High Reliability Semiconductor Market was valued at US$ 2.48 Bn. in 2022. High Reliability Semiconductor Market size is estimated to grow at a CAGR of 5.7% over the forecast period.High Reliability Semiconductor Market Overview:

High-reliability semiconductors can withstand severe temperatures for an extended period. High-reliability semiconductors have applications in extreme settings due to high performance and device continuity attributes. The aerospace and defence sectors require high-level, long-term reliability solutions for their tasks. This requirement is met by high-reliability semiconductors used in avionics systems, satellites, combat vehicles, and other applications. Data converters, amplifiers, RF microwaves, and MEMS products are examples of high-reliability semiconductors. The growth of the high-reliability semiconductor industry across the globe is fuelled by MEMS products that are made to work in hazardous circumstances.To know about the Research Methodology :- Request Free Sample Report

High Reliability Semiconductor Market Dynamics:

Growing Investment in Aerospace and Defense Sector across the Globe: As a result of global geopolitical concerns, several countries are focusing on reinforcing their military bases and boosting their expenditures to do so. For example, the US Department of Defense has sought a budget allocation of US$ 718 billion in 2022, a 5% increase over the 2022 budget. The United States is also encouraging NATO members to increase their military spending to 2% of their respective GDPs. France has indicated that it will increase defense spending by roughly 40% over the next six years in order to reach NATO's goal of spending 2% of GDP on defense. According to SIPRI, the Middle East contains seven of the top ten countries with the highest military spending as a proportion of GDP. Jordan, Saudi Arabia, Lebanon, Kuwait, Bahrain, Oman, and Israel are among them. A major percentage of a country's defense budget must be allocated to systems that can operate in harsh environments. As a result, increased defense budgets are expected to drive the global high-reliability semiconductors for the aerospace and defense sector over the forecast period. Growing Number of Commercial Aircraft across the Globe: The commercial aviation industry is growing rapidly as a result of factors such as rising passenger numbers and the need to replace outmoded equipment. According to the report, due to commercial aviation businesses' order backlog, a big number of aircraft are anticipated to be constructed. These planes are built using cutting-edge fuel-efficient technologies. In addition, urbanization in emerging nations, such as India, China, and South Korea is expected to result in a 50% increase in middle-class air travelers to around 6 billion by 2030. The Asia Pacific is expected to surpass Europe and North America in terms of air traffic. The demand for aircraft parts and components is increasing as a result of the increased air traffic, which is fueling the growth of the high reliability semiconductor market.Growing Adoption of Semiconductors in the Automotive Industry:

In the automotive sector, electronic devices are becoming more prevalent, notably in self-driving cars. High-reliability components are required for the operation of these vehicles. According to the Society of Automotive Engineers International, level one automobiles are fully automated with no human involvement, and level zero cars are completely automated with no human interaction. The fully autonomous vehicles provide data to a central computer, which decides what action to take, such as braking, slowing down, or speeding up. These need the employment of high-quality components, as the car will be unable to make a decision if one of the components fails. These factor are fueling the growth of the high-reliability semiconductor market across the globe. However, due to restraints such as the high cost of complex technologies, the aerospace industry is unable to implement new technology. The most up-to-date and trustworthy technologies are more expensive, resulting in a higher price for the final product. These factors are expected to limit demand for high-reliability semiconductors during the forecast period.High Reliability Semiconductor Market Segment Analysis:

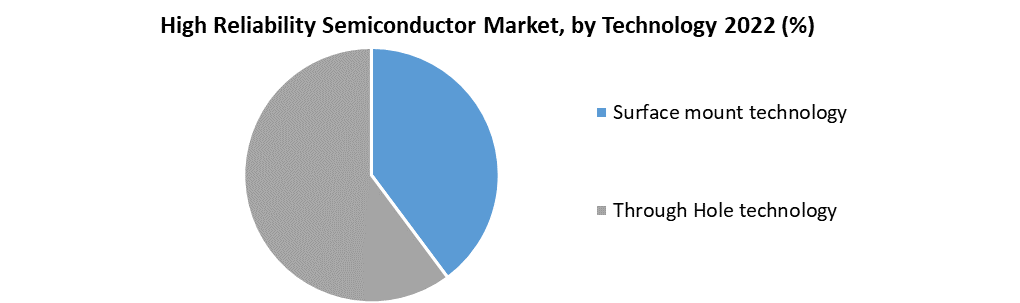

Based on the Technology, the High Reliability Semiconductor Market is segmented into Surface mount technology and Through Hole technology. The Surface mount technology segment held the largest market share accounting for 73% in 2022. Compared to traditional PCB manufacturing methods, SMT allows for more complex boards with a large number of very small and specialized parts. Components can also be stacked on both sides of the circuit board, resulting in even more utility per square inch. Due to equipment such as fully automated pick and place systems, high-volume reflow ovens, conveyors, and stencil printing machines, SMT is perfect for mass assembly of these delicate and intricate PCBs that will be used in a range of electronic devices.

High Reliability Semiconductor Market Regional Insights:

The Asia Pacific region held the largest market share accounting for 48% in 2022. The region's growth in the high-reliability semiconductors for the aerospace and military market is due to the region's manufacturers' significant expenditure in research and development. In addition, technical developments and cost effectiveness are expected to drive the high-reliability semiconductors for the market in the Asia Pacific during the forecast period. In order to ensure the robust performance of military systems, such as avionics, satellites, and combat vehicles, developing countries in the region are increasing their use of high-reliability semiconductor components. In addition, the increased use of high-reliability semiconductors in the aerospace and automotive sectors is expected to boost the market growth through the forecast period. The North America region is expected to grow significantly at a CAGR of 5.6% during the forecast period. Because of the presence of major industry players, technological advances, and the expanding use of high reliability semiconductors in various applications in the region, the high reliability semiconductor market in North America is likely to increase over the forecast period. The high-reliability semiconductor market in Europe is expected to grow at a favorable rate throughout the forecast period, thanks to increased investments by manufacturers in the region. The objective of the report is to present a comprehensive analysis of the global High Reliability Semiconductor Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the High Reliability Semiconductor Market dynamic, structure by analyzing the market segments and projecting the High Reliability Semiconductor Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the High Reliability Semiconductor Market make the report investor’s guide.High Reliability Semiconductor Market Scope: Inquiry Before Buying

High Reliability Semiconductor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 2.48 Bn. Forecast Period 2023 to 2029 CAGR: 5.7% Market Size in 2029: US$ 3.66 Bn. Segments Covered: by Technology • Surface mount technology • Through Hole technology by Application • Aerospace • Defense • Automotive • Others High Reliability Semiconductor Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)High Reliability Semiconductor Market, Key Players are:

• Digitron Semiconductors • Infineon Technologies AG • Microsemi • SEMICOA • Semtech Corporation • Skyworks Inc. • Teledyne Technologies Inc. • Time Technology Ltd. • Texas Instruments Incorporated • Vishay Intertechnology, Inc. • Microsemi Corporation • Toshiba Corporation • KCB Solutions • ROHM Group Frequently Asked Questions: 1] What segments are covered in the Global High Reliability Semiconductor Market report? Ans. The segments covered in the High Reliability Semiconductor Market report are based on Technology and Application. 2] Which region is expected to hold the highest share in the Global High Reliability Semiconductor Market? Ans. The Asia Pacific region is expected to hold the highest share in the High Reliability Semiconductor Market. 3] What is the market size of the Global High Reliability Semiconductor Market by 2029? Ans. The market size of the High Reliability Semiconductor Market by 2029 is expected to reach US$ 3.66 Bn. 4] What is the forecast period for the Global High Reliability Semiconductor Market? Ans. The forecast period for the High Reliability Semiconductor Market is 2023-2029. 5] What was the market size of the Global High Reliability Semiconductor Market in 2022? Ans. The market size of the High Reliability Semiconductor Market in 2022 was valued at US$ 2.48 Bn.

1. High Reliability Semiconductor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. High Reliability Semiconductor Market: Dynamics 2.1. High Reliability Semiconductor Market Trends by Region 2.1.1. North America High Reliability Semiconductor Market Trends 2.1.2. Europe High Reliability Semiconductor Market Trends 2.1.3. Asia Pacific High Reliability Semiconductor Market Trends 2.1.4. Middle East and Africa High Reliability Semiconductor Market Trends 2.1.5. South America High Reliability Semiconductor Market Trends 2.2. High Reliability Semiconductor Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America High Reliability Semiconductor Market Drivers 2.2.1.2. North America High Reliability Semiconductor Market Restraints 2.2.1.3. North America High Reliability Semiconductor Market Opportunities 2.2.1.4. North America High Reliability Semiconductor Market Challenges 2.2.2. Europe 2.2.2.1. Europe High Reliability Semiconductor Market Drivers 2.2.2.2. Europe High Reliability Semiconductor Market Restraints 2.2.2.3. Europe High Reliability Semiconductor Market Opportunities 2.2.2.4. Europe High Reliability Semiconductor Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific High Reliability Semiconductor Market Drivers 2.2.3.2. Asia Pacific High Reliability Semiconductor Market Restraints 2.2.3.3. Asia Pacific High Reliability Semiconductor Market Opportunities 2.2.3.4. Asia Pacific High Reliability Semiconductor Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa High Reliability Semiconductor Market Drivers 2.2.4.2. Middle East and Africa High Reliability Semiconductor Market Restraints 2.2.4.3. Middle East and Africa High Reliability Semiconductor Market Opportunities 2.2.4.4. Middle East and Africa High Reliability Semiconductor Market Challenges 2.2.5. South America 2.2.5.1. South America High Reliability Semiconductor Market Drivers 2.2.5.2. South America High Reliability Semiconductor Market Restraints 2.2.5.3. South America High Reliability Semiconductor Market Opportunities 2.2.5.4. South America High Reliability Semiconductor Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For High Reliability Semiconductor Industry 2.8. Analysis of Government Schemes and Initiatives For High Reliability Semiconductor Industry 2.9. High Reliability Semiconductor Market Trade Analysis 2.10. The Global Pandemic Impact on High Reliability Semiconductor Market 3. High Reliability Semiconductor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 3.1.1. Surface mount technology 3.1.2. Through Hole technology 3.2. High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 3.2.1. Aerospace 3.2.2. Defense 3.2.3. Automotive 3.2.4. Others 3.3. High Reliability Semiconductor Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America High Reliability Semiconductor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 4.1.1. Surface mount technology 4.1.2. Through Hole technology 4.2. North America High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 4.2.1. Aerospace 4.2.2. Defense 4.2.3. Automotive 4.2.4. Others 4.3. North America High Reliability Semiconductor Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 4.3.1.1.1. Surface mount technology 4.3.1.1.2. Through Hole technology 4.3.1.2. United States High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 4.3.1.2.1. Aerospace 4.3.1.2.2. Defense 4.3.1.2.3. Automotive 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 4.3.2.1.1. Surface mount technology 4.3.2.1.2. Through Hole technology 4.3.2.2. Canada High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 4.3.2.2.1. Aerospace 4.3.2.2.2. Defense 4.3.2.2.3. Automotive 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 4.3.3.1.1. Surface mount technology 4.3.3.1.2. Through Hole technology 4.3.3.2. Mexico High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 4.3.3.2.1. Aerospace 4.3.3.2.2. Defense 4.3.3.2.3. Automotive 4.3.3.2.4. Others 5. Europe High Reliability Semiconductor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.2. Europe High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3. Europe High Reliability Semiconductor Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.1.2. United Kingdom High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.2. France 5.3.2.1. France High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.2.2. France High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.3. Germany 5.3.3.1. Germany High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.3.2. Germany High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.4. Italy 5.3.4.1. Italy High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.4.2. Italy High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.5. Spain 5.3.5.1. Spain High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.5.2. Spain High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.6.2. Sweden High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.7. Austria 5.3.7.1. Austria High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.7.2. Austria High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 5.3.8.2. Rest of Europe High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific High Reliability Semiconductor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.2. Asia Pacific High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific High Reliability Semiconductor Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.1.2. China High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.2.2. S Korea High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.3. Japan 6.3.3.1. Japan High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.3.2. Japan High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.4. India 6.3.4.1. India High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.4.2. India High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.5. Australia 6.3.5.1. Australia High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.5.2. Australia High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.6.2. Indonesia High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.7.2. Malaysia High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.8.2. Vietnam High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.9.2. Taiwan High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 6.3.10.2. Rest of Asia Pacific High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa High Reliability Semiconductor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 7.2. Middle East and Africa High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa High Reliability Semiconductor Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 7.3.1.2. South Africa High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 7.3.2. GCC 7.3.2.1. GCC High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 7.3.2.2. GCC High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 7.3.3.2. Nigeria High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 7.3.4.2. Rest of ME&A High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 8. South America High Reliability Semiconductor Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 8.2. South America High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 8.3. South America High Reliability Semiconductor Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 8.3.1.2. Brazil High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 8.3.2.2. Argentina High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America High Reliability Semiconductor Market Size and Forecast, by Technology (2022-2029) 8.3.3.2. Rest Of South America High Reliability Semiconductor Market Size and Forecast, by Application (2022-2029) 9. Global High Reliability Semiconductor Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading High Reliability Semiconductor Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Digitron Semiconductors 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Infineon Technologies AG 10.3. Microsemi 10.4. SEMICOA 10.5. Semtech Corporation 10.6. Skyworks Inc. 10.7. Teledyne Technologies Inc. 10.8. Time Technology Ltd. 10.9. Texas Instruments Incorporated 10.10. Vishay Intertechnology, Inc. 10.11. Microsemi Corporation 10.12. Toshiba Corporation 10.13. KCB Solutions 10.14. ROHM Group 11. Key Findings 12. Industry Recommendations 13. High Reliability Semiconductor Market: Research Methodology 14. Terms and Glossary