The Global Fruit Juice Market, valued at USD 159.10 Bn in 2024, is expected to reach USD 222.98 Bn by 2032, growing at a steady CAGR of 4.31% during the forecast period. The growth is driven by rising health consciousness, increasing demand for 100% juices, clean-label beverages, cold-pressed juices, and functional, fortified juice innovations.Fruit Juice Market Overview:

Fruit juice is a natural, refreshing beverage extracted from fruits and widely consumed for its taste and nutritional benefits. The Fruit Juice Market is driven by consumers worldwide increasingly shifting from carbonated soft drinks to healthier alternatives, driving demand for 100% fruit juice, cold-pressed juice, organic fruit juice, functional juice, and sugar-free juice options. The global fruit juice industry is growing due to rising health consciousness, clean-label preferences, and growing awareness of the nutritional benefits associated with different juices. Fruit juice is an unfermented beverage obtained by mechanically pressing or softening fruits, and each variant offers unique benefits. Avocado juice boosts natural energy, watermelon juice supports hydration and metabolism, papaya juice aids digestion, lemon juice combats viral infections, and pineapple juice helps reduce cholesterol. As soft drinks face declining consumption due to high sugar, artificial colors, phosphoric acid, sweeteners, and caffeine, consumers are increasingly choosing natural fruit juice, fueling market growth across supermarkets, hypermarkets, convenience stores, and online fruit juice sales channels. Key segments such as juice drinks, fruit nectar, concentrates, and powdered juice continue to diversify the product landscape, while flavors such as orange juice, apple juice, mango juice, and mixed fruit juice dominate global Fruit Juice Market demand. Major companies such as Tropicana, Del Monte, Dabur Real, Dole, Coca-Cola, and PepsiCo are strengthening their portfolios as demand grows for fortified, vitamin-rich, healthy beverage options.To know about the Research Methodology:-Request Free Sample Report

Trend: Premiumization Through Cold-Pressed, Fortified & Clean-Label Juice Innovations

The premiumization of beverages through cold-pressed, fortified, and functional formulations. Consumers increasingly seek authenticity, freshness, and higher nutritional value, resulting in strong momentum for the cold-pressed fruit juice segment, organic juice trends, vitamin-fortified juices, and functional juice products with probiotics, antioxidants, and natural extracts. This trend is redefining the competitive landscape of the Fruit Juice Industry, encouraging brands to innovate within the juice drinks market, mixed fruit juice market, exotic fruit juice variants, and fruit nectar market. Growing interest in natural fruit juice, clean-label beverages, and eco-friendly packaging is accelerating product diversification across PET bottle, Tetrapak, and glass bottle juice packaging markets. The premium juices available in flavors such as mango, apple, orange, and tropical blends are gaining strong traction across the U.S. fruit juice industry, the European Fruit Juice industry, and emerging economies such as India, Brazil, and ASEAN countries. The Rise of Cold-Pressed, Functional & Clean-Label InnovationsRising Health Consciousness and Shift from Carbonated Drinks to Natural Beverages As consumers increasingly reject high-sugar carbonated drinks, artificial sweeteners, phosphoric acid, and caffeine, the demand for 100% fruit juice, natural fruit juice, organic fruit juice, sugar-free juice, and functional juice beverages has surged. This change is deeply aligned with rising awareness of nutrition, wellness, immunity boosting, and preventive healthcare. Health-conscious buyers prefer juices rich in vitamins, antioxidants, and natural phytonutrients, boosting the expansion of the cold-pressed juice market, functional juice market, Fortified Juice Market, and fruit and vegetable juice market. The growing adoption of clean-label, no-added-sugar, and minimally processed drinks is reshaping the global Fruit Juice Market and boosting fruit juice demand across supermarkets, hypermarkets, and online fruit juice sales platforms. Countries across North America, Europe, and the Asia Pacific are witnessing rapid growth in premium juice categories, supported by innovations in fruit juice production, fruit juice supply chains, and eco-friendly packaging. In the UK, rising health consciousness is driving consumers away from sugary carbonated drinks toward natural, fruit-based beverages. Orange and fruit cocktail flavors dominate dilutable soft drink preferences, reflecting increasing demand for healthier, refreshing, and vitamin-rich drink options in 2024.

Rising Sugar Regulations, Raw Material Costs & Concerns Over Added Sugars to Restrain Fruit Juice Market Growth Many governments, including those in Europe, the U.S., and parts of the Asia Pacific, are imposing taxes, warning labels, and reformulation requirements to reduce added sugar, directly impacting categories such as juice drinks, fruit nectar, and concentrates. As clean-label and no-added-sugar juices gain popularity, brands must invest heavily in R&D, supply chain adjustments, and advanced processing technologies to maintain taste while meeting regulatory norms. The fluctuating prices of raw materials such as fruit puree, concentrate, and natural sweeteners pose major challenges within the fruit juice supply chain and the Fruit Juice Production Market. Weather variations, agricultural disruptions, and limited availability of certain fruits (like oranges and apples) can significantly influence output and pricing, affecting both local and global players, including Tropicana, Del Monte, Dole, Dabur Real, and Coca-Cola’s fruit juice brands. Packaging and logistics costs, especially in cold-chain distribution for cold-pressed juice, restrain Fruit Juice Market margins.

Fruit Juice Market Segment Analysis

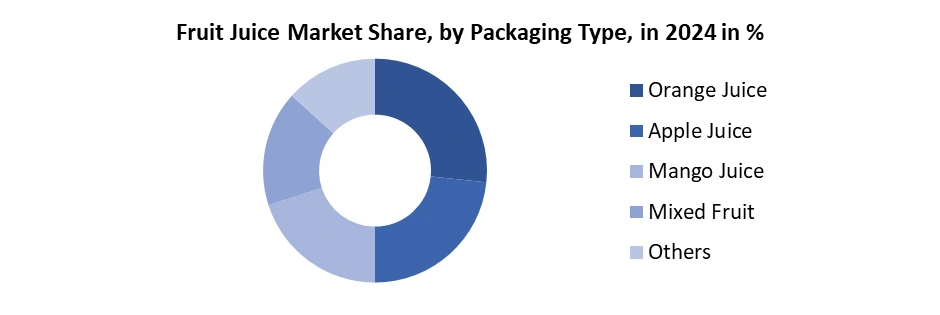

Based on Product Type, the market is segmented into 100% Fruit Juice, Fruit Nectars, Juice Drinks, Concentrated Juice and Others. The 100% fruit juice dominated product type in 2024 for the Fruit Juice Market, due to rising health awareness, clean-label preferences, and the growing shift toward natural fruit juice, organic fruit juice, and sugar-free juice market offerings. Consumers increasingly prefer pure beverages with no artificial additives, which strengthens the position of this segment in the broader fruit juice industry. Meanwhile, categories such as the fruit nectar market, juice drinks market, concentrates market for juice, and powdered Fruit Juice Industry continue to expand but remain secondary, as health-conscious juice consumers now prioritize authenticity, transparency, and nutritional value. The dominance of 100% fruit juice is reinforced by evolving fruit juice consumer trends, demand for ready-to-drink fruit juice, and innovations in functional juice market products fortified with vitamins and natural ingredients.Based on Flavor, the Fruit Juice Market is categorized into Orange Juice, Apple Juice, Mango Juice, Mixed Fruit and Others. Orange juice is the dominant flavour, consistently outperforming all other categories such as apple, mango, mixed fruit, and tropical blends. The orange juice market leads due to its strong consumer association with immunity, vitamin C, natural freshness, and its long-established role as a daily breakfast beverage. Within the broader fruit juice industry, orange juice benefits from high fruit juice demand, strong brand presence, and major investments by leading fruit juice companies such as Tropicana, Minute Maid, and Florida’s Natural. As fruit juice Market trends shift toward healthier, clean-label, and fortified options, orange juice remains preferred because it aligns naturally with functional juice market growth, organic juice trends, and rising interest in natural fruit juice worldwide.

Fruit Juice Market Regional Insights

North America dominated the Fruit Juice Market in 2024 and is expected to continue its dominance over the forecast period. The rising health consciousness, clean-label preferences, and strong demand for 100% fruit juice, orange juice, and premium cold-pressed juice. The U.S. fruit juice market remains dominant due to high consumption levels, well-established brands, and widespread availability across supermarkets, hypermarkets, convenience stores, and rapidly expanding online fruit juice sales channels. Orange juice continues to lead the market because of its strong consumer acceptance, high vitamin C content, refreshing flavor, and long-standing presence in American breakfast culture. The U.S. orange juice market forecast shows stable demand supported by fortified and low-sugar formulations. In Canada, growing adoption of organic juice, functional juice, and no-added-sugar juices is shaping new consumption patterns, especially among young, health-focused consumers. North America also benefits from advanced fruit juice production, efficient fruit juice supply chains, and innovations in PET bottles, Tetrapak, and eco-friendly packaging. While traditional juice segments such as apple juice and grape juice maintain consistent demand, premium offerings such as cold-pressed fruit juice, mixed fruit juice, and vitamin-fortified juices are witnessing strong growth.Fruit Juice Market Competitive Landscape

The Fruit Juice Market is highly competitive, characterized by strong global brands, regional producers, and rapidly emerging premium juice companies. Leading players such as Tropicana, Minute Maid, Simply Orange, Del Monte, Dole, PepsiCo, Coca-Cola, Welch’s, and Dabur Real dominate the market through extensive distribution networks, strong brand equity, and diversified product portfolios. These companies continuously invest in innovation, introducing 100% fruit juices, cold-pressed blends, organic variants, fortified juices, and low-sugar formulations to meet evolving consumer preferences. Premium and niche brands are gaining traction by offering clean-label, minimally processed, functional, and probiotic-rich juices, appealing to health-conscious consumers. Regional players in the Asia Pacific, South America, and the Middle East are expanding quickly due to rising disposable incomes and demand for natural beverages.Recent Developments:

• On 10 January 2024, Tropicana introduced its limited-edition “Tropcn” packaging, intentionally removing the letters “AI” to highlight that its orange juice contains no artificial ingredients. Launched at CES 2024 in Las Vegas, this campaign emphasizes Tropicana’s commitment to natural, 100% pure orange juice made from oranges squeezed within 24 hours of picking. The initiative responds to growing consumer concerns about artificial additives and technology-driven products, strengthening Tropicana’s reputation in the fruit juice market for purity, transparency, and clean-label innovation. • On 9 September 2024, PepsiCo launched DRIPS by Pepsi, a premium mixology-based beverage concept featuring crafted drinks made with iconic PepsiCo brands. The lineup includes innovative creations such as Tropicana Cotton Candy Lemonade, blending fruit-forward flavors with experiential presentation. Debuting through pop-up events in New York City, DRIPS targets younger consumers seeking creative, customizable, and flavorful beverages. The initiative showcases PepsiCo’s commitment to beverage innovation and expands its footprint in the evolving fruit juice and Flavored Drinks Market.Fruit Juice Market Scope:Inquire before buying

Global Fruit Juice Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 159.10 Bn. Forecast Period 2025 to 2032 CAGR: 4.31% Market Size in 2032: USD 222.98 Bn. Segments Covered: by Product Type 100% Fruit Juice Fruit Nectars Juice Drinks Concentrated Juice Others by Flavor Orange Juice Apple Juice Mango Juice Mixed Fruit Others by Packaging Type PET Bottles Glass Bottles Others by Distribution Channel Supermarkets/Hypermarkets Specialty Food Stores Convenience Stores Online Retail Others Fruit Juice Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Fruit Juice Key Players

1. Tropicana 2. Minute Maid 3. Simply Orange 4. Del Monte Foods 5. Dole Packaged Foods 6. PepsiCo 7. The Coca-Cola Company 8. Welch’s 9. Ocean Spray 10. Parle Agro 11. Dabur Real 12. Eckes-Granini Group 13. Rauch Fruchtsäfte 14. Cutrale 15. Citrosuco 16. Huiyuan Group 17. Florida’s Natural 18. Langer Juice Company 19. Pioneer Foods 20. Kraft Heinz 21. Mott’s 22. Ceres Fruit Juices 23. Andros Group 24. Pfanner 25. Old Orchard Brands 26. Capri-Sun 27. Rani Float 28. Juicy Juice 29. Odwalla 30. Keurig Dr PepperFrequently Asked Questions:

1] What is the growth rate of the Global Fruit Juice Market? Ans. The Global Fruit Juice Market is growing at a significant rate of 4.31 % during the forecast period. 2] Which region is expected to dominate the Global Fruit Juice Market? Ans. North America is expected to dominate the Fruit Juice Market during the forecast period. 3] What was the Global Fruit Juice Market size in 2024? Ans. The Fruit Juice Market size is expected to reach USD 159.10 billion in 2024. 4] What is the expected Global Fruit Juice Market size by 2032? Ans. The Fruit Juice Market size is expected to reach USD 222.98 billion by 2032. 5] Which are the top players in the Global Market? Ans. The major players in the Global Market are Tropicana, Minute Maid, Simply Orange, Del Monte Foods, Dole Packaged Foods and Others. 6] What are the factors driving the Global FMarket growth? Ans. The Global Market is driven by rising health consciousness, demand for natural and clean-label beverages, growth of 100% and cold-pressed juices, expanding retail distribution, and increasing preference for functional, fortified, and low-sugar juice options.

1. Fruit Juice Market: Research Methodology 2. Fruit Juice Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Fruit Juice Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Fruit Juice Market: Dynamics 4.1. Fruit Juice Market Trends 4.2. Fruit Juice Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Fruit Juice Market 5. Sustainability & Environmental Impact Analysis 5.1. Sustainable sourcing of fruits 5.2. Carbon footprint of juice production 5.3. Eco-friendly packaging innovations 5.4. Waste reduction & circular economy initiatives 6. Consumer Behavior & Preference Insights 6.1. Health-conscious consumer trends 6.2. Sugar-reduction preferences 6.3. Flavor innovation and regional taste profiles 6.4. Online vs offline purchasing behavior 7. Innovation & Technology in Juice Processing 7.1. Cold-pressed technology advancements 7.2. Nutrient-retention processing 7.3. Automation in bottling & packaging 7.4. AI/IoT in quality monitoring & supply chain 8. Regulatory & Policy Framework 8.1. Regional sugar tax policies 8.2. Food safety standards for fruit juice 8.3. Additives & clean-label regulations 8.4. Import/export compliance for juice concentrates 9. Fruit Juice Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 9.1. Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 9.1.1. 100% Fruit Juice 9.1.2. Fruit Nectars 9.1.3. Juice Drinks 9.1.4. Concentrated Juice 9.1.5. Others 9.2. Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 9.2.1. Orange Juice 9.2.2. Apple Juice 9.2.3. Mango Juice 9.2.4. Mixed Fruit 9.2.5. Others 9.3. Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 9.3.1. PET Bottles 9.3.2. Glass Bottles 9.3.3. Others 9.4. Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.1. Supermarkets/Hypermarkets 9.4.2. Specialty Food Stores 9.4.3. Convenience Stores 9.4.4. Online Retail 9.4.5. Others 9.5. Fruit Juice Market Size and Forecast, by Region (2024-2032) 9.5.1. North America 9.5.2. Europe 9.5.3. Asia Pacific 9.5.4. Middle East and Africa 9.5.5. South America 10. North America Fruit Juice Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 10.1. North America Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 10.1.1. 100% Fruit Juice 10.1.2. Fruit Nectars 10.1.3. Juice Drinks 10.1.4. Concentrated Juice 10.1.5. Others 10.2. North America Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 10.2.1. Orange Juice 10.2.2. Apple Juice 10.2.3. Mango Juice 10.2.4. Mixed Fruit 10.2.5. Others 10.3. North America Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 10.3.1. PET Bottles 10.3.2. Glass Bottles 10.3.3. Others 10.4. North America Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 10.4.1. Supermarkets/Hypermarkets 10.4.2. Specialty Food Stores 10.4.3. Convenience Stores 10.4.4. Online Retail 10.4.5. Others 10.5. North America Fruit Juice Market Size and Forecast, by Country (2024-2032) 10.5.1. United States 10.5.2. Canada 10.5.3. Mexico 11. Europe Fruit Juice Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 11.1. Europe Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 11.2. Europe Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 11.3. Europe Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 11.4. Europe Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 11.5. Europe Fruit Juice Market Size and Forecast, by Country (2024-2032) 11.5.1. United Kingdom 11.5.2. France 11.5.3. Germany 11.5.4. Italy 11.5.5. Spain 11.5.6. Russia 11.5.7. Rest of Europe 12. Asia Pacific Fruit Juice Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 12.1. Asia Pacific Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 12.2. Asia Pacific Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 12.3. Asia Pacific Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 12.4. Asia Pacific Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 12.5. Asia Pacific Fruit Juice Market Size and Forecast, by Country (2024-2032) 12.5.1. China 12.5.2. S Korea 12.5.3. Japan 12.5.4. India 12.5.5. Australia 12.5.6. Rest of Asia Pacific 13. Middle East and Africa Fruit Juice Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 13.1. Middle East and Africa Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 13.2. Middle East and Africa Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 13.3. Middle East and Africa Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 13.4. Middle East and Africa Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 13.5. Middle East and Africa Fruit Juice Market Size and Forecast, by Country (2024-2032) 13.5.1. South Africa 13.5.2. GCC 13.5.3. Nigeria 13.5.4. Rest of ME&A 14. South America Fruit Juice Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Liter) (2024-2032) 14.1. South America Fruit Juice Market Size and Forecast, by Product Type (2024-2032) 14.2. South America Fruit Juice Market Size and Forecast, by Flavor (2024-2032) 14.3. South America Fruit Juice Market Size and Forecast, by Packaging Type (2024-2032) 14.4. South America Fruit Juice Market Size and Forecast, by Distribution Channel (2024-2032) 14.5. South America Fruit Juice Market Size and Forecast, by Country (2024-2032) 14.5.1. Brazil 14.5.2. Argentina 14.5.3. Colombia 14.5.4. Chile 14.5.5. Rest Of South America 15. Company Profile: Key Players 15.1. Tropicana 15.1.1. Company Overview 15.1.2. Business Portfolio 15.1.3. Financial Overview 15.1.4. SWOT Analysis 15.1.5. Strategic Analysis 15.1.6. Recent Developments 15.2. Minute Maid 15.3. Simply Orange 15.4. Del Monte Foods 15.5. Dole Packaged Foods 15.6. PepsiCo 15.7. The Coca-Cola Company 15.8. Welch’s 15.9. Ocean Spray 15.10. Parle Agro 15.11. Dabur Real 15.12. Eckes-Granini Group 15.13. Rauch Fruchtsäfte 15.14. Cutrale 15.15. Citrosuco 15.16. Huiyuan Group 15.17. Florida’s Natural 15.18. Langer Juice Company 15.19. Pioneer Foods 15.20. Kraft Heinz 15.21. Mott’s 15.22. Ceres Fruit Juices 15.23. Andros Group 15.24. Pfanner 15.25. Old Orchard Brands 15.26. Capri-Sun 15.27. Rani Float 15.28. Juicy Juice 15.29. Odwalla 15.30. Keurig Dr Pepper 16. Key Findings 17. Analyst Recommendations