LED Driver and Chipset Market size was valued at US$ 24.97 Bn. in 2022 and the total revenue is expected to grow at 26.5 % through 2023 to 2029, reaching nearly US$ 129.48 Bn.LED Driver and Chipset Market Overview:

Light emitting diode (LED) is a semiconductor light source with two leads. Backlighting in electronic devices such as LCD TVs, laptops, and phones, as well as street lighting, automobile lighting, and general illumination, are all examples of applications. This is owing to LEDs' superior picture quality, which is a result of their higher power efficiency and brightness. LED technologies are currently being employed in a variety of display and lighting applications. Because LED drivers are critical components for improving the performance of LED lights, these factors are having a favourable impact on the global LED driver and chipset market.To know about the Research Methodology:- Request Free Sample Report

LED Driver and Chipset Market Dynamics:

The adoption of energy-saving LED technology is being aided by the ever-increasing demand for energy, which is resulting in an ever-increasing carbon footprint. As a result, LED drivers and chipsets are in high demand. In lighting and display systems, LED system has a lot of applications. LED drivers are essential for increasing the efficiency of LED lighting. These factors are combining to boost the LED driver and chipset markets. Furthermore, several governments provide subsidies for LED devices, incentivizing individuals to migrate from traditional to LED lighting. The LED driver and chipset markets will be affected significantly as a result of this. The Indian government has backed a proposal to roll out low-cost LEDs to various end customers across the country. LED adoption, according to research, saves over 3,350 million kWh per year and prevents over 6,725 MW of peak demand. In addition, according to a report provided by India's Minister of Urban and Housing Affairs, 148 projects under the country's Smart Cities Mission have been completed by January 2022. Aside from that, 407 projects have already begun, with another 237 in the tendering process. LEDs are increasingly used in high-end applications, and companies are investing heavily in product development. In January 2022, Osram released its latest line of projector power LED chips, which offer 000 ANSI lumens of brightness. LEDs are critical for developing new visual displays and sensors, as well as enhanced communication technologies, because of their fast switching rates. More and more applications require more choices of LED chips. However, the high initial capital involved in setting up a facility to produce LED drivers and chipsets may limit their adoption in the future, thereby challenging the growth of this market. Lack of consumer awareness of the advantages of LED lighting over traditional lighting solutions is also expected to challenge the growth of the LED driver and chipset market to some extent.LED Driver and Chipset Market Segment Analysis:

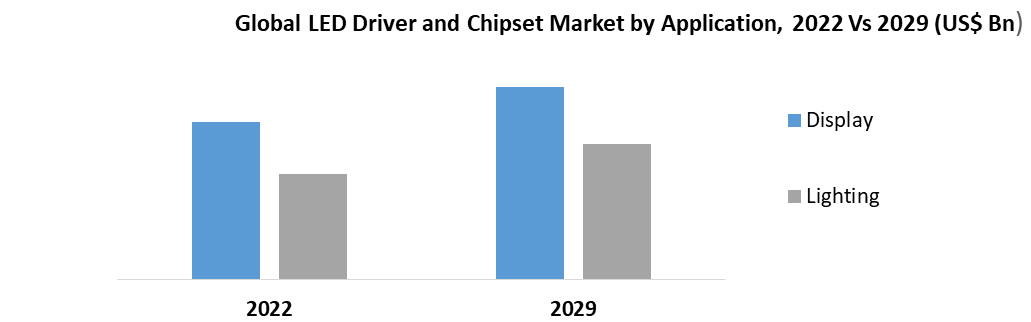

Based on the Application, the LED Driver and Chipset market is sub-segmented into Display and Lightning. The Display segment held the largest market share of xx% in 2022. LED drivers and chipsets are utilised in lighting systems and displays that are connected to a variety of electronic devices. LED drivers and chipsets are becoming more widely used in the LED displays industry as a result of the growing demand for devices with displays. Because of the exponential usage of mobile phones, television gadgets, sports arenas, medical devices, and billboards, among other things, displays are in high demand recent times. Due to the aforementioned variables LEDs are being used more frequently by display manufacturers because they reduce maintenance and repair expenses, letting customers to utilise their gadgets without any hassles or additional charges.

LED Driver and Chipset Market Regional Insights:

Asia Pacific held the largest market share of 55% in 2022 and expected to grow at a highest CAGR of xx% in the global LED Driver and Chipset market during the forecast period. The growth of the LED driver and chipset market in Asia Pacific is attributed to a dramatic drop in LED prices due to growing expenditures by companies in growing production facilities. Over the forecast period, a large presence of LED producers in growing economies such as China, who are constantly increasing the conductivity, consumption, and voltage aspects of LEDs, will boost the use of LED drivers and chipsets. The objective of the report is to present a comprehensive analysis of the global LED Driver and Chipset Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global LED Driver and Chipset Market dynamic, structure by analyzing the market segments and project the global LED Driver and Chipset Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global LED Driver and Chipset Market make the report investor’s guide.LED Driver and Chipset Market Scope: Inquire before buying

Global LED Driver and Chipset Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 24.97 Bn. Forecast Period 2023 to 2029 CAGR: 26.5% Market Size in 2029: US $ 129.48 Bn. Segments Covered: by Type • LED Driver • Chipset by Application • Display o Mobile Phones o Digital Cameras o Navigation and Gaming Devices o Medical Devices o Computers/Laptop Peripherals o Others ( Digital Photo Frame, MP3 Players) • Lighting o Outdoor Area and Traffic Signals o Automotive Lightings o Industrial Lightings o Commercial and Indoor Lightings o Others LED Driver and Chipset Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)LED Driver and Chipset Market, Key Players are:

• Advanced Analogic Technologies • Texas Instruments, INC. • Diodes, INC • Exar Corp • Nxp Semiconductors Nv • Stmicroelectronics N.V. • Fairchild Semiconductor • Freescale Semiconductor, INC • Infineon Technologies AG • Maxim Integrated Products • LED Emotion Gmbh • Schwarz Beschaffung Gmbh • F/ART • LEDCLUSIVE.DE • ELEKTRAFrequently Asked Questions:

1] What segments are covered in LED Driver and Chipset Market report? Ans. The segments covered in LED Driver and Chipset Market report are based on Type, and Application. 2] Which region is expected to hold the highest share in the global LED Driver and Chipset Market? Ans. Asia Pacific is expected to hold the highest share in the global LED Driver and Chipset Market. 3] What is the market size of LED Driver and Chipset Market by 2029? Ans. The market size of LED Driver and Chipset Market is expected to reach US $ 129.48 Bn. by 2029. 4] Who are the top key players in the LED Driver and Chipset Market? Ans. Advanced Analogic Technologies, Texas Instruments, INC., Diodes, INC, Exar Corp, Nxp Semiconductors Nv, Stmicroelectronics N.V. and Fairchild Semiconductor are the top key players in the global LED Driver and Chipset Market. 5] What was the market size of global LED Driver and Chipset Market in 2022? Ans. The market size of global LED Driver and Chipset Market in 2022 was valued at US $ 24.97 Bn.

1. Global LED Driver and Chipset Market: Research Methodology 2. Global LED Driver and Chipset Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global LED Driver and Chipset Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global LED Driver and Chipset Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global LED Driver and Chipset Market Segmentation 4.1 Global LED Driver and Chipset Market, by Type (2023-2029) • LED Driver • Chipset 4.2 Global LED Driver and Chipset Market, by Application (2023-2029) • Display o Mobile Phones o Digital Cameras o Navigation and Gaming Devices o Medical Devices o Computers/Laptop Peripherals o Others ( Digital Photo Frame, MP3 Players) • Lighting o Outdoor Area and Traffic Signals o Automotive Lightings o Industrial Lightings o Commercial and Indoor Lightings o Others 5. North America LED Driver and Chipset Market(2023-2029) 5.1 Global LED Driver and Chipset Market, by Type (2023-2029) • LED Driver • Chipset 5.2 Global LED Driver and Chipset Market, by Application (2023-2029) • Display o Mobile Phones o Digital Cameras o Navigation and Gaming Devices o Medical Devices o Computers/Laptop Peripherals o Others ( Digital Photo Frame, MP3 Players) • Lighting o Outdoor Area and Traffic Signals o Automotive Lightings o Industrial Lightings o Commercial and Indoor Lightings o Others 5.3 North America LED Driver and Chipset Market, by Country (2023-2029) • United States • Canada • Mexico 6. Asia Pacific LED Driver and Chipset Market (2023-2029) 6.1. Asia Pacific LED Driver and Chipset Market, by Type (2023-2029) 6.2. Asia Pacific LED Driver and Chipset Market, by Application (2023-2029) 6.3. Asia Pacific LED Driver and Chipset Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa LED Driver and Chipset Market (2023-2029) 7.1 Middle East and Africa LED Driver and Chipset Market, by Type (2023-2029) 7.2. Middle East and Africa LED Driver and Chipset Market, by Application (2023-2029) 7.3. Middle East and Africa LED Driver and Chipset Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America LED Driver and Chipset Market (2023-2029) 8.1. Latin America LED Driver and Chipset Market, by Type (2023-2029) 8.2. Latin America LED Driver and Chipset Market, by Application (2023-2029) 8.3 Latin America LED Driver and Chipset Market, by Country (2023-2029) • Brazil • Argentina • Rest Of Latin America 9. European LED Driver and Chipset Market (2023-2029) 9.1. European LED Driver and Chipset Market, by Type (2023-2029) 9.2. Latin America LED Driver and Chipset Market, by Application (2023-2029) 9.3. European LED Driver and Chipset Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Advanced Analogic Technologies 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Texas Instruments, INC. 10.3. Diodes, INC 10.4. Exar Corp 10.5. Nxp Semiconductors Nv 10.6. Stmicroelectronics N.V. 10.7. Fairchild Semiconductor 10.8. Freescale Semiconductor, INC 10.9. Infineon Technologies AG 10.10. Maxim Integrated Products 10.11. LED Emotion Gmbh 10.12. Schwarz Beschaffung Gmbh 10.13. F/ART 10.14. LEDCLUSIVE.DE 10.15. ELEKTRA