in their manufacturing and packaging lines. Several manufacturers focus on efficient automated processes to reduce throughput time and increase productivity. Increasing demand for better control over products manufactured or services delivered across industries fuels the need for quality inspection and automation, which significantly boosts the Linear Motion System Market growth. The Linear Motion System Market is driven by many factors, including the shift in technology from hydraulic and pneumatic systems toward electromechanical systems to achieve higher precision, flexibility, reliability, and efficiency with less energy usage. These linear motion systems are in high demand due to their superior performance in extreme environmental conditions in industries. With reference to some industrial fields, such as packaging and automatic machines, the current trend is the transition from using hydraulic or pneumatic cylinders to electric linear actuators. The primary purpose is to have better control and greater versatility in automation and detailed customization of the machine or system in which the electric linear actuator is mounted. Linear motion systems have a diverse range of applications in manufacturing. They are used to provide precise and accurate positioning of equipment and products, making them suitable for use in automated manufacturing processes. These systems are used in packaging & palletizing, pick & place operations, material handling, precision machining, assembly & disassembly of products, inspection& quality control, die making, etc. High cost of installation for less volume production to limit the Linear Motion System Market growth The high demand for linear motion in manufacturing and packaging industries, even though there still exist restraints to adopting linear motion products for low-volume production, especially in businesses that produce low-volume products with a single production line. As linear motion products are designed according to the requirements of an application of a user, it is an inevitable process of modifying or reconfiguring systems every time the application is changed. The cost of reconfiguring and reinstalling these products is high for low-volume production, which significantly restrains the Linear Motion System Market growth. Installation time is a significant challenge for the market. The high component count contributes to a longer and more complex installation process. All corresponding components need to be carefully and correctly positioned and secured for a proper motion to occur. For example, if the lead screw and linear guides are not parallel with one another in both axes, there is a high likelihood of binding occurring, causing the entire drive mechanism to stall out. Increasing dependence on automated linear motion equipment challenge the industry demand, as any small error in the machine might cause a total system failure. These failures is reduced by hiring skilled workers. This increases the demand for skilled technicians. In most industries, managers face a shortage of qualified engineers and maintenance staff to support and maintain equipment properly and limits the Linear Motion System Industry growth. The use of many linear motion components necessitates the requirement of highly skilled workers to mount components and harness cables. Growing investments in industrial automation and robotics present a significant growth opportunity for the Linear Motion System Market. Linear motion products are designed to meet the requirements of engineers involved in designing applications in industrial automation and robotics. These products reduce the size of robots while increasing their rigidity and operational speed. The robotic sector gives companies access to the rapidly growing linear motion in manufacturing industries through partnerships, mergers, product expansion, and acquisitions.Linear Motion System Market Segment Analysis

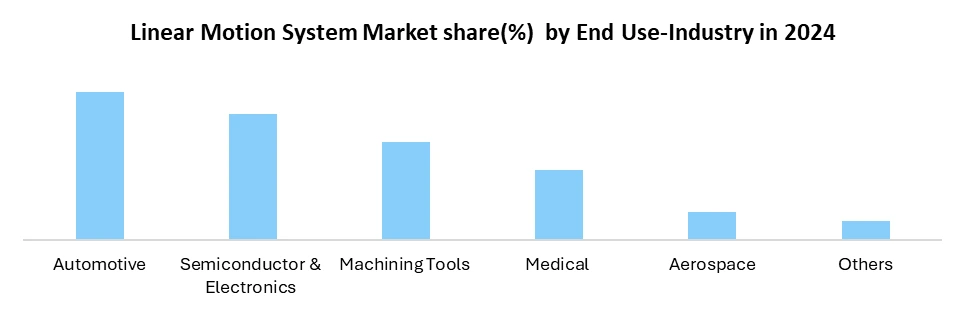

Based on End-Use Industry, the Linear Motion System Market is segmented into Medical, Semiconductor & Electronics, Aerospace, Machining Tools, Food and Beverages, and Automotive. The automotive segment dominated the market in 2024 and is expected to hold the largest Linear Motion System Market share over the forecast period. Linear moving parts, such as electronic linear actuators and lead screws, are increasingly used in automotive applications to achieve performance automation. Linear actuators are commonly employed in automotive applications when a part lifted, lowered, opened, or closed, assuring driver safety and convenience. US Autocure, an Arizona-based coating and automation company, created an automated system in April 2022 that delivers IR beams evenly across curved car surfaces while also moving heavy metal booms and shutters smoothly and silently. The vehicle fleet grows and sales increase, carbon emissions rise, causing the automobile industry to become a major contributor to the greenhouse effect. Various organizations have developed legislation for the development of fuel-efficient automobiles and green technology, which assist in driving growth for linear motion items such as roller screws and ball screws, and significantly boost the Linear Motion System Market growth.

Linear Motion System Market Regional Insights

Increasing industrial activities to boost the Asia Pacific Linear Motion System Market growth The Asia Pacific region is expected to see the fastest growth in linear motion systems over the forecast period. Increased industrial activity, technological advancements in the field of linear motion systems, increased government investment in industrial automation systems, and the presence of well-established players providing linear motion systems across the region have all contributed to the growth of linear motion systems in the region. The region has a large semiconductor industry, as well as automotive, pharmaceutical, food and beverage, and machine manufacturing. In addition, reduction is becoming increasingly common in many application areas, leading to an increase in the manufacturing of various linear motion systems in the region. Because of the large deployment in the country's major electronic and automobile manufacturing industries, China is leading the region in terms of motion system adoption, which significantly boosts the Asia Pacific Linear Motion System Market growth. Because the industry is growing at a rapid pace in other economies in the region, such as India, the market under consideration has a lot of room to improve. By 2025, Schaeffler Group estimates that 110 million automobiles will have been built. In terms of passenger vehicle production, Asia has become the largest market. In addition to Japan, India, and South Korea, Japan, India, and South Korea rounded out the list of the world's largest vehicle manufacturers. Most of these countries are home to the world's largest automakers. Linear Motion System Market Competitive Landscape The Linear Motion System Market has some of the key global players, including THK Co., Ltd. (Japan), Bosch Rexroth AG (Germany), SKF Group (Sweden), NSK Ltd. (Japan) and HIWIN Technologies Corp. (Taiwan). The players lead the linear motion system space by offering a diverse mix of linear motion solutions that consist of linear guides, based screws, actuators and drive systems designed for major industrial applications, including automotive, semiconductors, machine tools, and medical devices. The report discusses how players are also shifting towards focusing on product offerings and the development of customized motion solutions, as well as integrating smart technologies like IoT-enabled sensors for predictive maintenance, supporting transformation into Industry 4.0. The larger players, companies like Parker Hannifin, Thomson Industries, Rollon S.p.A. and Schneeberger are quickly gaining market share through specialized applications in robotics, aerospace and food automation. In terms of competitive strategy, geographic expansion is noted as an important way for many players to create. Most of this exponential growth is occurring in hard-to-reach or quickly moving markets like Asia-Pacific and the U.S. as rapid industrial automation increases the use of linear motion systems. The report also discusses how newly identified and regional players are focusing on competing by minimizing costs, improving delivery time, and providing better localized support to develop a market propelled by innovation and dynamic developments. Recent key developments in the linear motion system market • April 2024 - Europe - Igus (Germany): Introduced 247 new products at Hannover Messe 2024 including new “Zero Lubrication” technology via the igusGO app, and many new eco-friendly slewing ring bearings made from 50% wood and 50% high-performance plastic. • March 2024 - North America - Actuonix (Canada/USA): Announced their most powerful linear track servo to date - the T16 R series - which offers multiple stroke lengths and the capability of side-loads, and is also compact. Key trends in the Linear Motion System market: 1. Emphasis on Eco-Friendly and Smart Technologies Companies like Igus are paving the way with sustainable materials (e.g., slewing ring bearings utilizing 50% wood) and smart lubrication-free systems using apps like igusGO. This is indicative of a growing trend where companies are embracing green engineering practices and harnessing digital developments to improve efficiencies, decrease maintenance, and embrace environmental strategies. 2. Regional Manufacturing & Nearshoring Strategies Grupo Industrial Saltillo expanding its production in Mexico due to U.S.–China trade inconsistencies, showing a clear transition in nearshoring whereby companies are establishing production hubs in close regional proximity to abate their reliance on global supply chains and tariffs, etc. 3. Strategic Partnerships & Certification Advantage Partnerships such as Bosch Rexroth AG & Jungheinrich, and Schaeffler's strength in Brazil because of its certification, demonstrate a trend, which is: • Strategic partnerships for product development in fast-growing sectors like intralogistics. • Taking advantage of regulatory advantages to increase market penetration in developing areas.Linear Motion System Market Scope: Inquire before buying

Global Linear Motion System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.9 Bn. Forecast Period 2025 to 2032 CAGR: 4.8% Market Size in 2032: USD 5.67 Bn. Segments Covered: by Component Linear Guides & Tables Linear Drive System Actuators Motors Others by Type Single-Axis Linear Motion System Multi-Axis Linear Motion System by Technology Mechanical Linear Motion Electromechanical Linear Motion Pneumatic Linear Motion Hydraulic Linear Motion by Drive Type Ball Screw Driven Lead Screw Driven Rack and Pinion Driven Direct Drive Others by End Use Industry Automotive Semiconductor & Electronics Aerospace Medical Machining Tools Others Linear Motion System Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Leading Linear Motion System manufacturers include:

North America 1. Parker Hannifin Corporation – USA 2. Actuonix (Canada/USA) 3. Thomson Industries, Inc. – USA 4. Rockwell Automation, Inc. – USA 5. Tolomatic, Inc. – USA 6. HepcoMotion (U.S. Division) – USA Europe 1. Bosch Rexroth AG – Germany 2. Igus (Germany) 3. SKF Group – Sweden 4. Thyssenkrupp AG – Germany 5. Nadella Group – Italy 6. Ewellix – Switzerland Asia-Pacific 1. Hiwin Technologies Corp. – Taiwan 2. Bosch Rexroth AG & Jungheinrich- China 3. NSK Ltd. – Japan 4. THK Co., Ltd. – Japan 5. IKO International – Japan 6. PMI Group – Taiwan South America 1. IMC Group Motion Systems – Brazil 2. Schaeffler Brazil – Brazil 3. SKF Argentina – Argentina Middle East & Africa 1. Schaeffler Middle East – (UAE) 2. IKO International / Schaeffler joint ventures (Brazil) 3. SKF South Africa – South Africa 4. Bosch Rexroth South Africa – South Africa 5. Parker Middle East – UAE 6. THK South Africa – South AfricaFrequently Asked Questions:

1] What segments are covered in the Global Market report? Ans. The segments covered in the Linear Motion System Market report are based on components, Type, Technology, Drive Type, end-use industry, and Regions. 2] Which region is expected to hold the highest share of the Global Linear Motion System Market? Ans. The Asia Pacific region is expected to hold the largest share of the Linear Motion System Market. 3] What is the market size of the Global Linear Motion System Market by 2032? Ans. The Linear Motion System Market by 2032 is expected to reach USD 5.67 Bn. 4] What was the market size of the Global Linear Motion System Market in 2024? Ans. The market size of the Linear Motion System Market in 2024 was valued at USD 3.9 Bn. 5] What are the Key players in the Linear Motion System Market? Ans. Bosch Rexroth AG (Germany), Igus (Germany), Thomas Industries (US), Hiwin Technologies Corp, THK Co. Ltd (Japan), SKF Group, etc. These are the key players of the linear motion system market.

1. Linear Motion System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Linear Motion System Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Linear Motion System Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Linear Motion System Market: Dynamics 3.1. Linear Motion System Market Trends by Region 3.1.1. North America Linear Motion System Market Trends 3.1.2. Europe Linear Motion System Market Trends 3.1.3. Asia Pacific Linear Motion System Market Trends 3.1.4. Middle East and Africa Linear Motion System Market Trends 3.1.5. South America Linear Motion System Market Trends 3.2. Linear Motion System Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Linear Motion System Market Drivers 3.2.1.2. North America Linear Motion System Market Restraints 3.2.1.3. North America Linear Motion System Market Opportunities 3.2.1.4. North America Linear Motion System Market Challenges 3.2.2. Europe 3.2.2.1. Europe Linear Motion System Market Drivers 3.2.2.2. Europe Linear Motion System Market Restraints 3.2.2.3. Europe Linear Motion System Market Opportunities 3.2.2.4. Europe Linear Motion System Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Linear Motion System Market Drivers 3.2.3.2. Asia Pacific Linear Motion System Market Restraints 3.2.3.3. Asia Pacific Linear Motion System Market Opportunities 3.2.3.4. Asia Pacific Linear Motion System Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Linear Motion System Market Drivers 3.2.4.2. Middle East and Africa Linear Motion System Market Restraints 3.2.4.3. Middle East and Africa Linear Motion System Market Opportunities 3.2.4.4. Middle East and Africa Linear Motion System Market Challenges 3.2.5. South America 3.2.5.1. South America Linear Motion System Market Drivers 3.2.5.2. South America Linear Motion System Market Restraints 3.2.5.3. South America Linear Motion System Market Opportunities 3.2.5.4. South America Linear Motion System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Linear Motion System Industry 3.8. Analysis of Government Schemes and Initiatives For Linear Motion System Industry 3.9. Linear Motion System Market Trade Analysis 3.10. The Global Pandemic Impact on Linear Motion System Market 4. Linear Motion System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Linear Motion System Market Size and Forecast, by Component (2024-2032) 4.1.1. Linear Guides & Tables 4.1.2. Linear Drive System 4.1.3. Actuators 4.1.4. Motors 4.1.5. Others 4.2. Linear Motion System Market Size and Forecast, by Type (2024-2032) 4.2.1. Single-Axis Linear Motion System 4.2.2. Multi-Axis Linear Motion System 4.3. Linear Motion System Market Size and Forecast, by Technology (2024-2032) 4.3.1. Mechanical Linear Motion 4.3.2. Electromechanical Linear Motion 4.3.3. Pneumatic Linear Motion 4.3.4. Hydraulic Linear Motion 4.4. Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 4.4.1. Ball Screw Driven 4.4.2. Lead Screw Driven 4.4.3. Rack and Pinion Driven 4.4.4. Direct Drive 4.4.5. Others 4.5. Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 4.5.1. Automotive 4.5.2. Semiconductor & Electronics 4.5.3. Aerospace 4.5.4. Medical 4.5.5. Machining Tools 4.5.6. Others 4.6. Linear Motion System Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Linear Motion System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Linear Motion System Market Size and Forecast, by Component (2024-2032) 5.1.1. Linear Guides & Tables 5.1.2. Linear Drive System 5.1.3. Actuators 5.1.4. Motors 5.1.5. Others 5.2. North America Linear Motion System Market Size and Forecast, by Type (2024-2032) 5.2.1. Single-Axis Linear Motion System 5.2.2. Multi-Axis Linear Motion System 5.3. North America Linear Motion System Market Size and Forecast, by Technology (2024-2032) 5.3.1. Mechanical Linear Motion 5.3.2. Electromechanical Linear Motion 5.3.3. Pneumatic Linear Motion 5.3.4. Hydraulic Linear Motion 5.4. North America Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 5.4.1. Ball Screw Driven 5.4.2. Lead Screw Driven 5.4.3. Rack and Pinion Driven 5.4.4. Direct Drive 5.4.5. Others 5.5. North America Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 5.5.1. Automotive 5.5.2. Semiconductor & Electronics 5.5.3. Aerospace 5.5.4. Medical 5.5.5. Machining Tools 5.5.6. Others 5.6. North America Linear Motion System Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Linear Motion System Market Size and Forecast, by Component (2024-2032) 5.6.1.1.1. Linear Guides & Tables 5.6.1.1.2. Linear Drive System 5.6.1.1.3. Actuators 5.6.1.1.4. Motors 5.6.1.1.5. Others 5.6.1.2. United States Linear Motion System Market Size and Forecast, by Type (2024-2032) 5.6.1.2.1. Single-Axis Linear Motion System 5.6.1.2.2. Multi-Axis Linear Motion System 5.6.1.3. United States Linear Motion System Market Size and Forecast, by Technology (2024-2032) 5.6.1.3.1. Mechanical Linear Motion 5.6.1.3.2. Electromechanical Linear Motion 5.6.1.3.3. Pneumatic Linear Motion 5.6.1.3.4. Hydraulic Linear Motion 5.6.1.4. United States Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 5.6.1.4.1. Ball Screw Driven 5.6.1.4.2. Lead Screw Driven 5.6.1.4.3. Rack and Pinion Driven 5.6.1.4.4. Direct Drive 5.6.1.4.5. Others 5.6.1.5. United States Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 5.6.1.5.1. Automotive 5.6.1.5.2. Semiconductor & Electronics 5.6.1.5.3. Aerospace 5.6.1.5.4. Medical 5.6.1.5.5. Machining Tools 5.6.1.5.6. Others 5.6.2. Canada 5.6.2.1. Canada Linear Motion System Market Size and Forecast, by Component (2024-2032) 5.6.2.1.1. Linear Guides & Tables 5.6.2.1.2. Linear Drive System 5.6.2.1.3. Actuators 5.6.2.1.4. Motors 5.6.2.1.5. Others 5.6.2.2. Canada Linear Motion System Market Size and Forecast, by Type (2024-2032) 5.6.2.2.1. Single-Axis Linear Motion System 5.6.2.2.2. Multi-Axis Linear Motion System 5.6.2.3. Canada Linear Motion System Market Size and Forecast, by Technology (2024-2032) 5.6.2.3.1. Mechanical Linear Motion 5.6.2.3.2. Electromechanical Linear Motion 5.6.2.3.3. Pneumatic Linear Motion 5.6.2.3.4. Hydraulic Linear Motion 5.6.2.4. Canada Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 5.6.2.4.1. Ball Screw Driven 5.6.2.4.2. Lead Screw Driven 5.6.2.4.3. Rack and Pinion Driven 5.6.2.4.4. Direct Drive 5.6.2.4.5. Others 5.6.2.5. Canada Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 5.6.2.5.1. Automotive 5.6.2.5.2. Semiconductor & Electronics 5.6.2.5.3. Aerospace 5.6.2.5.4. Medical 5.6.2.5.5. Machining Tools 5.6.2.5.6. Others 5.6.3. Mexico 5.6.3.1. Mexico Linear Motion System Market Size and Forecast, by Component (2024-2032) 5.6.3.1.1. Linear Guides & Tables 5.6.3.1.2. Linear Drive System 5.6.3.1.3. Actuators 5.6.3.1.4. Motors 5.6.3.1.5. Others 5.6.3.2. Mexico Linear Motion System Market Size and Forecast, by Type (2024-2032) 5.6.3.2.1. Single-Axis Linear Motion System 5.6.3.2.2. Multi-Axis Linear Motion System 5.6.3.3. Mexico Linear Motion System Market Size and Forecast, by Technology (2024-2032) 5.6.3.3.1. Mechanical Linear Motion 5.6.3.3.2. Electromechanical Linear Motion 5.6.3.3.3. Pneumatic Linear Motion 5.6.3.3.4. Hydraulic Linear Motion 5.6.3.4. Mexico Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 5.6.3.4.1. Ball Screw Driven 5.6.3.4.2. Lead Screw Driven 5.6.3.4.3. Rack and Pinion Driven 5.6.3.4.4. Direct Drive 5.6.3.4.5. Others 5.6.3.5. Mexico Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 5.6.3.5.1. Automotive 5.6.3.5.2. Semiconductor & Electronics 5.6.3.5.3. Aerospace 5.6.3.5.4. Medical 5.6.3.5.5. Machining Tools 5.6.3.5.6. Others 6. Europe Linear Motion System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.2. Europe Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.3. Europe Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.4. Europe Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.5. Europe Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6. Europe Linear Motion System Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.1.2. United Kingdom Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.1.3. United Kingdom Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.1.4. United Kingdom Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.1.5. United Kingdom Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.2. France 6.6.2.1. France Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.2.2. France Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.2.3. France Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.2.4. France Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.2.5. France Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.3.2. Germany Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.3.3. Germany Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.3.4. Germany Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.3.5. Germany Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.4.2. Italy Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.4.3. Italy Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.4.4. Italy Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.4.5. Italy Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.5.2. Spain Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.5.3. Spain Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.5.4. Spain Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.5.5. Spain Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.6.2. Sweden Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.6.3. Sweden Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.6.4. Sweden Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.6.5. Sweden Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.7.2. Austria Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.7.3. Austria Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.7.4. Austria Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.7.5. Austria Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Linear Motion System Market Size and Forecast, by Component (2024-2032) 6.6.8.2. Rest of Europe Linear Motion System Market Size and Forecast, by Type (2024-2032) 6.6.8.3. Rest of Europe Linear Motion System Market Size and Forecast, by Technology (2024-2032) 6.6.8.4. Rest of Europe Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 6.6.8.5. Rest of Europe Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7. Asia Pacific Linear Motion System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.4. Asia Pacific Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.5. Asia Pacific Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6. Asia Pacific Linear Motion System Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.1.2. China Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.1.3. China Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.1.4. China Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.1.5. China Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.2.2. S Korea Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.2.3. S Korea Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.2.4. S Korea Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.2.5. S Korea Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.3.2. Japan Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.3.3. Japan Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.3.4. Japan Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.3.5. Japan Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.4. India 7.6.4.1. India Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.4.2. India Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.4.3. India Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.4.4. India Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.4.5. India Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.5.2. Australia Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.5.3. Australia Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.5.4. Australia Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.5.5. Australia Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.6.2. Indonesia Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.6.3. Indonesia Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.6.4. Indonesia Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.6.5. Indonesia Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.7.2. Malaysia Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.7.3. Malaysia Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.7.4. Malaysia Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.7.5. Malaysia Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.8.2. Vietnam Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.8.3. Vietnam Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.8.4. Vietnam Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.8.5. Vietnam Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.9.2. Taiwan Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.9.3. Taiwan Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.9.4. Taiwan Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.9.5. Taiwan Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Linear Motion System Market Size and Forecast, by Component (2024-2032) 7.6.10.2. Rest of Asia Pacific Linear Motion System Market Size and Forecast, by Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Linear Motion System Market Size and Forecast, by Technology (2024-2032) 7.6.10.4. Rest of Asia Pacific Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 7.6.10.5. Rest of Asia Pacific Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 8. Middle East and Africa Linear Motion System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Linear Motion System Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Linear Motion System Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Linear Motion System Market Size and Forecast, by Technology (2024-2032) 8.4. Middle East and Africa Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 8.5. Middle East and Africa Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 8.6. Middle East and Africa Linear Motion System Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Linear Motion System Market Size and Forecast, by Component (2024-2032) 8.6.1.2. South Africa Linear Motion System Market Size and Forecast, by Type (2024-2032) 8.6.1.3. South Africa Linear Motion System Market Size and Forecast, by Technology (2024-2032) 8.6.1.4. South Africa Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 8.6.1.5. South Africa Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Linear Motion System Market Size and Forecast, by Component (2024-2032) 8.6.2.2. GCC Linear Motion System Market Size and Forecast, by Type (2024-2032) 8.6.2.3. GCC Linear Motion System Market Size and Forecast, by Technology (2024-2032) 8.6.2.4. GCC Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 8.6.2.5. GCC Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Linear Motion System Market Size and Forecast, by Component (2024-2032) 8.6.3.2. Nigeria Linear Motion System Market Size and Forecast, by Type (2024-2032) 8.6.3.3. Nigeria Linear Motion System Market Size and Forecast, by Technology (2024-2032) 8.6.3.4. Nigeria Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 8.6.3.5. Nigeria Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Linear Motion System Market Size and Forecast, by Component (2024-2032) 8.6.4.2. Rest of ME&A Linear Motion System Market Size and Forecast, by Type (2024-2032) 8.6.4.3. Rest of ME&A Linear Motion System Market Size and Forecast, by Technology (2024-2032) 8.6.4.4. Rest of ME&A Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 8.6.4.5. Rest of ME&A Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 9. South America Linear Motion System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Linear Motion System Market Size and Forecast, by Component (2024-2032) 9.2. South America Linear Motion System Market Size and Forecast, by Type (2024-2032) 9.3. South America Linear Motion System Market Size and Forecast, by Technology(2024-2032) 9.4. South America Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 9.5. South America Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 9.6. South America Linear Motion System Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Linear Motion System Market Size and Forecast, by Component (2024-2032) 9.6.1.2. Brazil Linear Motion System Market Size and Forecast, by Type (2024-2032) 9.6.1.3. Brazil Linear Motion System Market Size and Forecast, by Technology (2024-2032) 9.6.1.4. Brazil Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 9.6.1.5. Brazil Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Linear Motion System Market Size and Forecast, by Component (2024-2032) 9.6.2.2. Argentina Linear Motion System Market Size and Forecast, by Type (2024-2032) 9.6.2.3. Argentina Linear Motion System Market Size and Forecast, by Technology (2024-2032) 9.6.2.4. Argentina Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 9.6.2.5. Argentina Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Linear Motion System Market Size and Forecast, by Component (2024-2032) 9.6.3.2. Rest Of South America Linear Motion System Market Size and Forecast, by Type (2024-2032) 9.6.3.3. Rest Of South America Linear Motion System Market Size and Forecast, by Technology (2024-2032) 9.6.3.4. Rest Of South America Linear Motion System Market Size and Forecast, by Drive Type (2024-2032) 9.6.3.5. Rest Of South America Linear Motion System Market Size and Forecast, by End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. Parker Hannifin Corporation – USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Actuonix (Canada/USA) 10.3. Thomson Industries, Inc. – USA 10.4. Rockwell Automation, Inc. – USA 10.5. Tolomatic, Inc. – USA 10.6. HepcoMotion (U.S. Division) – USA 10.7. Bosch Rexroth AG – Germany 10.8. Igus (Germany) 10.9. SKF Group – Sweden 10.10. Thyssenkrupp AG – Germany 10.11. Nadella Group – Italy 10.12. Ewellix – Switzerland 10.13. Hiwin Technologies Corp. – Taiwan 10.14. Bosch Rexroth AG & Jungheinrich- China 10.15. NSK Ltd. – Japan 10.16. THK Co., Ltd. – Japan 10.17. IKO International – Japan 10.18. PMI Group – Taiwan 10.19. IMC Group Motion Systems – Brazil 10.20. Schaeffler Brazil – Brazil 10.21. SKF Argentina – Argentina 10.22. Schaeffler Middle East – (UAE) 10.23. IKO International / Schaeffler joint ventures (Brazil) 10.24. SKF South Africa – South Africa 10.25. Bosch Rexroth South Africa – South Africa 10.26. Parker Middle East – UAE 10.27. THK South Africa – South Africa 11. Key Findings 12. Industry Recommendations 13. Linear Motion System Market: Research Methodology 14. Terms and Glossary