Industrial Inkjet Printers Market size was valued at USD 9.38 Billion in 2023 and the Industrial Inkjet Printers Market revenue is expected to reach USD 12.51 Billion by 2030, at a CAGR of 4.2 % over the forecast period.Industrial Inkjet Printers Market Overview

Industrial inkjet printers are specialized printing machines designed for use in industrial environments. Unlike traditional inkjet printers used in offices or homes, industrial inkjet printers are built to handle larger volumes, harsher conditions, and a wider variety of materials. They are used for printing on various substrates such as metal, plastic, glass, wood, ceramics, textiles, and more. These printers typically utilize high-resolution printheads that produce high-quality prints with precision and speed. They employ different types of ink, including solvent-based, UV-curable, aqueous, and specialty inks, depending on the requirements of the application. Industrial inkjet printers find applications in various industries such as packaging, textiles, automotive, electronics, aerospace, and signage.To know about the Research Methodology :- Request Free Sample Report The industrial inkjet printers market has been experiencing significant growth and transformation in recent years, driven by technological advancements, increasing demand for customization, and the need for efficient printing solutions across various industrial sectors. Industrial inkjet printers are specialized printing machines designed to meet the demanding requirements of industrial environments, offering capabilities such as printing on a wide range of substrates, handling variable data printing, and integrating seamlessly into production lines. The market is highly competitive, with several key players vying for Industrial Inkjet Printers market share. Industrial Inkjet printers companies are investing in research and development to introduce innovative products and stay ahead of the competition. Consolidation through mergers and acquisitions is also prevalent as companies seek to expand their product portfolios and strengthen their market positions.

Industrial Inkjet Printers Market Dynamics

Demand for Customization and Personalization to boost the Industrial Inkjet Printers Market growth There is increasing consumer preference for customized products and packaging. Industrial inkjet printers enable manufacturers to meet this demand by offering flexibility in printing variable data such as product labels, barcodes, serial numbers, and graphics. This capability allows for mass customization, where each product is tailored to meet specific customer requirements. As businesses strive to differentiate themselves and create unique brand experiences, the demand for industrial inkjet printers continues to rise, which significantly boosts the Industrial Inkjet Printers Market growth. Continuous innovation in inkjet printing technology has been a significant driver of market growth. Advancements in printhead design, ink formulations, and printing processes have led to improved print quality, higher speed, and enhanced reliability. Printheads with increased resolution enable finer details and more precise printing, catering to the demands of various industries for high-quality prints. Advancements in ink chemistry have expanded the range of substrates that are printed on, further broadening the application scope of industrial inkjet printers. Digital printing technologies in inkjet printing, have gained traction across various industries due to their numerous advantages over traditional printing methods. Digital printing offers faster turnaround times, reduced setup costs, and the ability to produce short print runs economically. Industrial inkjet printers, with their versatility and ability to handle variable data printing, are well-suited to meet the demands of industries such as packaging, textiles, and labels. As businesses seek efficient and flexible printing solutions, the adoption of industrial inkjet printers is expected to increase further, which is expected to boost the Industrial Inkjet Printers Market growth. The adoption of additive manufacturing processes, particularly 3D printing, has opened up new opportunities for industrial inkjet printers. Inkjet-based 3D printing technologies, such as binder jetting, use inkjet printheads to selectively deposit binding agents onto powder beds, enabling the production of complex parts with high precision. As additive manufacturing continues to gain traction across industries, the demand for industrial inkjet printers for 3D printing applications is expected to increase. High Initial Investment Costs to restraint Industrial Inkjet Printers Market Growth The adoption of industrial inkjet printers is the high initial investment costs associated with purchasing and installing the equipment, which significantly restraints the Industrial Inkjet Printers Market Growth. Industrial-grade inkjet printers, especially those equipped with advanced features and capabilities, are expensive, making it challenging for small and medium-sized enterprises (SMEs) to afford them. The cost of maintenance, consumables such as inks and printheads, and ongoing operational expenses are further strain budgets, limiting the adoption of industrial inkjet printers. While industrial inkjet printers offer versatility in printing on various substrates, including paper, plastic, metal, and ceramics, there are limitations regarding compatibility with certain materials. Some substrates require specialized inks or pre-treatment processes to ensure proper adhesion and print quality, which add complexity and cost to printing operations. Challenging substrates such as highly porous or uneven surfaces pose technical challenges for industrial inkjet printers, limiting their applicability in certain industries and applications. Despite advancements in printhead technology and printing processes, industrial inkjet printers still face limitations in terms of print speed and throughput, especially when compared to traditional printing methods such as offset or flexography. High-speed production environments require faster printing capabilities to meet production demands, and industrial inkjet printers struggle to match the throughput of traditional printing presses. This is a significant restraint for industries with high-volume printing requirements, where production efficiency is critical, which is expected to restrain Industrial Inkjet Printers Market Growth. Integrating industrial inkjet printers into existing production lines or workflow processes is complex and time-consuming, particularly for industries with specialized manufacturing requirements. Achieving seamless integration with other equipment, such as packaging machinery or automated systems, requires careful planning, customization, and coordination. Software compatibility issues and the need for specialized training for operators further complicate the integration process, delaying deployment and increasing implementation costs.Industrial Inkjet Printers Market Segment Analysis

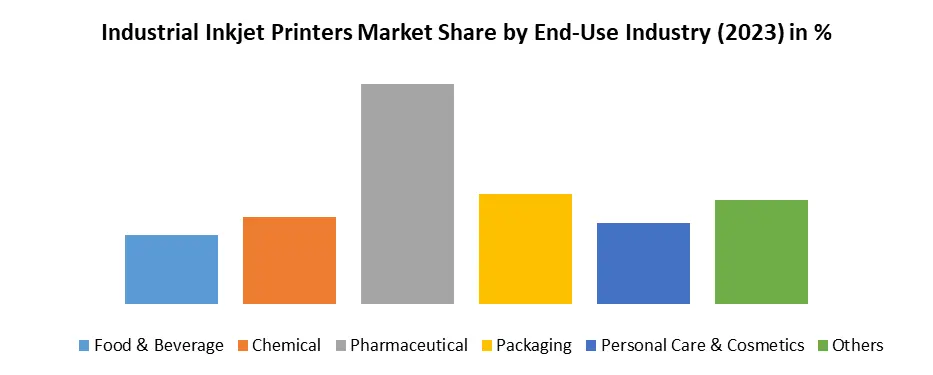

Based on Type, the market is segment into On-demand Inkjet Printer and Continuous Inkjet Printer. Continuous Inkjet Printer segment dominated the market in 2023 and is expected to hold the largest Industrial Inkjet Printers Market share over the forecast period. Continuous inkjet printers work by generating a continuous stream of ink droplets from a printhead. These droplets are electrically charged and passed through a deflection field, where they are selectively charged or deflected based on the desired print pattern. Continuous inkjet printers are designed to seamlessly integrate into existing production lines or manufacturing processes. They are mounted on conveyors, packaging machines, or other equipment to enable inline printing. The continuous inkjet printer segment is witnessing technological advancements aimed at enhancing print quality, speed, efficiency, and connectivity. Industrial Inkjet Printers Market players are focusing on developing innovative features such as remote monitoring and diagnostics, advanced ink formulations, user-friendly interfaces, and integration with Industry 4.0 technologies to meet the evolving needs of manufacturers. Based on End-Use Industry, the market is segmented into Food & Beverage, Chemical, Pharmaceutical, Packaging, Personal Care & Cosmetics, and Others. The pharmaceutical segment dominated the market in 2023 and is expected to hold the largest Industrial Inkjet Printers Market share over the forecast period. The pharmaceutical industry operates under stringent regulations governing product labeling, serialization, and traceability to ensure patient safety, product integrity, and regulatory compliance. Industrial inkjet printers play a critical role in meeting these regulatory requirements by enabling the printing of important information such as batch numbers, expiration dates, serial numbers, barcodes, QR codes, and product identification codes directly onto pharmaceutical packaging materials. The pharmaceutical segment of the industrial inkjet printers market benefits from advancements in printing technologies such as high-resolution printheads, precision ink deposition, micro-droplet control, and vision inspection systems. These technologies enable pharmaceutical manufacturers to achieve high-quality prints with accurate coding, legible text, and crisp barcodes on various packaging materials, including labels, foils, films, and cartons.

Industrial Inkjet Printers Market Regional Insights

Rapid Industrialization with manufacturing boom to boost the Asia Pacific Industrial Inkjet Printers Market growth Many countries in the Asia-Pacific region are undergoing rapid industrialization, leading to increased demand for advanced manufacturing technologies, including industrial inkjet printers. As industries modernize and adopt digital manufacturing processes, there is a growing need for efficient and flexible printing solutions to meet evolving production requirements. Industrial inkjet printers offer the versatility and customization capabilities necessary to support this transition. The Asia-Pacific region is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and India. The region's robust manufacturing sector, fueled by factors such as low labor costs, favorable government policies, and access to raw materials, has been a major driver of demand for industrial inkjet printers, which is expected to boost the Asia Pacific Industrial Inkjet Printers Market growth. These printers are essential for printing on a wide range of manufactured goods, including packaging, textiles, electronics, automotive parts, and more. The Asia-Pacific region is experiencing significant growth in the packaging industry, driven by factors such as urbanization, changing consumer lifestyles, and e-commerce growth. Industrial inkjet printers play a crucial role in the packaging sector by enabling high-quality printing on various packaging materials, including paper, plastic, and flexible packaging. The demand for customized and visually appealing packaging designs further fuels the adoption of industrial inkjet printers in the region, which is expected to boost the Industrial Inkjet Printers Market growth. The region is a hub for technological innovation and R&D activities, driving advancements in inkjet printing technology. Industrial Inkjet Printers local manufacturers and international companies operating in the region are investing in research and development to enhance the performance, speed, and capabilities of industrial inkjet printers. These technological advancements enable industrial inkjet Printers manufacturers to improve print quality, increase production efficiency, and expand the application scope of industrial inkjet printers.Scope of the Global Industrial Inkjet Printers Market: Inquire before buying

Global Industrial Inkjet Printers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.38 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 12.51 Bn. Segments Covered: by Type On-demand Inkjet Printer Continuous Inkjet Printer by End Use Industry Food & Beverage Chemical Pharmaceutical Packaging Personal Care & Cosmetics Others Industrial Inkjet Printers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Industrial Inkjet Printers Manufacturers include:

North America: 1. Markem-Imaje : Bourg-lès-Valence, France 2. Videojet Technologies Inc.: Wood Dale, Illinois, USA 3. Domino Printing Sciences plc: Cambridge, United Kingdom 4. Squid Ink: Brooklyn Park, Minnesota, USA 5. Eastman Kodak Company: Rochester, New York, USA Europe: 6. Linx Printing Technologies: Saint Ives, Cambridgeshire, United Kingdom 7. Xaar plc: Cambridge, United Kingdom 8. Koenig & Bauer Coding GmbH: Veitshöchheim, Germany 9. Durst Group: Brixen, Italy 10. Leibinger Group: Tuttlingen, Germany Asia-Pacific: 11. Beijing Founder Electronics Co., Ltd: Beijing, China 12. Konica Minolta, Inc.: Tokyo, Japan 13. Hitachi Industrial Equipment Systems Co., Ltd.: Tokyo, Japan 14. Keyence Corporation: Osaka, Japan Frequently asked Questions: 1. What are industrial inkjet printers? Ans: Industrial inkjet printers are specialized printing machines designed for use in industrial environments. Unlike traditional inkjet printers used in offices or homes, industrial inkjet printers are built to handle larger volumes, harsher conditions, and a wider variety of materials. 2. What types of ink do industrial inkjet printers use? Ans: Industrial inkjet printers utilize different types of ink, including solvent-based, UV-curable, aqueous, and specialty inks, depending on the requirements of the application. 3. What are the main drivers of growth in the industrial inkjet printers market? Ans: The main drivers of growth in the industrial inkjet printers market include technological advancements, increasing demand for customization, and the need for efficient printing solutions across various industrial sectors. 4. Which segment dominates the industrial inkjet printers market based on type? Ans: The continuous inkjet printer segment dominates the industrial inkjet printers market, offering high-speed, continuous printing capabilities suitable for various industrial applications. 5. Which end-use industry dominates the industrial inkjet printers market? Ans: The pharmaceutical industry dominates the industrial inkjet printers market, driven by stringent regulatory requirements for product labeling, serialization, and traceability.

1. Industrial Inkjet Printers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Industrial Inkjet Printers Market: Dynamics 2.1. Industrial Inkjet Printers Market Trends by Region 2.1.1. North America Industrial Inkjet Printers Market Trends 2.1.2. Europe Industrial Inkjet Printers Market Trends 2.1.3. Asia Pacific Industrial Inkjet Printers Market Trends 2.1.4. Middle East and Africa Industrial Inkjet Printers Market Trends 2.1.5. South America Industrial Inkjet Printers Market Trends 2.2. Industrial Inkjet Printers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Industrial Inkjet Printers Market Drivers 2.2.1.2. North America Industrial Inkjet Printers Market Restraints 2.2.1.3. North America Industrial Inkjet Printers Market Opportunities 2.2.1.4. North America Industrial Inkjet Printers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Industrial Inkjet Printers Market Drivers 2.2.2.2. Europe Industrial Inkjet Printers Market Restraints 2.2.2.3. Europe Industrial Inkjet Printers Market Opportunities 2.2.2.4. Europe Industrial Inkjet Printers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Industrial Inkjet Printers Market Drivers 2.2.3.2. Asia Pacific Industrial Inkjet Printers Market Restraints 2.2.3.3. Asia Pacific Industrial Inkjet Printers Market Opportunities 2.2.3.4. Asia Pacific Industrial Inkjet Printers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Industrial Inkjet Printers Market Drivers 2.2.4.2. Middle East and Africa Industrial Inkjet Printers Market Restraints 2.2.4.3. Middle East and Africa Industrial Inkjet Printers Market Opportunities 2.2.4.4. Middle East and Africa Industrial Inkjet Printers Market Challenges 2.2.5. South America 2.2.5.1. South America Industrial Inkjet Printers Market Drivers 2.2.5.2. South America Industrial Inkjet Printers Market Restraints 2.2.5.3. South America Industrial Inkjet Printers Market Opportunities 2.2.5.4. South America Industrial Inkjet Printers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Industrial Inkjet Printers Industry 2.8. Analysis of Government Schemes and Initiatives For Industrial Inkjet Printers Industry 2.9. Industrial Inkjet Printers Market Trade Analysis 2.10. The Global Pandemic Impact on Industrial Inkjet Printers Market 3. Industrial Inkjet Printers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 3.1.1. On-demand Inkjet Printer 3.1.2. Continuous Inkjet Printer 3.2. Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 3.2.1. Food & Beverage 3.2.2. Chemical 3.2.3. Pharmaceutical 3.2.4. Packaging 3.2.5. Personal Care & Cosmetics 3.2.6. Others 3.3. Industrial Inkjet Printers Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Industrial Inkjet Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 4.1.1. On-demand Inkjet Printer 4.1.2. Continuous Inkjet Printer 4.2. North America Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 4.2.1. Food & Beverage 4.2.2. Chemical 4.2.3. Pharmaceutical 4.2.4. Packaging 4.2.5. Personal Care & Cosmetics 4.2.6. Others 4.3. North America Industrial Inkjet Printers Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. On-demand Inkjet Printer 4.3.1.1.2. Continuous Inkjet Printer 4.3.1.2. United States Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 4.3.1.2.1. Food & Beverage 4.3.1.2.2. Chemical 4.3.1.2.3. Pharmaceutical 4.3.1.2.4. Packaging 4.3.1.2.5. Personal Care & Cosmetics 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. On-demand Inkjet Printer 4.3.2.1.2. Continuous Inkjet Printer 4.3.2.2. Canada Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 4.3.2.2.1. Food & Beverage 4.3.2.2.2. Chemical 4.3.2.2.3. Pharmaceutical 4.3.2.2.4. Packaging 4.3.2.2.5. Personal Care & Cosmetics 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1. Mexico Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. On-demand Inkjet Printer 4.3.3.1.2. Continuous Inkjet Printer 4.3.3.2. Mexico Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 4.3.3.2.1. Food & Beverage 4.3.3.2.2. Chemical 4.3.3.2.3. Pharmaceutical 4.3.3.2.4. Packaging 4.3.3.2.5. Personal Care & Cosmetics 4.3.3.2.6. Others 5. Europe Industrial Inkjet Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.2. Europe Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3. Europe Industrial Inkjet Printers Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.2. France 5.3.2.1. France Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6. Asia Pacific Industrial Inkjet Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3. Asia Pacific Industrial Inkjet Printers Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.4. India 6.3.4.1. India Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 7. Middle East and Africa Industrial Inkjet Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 7.3. Middle East and Africa Industrial Inkjet Printers Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 8. South America Industrial Inkjet Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 8.2. South America Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 8.3. South America Industrial Inkjet Printers Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Industrial Inkjet Printers Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Industrial Inkjet Printers Market Size and Forecast, by End Use industry (2023-2030) 9. Global Industrial Inkjet Printers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Industrial Inkjet Printers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Markem-Imaje : Bourg-lès-Valence, France 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Videojet Technologies Inc.: Wood Dale, Illinois, USA 10.3. Domino Printing Sciences plc: Cambridge, United Kingdom 10.4. Squid Ink: Brooklyn Park, Minnesota, USA 10.5. Eastman Kodak Company: Rochester, New York, USA 10.6. Linx Printing Technologies: Saint Ives, Cambridgeshire, United Kingdom 10.7. Xaar plc: Cambridge, United Kingdom 10.8. Koenig & Bauer Coding GmbH: Veitshöchheim, Germany 10.9. Durst Group: Brixen, Italy 10.10. Leibinger Group: Tuttlingen, Germany 10.11. Beijing Founder Electronics Co., Ltd: Beijing, China 10.12. Konica Minolta, Inc.: Tokyo, Japan 10.13. Hitachi Industrial Equipment Systems Co., Ltd.: Tokyo, Japan 10.14. Keyence Corporation: Osaka, Japan 11. Key Findings 12. Industry Recommendations 13. Industrial Inkjet Printers Market: Research Methodology 14. Terms and Glossary