Global Industrial Heaters Market size was valued at USD 5.91 Bn. in 2025, and the total Industrial Heaters revenue is expected to grow at a CAGR of 5.14% from 2026 to 2032, reaching nearly USD 8.39 Bn. This growth is driven by the increasing demand across diverse industries, technological advancements, and the rising focus on energy-efficient and eco-friendly heating solutions.Industrial Heaters Market Overview

As industrial sectors across the globe focus on reducing energy consumption, the demand for industrial heaters continues to soar. The integration of smart heating solutions, capable of remote monitoring and predictive maintenance, is becoming a game-changer, offering industries the ability to optimize operations and minimize downtime, this is especially true for the Asia Pacific region. In Asia-Pacific, China Industrial Heaters Market is expected to account for more than 30% of global industrial heater demand by 2032, driven by industrial growth and energy efficiency initiatives.To know about the Research Methodology :- Request Free Sample Report

Key Highlights:

• Industrial heater adoption rates in India and Southeast Asia are growing at 8-10% annually, fueled by expanding industrial parks and rental warehouse facilities requiring localized heating. • In 2025 alone, over 1.2 million industrial heater units were sold globally, with rental warehouse sectors accounting for approximately xx% of demand. • The global penetration rate of industrial heaters in manufacturing units is estimated at around 65% in 2025, with an expected increase to xx% by 2032.

Industrial Heaters Market Dynamics: Key Growth Drivers and Trends

The global Industrial Heaters Market is witnessing rapid adoption of smart technologies, enabling remote monitoring, predictive maintenance, and optimisation of heating processes. These advancements reduce operational costs and downtime, while enhancing system reliability. The demand for electric-based industrial heaters is growing significantly due to their energy efficiency and lower operational costs. Additionally, the duct industrial heater market is also witnessing growth, as industries seek localised heating solutions to minimise energy consumption and improve process efficiency. Below are key growth drivers and key trends for the Industrial Heaters Market.• Flourishing Industrial Sector: Increasing manufacturing activities globally, particularly in emerging economies, are driving the demand for industrial heaters. The industrial heater market penetration in manufacturing plants in North America stands at approximately 72%, whereas Europe follows closely at 68%. • Investment in Manufacturing: Increased investments in industrial facilities, particularly in chemicals, food processing, and automotive sectors, are pushing the need for efficient heating systems. • Integration of Renewable Energy: The shift toward renewable energy sources like solar thermal systems and biomass heating is reshaping the landscape of industrial heating. • Smart Industrial Heaters: The rise of IoT-enabled heaters is changing how businesses monitor and control their heating systems, offering greater flexibility, energy savings, and remote management. • Electric Heaters: The electric industrial heater segment is expected to reach USD xx billion by 2032, driven by the increasing focus on sustainability and energy efficiency.

The Industrial Heaters Market is fueled by heavy industries blazing at high temperatures with iron & steel, cement, aluminium, and chemicals burning over 80% of their energy, driving a massive demand for cutting-edge, energy-efficient heating technologies that keep global manufacturing engines roaring.The graph shows that the aluminium & non-ferrous metals and cement sectors consume 17 EJ and 10.4 EJ, respectively, at high temperatures (>400°C), driving intense demand for high-temp heaters. Meanwhile, food & beverage use 6.7 EJ (96%) at low-to-medium temps, highlighting varied heating needs across industries.

Industrial Heaters Market Challenges:

• High Initial Investment: Despite the long-term benefits, the initial cost of advanced industrial heating systems can be a barrier to entry for many companies. However, adoption rates in rental warehouses and leased industrial spaces are rising due to flexible financing and rental options, increasing heater utilization by 7% year-over-year.Industrial Heaters Market Segment Analysis

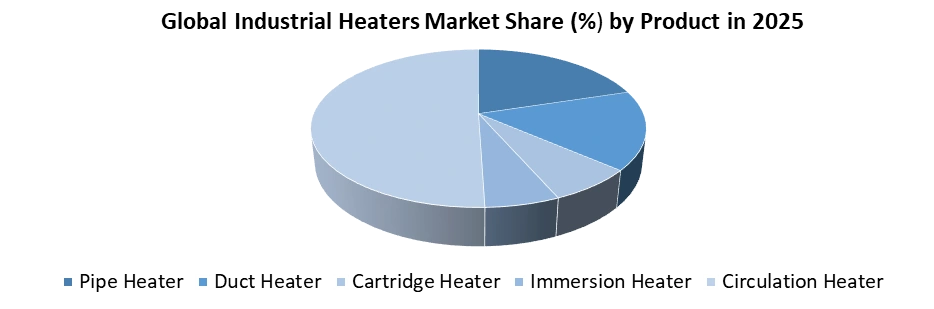

By Product The Circulation Heaters segment held the largest Industrial Heaters Market share in 2025, supported by high-efficiency gas and fluid heating across semiconductor and industrial processes. For example, semiconductor fabs using circulation heaters achieve up to 30–35% higher thermal efficiency in de-ionized water and inert gas circulation. Electric immersion and strip heaters continue to dominate technology adoption, while duct heaters see moderated growth due to rising fire-safety compliance and maintenance costs. The adoption rate of circulation heaters is approximately 40% of total units sold worldwide in 2025, with significant uptake in semiconductor manufacturing hubs across East Asia.

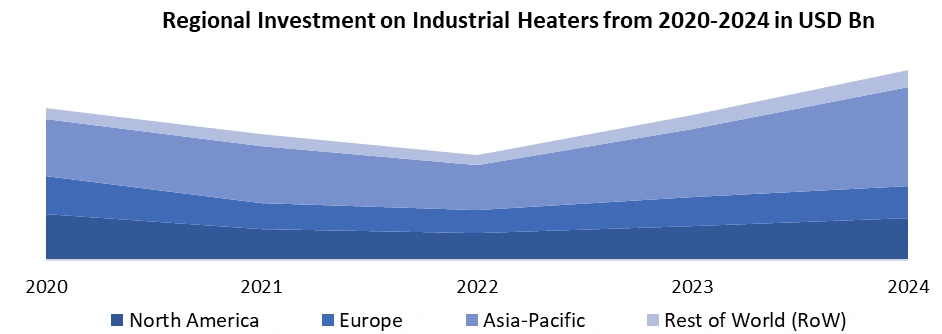

Industrial Heaters Market Regional Analysis

• North America dominated the largest Industrial Heaters Market share in 2025, benefiting from strong industrial electrification, with over 75% of U.S. manufacturing facilities now using electric-based process heating, boosting demand for advanced industrial heaters. • More than 12,000 new semiconductor and advanced manufacturing projects were announced or expanded in the U.S. between 2022 and 2024, directly increasing demand for precision heating systems. • Asia Pacific is witnessing rapid industrial growth, with China accounting for over 30% of global manufacturing output, driving large-scale adoption of industrial heaters in engineering and process industries. The industrial heater penetration rate in new industrial zones in APAC is estimated at 70%, with annual unit sales exceeding 500,000 in 2025. • India added over 25 million square meters of new industrial and logistics space in 2025, accelerating demand for localized and process heating solutions. Government-led clean energy policies across APAC target 20–30% reductions in industrial process emissions by 2030, accelerating the shift toward electric and energy-efficient industrial heater technologies.

Competitive Landscape Analysis

The Industrial Heaters Market is led by organised global players such as Chromalox, Backer Hotwatt, Accutherm, Dragon Power Electric, and Auzhan Electric Appliances, alongside numerous unorganised regional manufacturers. Organised players command higher production capacities, advanced electric and process heaters, and strong global distribution networks, while unorganised players compete on cost-effective and customised solutions. Key strategies include energy-efficient product innovation, smart heater integration, capacity expansion, localised manufacturing, and aftermarket services, as industries increasingly prioritise sustainability, compliance, and total cost of ownership. Recent Industry DevelopmentStrategic Impact and Opportunities • The growth of smart heating systems, combined with the increasing adoption of renewable energy sources, presents new opportunities for market players to innovate and capture a larger market share. Companies that focus on smart controls, IoT integration, and energy-efficient designs will have a competitive advantage in the evolving Industrial Heaters Market. • Opportunities also lie in emerging economies where industrialisation is rapidly increasing. Companies can capitalise on the growing demand for specialized heating applications in sectors like pharmaceuticals, textiles, and food processing.

Date Company Development Impact Jan 2024 Powermatic Launched eco-friendly EUX unit heater Boosts energy-efficient heating May 2023 Nudyne Group Acquired Warren Electric Expanded electric heater portfolio Global Industrial Heaters Market Scope: Inquire before buying

Global Industrial Heaters Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 5.91 Bn. Forecast Period 2026 to 2032 CAGR: 5.14% Market Size in 2032: USD 8.39 Bn. Segments Covered: by Product Pipe Heater Duct Heater Cartridge Heater Immersion Heater Circulation Heater by Capacity Low Medium High by Technology Electric-based Steam-based Hybrid-based Fuel-based by Distribution Channel Direct Sales Indirect Sales by End Use Industry Oil & Gas Chemical Food & Beverage Manufacturing Automotive Pharmaceuticals Others Industrial Heaters Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Industrial Heaters Key Players

1. Watlow 2. Chromalox 3. NIBE Industrier 4. Tempco Electric Heater 5. Indeeco 6. Durex Industries 7. OMEGA Engineering 8. Tutco Heating Solutions 9. Heatrod Elements 10. Backer Hotwatt 11. Friedr. Freek 12. Wattco 13. Industrial Heater Corporation 14. Elmatic 15. Excel Heaters 16. Powrmatic 17. Auzhan Electric Appliances 18. Dragon Power Electric 19. Honeywell International 20. Siemens 21. Robert Bosch (Bosch Thermotechnik) 22. Johnson Controls 23. Emerson Electric 24. Schneider Electric 25. Lennox International 26. Thermon 27. Hotset 28. Thermal Flow Technologies 29. Winterwarm Heating Solutions 30. Ahlstrom 31. Others FAQ 1. What is the size of the Industrial Heaters Market in 2025? Ans: The global Industrial Heaters Market was valued at USD 5.91 billion in 2025 and is expected to reach USD 8.39 billion by 2032 with a CAGR of 5.14%. 2. Which regions lead the Industrial Heaters Market? Ans: North America dominated the market due to strong industrial growth and the adoption of energy-efficient heating technologies. 3. What types of industrial heaters are most popular? Ans: Circulation heaters, electric heaters, immersion heaters, and duct heaters are key types, with electric and circulation heaters leading due to efficiency and technology adoption. 4. How are smart technologies influencing industrial heaters? Ans: Smart heaters with IoT, remote monitoring, and predictive maintenance improve efficiency, reduce downtime, and optimize heating operations. 5. Who are the top players in the Industrial Heaters Market? Ans: Leading companies include Chromalox, Backer Hotwatt, Accutherm, Dragon Power Electric, and Auzhan Electric Appliances.

1. Industrial Heaters Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industrial Heaters Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Industrial Heaters Market: Dynamics 3.1. Industrial Heaters Market Trends 3.2. Industrial Heaters Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Production & Capacity Analysis 4.1. Global Industrial Heater Production by Region and Country 4.2. Manufacturing Output by Heater Type (Electric, Gas-Fired, Oil-Fired, Steam) 4.3. Installed Production Capacity vs Capacity Utilization Trends 4.4. In-house Manufacturing vs Outsourced Heater Production 4.5. Impact of Industrial Cyclicality on Heater Production Volumes 4.6. Raw Material Availability (Alloys, Heating Elements, Insulation Materials) 5. Demand Analysis 5.1. Demand Trends by Heater Type (Circulation, Duct, Immersion, Process Air, Radiant) 5.2. End-Use Industry Demand Analysis (Oil & Gas, Chemicals, Food Processing, Power, Semiconductor) 5.3. Energy Efficiency and Electrification-Driven Demand Growth 5.4. Regional Demand Outlook and Industrial Growth Hotspots 5.5. Demand from Retrofit, Replacement, and Maintenance Cycles 5.6. Substitution Threats from Alternative Heating Technologies (Heat Pumps, Waste Heat Recovery) 6. Trade Analysis (2025) 6.1. Global Import and Export Volumes of Industrial Heaters by Region 6.2. Major Exporting and Importing Countries for Industrial Heating Equipment 6.3. Trade Regulations, Industrial Standards, and Certification Requirements (IEC, UL, ATEX) 6.4. Global Trade Flow Mapping and Value Chain Shifts 6.5. Impact of Supply Chain Disruptions on Heater Availability 6.6. Role of Regional Trade Agreements and Localization Policies 7. Pricing Analysis (2025) 7.1. Pricing Benchmarks by Heater Type and Power Rating 7.2. Electric vs Fossil Fuel-Based Industrial Heater Cost Comparison 7.3. Regional Price Variations and Cost Competitiveness (2019-2024) 7.4. Impact of Customization and High-Temperature Ratings on Pricing 7.5. Price Sensitivity by End-Use Industry 7.6. Influence of Raw Material, Energy, and Logistics Costs on Final Pricing 8. Supply Chain & Manufacturing Insights 9.1. Core Inputs: Heating Elements, Steel Alloys, Control Systems, Insulation Materials 9.2. Supplier Landscape for Components and Sub-Assemblies 9.3. Manufacturing Technologies and Automation Adoption 9.4. Quality Standards, Safety Compliance, and Testing Procedures 9.5. Regional Sourcing Strategies and Localization Trends 9.6. Supply Chain Risks: Energy Prices, Material Volatility, and Lead Times 9. End-User & Buyer Insights 11.1. Buyer Segmentation by Industry Vertical and Plant Size 11.2. Procurement Criteria: Efficiency, Reliability, Compliance, and Cost of Ownership 11.3. Preference for Smart and Digitally Enabled Heating Systems 11.4. OEM vs Aftermarket Purchasing Behavior 11.5. Role of EPC Contractors and System Integrators in Buying Decisions 11.6. Customer Retention, Service Contracts, and Replacement Cycles 10. Technology & Innovation Trends 13.1. Smart Industrial Heaters with IoT and Remote Monitoring 13.2. Advanced Heating Element Materials for High-Temperature Applications 13.3. Digital Control Systems and Predictive Maintenance Technologies 13.4. Energy-Efficient and Low-Emission Heating Designs 13.5. Automation and AI in Heater Control and Process Optimization 13.6. Emerging Innovations: Hydrogen-Ready Heaters and Hybrid Heating Systems 11. Industrial Heaters Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 11.1. Industrial Heaters Market Size and Forecast, By Product (2025-2032) 11.1.1. Pipe Heater 11.1.2. Duct Heater 11.1.3. Cartridge Heater 11.1.4. Immersion Heater 11.1.5. Circulation Heater 11.2. Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 11.2.1. Low 11.2.2. Medium 11.2.3. High 11.3. Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 11.3.1. Electric-based 11.3.2. Steam-based 11.3.3. Hybrid-based 11.3.4. Fuel-based 11.4. Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.1. Direct Sales 11.4.2. Indirect Sales 11.5. Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 11.5.1. Oil & Gas 11.5.2. Chemical 11.5.3. Food & Beverage 11.5.4. Manufacturing 11.5.5. Automotive 11.5.6. Pharmaceuticals 11.5.7. Others 11.6. Industrial Heaters Market Size and Forecast, By Region (2025-2032) 11.6.1. North America 11.6.2. Europe 11.6.3. Asia Pacific 11.6.4. Middle East and Africa 11.6.5. South America 12. North America Industrial Heaters Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 12.1. North America Industrial Heaters Market Size and Forecast, By Product (2025-2032) 12.2. North America Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 12.3. North America Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 12.4. North America Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 12.5. North America Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 12.6. North America Industrial Heaters Market Size and Forecast, by Country (2025-2032) 12.6.1. United States 12.6.2. Canada 12.6.3. Mexico 13. Europe Industrial Heaters Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 13.1. Europe Industrial Heaters Market Size and Forecast, By Product (2025-2032) 13.2. Europe Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 13.3. Europe Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 13.4. Europe Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 13.5. Europe Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 13.6. Europe Industrial Heaters Market Size and Forecast, by Country (2025-2032) 13.6.1. United Kingdom 13.6.1.1. United Kingdom Industrial Heaters Market Size and Forecast, By Product (2025-2032) 13.6.1.2. United Kingdom Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 13.6.1.3. United Kingdom Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 13.6.1.4. United Kingdom Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 13.6.1.5. United Kingdom Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 13.6.2. France 13.6.3. Germany 13.6.4. Italy 13.6.5. Spain 13.6.6. Sweden 13.6.7. Russia 13.6.8. Rest of Europe 14. Asia Pacific Industrial Heaters Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 14.1. Asia Pacific Industrial Heaters Market Size and Forecast, By Product (2025-2032) 14.2. Asia Pacific Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 14.3. Asia Pacific Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 14.4. Asia Pacific Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 14.5. Asia Pacific Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 14.6. Asia Pacific Industrial Heaters Market Size and Forecast, by Country (2025-2032) 14.6.1. China 14.6.2. S Korea 14.6.3. Japan 14.6.4. India 14.6.5. Australia 14.6.6. Indonesia 14.6.7. Malaysia 14.6.8. Philippines 14.6.9. Thailand 14.6.10. Vietnam 14.6.11. Rest of Asia Pacific 15. Middle East and Africa Industrial Heaters Market Size and Forecast (by Value in USD Million and Volume in Units) (2025-2032) 15.1. Middle East and Africa Industrial Heaters Market Size and Forecast, By Product (2025-2032) 15.2. Middle East and Africa Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 15.3. Middle East and Africa Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 15.4. Middle East and Africa Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 15.5. Middle East and Africa Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 15.6. Middle East and Africa Industrial Heaters Market Size and Forecast, by Country (2025-2032) 15.6.1. South Africa 15.6.2. GCC 15.6.3. Egypt 15.6.4. Nigeria 15.6.5. Rest of ME&A 16. South America Industrial Heaters Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 16.1. South America Industrial Heaters Market Size and Forecast, By Product (2025-2032) 16.2. South America Industrial Heaters Market Size and Forecast, By Capacity (2025-2032) 16.3. South America Industrial Heaters Market Size and Forecast, By Technology (2025-2032) 16.4. South America Industrial Heaters Market Size and Forecast, By Distribution Channel (2025-2032) 16.5. South America Industrial Heaters Market Size and Forecast, By End Use Industry (2025-2032) 16.6. South America Industrial Heaters Market Size and Forecast, by Country (2025-2032) 16.6.1. Brazil 16.6.2. Argentina 16.6.3. Colombia 16.6.4. Chile 16.6.5. Rest Of South America 17. Company Profile: Key Players 17.1. Watlow 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Chromalox 17.3. NIBE Industrier 17.4. Tempco Electric Heater 17.5. Indeeco 17.6. Durex Industries 17.7. OMEGA Engineering 17.8. Tutco Heating Solutions 17.9. Heatrod Elements 17.10. Backer Hotwatt 17.11. Friedr. Freek 17.12. Wattco 17.13. Industrial Heater Corporation 17.14. Elmatic 17.15. Excel Heaters 17.16. Powrmatic 17.17. Auzhan Electric Appliances 17.18. Dragon Power Electric 17.19. Honeywell International 17.20. Siemens 17.21. Robert Bosch (Bosch Thermotechnik) 17.22. Johnson Controls 17.23. Emerson Electric 17.24. Schneider Electric 17.25. Lennox International 17.26. Thermon 17.27. Hotset 17.28. Thermal Flow Technologies 17.29. Winterwarm Heating Solutions 17.30. Ahlstrom 18. Key Findings 19. Analyst Recommendations 20. Industrial Heaters Market: Research Methodology