The Heat Pump Market size was valued at USD 65.54 Billion in 2024 and the total Heat Pump Market size is expected to grow at a CAGR of 7.75% from 2025 to 2032, reaching nearly USD 119.08 Billion by 2032. The global heat pump industry is undergoing a structural transition, reflected in shifting installation patterns, evolving policy frameworks, and rising consumer adoption in key markets. In the United States, heat pump uptake strengthened in 2024 with approximately 4.1 million units sold, surpassing gas-furnace shipments by nearly 32%, indicating a clear pivot toward electrified heating solutions. Europe maintains a sizeable installed base estimated at 24 million units with 3.02 million units sold across 21 countries in 2023. Penetration remains particularly strong in Nordic markets, where Norway records around 632 units per 1,000 households and Finland about 524 units per 1,000 households, illustrating advanced maturity levels. These adoption rates are complemented by sustained traction in air-source, hybrid, and smart-enabled systems, supported by policy incentives and building-sector decarbonization initiatives. The recalibration period for several European heat pump markets. Heat pump sales contracted by 22%, with volumes falling to about 2.31 million units across 19 countries, driven largely by policy uncertainty, subsidy delays, and installation-capacity constraints. Germany experienced a 48% decline, while the Czech Republic experienced a sharper contraction of 64%. Conversely, the United Kingdom's resilience, with unit sales expanding by approximately 63% year-on-year, was supported by streamlined planning regulations and increased grant uptake. These dynamics signal a sector characterised by strong long-term fundamentals but short-term variability, with performance increasingly tied to regulatory stability, cost structures, consumer readiness, and the ability of heat pump manufacturers and installers to scale deployment efficiently.To know about the Research Methodology :- Request Free Sample Report

Heat Pump Market Dynamics:

The Heat Pump Market is growing rapidly as governments accelerate heating electrification, strengthen carbon-reduction mandates, and increase consumer incentives. Modern heat pumps deliver reliable performance even saving households energy annually. With annual CO₂ reductions of in home and strong regulatory backing in major economies, heat pumps are becoming the preferred replacement for oil and gas heating systems. Industrial & Commercial Efficiency Gains in Heat Pump MarketLow-Carbon Technology, Energy-Efficient HVAC & Decarbonized Buildings Lead the Heating Revolution Global policy frameworks for heat pumps are strengthening as governments accelerate the shift toward clean heating, low-carbon technology, and energy-efficient HVAC solutions. Across regions, national strategies are creating strong tailwinds for renewable heating systems, incentivizing households, commercial facilities, and industries to transition from fossil-fuel boilers to electric heat pumps. Table: Driving Factors in Heat Pump Market

In France, policy emphasis remains strong through the MaPrimeRénov’ scheme, which provides significant financial support for heat pump installations in both existing and new buildings. The French government is prioritizing heat pumps as a central tool for its Stratégie Nationale Bas-Carbone (SNBC), aiming to scale millions of installed units by 2030 to reduce dependence on gas heating which boost heat pump market. In Italy, the Superbonus 110% program has played a transformative role by reimbursing homeowners up to 110% of renovation costs when switching to heat pumps as part of energy-efficiency upgrades. Although revised in 2024, the incentive remains one of the strongest drivers of home electrification and sustainable HVAC adoption in Southern Europe. In Canada, the federal Oil-to-Heat Pump Affordability Program offers up to USD 7128.95 for households replacing oil furnaces with high-efficiency heat pumps, with additional provincial support from British Columbia, Nova Scotia, and Newfoundland. This aligns with Canada’s Net-Zero 2050 agenda and its push for decarbonized residential buildings in cold climates in heat pump market. In Japan, long-standing support for air-source and CO₂ heat pumps under its Top Runner Program and ZEB/ZEH initiatives has made the country a global leader in advanced heat-pump manufacturing and deployment. Japan targets widespread adoption of high-efficiency electric heating systems across residential and commercial sectors by 2030. In China, the government promotes heat pumps through clean-heating programs in the Northern provinces, supporting large-scale deployment in district heating, industrial processes, and rural building upgrades as part of its coal-to-clean-heating transition. Government Policy, by Country

Heat Pump Market Drivers Description Incentive / Tax Credit Support in U.S. Under the Inflation Reduction Act (IRA), homeowners installing qualified heat pumps can access tax credits and rebates to help defray upfront costs. Household Bill Savings Potential According to the U.S. Department of Energy (DOE), replacing worn-out heating equipment with the “right” heat pump can save U.S. households “hundreds of dollars or more” annually. Subsidy Level in Germany (Official Scheme) Germany’s federal funding programme (via Federal Office for Economic Affairs and Export Control BAFA) offers subsidies up to 70% of installed cost for eligible heat pumps. Policy / Carbon Price Influence in Europe Agora Energiewende, the upcoming “ETS 2” carbon-pricing regime for heating fuels, is expected to raise heating-fuel costs, thereby increasing the competitiveness of heat pumps market. Climate Emission Reduction Potential The International Energy Agency (IEA) estimates that heat pumps industry have the potential to reduce global CO₂ emissions by 500 million tonnes by 2030 equivalent to the annual emissions of all cars in Europe. Structural Barriers and Cost Constraints Impacting Heat Pump Market Growth The Heat Pump Market continues to meeting a series of structural and operational challenges that are shaping its near-term expansion trajectory. A primary barrier remains the high upfront capital cost, particularly for air-to-water and ground-source technologies, which require substantial installation work, system integration, and in some cases, electrical panel upgrades. This cost sensitivity is more pronounced in regions where subsidy intensity has weakened or policy frameworks have shifted, resulting in slower consumer adoption despite long-term efficiency gains. A major challenge is the persistent shortage of certified installers and technicians, which has created execution bottlenecks across Europe, North America, and parts of APAC. Limited workforce capacity has extended installation timelines, raised labour costs, and constrained the industry’s ability to scale in line with national decarbonisation targets. In addition, heat pump performance remains climate-dependent, with efficiency drops in extremely cold regions necessitating auxiliary heating systems. While cold-climate models have advanced, variability in real-world performance continues to influence market perceptions. The sector is affected by policy volatility, supply chain disruptions, and inflationary pressures, which have increased equipment prices and reduced affordability. Moreover, widespread adoption is expected to place additional strain on electrical grids, requiring grid reinforcement and smart-load management to maintain system stability.

Heat Pump Market Segment Analysis:

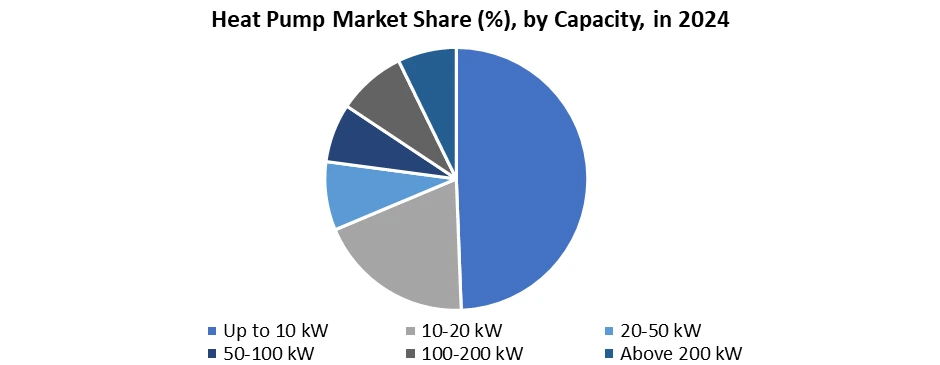

Based on Product Type, the Heat Pump Market is segmented into Air-to-Air Heat Pumps, Air-to-Water Heat Pumps, Water Source Heat Pumps, Ground Source Heat Pumps, Hybrid Heat Pumps, and Others. Among these, the Air-to-Air Heat Pump segment dominated the market in 2024 and is projected to maintain its leadership throughout the forecast period. Globally, over 42 million Air-to-Air units were installed in 2024, driven by rapid adoption in the U.S., Japan, China, and Northern Europe where dual heating–cooling capability is a major advantage. The segment’s strength comes from its lower installation cost, high energy efficiency, and suitability for both new buildings and retrofits. Rising demand for energy-efficient HVAC systems, along with increased consumer preference for all-electric homes, continues to accelerate the penetration of Air-to-Air heat pumps. Meanwhile, Air-to-Water Heat Pumps are gaining strong traction in Europe and parts of Asia due to government-led clean-heating programs. They accounted for nearly 28% of total heat pump installations in 2024, particularly supported by hydronic heating systems and high-performance buildings. Ground Source Heat Pumps are expanding steadily in regions with stable geology and cold climates, supported by long-term energy savings and high SCOP values. Hybrid Heat Pumps, combining electric and gas systems, are attracting attention in markets transitioning to electrification but still reliant on gas grids. This category is expected to see the fastest adoption in legacy-building retrofits between 2025 and 2032. Based on Capacity, the heat pump market is segmented into Up to 10 kW, 10–20 kW, 20–50 kW, 50–100 kW, 100–200 kW, and Above 200 kW. The Up to 10 kW segment dominated the market in 2024, owing to its extensive use in residential buildings and small commercial spaces. Globally, more than 18 million small-capacity heat pumps were sold in 2024, supported by rising installations in apartments, single-family homes, and small offices. The 10–20 kW segment is growing rapidly due to increased adoption in mid-sized residential complexes and light commercial buildings, representing approximately 25% of total heat pump installations. Larger capacities such as 50–100 kW and 100–200 kW are gaining demand in commercial facilities, district heating networks, hotels, hospitals, and educational institutions, particularly in Europe and East Asia. Systems Above 200 kW, though niche, are witnessing strong momentum in industrial process heat, warehouses, food-processing units, and commercial complexes, where heat pumps are increasingly replacing conventional boilers. This trend is reinforced by the push for industrial electrification, rising energy costs, and growing preference for high-temperature heat pumps (90°C–160°C) in manufacturing environments.

Heat Pump Market Regional Analysis:

Europe is expected to witness rapid expansion throughout the forecast period, supported by its strong clean-energy transition policies and rising adoption of low-carbon heating technologies in 2024. Global organizations such as the International Energy Agency (IEA) and the UN Intergovernmental Panel on Climate Change (IPCC) identify heat pumps as the most scalable energy-efficient HVAC solution capable of achieving net-zero emissions in the building sector. Increasing consumer concerns over high fossil-fuel prices, combined with the Russia–Ukraine conflict, have accelerated Europe’s shift from gas dependency to renewable heating systems. After a period of slow adoption, heat pumps in Europe achieved record growth in 2022, mirroring the surge seen in electric vehicles. The European heat pump market expanded by 34% in 2022, surpassing 2 million units sold in a single year. Poland and Italy recorded exceptional increases of 70% and 60%, driven by government subsidies, higher awareness of clean-heating technologies, and the need for resilient, future-proof energy systems. In the Asia-Pacific region, the heat pump market dominated global demand in 2022 and is expected to sustain its leadership. Growth is fueled by the rising need for energy-efficient heating and cooling, rapid urbanization, and strong climate-change commitments. China, in particular, experienced a robust rebound in 2022 with sales reaching 2.19 million units, supported by the government’s clean-heating programs and industrial electrification initiatives.Heat Pump Market Competitive Landscape

The global heat pump market features intense competition due to the presence of major players such as Trane Inc., Midea Group, Panasonic Corporation, Mitsubishi Electric Corporation, and Daikin Industries Ltd. Manufacturers are significantly expanding production capacities to meet rising demand for high-efficiency heat pumps, natural-refrigerant systems, and smart HVAC technologies. New factories have been announced in regions like Turkey and Poland, while Western Europe is witnessing rapid investments in air-to-water and natural refrigerant heat pump manufacturing. Governments, particularly in Germany, are urging companies to scale up production to support national clean-heating goals. Innovation-driven companies are adopting new models, including heat-pump-as-a-service, already deployed in Estonia, Germany, and parts of Northern Europe. Leading brands are leveraging mergers, acquisitions, and R&D investments to widen their competitive edge. For example, Viessmann introduced the Vitocal 250-AH and Vitocal 250-SH hybrid heat pumps, enabling homeowners to reduce carbon emissions while maintaining compatibility with gas or oil heating systems.Recent Development:

• On 18 March 2025, Daikin highlighted at the ISH 25 trade event its strategic refrigerant roadmap and commitment to Europe’s heating-sector decarbonisation. The company showcased its new “Altherma 4” residential heat pump generation and a CO₂ (R-744) VRV commercial system, both designed to support the transition away from fossil-fuel heating. Daikin reaffirmed its long-term heat pump market growth projection of ~250% by 2030 and underscored its role in delivering low-carbon technology solutions across residential, commercial and industrial applications. The announcement signals Daikin’s heightened focus on natural-refrigerant systems and sustainable HVAC solutions. • On 19 November 2024, Trane unveiled its new “CITY™ RTSF HT” high-temperature water-to-water heat pump system capable of delivering up to 110 °C hot water, aimed at replacing fossil-fuel boilers in industrial and commercial processes. The product leverages proprietary screw-compressor technology and ultra-low-GWP refrigerant R-1233zd(E), achieving a COP of up to 4.6. With a compact footprint and broad geographic scope (EMEA, Australia, New Zealand), this launch positions Trane as a leader in decarbonising process-heat applications and demonstrates momentum in the high-temperature heat pump market segment. • In 2024, Midea Group accelerated its global heat pump export strategy, substantially increasing shipments of air-to-water systems into the European Heat Pump Market to support regional electrification and building-retrofit initiatives. At the same time, the Chinese manufacturer introduced a new range of smart-AI enabled residential heat pumps incorporating advanced monitoring and controls to optimise energy efficiency. These updates strengthen Midea’s competitive position in both mature and emerging markets, as demand for energy-efficient heating solutions and low-carbon HVAC systems continues to rise.Heat Pump Market Scope: Inquire before buying

Global Heat Pump Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 65.54 Bn. Forecast Period 2025 to 2032 CAGR: 7.75% Market Size in 2032: USD 119.08 Bn. Segments Covered: by Type Air-to-Air Heat Pump Air-to-Water Heat Pump Water Source Heat Pump Ground Source Heat Pump Hybrid Heat Pump Others by Capacity Up to 10 kW 10-20 kW 20-50 kW 50-100 kW 100-200 kW Above 200 kW by Operation Type Electric Hybrid by End-User Residential Commercial Industrial Heat Pump Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Heat Pump Market, Key Players are:

The Competitive Strategy in Heat Pump Industry competitive landscape dominated by leading manufacturing companies such as Rheem, Emerson Electric Co, and Daikin. These firms leverage strategic initiatives, including innovation in energy efficiency and smart technology integration, to strengthen their market position. Emerging players are also gaining traction by focusing on sustainable solutions and competitive pricing. The competitive strategy in this industry emphasizes partnerships and collaborations to enhance product offerings. As the demand for energy-efficient heating solutions grows, both established companies and new entrants are adapting to market trends to maintain their competitive edge. 1. Rheem 2. Emerson Electric Co 3. Lennox International 4. Carrier 5. Stiebel Eltron 6. GEA Group 7. Viessmann 8. NIBE 9. Glen Dimplex 10. Johnson Controls 11. Trane Technologies 12. Danfoss 13. Midea 14. Samsung(South Korea) 15. Gaungzhou Sprsun New Energy Technology Development Co. Limited 16. Panasonic 17. Grundfos 18. Daikin 19. Hitachi 20. Mitsubishi Electric Corporation 21. Fujitsu General 22. LG Electronics 23. Thermax Limited 24. Vaillant Group 25. Ariston Thermo Group 26. Others Key PlayersFAQs:

1. What was the Global Heat Pump Market size in 2024? Ans. The Global Heat Pump Market size was USD 65.54 Billion in 2024. 2. What is the major drivers for the Heat Pump market? Ans. The significance of heat pump technology to reducing carbon footprint and government regulations and incentives to improve energy efficiency are the factors propelling the growth of the heat pump industry. 3. What is the growth rate of the Heat Pump Market? Ans. The heat Pump Market is growing at a CAGR of 7.75% over forecast the period. 4. What is the market size of the Heat Pump Market by 2032? Ans. The market size of the Heat Pump Market by 2032 is expected to reach at 119.08 Bn. 5. What is the forecast period for the Heat Pump Market? Ans. The forecast period for the heat pump Market is 2025-2032.

1. Heat Pump Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units) - By Segments, Regions, and Country 2. Heat Pump Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Integration Capabilities 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Heat Pump Market: Dynamics 3.1. Heat Pump MarketTrends 3.2. Heat Pump MarketDynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Heat Pump Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Statistical & Market Insights on Heat Pumps 4.1. Global heat pump installation and sales trends (2019–2024) 4.2. Installed base and annual additions by region (Europe, North America, APAC, Rest of World) 4.3. Heat pump demand by type (Air-to-Air, Air-to-Water, Ground Source, Water Source, Hybrid) 4.4. Penetration rates by building type (new build vs retrofit; residential vs commercial) 4.5. Energy savings and CO₂ reduction metrics vs conventional heating systems 5. Heat Pump Supply Chain, Components & Technology Dynamics 5.1. Key component landscape: compressors, heat exchangers, controls, refrigerants 5.2. Global manufacturing footprint and capacity expansions (Europe, APAC, North America) 5.3. Technology comparison: air-source, ground-source, water-source, hybrid & cold-climate heat pumps 5.4. Natural and low-GWP refrigerant adoption (R290, CO₂, R32, etc.) 5.5. Smart, connected & grid-interactive heat pumps (demand response, building automation) 6. Regulatory, Policy & Sustainability Landscape (2019–2024) 6.1. Government incentives and subsidies for heat pumps (EU, US, UK, China, others) 6.2. Building codes, minimum efficiency standards & fossil boiler phase-out policies 6.3. Role of heat pumps in national decarbonisation roadmaps & net-zero targets 6.4. Carbon pricing, ETS/ETS2, and their impact on heat pump competitiveness 6.5. Sustainability considerations: refrigerant regulation, lifecycle emissions, eco-design 7. Heat Pump Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 7.1. Heat Pump Market Size and Forecast, By Type (2024-2032) 7.1.1.1. Air-to-Air Heat Pump 7.1.1.2. Air-to-Water Heat Pump 7.1.1.3. Water Source Heat Pump 7.1.1.4. Ground Source Heat Pump 7.1.1.5. Hybrid Heat Pump 7.1.1.6. Others 7.2. Heat Pump Market Size and Forecast, By Capacity(2024-2032) 7.2.1.1. Up to 10 kW 7.2.1.2. 10-20 kW 7.2.1.3. 20-50 kW 7.2.1.4. 50-100 kW 7.2.1.5. 100-200 kW 7.2.1.6. Above 200 kW 7.3. Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 7.3.1.1. Electric 7.3.1.2. Hybrid 7.4. Heat Pump Market Size and Forecast, By End-User (2024-2032) 7.4.1.1. Residential 7.4.1.2. Commercial 7.4.1.3. Industrial 7.5. Heat Pump Market Size and Forecast, By Region (2024-2032) 7.5.1. North America 7.5.2. Europe 7.5.3. Asia Pacific 7.5.4. Middle East and Africa 7.5.5. South America 8. North America Heat Pump Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 8.1. North America Heat Pump Market Size and Forecast, By Type (2024-2032) 8.1.1.1. Air-to-Air Heat Pump 8.1.1.2. Air-to-Water Heat Pump 8.1.1.3. Water Source Heat Pump 8.1.1.4. Ground Source Heat Pump 8.1.1.5. Hybrid Heat Pump 8.1.1.6. Others 8.2. North America Heat Pump Market Size and Forecast, By Capacity(2024-2032) 8.2.1.1. Up to 10 kW 8.2.1.2. 10-20 kW 8.2.1.3. 20-50 kW 8.2.1.4. 50-100 kW 8.2.1.5. 100-200 kW 8.2.1.6. Above 200 kW 8.3. North America Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 8.3.1.1. Electric 8.3.1.2. Hybrid 8.4. North America Heat Pump Market Size and Forecast, By End-User (2024-2032) 8.4.1.1. Residential 8.4.1.2. Commercial 8.4.1.3. Industrial 8.5. North America Heat Pump Market Size and Forecast, by Country (2024-2032) 8.5.1.1. United States 8.5.1.2. Canada 8.5.1.3. Mexico 9. Europe Heat Pump Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 9.1. Europe Heat Pump Market Size and Forecast, By Type (2024-2032) 9.2. Europe Heat Pump Market Size and Forecast, By Capacity (2024-2032) 9.3. Europe Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 9.4. Europe Heat Pump Market Size and Forecast, By End-User (2024-2032) 9.5. Europe Heat Pump Market Size and Forecast, By Country (2024-2032) 9.5.1. United Kingdom 9.5.2. France 9.5.3. Germany 9.5.4. Italy 9.5.5. Spain 9.5.6. Sweden 9.5.7. Russia 9.5.8. Rest of Europe 10. Asia Pacific Heat Pump Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 10.1. Asia Pacific Heat Pump Market Size and Forecast, By Type (2024-2032) 10.2. Asia Pacific Heat Pump Market Size and Forecast, By Capacity (2024-2032) 10.3. Asia Pacific Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 10.4. Asia Pacific Heat Pump Market Size and Forecast, By End-User (2024-2032) 10.5. Asia Pacific Heat Pump Market Size and Forecast, by Country (2024-2032) 10.5.1. China 10.5.2. S Korea 10.5.3. Japan 10.5.4. India 10.5.5. Australia 10.5.6. Indonesia 10.5.7. Malaysia 10.5.8. Philippines 10.5.9. Thailand 10.5.10. Vietnam 10.5.11. Rest of Asia Pacific 11. Middle East and Africa Heat Pump Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. Middle East and Africa Heat Pump Market Size and Forecast, By Type (2024-2032) 11.2. Middle East and Africa Heat Pump Market Size and Forecast, By Capacity (2024-2032) 11.3. Middle East and Africa Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 11.4. Middle East and Africa Heat Pump Market Size and Forecast, By End-User (2024-2032) 11.5. Middle East and Africa Heat Pump Market Size and Forecast, By Country (2024-2032) 11.5.1. South Africa 11.5.2. GCC 11.5.3. Nigeria 11.5.4. Rest of ME&A 12. South America Heat Pump Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 12.1. South America Heat Pump Market Size and Forecast, By Type (2024-2032) 12.2. South America Heat Pump Market Size and Forecast, By Capacity (2024-2032) 12.3. South America Heat Pump Market Size and Forecast, By Operation Type (2024-2032) 12.4. South America Heat Pump Market Size and Forecast, By End-User (2024-2032) 12.5. South America Heat Pump Market Size and Forecast, By Country (2024-2032) 12.5.1. Brazil 12.5.2. Argentina 12.5.3. Colombia 12.5.4. Chile 12.5.5. Rest of South America 13. Company Profile: Key Players 13.1. Rheem 13.1.1. Company Overview 13.1.2. Business Portfolio 13.1.3. Financial Overview 13.1.4. SWOT Analysis 13.1.5. Strategic Analysis 13.2. Emerson Electric Co 13.3. Lennox International 13.4. Carrier 13.5. Stiebel Eltron 13.6. GEA Group 13.7. Vissemann 13.8. NIBE 13.9. Glen Dimplex 13.10. Johnson Control 13.11. Trane Technologies 13.12. Danfoss 13.13. Midea 13.14. Samsung(South Korea) 13.15. Gaungzhou Sprsun New Energy Technology Development Co. Limited 13.16. Panasonic 13.17. Grundfos 13.18. Daikin 13.19. Hitachi 13.20. Mitsubishi Electric Corporation 13.21. Fujitsu General 13.22. LG Electronics 13.23. Thermax Limited 13.24. Vaillant Group 13.25. Ariston Thermo Group 13.26. Others 14. Key Findings 15. Analyst Recommendations 16. Heat Pump Market– Research Methodology