The Glass Packaging Market size was valued at USD 274.76 billion in 2024, and the total Revenue is expected to grow at a CAGR of 5.9% from 2025 to 2032, reaching nearly USD 434.63 billion.Glass Packaging Market Overview:

The MMR report on the Global Glass Packaging Market provides a detailed analysis covering all key aspects of the industry ecosystem, including value chain dynamics, raw material sourcing, production technologies, and regional pricing trends. It examines recycling practices, circular economy initiatives, and advancements in manufacturing such as lightweighting, automation, and digital printing. The report further explores consumer and market trends like eco-friendly packaging, premiumization, and the rise of refillable solutions, alongside the growing role of smart and connected packaging technologies. it offers detailed insights into end-use sectors including food & beverages, pharmaceuticals, cosmetics, and chemicals, while also addressing regulatory frameworks, sustainability standards, and government policies influencing global glass packaging development.To know about the Research Methodology :- Request Free Sample Report

Glass Packaging Market Dynamics:

Glass Packaging Market Driver Glass Packaging Dominates Beverage Industry with Highest Market Share The trend of premiumization has resulted in the use of glass packaging for various beverage categories, including soft drinks, which hold a significant share of the market due to their worldwide popularity. The alcoholic beverage industry faces intense competition from metal packaging, but glass packaging is expected to maintain its share due to its use of premium products. The growth of glass packaging is predicted across different beverage categories, including juices, coffee, tea, soups, and non-dairy beverages. Beer has seen tremendous growth in recent years, with most of the beer volume sold in glass bottles, driving the need for increased production in the glass packaging industry. The increasing demand for premium alcoholic drinks is driving the growth of glass bottles, and developing nations like India have shown a higher quality perception of beer. Returnable glass bottles are a cost-effective option for companies to deliver their products, mainly in the non-alcoholic beverage industry. While about 70% of bottles used for natural mineral water are made of plastic, the choice of bottled-water packaging material is increasing, considering environmental considerations. Growing Demand for Sustainable Packaging Drives Metal Glass Packaging Market to Emphasize Reuse and Recycling for an Eco-friendlier Future Metal packaging is increasingly focused on reuse to extend the lifespan of finite resources by recycling containers. The industrial metal Glass Packaging Market benefits from a well-established infrastructure for products, such as reconditioned drums, to maximize reuse. Compared to other packaging types, aluminum cans have a higher recycling rate and more recycled content. Additionally, aluminum cans can be recycled infinitely in a "closed loop" recycling process, whereas glass and plastic are usually "down-cycled" into products such as carpet fiber or landfill liner. Glass Packaging Market Restraints Glass Packaging Demand Creates Supply Chain Challenges and Occupational Health Concerns Packaging is creating difficulties in the supply chain for glass. The main external force impacting our business has been the ever-growing demand for glass and the consolidation among glass producers. “This has led to long lead times to get the production quantities needed, as the big players tend to get priority and there are only a handful of big glass manufacturers left. The sustainability of glass packaging is a key aspect considered by many in the beverage industry. A glass bottle can be bought, product consumed, recycled, and back on the shelf in as little as 30 days. The glass manufacturing industry seems to have higher than average incidences of injury or illness than the manufacturing sector. The main occupational health and safety concerns occur during the operational phase of glass manufacturing projects and primarily include general hazards such as exposure to heat and noise, and respiratory and physical hazards. There are other specific hazards related to exposure to chemicals, physical hazards, and ergonomic hazards such as posture and movement-related hazards. In addition, there are psychosocial and physical environmental impacts.Glass Packaging Market Opportunities

Glass Packaging Continues to Shine as Eco-Friendly and Sustainable Choice Amidst Global Plastic Pollution Crisis Glass bottles remain the packaging solution of choice for alcohol, in particular beers, wines, and spirits. The eco-friendly credentials of glass are hard to ignore and with much media coverage and international political debate surrounding the global plastic pollution crisis, the cradle-to-cradle closed-loop recycling of glass will continue to work in its favour. While glass remains the second most popular packaging material in Europe, in terms of volume, there is no doubt that flexible packaging solutions will continue to dominate the packaging landscape in the coming years. However, the industry should not dismiss the niche growth areas for glass packaging fuelled by changing attitudes towards sustainable and safe packaging.Glass Packaging Market Segment Analysis

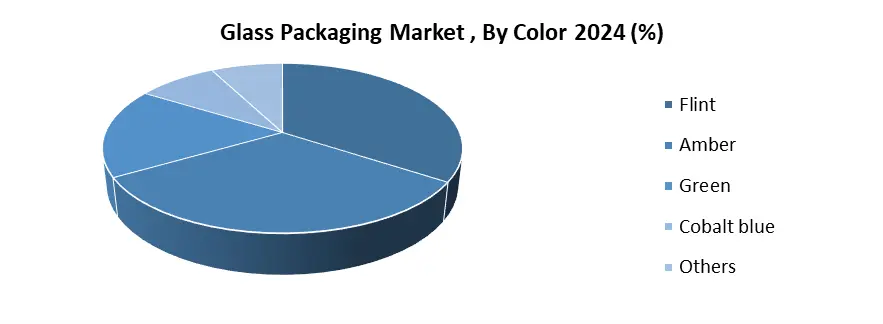

Based on Product, the market is segmented into Bottles, Jars & Containers, Vials, Ampoules, Cartridges & Syringes, and Others. The Bottles segment dominated the Glass Packaging Market in 2024 and is expected to hold the largest Glass Packaging Market Share over the forecast period. Bottles are extensively used across food & beverages, pharmaceuticals, and personal care industries due to their durability, non-reactive nature, and ability to preserve product freshness and flavor. Jars & Containers follow, driven by growing demand for reusable and sustainable household and cosmetic packaging. Vials and Ampoules hold significant shares in the pharmaceutical sector, where they are preferred for storing injectable drugs and vaccines, ensuring sterility and chemical stability. Cartridges & Syringes serve specialized applications in medical and laboratory settings, offering precise dosage delivery. The Others category includes specialty and decorative glass packaging products catering to niche markets.Based on Color, the market is segmented into Flint, Amber, Green, Cobalt Blue, and Others. The Flint segment dominated the Glass Packaging Market in 2024 and is expected to hold the largest share over the forecast period. Flint glass, known for its high clarity and transparency, is widely used in food, beverage, and cosmetics packaging to showcase product appearance and enhance shelf appeal. Amber glass follows closely, favored in pharmaceuticals and beverages for its superior UV protection and light-blocking properties that preserve product integrity. Green glass holds a notable share, particularly in the wine, beer, and beverage industries, due to its aesthetic appeal and recyclability. Cobalt Blue glass caters to premium cosmetics and luxury products, offering a distinct visual identity, while the Others category includes specialty and tinted glasses used for branding differentiation and niche applications.

Competitive Landscape-

1. The Patient Controlled Analgesia Pumps Market is highly competitive, with different major players competing for market share. Some of the key players in the market include Amcor Ltd, Ardagh Group, Bormioli Rocco Spa, Gerresheimer AG, Hindusthan National Glass & Industries Ltd., Koa Glass Co. Ltd, Nihon Yamamura Glass Co Ltd, Owens-Illinois Inc, Piramal Glass Limited, Saint-Gobain S.A, Stölzle-Oberglas GmbH, Vetropack Holding AG, Vidrala SA, Wiegand-Glas, Heinz-Glas GmbH., Koa Glass Co. Ltd, Consol Specialty Glass (Pty) Limited, Berry Global Inc, Westpack LLC, Schott A.G, VeralliaGlass Packaging Market Regional Insights:

North America dominated the market in the year 2023 with a market share of 43% and is expected to continue its dominance during the forecast period. The alcoholic beverage packaging market is anticipated to witness the fastest growth because of the increasing consumption of alcoholic drinks in North America. The glass packaging market for pharmaceutical packaging will grow in North America and Europe on account of the introduction of new therapies. Likewise, North America, Europe, and Asia Pacific are mature markets in food containers. Therefore, food packaging growth is expected to decline in the region in the forecast period. Various authenticated sources have been used to refine and provide complete and accurate research on the glass packaging market. Interviews with main industry leaders were conducted along with secondary research during the study. Several governmental regulations and their effects on the glass packaging market were studied in detail. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data, and projections with a suitable set of assumptions and methodology. The report also helps in understanding global glass packaging market dynamics, and structure by identifying and analyzing the market segments and projecting the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence.Glass Packaging Market Scope: Inquire before buying

Global Glass Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 274.76 Bn. Forecast Period 2025 to 2032 CAGR: 5.9% Market Size in 2032: USD 434.63 Bn. Segments Covered: by Product Bottles Jars & Containers Vials Ampoules Cartridges & Syringes Others by Material Borosilicate De-alkalized Soda Lime Glass Soda Lime Glass by Color Flint Amber Green Cobalt blue Others by Capacity Less than 200 ml 200-500 ml 500-1000 ml More than 1000 ml by End User Industry Food & Beverages Pharmaceuticals Chemicals Personal Care & Cosmetics Others Glass Packaging Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Glass Packaging Market, Key Players

1. Ardagh Group S.A. 2. Verallia SA 3. O-I Glass 4. Gerresheimer AG 5. Vetropack Group 6. Vidrala S.A. 7. Heinz-Glas GmbH & Co. KGaA 8. BA Glass B.V. 9. Berlin Packaging 10. Piramal Glass Pvt. Ltd. 11. AGI Greenpac Ltd. 12. SGD Pharma 13. Borosil Glass Works Ltd. 14. Vitro S.A.B. de C.V. 15. KOA Glass Co., Ltd. 16. Steklarna Hrastnik d.o.o. 17. Stoelzle-Oberglas GmbH 18. Beatson Clark 19. Wiegand-Glas Holding GmbH 20. Zignago Vetro S.p.A. 21. Haldyn Glass Limited 22. Sunrise Glass Industries Pvt. Ltd. 23. Schott Kaisha Pvt. Ltd. 24. Pragati Glass Pvt. Ltd. 25. Ajanta Bottle Pvt. Ltd. 26. Consol Glass Ltd. 27. Vitrum Glass (Empire Industries Ltd.) 28. Yantai Changyu Glass Co., Ltd. 29. Yantai NBC Glass Packaging Co., Ltd. 30. Feemio Glass Packaging 31. OthersFrequently Asked Questions:

1] What segments are covered in the Glass Packaging Market report? Ans. The segments covered in the Glass Packaging Market report are based on Product, Material, Color, Capacity, End-user Industry, and region 2] Which region is expected to hold the highest share of the Glass Packaging Market? Ans. The Asia Pacific region is expected to hold the highest share of the Glass Packaging Market. 3] What is the market size of the Glass Packaging Market by 2032? Ans. The market size of the Glass Packaging Market by 2032 is USD 434.63 Bn. 4] What is the growth rate of the Glass Packaging Market? Ans. The Global Glass Packaging Market is growing at a CAGR of 5.9 % during the forecasting period 2025-2032. 5] What was the market size of the Glass Packaging Market in 2024? Ans. The market size of the Glass Packaging Market in 2024 was USD 274.76 Bn.

1. Glass Packaging Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion & Volume in Ton) - By Segments, Regions, and Country 2. Glass Packaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Revenue 2024 2.3.5. Market Share(%) by Region 2.3.6. Growth Rate (%) 2.3.7. Production Capacity (Tons) 2.3.8. Marketing Channels 2.3.9. Awards & Ratings 2.3.10. R&D Investments 2.3.11. Digital Engagement Metrics 2.3.12. Sustainability Certification 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Glass Packaging Market: Dynamics 3.1. Glass Packaging Market Trends 3.2. Glass Packaging Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Glass Packaging Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Industry Ecosystem and Value Chain 4.1. Overview of Glass Packaging Value Chain 4.2. Key Raw Material Suppliers (Silica, Soda Ash, Limestone) 4.3. Manufacturers, Distributors, and Brand Owners 4.4. Role of Recycling Networks and Glass Collectors 4.5. Collaboration Trends Across Beverage, Pharma, and Cosmetic Industries 5. Raw Material and Production Analysis 5.1. Overview of Raw Material Sourcing (Silica, Soda Ash, Feldspar) 5.2. Price Trend Analysis of Key Inputs 5.3. Global Glass Melting and Molding Technologies 5.4. Furnace Efficiency and Energy Consumption Metrics 5.5. Cost Structure and Margin Breakdown 5.6. Supply Chain Dependencies and Risk Assessment 6. Pricing Analysis By Region 6.1. Historical and Current Pricing Trends (2019–2024) 6.2. Regional Price Comparison by Product and Application 6.3. Impact of Energy and Fuel Costs on Glass Production 6.4. Pricing Strategies in Returnable vs. Non-Returnable Systems 7. Recycling and Circular Economy Analysis 7.1. Glass Recycling Rates by Region (Europe, North America, APAC) 7.2. Closed-Loop Manufacturing and Circular Economy Practices 7.3. Environmental Benefits and CO₂ Reduction Analysis 7.4. Refillable Bottle Programs and Reverse Logistics Models 7.5. Challenges in Collection, Sorting, and Contamination 7.6. Case Studies: Industry Leaders in Glass Circularity 8. Technological Innovations and Product Development 8.1. Advancements in Lightweighting and Strength Enhancement 8.2. Digital Printing, Smart Labels, and Laser Etching on Glass 8.3. Coating and Surface Treatment Technologies 8.4. Automation and Robotics in Glass Manufacturing 8.5. Integration of AI and Data Analytics in Quality Control 8.6. Future Trends: Smart, Connected, and Customizable Glass Packaging 9. Consumer and Market Trends 9.1. Growing Consumer Preference for Eco-Friendly Packaging 9.2. Premiumization of Beverages and Luxury Cosmetics 9.3. Rise of Refillable and Returnable Packaging Solutions 9.4. Impact of E-Commerce on Glass Packaging Demand 9.5. Brand Positioning Through Aesthetic and Functional Design 10. Smart Packaging and Digital Transformation 10.1. Integration of QR Codes, NFC Tags, and Track-and-Trace Systems 10.2. Augmented Reality (AR) Packaging Experiences 10.3. Connected Packaging for Customer Engagement 10.4. Real-Time Quality and Inventory Monitoring Solutions 10.5. Role of AI in Packaging Design Optimization 11. End-Use Sector Deep Dives 11.1. Food & Beverage Industry Analysis – Premiumization, Craft Beverages, Dairy, and Juices 11.2. Pharmaceutical Packaging Trends – Vials, Ampoules, and Vaccines 11.3. Cosmetics & Perfumes – Luxury and Refillable Packaging Demand 11.4. Chemical & Industrial Uses – Durability and Chemical Resistance 11.5. Comparative Forecasts by Sector Contribution to Global Demand 12. Regulatory and Standards Landscape 12.1. Global Packaging Material Regulations (FDA, EU, etc.) 12.2. Food Contact and Pharmaceutical Safety Standards 12.3. Recyclability and Labeling Mandates 12.4. Government Incentives for Sustainable Packaging 12.5. Impact of Extended Producer Responsibility (EPR) Policies 13. Glass Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 13.1. Glass Packaging Market Size and Forecast, By Product (2024-2032) 13.1.1. Bottles 13.1.2. Jars & Containers 13.1.3. Vials 13.1.4. Ampoules 13.1.5. Cartridges & Syringes 13.1.6. Others 13.2. Glass Packaging Market Size and Forecast, By Material (2024-2032) 13.2.1. Borosilicate 13.2.2. De-alkalized Soda Lime Glass 13.2.3. Soda Lime Glass 13.3. Glass Packaging Market Size and Forecast, By Color (2024-2032) 13.3.1. Flint 13.3.2. Amber 13.3.3. Green 13.3.4. Cobalt blue 13.3.5. Others 13.4. Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 13.4.1. Less than 200 ml 13.4.2. 200-500 ml 13.4.3. 500-1000 ml 13.4.4. More than 1000 ml 13.5. Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 13.5.1. Food & Beverages 13.5.2. Pharmaceuticals 13.5.3. Chemicals 13.5.4. Personal Care & Cosmetics 13.5.5. Others 13.6. Glass Packaging Market Size and Forecast, By Region (2024-2032) 13.6.1. North America 13.6.2. Europe 13.6.3. Asia Pacific 13.6.4. Middle East and Africa 13.6.5. South America 14. North America Glass Packaging Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 14.1. North America Glass Packaging Market Size and Forecast, By Product (2024-2032) 14.1.1. Bottles 14.1.2. Jars & Containers 14.1.3. Vials 14.1.4. Ampoules 14.1.5. Cartridges & Syringes 14.1.6. Others 14.2. North America Glass Packaging Market Size and Forecast, By Material (2024-2032) 14.2.1. Borosilicate 14.2.2. De-alkalized Soda Lime Glass 14.2.3. Soda Lime Glass 14.3. North America Glass Packaging Market Size and Forecast, By Color (2024-2032) 14.3.1. Flint 14.3.2. Amber 14.3.3. Green 14.3.4. Cobalt blue 14.3.5. Others 14.4. North America Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 14.4.1. Less than 200 ml 14.4.2. 200-500 ml 14.4.3. 500-1000 ml 14.4.4. More than 1000 ml 14.5. North America Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 14.5.1. Food & Beverages 14.5.2. Pharmaceuticals 14.5.3. Chemicals 14.5.4. Personal Care & Cosmetics 14.5.5. Others 14.6. North America Glass Packaging Market Size and Forecast, by Country (2024-2032) 14.6.1. United States 14.6.1.1. United States Glass Packaging Market Size and Forecast, By Product (2024-2032) 14.6.1.1.1. Bottles 14.6.1.1.2. Jars & Containers 14.6.1.1.3. Vials 14.6.1.1.4. Ampoules 14.6.1.1.5. Cartridges & Syringes 14.6.1.1.6. Others 14.6.1.2. United States Glass Packaging Market Size and Forecast, By Material (2024-2032) 14.6.1.2.1. Borosilicate 14.6.1.2.2. De-alkalized Soda Lime Glass 14.6.1.2.3. Soda Lime Glass 14.6.1.3. United States Glass Packaging Market Size and Forecast, By Color (2024-2032) 14.6.1.3.1. Flint 14.6.1.3.2. Amber 14.6.1.3.3. Green 14.6.1.3.4. Cobalt blue 14.6.1.3.5. Others 14.6.1.4. United States Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 14.6.1.4.1. Less than 200 ml 14.6.1.4.2. 200-500 ml 14.6.1.4.3. 500-1000 ml 14.6.1.4.4. More than 1000 ml 14.6.1.5. United States Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 14.6.1.5.1. Food & Beverages 14.6.1.5.2. Pharmaceuticals 14.6.1.5.3. Chemicals 14.6.1.5.4. Personal Care & Cosmetics 14.6.1.5.5. Others 14.6.2. Canada 14.6.2.1. Canada Glass Packaging Market Size and Forecast, By Product (2024-2032) 14.6.2.1.1. Bottles 14.6.2.1.2. Jars & Containers 14.6.2.1.3. Vials 14.6.2.1.4. Ampoules 14.6.2.1.5. Cartridges & Syringes 14.6.2.1.6. Others 14.6.2.2. Canada Glass Packaging Market Size and Forecast, By Material (2024-2032) 14.6.2.2.1. Borosilicate 14.6.2.2.2. De-alkalized Soda Lime Glass 14.6.2.2.3. Soda Lime Glass 14.6.2.3. Canada Glass Packaging Market Size and Forecast, By Color (2024-2032) 14.6.2.3.1. Flint 14.6.2.3.2. Amber 14.6.2.3.3. Green 14.6.2.3.4. Cobalt blue 14.6.2.3.5. Others 14.6.2.4. Canada Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 14.6.2.4.1. Less than 200 ml 14.6.2.4.2. 200-500 ml 14.6.2.4.3. 500-1000 ml 14.6.2.4.4. More than 1000 ml 14.6.2.5. Canada Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 14.6.2.5.1. Food & Beverages 14.6.2.5.2. Pharmaceuticals 14.6.2.5.3. Chemicals 14.6.2.5.4. Personal Care & Cosmetics 14.6.2.5.5. Others 14.6.3. Mexico 14.6.3.1. Mexico Glass Packaging Market Size and Forecast, By Product (2024-2032) 14.6.3.1.1. Bottles 14.6.3.1.2. Jars & Containers 14.6.3.1.3. Vials 14.6.3.1.4. Ampoules 14.6.3.1.5. Cartridges & Syringes 14.6.3.1.6. Others 14.6.3.2. Mexico Glass Packaging Market Size and Forecast, By Material (2024-2032) 14.6.3.2.1. Borosilicate 14.6.3.2.2. De-alkalized Soda Lime Glass 14.6.3.2.3. Soda Lime Glass 14.6.3.3. Mexico Glass Packaging Market Size and Forecast, By Color (2024-2032) 14.6.3.3.1. Flint 14.6.3.3.2. Amber 14.6.3.3.3. Green 14.6.3.3.4. Cobalt blue 14.6.3.3.5. Others 14.6.3.4. Mexico Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 14.6.3.4.1. Less than 200 ml 14.6.3.4.2. 200-500 ml 14.6.3.4.3. 500-1000 ml 14.6.3.4.4. More than 1000 ml 14.6.3.5. Mexico Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 14.6.3.5.1. Food & Beverages 14.6.3.5.2. Pharmaceuticals 14.6.3.5.3. Chemicals 14.6.3.5.4. Personal Care & Cosmetics 14.6.3.5.5. Others 15. Europe Glass Packaging Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 15.1. Europe Glass Packaging Market Size and Forecast, By Product (2024-2032) 15.2. Europe Glass Packaging Market Size and Forecast, By Material (2024-2032) 15.3. Europe Glass Packaging Market Size and Forecast, By Color (2024-2032) 15.4. Europe Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 15.5. Europe Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 15.6. Europe Glass Packaging Market Size and Forecast, By Country (2024-2032) 15.6.1. United Kingdom 15.6.2. France 15.6.3. Germany 15.6.4. Italy 15.6.5. Spain 15.6.6. Sweden 15.6.7. Russia 15.6.8. Rest of Europe 16. Asia Pacific Glass Packaging Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 16.1. Asia Pacific Glass Packaging Market Size and Forecast, By Product (2024-2032) 16.2. Asia Pacific Glass Packaging Market Size and Forecast, By Material (2024-2032) 16.3. Asia Pacific Glass Packaging Market Size and Forecast, By Color (2024-2032) 16.4. Asia Pacific Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 16.5. Asia Pacific Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 16.6. Asia Pacific Glass Packaging Market Size and Forecast, by Country (2024-2032) 16.6.1. China 16.6.2. S Korea 16.6.3. Japan 16.6.4. India 16.6.5. Australia 16.6.6. Indonesia 16.6.7. Malaysia 16.6.8. Philippines 16.6.9. Thailand 16.6.10. Vietnam 16.6.11. Rest of Asia Pacific 17. Middle East and Africa Glass Packaging Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 17.1. Middle East and Africa Glass Packaging Market Size and Forecast, By Product (2024-2032) 17.2. Middle East and Africa Glass Packaging Market Size and Forecast, By Material (2024-2032) 17.3. Middle East and Africa Glass Packaging Market Size and Forecast, By Color (2024-2032) 17.4. Middle East and Africa Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 17.5. Middle East and Africa Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 17.6. Middle East and Africa Glass Packaging Market Size and Forecast, By Country (2024-2032) 17.6.1. South Africa 17.6.2. GCC 17.6.3. Nigeria 17.6.4. Rest of ME&A 18. South America Glass Packaging Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in Ton) (2024-2032) 18.1. South America Glass Packaging Market Size and Forecast, By Product (2024-2032) 18.2. South America Glass Packaging Market Size and Forecast, By Material (2024-2032) 18.3. South America Glass Packaging Market Size and Forecast, By Color (2024-2032) 18.4. 18.5. South America Glass Packaging Market Size and Forecast, By Capacity (2024-2032) 18.6. South America Glass Packaging Market Size and Forecast, By End-User Industry (2024-2032) 18.7. South America Glass Packaging Market Size and Forecast, By Country (2024-2032) 18.7.1. Brazil 18.7.2. Argentina 18.7.3. Colombia 18.7.4. Chile 18.7.5. Rest of South America 19. Company Profile: Key Players 19.1. Ardagh Group S.A. 19.1.1. Company Overview 19.1.2. Business Portfolio 19.1.3. Financial Overview 19.1.4. SWOT Analysis 19.1.5. Strategic Analysis 19.2. Verallia SA 19.3. O-I Glass 19.4. Gerresheimer AG 19.5. Vetropack Group 19.6. Vidrala S.A. 19.7. Heinz-Glas GmbH & Co. KGaA 19.8. BA Glass B.V. 19.9. Berlin Packaging 19.10. Piramal Glass Pvt. Ltd. 19.11. AGI Greenpac Ltd. 19.12. SGD Pharma 19.13. Borosil Glass Works Ltd. 19.14. Vitro S.A.B. de C.V. 19.15. KOA Glass Co., Ltd. 19.16. Steklarna Hrastnik d.o.o. 19.17. Stoelzle-Oberglas GmbH 19.18. Beatson Clark 19.19. Wiegand-Glas Holding GmbH 19.20. Zignago Vetro S.p.A. 19.21. Haldyn Glass Limited 19.22. Sunrise Glass Industries Pvt. Ltd. 19.23. Schott Kaisha Pvt. Ltd. 19.24. Pragati Glass Pvt. Ltd. 19.25. Ajanta Bottle Pvt. Ltd. 19.26. Consol Glass Ltd. 19.27. Vitrum Glass (Empire Industries Ltd.) 19.28. Yantai Changyu Glass Co., Ltd. 19.29. Yantai NBC Glass Packaging Co., Ltd. 19.30. Feemio Glass Packaging 19.31. Others 20. Key Findings 21. Analyst Recommendations 22. Glass Packaging Market – Research Methodology