The Hardware Load Balancer Devices Market size was valued at USD 3.9 billion in 2024, and the Hardware Load Balancer Device market revenue is projected to grow at a CAGR of 7.5% from 2025 to 2032, reaching USD 6.96 billion by 2032.The Hardware Load Balancer Devices Market Overview

A hardware load balancer is a network device that efficiently distributes incoming traffic across multiple servers to ensure applications run smoothly, reliably, and without interruptions. It helps organizations maintain high performance, reduce downtime, and optimize resource usage, making it essential for sectors like banking, healthcare, e-commerce, telecom, and cloud computing, where uninterrupted services and low latency are crucial.To know about the Research Methodology:- Request Free Sample Report The global hardware load balancer market has been expanding steadily due to the growing need for secure, scalable, and high-performing network infrastructure. Increasing internet traffic, data-intensive applications, and cloud adoption are driving organizations to implement robust traffic management solutions. Modern devices provide advanced features, including application-aware traffic routing, SSL offloading, integrated security, and real-time analytics. These functionalities allow companies to improve application performance, minimize maintenance-related downtime, and manage IT resources efficiently. Regionally, North America led the hardware load balancer devices market, fuelled by large-scale enterprise IT modernization, strong cloud adoption, and increasing focus on cybersecurity. Europe is the second-largest market, driven by regulatory compliance requirements such as GDPR and rising concerns about data privacy and trusted IT infrastructure. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market. Rapid digitalization, adoption of 5G, and growth in e-commerce and fintech services in countries like China, India, and Japan are boosting demand for high-performance load balancers. Leading companies in the market include F5 Networks, A10 Networks, and Citrix Systems, which continue to innovate with devices that combine reliability, security, and intelligent traffic management. Overall, the hardware load balancer market is poised for strong growth, supported by ongoing digital transformation and the increasing demand for uninterrupted, efficient, and secure application delivery.

Hardware Load Balancer Devices Market Dynamics

Rising demand for high-performance networking to Create Growth in the Hardware Load Balancer Device Market One of the primary drivers propelling the growth of the hardware load balancer market is the increasing reliance on seamless digital connectivity and uninterrupted application performance across industries. Hardware load balancers ensure optimized traffic distribution, reduced latency, and improved scalability for data centers, cloud platforms, and enterprise networks. The surge in e-commerce, online banking, video streaming, and remote working has accelerated the adoption of these devices for maintaining reliable user experiences. Additionally, the rising deployment of 5G networks, IoT devices, and edge computing infrastructure requires robust traffic management solutions, further fueling market expansion. Continuous innovation in load balancing hardware, with integration of advanced security features, encryption, and AI-driven traffic analytics, enhances efficiency and resilience, thereby strengthening growth prospects. High deployment costs and cloud-native alternatives to restrain the Hardware Load Balancer Device Market High upfront investment and operational costs associated with hardware-based load balancers act as a key restraint, especially for SMEs with limited IT budgets. The installation and maintenance of these devices often require skilled IT personnel and dedicated infrastructure, adding to the total cost of ownership. Furthermore, the growing shift toward software-defined and cloud-native load balancing solutions is challenging the demand for traditional hardware devices. Issues such as hardware scalability limitations, energy consumption, and system downtime during upgrades also hinder market adoption. In fast-evolving industries with dynamic workloads, organizations often opt for virtual or hybrid load balancing tools that offer flexibility and lower upfront costs. Supply chain disruptions and semiconductor shortages may further impact the affordability and availability of advanced hardware units. Growing Digital Transformation and Integration of Advanced Security Features to Create Market Opportunity The rising trend of digital transformation across enterprises, government, and telecom sectors is creating significant opportunities for hardware load balancer manufacturers. As hybrid and multi-cloud environments expand, organizations are seeking advanced traffic management solutions that deliver both performance and security. Integration of features such as SSL offloading, intrusion prevention, DDoS protection, and AI-based traffic monitoring presents a strong growth avenue. The proliferation of edge data centers and 5G infrastructure in emerging economies further boosts market demand. Moreover, industries such as BFSI, healthcare, and e-commerce are investing heavily in reliable networking equipment to ensure compliance, safeguard sensitive data, and support mission-critical applications. Increasing focus on energy-efficient designs and modular hardware architectures will provide scalable, future-ready solutions, opening new opportunities for market players.Hardware Load Balancer Devices Market Segment Analysis

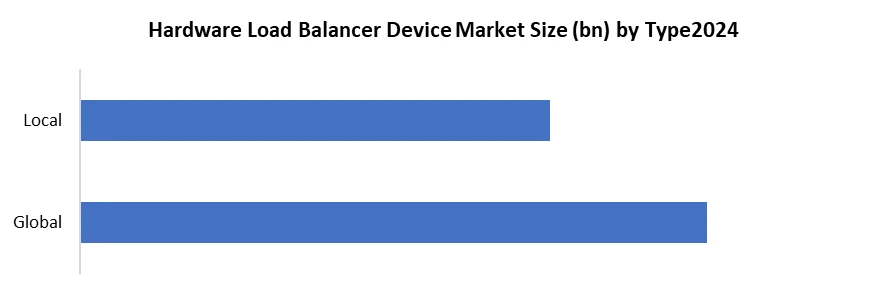

By Type, the hardware load balancer market is divided into Global and Local solutions, with the global segment holding dominance. Global load balancers are widely adopted as they enable enterprises to manage and distribute traffic across multiple geographically dispersed data centres, ensuring low latency, seamless scalability, disaster recovery, and business continuity. Their importance has increased with the rising adoption of cloud-based services, SaaS applications, and multi-cloud environments, particularly among large enterprises operating internationally. On the other hand, local load balancers play a vital role within single data centers or regional setups by distributing traffic efficiently among servers in one location. They are cost-effective and preferred by small and medium enterprises (SMEs) or organizations with localized IT infrastructure, especially in sectors with region-specific operations such as government and local service providers. While local load balancers continue to find relevance in budget-sensitive or confined environments, the global load balancer segment dominates overall due to its ability to meet the growing demand for high availability, global traffic management, and performance optimization in distributed networks.

Hardware Load Balancer Devices Market Regional Insights

The North American region held dominance in the hardware load balancer device market in 2024, contributing the largest revenue share globally. This leadership stems from the region’s strong presence of hyperscale data centres operated by tech giants like AWS, Microsoft Azure, and Google Cloud. Enterprises across industries such as BFSI, healthcare, government, and telecom rely heavily on hardware load balancers to ensure low latency and secure traffic distribution. The region’s rapid adoption of hybrid and multi-cloud architectures has also fuelled consistent demand for advanced ADC appliances. North America is further characterized by early adoption of zero-trust security frameworks, making integrated load balancing and security features essential. Hardware load balancers are favoured for handling ultra-high throughput and mission-critical workloads such as financial transactions and large e-commerce platforms. Stringent data protection and compliance regulations drive enterprises to maintain robust on-prem and private data centre infrastructures. Vendors like F5 Networks, A10 Networks, Radware, and NetScaler hold strong market positions in this geography. The U.S. leads the region due to its massive IT spending and innovation-driven enterprises. Overall, a mature digital ecosystem, security focus, and large-scale cloud expansion firmly establish North America as the dominant region in the global market.Hardware Load Balancer Devices Market Competitive Landscape

The North America hardware load balancer device market is led by two strong players, including F5 Networks and A10 Networks, each holding a distinct competitive position. F5 Networks stands as the clear market leader, commanding the largest share with its advanced hardware-based application delivery and load balancing solutions. Its BIG-IP platform is highly recognized for delivering ultra-low latency, high throughput, and integrated security capabilities such as web application firewall (WAF), DDoS mitigation, and TLS 1.3 offload. The company has built strong relationships with major enterprises in the BFSI, telecom, government, and healthcare sectors that demand mission-critical uptime and compliance. What sets F5 apart is its ability to support hybrid and multi-cloud deployment models while maintaining programmability and flexibility through iRules and automation tools. F5 continues to strengthen its competitive edge by investing in AI-driven traffic management, zero-trust integration, and SaaS-based ADC offerings, making it the preferred choice for enterprises with large-scale and complex workloads. A10 Networks has established itself as a strong challenger, particularly in telecom and large enterprise segments. It’s hardware load balancers are optimized for 5G core networks, carrier-grade NAT, and API protection, catering to high-concurrency environments where performance and efficiency are critical. A10 differentiates itself through cost-effective, energy-efficient appliances that integrate SSL inspection and advanced DDoS protection, making them attractive for service providers and enterprises modernizing their infrastructure. Unlike F5’s broad enterprise dominance, A10’s competitive strength lies in its focus on telecom operators and ISPs, where the demand for scalable, automation-ready solutions continues to rise with the expansion of 5G and data traffic growth. By combining affordability, performance, and security, A10 positions itself as a nimble alternative to larger players, appealing to customers looking for specialized, high-performance solutions. Key Development in the Market • In February 2024, IBM introduced the NS1 Connect Global Server Load Balancer, aiming to revolutionize traditional load balancing by offering improved traffic distribution and application performance across global networks. • In July 2024, Hewlett Packard Enterprise's Ezmeral division partnered with Loadbalancer.org to enhance the performance and reliability of HPE Ezmeral Data Fabric Software. This collaboration aims to optimize storage capabilities and improve user experience by integrating robust load-balancing solutions. • In March 2024, the United States – F5 Networks enhanced its hardware load balancer portfolio by integrating advanced security features such as a built-in web application firewall (WAF) and DDoS mitigation. This positioned its devices as not only traffic distribution solutions but also as comprehensive application delivery and security platforms, addressing the rising need for secure infrastructures in hybrid and multi-cloud environments.Key Trends of the Market

• Integration of AI and Machine Learning for Intelligent Traffic Management Hardware load balancers are increasingly being equipped with AI-driven analytics and ML algorithms to predict traffic spikes, detect anomalies, and automatically optimize routing decisions. This trend is enabling enterprises to improve application performance, enhance user experience, and reduce downtime. AI-powered load balancers are particularly being adopted in sectors like BFSI, e-commerce, and telecom where latency and uptime are critical. • Rising Adoption of Hybrid and Multi-Cloud Deployments As businesses migrate workloads to hybrid and multi-cloud environments, the demand for hardware load balancers that support seamless connectivity across on-premises data centers and cloud platforms is growing. Vendors are developing solutions that offer unified control, cross-cloud visibility, and enhanced security features, ensuring consistent performance and compliance across distributed infrastructures.Hardware Load Balancer Devices Market Scope: Inquire before buying

Global Hardware Load Balancer Devices Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.9 Bn. Forecast Period 2025 to 2032 CAGR: 7.5% Market Size in 2032: USD 6.96 Bn. Segments Covered: by Component Hardware Software Services by Type Global Local by Organization Size SME Large Enterprise by Verticals BFSI IT and Telecom Government Retail Energy Hardware Load Balancer Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South AmericaHardware Load Balancer Devices Market: Key Players are

North America 1. F5 Networks — Seattle, Washington, USA 2. A10 Networks — San Jose, California, USA 3. Citrix (NetScaler / Citrix ADC) — Fort Lauderdale, Florida, USA 4. Kemp (LoadMaster / Progress-owned) — Burlington, Massachusetts, USA 5. Barracuda Networks — Campbell, California, USA Europe 1. Radware — Tel Aviv, Israel (strong EMEA vendor, often grouped with Europe) 2. NGINX — Moscow 3. Loadbalancer.org — Portsmouth, United Kingdom 4. Zevenet — Seville, Spain 5. HAProxy Technologies — Paris, France Asia-Pacific 1. Huawei Technologies — Shenzhen, China 2. Array Networks — Milpitas, US 3. Sangfor Technologies — Shenzhen, China 4. Hillstone Networks — Beijing, China 5. SITONet / Beijing TongTech — Beijing, ChinaFrequently Asked Questions:

1. Which region has the largest share in the Global Hardware Load Balancer Devices Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Market? Ans: The Global Market is growing at a CAGR of 7.5% during the forecasting period 2024-2032. 3. What is the scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Hardware Load Balancer Devices market? Ans: The important key players in the Global Market are – Kemp Technologies, F5 Networks, Inc., A10 Networks, Fortinet, Barracuda Networks, Inc., Radware, Zevenet. 5. What is the study period of this market? Ans: The Global Hardware Load Balancer Devices Market is studied from 2024 to 2032.

1. Hardware Load Balancer Device Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Hardware Load Balancer Device Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. VerticalsSegment 2.2.5. Revenue (2024) 2.2.6. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Hardware Load Balancer Device Market: Dynamics 3.1. Hardware Load Balancer Device Market Trends 3.2. Hardware Load Balancer Device Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Hardware Load Balancer Device Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 4.2.1. Global 4.2.2. Local 4.3. Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 4.3.1. SME 4.3.2. Large Enterprise 4.4. Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 4.4.1. BFSI 4.4.2. IT and Telecom 4.4.3. Government 4.4.4. Retail 4.4.5. Energy 4.5. Hardware Load Balancer Device Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Hardware Load Balancer Device Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.1.3. Services 5.2. North America Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 5.2.1. Global 5.2.2. Local 5.3. North America Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 5.3.1. SME 5.3.2. Large Enterprise 5.4. North America Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 5.4.1. BFSI 5.4.2. IT and Telecom 5.4.3. Government 5.4.4. Retail 5.4.5. Energy 5.5. North America Hardware Load Balancer Device Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 5.5.1.1.1. Hardware 5.5.1.1.2. Software 5.5.1.1.3. Service 5.5.1.2. United States Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 5.5.1.2.1. Global 5.5.1.2.2. Local 5.5.1.3. United States Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 5.5.1.3.1. SME 5.5.1.3.2. Large Enterprise 5.5.1.4. United States Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 5.5.1.4.1. BFSI 5.5.1.4.2. IT and Telecom 5.5.1.4.3. Government 5.5.1.4.4. Retail 5.5.1.4.5. Energy 5.5.2. Canada 5.5.2.1. Canada Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 5.5.2.1.1. Hardware 5.5.2.1.2. Software 5.5.2.1.3. Services 5.5.2.2. Canada Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 5.5.2.2.1. Global 5.5.2.2.2. Local 5.5.2.3. Canada Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 5.5.2.3.1. SME 5.5.2.3.2. Large Enterprise 5.5.2.4. Canada Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 5.5.2.4.1. BFSI 5.5.2.4.2. IT and Telecom 5.5.2.4.3. Government 5.5.2.4.4. Retail 5.5.2.4.5. Energy 5.5.3. Mexico 5.5.3.1. Mexico Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 5.5.3.1.1. Hardware 5.5.3.1.2. Software 5.5.3.1.3. Services 5.5.3.2. Mexico Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 5.5.3.2.1. Global 5.5.3.2.2. Local 5.5.3.2.3. Others 5.5.3.3. Mexico Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 5.5.3.3.1. SME 5.5.3.3.2. Large Enterprise 5.5.3.4. Mexico Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 5.5.3.4.1. BFSI 5.5.3.4.2. IT and Telecom 5.5.3.4.3. Government 5.5.3.4.4. Retail 5.5.3.4.5. Energy 6. Europe Hardware Load Balancer Device Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.2. Europe Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.3. Europe Hardware Load Balancer Device Market Size and Forecast, By Organization Size Type (2024-2032) 6.4. Europe Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5. Europe Hardware Load Balancer Device Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.1.2. United Kingdom Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.1.3. United Kingdom Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.1.4. United Kingdom Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.2. France 6.5.2.1. France Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.2.2. France Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.2.3. France Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.2.4. France Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.3.2. Germany Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.3.3. Germany Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.3.4. Germany Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.4.2. Italy Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.4.3. Italy Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.4.4. Italy Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.5.2. Spain Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.5.3. Spain Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.5.4. Spain Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.6.2. Sweden Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.6.3. Sweden Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.6.4. Sweden Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.7.2. Russia Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.7.3. Russia Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.7.4. Russia Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 6.5.8.2. Rest of Europe Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 6.5.8.3. Rest of Europe Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 6.5.8.4. Rest of Europe Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7. Asia Pacific Hardware Load Balancer Device Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.4. Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5. Asia Pacific Hardware Load Balancer Device Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.1.2. China Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.1.3. China Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.1.4. China Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.2.2. S Korea Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.2.3. S Korea Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.2.4. S Korea Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.3.2. Japan Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.3.3. Japan Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.3.4. Japan Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.4. India 7.5.4.1. India Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.4.2. India Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.4.3. India Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.4.4. India Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.5.2. Australia Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.5.3. Australia Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.5.4. Australia Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.6.2. Indonesia Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.6.3. Indonesia Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.6.4. Indonesia Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.7.2. Malaysia Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.7.3. Malaysia Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.7.4. Malaysia Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.8.2. Philippines Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.8.3. Philippines Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.8.4. Philippines Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.9.2. Thailand Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.9.3. Thailand Hardware Load Balancer Device Market Size and Forecast, Organization Size (2024-2032) 7.5.9.4. Thailand Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.10.2. Vietnam Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.10.3. Vietnam Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.10.4. Vietnam Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 7.5.11.2. Rest of Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 7.5.11.4. Rest of Asia Pacific Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.4. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8.5. Middle East and Africa Hardware Load Balancer Device Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.5.1.2. South Africa Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.5.1.3. South Africa Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.5.1.4. South Africa Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.5.2.2. GCC Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.5.2.3. GCC Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.5.2.4. GCC Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.5.3.2. Egypt Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.5.3.3. Egypt Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.5.3.4. Egypt Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.5.4.2. Nigeria Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.5.4.3. Nigeria Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.5.4.4. Nigeria Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 8.5.5.2. Rest of ME&A Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 8.5.5.3. Rest of ME&A Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 8.5.5.4. Rest of ME&A Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9. South America Hardware Load Balancer Device Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.2. South America Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.3. South America Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.4. South America Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9.5. South America Hardware Load Balancer Device Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.5.1.2. Brazil Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.5.1.3. Brazil Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.5.1.4. Brazil Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.5.2.2. Argentina Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.5.2.3. Argentina Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.5.2.4. Argentina Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.5.3.2. Colombia Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.5.3.3. Colombia Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.5.3.4. Colombia Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.5.4.2. Chile Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.5.4.3. Chile Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.5.4.4. Chile Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Hardware Load Balancer Device Market Size and Forecast, By Component (2024-2032) 9.5.5.2. Rest Of South America Hardware Load Balancer Device Market Size and Forecast, By Type (2024-2032) 9.5.5.3. Rest Of South America Hardware Load Balancer Device Market Size and Forecast, By Organization Size (2024-2032) 9.5.5.4. Rest Of South America Hardware Load Balancer Device Market Size and Forecast, By Verticals (2024-2032) 10. Company Profile: Key Players 10.1. F5 Networks 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. F5 Networks 10.3. A10 Networks 10.4. Citrix (NetScaler / Citrix ADC) 10.5. Kemp (LoadMaster / Progress-owned) 10.6. Barracuda Networks 10.7. Radware 10.8. NGINX 10.9. Loadbalancer.org 10.10. Zevenet 10.11. HAProxy Technologies 10.12. Huawei Technologies 10.13. Array Networks 10.14. Sangfor Technologies 10.15. Hillstone Networks 10.16. SITONet / Beijing TongTech 11. Key Findings 12. Industry Recommendations 13. Hardware Load Balancer Device Market: Research Methodology