Global Electric Public Transport Market is anticipated to reach US$ XX Mn by 2026 from US$ XX Mn in 2019 at a CAGR of 43.2% during a forecast period.Global Electric Public Transport Market Overview

Electric mass transportation is a public transportation infrastructure powered by electricity, which incorporates electric buses and locomotives. Electric mass transit includes electric and hybrid vehicles, public buses, and locomotives such as metros, subways, monorails, and trams. Electric mass transit rapidly lowers transportation emissions and thereby saves the atmosphere. Due to improved range, battery life, reliability, and affordability, electric public transport have become a much more appealing option for customers in recent years. EVs have dominated the automotive markets of northern European countries, with sales in China forecast to hit 3.7 million by 2026. However, Norway now has the highest proportion of electric vehicles in its fleet, accounting for the bulk of new registrations in 2019. Electric public transport is incredibly common in Norway, thanks to the government's strong subsidies, but also to the abundance of charging stations. The provision of charging stations is critical to making electric public transport a feasible choice for vehicles. With so many countries committed to electric public transport, it looks set to dominate infrastructure during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Global Electric Public Transport Market Dynamics

Rising demand for green vehicles and minimizing pollution requirements are significant factors projected to boost the public transport electricity market during the forecast period. In addition, regulators around the world have subsidies for electric vehicles and tax credits that are supposed to fuel the public transport electricity market during the forecast period. According to the Zero Emission Urban Bus System Project, 19 European public transportation companies and operators have a circulating e-bus plan for 2020 that includes 25 cities. At the end of 2019, over 2,500 electric buses were running in these cities, accounting for around 6% of the overall fleet of 40,000 city buses. Furthermore, more than 6,100 electric vehicles are expected to be in operation in more than 13 public transportation agencies and operators in another 18 cities throughout Europe, accounting for about 43% of their overall fleet of 14,000 public buses. Another big adoption of electric public transportation in China is the increase in the rate of adoption of electric public transportation, especially by the Shenzhen bus community. This is expected to provide producers with profitable prospects, as well as government connections in the areas of hybrid vehicles and locomotives. However, higher electric vehicle costs and reduced charging station capacity are expected to hinder the electric public transportation market during the projected period. Although investment into electric public transport exists across Europe, budgets restrict the speed at which diesel engines can be phased out. In the United States, only 0.03 per cent of vehicles were electric in 2019.New Technology:

The exchanging of energy between the EV and the charging station is allowed by an electromagnetic field in inductive charging. There is no direct interaction between the energy source and the vehicle in this process. The advantages of such wireless charging systems include safety (no exposed conducting surfaces, hence no electric shock), no cable needs, high reliability, low maintenance (automatic, minimum intervention required), reduced risk of theft, and long product life due to less wear and tear. This trend is expected to surge the market of electric public transport during the forecast period.Global Electric Public Transport Market Segmentation Analysis

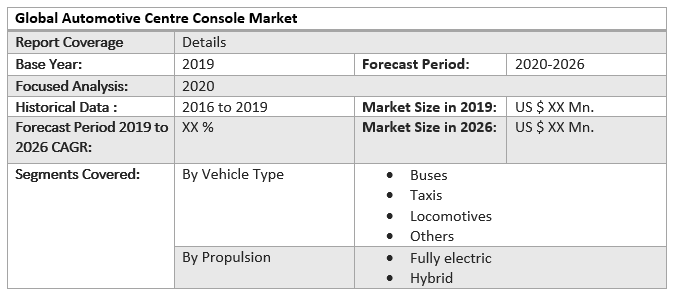

By Vehicle Type, the buses segment is expected to grow at the largest CAGR of nearly 23.24% during the forecast period. This growth is attributed to the rise in electrification of public transport by government bodies to curb emission. According to data collected, the UK is on track to have Europe's biggest electric bus fleet by 2026, with the number of buses expected to increase by about 180% from about 1,000 to 2,800 vehicles. With about 800 ZE buses, Poland actually has the second-largest fleet of Zero Emission (ZE) buses in Europe. At about 600 buses each, the Netherlands and Italy are the third and fourth largest fleets. Germany's urban fleet, which is the fifth-largest in Europe, has just 550 vehicles. With about 500 ZE buses, France is currently in sixth position, about half the number of ZE buses in the UK. Electric buses are expected to rise by 189 per cent in Europe over the next three years, with significant growth in France and the Nordic countries.

By Propulsion, the fully electric segment is expected to grow at the largest CAGR of nearly XX% during the forecast period. The fully electric segment of the electric public transportation market is expected to grow due to the rapid transformation to public transportation and an increase in the need to purchase electric vehicles. Also, factors like more convenience, no emissions, popularity, and safe to drive, cost-effectiveness, and low maintenance are expected to fuel the fully electric vehicles segment by 2026.The Asia Pacific region accounts for a significant share of the global electric public transportation industry. Higher adoption of electric buses and coaches, as well as increased electric vehicle penetration, are major factors driving the rise in the number of electric buses launched in the region. Electric vehicles are being considered for use in public transit networks in China, India, Japan, and South Korea. This is an important factor that is expected to drive demand in the region. The region's growth can be traced to the Chinese market's dominance as well as the global presence of leading OEMs such as BYD, Yutong, Zhongtong, and Ankai resulting in the exponential growth of the Asia Pacific electric public transport market. Similarly, France, the United Kingdom, Poland, the Nordics, the Netherlands, and Germany account for more than half of all-electric public transport in Europe today. Thus, it is estimated that 16,710 buses are expected to be in service by 2026.

Global Electric Public Transport Market Scope: Inquire before buying

Global Electric Public Transport Market by Region

• North America • Asia pacific • Europe • Middle East and Africa • South AmericaGlobal Electric Public Transport Market Key Players

• General Motors • Ford Motor Company • AB Volvo • BMW AG • BYD Company Limited • Daimler AG • BYD Company Limited., • Shenzhen Wuzhoulong Motors Co., Ltd • Yutong • Solaris Bus & Coach S.A. • Nippon Seiki Co., Ltd., Proterra • Ashok Leyland • Tata Motors • Foton Motor Inc • Zhongtong Bus Holding Co., Ltd • FAW Group, IVECO • Dongfeng Automobile Co., Ltd • Bombardier Inc • Siemen AG • Mitsubishi Electric Corporation • CRRC Corporation Limited • Hitachi Ltd

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Electric Public Transport Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Electric Public Transport Market 3.4. Geographical Snapshot of the Electric Public Transport Market, By Manufacturer share 4. Global Electric Public Transport Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Electric Public Transport Market 5. Supply Side and Demand Side Indicators 6. Global Electric Public Transport Market Analysis and Forecast, 2019-2026 6.1. Global Electric Public Transport Market Size & Y-o-Y Growth Analysis. 7. Global Electric Public Transport Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 7.1.1. Buses 7.1.2. Taxis 7.1.3. Locomotives 7.1.4. Others 7.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 7.2.1. Fully electric 7.2.2. Hybrid 8. Global Electric Public Transport Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Electric Public Transport Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 9.1.1. Buses 9.1.2. Taxis 9.1.3. Locomotives 9.1.4. Others 9.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 9.2.1. Fully electric 9.2.2. Hybrid 10. North America Electric Public Transport Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Electric Public Transport Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 12. Canada Electric Public Transport Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 13. Mexico Electric Public Transport Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 14. Europe Electric Public Transport Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 15. Europe Electric Public Transport Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Electric Public Transport Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 17. France Electric Public Transport Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 18. Germany Electric Public Transport Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 19. Italy Electric Public Transport Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 20. Spain Electric Public Transport Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 21. Sweden Electric Public Transport Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 22. CIS Countries Electric Public Transport Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 23. Rest of Europe Electric Public Transport Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 24. Asia Pacific Electric Public Transport Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 25. Asia Pacific Electric Public Transport Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Electric Public Transport Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 27. India Electric Public Transport Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 28. Japan Electric Public Transport Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 29. South Korea Electric Public Transport Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 30. Australia Electric Public Transport Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 31. ASEAN Electric Public Transport Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 32. Rest of Asia Pacific Electric Public Transport Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 33. Middle East Africa Electric Public Transport Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 34. Middle East Africa Electric Public Transport Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Electric Public Transport Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 36. GCC Countries Electric Public Transport Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 37. Egypt Electric Public Transport Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 38. Nigeria Electric Public Transport Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 39. Rest of ME&A Electric Public Transport Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 40. South America Electric Public Transport Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 41. South America Electric Public Transport Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Electric Public Transport Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 43. Argentina Electric Public Transport Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 44. Rest of South America Electric Public Transport Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By Propulsion, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Electric Public Transport Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile : Key Players 45.3.1. AB Volvo 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. General Motors 45.5. Ford Motor Company 45.6. AB Volvo 45.7. BMW AG 45.8. BYD Company Limited 45.9. Daimler AG 45.10. BYD Company Limited., 45.11. Shenzhen Wuzhoulong Motors Co., Ltd 45.12. Yutong 45.13. Solaris Bus & Coach S.A. 45.14. Nippon Seiki Co., Ltd., Proterra 45.15. Ashok Leyland 45.16. Tata Motors 45.17. Foton Motor Inc 45.18. Zhongtong Bus Holding Co., Ltd 45.19. FAW Group, IVECO 45.20. Dongfeng Automobile Co., Ltd 45.21. Bombardier Inc 45.22. Siemen AG 45.23. Mitsubishi Electric Corporation 45.24. CRRC Corporation Limited 45.25. Hitachi Ltd 46. Primary Key Insights