Global Industrial Packaging Market size was valued at USD 68.92 Bn. in 2024 and the total Industrial Packaging Market is expected to grow by 4.5% from 2025 to 2032, reaching nearly USD 98.01 Bn.Industrial Packaging Market Overview:

Industrial packaging includes high-strength materials and containers designed for security, storage and transportation of bulk goods, equipment and raw materials in industrial supply chains. The industrial packaging market has been growing due to increasing global trade, e-commerce, demand for stability, industrial production and smart packaging. Asia Pacific dominated the Industrial Packaging Market in 2024, with strong logistics infrastructure and high industrial demands, while North America is witnessing rapid growth because of rising export and manufacturing expansion. The top key players in the industrial packaging market include Greif, Inc., Berry Global Group, Inc., and Mondi Group. Greif, Inc. (U.S.). The government rules are re-shaping the landscape on the lack of waste, goals of the circular economy and investment in smart packaging technologies. Emerging collaborations, AI integration in packaging lines and green material innovation are further intensifying the market change. The major end users of industrial packaging include industries such as food and drinks, chemicals, pharmaceuticals, automotive, construction and electronics, which require safe and efficient transportation and storage of bulk materials and equipment. Report covers the Industrial Packaging Market dynamics and structure by analyzing market segments and projecting Industrial Packaging Market size. Clear representation of competitive analysis of key players by product type, material, financials, strategic developments, and regional presence in the Industrial Packaging Market.To Know About The Research Methodology :- Request Free Sample Report

Packaging Market scope

The industrial packaging market is segmented by products (intermediate bulk container (IBC), Snacks, Drums, Pails), by end users’ industry (Automotive, Food & Beverage, Chemicals and Pharmaceuticals, and Building and Constructions & Geography). The report covers forecast revenue growth at the global, regional, and country level and provide analyses of industry trends and restrains in each segment Besides this, the report analyses factors affecting the market from both the demand and supply side and further evaluates market dynamics affecting the market during the forecast period i.e., restraints, opportunities, drivers, and future trend. The report also provides an exhaustive PORTER, & PEST analysis for all five regions. Industrial packaging market report collects data from primary and secondary research secondary data has been collected from the internal database, paid sources, annual reports of businesses, news releases from the government, and price databases & many more sources. Primary interviews have been conducted with key players, industry experts, and consultants across the regions. After acquiring knowledge about the industrial packaging market with the help of secondary research. Several primary interviews have been conducted with market experts from both, demand- and supply-sides across major countries in North America, Asia Pacific, Europe, Middle East and Africa and South America. The primary data has been collected through surveys, emails, and telephonic interviews. Bottom-up approach was used to estimate and validate the global market. These methods were applied extensively to estimate the sub-segments and market size. Key stages for the market estimation included key players Greif Inc. (US), Amcor (Australia), Berry Global Inc. (US).Global Industrial Packaging Market Dynamics:

Easy to Open Packaging The design of Easy to open packages is flexible for packaging this feature surprising customers with convenience, simple functionality, and eco-friendly. It is a safe open, enjoyable, and sustainable solution for packaging. Because of these advantages easy to open packaging drives market growth. These easy open packages are customized for thousands of unique package shapes and sizes for both liquid and solid products. Package type includes multi-use bottles, pouches, sachets, trays, and stick packs.Wipes Packaging to Drive Industrial Packaging Market Growth

Packaging is the most important factor in wipes to keep wipes fresh, clean, hygienic, and healthy. Wet wipes packages, baby wipes, hand cleansing wipes, and facial wipes are all types of wipes packages. This wipes packaging material offers high-performing water and oxygen barrier properties with transparency, improves the shelf life of the package, and at the same time protects against gases, water vapour, and aromas.Self-heating packaging to drive Industrial Packaging Market Growth

Self-heating packages are the major key driver of packaging market growth. They are heat up food without requiring external heat sources like fire or hot water. These pouches are single-use only and it contains food-grade iron, magnesium powder, and salt. Nestle UK started the self-heating cans for the prepared coffee project in 2001the company was looking to target the on-the-go customers with these cans. Another project was initiated by On Tech, which launched Hillside Beverages in 2004 in self-heating cans. There are some advantages of self-heating packages self-heating packages are designed for people who are always on the run. They are safe and ready to use, also it is disposal with household trash and they can be recycled. The key factor of self-heating packages is light in weight and portable and easy to fit in backpacks.The Growing Environmental Concerns All over the World are Hampering the Industrial Packaging Market Growth

Plastic packaging is harmful and it’s a high impact on the economy this is happed due to poor product design and lack of infrastructure the majority of plastic waste is sent to dispose of into the environment. 9.2 billion tons of plastic have been produced, out of, which only 9% have been recycled. Plastic pollution threatens wildlife, alters ecosystems, and poses risks to human health. Reducing the production of plastic packaging decrease the chance of such damage. Moreover, plastic waste that is sent to landfills is ultimately incinerated to make room for more incoming waste. Burning plastic discharges toxic pollutants and irritants into the air we breathe. Reducing the amount of plastic waste sent to landfills can dramatically increase air quality around the world.Industrial Packaging Market Segment Analysis:

By Product type, the corrugated boxes segment is projected to be the largest market in the industrial packaging market. Because corrugated boxes are low cost, low weight, and one of the most easily available. And these boxes are help full for company branding, custom branding is a great way to impress customers because it looks more professional in the business. Corrugated boxes are stronger than cardboard boxes. They act as a stable and safe for any product during handling and shipping. A corrugated box is designed to keep moisture and bacteria away from the products. The most important factor for the growth of corrugated boxes is they are made up of 70 to 100% recycled material and the market makes eco-friendly green packaging material. Another key factor of corrugated box packaging is one of the most highly recycled materials on the planet, these boxes can also be folded up and packed away for reuse when needed. Corrugated boxes can be manufactured in a wide variety of sizes and can either be double single, or even triple walled for more protection. Corrugated boxes can be used to pack a lot of different products making them one of the most flexible packaging options in the market today.By Material Type, Plastic is one of the main raw materials, which is highly used in the packaging industry. The plastic packaging is made up of synthetic polymers like polypropylene and polyethylene. Plastic is the most feasible material as it is flexible, light in weight, cost-effective, easy to handle and it is protected from damage Many types of plastic have different functional properties such as being safe for food, flexible, transparent, opaque, and chemical and heat resistant. Plastics thus are the ideal packaging material for a variety of modern requirements. Without plastic packaging to serve all these needs, it becomes very difficult to transport and utilize a wide range of products people rely on every day.

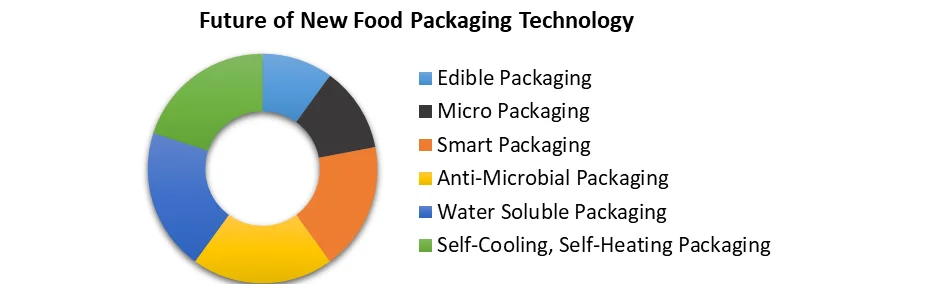

By Application, The food & beverage segment is projected to be the largest segment in the industrial packaging market. The rising customer demand for packaged products due to eating habits and changing lifestyles has a high impact on the industrial packaging market. Food packaging is used to allow for easy transport of goods, protect the integrity of food products and ensure food is safe from harmful chemicals, particles, and bacteria also food packaging allows for food labelling and labelling formation such as ingredients or information regarding any lows and regulation. The material depends on the type of food, most food packaging consists of either glass, cardboard, metal, or plastics, furthermore different types of packaging will depend on the size and nature of food products. Food packaging plays an important role in preserving food throughout the supply and distribution chain. Without packaging, the processing of food shells is compromised as they may get contaminated with direct contact with physical, chemical, and biological content.in recent years, the development in food packaging systems such as vacuum packaging, Nano packaging, shrink wrap packaging, active packaging, etc. This not only increases the shelf life of food without compromising its safety and quality. As per the packaging survey packaging protect products from damage, extends the shelf life of food, and promotes the brands to customers this is distributed in primary, secondary, and tertiary food packaging.

Industrial Packaging Market Regional Insights:

Industrial packaging industry movements are remarkably working in 3 major regions of the world Asia Pacific, Europe, North America, and the rest of the world. The Asia Pacific is expected to be the largest market and may observe significant growth over the forecast period. The region including India, china, Japan, China, and South Korea has set several regulations in order to quality and safety of packaging products during the forecast period. Rising population, rising disposable income, and a rise in demand for attractively packaged materials are among the major motivators for the growth of the packaging industry market across the region. Along with this, the considerable presence of end-user industry verticals in the region such as the food industry, pharmaceutical industry, healthcare industry, and cosmetics industry in the region is further aiding the regional market growth. GPA global, Amcor Ltd., Essel Propack Ltd, Shanghai Forests Packaging Group Co., Ltd., WestRock India Pvt. Ltd., Ester Industries Ltd, Kapco Packaging., OJI India Packaging Pvand t Ltd. among others are the key players operating in the Asia-Pacific packaging industry. The presence of key market players in the region along with their motive to produce high-end packaging solutions is a key factor contributing to the high share of the market in the region. These players operating in the market are adopting several innovative packaging technologies to thrive in the marketplace. Objective of the report is to present a comprehensive analysis of the Industrial Packaging Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key, including include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.Industrial Packaging Market: Competitive Landscape:

Top major players of the industrial packaging market include Greif, Inc., Berry Global Group, Inc., and Mondi Group. Greif, Inc. (U.S.) is a global leader in industrial Packaging, recognized for a wide range of drums, IBCs and fiber packaging solutions. Greif, Inc. (U.S.), is a leading player in the industrial packaging market. recorded a revenue of approximately USD 5.448 billion for the fiscal year ending October 31, 2024. Companies like Mauser Packaging Solutions and SCHÜTZ GmbH & Co. KGaA are expanding returnable packaging systems and reconditioning services, enabling circular supply chains. The market is witnessing increased strategic merger and acquisition, especially in emerging areas, to increase production capabilities and regional access. Berry Global Group, Inc. (U.S.) is another major player, combining rigid and flexible industrial packaging with sustainability-driven design. It supports various fields including food, pharma and chemicals, supported by investing in light material and recycled formats. Technological advancement such as RFID-enabled tracking, automatic filling systems, and digital warehouse integration is re-shaping competitive dynamics, driving efficiency, traceability and durable scale for these companies.Key Trends in the Industrial Packaging Market:

Trend Details Impact on Market Shift Toward Sustainable Packaging Increasing demand for recyclable, reusable, and biodegradable materials in packaging. Drives innovation in eco-friendly products and boosts demand across end-user sectors. Expansion of E-commerce and Logistics Growth of online retail and global trade requires durable and efficient bulk packaging. Increases demand for flexible, protective, and lightweight packaging solutions. Integration of Smart Packaging Adoption of RFID tags, QR codes, and IoT for tracking and monitoring industrial goods. Enhances supply chain transparency, safety, and operational efficiency. Recent Devlopments in Industrial Packaging Market:

On February 24, 2025, Berry Global Inc. announced the launch of 100% recycled-content plastic jars for Mars brands like M&M’s and Skittles, eliminating approximately 1,300 tonnes of virgin plastic annually. On February 3, 2025, Sonoco received How2Recycle® “Check Locally” labeling for its EnviroCan® metal-bottom rigid paper container made from 100% recycled fiber, advancing its sustainable packaging portfolio. On January 19, 2025, Sigma Plastics Group expanded its stretch film production capacity in North America through new multi-layer extrusion lines to meet rising demand from food and industrial logistics sectors. On June 19, 2024, Mondi Group (UK) completed a €125 million upgrade at its Kuopio mill (Finland), boosting containerboard capacity by 55,000 tpa and improving environmental performance under its MAP2030 sustainability plan On January 12, 2024, Greif partnered with IonKraft on a pilot project for plasma‑based barrier coatings on plastic jerrycans, offering a 100% recyclable alternative to traditional fluorination and enhancing recyclability in industrial packagingIndustrial Packaging Market Scope: Inquire before buying

Industrial Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: US$68.92 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: US$98.01 Bn. Segments Covered: by Product Type Drums IBCs Sacks Crates Pails Corrugated Boxes Others by Material type Plastic Wood Metal Paperboard by Applications Food & Beverage Automotive Pharmaceutical Chemical Oil & Lubricant Building & Constructions Other Industrial Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Industrial Packaging Market Key Companies are:

North America: 1. Greif Inc. (USA) 2. Berry Global Inc. (USA) 3. International Paper (USA) 4. Sonoco Products Company (USA) 5. Sigma Plastics Group (USA) Europe: 6. Amcor (Switzerland) 7. Mondi Group (UK) 8. Stora Enso (Finland) 9. Constantia Flexibles (Austria) 10. DS Smith (UK) Asia-Pacific: 11. Orora Limited (Australia) 12. Tetra Pak International S.A. (Singapore) 13. Plastipak Packaging, Inc. (China) 14. Coveris Group (Vietnam) 15. Jiangsu Zhongjin Matai Medicinal Packaging Co., Ltd. (China) Middle East & Africa: 16. Napco National Packaging (Saudi Arabia) 17. Taghleef Industries (UAE) 18. Zamil Plastic Industries Ltd. (Saudi Arabia) 19. Flexipack Ltd. (Kenya) South America: 20. Klabin S.A. (Brazil)Frequently Asked Questions:

1. What is the forecast period considered for the Industrial Packaging Market report? Ans. The forecast period for the Industrial Packaging Market is 2025-2032. 2. Which key factors are hindering the growth of the Industrial Packaging Market? Ans. The Growing Environmental Concerns All Over the World Will Hamper the Industrial Packaging Market Growth. 3. What is the compound annual growth rate (CAGR) of the Industrial Packaging Market for the forecast period? Ans. 4.5% is the compound annual growth rate of the Industrial Packaging Market. 4. What are the key factors driving the growth of the Industrial Packaging Market? Ans. Self-heating packages are the major key driver of packaging market growth. 5. Which are the worldwide major key players covered for the Industrial Packaging Market report? Ans. Top key players of Industrial Packaging Market include Greif, Inc., Berry Global Group, Inc., and Mondi Group. Greif, Inc. (U.S.)

1. Industrial Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Industrial Packaging Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Industrial Packaging Market: Dynamics 3.1. Region-wise Trends of Industrial Packaging Market 3.1.1. North America Industrial Packaging Market Trends 3.1.2. Europe Industrial Packaging Market Trends 3.1.3. Asia Pacific Industrial Packaging Market Trends 3.1.4. Middle East and Africa Industrial Packaging Market Trends 3.1.5. South America Industrial Packaging Market Trends 3.2. Industrial Packaging Market Dynamics 3.2.1. Global Industrial Packaging Market Drivers 3.2.1.1. Wipes Packaging 3.2.1.2. Self-heating packaging 3.2.2. Global Industrial Packaging Market Restraints 3.2.3. Global Industrial Packaging Market Opportunities 3.2.3.1. Circular packaging systems 3.2.3.2. Smart automated packaging 3.2.3.3. Bio-based packaging materials 3.2.4. Global Industrial Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Labor cost pressure 3.4.2. Consumer eco demand 3.4.3. Energy price volatility 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Industrial Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Drums 4.1.2. IBCs 4.1.3. Sacks 4.1.4. Crates 4.1.5. Pails 4.1.6. Corrugated Boxes 4.1.7. Others 4.2. Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 4.2.1. Plastic 4.2.2. Wood 4.2.3. Metal 4.2.4. Paperboard 4.3. Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 4.3.1. Food & Beverage 4.3.2. Automotive 4.3.3. Pharmaceutical 4.3.4. Chemical 4.3.5. Oil & Lubricant 4.3.6. Building & Constructions 4.3.7. Other 4.4. Industrial Packaging Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Industrial Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Drums 5.1.2. IBCs 5.1.3. Sacks 5.1.4. Crates 5.1.5. Pails 5.1.6. Corrugated Boxes 5.1.7. Others 5.2. North America Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 5.2.1. Plastic 5.2.2. Wood 5.2.3. Metal 5.2.4. Paperboard 5.3. North America Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 5.3.1. Food & Beverage 5.3.2. Automotive 5.3.3. Pharmaceutical 5.3.4. Chemical 5.3.5. Oil & Lubricant 5.3.6. Building & Constructions 5.3.7. Other 5.4. North America Industrial Packaging Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 5.4.1.1.1. Drums 5.4.1.1.2. IBCs 5.4.1.1.3. Sacks 5.4.1.1.4. Crates 5.4.1.1.5. Pails 5.4.1.1.6. Corrugated Boxes 5.4.1.1.7. Others 5.4.1.2. United States Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 5.4.1.2.1. Plastic 5.4.1.2.2. Wood 5.4.1.2.3. Metal 5.4.1.2.4. Paperboard 5.4.1.3. United States Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 5.4.1.3.1. Food & Beverage 5.4.1.3.2. Automotive 5.4.1.3.3. Pharmaceutical 5.4.1.3.4. Chemical 5.4.1.3.5. Oil & Lubricant 5.4.1.3.6. Building & Constructions 5.4.1.3.7. Other 5.4.2. Canada 5.4.2.1. Canada Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 5.4.2.1.1. Drums 5.4.2.1.2. IBCs 5.4.2.1.3. Sacks 5.4.2.1.4. Crates 5.4.2.1.5. Pails 5.4.2.1.6. Corrugated Boxes 5.4.2.1.7. Others 5.4.2.2. Canada Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 5.4.2.2.1. Plastic 5.4.2.2.2. Wood 5.4.2.2.3. Metal 5.4.2.2.4. Paperboard 5.4.2.3. Canada Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 5.4.2.3.1. Food & Beverage 5.4.2.3.2. Automotive 5.4.2.3.3. Pharmaceutical 5.4.2.3.4. Chemical 5.4.2.3.5. Oil & Lubricant 5.4.2.3.6. Building & Constructions 5.4.2.3.7. Other 5.4.3. Mexico 5.4.3.1. Mexico Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 5.4.3.1.1. Drums 5.4.3.1.2. IBCs 5.4.3.1.3. Sacks 5.4.3.1.4. Crates 5.4.3.1.5. Pails 5.4.3.1.6. Corrugated Boxes 5.4.3.1.7. Others 5.4.3.2. Mexico Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 5.4.3.2.1. Plastic 5.4.3.2.2. Wood 5.4.3.2.3. Metal 5.4.3.2.4. Paperboard 5.4.3.3. Mexico Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 5.4.3.3.1. Food & Beverage 5.4.3.3.2. Automotive 5.4.3.3.3. Pharmaceutical 5.4.3.3.4. Chemical 5.4.3.3.5. Oil & Lubricant 5.4.3.3.6. Building & Constructions 5.4.3.3.7. Other 6. Europe Industrial Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.3. Europe Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4. Europe Industrial Packaging Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.1.2. United Kingdom Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.1.3. United Kingdom Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.2. France 6.4.2.1. France Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.2.2. France Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.2.3. France Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.3.2. Germany Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.3.3. Germany Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.4.2. Italy Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.4.3. Italy Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.5.2. Spain Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.5.3. Spain Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.6.2. Sweden Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.6.3. Sweden Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.7.2. Austria Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.7.3. Austria Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 6.4.8.2. Rest of Europe Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 6.4.8.3. Rest of Europe Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7. Asia Pacific Industrial Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.3. Asia Pacific Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4. Asia Pacific Industrial Packaging Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.1.2. China Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.1.3. China Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.2.2. S Korea Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.2.3. S Korea Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.3.2. Japan Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.3.3. Japan Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.4. India 7.4.4.1. India Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.4.2. India Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.4.3. India Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.5.2. Australia Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.5.3. Australia Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.6.2. Indonesia Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.6.3. Indonesia Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.7.2. Philippines Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.7.3. Philippines Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.8.2. Malaysia Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.8.3. Malaysia Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.9.2. Vietnam Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.9.3. Vietnam Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.10.2. Thailand Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.10.3. Thailand Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 7.4.11.3. Rest of Asia Pacific Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 8. Middle East and Africa Industrial Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 8.3. Middle East and Africa Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 8.4. Middle East and Africa Industrial Packaging Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 8.4.1.2. South Africa Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 8.4.1.3. South Africa Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 8.4.2.2. GCC Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 8.4.2.3. GCC Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 8.4.3.2. Nigeria Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 8.4.3.3. Nigeria Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 8.4.4.2. Rest of ME&A Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 8.4.4.3. Rest of ME&A Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 9. South America Industrial Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 9.3. South America Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 9.4. South America Industrial Packaging Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 9.4.1.2. Brazil Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 9.4.1.3. Brazil Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 9.4.2.2. Argentina Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 9.4.2.3. Argentina Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Industrial Packaging Market Size and Forecast, By Product Type (2024-2032) 9.4.3.2. Rest of South America Industrial Packaging Market Size and Forecast, By Material type (2024-2032) 9.4.3.3. Rest of South America Industrial Packaging Market Size and Forecast, By Applications (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Greif Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Berry Global Inc. (USA) 10.3. International Paper (USA) 10.4. Sonoco Products Company (USA) 10.5. Sigma Plastics Group (USA) 10.6. Amcor (Switzerland) 10.7. Mondi Group (UK) 10.8. Stora Enso (Finland) 10.9. Constantia Flexibles (Austria) 10.10. DS Smith (UK) 10.11. Orora Limited (Australia) 10.12. Tetra Pak International S.A. (Singapore) 10.13. Plastipak Packaging, Inc. (China) 10.14. Coveris Group (Vietnam) 10.15. Jiangsu Zhongjin Matai Medicinal Packaging Co., Ltd. (China) 10.16. Napco National Packaging (Saudi Arabia) 10.17. Taghleef Industries (UAE) 10.18. Zamil Plastic Industries Ltd. (Saudi Arabia) 10.19. Flexipack Ltd. (Kenya) 10.20. Klabin S.A. (Brazil) 11. Key Findings 12. Analyst Recommendations 13. Industrial Packaging Market: Research Methodology