Global Electronic Chemicals Market was valued at US$ 54.41 Bn. in 2022. Electronic Chemicals Market size is estimated to grow at a CAGR of 6.21 % over the forecast period.Electronic Chemicals Market Overview:

The Electronic chemicals refer to a broad spectrum of extremely sophisticated specialty chemicals utilized in the electronics sector. Chemicals that are used in electronic products can be solid, liquid, or gaseous. Chips and integrated circuits are produced using electronic chemicals in the automobile and electronic appliance industries, both of which are seeing tremendous global growth. Additionally, for high-end performance and production, digital semiconductors—which are used in computers, servers, tablets, mobile phones, and consumer electronics—need specialized Electronic Chemicals. With an increase in the use of smartphones and computers around the world, demand for semiconductors and printed circuit boards (PCBs) is rising, which is also driving up demand for electronic chemicals.To know about the Research Methodology :- Request Free Sample Report The report explores the Electronic Chemicals Market's segments (Product Type, Application). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Electronic Chemicals Market’s drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Electronic Chemicals Market's contemporary competitive scenario.

Electronic Chemicals Market Dynamics:

Rising demand of semiconductor is the key factor for the grow of this market: Emerging technologies like 5G, AI, IoT, HPC, VR, and strong advancements in ultrapure, organic chemical products for highly efficient capacitors, new smartphone displays, and semiconductor chips for the electronic and automotive industries during the forecasted period are factors that will contribute to the growth of the global electronic chemicals market. As entertainment moves from large venues to more intimate settings, it is predicted that consumer electronics and home improvements will increase, which will have a favorable, long-lasting impact on the demand for electronic chemicals during the foreseeable period. The market for electronic chemicals is anticipated to grow as a result of the shrinking feature sizes and rising complexity of circuits that need the purity of the manufacturing processes chemicals used to create integrated circuits. The largest market share belongs to the semiconductor sector as a result of the rising demand for electronic components across a range of technologies. In order to power tablets, electronic appliances, laptops, and smartphones, semiconductors are increasingly used in a variety of industries, including the automotive, aerospace, and defense sectors. Thus, over the anticipated period, the market is predicted to rise as a result of rising demand for such specialized chemicals and rising demand for the shrinking of electronic components. For cleaning and etching activities on semiconductors, wet chemicals are frequently utilized. A semiconductor is a solid chemical substance or element that, depending on the dopants added during the production process, can conduct electricity under specific conditions. Because semiconductor devices need regular maintenance to function properly, they are cleaned, etched, polished, doped, and serviced using specific electronic chemicals and materials. In the cleaning process, impurities are removed from the wafer surface, and chemically generated oxide is controlled. The market growth of electronic materials and chemicals will likely be constrained by the rapid drop in the use of outdated technologies and the strict health and environmental laws governing certain chemicals and materials. New entrants are anticipated to be constrained by high capital costs for new production facilities and R&D. A significant demand-pull will be exerted on electronic gadgets, such as computers and smartphones, which significantly rely on electronic chips and circuits, by the establishment and growth of corporate companies. Additionally, the growth of the computer hardware market is related to the rise in demand for electronic chemical components. The market moves toward MEMS (micro-electromechanical systems) & NEMS (nanoelectromechanical systems) devices has been facilitated by the widespread adoption of nanotechnology. Nano-devices are now accepted on a global scale due to their smaller size, lighter weight, lower power consumption, and lower manufacturing costs. The market potential for photoresist and its ancillaries has increased as a result of the commercialization of nano-based technologies and other technological breakthroughs. The demand for nanomaterials and, consequently, electronic chemicals in the semiconductor industry is being enabled. Possible hazards like combustible gases, solvents of all kinds, hydrogen chloride gas, and other substances that are bad for both people and the environment. The rising levels of environmental risks linked with electronic chemicals is the biggest challenge for this market. COVID-19 Impact on the Electronic Chemicals Market The COVID-19 pandemic is expected to have a negative effect on the market for electronic compounds worldwide. This is mostly caused by a global scarcity of raw material supply and shipping delays from several nations. According to an estimate by ET Markets, the lack of raw materials from China has had a close to impact on the production of electronic chemicals. In addition, the leading producers of electronic chemicals have scaled back production due to manpower shortages and disruptions in the supply of raw materials. Furthermore, end customers' demand for electronic chemicals is declining as a result of the temporary suspension of activities. The output of electronic chemicals was reduced according to Independent Chemical Information Services (ICIS), as a result of supply chain and logistical problems. Furthermore, the profit margin in the market for electronic chemicals has been adversely influenced by several limitations implemented by governments of various nations. On the other hand, because to developments in electronic chemicals that will improve the functionality of electronic gadgets, the global market for electronic chemicals is anticipated to expand at an amazing rate following the COVID-19 pandemic.Electronic Chemicals Market Segment Analysis:

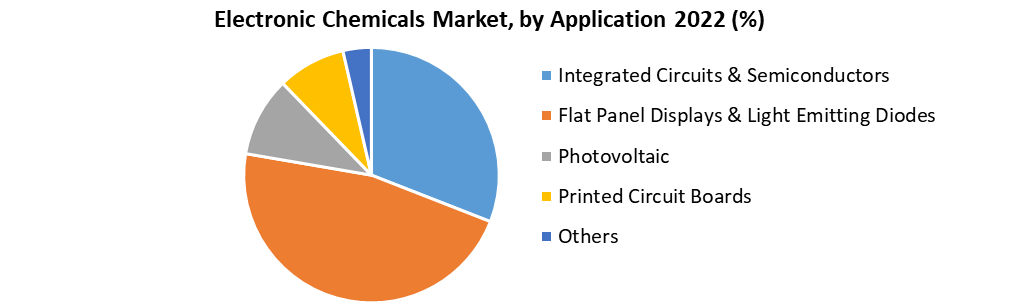

Based on Product Type, Wet chemicals and solvents segment is dominating the market with the highest CAGR of 6% during the forecast period. Due to their ultra-pure quality, electronic wet chemicals are frequently utilized in cleaning and etching applications during the fabrication and processing of semiconductors. Wet chemicals are widely used at different stages of the production of electronic products, including used semiconductors and a variety of electronic applications, including the production of integrated circuits (ICs), printed circuit boards (PCBs), LCDs, LEDs, display panels, monitors, televisions, and other electronics. Phosphoric acid, sulfuric acid, nitric acid, ammonium-hydroxide, and iso-propyl alcohol are some of the chemicals used in wet processing the most commonly. Based on the Application, Integrated circuits & semiconductors segment is dominating the market with highest CAGR during the forecast period. A semiconductor is a solid chemical substance or element that, depending on the dopants added during the production process, can conduct electricity under specific conditions. Technological developments in the electronics sector have an impact on the semiconductor sector. Future technologies like artificial intelligence, in addition to the rising demand for circuit boards and memory chips, are anticipated to fuel the semiconductor market. The printed circuit board market would grow during the forecast period due to the growing use of printed circuit boards in a variety of products, including medical devices, LEDs, consumer electronics, industrial equipment, and components.

Regional Insights:

The Asia-Pacific region dominated the market with highest share in 2022. The Asia-Pacific region is expected to witness significant growth at a CAGR of XX% through the forecast period. Due to low manufacturing costs and the demand for electronic chemicals, which is primarily driven by an increase in the manufacture of semiconductors and microelectronics, the Asia-Pacific region is anticipated to represent the largest global market for electronic chemicals. China, Japan, South Korea, and Malaysia are the Asia-Pacific nations that dominated the market. The forecast year is expected to see a growth in the market's total size due to rising capital costs for starting new significant manufacturing businesses and major corporations' investments in research and development. Additionally, it is anticipated that leading businesses' important technical innovations will boost the market in this region. The growth of the electronics industry is being fuelled by economic progress and an increase in disposable income, which is anticipated to propel the growth of the local market. A robust rise in the North American market is anticipated due to the high demand for smart devices and developments in technology. A shift in consumer preference toward fitness & wellness equipment and smartwatches has an impact on the region. For instance, the US, the second-largest market for electronic goods, generated electronic goods worth around USD 412.19 billion, which is anticipated to help the regional industry grow. The objective of the report is to present a comprehensive analysis of the Electronic Chemicals Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Electronic Chemicals Market dynamic, structure by analyzing the market segments and projecting the Electronic Chemicals Market size. Clear representation of competitive analysis of key players by Vehicle Product Type, price, financial position, product portfolio, growth strategies, and regional presence in the Electronic Chemicals Market make the report investor’s guide.Electronic Chemicals Market Scope: Inquire before buying

Global Electronic Chemicals Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 54.41 Bn. Forecast Period 2023 to 2029 CAGR: 6.21 % Market Size in 2029: US$ 82.96 Bn. Segments Covered: by Product Type Atmospheric and Specialty Gases Photoresist Chemicals Wet Chemicals & Solvents Others by Application Integrated Circuits & Semiconductors Flat Panel Displays & Light Emitting Diodes Photovoltaic Printed Circuit Boards Others Electronic Chemicals Market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. BASF SE 2. MacDermid, Inc 3. Sumitomo Chemical Co. Ltd 4. Honeywell International, Inc. 5. Hitachi Chemical Co. Ltd. 6. Air Liquide SA 7. Merck KGaA 8. SIDLEY CHEMICAL CO., LTD. 9. Solvay S. A. 10. Wacker Chemie AG 11. Air Products 12. Chemicals Inc. 13. Albemarle Corporation 14. DuPont de Nemours Inc. 15. Eastman Chemical Company 16. FUJIFILM Corporation 17. Huntsman Corporation 18. Linde plc Frequently Asked Questions: 1] What segments are covered in the Global Electronic Chemicals Market report? Ans. The segments covered in the Electronic Chemicals Market report are based on Product Type, Application. 2] Which region is expected to hold the highest share in the Electronic Chemicals Market? Ans. Asia-Pacific region is expected to hold the highest share in the Electronic Chemicals Market. 3] What is the market size of the Electronic Chemicals Market by 2029? Ans. The market size of the Electronic Chemicals Market by 2029 is expected to reach US$ 82.96 Bn. 4] What is the forecast period for the Electronic Chemicals Market? Ans. The forecast period for the Electronic Chemicals Market is 2023-2029. 5] What was the market size of the Electronic Chemicals Market in 2022? Ans. The market size of the Electronic Chemicals Market in 2022 was valued at US$ 54.41 Bn.

1. Global Electronic Chemicals Market: Research Methodology 2. Global Electronic Chemicals Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Electronic Chemicals Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Electronic Chemicals Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Electronic Chemicals Market Segmentation 4.1 Global Electronic Chemicals Market, By Product Type (2022-2029) • Atmospheric and Specialty Gases • Photoresist Chemicals • Wet Chemicals & Solvents • Others 4.2 Global Electronic Chemicals Market, By Application (2022-2029) • Integrated Circuits & Semiconductors • Flat Panel Displays & Light Emitting Diodes • Photovoltaic • Printed Circuit Boards • Others 5. North America Electronic Chemicals Market (2022-2029) 5.1 North America Electronic Chemicals Market, By Product Type (2022-2029) • Atmospheric and Specialty Gases • Photoresist Chemicals • Wet Chemicals & Solvents • Others 5.2 North America Electronic Chemicals Market, By Application (2022-2029) • Integrated Circuits & Semiconductors • Flat Panel Displays & Light Emitting Diodes • Photovoltaic • Printed Circuit Boards • Others 5.3 North America Electronic Chemicals Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Electronic Chemicals Market (2022-2029) 6.1. Asia Pacific Electronic Chemicals Market, By Product Type (2022-2029) 6.2. Asia Pacific Electronic Chemicals Market, By Application (2022-2029) 6.3. Asia Pacific Electronic Chemicals Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Electronic Chemicals Market (2022-2029) 7.1 Middle East and Africa Electronic Chemicals Market, By Product Type (2022-2029) 7.2. Middle East and Africa Electronic Chemicals Market, By Application (2022-2029) 7.3. Middle East and Africa Electronic Chemicals Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. South America Electronic Chemicals Market (2022-2029) 8.1. South America Electronic Chemicals Market, By Product Type (2022-2029) 8.2. South America Electronic Chemicals Market, By Application (2022-2029) 8.3. South America Electronic Chemicals Market, by Country (2022-2029) • Brazil • Argentina • Rest of South America 9. European Electronic Chemicals Market (2022-2029) 9.1. European Electronic Chemicals Market, By Product Type (2022-2029) 9.2. European Electronic Chemicals Market, By Application (2022-2029) 9.3. European Electronic Chemicals Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe 10. Company Profile: Key players 10.1. BASF SE 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 MacDermid, Inc 10.3 Sumitomo Chemical Co. Ltd 10.4 Honeywell International, Inc. 10.5 Hitachi Chemical Co. Ltd. 10.6 Air Liquide SA 10.7 Merck KGaA 10.8 SIDLEY CHEMICAL CO., LTD. 10.9 Solvay S. A. 10.10 Wacker Chemie AG 10.11 Air Products 10.12 Chemicals Inc. 10.13 Albemarle Corporation 10.14 DuPont de Nemours Inc. 10.15 Eastman Chemical Company 10.16 FUJIFILM Corporation 10.17 Huntsman Corporation 10.18 Linde plc