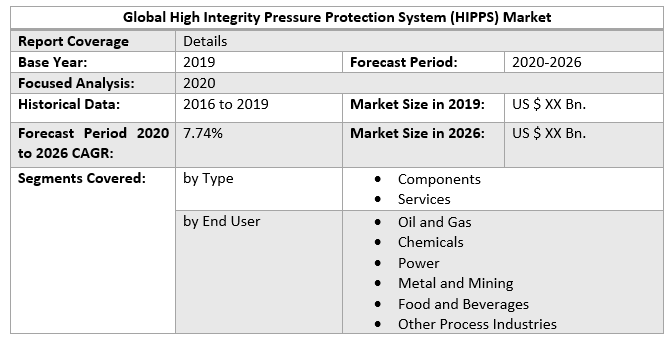

Global High Integrity Pressure Protection System (HIPPS) Market is expected to reach USD 5299. 92 million at a CAGR of 5% during the forecast period 2026.Global High Integrity Pressure Protection System (HIPPS) Market Introduction

HIPPS stands for High Integrity Pressure Protection System, and it is a safety device that prevents over-pressurization of any plant. HIPPS is intended to improve process shutdown and emergency response systems. A high-integrity pressure protection system keeps a system from exceeding its rated pressure. Before the overall design pressure is surpassed, the HIPPS shuts down the system's source of high pressure. This aids in the prevention of loss due to a line or vessel rupture, and is consequently employed in a variety of industry verticals.Global High Integrity Pressure Protection System (HIPPS) Market Dynamics

Government regulatory norms for manufacturing plant safety and security, countries around the world focusing more on gas flaring and venting reduction programs, and rising demand for reliable safety solutions for personnel and asset protection in high-pressure environments are driving demand for HIPPS. One of the major target segments for the high integrity pressure protection system (HIPPS) industry is oil and gas. The industry has seen a decreasing trend as a result of the recent outbreak, which has hampered market growth. Oil and gas have been hampered by the impacts of the COVID-19 epidemic in terms of demand. Producers have reduced capital investment and drilling plans as a result of this. The epidemic has slowed or halted the progress of several projects, causing pipelines to become blocked or delayed. Mechanical relief devices have frequently been necessary when connecting new gas production sources to a gas plant facility to protect gas production facilities or pipelines. New production sources connected to existing pipelines necessitate pipeline protection against potential overpressure, which could result in hydrocarbons being released into the atmosphere or unwanted burning of these hydrocarbons via a flaring process. The market is expected to develop as government regulatory standards to protect industrial plant safety and security rise in response to an increase in plant accidents. The market is expected to grow as government regulatory standards to protect industrial plant safety and security rise in response to an increase in plant accidents. At least six persons killed and up to 17 others were seriously injured in a boiler explosion at India's Neyveli Thermal Power Station in July 2020. This was the plant's second boiler explosion in two months. The power plant explosion in Tamil Nadu is thought to have been caused by overheating and high pressure (India). Players in the market under investigation have been concentrating on cutting-edge technology improvements in HIPPS applications. For example, High-Pressure Equipment Company (a Graco Inc. affiliate) launched a novel soft seat relief valve in December 2019 to safeguard liquid and gas tube systems from overpressure damage and failure.Global High Integrity Pressure Protection System (HIPPS) Market Segment Analysis

Components held the greatest share XX% of the HIPPS market in 2019, and this trend is projected to continue in the coming years due to its growing implementation in process industries. Pressure sensors/transmitters, logic solvers, valves, actuators, and other components such as solenoids, control panels and software, alarms, valve positioners, manifolds, and accessories make up the whole HIPPS solution. Without the use of electricity, valves are used to manage plant pressure and release a specific volume of steam or gas. When a hazardous activity is detected, valves trigger or halt the flow of any toxic fluid or external hydrocarbons (gases). Logic solvers are very adaptable, efficient, dependable, and secure, and they're also simple to set up. Many standard and safety-related applications in the process industry necessitate the use of one or more single-loop logic solvers, which provide flexibility and user-friendliness to professionals. Throughout the forecast period, the oil and gas segment is expected to grow at a CAGR of XX%. A high integrity pressure protection system is a safety-instrumented system designed to prevent over-pressurization in oil and gas production, refinery, and pipeline systems. HIPPS makes use of an oil and Gas Company’s system design and integration skills. The industry's players are concentrating on producing unique products and solutions, which might help the HIPPS market grow in the approaching years. ATV HIPPS is a subsidiary of ATV Group and ATV SpA, a key player in the oil and gas industry's subsea and topside critical service valves. Hydro pneumatic, a company that specializes in wellhead equipment and controls, was bought by the business. This could benefit from the company's expanded technological offering of HIPPS solutions. HIPPS demand is also influenced by sustainable development policies, which may lead to further deviations in industry application requirements. Determined policy initiatives in the sustainable development scenario may lead to a peak in global oil demand within the next several years. Between 2018 and 2040, the demand is expected to drop by more than 50% in advanced nations and 10% in developing nations.To know about the Research Methodology :- Request Free Sample Report

Global High Integrity Pressure Protection System (HIPPS) Market Regional Insights

Over the forecast period, the Asia-Pacific segment is expected to grow at a significant rate. The Asia-Pacific HIPPS market is expected to grow at the fastest rate during the forecast period, owing to the region's focus on developing oil and gas refining capacity as well as significant growth in the chemicals industry, with China, Japan and India being some of the region's major countries. According to the International Energy Agency, Asia remained the most important LNG destination in 2019, accounting for 70% of total LNG imports. According to the International Energy Agency, Asia-Pacific is expected to drive gas demand in the next five years, accounting for over 60% of overall consumption growth by 2024. Due to the expansion of the petroleum industry, rising living standards, and the construction of gas infrastructure, China's demand for gas increased dramatically in 2019. North America is one of the largest contributors to the global market for high-integrity pressure protection systems. The high use of high-integrity pressure protection systems in the oil and gas industry, which is being concentrated on in North America is expected to be a major driver for market expansion. Aside from this, shale gas exploration in Mexico is also expected to be a major driver for the high-integrity pressure protection system market due to its extensive uses in the oil and gas sector.Global High Integrity Pressure Protection System (HIPPS) Market Report Scope: Inquire before buying

Global High Integrity Pressure Protection System (HIPPS) Market, by Region

• North America • Europe • South America • MEA • Asia PacificGlobal High Integrity Pressure Protection System (HIPPS) Market Key Players

• Emerson Electric • Yokogawa Electric • Hima • Schneider Electric • General Electric • ABB • Rockwell Automation • Honeywell • Schlumberger • Siemens • Mokveld Valves • MOGAS • Severn Glocon Group

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global High Integrity Pressure Protection System (HIPPS) Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the High Integrity Pressure Protection System (HIPPS) Market 3.4. Geographical Snapshot of the High Integrity Pressure Protection System (HIPPS) Market, By Manufacturer share 4. Global High Integrity Pressure Protection System (HIPPS) Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global High Integrity Pressure Protection System (HIPPS) Market 5. Supply Side and Demand Side Indicators 6. Global High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast, 2019-2026 6.1. Global High Integrity Pressure Protection System (HIPPS) Market Size & Y-o-Y Growth Analysis. 7. Global High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 7.1.1. Components 7.1.2. Services 7.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 7.2.1. Oil and Gas 7.2.2. Chemicals 7.2.3. Power 7.2.4. Metal and Mining 7.2.5. Food and Beverages 7.2.6. Other Process Industries 8. Global High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 9.1.1. Components 9.1.2. Services 9.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 9.2.1. Oil and Gas 9.2.2. Chemicals 9.2.3. Power 9.2.4. Metal and Mining 9.2.5. Food and Beverages 9.2.6. Other Process Industries 10. North America High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 12. Canada High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 13. Mexico High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 14. Europe High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 15. Europe High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 17. France High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 18. Germany High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 19. Italy High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 20. Spain High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 21. Sweden High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 22. CIS Countries High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 23. Rest of Europe High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 24. Asia Pacific High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 25. Asia Pacific High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 27. India High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 28. Japan High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 29. South Korea High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 30. Australia High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 31. ASEAN High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 32. Rest of Asia Pacific High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 33. Middle East Africa High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 34. Middle East Africa High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 36. GCC Countries High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 37. Egypt High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 38. Nigeria High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 39. Rest of ME&A High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 40. South America High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 41. South America High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 43. Argentina High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 44. Rest of South America High Integrity Pressure Protection System (HIPPS) Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Type, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global High Integrity Pressure Protection System (HIPPS) Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Emerson Electric 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Yokogawa Electric 45.3.3. Hima 45.3.4. Schneider Electric 45.3.5. General Electric 45.3.6. ABB 45.3.7. Rockwell Automation 45.3.8. Honeywell 45.3.9. Schlumberger 45.3.10. Siemens 45.3.11. Mokveld Valves 45.3.12. MOGAS 45.3.13. Severn Glocon Group 45.3.14. Other Key Players 46. Primary Key Insights