Hybrid Excavator Market was valued at USD 1.6 Billion in 2024, and total Global Hybrid Excavator Market revenue is expected to grow at a CAGR of 6.8 % and reach nearly USD 2.71 Billion from 2025 to 2032.Hybrid Excavator Market Overview

Hybrid Excavator Market is witnessing strong growth as construction, mining and infrastructure industries increasingly demand fuel efficient, low emission and sustainable construction machinery. Hybrid excavators, combining electric and diesel power, deliver enhanced fuel efficiency, lower operational costs and reduced carbon footprint, making them essential for modern green construction and smart infrastructure projects. Among hybrid types, medium and heavy duty excavators dominate due to their versatility, energy saving capabilities and suitability for urban construction and large scale infrastructure developments.To know about the Research Methodology :- Request Free Sample Report Asia Pacific dominated Hybrid Excavator industry, driven by China, India and Japan, where rapid urbanization, infrastructure expansion and industrial growth fuel high demand. Government initiatives promoting sustainable construction and low emission machinery further accelerate adoption. North America and Europe are also significant markets, supported by stringent emission regulations, electrification of construction equipment and growing emphasis on automation and smart machinery. The hybrid excavator market is highly competitive, with top players such as Caterpillar, Komatsu, Hitachi Construction Machinery and Volvo Construction Equipment focusing on innovative hybrid propulsion systems, telematics solutions and predictive maintenance technologies to enhance efficiency and productivity. With up to 30% higher fuel efficiency and 25% reduced CO₂ emissions, hybrid excavators are becoming the preferred choice for contractors and investors seeking sustainable, cost effective and future ready construction solutions. The sector presents significant opportunities for OEMs, construction firms and equipment investors, positioning the Hybrid Excavator Market as a strategic and technology driven segment in the global construction equipment landscape. Hybrid Technology & Emission Regulations to Drive Hybrid Excavator Market Growth Primary growth driver for the Hybrid Excavator Market is the rising demand for fuel efficient, low emission and high performance construction equipment across infrastructure, mining and urban development projects. Hybrid excavators integrate advanced diesel electric powertrains, energy recovery systems and intelligent hydraulic controls to deliver up to 25–30% fuel savings and substantial CO₂ emission reductions compared to conventional models. Features such as regenerative braking, lithium ion battery storage, smart energy management and telematics enabled monitoring enhance operational efficiency, reduce lifecycle costs and extend machine uptime. These attributes make hybrid excavators increasingly vital in meeting stringent emission standards and supporting sustainable construction practices, especially in regions like Asia Pacific, Europe and North America where environmental regulations and green construction mandates are tightening. Sustainability Mandates & Infrastructure Investment to Unlock Hybrid Excavator Market Opportunity Hybrid Excavator Market presents significant growth opportunities driven by global sustainability initiatives, carbon neutrality targets and massive infrastructure spending. Expanding investments in smart cities, renewable energy projects and sustainable transportation are accelerating adoption of hybrid construction equipment. Governments worldwide are offering incentives, subsidies and procurement support for low emission machinery, opening doors for OEMs to scale production and innovate hybrid models across multiple tonnage classes. Growing awareness of total cost of ownership (TCO) benefits, rising equipment rental demand, and retrofit potential in existing fleets are further boosting market prospects.

Hybrid Excavator Market Segment Analysis

Based on application, Residential construction segment dominated the Hybrid Excavator Market in 2024 and is expected to hold a major share by 2032. Rising urbanization, population growth, housing demand and real estate transactions are driving large scale adoption of hybrid excavators in residential projects. Factors such as increasing property prices, favorable mortgage policies, higher incomes and government housing initiatives further boost market growth. Hybrid excavators, with their fuel efficiency, low emissions and cost effective operations, align with green construction, smart city projects and ESG goals, making them vital for sustainable residential development. Based on type, hybrid excavators are categorized into wheel driven and crawler driven models. Wheel-driven hybrid excavators offer higher fuel efficiency as the engine is mechanically decoupled from the wheels, enabling operation in an optimal speed and torque range, ideal for urban construction, roadworks and material handling. In contrast, crawler driven hybrid excavators use a track based system with accumulators that store and reuse energy to power or assist the engine, delivering superior stability, traction and digging power for heavy duty mining, infrastructure, and large-scale construction projects. Both types enhance energy recovery, emission reduction and cost effectiveness, supporting the global shift toward sustainable and high performance construction equipment.Hybrid Excavator Market Regional Insights

Asia Pacific region is expected to command the largest market share of xx% by 2032, driven by rapid urbanization, smart city projects and massive infrastructure investments in China, India and Japan. China’s continued focus on transportation, energy and sustainable construction along with India’s smart city and highway expansion programs are fueling hybrid excavator adoption. Japan is advancing with IoT enabled, autonomous and green construction equipment to modernize infrastructure. Overall, APAC leads the market with strong regulatory push, demand for low emission machinery and large scale infrastructure spending, making it the fastest growing regional hub for sustainable hybrid excavators.Hybrid Excavator Market Competitive Analysis

Hybrid Excavator Market is highly competitive, led by global OEMs like Caterpillar, Komatsu, Hitachi, Volvo CE, Liebherr, Hyundai, JCB, Kobelco and SANY, along with regional players in China, India and Southeast Asia offering cost effective, application specific models. Hybrid excavator companies focus on wheel driven and crawler driven hybrids for construction, mining, urban infrastructure and smart city projects. Key strategies include R&D in hybrid powertrains, regenerative hydraulics, fuel efficient engines, IoT enabled telematics, predictive maintenance and autonomous operation. OEMs are expanding through joint ventures, rental partnerships, technology collaborations and mergers & acquisitions. Driven by urbanization, green construction, emission regulations and infrastructure modernization, market is evolving into a technology and sustainability focused sector, where fuel efficiency, carbon reduction, digitalization and after sales service are important differentiators.Hybrid Excavator Market Pricing Analysis

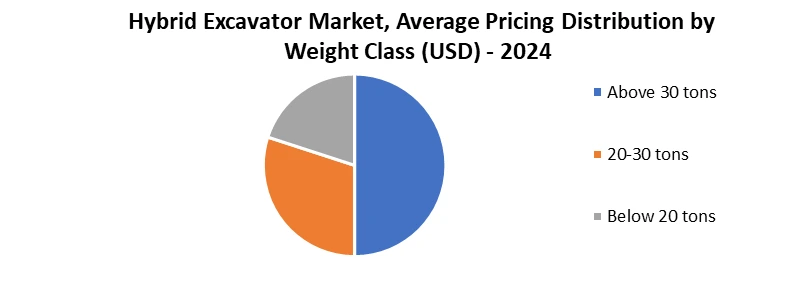

Hybrid Excavator Market Key Trends

• Hybrid & Fuel Efficient Powertrains Advancements in hybrid diesel electric and wheel or crawler driven powertrains with regenerative hydraulics and lithium ion battery integration are enhancing fuel efficiency, emission reduction and operational cost savings in construction and mining applications. • Sustainability & Green Construction Focus Stricter emission regulations, ESG compliance, carbon neutrality goals and green construction mandates are accelerating adoption of hybrid excavators as part of eco friendly and energy efficient machinery trends. • Fleet Optimization & Rental Models Growing interest from rental companies and fleet operators in hybrid excavators with low operating costs, TCO benefits and retrofit capabilities is boosting market growth, particularly in APAC and Europe.Hybrid Excavator Market Recent Developments

• On September 16, 2025, Cummins Inc. and Komatsu Ltd. announced a memorandum of understanding (MOU) to collaborate on the development of hybrid powertrains for surface haulage heavy mining equipment. This partnership aims to advance practical decarbonization solutions and support sustainability efforts in the mining industry. • On February 2025, Volvo Construction Equipment launched five new hybrid excavator models (EC260 Hybrid, EC300 Hybrid, EC370 Hybrid, EC400 Hybrid, EC500 Hybrid), claiming up to 20% better fuel efficiency and 15% CO₂ emissions reduction in heavy duty crawler applications. • On August 31, 2025, Komatsu unveiled the PC20E-6 mini electric excavator, marking a significant step forward in the electrification of construction machinery. This model is designed for a full day's work without emissions, tailored for both conventional jobsites and environments where noise and emissions must be minimized.Scope of the Global Hybrid Excavator Market :Inquire before Buying

Global Hybrid Excavator Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.6 Bn. Forecast Period 2025 to 2032 CAGR: 6.8% Market Size in 2032: USD 2.71 Bn. Segments Covered: by Type Wheel-driven Hybrid Excavators Crawler-driven Hybrid Excavators by Application Residential Construction Roads Dams Mining Others by End User Construction & Urban Development Mining & Natural Resources Public Infrastructure & Utilities Rental & Fleet Operators Hybrid Excavator Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hybrid Excavator Market, Key Players

North America 1. Caterpillar (USA) 2. Cummins Inc. (USA) 3. Dana Limited (USA) 4. Bobcat (USA) 5. Terex (USA) Europe 6. JCB (UK) 7. Volvo (Sweden) 8. Sennebogen (Germany) 9. Liebherr Group (Switzerland) 10. Mecalac (France) 11. Wacker Neuson (Germany) Asia Pacific 12. Komatsu Ltd. (Japan) 13. Hitachi Construction Machinery (Japan) 14. Kobelco Construction Machinery Co., Ltd. (Japan) 15. Takeuchi (Japan) 16. Sumitomo Heavy Industries (Japan) 17. Yanmar (Japan) 18. Hyundai Construction Equipment (South Korea) 19. Doosan (South Korea) 20. SANY (China) 21. Zoomlion (China) 22. Liugong Group (China) 23. Sunward Intelligent Equipment (China) 24. XCMG (China) 25. Kobelco (Japan)FAQs

1. Which region dominated the global Hybrid Excavator Market in 2024? Ans. Asia Pacific Region Dominated the Hybrid Excavator Market in 2024. 2. Who are the key players in the Hybrid Excavator Market? Ans: Major players include Caterpillar, Komatsu, Hitachi Construction Machinery, Volvo Construction Equipment, Liebherr, Hyundai, JCB, Kobelco, and SANY. 3. What are the latest technological trends in hybrid excavators? Ans: Key trends include hybrid diesel electric powertrains, regenerative hydraulic systems, lithium ion battery integration, IoT-based telematics and predictive maintenance for enhanced efficiency and sustainability. 4. What advantages do hybrid excavators offer over conventional models? Ans: They provide up to 30% higher fuel efficiency, 25% lower CO₂ emissions, reduced operating costs, and longer equipment life, making them a sustainable and cost-effective alternative. 5. How are emission regulations impacting the market? Ans: Stringent emission standards in Asia Pacific, Europe, and North America are driving OEMs to adopt hybrid technologies to meet environmental compliance and carbon neutrality goals.

1. Hybrid Excavator Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Hybrid Excavator Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Hybrid Excavator Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Hybrid Excavator Market: Dynamics 3.1. Hybrid Excavator Market Trends by Region 3.1.1. North America Hybrid Excavator Market Trends 3.1.2. Europe Hybrid Excavator Market Trends 3.1.3. Asia Pacific Hybrid Excavator Market Trends 3.1.4. Middle East and Africa Hybrid Excavator Market Trends 3.1.5. South America Hybrid Excavator Market Trends 3.2. Hybrid Excavator Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Hybrid Excavator Market Drivers 3.2.1.2. North America Hybrid Excavator Market Restraints 3.2.1.3. North America Hybrid Excavator Market Opportunities 3.2.1.4. North America Hybrid Excavator Market Challenges 3.2.2. Europe 3.2.2.1. Europe Hybrid Excavator Market Drivers 3.2.2.2. Europe Hybrid Excavator Market Restraints 3.2.2.3. Europe Hybrid Excavator Market Opportunities 3.2.2.4. Europe Hybrid Excavator Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Hybrid Excavator Market Drivers 3.2.3.2. Asia Pacific Hybrid Excavator Market Restraints 3.2.3.3. Asia Pacific Hybrid Excavator Market Opportunities 3.2.3.4. Asia Pacific Hybrid Excavator Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Hybrid Excavator Market Drivers 3.2.4.2. Middle East and Africa Hybrid Excavator Market Restraints 3.2.4.3. Middle East and Africa Hybrid Excavator Market Opportunities 3.2.4.4. Middle East and Africa Hybrid Excavator Market Challenges 3.2.5. South America 3.2.5.1. South America Hybrid Excavator Market Drivers 3.2.5.2. South America Hybrid Excavator Market Restraints 3.2.5.3. South America Hybrid Excavator Market Opportunities 3.2.5.4. South America Hybrid Excavator Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Hybrid Excavator Industry 3.8. Analysis of Government Schemes and Initiatives For Hybrid Excavator Industry 3.9. Hybrid Excavator Market Trade Analysis 3.10. The Global Pandemic Impact on Hybrid Excavator Market 4. Hybrid Excavator Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 4.1.1. Wheel-driven Hybrid Excavators 4.1.2. Crawler-driven Hybrid Excavators 4.2. Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 4.2.1. Residential Construction 4.2.2. Roads 4.2.3. Dams 4.2.4. Mining 4.2.5. Others 4.3. Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 4.3.1. Construction & Urban Development 4.3.2. Mining & Natural Resources 4.3.3. Public Infrastructure & Utilities 4.3.4. Rental & Fleet Operators 4.4. Hybrid Excavator Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Hybrid Excavator Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 5.1.1. Wheel-driven Hybrid Excavators 5.1.2. Crawler-driven Hybrid Excavators 5.2. North America Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 5.2.1. Residential Construction 5.2.2. Roads 5.2.3. Dams 5.2.4. Mining 5.2.5. Others 5.3. North America Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 5.3.1. Construction & Urban Development 5.3.2. Mining & Natural Resources 5.3.3. Public Infrastructure & Utilities 5.3.4. Rental & Fleet Operators 5.4. North America Hybrid Excavator Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Wheel-driven Hybrid Excavators 5.4.1.1.2. Crawler-driven Hybrid Excavators 5.4.1.2. United States Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Residential Construction 5.4.1.2.2. Roads 5.4.1.2.3. Dams 5.4.1.2.4. Mining 5.4.1.2.5. Others 5.4.1.3. United States Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Construction & Urban Development 5.4.1.3.2. Mining & Natural Resources 5.4.1.3.3. Public Infrastructure & Utilities 5.4.1.3.4. Rental & Fleet Operators 5.4.2. Canada 5.4.2.1. Canada Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Wheel-driven Hybrid Excavators 5.4.2.1.2. Crawler-driven Hybrid Excavators 5.4.2.2. Canada Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Residential Construction 5.4.2.2.2. Roads 5.4.2.2.3. Dams 5.4.2.2.4. Mining 5.4.2.2.5. Others 5.4.2.3. Canada Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Construction & Urban Development 5.4.2.3.2. Mining & Natural Resources 5.4.2.3.3. Public Infrastructure & Utilities 5.4.2.3.4. Rental & Fleet Operators 5.4.3. Mexico 5.4.3.1. Mexico Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Wheel-driven Hybrid Excavators 5.4.3.1.2. Crawler-driven Hybrid Excavators 5.4.3.2. Mexico Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Residential Construction 5.4.3.2.2. Roads 5.4.3.2.3. Dams 5.4.3.2.4. Mining 5.4.3.2.5. Others 5.4.3.3. Mexico Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Construction & Urban Development 5.4.3.3.2. Mining & Natural Resources 5.4.3.3.3. Public Infrastructure & Utilities 5.4.3.3.4. Rental & Fleet Operators 6. Europe Hybrid Excavator Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.2. Europe Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.3. Europe Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4. Europe Hybrid Excavator Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Hybrid Excavator Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific Hybrid Excavator Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Hybrid Excavator Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa Hybrid Excavator Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 9. South America Hybrid Excavator Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 9.2. South America Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 9.3. South America Hybrid Excavator Market Size and Forecast, by End User(2024-2032) 9.4. South America Hybrid Excavator Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Hybrid Excavator Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Hybrid Excavator Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Hybrid Excavator Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Caterpillar (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cummins Inc. (USA) 10.3. Dana Limited (USA) 10.4. Bobcat (USA) 10.5. Terex (USA) 10.6. JCB (UK) 10.7. Volvo (Sweden) 10.8. Sennebogen (Germany) 10.9. Liebherr Group (Switzerland) 10.10. Mecalac (France) 10.11. Wacker Neuson (Germany) 10.12. Komatsu Ltd. (Japan) 10.13. Hitachi Construction Machinery (Japan) 10.14. Kobelco Construction Machinery Co., Ltd. (Japan) 10.15. Takeuchi (Japan) 10.16. Sumitomo Heavy Industries (Japan) 10.17. Yanmar (Japan) 10.18. Hyundai Construction Equipment (South Korea) 10.19. Doosan (South Korea) 10.20. SANY (China) 10.21. Zoomlion (China) 10.22. Liugong Group (China) 10.23. Sunward Intelligent Equipment (China) 10.24. XCMG (China) 10.25. Kobelco (Japan) 11. Key Findings 12. Industry Recommendations 13. Hybrid Excavator Market: Research Methodology 14. Terms and Glossary