The global Ethernet Switch Market is expected to grow from USD 40.42 billion in 2024 to USD 63.94 billion by 2032, at a CAGR of 5.9%. The increasing demand for high-speed networking, data center expansion, and cloud adoption across industries such as IoT, 5G, and AI.Ethernet Switch Market Overview

An Ethernet switch is a networking device that connects devices within a local area network (LAN) and uses MAC addresses to forward data to the correct destination. It improves network efficiency by reducing collisions and creating dedicated communication paths for devices. The increasing demand for data center Ethernet switches, managed Ethernet switches, PoE switches, industrial Ethernet switches, and high-speed solutions such as 10G, 25G, 40G, and 100G Ethernet switches drives Ethernet Switch Market growth. Increasing cloud adoption, AI-driven workloads, 5G deployment, IoT integration, and enterprise digitalization are boosting demand for Layer 2 and Layer 3 switches, modular Ethernet switches, and fixed-configuration switches across telecom operators, cloud service providers, SMBs, governments, and industrial automation users. Regions such as the U.S., Canada, Germany, the UK, China, India, Japan, the UAE, Saudi Arabia, Brazil, and Africa show strong investment in network switch market growth, hyperscale data centers, and smart infrastructure. Key players, including Cisco, Arista Networks, Huawei, Juniper, HPE Aruba, Dell EMC, TP-Link, Netgear, Extreme Networks, Broadcom, and Intel, continue to expand their portfolios with AI-enabled Ethernet switches, SDN/NFV networking, IoT networking switches, and cloud data center switch technologies. Ethernet Switch Market trends highlight increasing demand for rugged industrial switches, edge computing switches, automotive Ethernet, smart city networking equipment, and next-generation Ethernet switching technology.To know about the Research Methodology :- Request Free Sample Report

Trend: Rapid Migration to High-Speed & Cloud Data Center Switches

The global migration toward high-speed Ethernet switching and the rapid expansion of the cloud data center switch market. As enterprises accelerate digital transformation, demand for AI-enabled Ethernet switches, SDN and NFV Ethernet switches, and high-performance data center Ethernet switches has surged across hyperscale data centers, co-location facilities, and cloud service provider networks. The growth of AI/ML workloads, generative AI training clusters, and hyperconverged infrastructure is pushing hyperscalers such as AWS, Google, Meta, and Microsoft to upgrade from 10G and 25G Ethernet switches to 100G and 400G switch platforms, leading to a 20–25% annual increase in global switching capacity. The Market trend supports the expansion of the modular Ethernet switch market, fixed configuration switch market, and Layer 2 and Layer 3 switch market solutions. The shift is further intensified by the rise of cloud networking switch technologies, carrier Ethernet market requirements, and campus network switch market upgrades across universities, BFSI, and government institutions. With cloud workloads expected to represent 60–65% of global enterprise traffic by 2030, organizations are modernizing their networks to support ultra-low latency, large-scale data processing, and reliable workload orchestration. The rapid expansion of APAC data center switch deployment, particularly in China, India, Japan, and Singapore, is accelerating the adoption of Gigabit Ethernet switch, 100G Ethernet switches, and next-generation Ethernet switches. The rapid increase in data centers drives the migration to high-speed Ethernet switches. As organizations upgrade their infrastructure for cloud data centers and AI applications, the demand for high-performance switches like 10G, 25G, and 100G continues to grow.IoT, Industry 4.0 & Edge Computing Expansion to Drive Ethernet Switch Market The adoption of IoT networking switch market solutions, industrial Ethernet switch market devices, and edge computing network switches across manufacturing, utilities, energy, transportation, and smart infrastructure. With Industry 4.0 transforming global Product Typeion, over 65% of manufacturing plants are deploying IoT-enabled industrial switches, rugged industrial Ethernet switches, and industrial automation switch market platforms to support robotics, PLC systems, sensor-based monitoring, and automated Product Typeion lines. This surge is increasing demand for managed Ethernet switch market Product Types, including the managed L2 switch segment and managed L3 switch segment, which offer enhanced control, redundancy, and cybersecurity. The need for PoE switches is also rising due to the deployment of smart cameras, access control systems, and industrial IoT devices, boosting PoE switch market growth in smart factories and smart city infrastructure. The shift toward edge computing, with over 50 billion IoT devices expected globally by 2030, continues to drive demand for multi-gigabit Ethernet switches, smart switch market solutions, LAN/WAN switch market devices, and converged networking infrastructure. The growing adoption of IoT, Industry 4.0, and edge computing technologies is driving the demand for high-speed Ethernet switches. These advancements require faster and more reliable network connectivity, driving the need for upgraded networking infrastructure across industries.

Rising Cybersecurity & Network Complexity Challenges to Restrain Market Growth The cybersecurity, network complexity, and rising deployment costs. Cyberattacks targeting enterprise networks, cloud data centers, and telecom infrastructure have increased by 35% year-on-year, putting pressure on organizations to invest in advanced network management switches, security-hardened Layer 2 and Layer 3 switch market devices, and segmentation strategies. As more enterprises transition toward multi-cloud and hybrid cloud environments, deploying and managing smart switch market, unmanaged switch market, and managed Ethernet switch market devices becomes more complex. Integrating legacy infrastructure with next-generation solutions such as AI-enabled Ethernet switches, SDN/NFV Ethernet switches, and high-speed 10G, 25G, 40G, and 100G Ethernet switches requires specialized expertise, leading to higher operational expenditures.

Ethernet Switch Market Segment Analysis

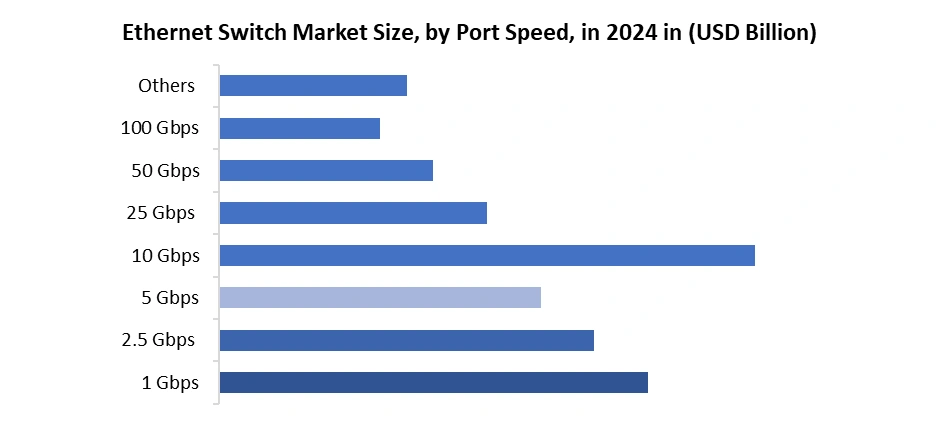

By Product Type, the market is segmented into Fixed Configuration Switches and Modular Switches. The Modular Ethernet switches market holds the largest share in the Ethernet switch market in 2024, driven by growing demand for scalable and flexible network infrastructure in data centers, telecom networks, and industrial applications. These switches offer expandability with additional modules, enabling businesses to add ports and capabilities as needed. Modular switches are designed to support high-bandwidth applications such as the cloud data center switch market, 5G infrastructure switch market, and AI-enabled Ethernet switches. With advancements like 10G Ethernet switches, 25G Ethernet switches, and 100G Ethernet switches, modular switches are increasingly preferred by large enterprises for their customization options and high-performance capabilities. The segment’s growth is also fueled by the rising need for converged networking infrastructure and software-defined networking (SDN) solutions, offering optimized network management.By Port Speed, the market is categorized into the 1 Gbps, 2.5 Gbps, 5 Gbps, 10 Gbps, 25 Gbps, 50 Gbps, 100 Gbps and Others. The 10G Ethernet switch Market has emerged as the dominant port speed segment, with 10G Ethernet switches accounting for a significant market share. As businesses move towards high-speed networks to handle large amounts of data traffic and support cloud computing, IoT, and AI-driven workloads, the demand for 10G Ethernet switches continues to rise. The growth of data center Ethernet switches, the deployment of 5G infrastructure switch market, and the increasing need for enterprise Ethernet switch industry solutions are major drivers. The 10G Ethernet switch is widely used for enterprise IT infrastructure, telecom networks, and network security applications due to its scalability and reliability.

Ethernet Switch Market Regional Insights

North America dominated the Ethernet Switch Market in 2024 and is expected to continue its dominance over the forecast period. The North America Ethernet Switch industry is experiencing strong growth, driven by rising investments in cloud infrastructure, digital transformation, and the rapid modernization of industrial automation systems across the U.S. and Canada. The adoption of smart device–friendly technologies such as IO-Link, Advanced Physical Layer (APL), and Single Pair Ethernet (SPE) is accelerating, particularly in automotive, food & beverage, oil & gas, and discrete manufacturing sectors. This shift is increasing demand for industrial Ethernet switches, managed Ethernet switch market solutions, and ruggedized Layer 2 and Layer 3 switches that support seamless connectivity, remote monitoring, and predictive maintenance. The expansion of hyperscale data centers led by AWS, Microsoft Azure, Google, and Meta is driving strong uptake of 10G, 25G, 40G, and 100G Ethernet switches, with North American data center switching capacity growing at 18–22% annually. The region is also witnessing significant growth in PoE switches, AI-enabled Ethernet switches, and SDN/NFV-based cloud networking switches to support AI training clusters and multi-cloud workloads. Government investments in smart cities, the rollout of 5G, and increased cybersecurity spending are boosting demand for enterprise Ethernet switches, edge computing switches, and IoT-enabled industrial switches, positioning North America as one of the most advanced and high-value markets for Ethernet switching technologies.Ethernet Switch Market Competitive Landscape

The Ethernet switch market is highly competitive and moderately concentrated, with the top 5 vendors controlling around 60% of global market share. Cisco Systems, Huawei Technologies, Arista Networks, Hewlett Packard Enterprise, and Dell Technologies dominate via broad product portfolios, global sales channels and strong brand positioning. They fiercely compete on performance, feature set (e.g., 10G/25G/100G speeds), pricing, customer service, and time to market for innovations. Emerging players and niche vendors push the market via modular Ethernet switches, AI-enabled Ethernet switches, and edge-oriented unmanaged/partially managed switches. Market entry remains high cost due to supply chain, chip scarcity and certification demands, lending an advantage to incumbent players. • MaxLinear and DrayTek Partnership (May 2025): MaxLinear and DrayTek have partnered to integrate the MxL86282S and MxL86252S 2.5G Ethernet Switch SoCs into DrayTek's new 7-port and 10-port switches. These chips improve performance and power efficiency, supporting faster data speeds for SMB networks. This collaboration highlights the increasing demand for 2.5G Ethernet switches in cost-effective, reliable networking for small to medium-sized businesses. • Arista Networks SWAG Feature (December 2024): Arista Networks introduced the Switch Aggregation Group (SWAG) feature in Arista EOS, allowing customers to easily cluster multiple switches under one IP address. This innovation improves network scalability and flexibility, enabling seamless management of distributed networks. SWAG enhances cloud-driven networking solutions and is ideal for large-scale, enterprise-level infrastructures, reinforcing Arista’s position in the AI-powered networking market. • Moxa MRX Series Layer 3 Switch Launch (July 2024): Moxa’s new MRX Series Layer 3 rackmount switches offer high-bandwidth and data aggregation capabilities for industrial environments. Supporting up to 64 ports, including 16 ports at 10GbE speeds, these switches are designed to enable IT/OT convergence. The MRX Series integrates seamlessly with Moxa’s EDS-4000/G4000 Series, providing reliable, high-capacity solutions for industries like manufacturing, energy, and utilities.Ethernet Switch Market Scope: Inquire before buying

Global Ethernet Switch Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 40.42 Bn. Forecast Period 2025 to 2032 CAGR: 5.9% Market Size in 2032: USD 63.94 Bn. Segments Covered: by Product Type Detachable Slate Rugged Others by Port Speed Android iOS Windows by Technology Small (7–8”) Medium (9–11”) Large (12” +) by Application Consumer Commercial Enterprise Others by End Use Industry Online Sales Offline Retail Ethernet Switch Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ethernet Switch Key Players

1. Cisco Systems 2. Arista Networks 3. Juniper Networks 4. Hewlett Packard Enterprise (HPE) 5. Dell Technologies 6. Huawei Technologies 7. Extreme Networks 8. NETGEAR 9. TP Link 10. D Link 11. Ubiquiti Networks 12. Lenovo Group 13. NEC Corporation 14. Mellanox Technologies 15. Broadcom Inc. 16. Supermicro 17. Accton Technology 18. Fortinet 19. Aruba Networks 20. HoweVision Technology 21. Edge Networks 22. Versitron 23. Datto, Inc. 24. Larch Networks 25. MikroTik 26. HoweVision 27. Linksys 28. TPV Technology 29. Dell EMC 30. H3C TechnologiesFrequently Asked Questions:

1] What is the growth rate of the Global Ethernet Switch Market? Ans. The Global Ethernet Switch Market is growing at a significant rate of 5.9% during the forecast period. 2] Which region is expected to dominate the Global Ethernet Switch Market? Ans. North America is expected to dominate the Ethernet Switch Market during the forecast period. 3] What was the Global Ethernet Switch Market size in 2024? Ans. The Ethernet Switch Market size is expected to reach USD 40.42 billion in 2024. 4] What is the expected Global Ethernet Switch Market size by 2032? Ans. The Ethernet Switch Market size is expected to reach USD 63.94 billion by 2032. 5] Which are the top players in the Global Ethernet Switch Market? Ans. The major players in the Global Ethernet Switch Market are Cisco Systems, Arista Networks, Juniper Networks, Hewlett Packard Enterprise (HP) and Others. 6] What are the factors driving the Global Ethernet Switch Market growth? Ans. The increasing demand for high-speed networking, data center expansion, cloud adoption, IoT integration, 5G infrastructure, and enterprise digital transformation drives Ethernet Switch Market growth.

1. Ethernet Switch Market: Research Methodology 2. Ethernet Switch Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Ethernet Switch Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End-User Industry Segment 3.3.5. Total Company Revenue (2024) 3.3.6. Market Share (%) 3.3.7. Profit Margin (%) 3.3.8. Geographical Presence 3.4. Mergers and Acquisitions Details 4. Ethernet Switch Market: Dynamics 4.1. Ethernet Switch Market Trends 4.2. Ethernet Switch Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Ethernet Switch Market 5. Ethernet Switch Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 5.1. Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Fixed Configuration Switches 5.1.2. Modular Switches 5.1.2.1. Unmanaged Switch 5.1.2.2. Partially Managed Switch 5.1.2.3. Fully Managed Switch 5.1.2.4. Others 5.2. Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 5.2.1. 1 Gbps 5.2.2. 2.5 Gbps 5.2.3. 5 Gbps 5.2.4. 10 Gbps 5.2.5. 25 Gbps 5.2.6. 50 Gbps 5.2.7. 100 Gbps 5.2.8. Others 5.3. Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 5.3.1. Layer 2 Switches 5.3.2. Layer 3 Switches 5.3.3. PoE (Power over Ethernet) Switches 5.3.4. Others 5.4. Ethernet Switch Market Size and Forecast, By Application (2024-2032) 5.4.1. Carrier Ethernet 5.4.2. Enterprise 5.4.3. Campus Network 5.4.4. Industrial Networking 5.4.5. Data Centers 5.4.6. Network Security 5.4.7. Others 5.5. Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 5.5.1. IT & Telecom 5.5.2. BFSI 5.5.3. Government & Defense 5.5.4. Industrial 5.5.5. Healthcare 5.5.6. Others 5.6. Ethernet Switch Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Ethernet Switch Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 6.1. North America Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 6.1.1. Fixed Configuration Switches 6.1.2. Modular Switches 6.1.2.1. Unmanaged Switch 6.1.2.2. Partially Managed Switch 6.1.2.3. Fully Managed Switch 6.1.2.4. Others 6.2. North America Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 6.2.1. 1 Gbps 6.2.2. 2.5 Gbps 6.2.3. 5 Gbps 6.2.4. 10 Gbps 6.2.5. 25 Gbps 6.2.6. 50 Gbps 6.2.7. 100 Gbps 6.2.8. Others 6.3. North America Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 6.3.1. Layer 2 Switches 6.3.2. Layer 3 Switches 6.3.3. PoE (Power over Ethernet) Switches 6.3.4. Others 6.4. North America Ethernet Switch Market Size and Forecast, By Application (2024-2032) 6.4.1. Carrier Ethernet 6.4.2. Enterprise 6.4.3. Campus Network 6.4.4. Industrial Networking 6.4.5. Data Centers 6.4.6. Network Security 6.4.7. Others 6.5. North America Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 6.5.1. IT & Telecom 6.5.2. BFSI 6.5.3. Government & Defense 6.5.4. Industrial 6.5.5. Healthcare 6.5.6. Others 6.6. North America Ethernet Switch Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Ethernet Switch Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 7.1. Europe Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 7.2. Europe Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 7.3. Europe Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 7.4. Europe Ethernet Switch Market Size and Forecast, By Application (2024-2032) 7.5. Europe Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 7.6. Europe Ethernet Switch Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Russia 7.6.7. Rest of Europe 8. Asia Pacific Ethernet Switch Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 8.1. Asia Pacific Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 8.2. Asia Pacific Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 8.3. Asia Pacific Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 8.4. Asia Pacific Ethernet Switch Market Size and Forecast, By Application (2024-2032) 8.5. Asia Pacific Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 8.6. Asia Pacific Ethernet Switch Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Rest of Asia Pacific 9. Middle East and Africa Ethernet Switch Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 9.1. Middle East and Africa Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 9.2. Middle East and Africa Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 9.3. Middle East and Africa Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 9.4. Middle East and Africa Ethernet Switch Market Size and Forecast, By Application (2024-2032) 9.5. Middle East and Africa Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 9.6. Middle East and Africa Ethernet Switch Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Nigeria 9.6.4. Rest of ME&A 10. South America Ethernet Switch Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. South America Ethernet Switch Market Size and Forecast, by Product Type (2024-2032) 10.2. South America Ethernet Switch Market Size and Forecast, by Port Speed (2024-2032) 10.3. South America Ethernet Switch Market Size and Forecast, by Technology (2024-2032) 10.4. South America Ethernet Switch Market Size and Forecast, By Application (2024-2032) 10.5. South America Ethernet Switch Market Size and Forecast, by End-Use Industry (2024-2032) 10.6. South America Ethernet Switch Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Colombia 10.6.4. Chile 10.6.5. Rest Of South America 11. Company Profile: Key Players 11.1. Cisco Systems 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Arista Networks 11.3. Juniper Networks 11.4. Hewlett Packard Enterprise (HPE) 11.5. Dell Technologies 11.6. Huawei Technologies 11.7. Extreme Networks 11.8. NETGEAR 11.9. TP Link 11.10. D Link 11.11. Ubiquiti Networks 11.12. Lenovo Group 11.13. NEC Corporation 11.14. Mellanox Technologies 11.15. Broadcom Inc. 11.16. Supermicro 11.17. Accton Technology 11.18. Fortinet 11.19. Aruba Networks 11.20. HoweVision Technology 11.21. Edge Networks 11.22. Versitron 11.23. Datto, Inc. 11.24. Larch Networks 11.25. MikroTik 11.26. HoweVision 11.27. Linksys 11.28. TPV Technology 11.29. Dell EMC 11.30. H3C Technologies 12. Key Findings 13. Analyst Recommendations