The Industry 4.0 Market size was valued at USD 141.95 Billion in 2025 and the total Industry 4.0 revenue is expected to grow at a CAGR of 20.07% from 2025 to 2032, reaching nearly USD 510.74 Billion by 2032.Industry 4.0 Market Overview

Industry 4.0 is revolutionizing manufacturing through the seamless integration of IoT, cloud computing, and AI, creating smart factories equipped with advanced sensors and robotics for data-driven decision-making and operational insights. By combining production data with ERP and supply chain systems, manufacturers achieve holistic visibility and agility, leading to enhanced automation, predictive maintenance, and process optimization. In the Industry 4.0 market, harnessing big data analytics enables real-time asset monitoring and predictive maintenance, reducing downtime, and AI-driven visual inspections enhance quality control efficiency. . Accessible across sectors such as discrete and process manufacturing, as well as industries such as oil, gas, and mining, Industry 4.0 redefines manufacturing excellence, reshaping efficiency, quality, and competitiveness on a global scale.To know about the Research Methodology :- Request Free Sample Report The increasing adoption of advanced technologies such as the Internet of Things (IoT), cloud computing, and artificial intelligence (AI) across manufacturing sectors is driving the expansion of Industry 4.0 initiatives. These technologies enable the creation of interconnected smart factories equipped with sensors and robotics, facilitating real-time data collection and analysis for enhanced decision-making and operational efficiency. The demand for improved productivity, quality, and cost-effectiveness is incentivizing companies to invest in Industry 4.0 solutions to optimize their manufacturing processes. The rise of digital transformation initiatives and the growing availability of data analytics tools are empowering manufacturers to leverage insights from production data to drive continuous improvement and innovation which boost Industry 4.0 Market growth. The increasing integration of Industry 4.0 technologies with existing enterprise systems such as enterprise resource planning (ERP) and supply chain management systems is streamlining operations and enhancing overall business performance. As awareness of the benefits of Industry 4.0 continues to grow and technological advancements accelerate, the adoption and growth of Industry 4.0 initiatives are poised for sustained growth across various industries globally. Industry 4.0 Market trend Increasing Convergence of Digital Technologies with Physical Systems, Leading to The Creation of Cyber-Physical Systems (CPS) CPS seamlessly integrates sensing, computation, control, and networking into physical objects and infrastructure, bridging the gap between the physical and digital realms. These systems allow for the interconnectedness of devices, infrastructure, and the internet, facilitating real-time data exchange and enabling intelligent decision-making processes. CPS plays a crucial role in Industry 4.0 by embedding intelligence and cognitive computing capabilities into the design and simulation processes of physical systems. This integration empowers engineers to create digital twins of physical instruments and processes, facilitating simulation, control and optimization from centralized interfaces which boosts Industry 4.0 Market growth. Industries ranging from healthcare to manufacturing leverage CPS to enhance operational efficiency, precision, and adaptability in dynamic environments. The applications of CPS are diverse and expansive, spanning industries such as healthcare, manufacturing, automotive, civil engineering, and energy. In healthcare, CPS enables real-time tracking of patient conditions remotely, enhancing monitoring capabilities and facilitating timely interventions. In manufacturing, CPS optimizes processes by simulating changes and controlling operations through digital twins, leading to increased efficiency and precision. CPS finds applications in smart cities and grids, where they streamline infrastructure management and resource allocation through data-driven insights. By leveraging CPS, organizations gain enhanced visibility, control, and predictive capabilities, driving innovation and efficiency across a wide range of industries and driving Industry 4.0 Market growth. As CPS continues to evolve and integrate with existing systems, they promise to revolutionize industrial processes, enabling smarter, more connected and adaptive systems that drive the future of Industry 4.0.

Industry 4.0 Market Dynamics

Demand for increased operational efficiency and productivity to Boost Market Growth In today's fiercely competitive business landscape, companies are compelled to optimize their operations to remain agile, profitable, and sustainable amidst evolving market dynamics and rising customer expectations. This drive for operational excellence is fueled by the imperative to navigate through disruptive challenges such as globalization and digitalization. Industry 4.0 technologies emerge as transformative enablers, offering innovative solutions to streamline processes, minimize resource wastage, and drive efficiencies to unprecedented levels. These technologies, including automation, data analytics, and artificial intelligence, empower businesses to automate routine tasks, improve decision-making processes and adapt quickly to changing market conditions, enabling them to gain a competitive edge and thrive in the fast-paced and ever-evolving business environment. The increasing demand for operational efficiency is prompted by the need for companies to optimize resource utilization, reduce costs, and enhance sustainability efforts. In today's cost-conscious environment, companies are constantly seeking ways to maximize value while minimizing waste, driving them to adopt Industry 4.0 technologies, which significantly boosts the Industry 4.0 Market growth. By leveraging these technologies, companies optimize production processes, reduce downtime, and minimize waste, leading to significant cost savings and improved profitability. Industry 4.0 technologies facilitate agile responses to rapidly changing market trends and customer preferences, while also supporting sustainability initiatives by enabling more eco-friendly and resource-efficient practices. The increased operational efficiency and productivity emerge as a key driver driving the Industry 4.0 Market growth, as companies strive to remain competitive, profitable, and sustainable in today's dynamic business landscape.Industry 4.0 Market Restraint

High Initial Investment Required for Implementing Industry 4.0 Technologies The high initial investment required for implementing Industry 4.0 technologies stands as a significant restraint on the Industry 4.0 market. The adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and cloud computing necessitates substantial upfront capital expenditure for infrastructure, equipment, software, and skilled personnel. This financial barrier is particularly challenging for small and medium-sized enterprises (SMEs) and organizations operating in cost-sensitive industries, as it deters them from embracing Industry 4.0 solutions. The concerns about the return on investment (ROI) and uncertainty regarding the long-term benefits of these technologies further exacerbate the reluctance among businesses to commit to Industry 4.0 initiatives. The significant upfront costs associated with implementation lead to delays or hesitations in adopting Industry 4.0 practices, hindering the Industry 4.0 Market growth potential and limiting the transformative impact of these technologies on various industries and sectors.Industry 4.0 Market Segment Analysis

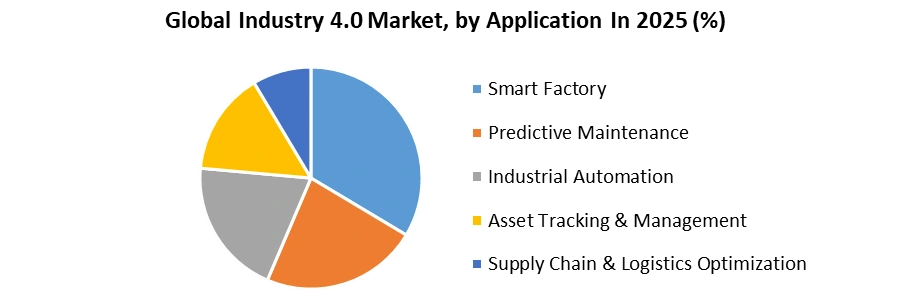

Based on the Technology Type, the market is segmented into the Internet of Things (IoT), Artificial Intelligence (AI), Big Data and Analytics, Cybersecurity, Additive Manufacturing and Others. Internet of Things (IoT) dominated the Industry 4.0 Market in 2025 and is expected to continue its dominance over the forecast period. The Internet of Things (IoT) has emerged as a transformative force within Industry 4.0, revolutionizing the way manufacturing and industrial processes are managed and optimized. IoT for Industry 4.0 entails the interconnection of physical devices, sensors, and machinery through internet-enabled networks, enabling seamless data exchange and communication. By embedding sensors into machines and equipment, manufacturers gain real-time visibility into their operations, allowing for predictive maintenance, remote monitoring, and enhanced decision-making capabilities. Based on Industrial Vertical the Industry 4.0 Market segmented into Manufacturing, Healthcare, Energy and Utilities, Transportation and Logistics, Agriculture and Others. Manufacturing Segment Dominated the market in 2025 and is Expected to hold largest Share during the forecast period. Dominance due to its rapid adoption of smart factory solutions, automation, and real-time data analytics. Manufacturers leveraged Industry 4.0 technologies like IoT, robotics, AI, and digital twins to enhance productivity, reduce downtime, and optimize supply chains. The push for mass customization, predictive maintenance, and operational efficiency further accelerated digital transformation in this sector.

Industry 4.0 Market Regional Insights

North America held the largest Industry 4.0 Market share in 2025 and is expected to continue its dominance over the forecast period. North America has emerged as a powerhouse in the Industry 4.0 landscape, largely due to its proactive embrace of cutting-edge technologies like the Internet of Things (IoT), artificial intelligence (AI), and automation. North America's dominance is its robust research and development infrastructure, which includes top-tier universities and technology companies. This environment fosters innovation tailored to various industries, from manufacturing to healthcare, boosting the region's technological advancement. North America provides a favorable business environment with supportive regulations and ample access to capital, encouraging companies to invest in transformative technologies and explore new business models. Public-private partnerships facilitate knowledge exchange and research initiatives, accelerating innovation. Initiatives including smart cities and industry consortia promote cross-sector collaboration, feeling the adoption of Industry 4.0. The region boasts a highly skilled workforce equipped to develop and deploy complex solutions. With a focus on STEM education and vocational training, the region ensures a steady supply of talent capable of driving digital transformation. As of 2022, Industry 4.0 technologies are anticipated to have a profound impact on organizations worldwide, with the Internet of Things (IoT) standing out as the primary driver of transformation. IoT seamlessly links physical devices, machinery, and systems, allowing real-time data collection for enhanced operational efficiency, productivity, and agility In the Industry 4.0 market. By leveraging IoT solutions, businesses optimize manufacturing processes, enable predictive maintenance, and facilitate seamless communication between various components of their operations. IoT empowers organizations to unlock new revenue streams, deliver personalized customer experiences, and adapt quickly to market dynamics. This leads IoT to emerge as the cornerstone technology within the Industry 4.0 landscape, boosting innovation and driving significant advancements across diverse industry sectors globally.The United States has emerged as a leader in the adoption of Industry 4.0 technologies, particularly evident in the manufacturing sector. With a strong emphasis on integrating cutting-edge technologies such as IoT, big data, DevOps, and mobility into their processes, US manufacturers are experiencing significant growth and innovation which drive regional Industry 4.0 Market growth. This trend is powered by heavy investments in research and development, coupled with the flexibility of SMEs and the substantial digitization efforts of large corporations including IBM and General Electric. The US boasts a strong ecosystem for Industry 4.0, with notable advancements in areas such as 3D printing, big data analytics, and robotics, positioning the country as a global leader in the Industry 4.0 landscape.

Industry 4.0 Market Scope: Inquire before buying

Global Industry 4.0 Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 141.95 Bn. Forecast Period 2026 to 2032 CAGR: 20.07% Market Size in 2032: USD 510.74 Bn. Segments Covered: by Technology Industrial Internet of Things (IIoT) Artificial Intelligence (AI) & Machine Learning Big Data & Analytics Augmented Reality (AR) & Virtual Reality (VR) Cybersecurity Cloud Computing Digital Twin by Industry Vertical Manufacturing Healthcare Energy and Utilities Transportation and Logistics Agriculture Others by Component Hardware Software Services by Application Smart Factory Predictive Maintenance Industrial Automation Asset Tracking & Management Supply Chain & Logistics Optimization Industry 4.0 Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Industry 4.0 Key Players

Global 1. Siemens AG (Munich, Germany) 2. General Electric (GE) (Boston, Massachusetts, USA) 3. Bosch (Stuttgart, Germany) 4. ABB Ltd (Zurich, Switzerland) 5. Schneider Electric (Rueil-Malmaison, France) North America 1. Honeywell International Inc. (Charlotte, North Carolina, USA) 2. Rockwell Automation (Milwaukee, Wisconsin, USA) 3. IBM Corporation (Armonk, New York, USA) 4. Emerson Electric Co (Ferguson, Missouri, USA) 5. Cisco Systems, Inc. (San Jose, California, USA) 6. HP Inc. (Palo Alto, California, USA) 7. 3M (Maplewood, Minnesota, USA) 8. Oracle Corporation (Redwood City, California, USA) 9. Intel Corporation (Santa Clara, California, USA) Europe 1. SAP SE (Walldorf, Germany) Asia Pacific 1. Mitsubishi Electric Corporation (Tokyo, Japan) 2. Fanuc Corporation ( Oshino, Japan) 3. Hitachi, Ltd. (Tokyo, Japan) 4. Toshiba Corporation (Tokyo, Japan) 5. Fujitsu Limited (Tokyo, Japan) 6. Panasonic Corporation (Osaka, Japan)Frequently Asked Questions:

1] What is the growth rate of the Global Industry 4.0 Market? Ans. The Global Industry 4.0 Market is growing at a significant rate of 20.07% during the forecast period. 2] Which region is expected to dominate the Global Industry 4.0 Market? Ans. North America is expected to dominated the Industry 4.0 Market during the forecast period. 3] What is the expected Global Industry 4.0 Market size by 2032? Ans. The Industry 4.0 Market size is expected to reach USD 510.74 Billion by 2032. 4] Which are the top players in the Global Industry 4.0 Market? Ans. The major top players in the Global Industry 4.0 Market are Siemens AG (Munich, Germany), General Electric (GE) (Boston, Massachusetts, USA), Bosch (Stuttgart, Germany), ABB Ltd (Zurich, Switzerland), Schneider Electric (Rueil-Malmaison, France) and Others. 5] What are the factors driving the Global Industry 4.0 Market growth? Ans. Technological Advancements and increasing demand for operational efficiency are expected to drive market growth during the forecast period.

1. Industry 4.0 Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industry 4.0 Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2025) 2.3.5. Company Locations 2.4. Leading Industry 4.0 Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Industry 4.0 Market: Dynamics 3.1. Industry 4.0 Market Trends by Region 3.1.1. North America Industry 4.0 Market Trends 3.1.2. Europe Industry 4.0 Market Trends 3.1.3. Asia Pacific Industry 4.0 Market Trends 3.1.4. Middle East and Africa Industry 4.0 Market Trends 3.1.5. South America Industry 4.0 Market Trends 3.2. Industry 4.0 Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Industry 4.0 Market Drivers 3.2.1.2. North America Industry 4.0 Market Restraints 3.2.1.3. North America Industry 4.0 Market Opportunities 3.2.1.4. North America Industry 4.0 Market Challenges 3.2.2. Europe 3.2.2.1. Europe Industry 4.0 Market Drivers 3.2.2.2. Europe Industry 4.0 Market Restraints 3.2.2.3. Europe Industry 4.0 Market Opportunities 3.2.2.4. Europe Industry 4.0 Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Industry 4.0 Market Drivers 3.2.3.2. Asia Pacific Industry 4.0 Market Restraints 3.2.3.3. Asia Pacific Industry 4.0 Market Opportunities 3.2.3.4. Asia Pacific Industry 4.0 Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Industry 4.0 Market Drivers 3.2.4.2. Middle East and Africa Industry 4.0 Market Restraints 3.2.4.3. Middle East and Africa Industry 4.0 Market Opportunities 3.2.4.4. Middle East and Africa Industry 4.0 Market Challenges 3.2.5. South America 3.2.5.1. South America Industry 4.0 Market Drivers 3.2.5.2. South America Industry 4.0 Market Restraints 3.2.5.3. South America Industry 4.0 Market Opportunities 3.2.5.4. South America Industry 4.0 Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Industry 4.0 Industry 3.8. Analysis of Government Schemes and Initiatives For Industry 4.0 Industry 3.9. Industry 4.0 Market Trade Analysis 3.10. The Global Pandemic Impact on Industry 4.0 Market 4. Industry 4.0 Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 4.1. Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 4.1.1. Industrial Internet of Things (IIoT) 4.1.2. Artificial Intelligence (AI) & Machine Learning 4.1.3. Big Data & Analytics 4.1.4. Augmented Reality (AR) & Virtual Reality (VR) 4.1.5. Cybersecurity 4.1.6. Cloud Computing 4.1.7. Digital Twin 4.2. Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 4.2.1. Manufacturing 4.2.2. Healthcare 4.2.3. Energy and Utilities 4.2.4. Transportation and Logistics 4.2.5. Agriculture 4.2.6. Others 4.3. Industry 4.0 Market Size and Forecast, by Component (2025-2032) 4.3.1. Hardware 4.3.2. Software 4.3.3. Services 4.4. Industry 4.0 Market Size and Forecast, by Application (2025-2032) 4.4.1. Smart Factory 4.4.2. Predictive Maintenance 4.4.3. Industrial Automation 4.4.4. Asset Tracking & Management 4.4.5. Supply Chain & Logistics Optimization 4.5. Industry 4.0 Market Size and Forecast, by Region (2025-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Industry 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. North America Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 5.1.1. Industrial Internet of Things (IIoT) 5.1.2. Artificial Intelligence (AI) & Machine Learning 5.1.3. Big Data & Analytics 5.1.4. Augmented Reality (AR) & Virtual Reality (VR) 5.1.5. Cybersecurity 5.1.6. Cloud Computing 5.1.7. Digital Twin 5.2. North America Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 5.2.1. Manufacturing 5.2.2. Healthcare 5.2.3. Energy and Utilities 5.2.4. Transportation and Logistics 5.2.5. Agriculture 5.2.6. Others 5.3. North America Industry 4.0 Market Size and Forecast, by Component (2025-2032) 5.3.1. Hardware 5.3.2. Software 5.3.3. Services 5.4. North America Industry 4.0 Market Size and Forecast, by Application (2025-2032) 5.4.1. Smart Factory 5.4.2. Predictive Maintenance 5.4.3. Industrial Automation 5.4.4. Asset Tracking & Management 5.4.5. Supply Chain & Logistics Optimization 5.5. North America Industry 4.0 Market Size and Forecast, by Country (2025-2032) 5.5.1. United States 5.5.1.1. United States Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 5.5.1.1.1. Industrial Internet of Things (IIoT) 5.5.1.1.2. Artificial Intelligence (AI) & Machine Learning 5.5.1.1.3. Big Data & Analytics 5.5.1.1.4. Augmented Reality (AR) & Virtual Reality (VR) 5.5.1.1.5. Cybersecurity 5.5.1.1.6. Cloud Computing 5.5.1.1.7. Digital Twin 5.5.1.2. United States Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 5.5.1.2.1. Manufacturing 5.5.1.2.2. Healthcare 5.5.1.2.3. Energy and Utilities 5.5.1.2.4. Transportation and Logistics 5.5.1.2.5. Agriculture 5.5.1.2.6. Others 5.5.1.3. United States Industry 4.0 Market Size and Forecast, by Component (2025-2032) 5.5.1.3.1. Hardware 5.5.1.3.2. Software 5.5.1.3.3. Services 5.5.1.4. United States Industry 4.0 Market Size and Forecast, by Application (2025-2032) 5.5.1.4.1. Smart Factory 5.5.1.4.2. Predictive Maintenance 5.5.1.4.3. Industrial Automation 5.5.1.4.4. Asset Tracking & Management 5.5.1.4.5. Supply Chain & Logistics Optimization 5.5.2. Canada 5.5.2.1. Canada Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 5.5.2.1.1. Industrial Internet of Things (IIoT) 5.5.2.1.2. Artificial Intelligence (AI) & Machine Learning 5.5.2.1.3. Big Data & Analytics 5.5.2.1.4. Augmented Reality (AR) & Virtual Reality (VR) 5.5.2.1.5. Cybersecurity 5.5.2.1.6. Cloud Computing 5.5.2.1.7. Digital Twin 5.5.2.2. Canada Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 5.5.2.2.1. Manufacturing 5.5.2.2.2. Healthcare 5.5.2.2.3. Energy and Utilities 5.5.2.2.4. Transportation and Logistics 5.5.2.2.5. Agriculture 5.5.2.2.6. Others 5.5.2.3. Canada Industry 4.0 Market Size and Forecast, by Component (2025-2032) 5.5.2.3.1. Hardware 5.5.2.3.2. Software 5.5.2.3.3. Services 5.5.2.4. Canada Industry 4.0 Market Size and Forecast, by Application (2025-2032) 5.5.2.4.1. Smart Factory 5.5.2.4.2. Predictive Maintenance 5.5.2.4.3. Industrial Automation 5.5.2.4.4. Asset Tracking & Management 5.5.2.4.5. Supply Chain & Logistics Optimization 5.5.3. Mexico 5.5.3.1. Mexico Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 5.5.3.1.1. Industrial Internet of Things (IIoT) 5.5.3.1.2. Artificial Intelligence (AI) & Machine Learning 5.5.3.1.3. Big Data & Analytics 5.5.3.1.4. Augmented Reality (AR) & Virtual Reality (VR) 5.5.3.1.5. Cybersecurity 5.5.3.1.6. Cloud Computing 5.5.3.1.7. Digital Twin 5.5.3.2. Mexico Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 5.5.3.2.1. Manufacturing 5.5.3.2.2. Healthcare 5.5.3.2.3. Energy and Utilities 5.5.3.2.4. Transportation and Logistics 5.5.3.2.5. Agriculture 5.5.3.2.6. Others 5.5.3.3. Mexico Industry 4.0 Market Size and Forecast, by Component (2025-2032) 5.5.3.3.1. Hardware 5.5.3.3.2. Software 5.5.3.3.3. Services 5.5.3.4. Mexico Industry 4.0 Market Size and Forecast, by Application (2025-2032) 5.5.3.4.1. Smart Factory 5.5.3.4.2. Predictive Maintenance 5.5.3.4.3. Industrial Automation 5.5.3.4.4. Asset Tracking & Management 5.5.3.4.5. Supply Chain & Logistics Optimization 6. Europe Industry 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Europe Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.2. Europe Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.3. Europe Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.4. Europe Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5. Europe Industry 4.0 Market Size and Forecast, by Country (2025-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.1.2. United Kingdom Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.1.3. United Kingdom Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.1.4. United Kingdom Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.2. France 6.5.2.1. France Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.2.2. France Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.2.3. France Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.2.4. France Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.3. Germany 6.5.3.1. Germany Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.3.2. Germany Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.3.3. Germany Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.3.4. Germany Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.4. Italy 6.5.4.1. Italy Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.4.2. Italy Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.4.3. Italy Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.4.4. Italy Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.5. Spain 6.5.5.1. Spain Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.5.2. Spain Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.5.3. Spain Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.5.4. Spain Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.6. Sweden 6.5.6.1. Sweden Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.6.2. Sweden Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.6.3. Sweden Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.6.4. Sweden Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.7. Austria 6.5.7.1. Austria Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.7.2. Austria Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.7.3. Austria Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.7.4. Austria Industry 4.0 Market Size and Forecast, by Application (2025-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 6.5.8.2. Rest of Europe Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 6.5.8.3. Rest of Europe Industry 4.0 Market Size and Forecast, by Component (2025-2032) 6.5.8.4. Rest of Europe Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7. Asia Pacific Industry 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Asia Pacific Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.2. Asia Pacific Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.3. Asia Pacific Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.4. Asia Pacific Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5. Asia Pacific Industry 4.0 Market Size and Forecast, by Country (2025-2032) 7.5.1. China 7.5.1.1. China Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.1.2. China Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.1.3. China Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.1.4. China Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.2. S Korea 7.5.2.1. S Korea Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.2.2. S Korea Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.2.3. S Korea Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.2.4. S Korea Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.3. Japan 7.5.3.1. Japan Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.3.2. Japan Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.3.3. Japan Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.3.4. Japan Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.4. India 7.5.4.1. India Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.4.2. India Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.4.3. India Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.4.4. India Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.5. Australia 7.5.5.1. Australia Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.5.2. Australia Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.5.3. Australia Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.5.4. Australia Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.6.2. Indonesia Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.6.3. Indonesia Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.6.4. Indonesia Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.7.2. Malaysia Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.7.3. Malaysia Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.7.4. Malaysia Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.8.2. Vietnam Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.8.3. Vietnam Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.8.4. Vietnam Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.9.2. Taiwan Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.9.3. Taiwan Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.9.4. Taiwan Industry 4.0 Market Size and Forecast, by Application (2025-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 7.5.10.2. Rest of Asia Pacific Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 7.5.10.3. Rest of Asia Pacific Industry 4.0 Market Size and Forecast, by Component (2025-2032) 7.5.10.4. Rest of Asia Pacific Industry 4.0 Market Size and Forecast, by Application (2025-2032) 8. Middle East and Africa Industry 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. Middle East and Africa Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 8.2. Middle East and Africa Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 8.3. Middle East and Africa Industry 4.0 Market Size and Forecast, by Component (2025-2032) 8.4. Middle East and Africa Industry 4.0 Market Size and Forecast, by Application (2025-2032) 8.5. Middle East and Africa Industry 4.0 Market Size and Forecast, by Country (2025-2032) 8.5.1. South Africa 8.5.1.1. South Africa Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 8.5.1.2. South Africa Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 8.5.1.3. South Africa Industry 4.0 Market Size and Forecast, by Component (2025-2032) 8.5.1.4. South Africa Industry 4.0 Market Size and Forecast, by Application (2025-2032) 8.5.2. GCC 8.5.2.1. GCC Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 8.5.2.2. GCC Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 8.5.2.3. GCC Industry 4.0 Market Size and Forecast, by Component (2025-2032) 8.5.2.4. GCC Industry 4.0 Market Size and Forecast, by Application (2025-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 8.5.3.2. Nigeria Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 8.5.3.3. Nigeria Industry 4.0 Market Size and Forecast, by Component (2025-2032) 8.5.3.4. Nigeria Industry 4.0 Market Size and Forecast, by Application (2025-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 8.5.4.2. Rest of ME&A Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 8.5.4.3. Rest of ME&A Industry 4.0 Market Size and Forecast, by Component (2025-2032) 8.5.4.4. Rest of ME&A Industry 4.0 Market Size and Forecast, by Application (2025-2032) 9. South America Industry 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 9.1. South America Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 9.2. South America Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 9.3. South America Industry 4.0 Market Size and Forecast, by Component(2025-2032) 9.4. South America Industry 4.0 Market Size and Forecast, by Application (2025-2032) 9.5. South America Industry 4.0 Market Size and Forecast, by Country (2025-2032) 9.5.1. Brazil 9.5.1.1. Brazil Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 9.5.1.2. Brazil Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 9.5.1.3. Brazil Industry 4.0 Market Size and Forecast, by Component (2025-2032) 9.5.1.4. Brazil Industry 4.0 Market Size and Forecast, by Application (2025-2032) 9.5.2. Argentina 9.5.2.1. Argentina Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 9.5.2.2. Argentina Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 9.5.2.3. Argentina Industry 4.0 Market Size and Forecast, by Component (2025-2032) 9.5.2.4. Argentina Industry 4.0 Market Size and Forecast, by Application (2025-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Industry 4.0 Market Size and Forecast, by Technology (2025-2032) 9.5.3.2. Rest Of South America Industry 4.0 Market Size and Forecast, by Industry Vertical (2025-2032) 9.5.3.3. Rest Of South America Industry 4.0 Market Size and Forecast, by Component (2025-2032) 9.5.3.4. Rest Of South America Industry 4.0 Market Size and Forecast, by Application (2025-2032) 10. Company Profile: Key Players 10.1. Siemens AG (Munich, Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. General Electric (GE) (Boston, Massachusetts, USA) 10.3. Bosch (Stuttgart, Germany) 10.4. ABB Ltd (Zurich, Switzerland) 10.5. Schneider Electric (Rueil-Malmaison, France) 10.6. Honeywell International Inc. (Charlotte, North Carolina, USA) 10.7. Rockwell Automation (Milwaukee, Wisconsin, USA) 10.8. IBM Corporation (Armonk, New York, USA) 10.9. Emerson Electric Co (Ferguson, Missouri, USA) 10.10. Cisco Systems, Inc. (San Jose, California, USA) 10.11. HP Inc. (Palo Alto, California, USA) 10.12. 3M (Maplewood, Minnesota, USA) 10.13. Oracle Corporation (Redwood City, California, USA) 10.14. Intel Corporation (Santa Clara, California, USA) 10.15. SAP SE (Walldorf, Germany) 10.16. Mitsubishi Electric Corporation (Tokyo, Japan) 10.17. Fanuc Corporation ( Oshino, Japan) 10.18. Hitachi, Ltd. (Tokyo, Japan) 10.19. Toshiba Corporation (Tokyo, Japan) 10.20. Fujitsu Limited (Tokyo, Japan) 10.21. Panasonic Corporation (Osaka, Japan) 11. Key Findings 12. Industry Recommendations 13. Industry 4.0 Market: Research Methodology 14. Terms and Glossary